Global Bioheat Fuel Market

Market Size in USD Million

CAGR :

%

USD

101.20 Million

USD

257.81 Million

2024

2032

USD

101.20 Million

USD

257.81 Million

2024

2032

| 2025 –2032 | |

| USD 101.20 Million | |

| USD 257.81 Million | |

|

|

|

|

Bioheat Fuel Market Size

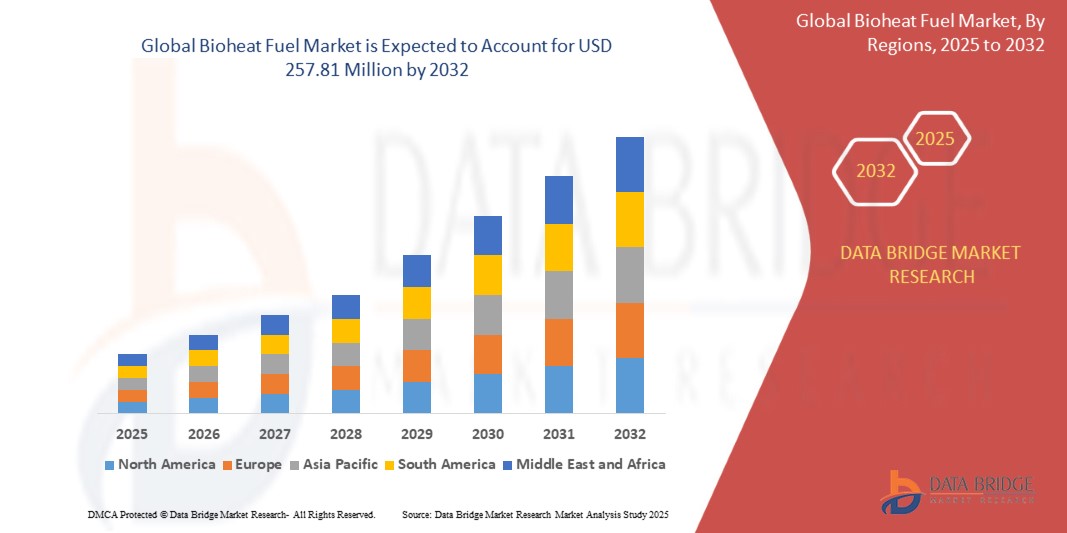

- The global bioheat fuel market size was valued at USD 101.2 million in 2024 and is expected to reach USD 257.81 million by 2032, at a CAGR of 12.4% during the forecast period

- The market growth is largely driven by increasing environmental regulations and growing demand for cleaner, renewable heating fuel alternatives that reduce greenhouse gas emissions and dependence on traditional fossil fuels

- Furthermore, rising consumer awareness about sustainability and government incentives promoting the use of bioheat fuels in residential, commercial, and industrial heating applications are accelerating market adoption, boosting overall demand and industry expansion

Bioheat Fuel Market Analysis

- Bioheat fuel is a blend of renewable bio-based oils and conventional heating oil designed to reduce carbon emissions while maintaining compatibility with existing heating systems, making it an attractive solution for transitioning toward greener energy

- The increasing focus on decarbonization in the heating sector, combined with advancements in biofuel production technologies and expanding supply infrastructure, is driving the steady growth of the bioheat fuel market globally

- North America dominated the bioheat fuel market with a share of 33.5% in 2024, due to increasing regulatory focus on reducing carbon emissions and growing consumer preference for sustainable heating alternatives

- Asia-Pacific is expected to be the fastest growing region in the bioheat fuel market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing environmental awareness in countries such as China, Japan, and India

- Up to 5% segment dominated the market with a market share of 62.5% in 2024, due to its widespread adoption as an immediate and practical solution for reducing carbon emissions without requiring significant changes to existing heating systems. This segment benefits from established supply chains and regulatory incentives encouraging incremental blending, making it the preferred choice for many fuel distributors and end-users

Report Scope and Bioheat Fuel Market Segmentation

|

Attributes |

Bioheat Fuel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bioheat Fuel Market Trends

Rising Adoption of Renewable Heating Solutions

- The bioheat fuel market is growing rapidly due to increasing preference for renewable heating solutions that combine traditional heating oil with biodiesel to reduce carbon emissions and support cleaner energy usage in residential and commercial heating systems

