Global Biomarker Driven Targeted Drug Market

Market Size in USD Billion

CAGR :

%

USD

12.63 Billion

USD

33.10 Billion

2025

2033

USD

12.63 Billion

USD

33.10 Billion

2025

2033

| 2026 –2033 | |

| USD 12.63 Billion | |

| USD 33.10 Billion | |

|

|

|

|

Biomarker-Driven Targeted Drug Market Size

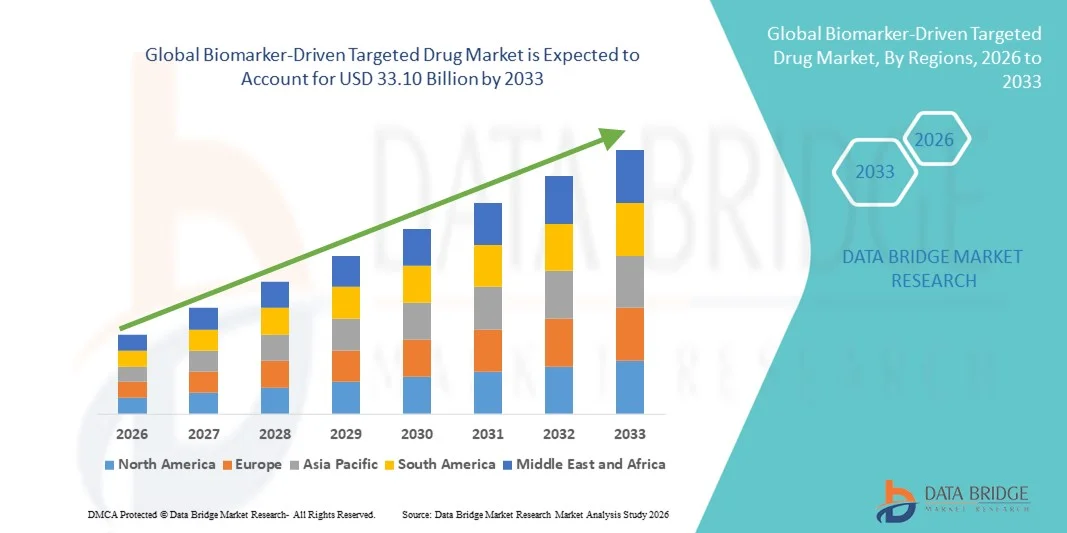

- The global biomarker-driven targeted drug market size was valued at USD 12.63 billion in 2025 and is expected to reach USD 33.10 billion by 2033, at a CAGR of 12.80% during the forecast period

- The market growth is largely fueled by the increasing integration of precision medicine approaches, rapid advancements in molecular diagnostics, and expanding use of companion diagnostics in oncology and other chronic diseases, leading to more personalized and effective therapeutic interventions

- Furthermore, rising demand for targeted therapies with improved efficacy and reduced adverse effects, along with continuous innovation in genomic profiling and biomarker identification, is positioning biomarker-driven drugs as the preferred treatment strategy across multiple disease indications. These converging factors are accelerating the adoption of precision-targeted treatments, thereby significantly boosting the industry’s growth

Biomarker-Driven Targeted Drug Market Analysis

- Biomarker-driven targeted drugs, designed to selectively act on specific molecular pathways identified through genetic, proteomic, or other biomarker testing, are increasingly critical components of modern precision medicine across oncology and other chronic disease areas due to their enhanced therapeutic efficacy, reduced systemic toxicity, and ability to deliver personalized treatment outcomes

- The escalating demand for biomarker-driven targeted therapies is primarily fueled by the growing adoption of companion diagnostics, expanding applications of genomic profiling, rising prevalence of cancer and complex chronic disorders, and a strong industry shift toward personalized and value-based healthcare models

- North America dominated the biomarker-driven targeted drug market with the largest revenue share of 38.5% in 2025, characterized by advanced healthcare infrastructure, significant R&D investments, favorable reimbursement frameworks, and a strong presence of leading pharmaceutical and biotechnology companies, with the U.S. experiencing substantial growth in precision oncology drug approvals and biomarker-based clinical trials driven by continuous innovation in molecular diagnostics

