Global Biogas Upgrading Equipment Market

Market Size in USD Billion

CAGR :

%

USD

9.52 Billion

USD

12.53 Billion

2024

2032

USD

9.52 Billion

USD

12.53 Billion

2024

2032

| 2025 –2032 | |

| USD 9.52 Billion | |

| USD 12.53 Billion | |

|

|

|

|

Biogas Upgrading Equipment Market Size

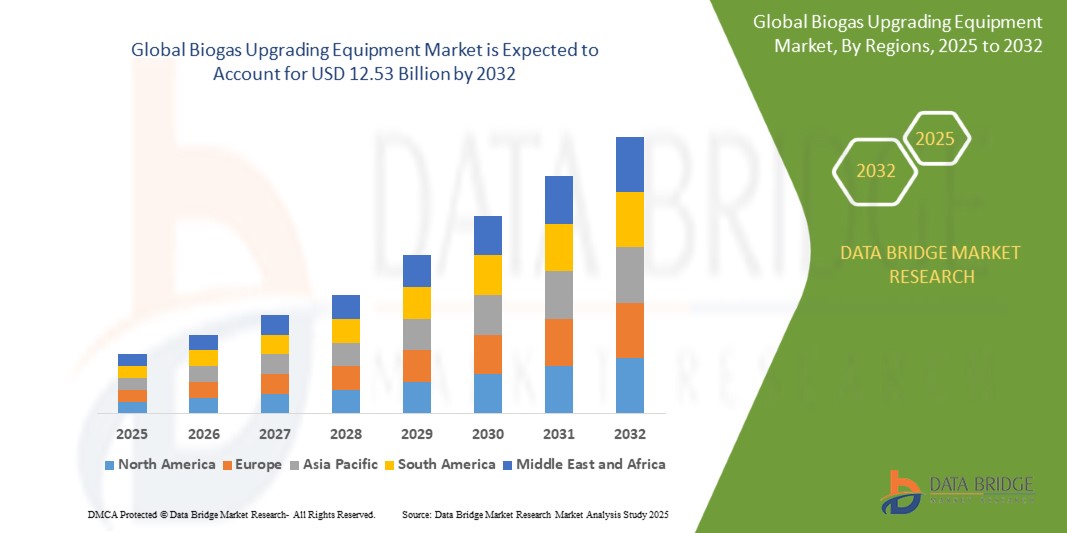

- The global biogas upgrading equipment market size was valued at USD 9.52 billion in 2024 and is expected to reach USD 12.53 billion by 2032, at a CAGR of 3.5% during the forecast period

- The market growth is largely fueled by the increasing global shift toward renewable energy, government incentives for reducing greenhouse gas emissions, and rising investments in waste-to-energy projects

- Technological advancements in biogas upgrading systems, including water wash, PSA, and membrane separation, are enhancing efficiency and cost-effectiveness, encouraging broader adoption across municipal, industrial, and agricultural applications. These converging factors are accelerating the deployment of biogas upgrading equipment, thereby significantly boosting the industry’s growth

Biogas Upgrading Equipment Market Analysis

- Biogas upgrading equipment is used to refine raw biogas by removing impurities such as carbon dioxide, hydrogen sulfide, and water vapor, producing high-purity biomethane suitable for injection into natural gas grids or use as vehicle fuel. These systems ensure compliance with energy standards and improve the economic value of biogas in renewable energy markets

- The escalating demand for biogas upgrading equipment is primarily driven by increasing renewable energy adoption, stricter environmental regulations, and a growing focus on circular economy practices. Rising agricultural and municipal waste generation, combined with technological innovation in upgrading solutions, is further strengthening the market trajectory

- Asia-Pacific dominated the biogas upgrading equipment market with a share of 38% in 2024, due to expanding renewable energy initiatives, increasing investments in municipal and industrial biogas projects, and a strong presence of technology providers for upgrading systems

- North America is expected to be the fastest growing region in the biogas upgrading equipment market during the forecast period due to increasing government incentives for renewable energy, expansion of industrial biogas projects, and focus on sustainable waste management