- For instance, bioheat fuel blends allowing use in existing oil burners without major equipment changes are gaining traction in North America and Europe, where policies and consumer awareness drive shifts toward renewable alternatives

- Advances in biodiesel production technology, including use of waste oils and improved transesterification processes, are enhancing the sustainability and cost-effectiveness of bioheat fuels

- The integration of bioheat fuels is supported by growing environmental concerns over fossil fuel combustion, incentivizing utilities and end-users to adopt lower-emission heating solutions

- Increased acceptance of bioheat fuels in regulatory frameworks and inclusion in renewable energy mandates are accelerating its market uptake, especially in cold climate regions dependent on oil heating infrastructure

- The rise of programs encouraging bioheat blend standards (e.g., B5, B10) and voluntary carbon reduction commitments is driving broad-based adoption across residential, commercial, and industrial heating sectors

Bioheat Fuel Market Dynamics

Driver

Government Policies Promoting Low-Carbon Fuels

- Supportive government policies worldwide encouraging low-carbon fuel adoption are a critical demand driver for bioheat fuel, with incentives, mandates, and subsidies promoting biofuel blending in heating oil to reduce greenhouse gas emissions

- For instance, regulatory frameworks in the U.S., Canada, and parts of Europe mandate bioheat blending targets and support research funding and infrastructure development to facilitate market growth

- The revised biomass co-firing policies in countries such as India further encourage biofuel use, creating new demand streams for bioheat and boosting cleaner energy transitions in power and heating applications

- Carbon pricing mechanisms and emissions reduction targets stimulate investments from private and public sectors in bioheat technologies, increasing industry participation. Collaboration between agricultural sectors and biofuel producers aids feedstock supply chain stabilization, reinforcing reliable bioheat fuel production and distribution

- Growing focus on energy security and domestic renewable resource utilization motivates governments to integrate bioheat fuels into national clean energy strategies

Restraint/Challenge

High Production Costs and Supply Chain Limitations

- High costs associated with biodiesel feedstocks, complex production processes, and logistical challenges in maintaining bioheat fuel quality along supply chains hinder large-scale adoption and cost competitiveness versus conventional heating oil

- For instance, fluctuating prices for vegetable oils and waste feedstocks impact operational costs for bioheat fuel manufacturers, complicating price stability for end consumers

- Limited infrastructure and specialized blending facilities, especially outside of established markets, constrain availability and timely distribution of bioheat fuels to end users

- Variability in feedstock availability can affect continuous production, while maintaining compliance with regulatory standards requires costly quality control and certification processes. Cold climate handling issues and fuel storage stability pose technical and operational that necessitate additional investments in additives and supply chain management

- The balance between meeting renewable fuel standards and controlling production expenses requires ongoing technological innovation and supply chain optimization to reduce barriers for market expansion

Bioheat Fuel Market Scope

The market is segmented on the basis of blending ratio and end-use.

- By Blending Ratio

On the basis of blending ratio, the bioheat fuel market is segmented into up to 5%, 5% to 10%, and above 10%. The up to 5% blending ratio segment dominated the market revenue share of 62.5% in 2024, owing to its widespread adoption as an immediate and practical solution for reducing carbon emissions without requiring significant changes to existing heating systems. This segment benefits from established supply chains and regulatory incentives encouraging incremental blending, making it the preferred choice for many fuel distributors and end-users. Moreover, the lower blend ratios maintain compatibility with conventional heating oil infrastructure, ensuring ease of transition and minimal operational disruptions. Residential and commercial consumers often favor this blend for its balance between environmental benefits and cost-effectiveness. The steady demand reflects increasing awareness and governmental policies supporting gradual decarbonization.

The 5% to 10% blending ratio segment is anticipated to witness the fastest growth rate from 2025 to 2032. This growth is driven by rising environmental regulations and consumer preference for cleaner energy alternatives that offer more significant carbon reduction benefits compared to lower blends. Advances in biofuel production technology have made these blends more economically viable and accessible, encouraging wider adoption in both new and retrofit heating systems. Additionally, industry players are investing in improving fuel quality and compatibility, further accelerating acceptance. The segment’s growth is bolstered by commercial and industrial end-users seeking to meet sustainability targets and lower operational emissions while maintaining fuel performance and reliability.

