Global Bioprocessing Reagent Market

Market Size in USD Billion

CAGR :

%

USD

3.43 Billion

USD

6.93 Billion

2025

2033

USD

3.43 Billion

USD

6.93 Billion

2025

2033

| 2026 –2033 | |

| USD 3.43 Billion | |

| USD 6.93 Billion | |

|

|

|

|

Bioprocessing Reagent Market Size

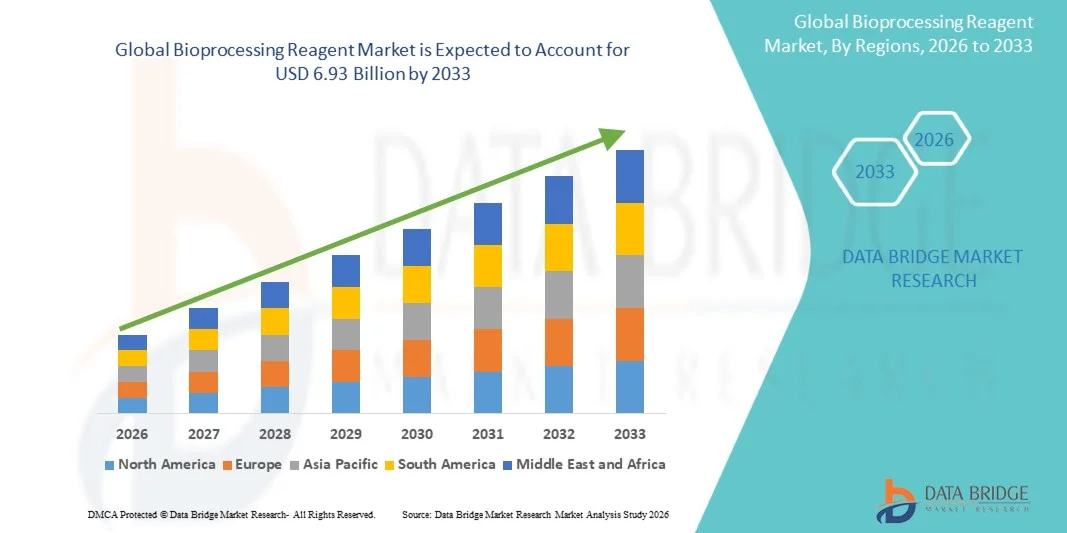

- The global bioprocessing reagent market size was valued at USD 3.43 billion in 2025 and is expected to reach USD 6.93 billion by 2033, at a CAGR of 9.2% during the forecast period

- The market growth is primarily driven by the increasing adoption of advanced biopharmaceutical manufacturing technologies and growing investments in biologics, biosimilars, and cell & gene therapy development

- In addition, rising demand for consistent, high-quality, and scalable bioprocessing solutions is driving the need for reliable reagents, including cell culture media, buffers, and growth supplements. These factors are accelerating the adoption of Bioprocessing Reagent solutions, thereby significantly boosting the overall market growth

Bioprocessing Reagent Market Analysis

- Bioprocessing reagents, including media, buffers, growth factors, and other critical consumables, are increasingly vital components of modern biopharmaceutical manufacturing and research processes in both upstream and downstream operations due to their role in ensuring consistent product quality, yield, and process efficiency

- The escalating demand for bioprocessing reagents is primarily fueled by the growing adoption of biologics, biosimilars, and cell & gene therapies, increasing investments in biopharmaceutical R&D, and a rising need for scalable and cost-effective manufacturing solutions

- North America dominated the bioprocessing reagent market with the largest revenue share of 40% in 2025, driven by strong biopharmaceutical manufacturing infrastructure, high R&D investments, and the presence of major reagent suppliers and biotech companies, with the U.S. experiencing substantial growth in bioprocessing reagent demand due to rapid expansion of biologics and cell therapy pipeline

- Asia-Pacific is expected to be the fastest growing region in the bioprocessing reagent market during the forecast period, with a projected CAGR of 19.2%, driven by increasing biologics manufacturing, rising healthcare expenditure, expanding contract manufacturing organizations (CMOs), and growing investments in life sciences research across countries such as China and India

- The Monoclonal Antibodies (mAbs) Production segment dominated the market with the largest revenue share of 31.4% in 2024, due to the strong global demand for mAbs in oncology and autoimmune disease treatment

Report Scope and Bioprocessing Reagent Market Segmentation

|

Attributes |

Bioprocessing Reagent Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Bioprocessing Reagent Market Trends

“Shift Towards Single-Use and Continuous Bioprocessing Technologies”

