Global Bioplastic Multi Layer Films Market

Market Size in USD Million

CAGR :

%

USD

203.06 Million

USD

370.32 Million

2024

2032

USD

203.06 Million

USD

370.32 Million

2024

2032

| 2025 –2032 | |

| USD 203.06 Million | |

| USD 370.32 Million | |

|

|

|

|

Bioplastic Multi-Layer Films Market for Compostable Food Service Packaging Size

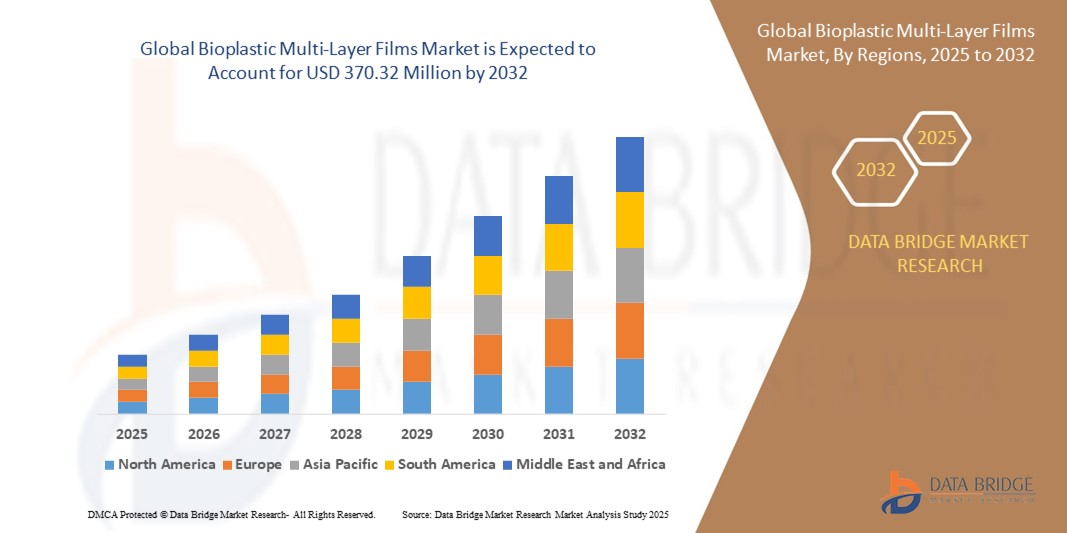

- The global bioplastic multi-layer films market for compostable food service packaging size was valued at USD 203.06 million in 2024 and is expected to reach USD 370.32 million by 2032, at a CAGR of 7.80% during the forecast period

- The market growth is largely fueled by increasing regulatory pressures and consumer preference for sustainable packaging, driving demand for biodegradable, compostable alternatives in the food service industry

- Furthermore, advancements in multilayer film technology enhancing barrier properties, durability, and compatibility with various composting standards are establishing these films as a viable replacement for traditional plastic packaging. These converging factors are accelerating the adoption of bioplastic multi-layer films, thereby significantly boosting the industry's growth

Bioplastic Multi-Layer Films Market for Compostable Food Service Packaging Analysis

- Bioplastic multi-layer films, offering compostable and eco-friendly alternatives for food service packaging, are becoming essential components of sustainable packaging strategies across quick-service restaurants, catering services, and institutional food providers due to their biodegradability, functional barrier properties, and compliance with environmental regulations

- The escalating demand for bioplastic multi-layer films is primarily fueled by increasing environmental concerns, government mandates on single-use plastics, and rising consumer awareness regarding compostable and renewable packaging options

- Europe dominated the bioplastic multi-layer films market with the largest revenue share of 41.8% in 2024, characterized by strict environmental regulations, widespread consumer preference for green packaging, and robust investment in biopolymer research, with countries such as Germany, France, and the Netherlands leading adoption across the food service sector

- Asia-Pacific is expected to be the fastest growing region in the bioplastic multi-layer films market during the forecast period due to rapid industrialization, rising demand for sustainable packaging, and expanding food service industries in countries such as India and China

- The polylactic acid (PLA)-based segment dominated the bioplastic multi-layer films market with a market share of 47.2% in 2024, driven by its excellent compostability, availability from renewable resources, and growing application in packaging perishable food items

Report Scope and Bioplastic Multi-Layer Films Market for Compostable Food Service Packaging Maret Segmentation

|

Attributes |

Bioplastic Multi-Layer Films Market for Compostable Food Service Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bioplastic Multi-Layer Films Market for Compostable Food Service Packaging Trends

