Global Bioprocessing Support Services Market

Market Size in USD Billion

CAGR :

%

USD

1.99 Billion

USD

4.90 Billion

2025

2033

USD

1.99 Billion

USD

4.90 Billion

2025

2033

| 2026 –2033 | |

| USD 1.99 Billion | |

| USD 4.90 Billion | |

|

|

|

|

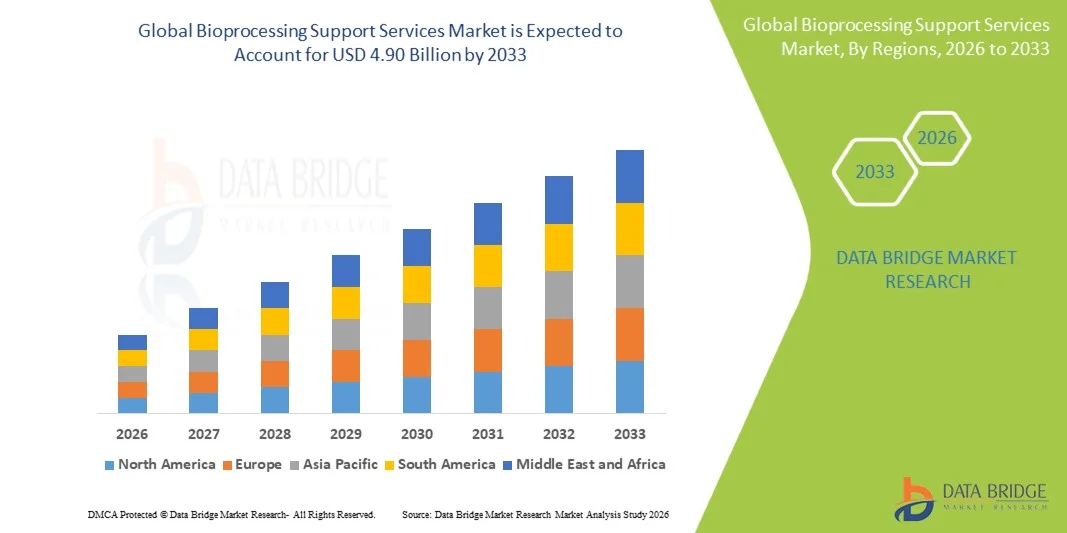

What is the Global Bioprocessing Support Services Market Size and Growth Rate?

- The global bioprocessing support services market size was valued at USD 1.99 billion in 2025 and is expected to reach USD 4.90 billion by 2033, at a CAGR of 11.20% during the forecast period

- The growing adoption of advanced biopharmaceutical production techniques and increasing reliance on outsourced support services are major factors driving market growth. In addition, the rising demand for faster development cycles, regulatory compliance support, and specialized analytical services is fueling the expansion of the bioprocessing support services market

- Rapid advancements in bioprocessing technologies, automation, and analytical instrumentation, coupled with the increasing focus on cell and gene therapies, are further boosting market adoption. Moreover, the need for efficient, cost-effective, and scalable support services in both established and emerging biotech markets is contributing significantly to overall growth

What are the Major Takeaways of Bioprocessing Support Services Market?

- The increasing investment in contract manufacturing organizations (CMOs) and contract research organizations (CROs) to handle complex bioprocessing tasks is positively impacting market growth

- Rising demand from biopharmaceutical companies for specialized process development, validation, and regulatory support services is enhancing market opportunities

- Furthermore, the focus on quality assurance, compliance with stringent regulations, and adoption of digital solutions in bioprocessing is driving innovation and operational efficiency, supporting sustained growth in the global bioprocessing support services market

- Asia-Pacific dominated the bioprocessing support services market with the largest revenue share of 41.9% in 2025, driven by the rapid expansion of biopharmaceutical manufacturing, rising demand for vaccines and biologics, and strong government support for biotechnology infrastructure

- North America is expected to witness the fastest CAGR of 8.2% from 2026 to 2033, driven by rising demand for contract bioprocessing, biologics manufacturing, and outsourced analytical services

- The analytical and quality control services segment dominated the market with the largest revenue share of 42.5% in 2025, owing to its critical role in ensuring product quality, consistency, and regulatory compliance across bioprocessing workflows

Report Scope and Bioprocessing Support Services Market Segmentation

|

Attributes |

Bioprocessing Support Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Bioprocessing Support Services Market?

