Global Biometrics In Government Market

Market Size in USD Billion

CAGR :

%

USD

33.24 Billion

USD

99.58 Billion

2024

2032

USD

33.24 Billion

USD

99.58 Billion

2024

2032

| 2025 –2032 | |

| USD 33.24 Billion | |

| USD 99.58 Billion | |

|

|

|

|

Biometrics in Government Market Size

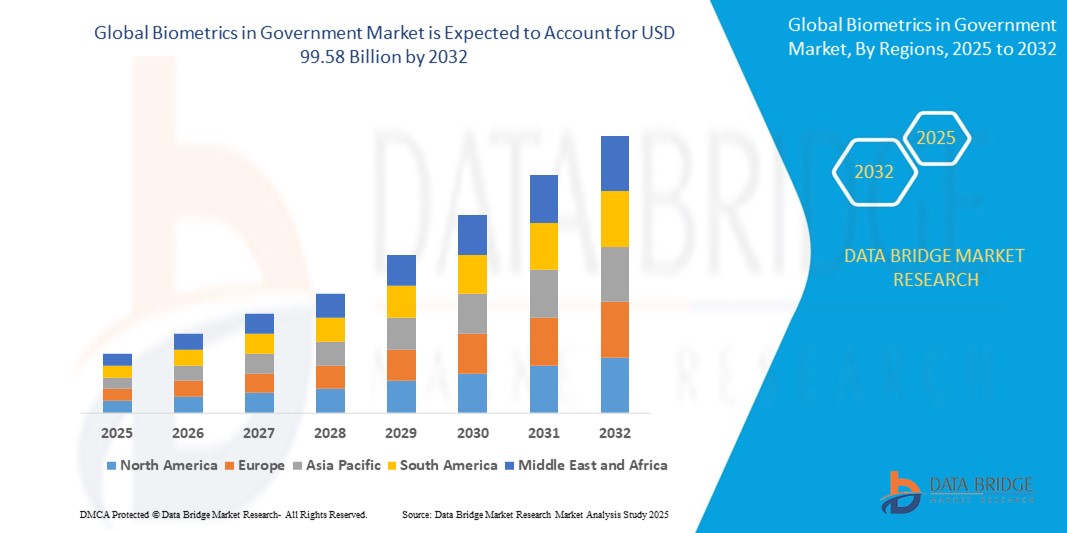

- The global biometrics in government market size was valued at USD 33.24 billion in 2024 and is expected to reach USD 99.58 billion by 2032, at a CAGR of 14.7% during the forecast period

- The market growth is primarily driven by the increasing adoption of advanced security technologies, rising government initiatives for digital identity management, and the need for enhanced public safety and border control measures

- Growing concerns over identity fraud, terrorism, and the demand for seamless, secure authentication solutions in government applications are accelerating the adoption of biometric systems, significantly boosting industry growth

Biometrics in Government Market Analysis

- Biometric systems, leveraging unique physiological and behavioral characteristics for identity verification, are critical components of modern government security frameworks, offering enhanced accuracy, scalability, and integration with digital infrastructure for applications such as border control, voter registration, and national ID programs

- The surge in demand for biometrics is fueled by increasing government investments in secure identity management, rising threats to national security, and the need for efficient, automated authentication processes

- North America dominated the biometrics in government market with the largest revenue share of 40.01% in 2024, driven by early adoption of biometric technologies, substantial government funding, and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid digitization, increasing government initiatives for national ID programs, and rising investments in smart city projects

- The standard connectors segment dominated the largest market revenue share of 32.5% in 2024, driven by their widespread adoption in government applications due to their reliability, compatibility, and cost-effectiveness in biometric systems deployment

Report Scope and Biometrics in Government Market Segmentation

|

Attributes |

Biometrics in Government Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Biometrics in Government Market Trends

“Increasing Integration of AI and Machine Learning”

- The biometrics in government market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies

- These technologies enable advanced data processing and analysis, providing deeper insights into identity verification, fraud detection, and security threat assessment

- AI-powered biometric systems allow for proactive identification of potential security risks, enhancing the efficiency of applications such as border control and national ID programs

