Global Biosimilar Market

Market Size in USD Billion

CAGR :

%

USD

64.93 Billion

USD

598.55 Billion

2024

2032

USD

64.93 Billion

USD

598.55 Billion

2024

2032

| 2025 –2032 | |

| USD 64.93 Billion | |

| USD 598.55 Billion | |

|

|

|

|

Biosimilar Market Size

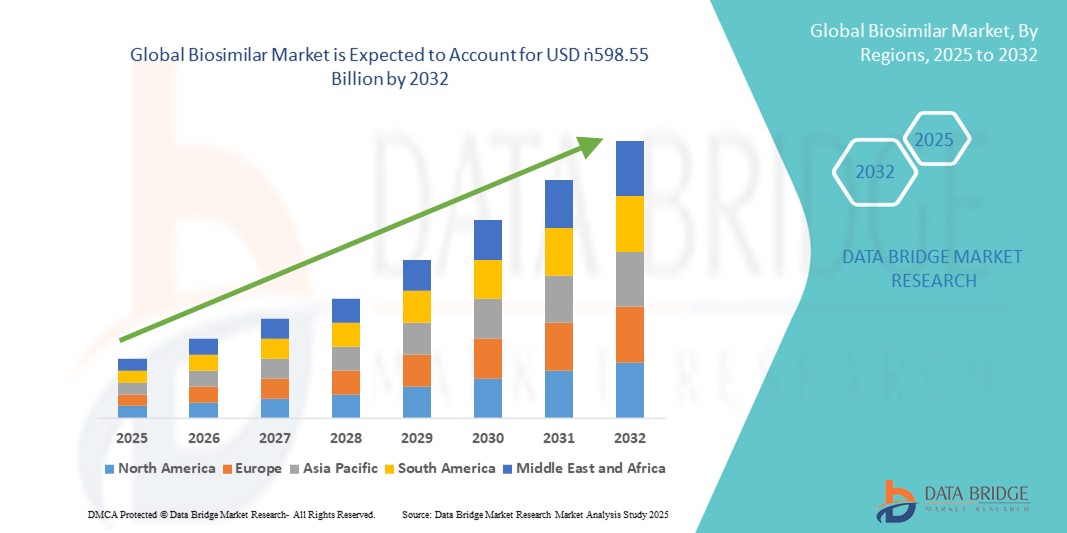

- The global biosimilar market size was valued at USD 64.93 billion in 2024 and is expected to reach USD 598.55 billion by 2032, at a CAGR of 32.00% during the forecast period

- The market expansion is primarily driven by the growing number of patent expiries of blockbuster biologics and the rising prevalence of chronic diseases such as cancer, autoimmune disorders, and diabetes, which are fueling demand for cost-effective alternatives

- In addition, favorable regulatory frameworks, increasing investments from pharmaceutical companies, and greater healthcare provider acceptance are accelerating the development and adoption of biosimilars worldwide. These trends are significantly contributing to the strong growth trajectory of the biosimilar industry

Biosimilar Market Analysis

- Biosimilars, designed as highly similar and cost-effective alternatives to approved biologic drugs, are becoming a crucial part of global healthcare systems as they enhance treatment accessibility, reduce healthcare costs, and broaden patient reach for chronic and life-threatening conditions such as cancer, autoimmune disorders, and diabetes

- The rising demand for biosimilars is primarily fueled by the wave of patent expirations of blockbuster biologics, increasing healthcare expenditure pressures, and greater acceptance of biosimilars among providers and patients as safe and effective therapeutic options

- North America dominated the global biosimilar market with the largest revenue share of 42.8% in 2024, led by strong regulatory support from the U.S. FDA, the increasing entry of biosimilars into high-value therapeutic categories, and heightened adoption among payers seeking affordable alternatives to costly biologics. The U.S. in particular has experienced rapid market penetration due to favorable policy shifts, competitive pricing, and the presence of leading pharmaceutical companies

- Asia-Pacific is expected to be the fastest-growing region in the biosimilar market during the forecast period due to expanding healthcare infrastructure, rising incidence of chronic diseases, and supportive government initiatives in countries such as China, India, and South Korea