“Rising Demand for High-Performance Compostable Solutions in Food Packaging”

- A significant and accelerating trend in the global bioplastic multi-layer films market for compostable food service packaging is the development of high-performance biodegradable film structures that rival conventional plastic in functionality, particularly for barrier protection, shelf-life extension, and heat resistance

- For instance, NatureWorks LLC has expanded its Ingeo PLA portfolio with barrier properties suitable for multi-layer food service packaging applications, enabling compostable films that maintain food freshness while reducing environmental impact. Similarly, BASF’s ecovio® multilayer films are engineered for industrial compostability, meeting international standards while offering sealing and moisture barrier capabilities

- Technological advancements in biopolymer blending and coating have made it possible to produce multilayer films that combine compostability with required mechanical and barrier properties, supporting diverse applications such as wraps, pouches, and disposable food containers. These films now often integrate layers made from PLA, PBS, or starch-based materials along with bio-based coatings to enhance performance without compromising sustainability

- The trend is also driven by growing food safety and waste reduction priorities, where compostable packaging plays a dual role: protecting food products and simplifying post-consumer waste management through composting. In response, companies such as TIPA Corp and Futamura are innovating with multi-layer films that degrade under commercial composting conditions within 180 days

- The rise in demand for certified compostable packaging solutions that align with global waste management goals is shaping new industry standards. As food service brands seek eco-label certifications and circular economy compliance, the adoption of bioplastic multi-layer films is accelerating globally

- Consequently, manufacturers are prioritizing R&D investments and partnerships with composting infrastructure providers to ensure end-of-life compatibility and increase consumer confidence, further propelling market growth across quick-service restaurants, institutional foodservice, and environmentally conscious brands

Bioplastic Multi-Layer Films Market for Compostable Food Service Packaging Dynamics

Driver

“Stringent Regulations and Demand for Sustainable Packaging in Food Services”

- The Increasing regulatory pressure to eliminate single-use plastics and meet sustainability mandates across the food service sector is a major driver for the global bioplastic multi-layer films market. These films offer a compliant and eco-conscious alternative for disposable food packaging, aligning with legislation in regions such as the European Union and North America

- For instance, in March 2024, the European Commission advanced its Circular Economy Action Plan, reinforcing directives on compostable packaging standards and extended producer responsibility. This is compelling foodservice operators to transition toward certified compostable solutions, boosting demand for multilayer bioplastics

- Rising consumer expectations for environmentally responsible packaging and the growing popularity of plant-based and organic food offerings are further intensifying the push for sustainable packaging formats. Bioplastic multilayer films fulfill both aesthetic and functional demands of food service operators while supporting brand sustainability goals

- In addition, as businesses seek to reduce their carbon footprints, the lifecycle benefits of bio-based materials—especially when combined into multilayer constructions for enhanced performance—make them increasingly attractive

- Growing food delivery and takeaway culture, accelerated by urbanization and changing eating habits, is also driving demand for single-use yet compostable food service packaging formats, positioning bioplastic multilayer films as a solution of choice

Restraint/Challenge

“Composting Infrastructure Limitations and Cost Competitiveness”

- A major challenge facing the bioplastic multi-layer films market is the limited availability and inconsistency of industrial composting infrastructure, which can impede the effective disposal and decomposition of compostable packaging in many regions

- For instance, while Europe leads in composting infrastructure, many developing economies and even some parts of North America lack adequate facilities to process certified compostable packaging, potentially leading to confusion and improper disposal

- The performance of bioplastic multilayer films is also highly dependent on proper disposal methods—when composted improperly, they may not degrade as intended, leading to skepticism among consumers and foodservice operators

- In addition, the cost of producing high-performance multilayer bioplastic films remains higher than conventional fossil-based alternatives due to complex material sourcing, processing challenges, and certification requirements. Although raw material prices are gradually stabilizing, cost sensitivity remains a barrier to wider adoption, especially among small-scale food vendors and in price-competitive markets

- Addressing these challenges through expansion of composting infrastructure, public-private initiatives to educate consumers, and continuous innovation in cost-effective bio-based materials will be essential for the sustained growth of this market

Bioplastic Multi-Layer Films Market for Compostable Food Service Packaging Scope

The market is segmented on the basis of material, end-use packaging, and end-user.

- By Material

On the basis of material, the bioplastic multi-layer films market is segmented into starch blends, polybutylene adipate terephthalate (PBAT), polylactic acid (PLA), polybutylene succinate (PBS), and others. The polylactic acid (PLA) segment dominated the market with the largest revenue share of 47.2% in 2024, attributed to its renewable sourcing, excellent clarity, compostability, and compatibility with other bio-based polymers in multilayer constructions. PLA-based films are widely used in food packaging due to their odor barrier, sealability, and suitability for heat-sensitive food service applications. In addition, ongoing innovation in blending PLA with other biodegradable polymers is enhancing its performance across diverse packaging needs.

