Global Biologics Virus Filtration Market

Market Size in USD Million

CAGR :

%

USD

2,316.72 Million

USD

5,082.85 Million

2024

2032

USD

2,316.72 Million

USD

5,082.85 Million

2024

2032

| 2025 –2032 | |

| USD 2,316.72 Million | |

| USD 5,082.85 Million | |

|

|

|

|

Biologics Virus Filtration Market Analysis

The Global Biologics Virus Filtration Market is driven by the rising prevalence of viral infections, such as HIV, which affects 37.7 million people globally, and the growing demand for biologic therapies such as monoclonal antibodies and vaccines. Stringent regulatory requirements and the need for safe blood products are boosting the adoption of virus filtration technologies. Additionally, the increasing use of gene and cell therapies further supports market growth, as these treatments require rigorous virus filtration during production to ensure safety and regulatory compliance.

Biologics Virus Filtration Market Size

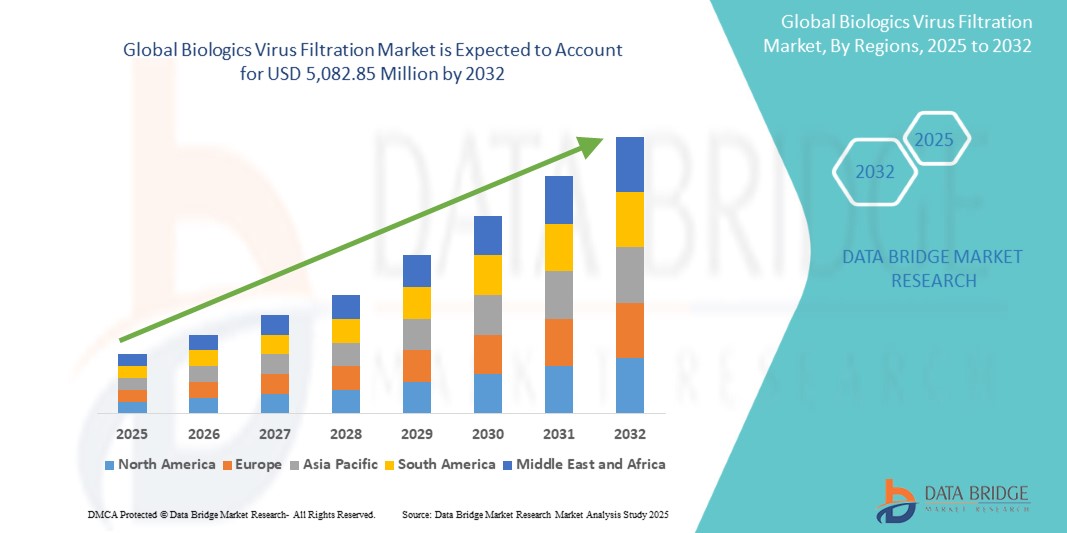

Global biologics virus filtration market size was valued at USD 2,316.72 million in 2024 and is projected to reach USD 5,082.85 million by 2032, with a CAGR of 10.32% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Biologics Virus Filtration Market Trends

“Rising Focus on Gene and Cell Therapies:”

The rise of personalized medicine and regenerative therapies is creating a shift in the global biologics virus filtration market. As gene and cell therapies become more prevalent, there is a growing focus on ensuring the safety and purity of these treatments. This has led to an increased emphasis on the development of tailored virus filtration solutions that are specifically designed to address the unique challenges of gene and cell therapy production. These therapies often involve complex biological processes that require higher levels of virus removal to avoid contamination and ensure patient safety. The growing complexity and specificity of gene and cell therapies have spurred the need for more advanced filtration technologies that can effectively handle these delicate and high-stakes treatments.

Report Scope and Biologics Virus Filtration Market Segmentation

|

Attributes |

Biologics Virus Filtration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America |

|

Key Market Players |

Merck KGaA (Germany), Sartorius AG (Germany), Danaher Corporation (U.S.), Fresenius Kabi AG (Germany), Charles River Laboratories International, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), GE Healthcare Life Sciences (U.S.), Lonza Group (Switzerland), Asahi Kasei Medical Co., Ltd. (Japan), Tecan Group Ltd. (Switzerland), Kraton Polymers LLC (U.S.), Thermo Fisher Scientific Inc. (U.S.), Mirus Bio LLC (U.S.), Abbott (U.S.), among others. |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Biologics Virus Filtration Market Definition

Biologics virus filtration is a process used in the biopharmaceutical industry to remove viruses and other potential viral contaminants from biologic products, such as vaccines, monoclonal antibodies, and gene therapies. This filtration technique utilizes specialized membrane filters or other filtration methods to ensure the safety and purity of biologics during production. The goal is to comply with stringent regulatory standards and prevent contamination that could pose risks to patient health, making it a critical step in the manufacturing of biologic therapies.

