Global Bispecific Antibody Market

Market Size in USD Million

CAGR :

%

USD

622.80 Million

USD

1,062.11 Million

2024

2032

USD

622.80 Million

USD

1,062.11 Million

2024

2032

| 2025 –2032 | |

| USD 622.80 Million | |

| USD 1,062.11 Million | |

|

|

|

|

Bispecific Antibody Market Size

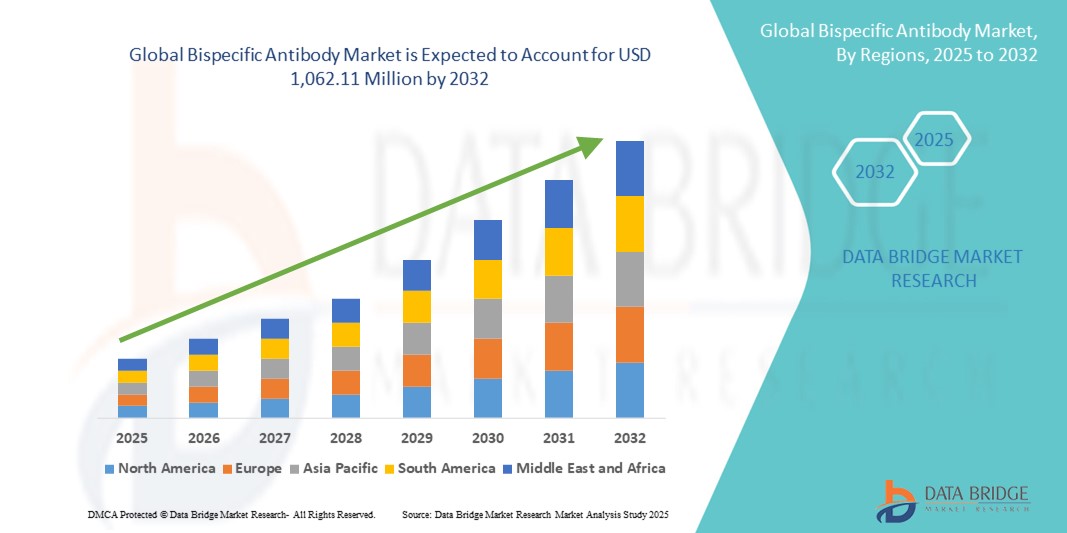

- The global bispecific antibody market size was valued at USD 622.80 million in 2024 and is expected to reach USD 1,062.11 million by 2032, at a CAGR of 6.90% during the forecast period

- The market growth is primarily driven by advancements in antibody engineering, along with a rising focus on targeted immunotherapies for cancer, autoimmune disorders, and infectious diseases, which are fueling significant pipeline expansion

- Moreover, the increasing number of regulatory approvals, strategic collaborations among biopharma companies, and strong demand for next-generation biologics are positioning bispecific antibodies as a transformative therapy class. These converging factors are accelerating clinical adoption and investment, thereby significantly boosting the industry’s growth

Bispecific Antibody Market Analysis

- Bispecific antibodies, engineered to target two distinct antigens or epitopes, are gaining rapid importance in therapeutic development due to their ability to enhance immune response, increase treatment precision, and provide novel options in oncology, autoimmune, and rare disease management

- The rising demand for bispecific antibodies is primarily driven by the growing cancer burden, strong pipeline advancements, strategic biopharma collaborations, and increasing clinical approvals, positioning them as a next-generation biologic therapy

- North America dominated the bispecific antibody market with the largest revenue share of 47.2% in 2024, supported by robust clinical trial activity, early regulatory approvals, and the strong presence of leading biopharma companies driving commercial adoption

- Asia-Pacific is expected to be the fastest-growing region in the bispecific antibody market during the forecast period, fueled by rising investments in biotechnology, expanding patient access to biologics, and government-backed initiatives across China, Japan, and South Korea

- Oncology segment dominated the bispecific antibody market with a market share of 71.9% in 2024, propelled by clinical success of bispecific T-cell engager (BiTE) therapies and a strong pipeline targeting both hematological malignancies and solid tumors

Report Scope and Bispecific Antibody Market Segmentation

|

Attributes |

Bispecific Antibody Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bispecific Antibody Market Trends

Expanding Clinical Adoption Through Oncology Breakthroughs

- A significant and accelerating trend in the global bispecific antibody market is their growing role in oncology, particularly in hematological malignancies, where bispecific T-cell engagers (BiTEs) and IgG-such as formats are showing remarkable clinical outcomes. This therapeutic advance is redefining cancer immunotherapy by enabling dual-targeting mechanisms that improve tumor elimination

