Global Bioplastic Textile Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

2.36 Billion

2024

2032

USD

1.70 Billion

USD

2.36 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 2.36 Billion | |

|

|

|

|

Bioplastic Textile Market Size

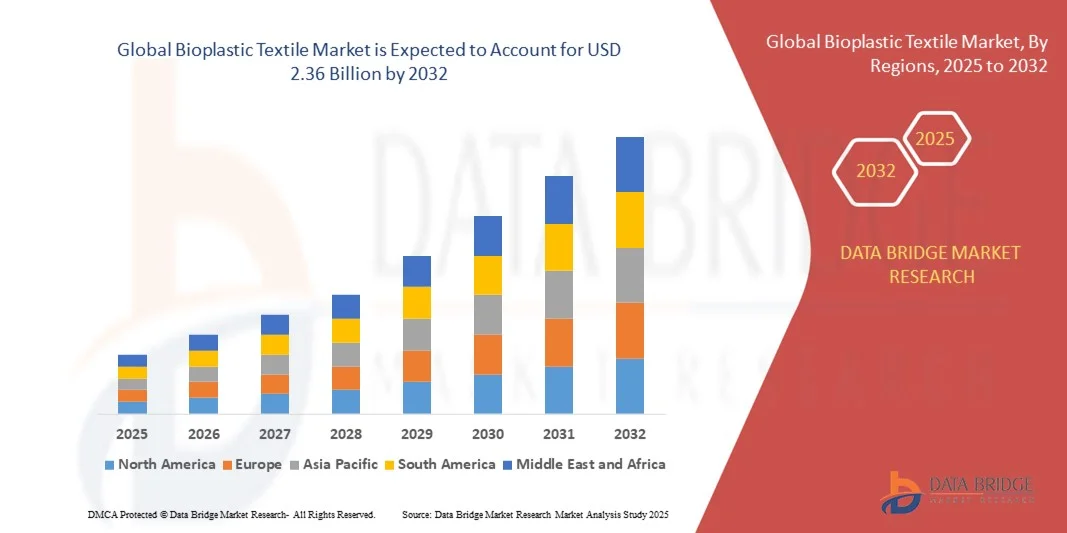

- The global bioplastic textile market size was valued at USD 1.70 billion in 2024 and is expected to reach USD 2.36 billion by 2032, at a CAGR of 4.2% during the forecast period

- The market growth is largely fuelled by rising demand for sustainable and eco-friendly fabrics, increasing consumer awareness regarding environmental impact, and supportive government regulations promoting biodegradable materials

- Growing adoption in apparel, home textiles, and industrial applications is driving market expansion, as manufacturers look for alternatives to conventional synthetic fibers with lower carbon footprints

Bioplastic Textile Market Analysis

- The global bioplastic textile market is witnessing growth driven by increasing demand for sustainable and eco-friendly fabrics, rising consumer awareness about environmental impact, and regulatory support promoting biodegradable materials

- Growing adoption in apparel, home textiles, and industrial applications is accelerating market expansion, as manufacturers seek alternatives to conventional synthetic fibers with lower carbon footprints

- Europe dominated the bioplastic textile market with the largest revenue share of 39.2% in 2024, driven by stringent environmental regulations, strong consumer awareness about sustainability, and widespread adoption of eco-friendly fabrics

- Asia-Pacific region is expected to witness the highest growth rate in the global bioplastic textile market, driven by increasing urbanization, rising disposable incomes, and the adoption of sustainable fabrics in countries such as China, Japan, and India. Growing industrial capabilities, technological advancements, and supportive government policies are accelerating the adoption of bioplastic textiles across clothing, footwear, and home textile applications

- The Polylactic Acid (PLA) segment held the largest market revenue share in 2024, driven by its biodegradability, versatility, and compatibility with various textile applications. PLA-based fibers offer durability, softness, and performance comparable to conventional synthetic fibers, making them highly favored in sustainable apparel and home textile production

Report Scope and Bioplastic Textile Market Segmentation

|

Attributes |

Bioplastic Textile Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bioplastic Textile Market Trends

Growing Adoption of Sustainable and Eco-Friendly Fabrics

- The increasing shift toward bioplastic textiles is transforming the global textile industry by enabling the production of sustainable, biodegradable, and environmentally friendly fabrics. These materials reduce reliance on conventional petroleum-based fibers, minimizing environmental impact and promoting circular economy principles. In addition, the integration of renewable feedstocks and closed-loop production methods is enhancing resource efficiency and reducing greenhouse gas emissions across the supply chain

