Global Biorational Pesticides Market

Market Size in USD Billion

CAGR :

%

USD

8.01 Billion

USD

25.02 Billion

2024

2032

USD

8.01 Billion

USD

25.02 Billion

2024

2032

| 2025 –2032 | |

| USD 8.01 Billion | |

| USD 25.02 Billion | |

|

|

|

|

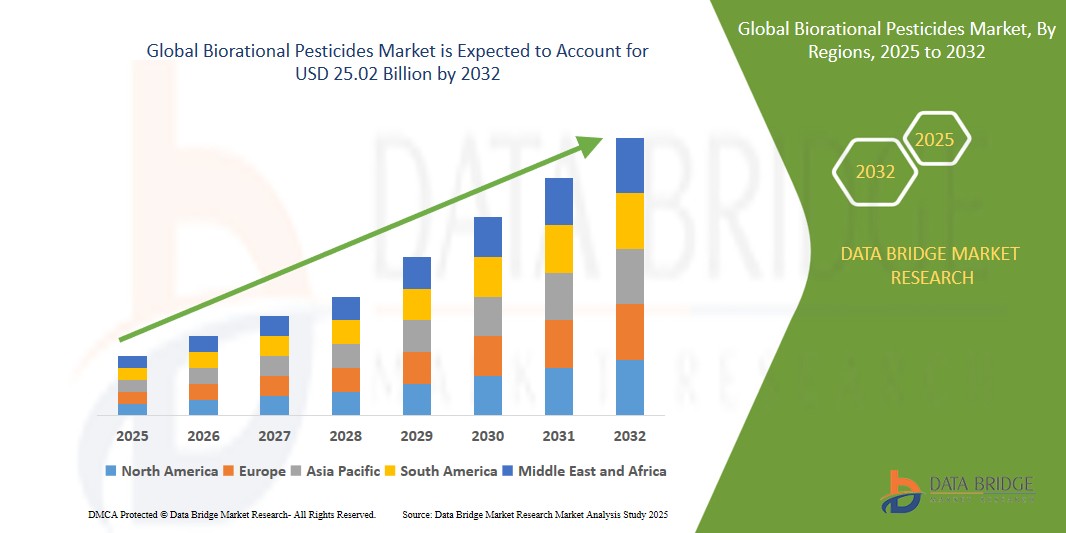

Biorational Pesticides Market Size

- The global biorational pesticides market was valued at USD 6.9 billion in 2024 and is expected to reach USD 14.6 billion by 2032, growing at a CAGR of 15.4%

- The market movement is attributed to the increasing adoption of biorational solutions within sustainable agriculture and Integrated Pest Management (IPM) frameworks.

- This growth is driven by factors such as the growing demand for sustainable and eco-friendly crop protection solutions and increasing regulatory bans on synthetic pesticides are pushing the adoption of eco-friendly alternatives like biorational pesticides

Biorational Pesticides Market Analysis

- The biorational pesticides market is driven by increasing demand for eco-friendly, sustainable pest control solutions, particularly in organic farming and integrated pest management (IPM) systems. Consumers and farmers are seeking alternatives to chemical pesticides that are less harmful to human health and the environment.

- Biorational pesticides are gaining traction due to their biodegradable properties, low toxicity to non-target species, and effectiveness against a broad range of pests, making them a favorable option for sustainable agriculture practices.

- North America and Europe remain dominant regions due to strong regulatory support for organic farming and growing consumer preference for eco-conscious products. However, Asia-Pacific is rapidly emerging as a key market due to rising awareness about sustainable farming and the need for natural pest control methods.

- The insecticides segment by type is expected to account for approximately 55.0% of the global revenue share in 2025, driven by the increasing adoption of such products for crop protection, particularly in vineyards, fruits, and vegetables

Report Scope and Biorational Pesticides Market Segmentation

|

Attributes |

Biorational Pesticides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biorational pesticides Market Trends

“Integration of Biorational Pesticides into Sustainable Farming Practices and IPM Programs”

- A significant trend in the global biorational pesticides market is the increasing adoption of biorational solutions within sustainable agriculture and Integrated Pest Management (IPM) frameworks. This shift is driven by growing environmental concerns and the need for eco-friendly pest control methods.

