Global Biopreservation Market

Market Size in USD Billion

CAGR :

%

USD

2.18 Billion

USD

3.56 Billion

2024

2032

USD

2.18 Billion

USD

3.56 Billion

2024

2032

| 2025 –2032 | |

| USD 2.18 Billion | |

| USD 3.56 Billion | |

|

|

|

|

Bio preservation Market Size

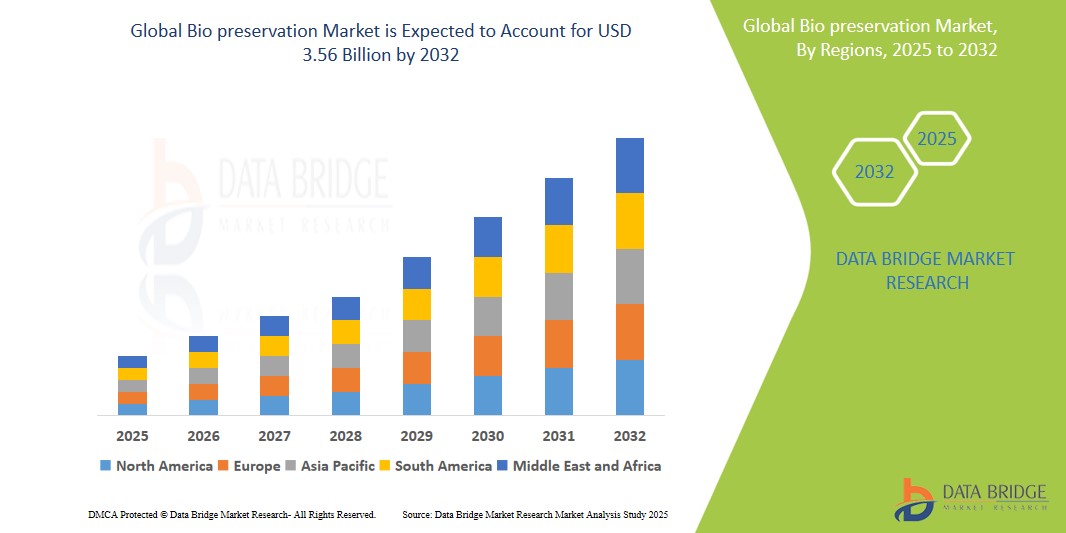

- The global Bio preservation Treatment market was valued at USD 2.18 billion in 2024 and is expected to reach USD 3.56 billion by 2032, at a CAGR of 4.5%, during the forecast period

- The growth of the Global Biopreservation Market is primarily driven by the increasing demand for long-term storage of biological samples, cells, tissues, and organs across biobanking, regenerative medicine, and drug discovery applications. Rising investments in life sciences research, the expansion of biobanks, and the growing prevalence of chronic diseases are fueling the need for advanced preservation solutions to maintain sample integrity.

Bio preservation Market Analysis

- Biopreservation plays a crucial role in maintaining the viability and functionality of biological samples such as cells, tissues, DNA, and organs for extended periods, making it indispensable in clinical diagnostics, biobanking, and regenerative medicine. Techniques such as cryopreservation and hypothermic storage are widely used to ensure sample integrity for research, transplantation, and therapeutic applications.

- North America emerges as a leading region in the Global Biopreservation Market, supported by a robust biotechnology and pharmaceutical industry, strong research infrastructure, and increasing adoption of personalized medicine approaches.

- The region’s continuous investments in stem cell research, widespread establishment of biobanks, and favorable regulatory and funding environments are driving the use of biopreservation systems across academic institutions, hospitals, and commercial research facilities, further accelerating market expansion and innovation in biospecimen storage solutions.

Report Scope and Bio preservation Segmentation

|

Attributes |

Bio preservation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bio preservation Market Trends

“Rising Demand for Long-Term Sample Storage and Technological Advancements in Preservation Methods”

- A key trend in the Global Biopreservation Market is the increasing demand for reliable, long-term preservation of biological materials to support growing biobanking initiatives, personalized medicine, and advanced therapeutic research.