- The rising demand for eco-conscious apparel, home textiles, and industrial fabrics is accelerating the adoption of bioplastic-based fibers and yarns. These materials are particularly favored by consumers and manufacturers seeking compliance with sustainability standards and certifications. Moreover, the growing popularity of “green fashion” and eco-labeled products is stimulating market growth and driving brand differentiation strategies globally

- Affordability improvements and advancements in production technology are making bioplastic textiles more accessible for large-scale apparel manufacturers as well as small and medium enterprises, allowing wider incorporation into everyday products. Innovations in polymer blending, extrusion, and fiber spinning techniques are enhancing fabric performance, durability, and aesthetics, thereby increasing market acceptance across diverse applications

- For instance, in 2023, several European and North American fashion brands introduced bioplastic textile collections, reducing carbon footprints and aligning with corporate sustainability goals while enhancing brand appeal. These initiatives also promoted consumer awareness of environmental issues and encouraged further investment in sustainable materials across the textile sector

- While bioplastic textiles offer substantial environmental and market benefits, their growth depends on scaling production, technological innovation, and increased awareness among designers, manufacturers, and end consumers. Strategic collaborations, investment in R&D, and government support programs are expected to further bolster the adoption of bioplastic textile solutions in the coming years

Bioplastic Textile Market Dynamics

Driver

Rising Environmental Awareness and Demand for Sustainable Apparel

- Growing global concerns about plastic pollution and environmental degradation are pushing both consumers and manufacturers toward sustainable alternatives such as bioplastic textiles. The adoption of biodegradable and renewable fibers helps reduce ecological impact across the supply chain. In addition, shifting consumer preferences toward ethical and sustainable fashion are influencing procurement policies, encouraging brands to source eco-friendly materials for their products

- Increasing regulatory pressure and sustainability mandates in regions such as Europe and North America are encouraging textile manufacturers to integrate bioplastic materials in clothing, home textiles, and industrial fabrics. Compliance with these regulations enhances brand reputation and market access. Governments and industry bodies are also providing incentives, certifications, and funding support for adopting renewable textile solutions, fostering greater market penetration

- Industry collaborations, research initiatives, and funding programs by public and private organizations are fostering innovation in bioplastic textile production, improving fiber quality, durability, and processing efficiency. Partnerships between fiber producers, fashion brands, and research institutions are helping address challenges such as mechanical strength, color fastness, and large-scale manufacturing feasibility

- For instance, in 2022, leading fashion brands in Europe adopted PLA-based fabrics for apparel and accessories, aligning with EU sustainability targets and responding to growing consumer demand for eco-friendly products. This not only helped brands reduce environmental footprints but also increased awareness about bioplastic textiles in mainstream fashion markets

- While environmental awareness and regulation are driving market growth, challenges such as high production costs and supply chain limitations need to be addressed to sustain adoption. Continuous technological development, scaling of production capacity, and strategic collaborations will be essential to meet rising global demand

Restraint/Challenge

High Production Costs and Limited Availability of Bioplastic Fibers

- The high cost of producing bioplastic textiles, including PLA, PHA, and other biodegradable fibers, makes them less accessible for small and medium-sized enterprises. Cost-sensitive manufacturers may prefer conventional synthetic fibers despite environmental concerns. Moreover, the capital-intensive nature of bioplastic fiber production facilities and dependence on specialized raw materials further limit affordability and market penetration

- Limited production capacity and inconsistent quality of bioplastic fibers restrict large-scale adoption, particularly in emerging markets where technical infrastructure and supply chain support are underdeveloped. Supply bottlenecks, variability in fiber properties, and logistical challenges can cause production delays and reduce confidence among textile manufacturers considering switching to sustainable alternatives

- Lack of awareness among consumers and designers about the benefits and applications of bioplastic textiles can slow market penetration, as adoption often depends on demonstrated performance and aesthetics comparable to conventional fabrics. Educational campaigns, product demonstrations, and certification programs are critical to building trust and promoting wider adoption in apparel, industrial, and home textile segments

- For instance, in 2023, several textile manufacturers in Asia-Pacific delayed the launch of bioplastic fabric lines due to high raw material costs and challenges in scaling production to meet market demand. These delays highlighted the importance of investment in local supply chains and R&D to overcome barriers and ensure consistent fiber quality

- While technological advancements are gradually improving affordability and fiber performance, overcoming cost, availability, and market education challenges remains crucial for long-term growth in the global bioplastic textile market. Strategic initiatives aimed at expanding production capacity, reducing material costs, and increasing consumer awareness are expected to drive sustainable market expansion

Bioplastic Textile Market Scope

The market is segmented on the basis of material, source, and application.