- For instance, Amgen’s Blinatumomab remains a landmark therapy for acute lymphoblastic leukemia (ALL), while Roche’s Hemlibra (emicizumab) has demonstrated breakthrough efficacy in hemophilia A, validating the broader potential of bispecific antibodies beyond oncology

- Pipeline expansion continues rapidly, with several candidates in Phase II and Phase III trials for lung, breast, and gastrointestinal cancers. Companies such as Genmab and Regeneron are leading efforts to develop bispecific formats with enhanced stability, safety, and manufacturability

- Novel platforms such as CrossMab (Roche) and DuoBody (Genmab) are enabling better drug-such as properties, reduced immunogenicity, and scalable production—key trends driving biopharma adoption. Furthermore, the trend toward combination regimens with immune checkpoint inhibitors is expanding the clinical utility of bispecifics

- This growing emphasis on oncology-driven innovation is fundamentally reshaping expectations in biologics development. Consequently, leading pharma and biotech companies are investing heavily in next-generation bispecific pipelines, positioning them as central assets in future cancer treatment strategies

- The demand for bispecific antibodies that offer superior efficacy, broader therapeutic coverage, and reduced treatment resistance is expanding rapidly across major healthcare markets, reflecting a transformative shift in modern immunotherapy

Bispecific Antibody Market Dynamics

Driver

Rising Cancer Burden and Advancements in Antibody Engineering

- The increasing global cancer incidence, alongside the growing prevalence of autoimmune diseases, is a major driver for the adoption of bispecific antibodies, as they offer superior targeting precision compared to conventional monoclonal antibodies

- For instance, in 2024, Regeneron and BioNTech expanded their collaboration to develop bispecific antibodies for solid tumors, demonstrating industry momentum toward harnessing dual-targeting immunotherapies. Such strategies are expected to accelerate innovation and market growth

- Bispecifics provide unique advantages, such as redirecting T-cells to tumors, blocking dual signaling pathways, and overcoming resistance to single-target biologics, making them highly attractive in oncology

- Furthermore, the rise of biotech pharma partnerships, increasing FDA fast-track approvals, and continuous improvements in manufacturing platforms are facilitating faster commercialization and patient access

- Growing clinical success stories, particularly in hematologic cancers and hemophilia, are enhancing physician and patient confidence, propelling demand across hospitals and specialty clinics worldwide

Restraint/Challenge

High Development Complexity and Cost Barriers

- Despite strong growth potential, the bispecific antibody market faces significant challenges due to complex manufacturing requirements, stability concerns, and stringent regulatory demands, which can delay commercialization timelines

- For instance, early-generation bispecific formats such as Catumaxomab were withdrawn due to immunogenicity issues and limited scalability, highlighting technical hurdles in design and production

- The high cost of therapy development, combined with pricing pressures in oncology biologics, poses barriers for both companies and patients. Treatments such as Blinatumomab can cost over USD 170,000 annually, restricting adoption in cost-sensitive markets

- In addition, managing safety concerns such as cytokine release syndrome (CRS) and off-target toxicity remains a regulatory and clinical challenge, requiring advanced monitoring and patient management protocols

- Overcoming these challenges through next-generation engineering platforms, strategic cost-sharing collaborations, and improved clinical trial designs will be critical for sustaining growth and expanding access to bispecific antibody therapies globally

Bispecific Antibody Market Scope

The market is segmented on the basis of type, mechanism of action, application, drugs, route of administration, end-users, and distribution channel.

- By Type

On the basis of type, the global bispecific antibody market is segmented into Immunoglobulin G (IgG)–such as Molecules and Non-Immunoglobulin G (IgG)–such as Molecules. The IgG-such as molecules segment dominated the market with the largest revenue share of 62.5% in 2024, due to their structural similarity to conventional monoclonal antibodies, which makes them easier to engineer, manufacture, and scale. Their longer half-life, higher stability, and established regulatory pathways also make them more attractive for commercial development. Leading biopharma companies prefer IgG-such as bispecifics for oncology pipelines, contributing to their wide clinical adoption. In addition, the format supports combination therapies and can integrate into existing biologics infrastructure, further driving market dominance.

