Global Biosurfactants Market

Market Size in USD Billion

CAGR :

%

USD

4.65 Billion

USD

6.71 Billion

2024

2032

USD

4.65 Billion

USD

6.71 Billion

2024

2032

| 2025 –2032 | |

| USD 4.65 Billion | |

| USD 6.71 Billion | |

|

|

|

|

Biosurfactants Market Size

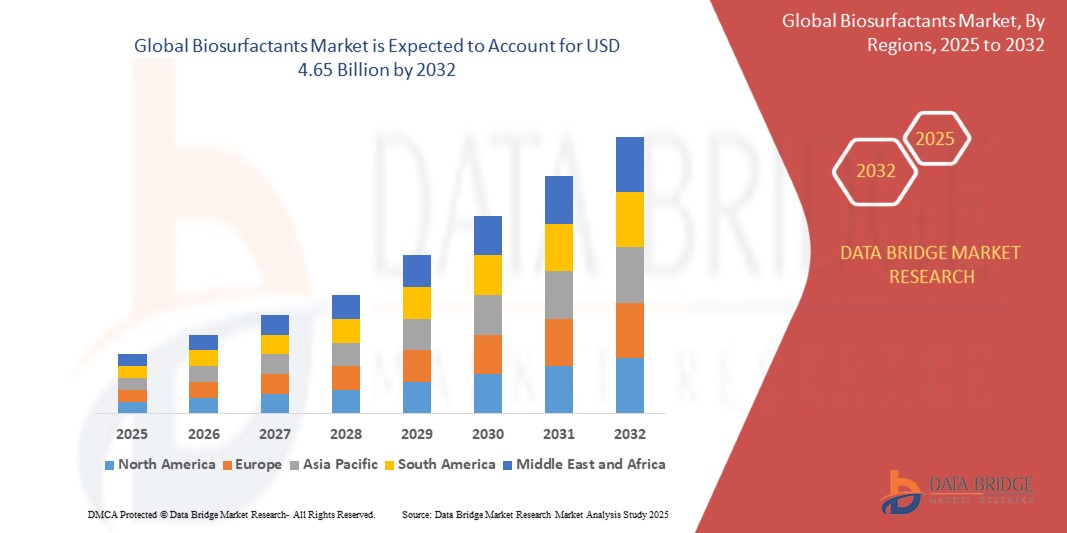

- The global biosurfactants market is projected to grow significantly in the coming years. According to Market Data Forecast, the market size is expected to reach USD 4.65 billion in 2024 and expand to USD 6.71 billion by 2032, reflecting a compound annual growth rate (CAGR) of 5.4% during the forecast period.

- The growth of the biosurfactants market is driven by factors such as increasing environmental concerns, growing demand for sustainable and biodegradable products, and stringent regulations against synthetic surfactants

Biosurfactants Market Analysis

- Biosurfactants are eco-friendly surface-active compounds produced by microorganisms, offering advantages such as biodegradability, low toxicity, and effectiveness under extreme conditions, making them ideal for a variety of industrial applications

- The growing emphasis on sustainable and green alternatives, along with stringent environmental regulations restricting the use of synthetic surfactants, is significantly driving the demand for biosurfactants across multiple sectors

- North America is expected to dominate the biosurfactants market with a largest market share of 35.7% in 2025 due to strong regulatory support, increasing investment in green chemistry, and a mature industrial and agricultural base that is adopting sustainable practices

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing environmental awareness, and the expansion of industries such as agriculture, personal care, and oil & gas

- The personal care and cosmetics segment is anticipated to hold the largest market share, supported by rising consumer preference for natural ingredients, clean-label products, and growing demand for biodegradable formulations in skincare and haircare

Report Scope and Biosurfactants Market Segmentation

|

Attributes |

Biosurfactants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biosurfactants Market Trends

Rising Shift Toward Biobased and Sustainable Ingredients in Industrial Formulations

- A major trend in the biosurfactants market is the increasing preference for biobased and renewable ingredients in industrial and consumer product formulations, driven by growing environmental awareness and regulatory pressures to reduce synthetic chemical use

- Industries such as personal care, detergents, agriculture, and oil & gas are actively replacing petroleum-derived surfactants with biosurfactants due to their biodegradability, low toxicity, and performance in extreme conditions

- For instance, leading cosmetics brands are reformulating skincare and haircare products with biosurfactants like rhamnolipids and sophorolipids to meet consumer demand for clean-label, vegan, and eco-friendly solutions