Biologics Virus Filtration Market Dynamics

Drivers

- Increasing Demand for Biologics

The increasing demand for biologic therapies, including monoclonal antibodies, vaccines, and gene therapies, has significantly heightened the need for effective virus filtration. Biologic products are complex and often derived from living organisms, making them vulnerable to contamination during the manufacturing process. As these therapies become more widely used in treating chronic diseases, cancers, and genetic disorders, ensuring their safety and purity is paramount. Virus filtration is a critical step in preventing the introduction of viral contaminants that could compromise product integrity and patient safety. For instance, vaccines and gene therapies, which involve viral vectors, are particularly susceptible to viral contamination, requiring advanced filtration methods to eliminate any potential risks. The growing reliance on biologics in modern medicine has led to stricter regulatory standards, pushing biopharmaceutical companies to adopt state-of-the-art virus filtration technologies to meet these requirements and protect public health. This trend is fueling the growth of the biologics virus filtration market. For instance, in 2024, according to an article published by RECIPHARM, the biologics market is rapidly growing and is expected to reach USD 900 billion by 2030. Given the sensitivity of biological actives, biopharmaceutical treatments require parenteral administration, which involves sterile filtration, aseptic processing, and sterile fill & finish for patient safety. This growth will drive demand for advanced filtration solutions, including virus filtration, to ensure the safety and efficacy of biologic products.

- Rising Prevalence of Infectious Diseases

The rising prevalence of infectious diseases, including viral outbreaks such as HIV, hepatitis, and emerging viruses, has heightened the demand for effective virus filtration in the production of biologic products. As these diseases continue to spread globally, there is an increasing need to ensure that biologic therapies, such as vaccines, plasma-derived products, and blood products, are free from viral contaminants that could pose serious health risks to patients. HIV alone affects millions worldwide, and the demand for safe, uncontaminated blood and plasma therapies has grown significantly. The process of virus filtration plays a crucial role in mitigating these risks by removing potential viral agents during the manufacturing process, thereby ensuring the safety and efficacy of these biologic products. Additionally, regulatory bodies have become more stringent in enforcing virus filtration protocols, pushing the biopharmaceutical industry to adopt advanced filtration technologies to comply with safety standards and protect public health. For instance, in April 2024, according to an article published by WHO, the Global Hepatitis Report indicates that viral hepatitis is the second leading cause of infectious death worldwide, with 1.3 million deaths annually, similar to tuberculosis. This rising burden of viral hepatitis will drive the demand for advanced virus filtration solutions to ensure the safety of blood products, vaccines, and therapies.

Opportunities

- Advancements in Filtration Technologies

Advancements in filtration technologies are creating significant opportunities in the biologics virus filtration market. Innovations such as the development of more efficient and cost-effective filtration membranes are improving the virus removal process, ensuring greater safety and purity of biologic products. These advanced filtration systems can remove viral contaminants more effectively, enhancing product quality while reducing operational costs for biopharmaceutical manufacturers. For instance, the introduction of novel, high-performance filters with increased throughput allows for faster and more efficient processing, enabling manufacturers to scale production without compromising safety. Additionally, these innovations help companies meet the growing regulatory demands for stringent virus removal, which is critical in the production of vaccines, monoclonal antibodies, and gene therapies. As the biopharmaceutical industry continues to evolve, these advanced filtration technologies will play a key role in improving overall production efficiency, ensuring patient safety, and supporting the growth of the biologics virus filtration market.

- Expansion of Cell and Gene Therapies

The rapid growth of cell and gene therapies is creating a significant opportunity for the biologics virus filtration market. These therapies, which often utilize viral vectors to deliver genetic material to cells, are increasingly being used to treat a variety of genetic disorders, cancers, and other diseases. However, the use of viral vectors also introduces the potential risk of viral contamination during the manufacturing process, making virus filtration an essential step in ensuring the safety and efficacy of these therapies. As the demand for personalized medicine and regenerative therapies rises, the need for advanced virus filtration solutions to remove any viral contaminants becomes even more critical. Biopharmaceutical companies will require cutting-edge filtration technologies to maintain the high standards of safety and purity required for gene and cell therapies. This growing need for reliable virus filtration solutions will continue to drive market growth, particularly as the adoption of these therapies accelerates globally.