- Asia-Pacific is expected to be the fastest growing region in the biomarker-driven targeted drug market during the forecast period due to expanding healthcare access, increasing investments in precision medicine initiatives, and rising awareness regarding early disease detection and targeted treatment strategies

- Oncology segment dominated the biomarker-driven targeted drug market with a share of 52.3% in 2025, driven by the high prevalence of cancer globally, expanding pipeline of targeted biologics and small molecule inhibitors, and the growing integration of biomarker testing into routine cancer care pathways

Report Scope and Biomarker-Driven Targeted Drug Market Segmentation

|

Attributes |

Biomarker-Driven Targeted Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Biomarker-Driven Targeted Drug Market Trends

Advancement of Precision Oncology Through Companion Diagnostics and Genomic Profiling

- A significant and accelerating trend in the global biomarker-driven targeted drug market is the deepening integration of advanced genomic sequencing, real-world data analytics, and companion diagnostics into routine clinical decision-making across oncology and other chronic diseases. This convergence of technologies is significantly enhancing treatment precision and patient stratification

- For instance, multiple targeted oncology therapies now require FDA-approved companion diagnostic tests to identify specific genetic mutations before initiation of treatment. Similarly, next-generation sequencing panels are increasingly used in hospitals to guide therapy selection based on actionable biomarkers

- The integration of molecular profiling enables identification of specific mutations such as EGFR, HER2, and BRAF, allowing clinicians to match patients with highly targeted therapies while minimizing unnecessary exposure to ineffective treatments. Furthermore, biomarker-driven approaches improve clinical trial efficiency by enrolling well-defined patient populations with higher response probabilities

- The seamless alignment of targeted drug development with diagnostic innovation facilitates a more coordinated precision medicine ecosystem. Through integrated platforms, healthcare providers can combine genomic insights, therapeutic selection, and response monitoring into a unified care pathway, creating a more personalized treatment experience

- This trend toward increasingly individualized and biomarker-guided therapeutic strategies is fundamentally reshaping drug development models and regulatory pathways. Consequently, leading pharmaceutical and biotechnology companies are investing heavily in co-development strategies that align targeted therapies with validated biomarker tests

- The demand for therapies supported by strong biomarker evidence is growing rapidly across both developed and emerging markets, as healthcare systems increasingly prioritize clinical efficacy, improved survival outcomes, and cost-effective personalized care

Biomarker-Driven Targeted Drug Market Dynamics

Driver

Rising Prevalence of Cancer and Shift Toward Personalized Medicine

- The increasing global burden of cancer and complex chronic diseases, coupled with the accelerating transition toward personalized healthcare models, is a significant driver for the heightened demand for biomarker-driven targeted drugs

- For instance, regulatory agencies have expanded approvals for targeted therapies linked to specific molecular alterations, encouraging pharmaceutical companies to prioritize biomarker-based drug development strategies. Such initiatives by key stakeholders are expected to drive market growth during the forecast period

- As clinicians seek more effective and less toxic alternatives to conventional chemotherapy, biomarker-driven drugs offer improved therapeutic precision, better response rates, and reduced adverse effects, providing a compelling advancement over traditional treatment approaches

- Furthermore, the growing adoption of companion diagnostics and reimbursement support for molecular testing are making biomarker-guided therapy an integral component of standard clinical practice across major healthcare markets

- The ability to tailor treatment based on individual genetic profiles, monitor therapeutic response, and optimize dosing strategies are key factors propelling the adoption of targeted drugs across oncology and other therapeutic areas. The expansion of precision medicine research programs and public-private partnerships further contributes to market expansion

- Growing investment in oncology research pipelines and accelerated clinical trial programs for targeted biologics and small molecule inhibitors are further strengthening the commercial landscape and expanding therapeutic indication

- Increasing patient awareness regarding personalized treatment options and improved diagnostic accessibility is also contributing to higher demand for biomarker-driven therapeutic interventions globally

Restraint/Challenge

High Development Costs and Regulatory Complexity

- Concerns surrounding the high cost of targeted drug development, complex clinical validation processes, and stringent regulatory requirements pose a significant challenge to broader market expansion. As biomarker-driven therapies require simultaneous validation of both drug and diagnostic components, development timelines can be prolonged and capital intensive

