Global Bioresorbable Scaffolds Market

Market Size in USD Billion

CAGR :

%

USD

1.79 Billion

USD

5.39 Billion

2025

2033

USD

1.79 Billion

USD

5.39 Billion

2025

2033

| 2026 –2033 | |

| USD 1.79 Billion | |

| USD 5.39 Billion | |

|

|

|

|

Bioresorbable Scaffolds Market Size

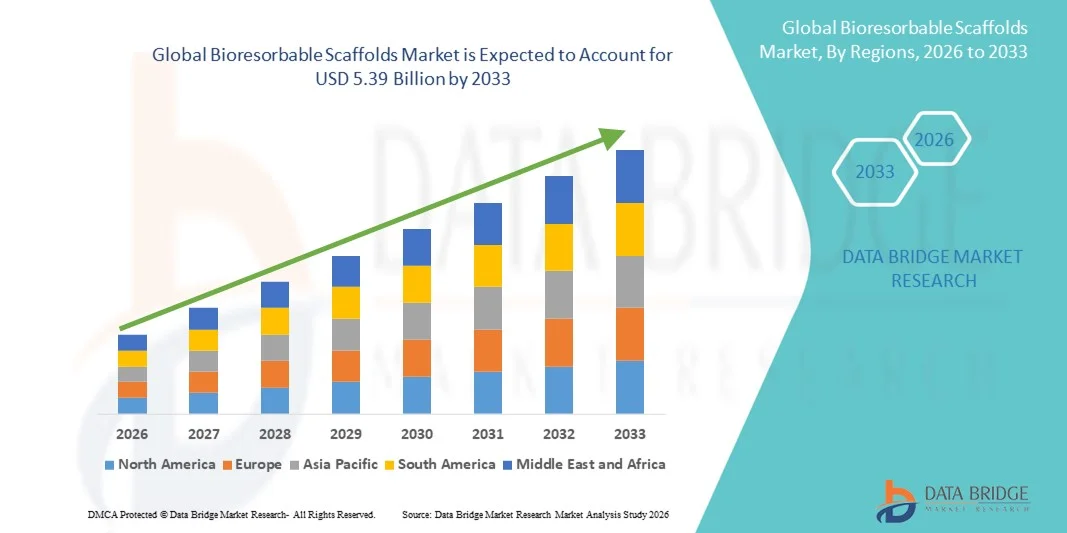

- The global bioresorbable scaffolds market size was valued at USD 1.79 billion in 2025 and is expected to reach USD 5.39 billion by 2033, at a CAGR of 14.80% during the forecast period

- The market growth is largely fueled by the rising prevalence of cardiovascular diseases and the increasing adoption of minimally invasive treatment options, which drive demand for scaffolds that naturally dissolve and reduce long‑term complications associated with permanent implants

- Furthermore, continuous technological advancements in scaffold materials and designs, such as polymer‑ and magnesium‑based platforms, along with upgraded drug‑eluting features, are enhancing clinical outcomes and broadening the scope of applications across cardiology, peripheral vascular intervention, and other medical specialties

Bioresorbable Scaffolds Market Analysis

- Bioresorbable scaffolds, providing temporary structural support for blood vessels and naturally dissolving after tissue healing, are increasingly vital components in interventional cardiology and vascular treatments due to their ability to reduce long-term complications associated with permanent stents while supporting natural vessel restoration

- The escalating demand for bioresorbable scaffolds is primarily fueled by the rising prevalence of cardiovascular diseases, growing adoption of minimally invasive procedures, and a rising preference for patient-friendly, temporary implant solutions that improve clinical outcomes

- North America dominated the bioresorbable scaffolds market with the largest revenue share of 40.9% in 2025, characterized by advanced healthcare infrastructure, high awareness of cardiovascular treatment options, and a strong presence of key market players, with the U.S. witnessing substantial growth in scaffold adoption for coronary and peripheral vascular interventions, driven by innovations in polymer- and magnesium-based scaffold technologies

- Asia-Pacific is expected to be the fastest-growing region in the bioresorbable scaffolds market during the forecast period due to increasing cardiovascular disease prevalence, improving healthcare facilities, and rising adoption of advanced interventional cardiology solutions

- The Absorbable Magnesium Stent (AMS) segment dominated the market in 2025 with a market share of 42.3%, driven by its superior biocompatibility and mechanical performance