- The oncology segment dominated the biosimilar market with a revenue share of 42.2% in 2024, driven by the high cost of reference biologics, increasing prevalence of cancer globally, and rapid uptake of biosimilar monoclonal antibodies and supportive therapies

Report Scope and Biosimilar Market Segmentation

|

Attributes |

Biosimilar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biosimilar Market Trends

Expanding Accessibility Through Favorable Regulations and Cost Savings

- A significant and accelerating trend in the global biosimilar market is the expansion of regulatory support and policy frameworks that encourage faster approvals and wider adoption of biosimilars as cost-effective alternatives to high-priced biologics. This is reshaping treatment affordability and patient accessibility across multiple therapeutic areas

- For instance, in 2023 the U.S. FDA released new interchangeability guidance to streamline the entry of biosimilars into the market, while the European Medicines Agency (EMA) continued to lead with the highest number of biosimilar approvals worldwide. These measures strengthen industry confidence and drive competitive market entry

- Increasing healthcare cost pressures have compelled payers and governments to prioritize biosimilar adoption. In the U.S., for example, Amgen’s Amjevita, a biosimilar to Humira, entered the market in 2023 at a significantly lower cost than AbbVie’s reference biologic, setting a precedent for expanded uptake. Similarly, Biocon and Viatris are actively rolling out oncology and diabetes biosimilars at accessible price points in Asia-Pacific

- The trend is reinforced by growing physician confidence as more real-world evidence confirms that biosimilars deliver safety and efficacy comparable to originator biologics. Widespread physician and patient education campaigns are further accelerating adoption across therapeutic areas such as oncology, autoimmune diseases, and diabetes

- In addition, partnerships between global pharma companies and regional players are facilitating cost-efficient development and distribution. For example, Samsung Bioepis has expanded its reach through collaborations with Organon and Biogen to strengthen its biosimilar portfolio in immunology and ophthalmology

- This regulatory and economic push toward biosimilar adoption is fundamentally reshaping global biologics markets, with demand rising rapidly in both developed and emerging economies as stakeholders increasingly prioritize cost savings and treatment accessibility

Biosimilar Market Dynamics

Driver

Rising Demand Fueled by Biologic Patent Expirations and Chronic Disease Burden

- The surge in biosimilar demand is primarily driven by the loss of patent exclusivity for blockbuster biologics such as Humira, Herceptin, and Avastin, creating opportunities for lower-cost biosimilars to capture significant market share

- For instance, multiple Humira biosimilars launched in the U.S. in 2023 from companies including Amgen, Boehringer Ingelheim, and Sandoz, leading to a competitive pricing environment and broader patient access

- The growing global burden of chronic diseases such as cancer, autoimmune disorders, and diabetes is intensifying the need for affordable biologic therapies, positioning biosimilars as critical to healthcare system sustainability

- Governments and insurers are increasingly implementing reimbursement incentives and substitution policies to encourage biosimilar uptake, creating a favorable environment for manufacturers

- Rising awareness among physicians and patients regarding the efficacy and safety equivalence of biosimilars compared to originators is further boosting adoption, supported by ongoing educational initiatives from healthcare authorities

Restraint/Challenge

Interchangeability Barriers and Manufacturing Complexity

- Despite strong growth prospects, challenges surrounding interchangeability and regulatory complexity continue to limit widespread adoption. In the U.S., interchangeability designation remains a critical hurdle, as not all biosimilars are granted automatic substitution rights at the pharmacy level

- For instance, while Amgen’s Amjevita entered the U.S. market, it did not initially hold interchangeability status, slowing substitution compared to traditional generics. This remains a challenge for newer entrants attempting to gain rapid traction

- Biosimilar manufacturing also presents high technical barriers, as biologics are large, complex molecules requiring advanced production and quality control systems. Any variation in production processes can raise regulatory concerns and delay approvals

- Moreover, physician reluctance and patient hesitancy in certain regions persist due to lingering misconceptions about biosimilar efficacy and safety. Sustained education and real-world data are essential to overcoming these perceptions

- Price erosion due to fierce competition poses another challenge, as companies face pressure to lower costs while managing high development and production expenses. This can limit profitability for smaller players entering the market

