Global Biorationals Market

Market Size in USD Billion

CAGR :

%

USD

8.68 Billion

USD

13.94 Billion

2025

2033

USD

8.68 Billion

USD

13.94 Billion

2025

2033

| 2026 –2033 | |

| USD 8.68 Billion | |

| USD 13.94 Billion | |

|

|

|

|

Biorationals Market Size

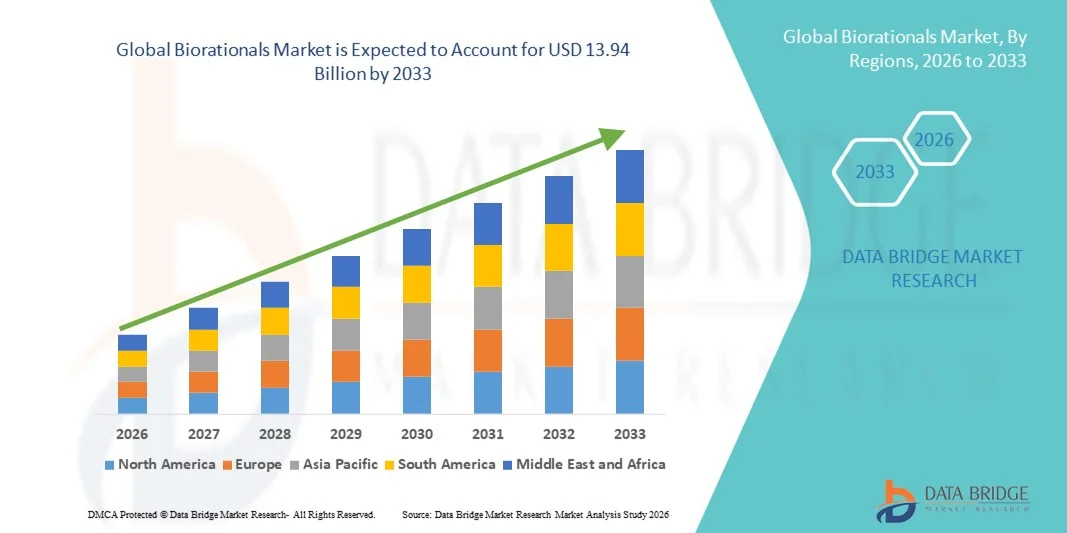

- The global biorationals market size was valued at USD 8.68 billion in 2025 and is expected to reach USD 13.94 billion by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by the rising adoption of sustainable agricultural practices, increasing demand for organic food products, and stringent regulations on chemical pesticide usage

- Growing awareness among farmers regarding the long-term benefits of biorationals, such as enhanced soil health, reduced residue levels, and improved crop resilience, is further supporting market growth across both developed and developing economies

Biorationals Market Analysis

- The biorationals market is witnessing steady expansion as farmers increasingly shift toward eco-friendly pest management solutions that minimize environmental impact while maintaining crop productivity. Governments and regulatory bodies are promoting integrated pest management (IPM) programs, driving the use of biorationals as a preferred alternative to synthetic chemicals

- Technological advancements in microbial and botanical formulations are improving the effectiveness and shelf life of biorational products, expanding their applicability across diverse crops and climatic conditions. Moreover, increased investment by key industry players in R&D for product innovation and regional market expansion is further enhancing market penetration

- North America dominated the biorationals market with the largest revenue share of 38.92% in 2025, driven by the region’s advanced agricultural practices, strong regulatory support for sustainable farming, and rising consumer demand for organic and residue-free food products

- Asia-Pacific region is expected to witness the highest growth rate in the global biorationals market, driven by rapid agricultural modernization, growing farmer awareness of biological solutions, and rising investments from global agrochemical companies in emerging economies

- The insecticides segment held the largest market revenue share in 2025, driven by the growing need for environmentally friendly pest control solutions in agriculture. The increasing prevalence of crop-damaging insects and the shift toward residue-free pest management practices have further strengthened the demand for biorational insecticides across diverse cropping systems

Report Scope and Biorationals Market Segmentation

|

Attributes |

Biorationals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biorationals Market Trends

Rising Adoption Of Sustainable Pest Management Practices

- The growing emphasis on environmentally friendly farming practices is driving widespread adoption of biorationals, which offer effective pest control without harming beneficial organisms or soil health. Farmers are increasingly replacing chemical pesticides with biopesticides and botanicals that align with sustainable agriculture goals and regulatory frameworks. This transition is also driven by consumer awareness and the global shift toward sustainable food production systems that emphasize long-term soil fertility and ecosystem preservation

