Global Thrombosis Drug Market

Market Size in USD Billion

CAGR :

%

USD

12.20 Billion

USD

23.59 Billion

2024

2032

USD

12.20 Billion

USD

23.59 Billion

2024

2032

| 2025 –2032 | |

| USD 12.20 Billion | |

| USD 23.59 Billion | |

|

|

|

|

Thrombosis Drug Market Size

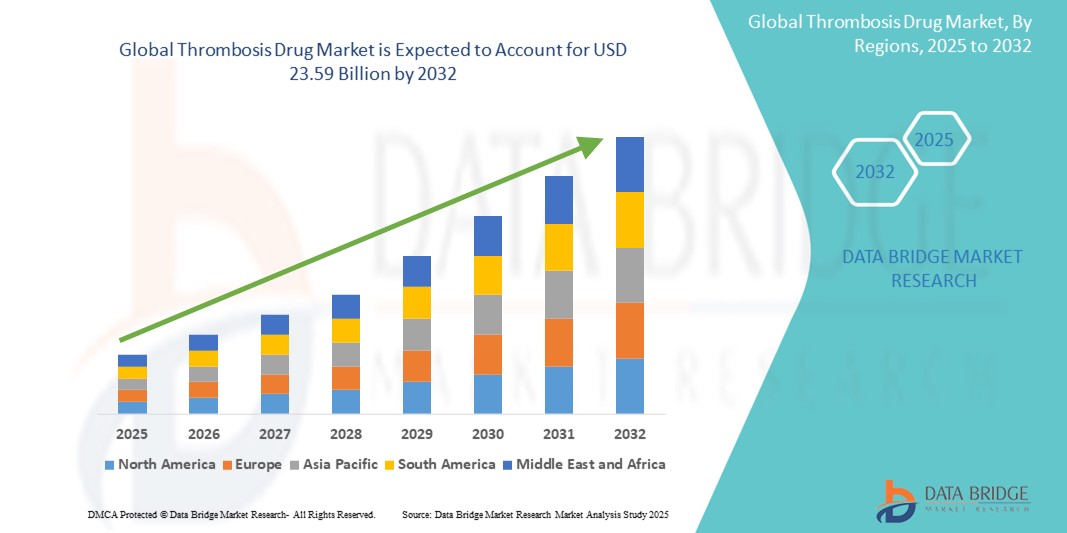

- The global thrombosis drug market size was valued at USD 12.20 billion in 2024 and is expected to reach USD 23.59 billion by 2032, at a CAGR of 8.59 % during the forecast period

- The market growth is primarily driven by the rising prevalence of thrombotic disorders such as deep vein thrombosis (DVT), pulmonary embolism (PE), and atrial fibrillation (AF), especially among the aging global population

- In addition, the increasing awareness about the risks associated with untreated thrombosis, along with advancements in anticoagulant therapies and improved diagnostic techniques, is fostering greater adoption of thrombosis drugs. These combined drivers are accelerating innovation and demand in the sector, fueling sustained market expansion

Thrombosis Drug Market Analysis

- Thrombosis drugs, designed to prevent or treat blood clot formation, are becoming increasingly essential in modern healthcare settings for managing conditions such as deep vein thrombosis, pulmonary embolism, and stroke prevention in atrial fibrillation patients, due to their life-saving potential and role in reducing long-term complications

- The surging demand for thrombosis drugs is primarily driven by the rising global incidence of cardiovascular diseases, expanding geriatric population, sedentary lifestyles, and growing awareness regarding early intervention and preventative care

- North America dominated the thrombosis drug market with the largest revenue share of 39.1% in 2024, attributed to advanced healthcare infrastructure, high awareness levels, favorable reimbursement policies, and the presence of leading pharmaceutical manufacturers actively engaged in R&D for novel anticoagulants

- Asia-Pacific is expected to be the fastest growing region in the thrombosis drug market during the forecast period due to increasing healthcare expenditure, improving diagnostic capabilities, and a growing burden of cardiovascular diseases

- Oral segment dominated the thrombosis drug market with a market share of 56.3% in 2024, driven by its patient preference for non-invasive options and the growing adoption of DOACs that do not require regular monitoring, thereby improving compliance and treatment outcomes

Report Scope and Thrombosis Drug Market Segmentation

|

Attributes |

Thrombosis Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thrombosis Drug Market Trends

“Innovation in Oral Anticoagulants and Personalized Medicine”