- Overcoming these hurdles through clearer regulatory pathways, improved manufacturing capabilities, and stronger stakeholder education will be vital to achieving sustained growth in the biosimilar sector

Biosimilar Market Scope

The market is segmented on the basis of product type, drug class, type of manufacturing, procedure, disease, indication, therapy type, and end users

- By Product Type

On the basis of product type, the biosimilar market is segmented into magnetic resonance imaging scanners, computed tomography scanners, positron emission tomography scanners, biosimilar (EEG), electromyography devices (EMG), magnetoencephalography devices, transcranial doppler devices, intracranial pressure monitors (ICP), electrodes, sensors, gels, and cables. The magnetic resonance imaging scanners segment dominated the market in 2024 with the largest revenue share, driven by its critical role in oncology and neurology for high-resolution imaging and disease monitoring. The demand for MRI is further fueled by its wide application in detecting tumors, joint disorders, and cardiovascular conditions, aligning with the rising prevalence of chronic diseases. Hospitals and diagnostic centers prefer MRI-based biosimilars because of their reliability, safety, and enhanced diagnostic accuracy. In addition, favorable reimbursement policies in developed markets support the higher adoption of MRI technologies in clinical settings.

The Electrodes segment is anticipated to register the fastest growth during 2025–2032 due to their widespread usage across various diagnostic procedures. Their affordability, disposability, and increasing demand in neurology and cardiology make them highly attractive in emerging markets where cost-effectiveness is critical. Rapid urbanization and a growing patient pool requiring EEG and EMG monitoring are also fueling adoption. Moreover, the trend of point-of-care diagnostics and portable monitoring devices is expanding the use of these consumables. The segment’s growth is also supported by advancements in material science that improve electrode sensitivity and patient comfort

- By Drug Class

On the basis of drug class, the biosimilar market is segmented into insulin, recombinant human growth hormone (RHGH), granulocyte colony-stimulating factor (G-CSF), interferon, erythropoietin, etanercept, monoclonal antibodies, follitropin, glucagon, calcitonin, teriparatide, and enoxaparin sodium. The monoclonal antibodies segment dominated the market in 2024 owing to their critical importance in oncology, immunology, and autoimmune disorders. Patent expirations of blockbuster monoclonal antibody drugs, combined with their high treatment costs, have created a strong incentive for biosimilar development. These biologics are widely used in treating cancers, rheumatoid arthritis, and inflammatory bowel disease, making them a top choice for biosimilar manufacturers. The segment further benefits from regulatory pathways encouraging faster approvals and clinical acceptance.

The insulin segment is expected to witness the fastest growth from 2025 to 2032, fueled by the rising prevalence of diabetes worldwide. The increasing global diabetic population, particularly in Asia-Pacific, is creating strong demand for affordable insulin alternatives. Several insulin biosimilars have received regulatory approvals, accelerating market penetration. Governments and healthcare systems are actively promoting insulin biosimilars to reduce treatment costs and enhance patient accessibility. Furthermore, improved manufacturing technologies and partnerships between pharmaceutical companies are facilitating greater availability.

- By Type of Manufacturing

On the basis of manufacturing type, the biosimilar market is segmented into in-house manufacturing and contract manufacturing. The in-house manufacturing segment dominated the market in 2024 as major pharmaceutical companies maintain control over production to ensure quality and compliance with stringent biosimilar regulations. Having in-house facilities allows firms to manage intellectual property, control supply chain logistics, and optimize production costs in the long run. It also ensures consistent product quality, which is critical for gaining physician and patient trust in biosimilars. Larger pharma companies with established biologics infrastructure continue to rely heavily on in-house systems to safeguard competitive advantage.

The contract manufacturing segment is projected to be the fastest growing during the forecast period due to increasing outsourcing trends among mid-sized and small biosimilar developers. Contract manufacturing organizations (CMOs) provide specialized expertise, scalability, and cost efficiency, enabling faster market entry for new players. The growing pipeline of biosimilars, combined with rising R&D activity in emerging markets, is boosting demand for outsourcing partnerships. In addition, CMOs are expanding their capabilities with advanced bioreactor systems and regulatory-compliant facilities to meet the needs of global clients. Strategic collaborations between pharma companies and CMOs are further driving this segment’s growth trajectory.