- By End-Use

On the basis of end-use, the bioheat fuel market is segmented into residential, commercial, and industrial sectors. The residential segment held the largest market revenue share in 2024, primarily due to the extensive use of heating oil in households, especially in colder regions where reliable heating is critical. Homeowners are increasingly adopting bioheat fuels to reduce their carbon footprint and comply with local regulations promoting cleaner energy sources. The compatibility of bioheat blends with existing residential heating systems enables easy adoption without requiring costly equipment upgrades. Furthermore, government incentives and awareness campaigns have significantly contributed to expanding the residential consumer base for bioheat fuels. The demand is further supported by the growing emphasis on sustainable living and energy-efficient home heating solutions.

The commercial segment is expected to experience the fastest growth rate from 2025 to 2032, fueled by increasing sustainability commitments among businesses and the hospitality industry’s push for greener operations. Commercial buildings and facilities require consistent and scalable heating solutions, making bioheat fuels an attractive option to meet environmental standards while maintaining energy reliability. Additionally, the adoption of bioheat fuels in commercial settings is supported by evolving policies mandating emissions reduction in public and private infrastructures. The segment benefits from investments in large-scale bioheat supply chains and partnerships aimed at reducing carbon emissions across various industries. The growth also stems from enhanced awareness of operational cost savings and bioheat fuel social responsibility initiatives driving cleaner fuel use.

Bioheat Fuel Market Regional Analysis

- North America dominated the bioheat fuel market with the largest revenue share of 33.5% in 2024, driven by increasing regulatory focus on reducing carbon emissions and growing consumer preference for sustainable heating alternatives

- The region’s established heating oil infrastructure allows for easier integration of bioheat blends, supporting widespread adoption. Consumers and businesses alike value the environmental benefits and compatibility with existing systems, fostering steady market growth

- In addition, government incentives and programs encouraging the use of renewable fuels further boost demand. The presence of key biofuel producers and distribution networks strengthens North America’s leadership position in the market

U.S. Bioheat Fuel Market Insight

The U.S. Bioheat Fuel market captured the largest revenue share in North America in 2024, driven by federal and state policies aimed at lowering greenhouse gas emissions from heating systems. The expanding awareness among homeowners and commercial users about sustainable fuel options is accelerating adoption. The U.S. market benefits from established supply chains, increasing production capacity of bio-based fuels, and growing investments in renewable energy infrastructure. Moreover, regional mandates and incentives are encouraging higher blend ratios, supporting market expansion. The increasing emphasis on energy efficiency and cleaner heating solutions is also stimulating demand.

Europe Bioheat Fuel Market Insight

The Europe Bioheat Fuel market is projected to witness significant growth during the forecast period, propelled by stringent environmental regulations and the continent’s commitment to net-zero carbon targets. Countries across Europe are actively encouraging the adoption of bioheat fuels through subsidies and mandates, especially in colder regions with high heating demand. Increasing urbanization and the modernization of heating infrastructure support wider bioheat fuel integration. European consumers are drawn to bioheat for its ability to reduce carbon footprints without requiring major changes to existing systems. The commercial and residential sectors are key contributors to the region’s market growth.

U.K. Bioheat Fuel Market Insight

The U.K. Bioheat Fuel market is expected to grow at a notable CAGR due to rising awareness of sustainable heating options and government-led programs promoting cleaner fuel use. The shift towards reducing reliance on fossil fuels, combined with growing consumer interest in environmentally friendly energy solutions, is driving demand. The U.K.’s established heating oil market facilitates smooth adoption of bioheat blends, especially in residential settings. Additionally, commercial users are increasingly integrating bioheat fuels to meet sustainability goals. The growth is supported by incentives encouraging higher blend ratios and cleaner fuel standards.

Germany Bioheat Fuel Market Insight

Germany’s Bioheat Fuel market is anticipated to expand steadily, supported by strong environmental policies and a focus on renewable energy. The country’s leadership in energy transition and sustainability initiatives encourages bioheat adoption across residential, commercial, and industrial sectors. Germany’s advanced infrastructure and innovation-driven market environment favor the development and deployment of bioheat fuels. Increasing consumer preference for eco-friendly heating and growing commercial demand to comply with emissions regulations are key growth drivers. Integration with existing heating systems and the focus on energy efficiency enhance market potential.