The non-IgG-such as molecules segment is expected to witness the fastest CAGR during the forecast period, driven by their innovative design flexibility and potential for higher binding specificity. These formats, including DARTs, TandAbs, and BiTEs, are increasingly used in novel clinical trials targeting hematologic cancers and solid tumors. Their smaller size allows for better tissue penetration and unique mechanisms of action, making them attractive for next-generation therapies. As biopharma R&D shifts toward platform diversification, non-IgG molecules are expected to see rapid adoption despite current manufacturing challenges.

- By Mechanism of Action

On the basis of mechanism of action, the bispecific antibody market is segmented into Bispecific T-Cell Engager (BiTE) Antibodies and Bispecific Diabodies. The BiTE antibodies segment dominated the market with a 55.3% share in 2024, supported by their proven efficacy in redirecting T-cells to cancer cells, resulting in strong tumor-killing activity. Drugs such as Blinatumomab have already set a benchmark, demonstrating high remission rates in acute lymphoblastic leukemia. The BiTE format benefits from streamlined development pathways, strong clinical validation, and increasing physician familiarity. Its success in hematological malignancies continues to fuel adoption and inspire ongoing research in solid tumors.

The bispecific diabodies segment is expected to be the fastest-growing during the forecast period, owing to their smaller size and potential for better tumor penetration. They are highly adaptable for preclinical development and provide improved binding efficiency compared to larger antibody constructs. Although still less clinically mature than BiTEs, diabodies are gaining traction in R&D pipelines due to their modularity and potential for cost-effective production. Companies exploring diabody platforms are expanding indications beyond oncology, which will further accelerate future adoption.

- By Application

On the basis of application, the bispecific antibody market is segmented into Oncology, Autoimmune Disease, and Others. The oncology segment dominated the market with a 71.9% share in 2024, as bispecific antibodies have emerged as a groundbreaking treatment in both hematological malignancies and solid tumors. The rising global cancer burden, coupled with robust pipeline development, has made oncology the largest and most commercially advanced therapeutic area for bispecifics. Multiple FDA fast-track designations and breakthrough therapy approvals are accelerating their adoption in cancer care. Their dual-targeting mechanism is particularly valuable for overcoming resistance associated with single-antibody therapies, driving market dominance.

The autoimmune disease segment is projected to grow at the fastest CAGR, fueled by increasing interest in bispecifics for conditions such as rheumatoid arthritis, lupus, and multiple sclerosis. These therapies can modulate immune system activity more precisely than conventional biologics, reducing side effects while enhancing therapeutic outcomes. With growing research collaborations and expanding clinical trials, the autoimmune pipeline for bispecific antibodies is expanding rapidly. This segment is expected to contribute significantly to long-term market diversification beyond oncology.

- By Drugs

On the basis of drugs, the bispecific antibody market is segmented into Blinatumomab, Catumaxomab, Duligotumab, and Others. Blinatumomab dominated the market with a 47.8% share in 2024, being the first FDA-approved bispecific antibody for relapsed or refractory B-cell precursor acute lymphoblastic leukemia (ALL). Its strong clinical efficacy, physician familiarity, and established commercialization by Amgen have given it a leading position. The drug continues to be a reference point for other bispecific therapies in development and benefits from expanded use cases in clinical trials. Its market dominance is reinforced by stable reimbursement pathways and proven survival benefits.

The “Others” segment, which includes newer candidates such as Emicizumab (Hemlibra) and multiple investigational pipeline drugs, is expected to be the fastest-growing during the forecast period. Hemlibra has already demonstrated breakthrough efficacy in hemophilia A, and other late-stage candidates from Roche, Regeneron, and Genmab are advancing rapidly in oncology and immunology. The expanding approvals pipeline, combined with growing global R&D investment, will make this category the key driver of future market growth.

- By Route of Administration

On the basis of route of administration, the bispecific antibody market is segmented into Injectable and Oral. The injectable segment dominated the market with a 93.6% share in 2024, since biologic therapies such as bispecific antibodies are large, complex molecules that require parenteral delivery. Injectable formats ensure drug stability, controlled dosing, and direct bioavailability, which are critical for life-threatening conditions such as leukemia and lymphoma. Hospitals and specialty clinics widely prefer this route for effective administration under medical supervision. In addition, most approved bispecifics and late-stage candidates are designed for injection, reinforcing the segment’s dominance.

The oral segment is projected to grow at the fastest CAGR, although from a very low base, driven by ongoing R&D into oral biologic delivery systems. Advances in nanocarrier technologies, peptide carriers, and bioavailability enhancers are making it possible to explore oral formulations of complex biologics. While clinical translation is still limited, the convenience of oral administration offers immense potential for long-term adoption if technological barriers are successfully addressed.