- Innovations in cryopreservation techniques, vitrification, and controlled-rate freezing are enhancing the quality and viability of preserved samples, minimizing cellular degradation during storage and thawing processes.

- For instance, recent advancements include cryoprotectant-free storage solutions and automated biopreservation systems integrated with real-time temperature monitoring and digital sample tracking to improve efficiency and compliance.

- The expansion of stem cell therapies, regenerative medicine, and immunotherapy is further boosting the need for high-performance preservation systems capable of maintaining the integrity of sensitive cell types and biological products.

- Additionally, the rise in chronic diseases, organ transplant programs, and global clinical trials is driving the adoption of scalable, compliant biopreservation solutions across both developed and emerging markets.

- This ongoing shift toward precision medicine and biologic-based treatments is transforming the biopreservation landscape, with technology-driven solutions playing a central role in ensuring quality, safety, and accessibility of critical biological materials.

Bio preservation Market Dynamics

Driver

“Increasing Demand for Long-Term Storage of Biological Materials”

- The rapid expansion of biobanks, stem cell research, and regenerative medicine is driving demand for reliable biopreservation solutions capable of maintaining the viability and functionality of biological specimens such as cells, tissues, organs, and DNA. This demand is further amplified by the rising prevalence of chronic diseases and the increasing need for personalized and precision medicine approaches.

- Biopreservation enables secure, long-term storage and transport of critical biological samples used in clinical trials, diagnostic testing, and therapeutic applications—ensuring sample integrity and consistency across research environments.

- For instance, In 2023, the International Society for Biological and Environmental Repositories (ISBER) reported a significant global increase in the number of biorepositories, particularly in support of oncology, neurology, and infectious disease research.

- According to a 2024 report, over 70% of pharmaceutical and biotechnology companies now rely on biopreserved samples for drug discovery and development processes.

- The growing focus on cell-based therapies, organ transplantation, and chronic disease management is accelerating the use of biopreservation techniques in both developed and emerging healthcare systems.

- As research institutions and pharmaceutical companies continue to prioritize high-quality sample preservation, demand for advanced cryopreservation media, freezing equipment, and cold chain logistics is expected to surge.

Opportunity

“Technological Innovations in Cryopreservation and Sample Management”

- Continuous advancements in biopreservation technology—such as the development of cryoprotectant-free storage solutions, vitrification techniques, and automated controlled-rate freezers—are improving sample viability, reducing cell damage, and increasing operational efficiency in biobanks and laboratories.

- Integration with digital inventory systems, cloud-based sample tracking, and IoT-enabled monitoring tools is streamlining biorepository management, ensuring real-time oversight of sample conditions and regulatory compliance.

- For instance, In 2024, companies like Thermo Fisher Scientific and Brooks Life Sciences introduced next-generation biostorage systems with AI-driven monitoring and remote access control for enhanced precision and safety.

- New preservation media and freezing protocols have shown improved outcomes in preserving induced pluripotent stem cells (iPSCs), hematopoietic stem cells, and immune cells for immunotherapy applications.

- These technological breakthroughs are expanding the applicability of biopreservation across research, clinical, and commercial sectors, while enabling faster scale-up of personalized treatments.

- Companies that innovate in automation, long-term data integration, and cost-effective preservation solutions are positioned to capitalize on the growing need for secure, scalable biospecimen storage.

Restraint/Challenge

“High Costs and Infrastructure Barriers in Low-Resource Settings”

- Despite clinical advantages, the high upfront cost of bone densitometry equipment, including installation, training, and maintenance, remains a significant barrier to widespread adoption, particularly in low- and middle-income countries (LMICs).

- In addition, limited reimbursement policies and low awareness about osteoporosis screening among primary care providers contribute to underutilization of these devices—even in developed healthcare systems.

- The challenge is compounded by disparities in access to advanced imaging infrastructure and qualified radiology personnel, limiting screening programs and diagnostic follow-up in remote or underserved areas.