“Increasing Adoption of Outsourced Bioprocessing Support Services and Contract Manufacturing Solutions”

- The Bioprocessing Support Services (BPS) market is witnessing a shift toward outsourcing of bioprocessing activities, including cell culture, fermentation, purification, and analytical testing. Biopharmaceutical companies are increasingly leveraging specialized service providers to enhance efficiency, reduce time-to-market, and mitigate operational risks

- For instance, Thermo Fisher Scientific, Inc. (U.S.) and Sartorius AG (Germany) offer end-to-end bioprocessing support services, enabling clients to accelerate biologics and vaccine production without heavy capital investment in infrastructure. This reflects the growing preference for flexible, scalable, and expertise-driven solutions

- Integration of advanced process monitoring, automation, and quality assurance platforms is enabling improved reproducibility, compliance, and data-driven decision-making. These innovations support high-quality production for both clinical and commercial manufacturing

- The rising trend toward contract development and manufacturing (CDMO/CDS) partnerships is promoting efficient resource utilization, allowing biopharma firms to focus on R&D while outsourcing routine or large-scale production tasks

- Expansion of cloud-based process analytics and digital bioprocessing solutions is enhancing traceability, regulatory compliance, and operational efficiency for outsourced services

- Overall, the increasing reliance on outsourced, technology-enabled bioprocessing services is redefining operational strategies, driving faster development cycles, and shaping long-term growth in the global bioprocessing support services market

What are the Key Drivers of Bioprocessing Support Services Market?

- The growing demand for biopharmaceuticals, vaccines, and biosimilars is a major driver for the bioprocessing support services market. Outsourced services enable companies to meet production volume requirements without significant capital expenditure

- For instance, in 2025, Lonza (Switzerland) reported increased demand for contract bioprocessing services from global vaccine manufacturers, reflecting rising adoption of outsourced production solutions in response to pandemic preparedness

- Increasing complexity of biologics and advanced therapies such as cell and gene therapy drives the need for specialized expertise, equipment, and regulatory compliance offered by bioprocessing support services providers

- Rising R&D investments and expedited drug development timelines encourage outsourcing to reduce operational bottlenecks and accelerate time-to-market for critical therapies

- Advancements in bioprocessing automation, single-use technologies, and modular facilities enhance efficiency, reduce contamination risks, and ensure consistent product quality, further promoting market growth

- As the biopharma industry continues to expand globally, the adoption of outsourced, scalable, and compliant bioprocessing support services is expected to grow steadily, fueling market development across regions

Which Factor is Challenging the Growth of the Bioprocessing Support Services Market?

- High operational costs and stringent regulatory compliance requirements pose challenges to the bioprocessing support services market. Providers must invest in specialized equipment, skilled personnel, and validated processes to meet global standards

- For instance, smaller CDMOs in Europe and Asia have faced difficulties scaling operations due to regulatory audits, GMP compliance, and capital-intensive infrastructure needs

- Supply chain disruptions, including sourcing of single-use bioprocessing materials, reagents, and specialized components, can impact service delivery timelines and cost efficiency

- Variability in regional regulatory requirements, such as FDA, EMA, and ICH guidelines, adds complexity to cross-border service provision, increasing operational challenges for global clients

- Intense competition among global and regional bioprocessing support services providers forces smaller firms to adopt continuous innovation and advanced technology to maintain market share

- To mitigate these issues, industry players are investing in modular, scalable facilities, strategic partnerships, and process standardization to ensure cost-effective, high-quality bioprocessing support services and long-term market sustainability

How is the Bioprocessing Support Services Market Segmented?