- For instance, delays in companion diagnostic approvals or inconsistencies in biomarker standardization across regions can hinder timely commercialization of targeted therapies

- Addressing these challenges through harmonized regulatory frameworks, improved biomarker validation standards, and collaborative research models is crucial for sustaining innovation. In addition, the high cost of targeted biologics compared to conventional therapies can be a barrier to accessibility, particularly in low- and middle-income countries

- While pricing pressures and patent expirations may gradually improve affordability, reimbursement uncertainties and healthcare budget constraints can still limit widespread adoption, especially in cost-sensitive healthcare systems

- Overcoming these challenges through strategic partnerships, value-based pricing models, and expanded global access programs will be vital for sustained market growth in the biomarker-driven targeted drug industry

- Limited availability of standardized biomarker testing infrastructure in developing regions may restrict patient identification and delay timely initiation of targeted therapies

- Furthermore, tumor heterogeneity and evolving resistance mechanisms can reduce long-term treatment effectiveness, necessitating continuous innovation and combination therapy strategies to maintain clinical benefits

Biomarker-Driven Targeted Drug Market Scope

The market is segmented on the basis of biomarker type, therapy type, indication, and end user.

- By Biomarker Type

On the basis of biomarker type, the global biomarker-driven targeted drug market is segmented into genomic biomarkers, proteomic biomarkers, metabolomic biomarkers, epigenetic biomarkers, and others. The genomic biomarkers segment dominated the market with the largest revenue share in 2025, driven by the widespread adoption of next-generation sequencing and mutation profiling in precision oncology. Genomic alterations such as EGFR, BRCA, KRAS, and HER2 are routinely used to guide therapy decisions, particularly in cancer treatment. The strong clinical validation of DNA-based biomarkers and their integration into companion diagnostics have strengthened their commercial viability. Pharmaceutical companies increasingly prioritize genomic targets in drug development pipelines due to high predictability and regulatory acceptance. The availability of advanced sequencing technologies and reimbursement support in developed markets further supports this segment’s leadership.

The epigenetic biomarkers segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by expanding research into gene expression regulation and tumor microenvironment dynamics. Epigenetic modifications such as DNA methylation and histone alterations are gaining recognition as actionable therapeutic targets. Advances in liquid biopsy and non-invasive testing technologies are accelerating adoption in early disease detection and monitoring. Growing interest in reversible epigenetic changes offers new opportunities for innovative targeted therapies. Increasing R&D investments in precision medicine and multi-omics integration further contribute to the rapid expansion of this segment.

- By Therapy Type

On the basis of therapy type, the market is segmented into monoclonal antibodies, small molecule inhibitors, antibody-drug conjugates, bispecific antibodies, gene-targeted therapies, and others. The monoclonal antibodies segment dominated the market with the largest revenue share in 2025, driven by their high specificity, proven clinical efficacy, and widespread regulatory approvals across oncology and autoimmune diseases. These biologics target extracellular proteins and receptors with precision, reducing off-target toxicity. Strong pipeline expansion and continuous innovation in antibody engineering have reinforced their market presence. Established manufacturing capabilities and physician familiarity further enhance adoption. In addition, their compatibility with biomarker-based patient stratification supports sustained demand.

The antibody-drug conjugates (ADCs) segment is expected to witness the fastest CAGR from 2026 to 2033, driven by their ability to combine targeted antibody precision with potent cytotoxic agents. ADCs deliver chemotherapy directly to cancer cells, minimizing systemic exposure and improving therapeutic outcomes. Growing approvals of next-generation ADCs in breast and hematologic cancers are accelerating clinical acceptance. Technological advancements in linker chemistry and payload optimization are improving safety profiles. Expanding clinical trials across multiple tumor types further support strong future growth prospects.