- A significant and evolving trend in the global thrombosis drug market is the growing preference for next-generation oral anticoagulants (NOACs/DOACs) and the adoption of personalized medicine approaches to optimize therapy and minimize risk. These advancements are streamlining treatment regimens and improving patient outcomes

- For instance, drugs such as apixaban (Eliquis) and rivaroxaban (Xarelto) are increasingly preferred over traditional warfarin due to their predictable pharmacokinetics, fewer dietary interactions, and no routine monitoring requirements. These benefits are enhancing patient compliance and convenience, especially in outpatient settings

- Precision medicine is also gaining traction, with clinicians utilizing genetic profiling and real-time monitoring tools to tailor anticoagulation therapy based on individual risk factors such as renal function, age, and comorbidities. This trend is fostering safer, more effective thrombosis management

- Furthermore, biopharmaceutical companies are investing in extended-release formulations, reversal agents, and combination therapies to address bleeding risks and improve emergency management. For instance, andexanet alfa, a reversal agent for Factor Xa inhibitors, has been a notable development in mitigating bleeding complications

- The integration of digital health tools, such as mobile apps and wearable tech for tracking medication adherence and symptoms, is also contributing to the transformation of thrombosis care and creating a connected treatment ecosystem

- This move toward more intelligent, tailored, and user-friendly anticoagulant therapies is reshaping the thrombosis drug market and driving innovation, particularly in chronic disease management and outpatient care

Thrombosis Drug Market Dynamics

Driver

“Rising Cardiovascular Disease Burden and Demand for Safer Anticoagulant”

- The increasing global burden of cardiovascular diseases (CVDs), including atrial fibrillation, stroke, and venous thromboembolism, is a major driver for the growing demand for thrombosis drugs. According to WHO estimates, CVDs remain the leading cause of death globally, significantly increasing the need for effective anticoagulation therapies

- For instance, in 2024, leading pharmaceutical firms such as Bristol Myers Squibb and Pfizer expanded their cardiovascular drug pipelines to address growing demand for novel anticoagulants with better safety profiles and minimal side effects

- The shift towards DOACs has gained strong momentum, as these therapies eliminate the need for frequent INR monitoring and reduce patient burden. Their use in outpatient and chronic care settings continues to drive market penetration across both developed and emerging economies

- In addition, an aging population, increased sedentary behavior, and rising obesity and diabetes rates are contributing to higher thrombosis risk, thereby boosting the demand for preventative anticoagulant therapies and long-term disease management

Restraint/Challenge

“Bleeding Risks and High Treatment Costs Pose Adoption Barriers”

- Despite advancements in therapy, one of the primary challenges facing the thrombosis drug market is the risk of bleeding, particularly gastrointestinal and intracranial hemorrhage, which limits widespread use of anticoagulants in certain high-risk populations such as the elderly or those with comorbidities

- For instance, real-world data from post-marketing surveillance of DOACs have highlighted instances of serious bleeding events, prompting caution among physicians and necessitating the use of costly reversal agents such as idarucizumab and andexanet alfa

- In addition, the high cost of newer anticoagulants relative to older therapies such as warfarin remains a substantial barrier, especially in low- and middle-income countries, where healthcare coverage is limited or out-of-pocket expenses are high

- Overcoming these barriers will require innovations in safer drug formulations, expanded access programs, insurance coverage improvements, and global education campaigns to promote early detection and proper management of thrombosis

- Regulatory complexities in launching biosimilars and new anticoagulants, along with strict pharmacovigilance requirements, further add to the market entry challenges faced by new players

Thrombosis Drug Market Scope

The market is segmented on the basis of drug class, disease type, distribution channel, and route of administration.

- By Drug Class

On the basis of drug class, the thrombosis drug market is segmented into Factor Xa Inhibitor, Heparin, P2Y12 Platelet Inhibitor, and Others. The Factor Xa Inhibitor segment dominated the market with the largest market revenue share of 39.4% in 2024, attributed to the rising use of direct oral anticoagulants (DOACs) such as rivaroxaban and apixaban. These drugs are favored for their predictable effects, reduced monitoring requirements, and improved safety profiles compared to traditional options such as warfarin. The convenience of once-daily dosing and minimal dietary restrictions has driven widespread adoption, especially in atrial fibrillation and venous thromboembolism cases.