Report Scope and Bioresorbable Scaffolds Market Segmentation

|

Attributes |

Bioresorbable Scaffolds Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Bioresorbable Scaffolds Market Trends

Advancements in Material Technology and Drug-Eluting Devices

- A key and accelerating trend in the global bioresorbable scaffolds market is the development of next-generation scaffold materials, including absorbable magnesium and advanced polymers, which improve vascular healing and reduce thrombosis risk

- For instance, the Magmaris magnesium-based scaffold integrates bioresorbable properties with drug-eluting capabilities, promoting faster vessel restoration while maintaining mechanical strength

- Drug-eluting scaffolds are being enhanced with drugs such as everolimus and sirolimus, enabling controlled drug release to prevent restenosis and improve long-term outcomes. For instance, Abbott’s Absorb GT1 scaffold demonstrates improved endothelialization while minimizing late lumen loss

- The integration of bioresorbable materials with optimized scaffold architecture facilitates easier deployment and better conformability within complex vessel anatomies, supporting wider adoption in both coronary and peripheral interventions

- This trend towards innovative, patient-friendly, and clinically effective scaffolds is reshaping interventional cardiology practices. Consequently, companies such as Biotronik are developing magnesium-based scaffolds with advanced drug-eluting coatings for enhanced vascular healing

- The demand for scaffolds combining superior mechanical performance with therapeutic drug delivery is growing rapidly across hospitals and specialized clinics, as physicians increasingly prioritize devices that reduce long-term complications

- The rising focus on personalized cardiovascular treatments, including scaffold selection based on lesion type and patient profile, is driving adoption of advanced bioresorbable devices in specialized care centers

Bioresorbable Scaffolds Market Dynamics

Driver

Rising Cardiovascular Disease Prevalence and Minimally Invasive Procedure Adoption

- The increasing prevalence of cardiovascular diseases, coupled with the growing adoption of minimally invasive interventional procedures, is a significant driver for heightened demand for bioresorbable scaffolds

- For instance, in March 2025, Abbott reported expanding clinical adoption of its Absorb GT1 scaffold in coronary artery disease patients, driven by physician preference for temporary implant solutions

- As healthcare providers seek patient-friendly alternatives to permanent stents, bioresorbable scaffolds offer advantages such as natural vessel restoration, reduced late thrombosis risk, and improved long-term outcomes

- Furthermore, the rising awareness among clinicians about scaffold biocompatibility and drug-eluting properties is making these devices integral to modern interventional cardiology procedures

- The ability to treat complex vascular lesions with temporary scaffolds, combined with the growing number of catheterization procedures, is propelling adoption in hospitals and cardiac care centers alike

- For instance, increasing initiatives to educate cardiologists on scaffold selection and post-implantation care are accelerating adoption in developed markets

- Rising government support and funding for minimally invasive cardiovascular interventions in emerging regions are further boosting scaffold market growth

Restraint/Challenge

High Cost and Regulatory Hurdles Limiting Adoption

- The relatively high cost of advanced bioresorbable scaffolds compared to conventional metallic stents poses a challenge to broader market penetration, particularly in developing regions

- For instance, limited reimbursement policies in several emerging markets have restricted the use of premium drug-eluting bioresorbable scaffolds, affecting adoption rates among cost-sensitive healthcare providers

- Stringent regulatory approval processes and clinical trial requirements in regions such as North America and Europe further slow market entry for new scaffold technologies, increasing time-to-market for innovative devices

- In addition, concerns about scaffold thrombosis and procedural complications among physicians can limit adoption, emphasizing the need for robust clinical evidence and post-market monitoring

- Overcoming these challenges through cost optimization, regulatory compliance, and comprehensive clinical validation will be vital for sustained growth in the global bioresorbable scaffolds market

- For instance, varying regulatory standards across countries create challenges for global product launches and market standardization

- The lack of awareness and training among healthcare providers in emerging markets can also hinder scaffold adoption despite clinical advantages, limiting market penetration

Bioresorbable Scaffolds Market Scope

The market is segmented on the basis of material, types, applications, and end users.