- Biorational pesticides, including microbial and botanical formulations, are gaining traction due to their targeted action and minimal impact on non-target organisms. Their compatibility with IPM practices enhances their appeal among modern agricultural stakeholders.

- The market is witnessing robust demand from the organic farming sector, where the need for sustainable and residue-free crop protection solutions is paramount. Additionally, regulatory support and government initiatives promoting sustainable agriculture are bolstering market growth.

- For instance, the UK government has announced plans to reduce pesticide use on arable farms by 10% by 2030 to protect pollinators like bees. This initiative includes promoting integrated pest management and encouraging the adoption of non-chemical alternatives, such as biorational pesticides.

Biorational pesticides Market Dynamics

Driver

“Growing Demand for Sustainable and Eco-Friendly Crop Protection Solutions”

- Increasing global awareness of the environmental and health impacts of synthetic agrochemicals is prompting a shift toward safer and sustainable alternatives like biorational pesticides

- Biorational pesticides offer targeted pest control, biodegradability, and low toxicity to non-target organisms, making them ideal for organic and sustainable farming practices

- Regulatory authorities across the U.S., EU, and Asia are increasingly approving and supporting the use of biorational alternatives, accelerating their adoption across conventional and organic farming systems

- Public and private sector investments in sustainable agriculture programs are also driving the market, with incentives and funding supporting integrated pest management and biological solutions

For instance,

- The U.S. Department of Agriculture (USDA) announced a $300 million investment in the Organic Transition Initiative (OTI) to support farmers transitioning to organic production. This initiative includes technical assistance, direct farmer support, and market development projects

- As sustainable farming gains momentum worldwide, the demand for eco-friendly, low-toxicity crop protection solutions is expected to significantly boost the growth of the biorational pesticides market

Opportunity

“Expanding Use of Biorational Pesticides in Integrated Pest Management (IPM) Programs”

- The adoption of Integrated Pest Management (IPM) is accelerating worldwide, driven by growing concerns over pesticide residues, resistance issues, and the environmental impact of synthetic chemicals

- Biorational pesticides, known for their specificity, low toxicity to non-target organisms, and biodegradability, are being increasingly incorporated into IPM programs across agriculture and horticulture sectors

- These pesticides complement biological controls and other eco-friendly practices, making them attractive to both organic and conventional farmers aiming to reduce chemical inputs and meet regulatory or certification requirements

For instance,

- In November 2023, the government of India issued new guidelines to strengthen IPM adoption by encouraging the use of biorational and biopesticide-based interventions in crop protection programs. The initiative supports farmers through training, subsidies, and regulatory ease to promote sustainable pest management practices

- As IPM policies and awareness increase globally, demand for biorational solutions is expected to surge, especially in high-value crops and export-oriented production systems

Restraint/Challenge

“Limited Shelf Life and Stability Constraints Affecting Market Penetration”

- Biorational pesticides, particularly those based on microbial and botanical formulations, often have shorter shelf lives and require specific storage conditions such as refrigeration or protection from light and humidity

- These constraints reduce product viability during transport and storage, especially in regions with limited cold-chain infrastructure or high ambient temperatures

- The instability of active ingredients under varying environmental conditions also limits their adoption in large-scale conventional farming, where ease of use and long shelf life are critical

- This creates logistical and cost-related challenges for distributors and restricts wider adoption in emerging markets and remote agricultural regions

For instance,

- A 2024 article from AgFunder News reports that while biopesticides offer eco-friendly solutions, their widespread adoption is hindered by inconsistent efficacy, especially under different environmental conditions. Many biopesticides are not as resilient to varying climates as synthetic alternatives, which limits their effectiveness in regions with extreme weather patterns. This variability makes it challenging for farmers to fully rely on these products, especially in regions with diverse climatic conditions.