- By Procedure

On the basis of procedure, the biosimilar market is segmented into invasive and non-invasive. The non-invasive segment dominated the market in 2024 with the largest revenue share, owing to growing patient preference for less painful, safer, and more convenient therapeutic options. Non-invasive approaches are widely used in oncology and chronic disease management where patient compliance is critical. Regulatory bodies and hospitals also favor non-invasive treatments due to reduced risk of complications, shorter hospital stays, and lower treatment costs. The rise of advanced imaging, diagnostic biosimilars, and targeted therapies is further cementing the dominance of this category.

The invasive segment is anticipated to register the fastest growth rate during 2025–2032, driven by the increasing demand for precise interventions in complex diseases such as cardiovascular and neurological disorders. Invasive biosimilars are critical in advanced surgeries and targeted therapies where direct delivery of biologics is necessary. The rising number of critical care patients requiring surgical interventions is fueling adoption. Furthermore, advancements in minimally invasive surgical techniques are improving safety profiles, leading to broader acceptance. The segment’s growth is also supported by rising healthcare infrastructure investments in developing countries.

- By Disease

On the basis of disease, the biosimilar market is segmented into stroke, dementia, and epilepsy. The stroke segment dominated the market in 2024 with the highest revenue share, primarily due to the increasing global incidence of ischemic and hemorrhagic strokes. Biosimilars play a critical role in improving affordability of advanced therapies used in post-stroke care. Hospitals and rehabilitation centers are increasingly relying on biosimilar-based therapies to manage recovery outcomes and reduce the financial burden on patients. Government initiatives aimed at improving access to affordable stroke treatments further strengthen this segment’s dominance.

The dementia segment is expected to witness the fastest growth from 2025 to 2032, driven by the rapidly aging global population and increasing prevalence of Alzheimer’s disease and related disorders. With healthcare systems under pressure to manage the rising costs of dementia care, biosimilars provide a cost-effective alternative for long-term treatment. Pharma companies are actively developing monoclonal antibody biosimilars targeting beta-amyloid and tau proteins associated with dementia. In addition, early diagnostic tools combined with biosimilar-based therapies are expanding clinical adoption. The segment’s growth is further supported by policy initiatives and research funding directed at neurodegenerative disorders.

- By Indication

On the basis of indication, the biosimilar market is segmented into atrial septal defect (ASD), ventricular septal defect (VSD), patent foramen ovale (PFO), aortic valve stenosis, and others. The aortic valve stenosis segment dominated the market in 2024 due to the high prevalence of cardiovascular conditions and the need for affordable biologic-based interventions. Biosimilars help in reducing the overall cost burden of valve replacement and related therapies, making treatments more accessible. Increasing adoption in both developed and emerging economies is strengthening this dominance. Hospitals also prefer biosimilar-based interventions due to proven efficacy and cost savings in large patient populations.

The ventricular septal defect (VSD) segment is projected to grow at the fastest rate during 2025–2032, driven by the rising incidence of congenital heart diseases in infants and children. Biosimilars are increasingly being incorporated into treatment protocols due to their affordability and accessibility. Improvements in pediatric cardiac care and growing healthcare expenditure in emerging economies are accelerating adoption. Moreover, increasing collaborations between biosimilar developers and pediatric hospitals are helping expand the treatment pipeline. Rising awareness campaigns around congenital heart conditions also contribute to this growth.

- By Therapy Type

On the basis of therapy type, the biosimilar market is segmented into oncology, immunology, hematology, hormone therapy, metabolic disorders, and others. The oncology segment dominated the market in 2024 with the largest revenue share of 42.2%, supported by the extensive use of monoclonal antibody biosimilars in cancer treatment. The increasing global cancer burden, along with the high costs of branded biologics, is driving biosimilar adoption. Regulatory bodies have prioritized approval pathways for oncology biosimilars, enabling faster access for patients. Hospitals and cancer centers are rapidly integrating biosimilars into treatment protocols to improve affordability and access. The growing pipeline of oncology biosimilars further reinforces this segment’s strong market position.