The PBAT segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its high flexibility, durability, and effective compostability under industrial conditions. PBAT’s ability to complement rigid biopolymers such as PLA in multilayer formats makes it ideal for applications requiring flexibility and toughness, such as wraps, liners, and pouches in food service. Its growing popularity is supported by increased R&D investment aimed at improving the mechanical strength and shelf life of fully compostable packaging.

- By End-Use Packaging

On the basis of end-use packaging, the bioplastic multi-layer films market is segmented into pouches and sachets, clamshell, cups, trays, and others. The pouches and sachets segment held the largest revenue share in 2024, due to their widespread use in ready-to-eat meals, condiments, and snack packaging in the food service sector. These formats benefit significantly from the multi-layer barrier properties of bioplastic films, which provide both structural integrity and moisture/oxygen resistance while maintaining compostability. Their lightweight nature and efficient space usage in storage and transport also contribute to cost savings and sustainability.

The clamshell segment is projected to grow at the fastest CAGR during the forecast period, driven by increased demand in quick-service restaurants and take-out food packaging. Clamshell containers offer rigidity and protection for hot and cold foods, and the use of bioplastic multilayer technology enhances their functional and aesthetic appeal while remaining compostable, aligning with regulatory compliance and consumer expectations for eco-friendly dining.

- By End-User

On the basis of end-user, the bioplastic multi-layer films market is segmented into chain restaurants, non-chain restaurants, chain cafés, non-chain cafés, delivery catering, independent sellers and kiosks, and others. The chain restaurants segment dominated the market in 2024, owing to their large-scale operations, uniform sustainability goals, and willingness to adopt compostable alternatives to meet corporate environmental commitments. Leading global QSR chains are increasingly transitioning to bioplastic-based multilayer packaging to align with regulatory and brand-driven waste reduction targets, enhancing customer loyalty and ESG performance.

The delivery catering segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the surge in online food delivery and demand for sustainable, single-use packaging. Compostable multi-layer films provide hygienic and durable solutions for packaging meals in transit while meeting sustainability standards. This growth is further accelerated by urbanization, changing consumer lifestyles, and increasing investment by catering companies in eco-friendly packaging formats.

Bioplastic Multi-Layer Films Market for Compostable Food Service Packaging Regional Analysis

- Europe dominated the bioplastic multi-layer films market with the largest revenue share of 41.8% in 2024, characterized by strict environmental regulations, widespread consumer preference for green packaging, and robust investment in biopolymer research, with countries such as Germany, France, and the Netherlands leading adoption across the food service sector

- Consumers in the region highly value compostable and eco-friendly solutions, and there is a strong preference for packaging made from renewable resources that align with circular economy principles and waste reduction goals

- This widespread adoption is further supported by a mature composting infrastructure, high environmental awareness, and proactive investments in biopolymer innovation, establishing bioplastic multilayer films as a preferred packaging choice for quick-service restaurants, cafés, and institutional food services across Europe

The Germany Bioplastic Multi-Layer Films Market Insight

The Germany bioplastic multi-layer films market is anticipated to grow at a considerable CAGR during the forecast period, supported by the country’s leadership in sustainability, advanced recycling systems, and innovation in biopolymer technologies. Strong government policies favoring circular economy models and a high level of environmental consciousness among consumers are driving the shift toward compostable multilayer food packaging. Foodservice operators are adopting these solutions to comply with national waste reduction targets and consumer preferences.

France Bioplastic Multi-Layer Films Market Insight

The France bioplastic multi-layer films market is expected to grow at a robust CAGR during the forecast period, driven by national legislation banning several categories of single-use plastics and strong consumer demand for eco-responsible food packaging. The French government’s roadmap toward a circular economy is encouraging the adoption of certified compostable packaging in both public and private foodservice sectors. Local producers are expanding their offerings to meet compliance and sustainability goals.

Italy Bioplastic Multi-Layer Films Market Insight

The Italy bioplastic multi-layer films market is witnessing strong growth, supported by the country’s leadership in bioplastics manufacturing and early adoption of compostable packaging materials. Italy’s national regulations promote compostable alternatives in foodservice, particularly for disposable cups, trays, and wraps. The country’s well-established composting infrastructure and environmentally conscious consumer base make it a key growth area for multilayer compostable films.