- The expansion of organic farming acreage worldwide is creating consistent demand for biorational products such as microbial insecticides, pheromones, and plant extracts. These solutions support residue-free crop production while maintaining yield quality and marketability across global export chains. As international certification standards tighten, biorationals have become essential tools for farmers aiming to meet export compliance and consumer expectations for transparency and sustainability

- Government policies promoting reduced chemical dependency in agriculture are accelerating the integration of biorationals into national crop protection programs. Subsidies, awareness campaigns, and technical training are further enhancing adoption at both commercial and smallholder levels. Furthermore, the establishment of dedicated biocontrol promotion schemes is ensuring that biorationals are recognized as core components of national food security and sustainability strategies

- For instance, in 2023, the European Union increased funding under its Farm to Fork Strategy to encourage biopesticide use, boosting the market presence of microbial-based pest control products across the region. This initiative helped farmers transition to sustainable alternatives while complying with stringent residue limits. It also stimulated domestic production of biorationals, reducing import dependency and creating new opportunities for local manufacturers and R&D institutions

- While the adoption rate of biorationals is increasing, success depends on consistent farmer education, improved product formulations, and cost competitiveness. Manufacturers need to focus on scalable production, extended shelf life, and distribution in emerging markets to meet growing global demand. Continued collaboration among policymakers, research institutions, and private players will be key to improving product accessibility and long-term market sustainability

Biorationals Market Dynamics

Driver

Stringent Regulatory Policies And Rising Demand For Organic Food

- Increasingly strict regulations on synthetic pesticide use across major agricultural economies are driving farmers and agrochemical companies toward biorational alternatives. These eco-friendly products meet compliance requirements while ensuring crop protection efficiency and environmental safety. With mounting environmental concerns, biorationals are being recognized as essential tools in achieving pesticide residue reduction targets set by various global regulatory frameworks

- Consumers’ growing preference for organic and chemical-free food products is pushing food producers to adopt natural pest management practices. Retailers and food chains are also prioritizing residue-free sourcing, which directly contributes to rising demand for biorationals in integrated farming systems. This consumer-driven transformation is encouraging food companies to invest in sustainable sourcing programs and build traceable supply chains supported by biological crop inputs

- Governments are supporting the transition by funding biopesticide R&D programs and establishing fast-track approval systems for biological products. These efforts are reducing entry barriers for innovative formulations and encouraging private-sector participation in sustainable crop protection. Strategic public-private partnerships are further facilitating localized manufacturing, boosting rural employment, and fostering innovation in the bio-agriculture space

- For instance, in 2022, the United States Environmental Protection Agency (EPA) simplified registration protocols for biopesticides, leading to a surge in new product launches and accelerating commercialization across North America. This regulatory clarity not only improved market competitiveness but also encouraged multinational firms to expand their biocontrol portfolios and invest in next-generation microbial and botanical solutions

- Although regulatory and consumer trends are supporting market growth, companies must continue focusing on awareness building, application precision, and field efficacy to sustain long-term adoption. The industry must also emphasize farmer training programs and demonstration projects to bridge the knowledge gap and promote confidence in biorational efficacy under varying climatic conditions

Restraint/Challenge

High Production Cost And Limited Shelf Life Of Biorational Products

- The complex fermentation and extraction processes involved in producing microbial and botanical-based products increase manufacturing costs compared to conventional agrochemicals. This cost disparity limits large-scale adoption, particularly among smallholder farmers in price-sensitive markets. The high investment required for quality control, culture maintenance, and production scalability continues to challenge producers seeking cost parity with synthetic alternatives

- Many biorational products have a relatively short shelf life and require specific storage conditions to maintain effectiveness, posing logistical challenges for distributors and retailers operating in tropical and remote regions. Exposure to fluctuating temperatures and humidity levels can degrade product efficacy, making supply chain reliability and packaging innovation critical to ensuring consistent field performance

- Limited availability of cold-chain infrastructure and inconsistent quality assurance mechanisms further hinder the stable distribution of biorational inputs. These challenges restrict the market’s ability to expand in developing economies where infrastructure gaps persist. In addition, small distributors often lack adequate storage facilities, leading to product wastage and reduced confidence among end-users

- For instance, in 2023, agricultural cooperatives in Southeast Asia reported a 20% product loss rate due to improper storage conditions of microbial formulations, underscoring the need for improved packaging and temperature management solutions. Similar patterns have been observed in African and Latin American regions where supply chain interruptions exacerbate product degradation

- While ongoing R&D is focused on enhancing product stability and reducing production costs, manufacturers must collaborate with local distributors and policymakers to develop cost-effective, durable formulations suitable for diverse climates. Strengthening regional infrastructure, adopting advanced encapsulation technologies, and implementing farmer education programs will be essential to overcoming these challenges and ensuring wider adoption of biorationals globally

Biorationals Market Scope

The market is segmented on the basis of product, source, formulation, application, and crop type.