- By Material

On the basis of material, the bioresorbable scaffolds market is segmented into Absorbable Magnesium Stent (AMS), Polymeric Scaffold, Poly Carbonate Scaffold, and Others. The Absorbable Magnesium Stent (AMS) segment dominated the market with the largest revenue share of 42.3% in 2025, driven by its superior biocompatibility, faster vessel healing, and reduced risk of thrombosis. Hospitals and clinics prefer AMS for complex coronary and peripheral vascular procedures due to its mechanical strength and predictable resorption profile. The clinical acceptance of AMS has increased following several successful trials demonstrating lower restenosis rates and improved patient outcomes. In addition, physicians favor AMS for its ease of deployment and compatibility with standard catheter-based delivery systems. Continuous innovations in magnesium alloys are further enhancing scaffold durability and drug-eluting capabilities, supporting broader clinical adoption. The segment also benefits from growing awareness among interventional cardiologists about its advantages over traditional metallic stents.

The Polymeric Scaffold segment is anticipated to witness the fastest CAGR from 2026 to 2033, fueled by its flexibility in design, proven safety, and cost-effectiveness. Polymeric scaffolds are widely used in both coronary and peripheral interventions due to their well-documented clinical performance and versatility in drug elution. Emerging polymer technologies allow for thinner strut designs, reducing vessel injury during implantation and promoting faster endothelial recovery. Polymeric scaffolds also offer opportunities for personalized treatments, where scaffold selection can be tailored to lesion type and patient profile. The increasing number of minimally invasive procedures in emerging markets is supporting the rapid growth of this segment. Hospitals and specialized cardiac centers are adopting polymeric scaffolds for both adult and pediatric cardiovascular interventions.

- By Types

On the basis of types, the bioresorbable scaffolds market is segmented into drug eluting coronary scaffolds, everolimus-eluting device, novolimus-eluting device, sirolimus-eluting device, and paclitaxel-eluting device. The Drug Eluting Coronary Scaffolds segment dominated with a market share of 61.5% in 2025, driven by its effectiveness in reducing restenosis and enhancing long-term vessel patency. These scaffolds release antiproliferative drugs in a controlled manner to prevent neointimal hyperplasia, improving clinical outcomes. Cardiologists prefer drug-eluting scaffolds for both stable and complex coronary lesions. The segment also benefits from extensive clinical studies supporting safety and efficacy, increasing physician confidence. Integration with advanced delivery systems enables precise placement and improved patient recovery. The growing prevalence of coronary artery disease globally further reinforces the dominance of this type.

The Everolimus-Eluting Device segment is expected to witness the fastest growth rate from 2026 to 2033, due to its proven effectiveness in complex lesions and favorable safety profile. Everolimus-eluting scaffolds provide targeted drug release with enhanced endothelialization. Hospitals and interventional centers are increasingly adopting these devices in high-risk patients to reduce restenosis and thrombosis. Technological advancements in polymer coatings and scaffold architecture are further boosting the adoption rate. The ease of integration into existing catheter-based procedures makes this type attractive to clinicians. Emerging markets with rising cardiovascular disease prevalence also contribute to the accelerated growth of this segment.

- By Applications

On the basis of applications, the bioresorbable scaffolds market is segmented into peripheral vascular intervention, regulation of blood flow, and others. The Peripheral Vascular Intervention segment dominated with the largest market share of 55.2% in 2025, driven by the increasing prevalence of peripheral arterial disease and the growing demand for minimally invasive treatments. Physicians prefer bioresorbable scaffolds in peripheral arteries for temporary support and reduced long-term complications. The segment benefits from improved clinical outcomes compared to conventional stents. Hospitals and specialty clinics favor these scaffolds for their versatility and patient-friendly design. The rising adoption of drug-eluting technology in peripheral interventions further supports segment growth. In addition, ongoing research into scaffold materials and design enhances procedural success rates.

The Regulation of Blood Flow segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the increasing need to manage complex vascular conditions and improve blood flow restoration in high-risk patients. Bioabsorbable scaffolds in this application are used to optimize vessel patency temporarily while supporting natural healing. Clinicians prefer this application for treating challenging lesions and maintaining vessel flexibility. Technological advancements in scaffold design allow precise control of degradation rates and drug elution. Growing awareness of these minimally invasive solutions in emerging markets is accelerating adoption. Hospitals and cardiac centers are increasingly investing in this application for specialized procedures.