The immunology segment is expected to register the fastest growth during 2025–2032, fueled by the rising prevalence of autoimmune conditions such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease. Biosimilars provide cost-effective alternatives to expensive biologics such as TNF inhibitors and IL-targeting therapies. The segment is further boosted by supportive regulatory frameworks promoting substitution in immunology. Patient demand for long-term, affordable treatment options also supports rapid uptake. With strong clinical data validating efficacy, immunology biosimilars are gaining widespread acceptance among physicians.

- By End Users

On the basis of end users, the biosimilar market is segmented into hospitals, clinics, diagnostic centers, and others. The hospitals segment dominated the market in 2024 due to their role as the primary centers for administering biosimilar therapies across oncology, cardiology, and neurology. Hospitals benefit from bulk purchasing power and established partnerships with biosimilar manufacturers, enabling them to reduce treatment costs significantly. Government-funded hospital programs and insurance reimbursement policies further promote biosimilar adoption in these settings. In addition, hospitals provide the necessary infrastructure and expertise for handling complex biologics safely.

The clinics segment is projected to witness the fastest growth from 2025 to 2032, driven by the rising trend of outpatient care and the expansion of specialty clinics for chronic disease management. Clinics are increasingly adopting biosimilars due to their lower cost and ease of integration into routine treatment protocols. Patients prefer clinics for their accessibility, shorter waiting times, and personalized care approach. Furthermore, clinics are playing an important role in expanding biosimilar access in suburban and rural regions. Partnerships between biosimilar developers and clinic networks are further driving adoption.

Biosimilar Market Regional Analysis

- North America dominated the global biosimilar market with the largest revenue share of 42.8% in 2024, led by strong regulatory support from the U.S. FDA, the increasing entry of biosimilars into high-value therapeutic categories, and heightened adoption among payers seeking affordable alternatives to costly biologics

- The region’s well-established regulatory framework, particularly the FDA’s biosimilar approval pathway, has encouraged strong market entry and fostered innovation among pharmaceutical manufacturers.

- High healthcare spending, advanced healthcare infrastructure, and strong insurance coverage further support the rapid uptake of biosimilars as affordable alternatives to branded biologics

The U.S. Biosimilar Market Insight

The U.S. biosimilar market captured the largest revenue share of 83% in 2024 within North America, fueled by a strong demand for cost-effective biologic alternatives and the rapid expansion of therapeutic applications in oncology and immunology. Physicians and patients are increasingly adopting biosimilars due to their proven safety and efficacy, alongside significant cost savings compared to branded biologics. Favorable regulatory support from the FDA and growing acceptance by insurers are accelerating penetration across hospitals and specialty clinics. Moreover, the entry of major pharmaceutical companies and expanded reimbursement coverage is significantly contributing to market growth.

Europe Biosimilar Market Insight

The Europe biosimilar market is projected to expand at a substantial CAGR throughout the forecast period, driven by well-established regulatory pathways and early adoption across key therapeutic classes. Countries such as Germany, France, and the U.K. are leading in biosimilar utilization due to strong government initiatives for reducing healthcare expenditures. The rising prevalence of chronic diseases, coupled with a push for affordable treatments, is fostering uptake across oncology, endocrinology, and rheumatology. Increasing physician confidence and competitive pricing strategies are also fueling biosimilar penetration across hospital and retail pharmacy channels.

U.K. Biosimilar Market Insight

The U.K. biosimilar market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by favorable NHS policies that actively promote biosimilar adoption. Healthcare providers are increasingly shifting towards biosimilars in oncology, immunology, and metabolic disorders due to cost pressures and the need for broader patient access. The growing acceptance among prescribers and patients, combined with competitive tenders and price reductions, is expected to accelerate market penetration. In addition, collaborations between the NHS and biosimilar manufacturers are enhancing confidence and driving further adoption.

Germany Biosimilar Market Insight

The Germany biosimilar market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s position as one of the earliest adopters of biosimilars in Europe. Strong healthcare policies encouraging substitution, coupled with competitive pricing, have made Germany a leader in biosimilar penetration across therapeutic areas. The emphasis on lowering healthcare costs and improving access to biologics supports rapid uptake in oncology and autoimmune diseases. Moreover, local innovation, physician awareness programs, and structured reimbursement frameworks are reinforcing growth in the market.