- A major trend in the global Bioprocessing Reagent market is the increasing shift toward single-use technologies (SUT) and continuous processing platforms, which are becoming preferred over traditional stainless-steel systems due to their ability to reduce contamination risk, minimize downtime, and lower operational costs

- For instance, many biopharmaceutical companies are adopting single-use bioreactors and disposable filtration systems to accelerate vaccine and biologics production. This shift is particularly driven by the increasing demand for faster drug development cycles and flexible manufacturing capacities

- Continuous bioprocessing is also gaining momentum, especially in mAb (monoclonal antibody) production, due to its capability to improve yield and consistency

- The adoption of these technologies has led reagent suppliers to innovate and offer specialized single-use buffers, media, chromatography resins, and disposable filtration consumables

- Overall, this trend is transforming the biomanufacturing ecosystem by enabling faster scale-up, reducing time-to-market, and supporting personalized medicine manufacturing

Bioprocessing Reagent Market Dynamics

Driver

“Rising Biologics Production and Expansion of Biopharmaceutical Manufacturing”

- The increasing global demand for biologics, vaccines, and cell-based therapies is a major driver for the Bioprocessing Reagent market, as these products require specialized reagents for upstream and downstream processing

- For instance, in 2024–2025, many global biopharma companies expanded their manufacturing facilities and capacity, leading to higher demand for chromatography resins, cell culture media, and filtration reagents

- In addition, government funding and private investments in biologics and vaccine manufacturing in emerging markets are accelerating the growth of reagent consumption

- The growing pipeline of biosimilars and complex biologics is also pushing companies to invest in high-quality reagents to ensure process efficiency and product consistency

- This increased biologics manufacturing capacity directly fuels the demand for advanced bioprocessing reagents across all stages of drug production

Restraint/Challenge

“High Cost of Advanced Reagents and Strict Regulatory Compliance”

- A key challenge restraining market growth is the high cost associated with advanced bioprocessing reagents, such as high-performance chromatography resins, specialized cell culture media, and novel filtration systems

- For instance, premium reagents used in high-purity biologics production can significantly increase overall manufacturing costs, especially for small- and mid-sized biopharma companies

- Moreover, stringent regulatory requirements and quality standards (GMP compliance, validation, and documentation) make reagent approval and usage more complex and time-consuming

- Companies must follow strict validation protocols and quality checks, which increases the cost and time of adoption

- These factors together create barriers for new entrants and slow down adoption rates in developing regions

Bioprocessing Reagent Market Scope

The market is segmented on the basis of product type, application, and end user.

• By Product Type

On the basis of product type, the Global Continuous Bioprocessing Reagents market is segmented into Cell Culture Reagents, Media & Supplements, Buffers & Salts, Enzymes & Proteins, Chromatography Reagents, Solvents & Others. The Cell Culture Reagents segment dominated the market with the largest revenue share of 27.6% in 2024, supported by increasing adoption of continuous cell culture systems and high demand for consistent product quality. These reagents play a vital role in maintaining cell viability and productivity during long-term continuous operations. Growth in biologics manufacturing, especially monoclonal antibodies and recombinant proteins, has further boosted demand. Biopharmaceutical companies are increasingly adopting continuous bioprocessing to reduce production costs and improve efficiency, which drives the need for reliable cell culture reagents. Moreover, technological advancements in media optimization and automation support large-scale continuous production. Increasing focus on process intensification and high productivity platforms also strengthens this segment.

The Enzymes & Proteins segment is expected to register the fastest CAGR of 16.8% from 2025 to 2032, driven by growing demand for enzyme-based processing in continuous purification and downstream workflows. Enzymes such as proteases and nucleases are essential for cell lysis, DNA removal, and protein processing, making them critical for continuous bioprocessing. The growth is further supported by rising adoption of single-use systems and continuous chromatography platforms that rely on enzyme-based steps. In addition, increasing R&D activities in gene therapy and cell therapy are driving demand for specialized enzymes. The expanding biopharma manufacturing capacity in emerging regions also contributes to the rapid growth of this segment.

• By Application

On the basis of application, the Global Continuous Bioprocessing Reagents market is segmented into Monoclonal Antibodies (mAbs) Production, Vaccines Production, Recombinant Proteins Production, Gene Therapy & Cell Therapy, and Others. The Monoclonal Antibodies (mAbs) Production segment dominated the market with the largest revenue share of 31.4% in 2024, due to the strong global demand for mAbs in oncology and autoimmune disease treatment. Continuous bioprocessing is increasingly preferred for mAb production because it offers higher productivity, reduced manufacturing footprint, and consistent product quality. The adoption of continuous perfusion culture and continuous downstream purification is driving the demand for related reagents. Major biopharma companies are expanding mAb pipelines and upgrading manufacturing facilities, further supporting this segment. The need for cost-effective manufacturing and faster time-to-market also strengthens the dominance of mAb production.