- By Material

On the basis of material, the bioplastic textile market is segmented into Polyamide, Polytrimethylene Terephthalate, Polyethylene Terephthalate, Polylactic Acid, and Others. The Polylactic Acid (PLA) segment held the largest market revenue share in 2024, driven by its biodegradability, versatility, and compatibility with various textile applications. PLA-based fibers offer durability, softness, and performance comparable to conventional synthetic fibers, making them highly favored in sustainable apparel and home textile production.

The Polyamide segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its excellent mechanical strength, moisture resistance, and adaptability for fashion and technical textiles. Polyamide-based bioplastic fabrics are particularly popular for performance clothing and industrial applications, offering a sustainable alternative without compromising on quality or functionality.

- By Source

On the basis of source, the bioplastic textile market is segmented into Beet, Sugarcane, Cassava, Corn Starch, and Others. The Corn Starch segment held the largest market revenue share in 2024, fueled by the wide availability of corn, cost-effectiveness, and established production technologies for bioplastic fibers. Corn starch-derived fibers provide high biodegradability and are increasingly used in eco-conscious clothing and home textile lines.

The Sugarcane segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising cultivation of sugarcane in Asia-Pacific and Brazil and its conversion into bio-based polymers. Sugarcane-derived textiles are gaining attention for sustainable fashion initiatives and reducing reliance on petroleum-based fibers.

- By Application

On the basis of application, the bioplastic textile market is segmented into Clothing, Footwear, Home Textiles, and Others. The Clothing segment held the largest market revenue share in 2024, driven by increasing consumer preference for eco-friendly apparel and growing adoption by fashion brands to meet sustainability targets. Bioplastic fabrics are being widely used in casual wear, sportswear, and high-fashion garments.

The Footwear segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the demand for sustainable, biodegradable materials in athletic, casual, and lifestyle shoes. Bioplastic-based footwear offers lightweight, durable, and eco-conscious alternatives to conventional synthetic materials, driving adoption across global markets.

Bioplastic Textile Market Regional Analysis

- Europe dominated the bioplastic textile market with the largest revenue share of 39.2% in 2024, driven by stringent environmental regulations, strong consumer awareness about sustainability, and widespread adoption of eco-friendly fabrics

- Manufacturers and consumers in the region highly value biodegradable and renewable fibers that reduce environmental impact while supporting circular economy principles

- This widespread adoption is further supported by high disposable incomes, an environmentally conscious population, and growing demand for sustainable apparel, footwear, and home textiles, establishing bioplastic textiles as a preferred material across multiple applications

Germany Bioplastic Textile Market Insight

The Germany bioplastic textile market captured the largest revenue share in 2024 within Europe, fueled by increasing awareness of environmental sustainability and strong government policies promoting green materials. Manufacturers are adopting bioplastic fibers such as PLA, PHA, and other biodegradable polymers to meet consumer demand for eco-friendly products. The country’s focus on innovation, high-quality textile production, and integration of sustainable fabrics in both domestic and export markets further propels the bioplastic textile industry.

U.K. Bioplastic Textile Market Insight

The U.K. bioplastic textile market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer preference for sustainable fashion and eco-conscious home textiles. Concerns about environmental pollution and carbon footprint are encouraging both manufacturers and retailers to adopt bioplastic fibers. The U.K.’s robust e-commerce and retail infrastructure, combined with government-backed sustainability initiatives, continues to stimulate market growth.

Asia-Pacific Bioplastic Textile Market Insight

The Asia-Pacific bioplastic textile market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region’s growing textile manufacturing base and government initiatives promoting eco-friendly materials are driving adoption of bioplastic textiles. Moreover, APAC is emerging as a key production hub for bioplastic fibers, making sustainable fabrics more affordable and accessible across commercial and industrial sectors.

China Bioplastic Textile Market Insight

The China bioplastic textile market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to strong manufacturing capabilities, growing consumer demand for sustainable products, and government policies supporting green materials. Bioplastic fibers are increasingly used in apparel, footwear, and home textiles across commercial and industrial applications. Domestic innovation in bioplastic production, combined with cost-effective large-scale manufacturing, is a key factor propelling market growth in China.

Japan Bioplastic Textile Market Insight

The Japan bioplastic textile market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s sustainability-focused culture, high technological expertise, and demand for eco-friendly apparel and home textiles. Japanese manufacturers are increasingly integrating bioplastic fibers into everyday products to minimize environmental impact. Government initiatives supporting green production and rising consumer preference for sustainable fabrics are significant drivers of market growth.