Biorational Pesticides Market Scope

The market is segmented on the basis of type, source, application, crop type and formulation.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Source |

|

|

By Application |

|

|

Crop Type |

|

|

Formulation |

|

In 2025, the Foliar Spray segment is projected to dominate the market with the largest share in the application segment.

The Foliar Spray segment is expected to dominate the biorational pesticides market with the largest share of approximately 58.5% in 2025. This growth is driven by the increasing adoption of foliar spray formulations for targeted pest control in crops such as fruits, vegetables, and ornamental plants, where precise application and rapid efficacy are key.

In 2025, the Insecticides segment is expected to account for the largest share during the forecast period in the type segment.

The Insecticides segment is expected to dominate the market by type, accounting for 55.0% of global revenue share in 2025, driven by the growing demand for natural pest control solutions in agriculture, particularly in organic farming, which has been expanding globally.

Biorational pesticides Market Regional Analysis

“• North America is the Dominant Region in the Biorational Pesticides Market”

- North America dominates the global biorational pesticides market, accounting for approximately 42% of the total market share in 2025, driven by stringent regulations on chemical pesticide use and a strong push toward sustainable agriculture.

- The U.S. leads the region, supported by proactive regulatory frameworks from the EPA and strong adoption of integrated pest management (IPM) practices in both row crops and specialty crop sectors.

- Growing consumer demand for organic produce and the rapid expansion of organic farming acreage are key contributors to sustained demand for biorational inputs across the U.S. and Canada.

- Technological innovation, favorable government subsidies, and a well-developed agri-inputs distribution infrastructure also support higher adoption levels in the region.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the fastest CAGR during the forecast period, propelled by growing awareness of the environmental and health impacts of synthetic pesticides and increasing demand for residue-free produce.

- Countries like India and China are investing in sustainable farming practices and providing regulatory support for low-toxicity alternatives, making the region fertile ground for biorational product expansion.

- Southeast Asian nations such as Vietnam, Thailand, and the Philippines are increasingly embracing biorational solutions as part of sustainable farming programs supported by international development organizations.

- The rapid commercialization of organic farming and increasing export focus on pesticide residue compliance are expected to further accelerate market growth across the region.

Biorational Pesticides Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF (Germany)

- Bayer AG (Germany)

- UPL (India)

- FMC Corporation (U.S.)

- Syngenta AG (Switzerland)

- Novozymes A/S (Denmark)

- Sumitomo Chemical Co. Ltd (Japan)

- Pro Farm Group Inc (U.S.)

- Koppert (Netherlands)

- Valent BioSciences LLC (U.S.)

- Gowan Company (U.S.)

- Certis Biologicals (U.S.)

- Biobest Group (Belgium)

- BIONEMA (UK)

- Vestaron Corporation (U.S.)

Latest Developments in Global Biorational Pesticides Market

- In January 2023, Valent BioSciences LLC, known for its expertise in creating environmentally friendly and highly efficient technologies for agriculture, public health, and forest health, has confirmed the acquisition of FBSciences Holdings, Inc. This move solidifies their position in the market as a leader in developing and marketing naturally derived solutions for plant, soil, and climate health. Through this acquisition, Valent BioSciences, along with its parent company Sumitomo Chemical Co., Ltd., now presents a comprehensive lineup of integrated biorational solutions. This includes a proven portfolio encompassing biostimulants, biopesticides, and crop nutrition solutions

- In March 2023, UPL Ltd. partnered with international biotech firms to expand its biopesticide product range

- In January 2022, Certis Biologicals had launched MeloCon LC (Active Ingredient: Purpureocilium lilacinum strain 251), a water dispersible concentrate that contained spores from a naturally occurring soil fungus, targeting a wide range of harmful nematodes at various lifecycle stages. The improved liquid concentrate formulation of MeloCon LC brought several advantages to growers operating both organic and conventional acreage

- In April 2021, FMC Corporation established a distribution partnership with Syngenta Crop Protection to market innovative biological seed treatments in Canada

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Biorational Pesticides Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Biorational Pesticides Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Biorational Pesticides Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.