The Gene Therapy & Cell Therapy segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, driven by rapid growth in advanced therapy development and increasing approvals of cell and gene-based therapeutics. Continuous processing in cell therapy manufacturing improves scalability and reduces contamination risks. The increasing number of clinical trials and investments in cell and gene therapy infrastructure are boosting reagent demand. Moreover, the complexity of these therapies requires specialized reagents for cell expansion, transduction, and purification. The rising focus on personalized medicine and precision therapeutics is expected to further accelerate this segment.

• By End User

On the basis of end user, the Global Continuous Bioprocessing Reagents market is segmented into Biopharmaceutical Companies, Contract Research Organizations (CROs), Contract Development & Manufacturing Organizations (CDMOs), Academic & Research Institutes, and Others. The Biopharmaceutical Companies segment dominated the market with the largest revenue share of 38.2% in 2024, driven by increasing biologics production and expanding global manufacturing capacities. These companies are adopting continuous bioprocessing to enhance productivity, reduce manufacturing costs, and ensure consistent quality. The growing pipeline of biologics and biosimilars also supports the high demand for reagents. In addition, major players are investing in advanced process technologies and partnerships to accelerate continuous bioprocessing adoption.

The Contract Development & Manufacturing Organizations (CDMOs) segment is expected to grow at the fastest CAGR of 17.6% from 2025 to 2032, supported by rising outsourcing of biologics manufacturing and increasing demand for flexible manufacturing solutions. CDMOs are increasingly investing in continuous processing platforms to meet customer needs for faster and cost-effective production. The trend of outsourcing to specialized manufacturers for biologics, vaccines, and cell therapy products is boosting reagent demand. Furthermore, CDMOs are expanding their capabilities in continuous downstream purification and single-use systems, which drives growth in this segment.

Bioprocessing Reagent Market Regional Analysis

- North America dominated the bioprocessing reagent market with the largest revenue share of 40% in 2025, driven by strong biopharmaceutical manufacturing infrastructure, high R&D investments, and the presence of major reagent suppliers and biotech companies

- The region benefits from advanced continuous bioprocessing technologies and early adoption of next-generation biologics manufacturing, which increases demand for high-quality reagents. The U.S. leads the region due to a rapidly expanding pipeline of biologics, cell therapy, and gene therapy products, driving substantial reagent consumption. High regulatory standards and stringent quality control requirements further strengthen demand for premium-grade bioprocessing reagents

- In addition, strong funding for life sciences research and significant investments in manufacturing capacity expansion contribute to the market dominance. North America’s mature supply chain and strong vendor ecosystem also ensure availability and faster adoption of new reagents

U.S. Bioprocessing Reagent Market Insight

The U.S. bioprocessing reagent market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of biologics and cell therapy pipelines. The country has a robust ecosystem of biotech startups, large pharma companies, and reagent suppliers, which accelerates innovation and reagent demand. Strong government and private funding for life sciences research supports continuous advancements in bioprocessing technologies. The U.S. also leads in adopting advanced continuous manufacturing and single-use systems, increasing the need for specialized reagents. The presence of major contract manufacturing organizations (CMOs) further boosts reagent consumption due to outsourced biologics production. High regulatory compliance and stringent quality standards drive demand for premium reagents, making the U.S. the largest contributor to North America’s market growth.

Europe Bioprocessing Reagent Market Insight

The Europe bioprocessing reagent market is projected to expand at a substantial CAGR during the forecast period, driven by strong pharmaceutical manufacturing, rising biologics production, and growing investments in life sciences research. Countries such as Germany, France, and the U.K. are strengthening their biomanufacturing capacities, which increases demand for continuous bioprocessing reagents. Europe’s regulatory focus on product quality and safety supports high-quality reagent adoption. The region also benefits from increasing collaborations between academia and industry, boosting R&D in bioprocessing. In addition, Europe’s push towards sustainable manufacturing and process intensification supports continuous bioprocessing technologies.

U.K. Bioprocessing Reagent Market Insight

The U.K. bioprocessing reagent market is anticipated to grow at a noteworthy CAGR, driven by increasing investments in biotech research and expanding biologics production capabilities. The country has strong academic research institutions and a growing biotech ecosystem, fueling demand for advanced reagents.

Germany Bioprocessing Reagent Market Insight

The Germany bioprocessing reagent market is expected to expand at a considerable CAGR, supported by its strong pharmaceutical manufacturing base and continuous adoption of advanced bioprocessing technologies. Germany’s well-developed infrastructure and focus on innovation promote the use of high-quality reagents across biologics production and research.