The market is segmented on the basis of service type, application, and end user.

• By Service Type

On the basis of service type, the bioprocessing support services market is segmented into process development and optimization, analytical and quality control services, regulatory support and compliance services, manufacturing support services, validation and qualification services, supply chain and logistics support, and training and consultancy services. The analytical and quality control services segment dominated the market with the largest revenue share of 42.5% in 2025, owing to its critical role in ensuring product quality, consistency, and regulatory compliance across bioprocessing workflows. These services encompass batch testing, stability analysis, and impurity profiling, which are essential for both large-scale and small-scale biopharmaceutical operations. The segment benefits from technological advancements in high-throughput screening, automation, and real-time monitoring, which enhance process efficiency and reduce error margins.

Meanwhile, regulatory support and compliance services are projected to witness the fastest growth rate during 2026–2033, driven by increasing global regulatory scrutiny, evolving compliance standards, and the expansion of international biopharmaceutical markets, prompting companies to adopt expert services for seamless approvals and audits.

• By Application

On the basis of application, the bioprocessing support services market is segmented into biopharmaceutical production, vaccine development, cell and gene therapy, monoclonal antibody production, recombinant protein production, and clinical trials and research. The biopharmaceutical production segment dominated the market with the largest revenue share of 44.1% in 2026, supported by the growing demand for innovative drugs, biosimilars, and therapeutic proteins. Increasing investments in large-scale biologics manufacturing, coupled with the need for stringent quality control and process optimization, further reinforces the segment’s dominance. Advanced process automation, real-time monitoring, and high-yield production technologies are driving efficiency improvements across this sector.

Meanwhile, cell and gene therapy is expected to register the fastest CAGR between 2026 and 2033, owing to the rapid expansion of personalized medicine, CAR-T therapies, and viral vector production. Rising funding for gene therapy research, coupled with growing adoption of advanced bioprocessing techniques, is accelerating the demand for specialized support services in this emerging application area.

• By End User

Based on end user, the bioprocessing support services market is segmented into biopharmaceutical companies, contract manufacturing organizations (CMOs), contract research organizations (CROs), academic and research institutes, and biotechnology startups. The biopharmaceutical companies segment dominated the market with the largest revenue share of 48.3% in 2025, driven by their substantial investments in large-scale production, quality assurance, and process optimization. Biopharmaceutical firms rely heavily on support services for analytical testing, validation, and regulatory compliance to ensure high-quality outputs for both domestic and international markets. Increasing R&D budgets, combined with rising global demand for biologics, vaccines, and recombinant products, further strengthens this segment’s market dominance.

Meanwhile, biotechnology startups are expected to witness the fastest CAGR from 2026 to 2033, fueled by a surge in innovation-focused ventures, venture capital funding, and collaborations with CMOs and CROs. Startups increasingly depend on external support for process development, regulatory guidance, and manufacturing scalability, driving rapid growth in this segment.

Which Region Holds the Largest Share of the Bioprocessing Support Services Market?

- Asia-Pacific dominated the bioprocessing support services market with the largest revenue share of 41.9% in 2025, driven by the rapid expansion of biopharmaceutical manufacturing, rising demand for vaccines and biologics, and strong government support for biotechnology infrastructure

- The region’s growing contract development and manufacturing (CDMO) sector, combined with increasing R&D investments and the presence of skilled technical workforce, is propelling market growth

- In addition, favorable regulatory initiatives, cost-efficient production capabilities, and strong adoption of advanced single-use and modular bioprocessing systems reinforce Asia-Pacific’s leadership in the global bioprocessing support services market

China Bioprocessing Support Services Market Insight

China held the largest share in the Asia-Pacific bioprocessing support services market in 2025, supported by robust biopharma production, expanding CDMO facilities, and rising domestic demand for vaccines and biologics. Government policies encouraging biotechnology investment and the modernization of production plants are boosting capacity. Leading domestic and international players are adopting state-of-the-art single-use systems, automated process analytics, and modular facilities to enhance efficiency and product quality. Rising export potential and large-scale vaccine manufacturing further strengthen China’s dominance in the region.