- Steel segment dominated the market with a market share of 46.8% in 2024, due to its superior durability, corrosion resistance, and ability to withstand high-pressure operations. Steel-based equipment is preferred for municipal and industrial facilities where long-term reliability and low maintenance requirements are critical. Its compatibility with various upgrading technologies and ability to handle large volumes of biogas ensure continued preference among end users

Report Scope and Biogas Upgrading Equipment Market Segmentation

|

Attributes |

Biogas Upgrading Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biogas Upgrading Equipment Market Trends

Growing Demand for Renewable Energy

- The biogas upgrading equipment market is expanding robustly driven by escalating global demand for renewable energy sources and stricter environmental regulations. The urgency to reduce greenhouse gas emissions propels technology adoption for biogas purification and biomethane production

- For instance, Pentair Haffmans and Greenlane Renewables lead market innovation with advanced membrane separation and pressure swing adsorption technologies, delivering high-purity biomethane for grid injection and vehicle fuel conversion. Their solutions underscore industry commitment to sustainability and efficiency

- Increasing government incentives and subsidies stimulate investments in biogas infrastructure in agriculture and municipal sectors. These policies support renewable natural gas (RNG) adoption and expand market opportunities for upgrading equipment providers

- Technological advancements including modular and decentralized systems help address diverse feedstock and site-specific purification needs. Innovations reduce energy consumption and improve cost-effectiveness, improving market accessibility for small-scale installations

- Rising urbanization and industrial waste management challenges accelerate biomethane demand as a clean energy alternative. Integration of biogas upgrading with waste-to-energy projects enhances circular economy prospects and environmental benefits

- Growing focus on data analytics, process automation, and smart control systems optimizes biogas upgrading plant performance. These digital solutions maximize methane yields and operational reliability while lowering maintenance requirements

Biogas Upgrading Equipment Market Dynamics

Driver

Advancements in Biogas Upgrading Technologies

- Continuous R&D in upgrading technologies such as membrane filtration, water scrubbing, and PSA ensures higher methane recovery rates with lower operational costs. These improvements position biogas as a competitive renewable fuel replacing natural gas combustion sources

- For instance, Evonik and Air Liquide invest heavily in developing next-generation upgrading units featuring enhanced energy efficiency and modular designs tailored for variable biogas quality and capacities. These innovations aid broader market penetration across industrial and municipal customers

- Improved process integration with biogas digesters and smart control systems reduces downtime and enhances gas quality consistency. This technological integration streamlines plant operations, significantly boosting sustainability and economics for project developers

- Emerging innovations in adsorbents and membrane materials extend equipment lifespan and lower environmental impact, addressing consumer and regulatory expectations for green technology solutions. These enhancements foster customer confidence and accelerate capital deployment

- Growing adoption of distributed and small-scale biogas upgrading systems supports decentralized energy generation. This trend enables rural and developing regions to harness biogas upgrading benefits, expanding market scope beyond traditional large-scale installations

Restraint/Challenge

High Capital and Operating Costs

- The significant upfront investment required for biogas upgrading equipment installation remains a major barrier for small and mid-sized projects. Capital costs, including hardware, installation, and commissioning, often limit market participation and slow adoption rates

- For instance, SMEs in emerging economies cite financial constraints and extended payback periods as critical hurdles in scaling biogas upgrading technologies at commercial levels. Limited access to affordable financing exacerbates these cost challenges

- Operating expenses, including energy, maintenance, and consumables, contribute to overall project economics that can deter potential adopters. Market players continuously seek strategies to optimize operational efficiency without compromising output quality

- Complex regulatory environments and varying standards between regions complicate project deployment and financing, increasing compliance costs and project risk profiles. These factors influence market dynamics and investor confidence globally

- Competition from alternative renewable energy options and fossil fuel subsidies in certain regions can reduce demand growth for biogas upgrading solutions, intensifying market pressures on equipment manufacturers

Biogas Upgrading Equipment Market Scope

The market is segmented on the basis of technology, application, and material.