- By End-Users

On the basis of end-users, the bispecific antibody market is segmented into Hospitals, Specialty Clinics, and Others. The hospital segment dominated the market with a 68.9% share in 2024, as the majority of bispecific antibody therapies are administered in controlled hospital settings. Hospitals provide advanced infrastructure for infusion therapies, monitoring, and management of potential adverse events such as cytokine release syndrome (CRS). In addition, large-scale clinical adoption in oncology wards has positioned hospitals as the primary point of care for these therapies. Centralized purchasing power and reimbursement mechanisms further strengthen hospital dominance in this market.

The specialty clinics segment is expected to be the fastest-growing during the forecast period, fueled by the rising shift toward decentralized care models and outpatient infusion services. Specialty clinics are increasingly equipped to administer advanced biologics, offering convenience to patients and reducing hospital burden. As more bispecific antibodies receive approval for chronic use in autoimmune diseases, specialty clinics are expected to capture a larger share of the market.

- By Distribution Channel

On the basis of distribution channel, the bispecific antibody market is segmented into Hospital Pharmacies and Retail Pharmacies. The hospital pharmacies segment dominated the market with a 65.7% share in 2024, reflecting the centralized role of hospitals in administering and dispensing bispecific therapies. These pharmacies manage procurement, storage, and patient distribution of high-cost biologics, ensuring regulatory compliance and safe handling. Their strong integration with hospital oncology and hematology departments ensures consistent access to bispecific drugs for inpatients.

The retail pharmacies segment is anticipated to grow at the fastest CAGR, driven by increasing outpatient prescriptions and expansion of biologics into chronic autoimmune indications. As more bispecific antibodies move into maintenance therapy settings, retail channels will play a larger role in accessibility. The shift toward specialty retail pharmacy networks is further expected to expand availability for patients outside hospital settings.

Bispecific Antibody Market Regional Analysis

- North America dominated the bispecific antibody market with the largest revenue share of 47.2% in 2024, supported by robust clinical trial activity, early regulatory approvals, and the strong presence of leading biopharma companies driving commercial adoption

- Patients and healthcare providers in North America highly value the clinical efficacy, targeted action, and advanced therapeutic options offered by bispecific antibodies, particularly in hematological malignancies and rare diseases

- This widespread adoption is further supported by strategic collaborations, R&D investments, and increasing physician awareness of next-generation biologics, establishing bispecific antibodies as a preferred treatment option across hospitals and specialty clinics in the region

U.S. Bispecific Antibody Market Insight

The U.S. bispecific antibody market captured the largest revenue share of 81% in 2024 within North America, fueled by the rapid adoption of innovative biologics and strong investment in oncology and immunology R&D. Healthcare providers and patients increasingly prioritize targeted therapies that offer improved efficacy and reduced side effects compared to conventional treatments. The growing pipeline of FDA-approved bispecific antibodies, along with advancements in manufacturing and delivery technologies, further propels the market. In addition, collaborations between biotech and pharmaceutical companies, combined with robust clinical trial infrastructure, are significantly contributing to market expansion.

Europe Bispecific Antibody Market Insight

The Europe bispecific antibody market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of cancer and autoimmune diseases, and supportive regulatory frameworks for biologics. Growing patient awareness of advanced therapies, coupled with investments in biopharma innovation, is fostering adoption. European healthcare systems are integrating bispecific antibodies across hospitals and specialty clinics, enhancing patient access. The market growth is also supported by ongoing clinical trials and collaborations with global pharmaceutical leaders.

U.K. Bispecific Antibody Market Insight

The U.K. bispecific antibody market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising incidence of hematologic malignancies and the focus on precision medicine. Healthcare providers and patients are increasingly seeking next-generation biologics offering dual-target mechanisms for better outcomes. Moreover, the U.K.’s strong clinical research infrastructure, coupled with favorable reimbursement policies, supports faster adoption of bispecific therapies in hospitals and specialty clinics.

Germany Bispecific Antibody Market Insight

The Germany bispecific antibody market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure and emphasis on cutting-edge biologics. Increasing awareness of novel therapies, ongoing oncology clinical trials, and the country’s focus on research and innovation promote market growth. Hospitals and specialty clinics are integrating bispecific antibodies into standard treatment regimens for both oncology and autoimmune indications. Strong government support for biotech R&D and emphasis on patient access to innovative therapies further contribute to market expansion.