- By End Users

On the basis of end users, the bioresorbable scaffolds market is segmented into hospitals, clinics, and others. The Hospitals segment dominated with a market share of 62.8% in 2025, due to advanced infrastructure, availability of skilled interventional cardiologists, and high procedure volumes. Hospitals conduct the majority of complex coronary and peripheral vascular interventions, preferring bioresorbable scaffolds for their clinical benefits. The segment also benefits from growing investments in cardiovascular care units and minimally invasive procedure capabilities. Hospitals leverage advanced drug-eluting scaffolds to improve patient outcomes and reduce long-term complications. Collaboration with scaffold manufacturers for training and clinical support further strengthens adoption. In addition, the growing number of cardiovascular interventions in aging populations reinforces hospital dominance.

The Clinics segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising number of outpatient interventional procedures and increasing cardiovascular awareness. Clinics are adopting bioresorbable scaffolds for simpler, low-risk procedures where hospital-level infrastructure may not be required. The segment benefits from the increasing availability of compact, easy-to-use scaffold delivery systems. Clinicians can offer advanced treatment options at lower costs, improving accessibility in semi-urban and emerging regions. Partnerships between scaffold manufacturers and clinics to provide training and support are further boosting adoption. Growth in cardiovascular diagnostic and interventional services in clinics is driving rapid expansion in this segment.

Bioresorbable Scaffolds Market Regional Analysis

- North America dominated the bioresorbable scaffolds market with the largest revenue share of 40.9% in 2025, characterized by advanced healthcare infrastructure, high awareness of cardiovascular treatment options, and a strong presence of key market players

- Healthcare providers in the region highly value the clinical benefits of bioresorbable scaffolds, including natural vessel restoration, reduced long-term complications, and drug-eluting capabilities that improve patient outcomes

- This widespread adoption is further supported by strong research and development initiatives, a skilled interventional cardiology workforce, robust reimbursement policies, and increasing awareness among physicians and patients, establishing bioresorbable scaffolds as a preferred solution for coronary and peripheral vascular interventions

U.S. Bioresorbable Scaffolds Market Insight

The U.S. bioresorbable scaffolds market captured the largest revenue share of 81% in North America in 2025, fueled by the widespread adoption of minimally invasive cardiovascular procedures and high awareness of advanced interventional cardiology solutions. Healthcare providers are increasingly prioritizing patient-friendly scaffold options that reduce long-term complications compared to permanent metallic stents. The growing preference for drug-eluting scaffolds and advanced scaffold materials, such as magnesium-based and polymeric scaffolds, further propels market growth. Moreover, increasing investments in research, training of interventional cardiologists, and integration of new scaffold technologies into clinical practice are significantly contributing to market expansion.

Europe Bioresorbable Scaffolds Market Insight

The Europe bioresorbable scaffolds market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the high prevalence of coronary artery disease and increasing demand for minimally invasive treatments. The region’s strict clinical guidelines and reimbursement policies encourage adoption of bioresorbable and drug-eluting scaffolds in hospitals and specialty clinics. Growing awareness among physicians regarding scaffold benefits, combined with advancements in polymer and magnesium-based devices, is fostering adoption. The market is also supported by increasing use of scaffolds in both new interventions and revisions of previous stent procedures.

U.K. Bioresorbable Scaffolds Market Insight

The U.K. bioresorbable scaffolds market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of interventional cardiology procedures and rising awareness of patient-friendly treatment options. Concerns regarding late stent thrombosis and long-term complications with permanent metallic stents are encouraging healthcare providers to choose bioresorbable alternatives. The country’s robust healthcare infrastructure and research initiatives, along with the availability of advanced scaffold types such as everolimus-eluting devices, are expected to continue stimulating market growth.

Germany Bioresorbable Scaffolds Market Insight

The Germany bioresorbable scaffolds market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of cardiovascular disease and the adoption of innovative, clinically validated scaffold technologies. Germany’s advanced healthcare infrastructure and focus on minimally invasive, patient-centric procedures promote scaffold adoption in hospitals and specialty clinics. The integration of drug-eluting scaffolds with standard interventional procedures is also becoming increasingly prevalent, with strong physician preference for devices that reduce long-term vessel complications.