- By Indication

On the basis of indication, the market is segmented into oncology, cardiovascular diseases, neurological disorders, autoimmune & inflammatory diseases, infectious diseases, and others. The oncology segment dominated the market with the largest revenue share of 52.3% in 2025, driven by the high global burden of cancer and the extensive availability of biomarker-guided targeted therapies. Precision oncology relies heavily on genetic and molecular profiling to tailor treatment strategies. Increasing FDA approvals of targeted biologics and small molecule inhibitors have strengthened this segment. Integration of companion diagnostics into routine cancer care enhances treatment accuracy. Strong R&D pipelines and public-private funding initiatives further reinforce oncology’s dominance.

The neurological disorders segment is projected to witness the fastest growth rate from 2026 to 2033, fueled by emerging biomarker research in conditions such as Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis. Advances in neurogenomics and protein-based biomarkers are opening new avenues for targeted drug development. Increasing awareness of early diagnosis and personalized interventions supports demand. Pharmaceutical companies are investing in precision neurology to address unmet clinical needs. Growing clinical trials and biomarker validation studies are expected to accelerate future segment expansion.

- By End User

On the basis of end user, the market is segmented into pharmaceutical & biotechnology companies, hospitals & clinics, diagnostic laboratories, and academic & research institutes. The pharmaceutical & biotechnology companies segment dominated the market with the largest revenue share in 2025, driven by extensive investments in targeted drug development and biomarker validation programs. These companies lead clinical trials, regulatory submissions, and commercialization of precision therapies. Strong collaboration with diagnostic firms for companion test development strengthens their market position. Increasing focus on pipeline diversification and strategic partnerships further supports dominance. Continuous innovation and global expansion strategies enhance revenue generation.

The diagnostic laboratories segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for biomarker testing and companion diagnostics. Expansion of next-generation sequencing services and liquid biopsy platforms supports higher testing volumes. Growing physician reliance on molecular diagnostics for treatment decisions strengthens this segment’s role. Increased reimbursement coverage and improved laboratory automation further accelerate adoption. As precision medicine becomes standard practice, diagnostic laboratories are expected to play a critical role in sustaining market growth.

Biomarker-Driven Targeted Drug Market Regional Analysis

- North America dominated the biomarker-driven targeted drug market with the largest revenue share of 38.5% in 2025, characterized by advanced healthcare infrastructure, significant R&D investments, favorable reimbursement frameworks, and a strong presence of leading pharmaceutical and biotechnology companies

- Healthcare providers in the region highly prioritize personalized treatment approaches, clinical trial innovation, and the integration of companion diagnostics with targeted drugs to improve patient outcomes and optimize therapeutic decision-making

- This widespread adoption is further supported by favorable reimbursement frameworks, a robust biotechnology ecosystem, strong regulatory support for biomarker-based drug approvals, and the growing emphasis on value-based healthcare models, establishing biomarker-driven therapies as a preferred strategy across major therapeutic areas

U.S. Biomarker-Driven Targeted Drug Market Insight

The U.S. biomarker-driven targeted drug market captured the largest revenue share within North America in 2025, fueled by rapid advancements in precision oncology and strong regulatory support for companion diagnostics. Healthcare providers increasingly prioritize molecular profiling and targeted therapies to enhance clinical outcomes and minimize adverse effects. The growing number of biomarker-based drug approvals, combined with substantial investments in biotechnology research and clinical trials, further propels the industry. Moreover, the integration of next-generation sequencing platforms and reimbursement support for genomic testing is significantly contributing to market expansion.

Europe Biomarker-Driven Targeted Drug Market Insight

The Europe biomarker-driven targeted drug market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing emphasis on personalized medicine and supportive regulatory frameworks for innovative therapies. Rising cancer prevalence, coupled with strong public healthcare systems, is fostering adoption of biomarker-guided treatments. European healthcare providers are also focused on improving treatment efficiency and cost-effectiveness through precision diagnostics. The region is witnessing steady growth across oncology, autoimmune, and rare disease indications, with targeted therapies being incorporated into both established treatment guidelines and new therapeutic protocols.

U.K. Biomarker-Driven Targeted Drug Market Insight

The U.K. biomarker-driven targeted drug market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding genomic medicine initiatives and increasing investments in oncology research. In addition, the focus on early disease detection and personalized therapeutic pathways is encouraging hospitals and research institutions to adopt biomarker-based treatments. The country’s strong clinical trial ecosystem and collaboration between academia and biotechnology firms are expected to continue stimulating market growth.