• By Technology

On the basis of technology, the biogas upgrading equipment market is segmented into water wash, chemical scrubbing, pressure swing adsorption (PSA), membrane separation, and cryogenic separation. The water wash segment dominated the largest market revenue share in 2024, driven by its proven efficiency in removing carbon dioxide and hydrogen sulfide from raw biogas while maintaining high methane recovery rates. Its well-established technology, ease of operation, and adaptability to various biogas sources make it a preferred choice among municipal and industrial operators. Water wash systems also offer scalability, allowing facilities to upgrade production capacity without significant redesign, which further reinforces its dominance in the market.

The membrane separation segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in decentralized and small-to-medium biogas facilities. Membrane systems offer compact design, lower operational costs, and modularity, enabling flexible installation across diverse applications. Their ability to achieve high methane purity and rapid processing makes them particularly attractive for industrial and agricultural users seeking efficient on-site upgrading solutions. Technological advancements and declining membrane costs are further accelerating their uptake globally.

• By Application

On the basis of application, the biogas upgrading equipment market is segmented into municipal, industrial, and agricultural. The municipal segment held the largest market revenue share in 2024, owing to large-scale wastewater treatment plants and city-level biogas projects that require consistent and reliable upgrading systems. Municipal facilities often prioritize proven technologies, such as water wash or PSA, to ensure stable methane output and compliance with regulatory standards. The steady growth of urban infrastructure projects and government incentives for renewable energy integration contribute to the segment’s leading position in the market.

The industrial segment is projected to register the fastest CAGR from 2025 to 2032, driven by rising demand from food processing, chemical, and energy-intensive manufacturing sectors. Industrial operators increasingly adopt compact, automated upgrading systems such as membrane separation to efficiently convert waste streams into high-purity biomethane. Factors such as growing sustainability initiatives, cost-saving incentives, and integration with on-site power generation are accelerating industrial adoption of advanced biogas upgrading technologies.

• By Material

On the basis of material, the biogas upgrading equipment market is segmented into steel, iron, and other materials. The steel segment dominated the largest market revenue share of 46.8% in 2024, attributed to its superior durability, corrosion resistance, and ability to withstand high-pressure operations. Steel-based equipment is preferred for municipal and industrial facilities where long-term reliability and low maintenance requirements are critical. Its compatibility with various upgrading technologies and ability to handle large volumes of biogas ensure continued preference among end users.

The other materials segment is expected to witness the fastest growth rate from 2025 to 2032, driven by lightweight composites and advanced alloys that enhance energy efficiency and reduce installation costs. These materials allow for modular designs and portability, making them suitable for small-scale and decentralized biogas upgrading units. In addition, innovations in non-metallic materials provide improved resistance to acidic or corrosive biogas components, supporting rapid adoption in agricultural and emerging market applications.

Biogas Upgrading Equipment Market Regional Analysis

- Asia-Pacific dominated the biogas upgrading equipment market with the largest revenue share of 38% in 2024, driven by expanding renewable energy initiatives, increasing investments in municipal and industrial biogas projects, and a strong presence of technology providers for upgrading systems

- The region’s cost-effective manufacturing landscape, growing focus on sustainable energy solutions, and rising adoption of advanced upgrading technologies are accelerating market expansion

- The availability of skilled labor, favorable government incentives for clean energy, and rapid industrialization across developing economies are contributing to increased adoption of biogas upgrading equipment

China Biogas Upgrading Equipment Market Insight

China held the largest share in the Asia-Pacific market in 2024, owing to its leadership in renewable energy deployment and large-scale industrial biogas production. Government support through subsidies and favorable policies for sustainable energy projects, coupled with the country’s robust manufacturing ecosystem for upgrading equipment, are key growth drivers. Increasing municipal and agricultural biogas initiatives and ongoing investments in technology integration further strengthen demand.

India Biogas Upgrading Equipment Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising government support for waste-to-energy projects, growing adoption of agricultural and industrial biogas systems, and increasing focus on achieving energy self-reliance. Initiatives promoting decentralized renewable energy, combined with rising investments in upgrading infrastructure and rural biogas projects, are driving market expansion.

Europe Biogas Upgrading Equipment Market Insight

The European market is expanding steadily, supported by stringent environmental regulations, high adoption of renewable energy technologies, and growing investments in sustainable biogas upgrading solutions. The region emphasizes efficiency, compliance with emission standards, and deployment of advanced upgrading technologies in municipal and industrial sectors. The increasing shift toward clean energy and circular economy practices is further enhancing market growth.