Asia-Pacific Bispecific Antibody Market Insight

The Asia-Pacific bispecific antibody market is poised to grow at the fastest CAGR of 24% during 2025–2032, driven by rising cancer prevalence, expanding healthcare infrastructure, and growing pharmaceutical R&D in countries such as China, Japan, and India. Increasing awareness of advanced therapies, favorable government initiatives for biologics, and rising patient access are accelerating adoption. Moreover, the region’s growing biotechnology sector and domestic manufacturing capabilities for biologics are improving affordability and availability, enabling wider market penetration.

Japan Bispecific Antibody Market Insight

The Japan bispecific antibody market is gaining momentum due to the country’s advanced medical technology infrastructure, increasing incidence of cancer, and rising demand for precision therapies. Hospitals and specialty clinics are adopting bispecific antibodies as part of innovative treatment regimens, often integrated with combination therapies and immunotherapy protocols. Japan’s aging population is further driving demand for effective, targeted biologics with manageable side effects, particularly in oncology and autoimmune disease treatment.

India Bispecific Antibody Market Insight

The India bispecific antibody market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to growing healthcare awareness, rising cancer and autoimmune disease prevalence, and expanding hospital infrastructure. Increasing availability of advanced therapies, ongoing clinical trials, and domestic pharmaceutical investment in biologics are key factors driving market growth. Furthermore, government initiatives supporting biotech research and increasing patient access to innovative treatments are propelling the adoption of bispecific antibodies across hospitals and specialty clinics.

Bispecific Antibody Market Share

The Bispecific Antibody industry is primarily led by well-established companies, including:

- Innovent Biologics, Inc (U.S.)

- Affimed GmbH (China)

- Amgen Inc (Germany

- AstraZeneca (U.K.)

- Xencor (U.S.)

- Sanofi (France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Regeneron Pharmaceuticals Inc (U.S.)

- Eli Lilly (U.S.)

- Pieris Pharmaceuticals, Inc (U.S.)

- Mereo BioPharma Group plc (U.K)

- Sobi, TG Therapeutics Inc (Swden)

- Merus (Netherlands)

- MacroGenics, Inc (U.S.)

- Genmab A/S (Denmark)

- Emergent BioSolutions Inc (U.S.)

- Alteogen (South Korea)

- Astellas Pharma Inc (Japan)

- Novartis AG (Switzerland)

- CELGENE CORPORATION (U.S.)

What are the Recent Developments in Global Bispecific Antibody Market?

- In July 2025, the U.S. Food and Drug Administration (FDA) granted accelerated approval to linvoseltamab-gcpt (Lynozyfic), a bispecific B-cell maturation antigen (BCMA)-directed CD3 T-cell engager developed by Regeneron Pharmaceuticals. This approval is for adults with relapsed or refractory multiple myeloma who have received at least four prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 monoclonal antibody

- In June 2025, BioNTech and Bristol Myers Squibb announced a global strategic partnership to co-develop and co-commercialize BNT327, a bispecific antibody targeting PD-L1 and VEGF-A for the treatment of various solid tumors. The collaboration includes an upfront payment and potential milestone payments, with multiple global clinical trials planned or underway, including Phase 3 studies in non-small cell lung cancer (NSCLC), small cell lung cancer (SCLC), and triple-negative breast cancer (TNBC)

- In April 2024, Alligator Bioscience and Orion Corporation announced the exercise of a development option under their 2021 immuno-oncology research collaboration and license agreement. The collaboration focuses on the development of bispecific antibody candidates targeting cancer cells, utilizing Alligator's proprietary phage display libraries and RUBY bispecific antibody format

- In March 2025, Sanofi announced the acquisition of Dren Bio's bispecific myeloid cell engager, DR-0201, which has shown robust B-cell depletion in preclinical and early clinical studies. This acquisition, valued at USD600 million upfront, aims to broaden Sanofi's immunology pipeline and position the company as a leader in immunology. DR-0201 is being evaluated in two ongoing Phase 1 studies and has the potential to reset the immune system, offering a new therapeutic approach for autoimmune diseases

- In June 2023, the U.S. Food and Drug Administration (FDA) granted accelerated approval to glofitamab (brand name Columvi), a bispecific antibody developed by Genentech. This approval was for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) who have received two or more prior lines of systemic therapy. Glofitamab targets CD20 on B cells and CD3 on T cells, facilitating T-cell-mediated destruction of B cells

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.