North America Bioplastic Textile Market Insight

North America bioplastic textile market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer awareness of sustainable fashion and strong regulatory support for eco-friendly materials. Manufacturers and consumers in the region highly value environmentally conscious fabrics that reduce plastic waste and support circular economy initiatives. The widespread adoption is further supported by high disposable incomes, a sustainability-focused population, and the growing preference for biodegradable and renewable fibers in clothing, footwear, and home textiles.

U.S. Bioplastic Textile Market Insight

The U.S. bioplastic textile market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing demand for sustainable apparel and eco-friendly home textiles. Companies are increasingly prioritizing bioplastic fibers such as PLA and PHA to meet consumer demand for environmentally responsible products. The growing trend of green fashion, combined with government incentives for sustainable manufacturing and strong retail support for eco-labeled products, further propels the market. Moreover, collaborations between textile manufacturers and research institutions are enhancing fiber quality and production efficiency, supporting market growth.

Bioplastic Textile Market Share

The Bioplastic Textile industry is primarily led by well-established companies, including:

- DSM (Netherlands)

- Medtronic (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Freudenberg Group (Germany)

- Bally Ribbon Mills (U.S.)

- ATEX TECHNOLOGIES (U.S.)

- Confluent Medical Technologies (U.S.)

- Elkem Silicones (Norway)

- BioSpace (U.S.)

- KCWW (U.K.)

- Mölnlycke Health Care AB (Sweden)

- Rochal Industries LLC (U.S.)

- AstraZeneca (U.K.)

- 3M (U.S.)

- Munksjö (Finland)

- Meister & Cie AG (Switzerland)

- Biomedical Structures LLC (U.S.)

Latest Developments in Global Bioplastic Textile Market

- In June 2025, Covestro acquired bioplastic textile startup BioTex Solutions to expand its portfolio of sustainable materials. The acquisition strengthens Covestro’s global presence in eco-friendly textiles, boosting innovation and accelerating market adoption of bioplastic fibers

- In May 2025, Gr3n, a Swiss recycling technology company, secured €15 million in investment to scale its bioplastic textile recycling process. The funding accelerates commercialization, supports circular economy objectives, and facilitates sustainable waste management in Europe

- In April 2025, Carbios received EU regulatory approval for its bioplastic textile recycling technology. The approval enables commercial deployment across Europe, advancing circular economy initiatives and promoting sustainable end-of-life solutions for bioplastic textiles

- In March 2025, Futerro inaugurated a PLA bioplastic textile production plant in Belgium. This facility increases output capacity for renewable textile materials, meeting rising European demand and supporting sustainable supply chains across the textile industry

- In February 2025, Novamont and H&M Group partnered to develop compostable bioplastic textiles for H&M’s sustainable clothing lines. The initiative aims to reduce the environmental impact of fast fashion while promoting circularity in textile consumption

- In January 2025, NatureWorks LLC launched its Ingeo bioplastic textile yarn targeting the fashion industry. The yarn provides high performance with biodegradability, supporting eco-friendly apparel lines and encouraging adoption of sustainable materials among designers and manufacturers

- In November 2024, Biovation, a biotech startup, raised $30 million in Series B funding to scale its bioplastic textile production. The investment supports commercialization of proprietary fiber technology, increasing production capacity and accelerating market penetration of sustainable textiles

- In October 2024, Teijin Limited secured a multi-year contract to supply bioplastic-based textiles for automotive interiors to a leading European car manufacturer. This expansion into mobility solutions enhances Teijin’s market footprint while promoting sustainable materials in the automotive industry

- In August 2024, Eastman Chemical appointed Dr. Maria Chen as the head of its bioplastics division. This leadership change emphasizes a renewed focus on innovation and commercialization of bioplastic textile products, aiming to strengthen the company’s position in the sustainable textiles market

- In July 2024, Toray Industries launched a new line of eco-friendly bioplastic textiles designed specifically for sportswear. These materials offer enhanced durability and biodegradability, appealing to environmentally conscious consumers and driving sustainable adoption in the activewear segment

- In May 2024, Lenzing AG inaugurated a new production facility in Austria dedicated to bioplastic textile fibers. The facility expands manufacturing capacity to meet rising European demand for sustainable textiles, improving supply chain resilience and supporting the shift toward eco-conscious fabrics in both fashion and home textiles

- In April 2024, BASF and Indorama Ventures announced a strategic partnership to co-develop bioplastic-based textile fibers. This collaboration aims to accelerate the adoption of sustainable materials in apparel and home textiles, enabling large-scale manufacturing and supporting eco-friendly production practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bioplastic Textile Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bioplastic Textile Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bioplastic Textile Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.