The P2Y12 platelet inhibitor segment is anticipated to witness the fastest growth rate of 20.6% from 2025 to 2032, fueled by its increasing use in dual antiplatelet therapy (DAPT) for managing acute coronary syndrome (ACS) and post-percutaneous coronary intervention (PCI). Drugs such as clopidogrel and ticagrelor are widely prescribed due to their proven efficacy in preventing recurrent thrombotic events, with ongoing clinical trials supporting expanded indications.

- By Disease Type

On the basis of disease type, the market is segmented into pulmonary embolism, atrial fibrillation, deep vein thrombosis, and others. The Atrial Fibrillation segment held the largest market share of 36.7% in 2024, driven by the rising global incidence of atrial fibrillation and its strong association with increased stroke risk. Anticoagulants are a cornerstone of AF management, with Factor Xa inhibitors and DOACs being widely prescribed. Increased screening and early diagnosis are also contributing to segment dominance.

The pulmonary embolism segment is projected to grow at the fastest CAGR of 18.9% from 2025 to 2032, due to growing awareness, improved diagnostic tools, and rising cases linked to sedentary lifestyles and post-surgical complications. Prompt therapeutic anticoagulation is essential in PE management, fueling demand for fast-acting and safe thrombosis drugs.

- By Distribution Channel

On distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominated the market with the highest revenue share of 42.1% in 2024, owing to their critical role in dispensing thrombosis drugs for inpatients and surgical recovery. Hospitals are the primary points of care for acute thrombosis conditions such as PE or stroke, where injectable anticoagulants are often required

The online pharmacies segment is expected to witness the fastest growth rate of 22.4% from 2025 to 2032, driven by the global shift toward digital health platforms, rising convenience for chronic medication delivery, and the expansion of e-pharmacy services, especially in urban and semi-urban regions.

- By Route Of Administration

On the basis of route of administration, the thrombosis drug market is segmented into oral and parenteral. The oral segment led the market with a dominant share of 56.3% in 2024, due to patient preference for non-invasive drug delivery, especially for long-term management of conditions such as atrial fibrillation and DVT. DOACs have revolutionized the market by offering effective and safer oral options, minimizing the need for injections and hospital visits.

The parenteral segment, is anticipated to grow steadily during forecast period, particularly in surgical and hospitalized patients requiring rapid anticoagulation through drugs such as heparin and low molecular weight heparins (LMWHs).

Thrombosis Drug Market Regional Analysis

- North America dominated the thrombosis drug market with the largest revenue share of 39.1% in 2024, attributed to advanced healthcare infrastructure, high awareness levels, favorable reimbursement policies, and the presence of leading pharmaceutical manufacturers actively engaged in R&D for novel anticoagulants

- Patients and healthcare providers in the region place significant value on the effectiveness, safety, and convenience offered by modern thrombosis drugs, particularly the growing preference for direct oral anticoagulants (DOACs) that reduce the need for routine blood monitoring

- This dominance is further supported by well-established healthcare infrastructure, favorable reimbursement policies, and strong investment in R&D and clinical trials, positioning the region as a key hub for the adoption and advancement of thrombosis treatment options

U.S. Thrombosis Drug Market Insight

The U.S. thrombosis drug market captured the largest revenue share of 79% in 2024 within North America, fueled by a high burden of cardiovascular diseases and the widespread adoption of advanced anticoagulant therapies. The market benefits from extensive healthcare infrastructure, favorable reimbursement systems, and strong physician awareness of the latest treatment guidelines. Moreover, ongoing R&D initiatives by major pharmaceutical firms and the increasing use of direct oral anticoagulants (DOACs) for stroke prevention in atrial fibrillation are key drivers of market growth in the U.S.

Europe Thrombosis Drug Market Insight

The Europe thrombosis drug market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by an aging population, growing incidence of thrombotic disorders, and government support for preventive healthcare. Rising demand for DOACs, supported by updated clinical guidelines and public health initiatives, is accelerating adoption. Furthermore, stringent regulatory standards and a strong emphasis on patient safety and pharmacovigilance are shaping the regional drug landscape, with increasing investments in biosimilars and novel oral therapies.

U.K. Thrombosis Drug Market Insight

The U.K. thrombosis drug market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by national health campaigns focused on cardiovascular risk reduction and early thrombosis detection. Widespread implementation of clinical pathways for managing atrial fibrillation and venous thromboembolism is promoting the uptake of newer anticoagulants. In addition, the National Health Service (NHS) plays a key role in facilitating drug access and supporting patient adherence, contributing to the consistent market expansion.