India Bioprocessing Support Services Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing biopharma R&D centers, expanding vaccine production, and rising domestic and international contract manufacturing demand. Government initiatives such as “Make in India” and biotechnology parks are promoting investment in modular, high-purity bioprocessing facilities. The growing adoption of single-use technologies, automation, and quality compliance standards enhances scalability and efficiency, while the rising global demand for vaccines and biosimilars continues to create opportunities for local service providers.

Europe Bioprocessing Support Services Market Insight

The Europe bioprocessing support services market is expanding steadily, supported by high investments in biologics, vaccines, and advanced therapies. Stringent regulatory frameworks such as EMA guidelines ensure consistent quality, driving adoption of contract bioprocessing and GMP-compliant solutions. Countries such as Germany, France, and Switzerland are leading with established biopharma clusters and robust CDMO networks. Increasing R&D funding, focus on innovation, and sustainable production practices continue to strengthen Europe’s position as a mature and stable market for bioprocessing support services.

Germany Bioprocessing Support Services Market Insight

Germany remains a key market in Europe, driven by advanced biopharma infrastructure, strong engineering capabilities, and demand for high-purity biologics production. Leading CDMO players provide scalable, GMP-compliant services for complex biologics, supporting both domestic and export needs. Investments in single-use and continuous bioprocessing technologies enhance efficiency and reduce contamination risks, solidifying Germany’s leadership within the European bioprocessing support services landscape.

U.K. Bioprocessing Support Services Market Insight

The U.K. market is growing steadily due to expanding biopharma R&D, vaccine production facilities, and the increasing use of outsourced bioprocessing services. Government initiatives to support life sciences innovation, regulatory compliance, and modern CDMO infrastructure promote market adoption. Strategic partnerships with international biopharma firms and digital process analytics adoption further strengthen the U.K.’s role in Europe’s bioprocessing support sector.

North America Bioprocessing Support Services Market Insight

North America is expected to witness the fastest CAGR of 8.2% from 2026 to 2033, driven by rising demand for contract bioprocessing, biologics manufacturing, and outsourced analytical services. Growth in the U.S. and Canada’s biotech sectors, coupled with increasing R&D investments and adoption of single-use and modular facilities, is accelerating market expansion. The region’s focus on regulatory compliance, digital process monitoring, and process optimization enhances operational efficiency and service quality.

U.S. Bioprocessing Support Services Market Insight

The U.S. accounted for the largest share in the North America bioprocessing support services market in 2025, driven by the presence of leading CDMOs, large-scale biologics and vaccine production, and continuous technological innovation. High investments in automation, single-use systems, and analytical services support scalability and regulatory compliance. The growing demand for outsourced bioprocessing solutions from small- and mid-sized biopharma firms ensures sustained market growth, making the U.S. a critical hub for North America’s bioprocessing support services landscape.

Which are the Top Companies in Bioprocessing Support Services Market?

The bioprocessing support services industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Thermo Fisher Scientific, Inc. (U.S.)

- Danaher (Cytiva) (U.S.)

- Corning Inc. (U.S.)

- Sartorius AG (Germany)

- Lonza (Switzerland)

- CESCO BIOENGINEERING CO., LTD (South Korea)

- Bio-Process Group (U.K.)

- BPC Instruments AB (Sweden)

- Eppendorf AG (Germany)

- Getinge AB (Sweden)

- PBS Biotech, Inc. (U.S.)

- Bio-Synthesis, Inc. (U.S.)

- Meissner Filtration Products, Inc. (U.S.)

- Entegris (U.S.)

- KUHNER AG (Switzerland)

- Saint-Gobain (France)

- ExcellGene SA (Switzerland)

- Repligen Corporation (U.S.)

- Avantor, Inc (U.S.)

- CerCell A/S (Denmark)

- Univercells Technologies (Belgium)

- Distek, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.