Restraints/Challenges

- High Cost of Filtration Systems

The high cost of advanced virus filtration systems poses a significant restraint to the growth of the global biologics virus filtration market. These systems require substantial initial investments, as well as ongoing operational expenses related to maintenance, replacement of filtration membranes, and training of personnel. For small and medium-sized biopharmaceutical companies, these costs can be a major barrier, as they may lack the financial resources to implement such sophisticated technologies. This financial burden can limit their ability to adopt virus filtration solutions, potentially hindering their competitiveness in the market. Additionally, the expense of maintaining high-performance filtration systems, such as regular membrane replacements and system upgrades, can further strain the budgets of companies, particularly in emerging markets with less access to funding. As a result, the high cost associated with these filtration systems may slow down the adoption of necessary virus filtration technologies, impacting overall market growth. For instance, in December 2024, according to an article published by ScienceDirect, Virus filtration is a costly unit operation in biopharmaceutical downstream processing, with virus-retentive filters priced at USD2000–USD4000/m², significantly higher than fiber-type ultrafiltration modules costing USD200–USD900/m². This high cost acts as a restraint by increasing operational expenses, which could limit adoption, particularly for smaller companies and in cost-sensitive markets, potentially slowing the overall growth of the virus filtration market.

- Complexity of Virus Filtration in Gene and Cell Therapy Production

The complexity of virus filtration in the production of gene and cell therapies presents a significant challenge in the global biologics virus filtration market. These therapies often utilize viral vectors for gene delivery, which can vary widely in size, structure, and characteristics. Traditional virus filtration methods, which are typically designed for smaller, more uniform viruses, may not be effective in removing all types of viral contaminants associated with these diverse viral vectors. As a result, specialized filtration technologies are required to address the unique challenges posed by these complex vectors. Developing and validating these advanced filtration systems can be a time-consuming and costly process, requiring significant expertise and resources. This complexity creates an obstacle for manufacturers, particularly when scaling up production for gene and cell therapies, where maintaining high levels of safety and efficacy is critical. Overcoming these technical challenges is essential for ensuring the broader adoption of virus filtration in gene and cell therapy production. In March 2022, according to an article published by ScienceDirect, downstream processing of viral vectors in gene therapy faces significant challenges due to the limitations of current separation and purification technologies. Despite various purification methods, many existing processes have notable drawbacks. This will act as a challenge by hindering the efficiency and scalability of viral vector production, making it difficult to meet the growing demand for gene therapies while maintaining high purity and safety standards.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Biologics Virus Filtration Market Scope

The market is segmented on the basis of product type, virus type, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Filtration Systems

- Virus Filtration Reagents

- Virus Filtration Devices

Virus Type

- Enveloped Viruses

- Non-Enveloped Viruses

- RNA Viruses

- DNA Viruses

Application

- Biopharmaceutical Manufacturing

- Gene Therapy and Cell Therapy

- Blood and Blood Products

- Others

End User

- Biopharmaceutical Companies

- Research Laboratories

- Contract Research Organizations (CROs)

- Blood Banks and Plasma Centers

Biologics Virus Filtration Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product type, virus type, application, and end user as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America is expected to dominate the market owing to its robust healthcare infrastructure, which supports the widespread adoption of advanced medical and biopharmaceutical technologies. The region's high investment in biopharmaceutical research and development accelerates innovation, particularly in the areas of biologics and gene therapies, where virus filtration technologies are essential for ensuring product safety and efficacy.

Asia-Pacific is expected to be the fastest growing due to increasing healthcare investments, rapid growth in the biopharmaceutical industry, and expanding demand for biologics and vaccines in emerging economies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Biologics Virus Filtration Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Biologics Virus Filtration Market Leaders Operating in the Market Are:

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- Danaher Corporation (U.S.)

- Fresenius Kabi AG (Germany)

- Charles River Laboratories International, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- GE Healthcare Life Sciences (U.S.)

- Lonza Group (Switzerland)

- Asahi Kasei Medical Co., Ltd. (Japan)

- Tecan Group Ltd. (Switzerland)

- Kraton Polymers LLC (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Mirus Bio LLC (U.S.)

- Abbott (U.S.)

Latest Developments in Biologics Virus Filtration Market

- In October 2024, Asahi Kasei Medical has introduced the Planova FG1, a virus removal filter with higher flux, designed to accelerate virus filtration in biotherapeutic manufacturing and reduce the risk of virus breakthrough during process interruptions.This launch will benefit the company by offering a more efficient and reliable filtration solution, enhancing production efficiency, and addressing key concerns in the biotherapeutics industry, which can improve market positioning and customer satisfaction.

- In May 2024, Asahi Kasei Medical Co., Ltd. Is expected to launch the 4.0 m² Planova™ S20N virus removal filters, made from next-generation regenerated cellulose, in July 2024.This innovation will help the company by enhancing its product portfolio with more efficient virus filtration solutions, meeting the growing demand for biologic safety and compliance, and strengthening its competitive position in the biologics market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.