Asia-Pacific Bioplastic Multi-Layer Films Market Insight

The Asia-Pacific bioplastic multi-layer films market is projected to grow at the fastest CAGR of 23.6% from 2025 to 2032, fueled by increasing urbanization, evolving food consumption patterns, and environmental policy reforms across nations such as India, China, and Japan. Rapid growth in the food delivery and QSR sectors, coupled with mounting pressure to curb plastic waste, is boosting the demand for compostable multilayer films. Local manufacturing expansion and government-backed sustainability initiatives further support market penetration.

India Bioplastic Multi-Layer Films Market Insight

The India bioplastic multi-layer films market accounted for the largest market revenue share in Asia Pacific in 2024, driven by the country’s aggressive push toward sustainable development, rapid urban growth, and rising demand for eco-friendly packaging in the foodservice industry. With national bans on single-use plastics and strong governmental support for biodegradable alternatives, compostable multilayer films are gaining traction across QSR chains, local food vendors, and delivery platforms.

Japan Bioplastic Multi-Layer Films Market Insight

The Japan bioplastic multi-layer films market is gaining momentum due to the country’s commitment to environmental innovation, strong foodservice industry, and advancements in material science. The market benefits from Japan’s focus on high-performance, compostable packaging solutions that align with food safety and waste management standards. Growing demand for minimalistic, sustainable packaging in urban centers and among health-conscious consumers is contributing to market expansion.

Bioplastic Multi-Layer Films Market for Compostable Food Service Packaging Share

The bioplastic multi-layer films market for compostable food service packaging industry is primarily led by well-established companies, including:

- Novamont S.p.A. (Italy)

- TIPA Corp Ltd. (Israel)

- BASF SE (Germany)

- Futamura Chemical Co., Ltd. (Japan)

- NatureWorks LLC (U.S.)

- Bioplastics International (U.S.)

- Plascon Group (U.S.)

- Rodenburg Biopolymers B.V. (Netherlands)

- BIOTEC GmbH & Co. KG (Germany)

- BioBag International AS (Norway)

- FKuR Kunststoff GmbH (Germany)

- Cortec Corporation (U.S.)

- Danimer Scientific, Inc. (U.S.)

- Polysack Flexible Packaging Ltd. (Israel)

- Clondalkin Group Holdings B.V. (Netherlands)

- Amcor plc (Switzerland)

- Taghleef Industries Group (United Arab Emirates)

- Toray Industries, Inc. (Japan)

- Treofan Germany GmbH & Co. KG (Germany)

- Walki Group Oy (Finland)

What are the Recent Developments in Global Bioplastic Multi-Layer Films Market for Compostable Food Service Packaging?

- In March 2024, Novamont S.p.A., a global leader in biodegradable materials, expanded its Mater-Bi product line with enhanced multi-layer films tailored for compostable food service packaging. These films offer improved barrier properties and heat resistance while maintaining full industrial compostability. The development reinforces Novamont’s commitment to replacing traditional plastics with high-performance, bio-based alternatives aligned with EU packaging regulations

- In February 2024, TIPA Corp., an Israeli-based compostable packaging innovator, launched a new range of transparent multi-layer films designed for food wraps and pouches. These films combine durability and printability with certified home compostability. The innovation underscores TIPA’s dedication to expanding compostable solutions for single-use applications and meeting the growing demand from environmentally conscious food service brands

- In January 2024, BASF SE announced advancements in its ecovio® line of biodegradable polymers, now optimized for multilayer film production in catering trays and clamshell packaging. These new grades improve sealing performance and moisture resistance, supporting hot and cold food applications. BASF’s development highlights its ongoing focus on engineering compostable solutions that meet stringent functional and regulatory requirements across global markets

- In November 2023, Futamura Group unveiled an upgraded version of its NatureFlex bio-based films used in compostable multilayer packaging for ready-to-eat meals and takeaway items. The new film range offers superior oxygen and aroma barriers while being compliant with EN 13432 compostability standards. This innovation positions Futamura as a key supplier of sustainable food packaging to European and Asian markets

- In October 2023, NatureWorks LLC collaborated with packaging converters to pilot new multilayer films using next-generation Ingeo PLA grades with enhanced flexibility and thermal performance. These films are targeted at pouches and foodservice wraps, and are designed for compatibility with existing composting infrastructure. This move aligns with NatureWorks’ goal to support scalable, environmentally responsible packaging for quick-service restaurants and institutional catering

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bioplastic Multi Layer Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bioplastic Multi Layer Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bioplastic Multi Layer Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.