Asia-Pacific Bioprocessing Reagent Market Insight

The Asia-Pacific bioprocessing reagent market is expected to be the fastest growing region with a projected CAGR of 19.2% during the forecast period, driven by increasing biologics manufacturing, rising healthcare expenditure, expanding contract manufacturing organizations (CMOs), and growing investments in life sciences research across countries such as China and India. The region is rapidly emerging as a major hub for biologics production, supported by growing government support and favorable policies. The increasing number of biotech startups and expansion of manufacturing facilities in APAC is creating strong demand for bioprocessing reagents. In addition, the adoption of continuous bioprocessing and single-use technologies is rising due to cost efficiency and scalability.

Japan Bioprocessing Reagent Market Insight

The Japan Bioprocessing Reagent market is gaining momentum due to high investments in advanced biologics research, strong pharmaceutical manufacturing capabilities, and early adoption of continuous bioprocessing technologies. Japan’s focus on innovation in cell therapy and regenerative medicine is driving demand for specialized reagents used in upstream and downstream bioprocessing. The country’s advanced healthcare infrastructure and strong government support for biotech R&D also contribute to market growth. Japanese biopharmaceutical companies are increasingly collaborating with global reagent suppliers to improve process efficiency and ensure regulatory compliance. Furthermore, Japan’s aging population and rising demand for novel therapies such as monoclonal antibodies and gene therapies are increasing the need for high-quality bioprocessing reagents. Continuous improvement in manufacturing standards and increasing investments in capacity expansion are expected to support long-term market growth.

China Bioprocessing Reagent Market Insight

The China Bioprocessing Reagent market accounted for the largest market revenue share in Asia-Pacific, driven by expanding biologics manufacturing infrastructure, increasing R&D spending, and growing collaborations between domestic and global biotech companies. China is rapidly emerging as a major hub for biologics production, supported by government initiatives promoting biotechnology and healthcare innovation. Major hospitals and research institutions are increasingly adopting advanced bioprocessing platforms, which is boosting reagent demand. The presence of strong domestic reagent manufacturers is also helping to reduce costs and improve accessibility, supporting broader adoption across small and mid-size biotech firms. In addition, China’s expanding clinical trials and growing pipeline of cell therapy and gene therapy products are fueling demand for specialized reagents. Continuous investments in manufacturing capacity and technology upgrades are expected to sustain strong market growth over the forecast period.

Bioprocessing Reagent Market Share

The Bioprocessing Reagent industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Thermo Fisher Scientific (U.S.)

- GE Healthcare (U.S.)

- Sartorius AG (Germany)

- Danaher Corporation (U.S.)

- Becton Dickinson (U.S.)

- Lonza Group (Switzerland)

- Fujifilm Irvine Scientific (U.S.)

- Corning Incorporated (U.S.)

- Cytiva (U.S.)

- Repligen Corporation (U.S.)

- Pall Corporation (U.S.)

- Bio-Rad Laboratories (U.S.)

- Sigma-Aldrich (U.S.)

- Avantor (U.S.)

- WuXi AppTec (China)

- Kerry Group (Ireland)

- Tecan Group (Switzerland)

- Takara Bio (Japan)

- Biocon (India)

Latest Developments in Global Bioprocessing Reagent Market

- In June 2024, Merck KGaA announced a major collaboration with Illumina to accelerate the development of sequencing-based diagnostic workflows and expand access to high-quality biological reagents across clinical and research markets, strengthening reagent portfolios that support both discovery and manufacturing workflows

- In January 2025, Thermo Fisher Scientific launched a new line of integrated molecular biology reagents and workflow kits aimed at increasing throughput for high-volume genomics and proteomics labs, enhancing reagent options for bioprocess quality control and analytical applications

- In January 2025, Bio-Rad Laboratories, Inc. launched Nuvia wPrime 2A Media, a next-generation mixed-mode chromatography resin for downstream purification that enables tunable, scalable purification from lab to manufacturing scale—a key reagent innovation supporting advanced biologics purification workflows

- In May 2025, Thermo Fisher Scientific introduced Nexus SUC, a single-use chromatography platform designed to streamline integration between upstream and downstream purification steps, reflecting the market’s shift toward modular single-use reagent and consumable solutions that reduce cleaning validation and contamination risk

- In July 2025, Purilogics (a Donaldson Life Sciences business) announced the commercial availability of Purexa™ NAEX Prep, its first manufacturing-grade anion-exchange membrane chromatography consumable, offering high binding capacity and compatibility with standard chromatography systems to accelerate plasmid DNA purification and other bioprocess steps

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.