Asia-Pacific Bioheat Fuel Market Insight

The Asia-Pacific Bioheat Fuel market is projected to grow at the fastest CAGR from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and increasing environmental awareness in countries such as China, Japan, and India. Government initiatives supporting clean energy transition and biofuel blending mandates are accelerating market penetration. The expanding industrial base and growing residential heating demand provide ample opportunities for bioheat fuels. Moreover, improvements in biofuel production technologies and increasing collaborations between regional players are enhancing supply capabilities. The region’s large population and rising energy needs make it a key growth hub for bioheat fuels.

Japan Bioheat Fuel Market Insight

Japan’s Bioheat Fuel market is gaining traction due to the country’s commitment to reducing carbon emissions and its technologically advanced energy sector. The aging population and urban concentration increase demand for reliable, clean heating solutions in residential and commercial spaces. Integration with smart energy management systems and government support for renewable energy accelerate adoption. Japan’s focus on innovation and sustainability positions it well to embrace higher blend ratios and advanced bioheat fuels.

China Bioheat Fuel Market Insight

China accounted for the largest market share in the Asia-Pacific region in 2024, driven by rapid industrialization, urbanization, and government policies promoting renewable energy and carbon neutrality goals. The country’s expanding middle class and increasing environmental consciousness are boosting demand for bioheat fuels in residential, commercial, and industrial segments. Domestic production capacity improvements and government incentives for blending biofuels with heating oil facilitate market growth. The focus on smart cities and cleaner energy infrastructure further supports bioheat fuel adoption across China.

Bioheat Fuel Market Share

The bioheat fuel industry is primarily led by well-established companies, including:

- Bourne’s Energy (U.S.)

- HERO BX (U.S.)

- Windsor Fuel (Canada)

- Chevron Renewable Energy Group (U.S.)

- Energo (U.S.)

- Densmore Oil Company (U.S.)

- Coan Oil (U.S.)

- Sound Oil (U.S.)

- Sprague Energy (U.S.)

- Genesee Energy (U.S.)

Latest Developments in Global Bioheat Fuel Market

- In 2024, Reese Marshall upgraded its bioheat fuel to B20, providing customers with a cleaner heating option. This upgrade significantly enhances the market appeal of Reese Marshall’s product by aligning with state-level incentives, such as the New York state tax credit of 20 cents per gallon for B20 heating oil purchased. This development strengthens the company’s competitive position by encouraging adoption through financial benefits while supporting statewide carbon emission reduction goals. The move also promotes greater awareness and acceptance of bioheat fuels in residential heating markets

- In 2023, New York-based residential fuel provider Petro Home Services announced the successful removal of 170,431 metric tons of carbon emissions through its Bioheat Fuel supply. This milestone demonstrates the tangible environmental impact of the company’s product and reinforces its market credibility. Since the inception of its Bioheat Fuel product, Petro Home Services has eliminated a total of 248,440 metric tons of carbon emissions, showcasing sustained contribution to cleaner energy efforts. This achievement bolsters customer confidence and strengthens Petro Home Services’ position in the bioheat fuel market by highlighting its role in advancing sustainability

- In 2023, Renewable Energy Group (REG) expanded its bioheat fuel production capacity by commissioning a new biodiesel refinery in Iowa. This expansion significantly increases the supply of sustainable bioheat fuels in the market, addressing growing demand from residential and commercial heating sectors. The enhanced production capability positions REG as a key player in meeting regional bioheat fuel needs while supporting national renewable energy goals. This development also enables the company to offer more competitive pricing and consistent supply, strengthening its market presence

- In 2022, the U.S. Department of Energy announced funding initiatives to support research and development of advanced bioheat fuels with lower carbon footprints. This governmental support drives innovation and accelerates the commercialization of next-generation bioheat products. The funding initiative improves market dynamics by encouraging manufacturers to invest in cleaner, more efficient fuel blends, fostering a competitive environment centered on sustainability. This push from the public sector is expected to expand bioheat fuel adoption and enhance its role in the transition to greener heating alternatives

- In 2022, Bioheat Fuel Association launched a nationwide awareness campaign to educate consumers and heating professionals about the environmental and economic benefits of bioheat fuels. This campaign has improved market acceptance by dispelling myths related to performance and cost, encouraging wider adoption in residential heating. By increasing knowledge and trust, the initiative supports growth in the bioheat fuel segment and strengthens collaboration between fuel suppliers, heating equipment manufacturers, and end users

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.