- For instance, The high initial investment required for biopreservation equipment—such as ultra-low temperature freezers, cryogenic storage tanks, and backup power systems—presents a major barrier to adoption, especially in low- and middle-income countries (LMICs).

- Additionally, the operational complexity and need for skilled personnel to manage sample handling, storage, and quality control limit widespread use in smaller institutions and rural settings.

- Regulatory challenges, including varying international standards for sample transport and storage, further complicate global biopreservation efforts and slow adoption in cross-border clinical research.

- Long-term operational costs—such as electricity, cryogen replenishment, equipment maintenance, and compliance management—can strain healthcare budgets and reduce sustainability in resource-limited settings.

- Addressing these barriers through public-private collaborations, affordable leasing models, modular biopreservation systems, and training initiatives will be essential to unlock broader access and support global biomedical innovation.

Bio preservation Market Scope

The market is segmented on the product and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

In 2025, the Equipment Segmentis Projected to Dominate the Market with the Largest Share in the product Segment

The Equipment segment is expected to dominate the Global Bio preservation Market in 2025, accounting for the largest market share of approximately 68.7%. This leadership is primarily driven by the rising demand for advanced cryogenic storage systems, freezers, and thawing equipment, essential for maintaining sample integrity across biobanks and research facilities.

Regenerative Medicine are Expected to Account for the Largest Share During the Forecast Period in application segment

In 2025, Regenerative Medicine are projected to dominate the Global Bio preservation Market, accounting for the largest market share of approximately 64.9%. This segment's dominance is fueled by the increasing use of stem cells, tissues, and engineered products in advanced therapies, requiring reliable long-term preservation to ensure viability and clinical effectiveness.

Bio preservation Market Regional Analysis

“North America is the Dominant Region in the Global Bio preservation Market”

- North America leads the Biopreservation market, driven by its well-established biobanking infrastructure, high R&D investment in regenerative medicine, and strong presence of pharmaceutical and biotechnology companies.

- The United States holds the largest market share due to increasing adoption of personalized medicine, rising demand for stem cell and tissue-based therapies, and extensive clinical trial activity requiring secure sample preservation.

- Favorable regulatory frameworks, robust funding for biomedical research, and strong collaborations between academic institutions and private companies further support market growth.

- Additionally, the presence of major players such as Thermo Fisher Scientific, Brooks Life Sciences, and BioLife Solutions, along with continuous advancements in cryopreservation and cold chain technologies, fuels ongoing innovation across the region.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the fastest growth in the Biopreservation market, fueled by rapid healthcare expansion, increasing prevalence of chronic diseases, and growing investment in biotechnology and cell therapy research.

- Key countries such as China, India, and Japan are driving regional demand through large-scale development of biobanks, supportive government initiatives, and growing interest in regenerative medicine and biologics.

- Japan stands out with its advanced research infrastructure and leadership in iPSC (induced pluripotent stem cell) technologies, while China and India are rapidly scaling up clinical research capabilities and biospecimen storage facilities.

- Government-backed funding programs, expanding pharmaceutical manufacturing, and rising adoption of cryogenic storage solutions in academic and hospital settings are accelerating regional growth.

- Moreover, the emergence of local biopreservation solution providers and improvements in regulatory clarity are positioning Asia-Pacific as a key growth engine for the global biopreservation industry.

Bio preservation Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (United States)

- BioLife Solutions, Inc. (United States)

- Chart Industries, Inc. (Cryoport Systems) (United States)

- Merck KGaA (Germany)

- VWR International, LLC (part of Avantor) (United States)

- Sigma-Aldrich Corporation (a subsidiary of Merck KGaA) (United States/Germany)

- Brooks Life Sciences (now part of Azenta Life Sciences) (United States)

- Biocision, LLC (United States)

- Lifeline Scientific, Inc. (United States)

- Cesca Therapeutics Inc. (part of ThermoGenesis Holdings) (United States)

Latest Developments in Global Bio preservation

- In April 2021, BioLife Solutions launched a new high-capacity controlled freezer to cater to the cell and gene therapy market, which helped the company expand its existing product portfolio.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.