Germany Biogas Upgrading Equipment Market Insight

Germany’s market is driven by its leadership in renewable energy deployment, strong industrial base, and focus on advanced technological solutions for biogas upgrading. Well-established R&D networks, collaboration between academic institutions and technology providers, and government incentives for clean energy projects contribute to robust adoption. Demand is particularly strong from municipal and industrial biogas facilities.

U.K. Biogas Upgrading Equipment Market Insight

The U.K. market is supported by increasing focus on sustainable energy, growing investments in waste-to-energy and industrial biogas projects, and efforts to modernize existing energy infrastructure. Rising R&D activities, policy incentives, and adoption of advanced upgrading technologies in municipal and agricultural applications are driving market growth.

North America Biogas Upgrading Equipment Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing government incentives for renewable energy, expansion of industrial biogas projects, and focus on sustainable waste management. Technological advancements in upgrading equipment, coupled with growing adoption of clean energy solutions by municipalities and industries, are boosting demand.

U.S. Biogas Upgrading Equipment Market Insight

The U.S. accounted for the largest share in the North American market in 2024, underpinned by strong renewable energy policies, significant investment in municipal and industrial biogas facilities, and well-established technology providers. The country’s emphasis on energy sustainability, coupled with advanced R&D and adoption of high-efficiency upgrading systems, reinforces its leading position in the region.

Biogas Upgrading Equipment Market Share

The biogas upgrading equipment industry is primarily led by well-established companies, including:

- Air Products (U.S.)

- Air Liquide (France)

- Greenlane Renewables Inc. (Canada)

- Asia Biogas (Thailand)

- Clarke Energy (U.K.)

- Axiom (U.S.)

- Aemetis, Inc. (U.S)

- Carbotech Gas Systems GmbH (Germany)

- Biogas Purifier (India)

- Ramboll (Denmark)

- Bright Biomethane (Netherlands)

Latest Developments in Global Biogas Upgrading Equipment Market

- In July 2024, Burckhardt Compression secured major orders to supply 82 high-pressure compressors for 45 biogas installations across India. This large-scale project highlights India’s rising focus on renewable energy and waste-to-energy solutions. The development strengthens Burckhardt Compression’s role as a key technology provider while accelerating India’s transition toward cleaner energy, significantly boosting demand for biogas upgrading equipment in the region

- In April 2024, Engie expanded its renewable energy portfolio by acquiring two biomethane production sites in the Netherlands, aligning with its target of producing 30 TWh of renewable gas annually in Europe by 2030. This acquisition enhances Engie’s biogas production capacity and reflects Europe’s growing emphasis on sustainable energy and integration of biomethane into mainstream gas supply. The move supports greater adoption of advanced biogas upgrading equipment to meet the region’s energy and climate targets

- In May 2023, Streamline Innovations introduced the VALKYRIE ECO and VALKYRIE ECO FLEX H₂S treating solutions, specifically designed for agricultural biogas and landfill gas applications. These solutions aim to remove hydrogen sulfide efficiently and meet commercial pipeline specifications without requiring additional polishing. By simplifying the upgrading process and reducing operational costs, this development enhances equipment adoption in small and large-scale biogas facilities

- In February 2023, Shell Petroleum NV completed the acquisition of Nature Energy Biogas A/S for $2 billion, making it one of the largest deals in the sector. This acquisition expanded Shell’s expertise in biogas plant technology and strengthened its renewable natural gas value chain. The integration of Nature Energy’s experience in biogas production and upgrading significantly advances efficiency improvements, creating wider opportunities for the global biogas upgrading equipment market

- In January 2020, Aemetis Biogas received a $4.1 million grant from the California Energy Commission to construct a biogas upgrading facility. The facility was designed to process dairy biogas delivered through a pipeline from anaerobic digesters and convert it into renewable natural gas. This project supported California’s renewable energy goals and demonstrated the role of government-backed funding in driving the deployment of advanced biogas upgrading technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.