- For instance, companies are developing AI-driven platforms that analyze biometric data, such as facial recognition patterns, to improve accuracy in real-time surveillance and authentication processes

- This trend is increasing the reliability and appeal of biometric systems for government agencies, particularly in law enforcement and e-passport applications

- AI algorithms can analyze multiple biometric traits, including fingerprint, iris, and voice patterns, to enhance multimodal authentication systems, reducing false positives and improving security

Biometrics in Government Market Dynamics

Driver

“Rising Demand for Enhanced Security and Identity Verification”

- The increasing need for secure identification and authentication in government applications, such as border control, voter registration, and national ID systems, is a major driver for the biometrics in government market

- Biometric systems enhance security by providing features such as automated identity verification, fraud prevention, and real-time monitoring for public safety

- Government mandates, particularly in regions such as North America and Europe, are promoting the adoption of biometric technologies to strengthen national security and streamline administrative processes

- The proliferation of IoT and advancements in 5G technology are enabling faster data transmission and lower latency, supporting sophisticated biometric applications such as real-time facial recognition at airports

- Governments are increasingly integrating biometric systems into e-passports, e-visas, and other civil applications to meet global security standards and enhance citizen services

Restraint/Challenge

“High Implementation Costs and Data Privacy Concerns”

- The significant initial investment required for biometric hardware, software, and system integration can be a barrier to adoption, particularly in emerging markets within the Asia-Pacific region

- Integrating biometric systems into existing government infrastructure can be complex and costly, requiring specialized equipment and expertise

- Data security and privacy concerns are a major challenge, as biometric systems collect and store sensitive personal data, raising risks of breaches, misuse, or non-compliance with data protection regulations

- The fragmented regulatory landscape across countries regarding biometric data collection, storage, and usage complicates operations for global service providers and government agencies

- These factors may deter adoption in regions with high cost sensitivity or strong data privacy awareness, potentially limiting market growth in certain applications such as healthcare and welfare

Biometrics in Government market Scope

The market is segmented on the basis of product, mode, components, type, authentication, end user, and application.

- By Product

On the basis of product, the global biometrics in government market is segmented into standard connectors, lucent connectors, ferrule connectors, straight tip, multiple-fiber push-on/pull-off, and others. The Standard Connectors segment dominated the largest market revenue share of 32.5% in 2024, driven by their widespread adoption in government applications due to their reliability, compatibility, and cost-effectiveness in biometric systems deployment.

The multiple-fiber push-on/pull-off segment is expected to witness the fastest growth rate of 16.8% from 2025 to 2032, fueled by increasing demand for high-speed, scalable connectivity solutions in advanced biometric systems, particularly for large-scale government projects such as national ID and border control.

- By Mode

On the basis of mode, the global biometrics in government market is segmented into fingerprint recognition, face recognition, iris recognition, palmprint recognition, vein recognition, signature recognition, voice recognition, and others. The fingerprint recognition segment dominated the market with a revenue share of 38.7% in 2024, owing to its high speed of detection, cost-effectiveness, and widespread use in law enforcement and national ID programs.

The face recognition segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by rising adoption of contactless biometric solutions, advancements in AI-powered facial recognition technologies, and increasing use in public safety and border control applications.

- By Components

On the basis of components, the global biometrics in government market is segmented into hardware and software. The hardware segment accounted for the largest market revenue share of 60.2% in 2024, driven by the high revenue generated from biometric devices such as scanners, cameras, and sensors deployed in government systems.

The software segment is expected to witness significant growth from 2025 to 2032, propelled by the increasing need for advanced algorithms, AI integration, and cloud-based biometric solutions to enhance system efficiency and scalability.

- By Type

On the basis of type, the global biometrics in government market is segmented into contactless, contact-based, and hybrid/multimodal. The contactless segment held the largest market revenue share of 45.3% in 2024, driven by consumer and government preference for hygienic, high-tech security solutions, particularly post-COVID-19, with technologies such as face and iris recognition leading the segment.