- This trend is reshaping product development strategies, fostering innovation in green chemistry, and positioning biosurfactants as key enablers of sustainable industry transformation

Biosurfactants Market Dynamics

Driver

Increasing Environmental Regulations and Demand for Sustainable Alternatives

- The global push for sustainability and the enforcement of stringent environmental regulations are major drivers propelling the biosurfactants market forward

- Traditional synthetic surfactants, derived from petrochemicals, are often associated with environmental toxicity and poor biodegradability, prompting industries to seek greener alternatives

- Biosurfactants offer a compelling solution, being biodegradable, non-toxic, and effective at lower concentrations, making them suitable for applications ranging from personal care to industrial cleaning and agriculture.

For instance,

- The European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) have introduced tighter controls on the use of non-biodegradable and hazardous substances in consumer and industrial products, encouraging the shift to biosurfactants. Companies that align with these sustainability goals are gaining regulatory and market advantages

- As environmental awareness and consumer expectations for clean-label and eco-friendly products continue to rise, manufacturers across sectors are increasingly investing in biosurfactant-based solutions to meet both regulatory compliance and consumer demand

Opportunity

Expanding Use of Biosurfactants in the Cosmetics and Personal Care Industry

- The increasing consumer preference for natural, organic, and sustainable personal care products is creating significant opportunities for the adoption of biosurfactants in the cosmetics industry.

- As awareness of harmful effects from synthetic ingredients grows, consumers are demanding safer, plant-based alternatives in products like shampoos, facial cleansers, and body washes. Biosurfactants, known for their mildness, biodegradability, and skin-friendly properties, are becoming key ingredients in “clean beauty” formulations.

- Cosmetic brands are leveraging biosurfactants not only for their functional benefits—such as foaming, emulsifying, and cleansing—but also to align with eco-conscious branding and regulatory trends.

For instance,

- According to the Soil Association’s 2023 Organic Beauty & Wellbeing Market Report, sales of certified organic and natural beauty products in the UK grew by over 15% in one year, reflecting a strong consumer shift toward eco-friendly ingredients. This growth is encouraging personal care manufacturers to integrate biosurfactants to meet evolving market demands.

- As sustainability becomes a core purchasing criterion, biosurfactants offer cosmetic companies a competitive edge in meeting green certification standards and appealing to ethically driven consumers, making this a rapidly growing application area.

Restraint/Challenge

High Production Costs and Limited Commercial Scale-Up Capabilities

- One of the key restraints hindering the growth of the biosurfactants market is the relatively high cost of production compared to conventional synthetic surfactants.

- The fermentation processes used to produce biosurfactants often require specialized equipment, high-purity feedstocks, and strict process controls, leading to increased manufacturing expenses. This cost barrier limits the widespread adoption of biosurfactants, particularly in price-sensitive industries like detergents and industrial cleaners.

- In addition, challenges related to low yield, long fermentation times, and downstream purification further constrain large-scale commercial production, affecting market competitiveness.

For instance,

- According to a study published in Biotechnology Advances, the cost of producing biosurfactants like rhamnolipids and sophorolipids can be 3–5 times higher than synthetic counterparts, primarily due to low process efficiency and the complexity of microbial cultivation. This has discouraged many companies from investing heavily in large-scale biosurfactant production

- As a result, despite the environmental advantages of biosurfactants, their adoption is currently limited by economic feasibility, highlighting the need for continued R&D investments and technological innovations to reduce costs and improve production scalability

Biosurfactants Market Scope

The market is segmented on the basis product type, source, application.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Source |

|

|

By Application |

|

In 2025, the glycolipids is projected to dominate the market with a largest share in product type.

Glycolipids accounted for 60.20% of market share due to their high biodegradability, low toxicity, versatile applications, and strong demand in cosmetics and pharmaceuticals.

The healthcare is expected to account for the largest share during the forecast period in technology market

In 2025, the healthcare segment is expected to dominate the technology market, accounting for the largest share of 51.31%. This dominance is driven by the high prevalence of age-related conditions and the growing demand for precision in medical procedures.