Germany Biomarker-Driven Targeted Drug Market Insight

The Germany biomarker-driven targeted drug market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure and high adoption of molecular diagnostics. Germany’s emphasis on innovation, research funding, and precision medicine strategies promotes the development and use of biomarker-targeted therapies, particularly in oncology and chronic disease management. The integration of targeted drugs with validated diagnostic platforms is becoming increasingly prevalent, aligning with the country’s focus on evidence-based and high-quality healthcare delivery.

Asia-Pacific Biomarker-Driven Targeted Drug Market Insight

The Asia-Pacific biomarker-driven targeted drug market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing healthcare expenditure, expanding access to molecular diagnostics, and rising cancer incidence in countries such as China, Japan, and India. The region's growing commitment to precision medicine initiatives, supported by government healthcare reforms and biotechnology investments, is accelerating adoption. Furthermore, as Asia-Pacific strengthens its pharmaceutical manufacturing and clinical research capabilities, access to innovative targeted therapies is expanding across diverse patient populations.

Japan Biomarker-Driven Targeted Drug Market Insight

The Japan biomarker-driven targeted drug market is gaining momentum due to the country’s advanced medical research capabilities, aging population, and strong focus on innovative cancer therapies. The Japanese healthcare system places significant emphasis on precision diagnostics, and adoption of targeted drugs is supported by increasing biomarker validation studies. Integration of genomic testing with hospital-based treatment pathways is fueling growth. Moreover, Japan’s regulatory support for innovative biologics is expected to stimulate continued market expansion in both oncology and rare disease segments.

India Biomarker-Driven Targeted Drug Market Insight

The India biomarker-driven targeted drug market accounted for a significant revenue share in Asia Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, rising cancer burden, and growing awareness of personalized medicine. India is emerging as a key market for precision oncology therapies, with increasing availability of molecular diagnostic laboratories and targeted treatment options. Government initiatives promoting advanced healthcare access and the presence of domestic pharmaceutical manufacturers are key factors propelling the market. In addition, expanding clinical research activities and collaborations with global biotechnology firms are supporting sustained growth in India.

Biomarker-Driven Targeted Drug Market Share

The Biomarker-Driven Targeted Drug industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- AstraZeneca plc (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Gilead Sciences, Inc. (U.S.)

- GSK plc (U.K.)

- Takeda Pharmaceutical Company Limited (Japan)

- Sanofi (France)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Biogen Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Netherlands)

- Bio-Rad Laboratories, Inc. (U.S.)

What are the Recent Developments in Global Biomarker-Driven Targeted Drug Market?

- In August 2025, Thermo Fisher Scientific received FDA approval for the Oncomine Dx Target Test as a companion diagnostic to identify patients eligible for the HER2-targeted therapy HERNEXEOS (zongertinib) in unresectable or metastatic non-small cell lung cancer (NSCLC), marking an important biomarker-guided precision therapy milestone

- In April 2025, the U.S. Food and Drug Administration granted approval to penpulimab-kcqx, a PD-1 targeted monoclonal antibody, in combination with chemotherapy as a first-line treatment for adults with recurrent or metastatic non-keratinizing nasopharyngeal carcinoma, expanding biomarker-driven immunotherapy options in oncology

- In May 2025, the U.S. Food and Drug Administration approved belzutifan (Welireg) as the first oral therapy for adults and pediatric patients aged 12 and older with locally advanced, unresectable, or metastatic pheochromocytoma or paraganglioma, marking a major milestone for HIF-2α inhibitor targeted therapy in rare tumor types

- In November 2024, Caris Life Sciences announced FDA approval of MI Cancer Seek™ as a companion diagnostic test, the first simultaneous whole-exome and whole-transcriptome sequencing assay to guide biomarker-based targeted therapies across multiple tumor types

- In August 2024, the U.S. FDA approved Illumina’s TruSight Oncology Comprehensive cancer biomarker test with two companion diagnostic indications, enabling genomic profiling across 500+ genes to match patients with targeted therapies more efficiently

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.