The hybrid/multimodal segment is anticipated to grow rapidly from 2025 to 2032, as governments increasingly adopt multi-factor biometric systems combining fingerprint, face, and iris recognition for enhanced security in applications such as e-passports and national IDs.

- By Authentication

On the basis of authentication, the global biometrics in government market is segmented into single factor authentication and multiple factor authentication. The single factor authentication segment dominated with a revenue share of 62.4% in 2024, due to its simplicity, accessibility, and widespread use in applications such as voter registration and civil identification.

The multiple factor authentication segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for enhanced security in sensitive government applications such as military and law enforcement, where combining biometrics with other verification methods reduces vulnerabilities.

- By End User

On the basis of end user, the global biometrics in government market is segmented into civil, military, law enforcement, e-passport, e-visas, commercial, healthcare and welfare, and others. The law enforcement segment held the largest market revenue share of 36.8% in 2024, driven by the extensive use of biometrics for criminal identification, surveillance, and public safety applications such as latent fingerprint matching.

The healthcare and welfare segment is expected to experience robust growth from 2025 to 2032, fueled by the increasing adoption of biometrics for patient identification and secure access to medical records, reducing fraud and enhancing operational efficiency in government healthcare systems.

- By Application

On the basis of application, the global biometrics in government market is segmented into border control, public safety, voter registration, latent fingerprint matching, and national id. The border Control segment dominated with a revenue share of 34.6% in 2024, driven by the global adoption of biometric systems such as e-passports and automated border control gates for enhanced security and faster processing.

The national ID segment is anticipated to witness the fastest growth from 2025 to 2032, propelled by government initiatives in developing nations to implement biometric-based national identification systems for improved citizen authentication and service delivery.

Biometrics in Government Market Regional Analysis

- North America dominated the biometrics in government market with the largest revenue share of 40.01% in 2024, driven by early adoption of biometric technologies, substantial government funding, and a strong presence of key industry players

- Consumers and agencies prioritize biometric systems for enhanced security, identity verification, and fraud prevention, particularly in regions with high security concerns

- Growth is supported by advancements in biometric technologies, including facial recognition and iris scanning, alongside increasing integration in both civil and military applications

U.S. Biometrics in Government Market Insight

The U.S. biometrics in government market captured the largest revenue share of 76.9% in 2024 within North America, fueled by strong demand for secure identity verification systems and growing government initiatives for public safety. The trend towards multimodal biometric systems and increasing regulations promoting secure authentication standards further boost market expansion. Government agencies’ incorporation of biometric solutions in e-passports and national ID systems complements adoption in law enforcement, creating a robust product ecosystem.

Europe Biometrics in Government Market Insight

The Europe biometrics in government market is expected to witness significant growth, supported by regulatory emphasis on secure identification and data protection. Agencies seek biometric systems that enhance security while complying with privacy standards such as GDPR. The growth is prominent in both new system deployments and upgrades of existing infrastructure, with countries such as Germany and France showing significant uptake due to rising security concerns and urban surveillance needs.

U.K. Biometrics in Government Market Insight

The U.K. market for biometrics in government is expected to witness rapid growth, driven by demand for enhanced public safety and identity verification in urban and border settings. Increased interest in advanced biometric technologies, such as facial and iris recognition, and rising awareness of fraud prevention benefits encourage adoption. Evolving regulations balancing security and privacy influence system choices, promoting compliance with secure authentication standards.

Germany Biometrics in Government Market Insight

Germany is expected to witness rapid growth in the biometrics in government market, attributed to its advanced technological sector and high focus on security and efficiency. German agencies prefer technologically advanced biometric systems, such as multimodal authentication, that enhance security and streamline processes. The integration of these systems in e-passports, national ID programs, and law enforcement applications supports sustained market growth.

Asia-Pacific Biometrics in Government Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding government initiatives and rising adoption in countries such as China, India, and Japan. Increasing awareness of secure identification, fraud prevention, and public safety is boosting demand. Government programs promoting digital identity, such as India’s Aadhaar initiative, and investments in smart city projects further encourage the use of advanced biometric systems.