Asia-Pacific Bioresorbable Scaffolds Market Insight

The Asia-Pacific bioresorbable scaffolds market is poised to grow at the fastest CAGR of 24% during the forecast period 2026–2033, driven by increasing prevalence of cardiovascular diseases, improving healthcare infrastructure, and rising adoption of minimally invasive procedures in countries such as China, Japan, and India. The region's growing focus on advanced cardiovascular interventions, supported by government initiatives promoting medical technology adoption, is driving scaffold uptake. Furthermore, as APAC emerges as a manufacturing hub for scaffold materials and devices, affordability and accessibility of advanced scaffolds are expanding to a wider patient base.

Japan Bioresorbable Scaffolds Market Insight

The Japan bioresorbable scaffolds market is gaining momentum due to the country’s high awareness of cardiovascular health, increasing interventional procedures, and demand for patient-friendly treatments. Japanese healthcare providers emphasize scaffolds that reduce long-term complications and improve vessel healing. The integration of drug-eluting and magnesium-based scaffolds in clinical practice is fueling growth. Moreover, Japan's aging population is likely to spur demand for minimally invasive, safer scaffold options in both hospital and specialized clinic settings.

India Bioresorbable Scaffolds Market Insight

The India bioresorbable scaffolds market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rising prevalence of coronary artery disease, expanding healthcare infrastructure, and increasing adoption of minimally invasive procedures. India is emerging as a key market for cardiovascular interventions, with hospitals and specialty clinics increasingly adopting bioresorbable and drug-eluting scaffolds. Government initiatives promoting advanced healthcare, availability of affordable scaffold options, and local manufacturers supporting clinical adoption are key factors propelling market growth in India.

Bioresorbable Scaffolds Market Share

The Bioresorbable Scaffolds industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Biotronik (Germany)

- REVA MEDICAL, LLC. (U.S.)

- Meril Life Sciences Pvt. Ltd. (India)

- MicroPort Scientific Corporation (China)

- OrbusNeich Medical Company Ltd. (U.S.)

- Kyoto Medical Planning Co., Ltd. (Japan)

- Elixir Medical Corporation (U.S.)

- Terumo Corporation (Japan)

- Amaranth Medical, Inc. (U.S.)

- Arterial Remodeling Technologies (France)

- ICON Interventional Systems (U.S.)

- Sinomed (China)

- Xenogenics Corporation (U.S.)

- S3V Vascular Technologies Pvt. Ltd. (India)

- Zorion Medical, Inc. (U.S.)

- Medtronic (Ireland)

- Biosensors International Group, Ltd. (Singapore)

- Cardionovum GmbH (Germany)

- Lepu Medical Technology (Beijing) Co., Ltd. (China)

What are the Recent Developments in Global Bioresorbable Scaffolds Market?

- In April 2025, R3 Vascular announced that the first patient was treated in the ELITE‑BTK pivotal clinical trial using its MAGNITUDE® drug‑eluting bioresorbable scaffold for peripheral arterial disease, marking a key milestone in real‑world clinical evaluation

- In February 2025, Shanghai MicroPort Medical received approval from the National Medical Products Administration (NMPA) in China for its Bioresorbable Rapamycin Target Eluting Coronary Scaffold System, a PLLA‑based scaffold with a unique single‑sided drug coating intended to improve coronary artery lumen diameter and promote endothelial healing in ischemic heart disease patients

- In November 2024, the U.S. FDA granted Investigational Device Exemption (IDE) approval to R3 Vascular to commence the pivotal ELITE‑BTK trial of its MAGNITUDE® next‑generation drug‑eluting bioresorbable scaffold for below‑the‑knee peripheral arterial disease, enabling broader clinical study and potential future commercialization

- In February 2024, the U.S. FDA granted Breakthrough Device designation to Efemoral Medical’s Efemoral Vascular Scaffold System (EVSS), a sirolimus‑eluting bioresorbable scaffold designed to treat infrapopliteal lesions and chronic limb‑threatening ischemia, potentially expediting its development and review

- In September 2021, R3 Vascular reported the initiation of its first‑in‑human clinical study evaluating the MAGNITUDE® bioresorbable sirolimus‑eluting scaffold in patients with occlusive below‑the‑knee arterial disease, representing one of the earliest modern clinical efforts in next‑generation bioresorbable scaffolds

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.