Biosurfactants Market Regional Analysis

Europe Holds the Largest Share in the Biosurfactants Market

- Europe is projected to lead the biosurfactants market with the largest share in 2025, driven by strong regulatory support for sustainable products, a mature bio-based chemicals industry, and growing demand for eco-friendly alternatives across various sectors

- Germany, holding a significant portion of the regional share, is at the forefront due to its advancements in green chemistry, well-developed industrial base, and proactive environmental policies promoting the use of biodegradable surfactants in home care, cosmetics, and agriculture

- The European Union’s strict environmental regulations, such as REACH and the Green Deal, are accelerating the shift from synthetic to natural surfactants, boosting biosurfactant production and consumption

- Increased consumer awareness of health and sustainability, alongside rising demand for clean-label personal care and household products, is further supporting market growth across the region

- Additionally, collaborative R&D initiatives and government-funded bioeconomy programs are fostering innovation and scalability in biosurfactant production, strengthening Europe’s position as a global leader in the market

Asia-Pacific is Projected to Register the Highest CAGR in the Biosurfactants Market

-

The Asia-Pacific region is expected to register the highest growth rate in the Biosurfactants Market, driven by rising environmental concerns, increasing industrialization, and the growing demand for eco-friendly and biodegradable alternatives across industries such as personal care, agriculture, food processing, and oil & gas

- Countries like China, India, and Japan are emerging as significant markets due to increasing regulatory pressure to reduce the use of petrochemical-based surfactants, heightened consumer awareness regarding green products, and the expansion of key end-use sectors requiring sustainable surface-active agents

- Japan, with its strong biotechnology sector and a focus on sustainability, is leading the region in adopting biosurfactants, particularly in the cosmetics, pharmaceutical, and household care segments. The country's commitment to reducing carbon emissions and promoting environmentally safe ingredients is fostering market growth

- China and India, supported by their expanding population bases and industrial activity, are experiencing rising demand for biosurfactants in agriculture, detergents, and food applications. Government initiatives promoting clean manufacturing and investments in bio-based technologies are acting as major catalysts for market development

- The region's growth is further reinforced by foreign direct investments, collaborations with global biosurfactant producers, and the establishment of local production facilities aimed at reducing dependency on imports and catering to cost-sensitive and sustainability-conscious consumers in the region

Biosurfactants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Givaudan SA (Switzerland)

- Ecover (Belgium)

- Jeneil Biotech Inc. (USA)

- AkzoNobel N.V. (Netherlands)

- Croda International PLC (UK)

- Saraya Co., Ltd. (Japan)

- Lion Corporation (Japan)

- Biotensidon GmbH (Germany)

- Solvay S.A. (Belgium)

- Mitsubishi Chemical Corporation (Japan)

- Kao Corporation (Japan)

- Clariant AG (Switzerland)

- Galaxy Surfactants Ltd. (India)

- Holiferm Ltd. (UK)

- TeeGene Biotech Ltd. (UK)

- Sasol Ltd. (South Africa)

- Stepan Company (USA)

Latest Developments in Global Biosurfactants Market

- In March 2025, Evonik Industries AG inaugurated its first industrial-scale biosurfactant production facility in Slovakia, focusing on rhamnolipids made from renewable raw materials. This marks a significant step toward sustainable surfactant alternatives for applications in cleaning and personal care, offering biodegradable and skin-friendly formulations that align with global environmental goals

- In February 2025, AmphiStar, a Belgian biotech startup, secured USD 6.5 million in funding to scale its production of cost-effective biosurfactants from agricultural and food waste. This innovation addresses both sustainability and circular economy goals, offering affordable, non-toxic solutions for use in detergents, cosmetics, and agricultural formulations

- In January 2025, Solvay launched its Mirasoft® SL L60 and SL A60 biosurfactants, derived from natural fermentation processes. Designed for the personal care industry, these surfactants provide excellent foaming and cleansing properties while being biodegradable and non-irritating, meeting the growing demand for eco-friendly beauty and hygiene products

- In December 2024, Holiferm Ltd partnered with Estonian bio-refinery Fibenol to produce biosurfactants using wood-based raw materials. This collaboration focuses on developing a low-carbon, sustainable production process to replace fossil-derived surfactants in sectors such as personal care, cleaning, and industrial formulations

- In November 2024, Givaudan expanded its Active Beauty portfolio with the launch of Biosurfactant Innovation Program, aimed at delivering high-performance, naturally derived surfactants for skin and hair care. This initiative supports Givaudan’s long-term sustainability goals and responds to consumer demand for safe, plant-based alternatives in cosmetic formulations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Biosurfactants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Biosurfactants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Biosurfactants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.