Asia-Pacific Biosimilar Market Insight

The Asia-Pacific biosimilar market is poised to grow at the fastest CAGR of 25% during the forecast period of 2025 to 2032, driven by the rising burden of chronic diseases, expanding healthcare infrastructure, and increasing affordability of biosimilars in countries such as China, Japan, and India. Favorable government initiatives, along with local manufacturing capabilities, are making biosimilars more accessible to a wider patient population. Moreover, strategic collaborations between domestic and international players are fostering innovation and ensuring regulatory approvals. The region’s expanding middle-class population and growing healthcare investments are further accelerating biosimilar adoption.

Japan Biosimilar Market Insight

The Japan biosimilar market is gaining momentum due to strong government support, aging population needs, and rising prevalence of cancer and autoimmune diseases. Regulatory bodies in Japan have streamlined approval pathways, boosting the availability of biosimilars across therapeutic areas. The increasing adoption in hospitals and specialty clinics, combined with growing trust among physicians, is fueling demand. In addition, the country’s advanced healthcare infrastructure and emphasis on cost containment are encouraging broader market uptake. Partnerships between Japanese and global biopharma companies further support market expansion.

India Biosimilar Market Insight

The India biosimilar market accounted for the largest market revenue share in Asia Pacific in 2024, supported by a robust domestic manufacturing ecosystem and a growing demand for affordable biologics. India has positioned itself as a global hub for biosimilar development and production, supplying both domestic and international markets. Rising cases of diabetes, cancer, and autoimmune diseases are fueling adoption across therapeutic areas. Moreover, government initiatives to boost healthcare accessibility, along with the presence of leading local players, are driving strong biosimilar penetration. Competitive pricing strategies and increasing physician confidence are further propelling market growth.

Biosimilar Market Share

The biosimilar industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- Orion Pharma AB (Sweden)

- Pfizer Inc. (U.S.)

- Samsung Bioepis. (South Korea)

- Coherus BioSciences, Inc. (U.S.)

- Amgen Inc. (U.S.)

- Lilly USA, LLC (U.S.)

- Takeda Pharmaceutical Company Limited. (Japan)

- Bristol-Myers Squibb Company (U.S.)

- Merck KGaA (Germany)

- Teva Pharmaceutical Industries Ltd. (U.S.)

- Biocon (India)

- Bayer AG (Germany)

- AbbVie Inc. (U.S.)

- Dr. Reddy’s Laboratories Ltd. (India)

- Boehringer Ingelheim International GmbH (Germany)

- Biogen (U.S.)

What are the Recent Developments in Global Biosimilar Market?

- In May 2025, the FDA approved Starjemza (ustekinumab-hmny) as the eighth biosimilar to Stelara (ustekinumab), offering patients enhanced treatment options for rheumatic and gastrointestinal conditions. This approval highlights continued expansion in the ustekinumab biosimilar class and supports greater accessibility to these therapies

- In February 2025, the FDA designated Selarsdi, a biosimilar to Stelara (ustekinumab), as interchangeable. This means pharmacists may substitute it for Stelara without prescriber intervention once exclusivity periods lapse, significantly streamlining access and adoption for patients

- In February 2025, the FDA approved Merilog (insulin-aspart-szjj), the first rapid-acting insulin biosimilar to Novolog (insulin aspart), available in both prefilled pen and vial formats. This marks a milestone in expanding affordable insulin options for diabetes patients

- In December 2024, the FDA granted approval to Steqeyma (ustekinumab-stba) as the seventh biosimilar to Stelara (ustekinumab), enabling more competition and expanded treatment options in autoimmune and inflammatory disease care

- In October 2024, Accord BioPharma, Inc. announced that the FDA approved Imuldosa (ustekinumab-srlf), a biosimilar to Stelara (ustekinumab), for all the same chronic inflammatory indications—including psoriasis, psoriatic arthritis, Crohn’s disease, and ulcerative colitis

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.