Japan Biometrics in Government Market Insight

Japan’s biometrics in government market is expected to witness rapid growth due to strong government preference for high-quality, technologically advanced biometric systems that enhance security and operational efficiency. The presence of major technology providers such as NEC Corporation and Fujitsu, along with integration in e-passports and border control systems, accelerates market penetration. Rising interest in public safety applications also contributes to growth.

China Biometrics in Government Market Insight

China holds the largest share of the Asia-Pacific biometrics in government market, propelled by rapid digitalization, increasing government surveillance programs, and growing demand for secure identity verification solutions. The country’s focus on smart cities and large-scale biometric projects, such as facial recognition cameras, supports the adoption of advanced systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Biometrics in Government Market Share

The biometrics in government industry is primarily led by well-established companies, including:

- Aware, Inc. (U.S.)

- BioEnable Technologies Pvt. Ltd (India)

- BIO-key International (U.S.)

- NEC Corporation (Japan)

- DERMALOG JENETRIC GmbH (Germany)

- Innovatrics (Slovakia)

- IDEMIA (France)

- 1d3 Technologies (France)

- Safran (France)

- NEC Corporation India Private Limited (India)

- Precise Biometrics (Sweden)

- secunet Security Networks AG (Germany)

What are the Recent Developments in Global Biometrics in Government Market?

- In April 2025, Anonybit and Fingerprint Cards AB (FPC) partnered with Ping Identity’s PingOne DaVinci, a no-code identity orchestration platform, to deliver multi-modal biometric authentication for enterprises and government agencies. This integration supports biometric modalities such as face, voice, iris, and palm, offering a privacy-first, decentralized architecture that eliminates centralized data storage and reduces breach risks. Designed for scalability and rapid deployment, the solution enables passwordless authentication across diverse environments, including shared devices and hybrid workforces. The collaboration reflects a growing trend toward secure, integrated identity management in response to rising credential-based cyber threats

- In March 2025, Iris ID, Inc. introduced the IrisAccess iA1000, a next-gen multimodal biometric access control reader that combines iris and facial recognition for enhanced identity verification. Designed to meet diverse operational needs, the iA1000 is available in two configurations to suit varying security levels and budgets. It features concurrent iris-face capture, a touchscreen interface, and supports mobile credentials, making it ideal for high-security environments such as government facilities. This launch underscores Iris ID’s commitment to delivering advanced, privacy-preserving authentication solutions for modern access control systems.

- In February 2025, Incode Technologies Inc. advanced its cloud-based biometric solutions, offering enhanced scalability, cost-effectiveness, and streamlined deployment. These improvements cater to the growing needs of enterprises and government agencies seeking flexible, remote-access authentication for initiatives such as national ID programs, e-passports, and digital public services. By leveraging AI-driven identity verification and biometric authentication, Incode enables secure, frictionless access across distributed environments. The company’s innovations support rapid onboarding, compliance with global privacy standards, and improved operational efficiency—making it a preferred choice for large-scale identity management

- In November 2024, NEC Corporation unveiled a breakthrough in multimodal biometric authentication, enabling simultaneous facial and iris recognition from a single camera image. This innovation allows accurate iris verification even from low-resolution, noisy images typically captured by facial recognition cameras—eliminating the need for specialized iris hardware. The compact solution supports rapid, high-precision authentication across diverse environments, including government surveillance and identity verification systems. By enhancing biometric capabilities without additional infrastructure, NEC’s technology marks a significant step toward scalable, secure, and cost-effective identity managemen

- In April 2024, Amadeus IT Group S.A. finalized its acquisition of Vision-Box, a global leader in biometric technologies for airports, airlines, and border control. This strategic move enhances Amadeus’s capabilities in seamless passenger processing, integrating Vision-Box’s advanced biometric hardware and software into its travel technology portfolio. The combined offering enables a fully connected traveler journey—from booking to boarding—while supporting secure, contactless identity verification. With Vision-Box’s founder and 470 employees joining Amadeus, the acquisition reinforces its commitment to innovation in airport security and government applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Biometrics In Government Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Biometrics In Government Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Biometrics In Government Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.