- By Product

On the basis of product, the biorationals market is segmented into insecticides, fungicides, and nematicides. The insecticides segment held the largest market revenue share in 2025, driven by the growing need for environmentally friendly pest control solutions in agriculture. The increasing prevalence of crop-damaging insects and the shift toward residue-free pest management practices have further strengthened the demand for biorational insecticides across diverse cropping systems.

The nematicides segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by the rising incidence of soil-borne nematode infestations and the limited effectiveness of chemical alternatives. Growing awareness about the long-term benefits of biological nematicides, coupled with advancements in microbial formulations, is expected to propel their adoption among both commercial and small-scale farmers.

- By Source

On the basis of source, the market is categorized into botanical, microbial, and non-organic. The microbial segment accounted for the largest market share in 2025, supported by the extensive use of bacteria, fungi, and viruses as biocontrol agents for pest and disease management. Their targeted mode of action, minimal environmental impact, and compatibility with integrated pest management programs have made microbial products the preferred choice among producers.

The botanical segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing demand for naturally derived pest control solutions. Rising consumer preference for organic produce and the availability of plant-based active ingredients such as neem and pyrethrin are driving the adoption of botanical biorationals across global markets.

- By Formulation

On the basis of formulation, the biorationals market is segmented into liquid and dry. The liquid segment held the largest market share in 2025, owing to its ease of application, better coverage, and compatibility with conventional spraying systems. Liquid formulations also offer enhanced bioavailability and quick absorption, making them suitable for large-scale commercial farming operations.

The dry segment is projected to record the fastest growth from 2026 to 2033, supported by its longer shelf life, stability during transport, and lower storage costs. The growing use of dry formulations such as granules and powders in smallholder farms and regions with limited cold-chain infrastructure is expected to accelerate segment growth.

- By Application

On the basis of application, the market is divided into foliar spray, soil treatment, and trunk injection. The foliar spray segment dominated the market in 2025, driven by its efficiency in delivering active ingredients directly to plant surfaces and providing rapid pest and disease control. The method’s compatibility with both conventional and precision spraying technologies has made it highly preferred across crop types.

The soil treatment segment is expected to witness the fastest growth rate from 2026 to 2033, owing to its role in improving soil health, suppressing root-borne pathogens, and enhancing plant resilience. Growing adoption of microbial inoculants and soil conditioners for regenerative farming practices is also contributing to this segment’s expansion.

- By Crop Type

On the basis of crop type, the biorationals market is segmented into fruits and vegetables, cereals and grains, and oilseeds and pulses. The fruits and vegetables segment accounted for the largest share in 2025, supported by the high export value of these crops and the strict residue regulations governing their trade. Farmers are increasingly using biorationals to maintain quality and extend shelf life, ensuring compliance with international safety standards.

The cereals and grains segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising global food demand and the need for sustainable pest management in staple crops. Large-scale adoption of integrated pest management programs in cereal production, especially in Asia-Pacific and Latin America, is further expected to boost demand for biorational crop protection solutions.

Biorationals Market Regional Analysis

- North America dominated the biorationals market with the largest revenue share of 38.92% in 2025, driven by the region’s advanced agricultural practices, strong regulatory support for sustainable farming, and rising consumer demand for organic and residue-free food products

- Farmers in the region are rapidly adopting biorational solutions such as microbial and botanical pesticides to enhance crop quality, maintain soil health, and comply with stringent environmental standards

- This widespread adoption is further supported by the presence of major biocontrol manufacturers, increased R&D funding, and government initiatives promoting integrated pest management programs, positioning North America as a global leader in the biorationals market

U.S. Biorationals Market Insight

The U.S. biorationals market captured the largest revenue share in 2025 within North America, fuelled by the country’s robust agricultural infrastructure, expanding organic farming acreage, and strong regulatory emphasis on reducing chemical pesticide usage. The market is witnessing a surge in the adoption of microbial-based biocontrol solutions driven by the demand for sustainable crop protection. In addition, strategic partnerships between agritech firms and research institutions are fostering product innovation and large-scale commercialization of next-generation biorationals.