Germany Thrombosis Drug Market Insight

The Germany thrombosis drug market is expected to expand at a considerable CAGR during the forecast period, fueled by a high rate of hospital-based treatments and a robust emphasis on research and clinical excellence. With a strong focus on preventative cardiology, Germany supports early diagnosis and treatment of thrombotic events, driving the use of oral and injectable anticoagulants. The country’s well-established pharmaceutical manufacturing capabilities and adoption of digital health tools also support continued growth in both the inpatient and outpatient segments.

Asia-Pacific Thrombosis Drug Market Insight

The Asia-Pacific thrombosis drug market is poised to grow at the fastest CAGR of 23.4% during the forecast period of 2025 to 2032, driven by rapid urbanization, increasing lifestyle-related risk factors, and improving access to healthcare. Countries such as China, India, and Japan are witnessing a rise in cardiovascular conditions, creating robust demand for thrombosis therapies. Government initiatives aimed at enhancing healthcare infrastructure and increasing awareness about stroke and DVT prevention are further supporting market expansion across both urban and rural populations.

Japan Thrombosis Drug Market Insight

The Japan thrombosis drug market is gaining momentum due to its rapidly aging population and high prevalence of atrial fibrillation and stroke. The healthcare system's emphasis on quality outcomes and cost-effectiveness is promoting the adoption of DOACs over traditional anticoagulants. Moreover, Japan’s advanced regulatory environment, coupled with its leadership in medical innovation and technology integration, supports sustained growth in both the hospital and outpatient settings.

India Thrombosis Drug Market Insight

The India thrombosis drug market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to increasing cardiovascular disease burden, expanded insurance coverage, and a rise in public awareness campaigns. Government-led health programs and the growing availability of affordable generic anticoagulants have significantly enhanced access across urban and semi-urban areas. With rising healthcare investments and digitalization in the pharmaceutical sector, India is emerging as a key growth market for thrombosis drug manufacturers.

Thrombosis Drug Market Share

The thrombosis drug industry is primarily led by well-established companies, including:

- AstraZeneca (U.K.)

- Boehringer Ingelheim International GmbH (Germany)

- Johnson & Johnson Services, Inc. (U.S.)

- Sanofi (France)

- Aspen Holdings (South Africa)

- Bayer AG (Germany)

- Bristol-Myers Squibb Company (U.S.)

- Pfizer Inc. (U.S.)

- Baxter (U.S.)

- GSK plc (U.K.)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- Grifols, S.A. (Spain)

- Viatris Inc. (U.S.)

- Biogen (U.S.)

- Vasudha Pharma (India)

- GoodRx, Inc. (U.S.)

- ITALFARMACO S.p.A. (Italy)

What are the Recent Developments in Global Thrombosis Drug Market?

- In April 2023, Bristol Myers Squibb and Pfizer Inc., co-developers of the leading anticoagulant Eliquis (apixaban), announced the expansion of their real-world evidence program to further evaluate the safety and efficacy of Eliquis across broader patient populations, including those with multiple comorbidities. This initiative emphasizes the companies' commitment to evidence-based practice and supports the growing global adoption of direct oral anticoagulants (DOACs) for thrombosis prevention and treatment

- In March 2023, Daiichi Sankyo launched a new clinical trial for its novel oral Factor XIa inhibitor, asundexian, aimed at reducing bleeding risk while maintaining thrombotic protection. This development signals a potential shift toward the next generation of anticoagulants that target clotting factors with greater selectivity, reflecting the industry’s focus on improving patient safety and long-term treatment adherence

- In March 2023, Sanofi entered into a strategic collaboration with Innate Pharma to investigate combination therapies that include anti-thrombotic and immunomodulatory agents for patients with cancer-associated thrombosis. This partnership underscores the growing recognition of thromboembolism as a critical complication in oncology and highlights the trend of integrating thrombosis care within broader treatment paradigms

- In February 2023, Boehringer Ingelheim reported positive Phase III trial results for idarucizumab, a reversal agent for its anticoagulant dabigatran (Pradaxa). The findings reinforced the drug’s safety profile in emergency bleeding scenarios, strengthening its clinical value and supporting regulatory submissions for broader global market access

- In January 2023, Janssen Pharmaceuticals, a Johnson & Johnson company, announced the global expansion of its real-world surveillance program for rivaroxaban (Xarelto), focusing on stroke prevention in atrial fibrillation patients in Asia-Pacific and Latin America. This move reflects Janssen's dedication to evidence-driven insights, especially in emerging markets with rising cardiovascular burdens, and supports broader access to safe and effective thrombosis therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.