Europe Biorationals Market Insight

The Europe biorationals market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by strict environmental regulations and the European Union’s Green Deal initiatives aimed at reducing synthetic pesticide use. Farmers across the region are transitioning toward biocontrol products to meet sustainability targets and export compliance requirements. In addition, rising consumer demand for organic produce and supportive policy frameworks are propelling the adoption of microbial and botanical pest control solutions.

Germany Biorationals Market Insight

The Germany biorationals market is expected to witness the fastest growth rate from 2026 to 2033, driven by the country’s advanced agricultural technology, commitment to sustainability, and high awareness of ecological farming methods. Germany’s strong regulatory framework promoting biological crop protection is further strengthening market demand. The integration of digital agriculture and precision farming tools is also enhancing the efficiency and adoption rate of biorational products across major crop segments.

Asia-Pacific Biorationals Market Insight

The Asia-Pacific biorationals market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid agricultural modernization, increasing organic farming activities, and government support for eco-friendly pest control solutions. Rising farmer awareness, coupled with large-scale cultivation of fruits, vegetables, and grains, is propelling market expansion across the region. The presence of emerging local manufacturers and affordable product options further strengthens Asia-Pacific’s position as a high-growth market.

China Biorationals Market Insight

The China biorationals market accounted for the largest market share within Asia-Pacific in 2025, attributed to the country’s vast agricultural base, government-backed green farming initiatives, and the rapid commercialization of domestic biocontrol technologies. Chinese farmers are increasingly adopting biorational insecticides and fungicides to comply with food safety regulations and improve export competitiveness. Strong local manufacturing capacity and continued policy support are further bolstering the market’s growth.

Japan Biorationals Market Insight

The Japan biorationals market is expected to witness the fastest growth rate from 2026 to 2033, supported by the country’s advanced agricultural practices, emphasis on environmental conservation, and increasing adoption of precision farming systems. Farmers are integrating microbial and botanical products into smart farming operations to optimize crop protection efficiency. In addition, strong governmental backing for biocontrol research and product innovation is helping Japan maintain a leading role in sustainable agricultural technology adoption.

Biorationals Market Share

The Biorationals industry is primarily led by well-established companies, including:

• Koppert Biological Systems (Netherlands)

• Bayer AG (Germany)

• Isagro (Italy)

• Gowan Company (U.S.)

• Summit Chemical, Inc. (U.S.)

• Suterra (U.S.)

• Russell IPM (U.K.)

• Agralan Ltd (U.K.)

• BASF SE (Germany)

• Rentokil Initial plc (U.K.)

• McLaughlin Gormley King Company (U.S.)

• INORA (India)

• Syngenta Group (Switzerland)

• DowDuPont (U.S.)

• Valent BioSciences LLC (U.S.)

• Marrone Bio Innovations (U.S.)

Latest Developments in Global Biorationals Market

- In May 2025, AgroAladdin introduced the mass-produced VDAL interaction protein in China, a plant-derived elicitor developed by China Agricultural University. The product is designed to activate plant immunity and improve crop resistance, yield, and quality without genetic modification. This launch supports the expanding adoption of biorationals by offering an eco-friendly alternative to chemical pesticides, enhancing sustainable farming practices and boosting market growth

- In May 2025, De Sangosse launched IRONMAX PRO, a biorational molluscicide in Portugal formulated with ferric phosphate and the patented Colzactive attractant. The product offers rapid action, strong attractiveness, and long-lasting durability against slugs and snails. Its commercial success is expected to reinforce De Sangosse’s position in the European crop protection market and advance the use of sustainable pest control solutions

- In March 2025, Sumitomo Chemical unveiled its Three-Year Corporate Business Plan (FY2025–2027) under the slogan “Leap Beyond,” directing 80% of its strategic investments toward growth sectors such as Agro & Life Solutions. The plan emphasizes biorationals and innovative R&D to enhance profitability and accelerate the company’s return to a strong growth trajectory, highlighting its commitment to sustainable agriculture

- In January 2025, Valent BioSciences, in collaboration with Meister Media Worldwide, launched the Biostimulant Innovator of the Year Award. The initiative recognizes farmers adopting biostimulants to enhance productivity and resource efficiency, promoting awareness and adoption of biorationals in modern agriculture while reinforcing Valent’s leadership in sustainable crop enhancement solutions

- In January 2025, Sumitomo Chemical completed the full acquisition of Philagro in France and Kenogard in Spain to strengthen its crop protection business across Europe. The move integrates biorationals with conventional agricultural products, expanding the company’s European footprint and supporting regional demand for sustainable, environmentally safe crop protection solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.