Global Bleached Eucalyptus Kraft Pulp Market

Market Size in USD Billion

CAGR :

%

USD

13.06 Billion

USD

26.04 Billion

2025

2033

USD

13.06 Billion

USD

26.04 Billion

2025

2033

| 2026 –2033 | |

| USD 13.06 Billion | |

| USD 26.04 Billion | |

|

|

|

|

Bleached Eucalyptus Kraft Pulp Market Size

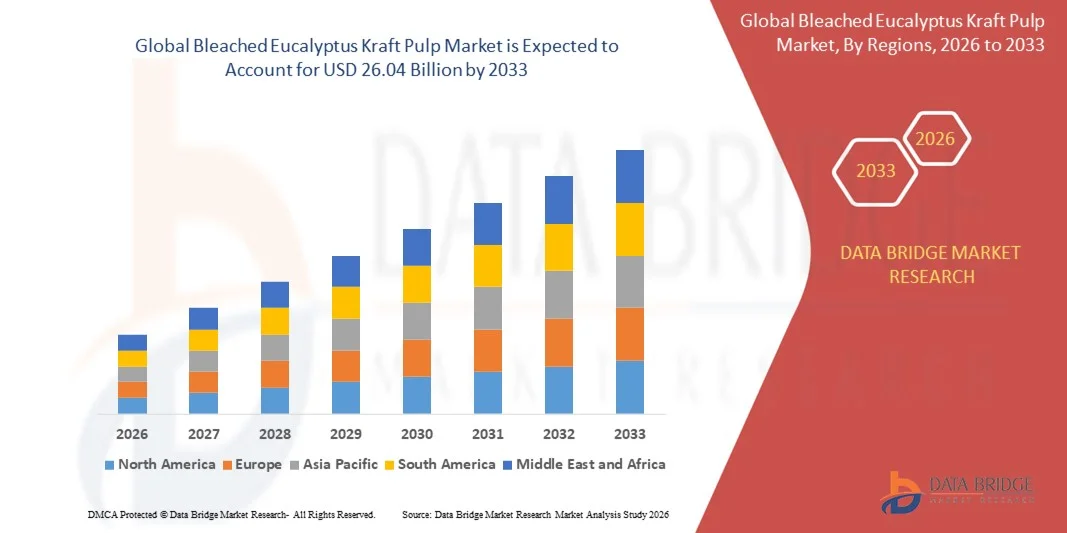

- The global bleached eucalyptus kraft pulp market size was valued at USD 13.06 billion in 2025 and is expected to reach USD 26.04 billion by 2033, at a CAGR of 9.00% during the forecast period

- The market growth is primarily driven by the rising demand for high-quality, sustainable, and fast-growing fiber sources that support the expanding global production of packaging, tissue, and specialty papers. Increasing adoption of eco-efficient pulp grades, combined with technological advancements in pulping and bleaching processes, is strengthening the preference for bleached eucalyptus kraft pulp across major paper-producing regions

- In addition, the growing emphasis on renewable raw materials, improved fiber uniformity, and cost-efficient production is positioning eucalyptus-based pulp as a preferred choice for manufacturers seeking both performance and sustainability. These converging factors are accelerating the consumption of bleached eucalyptus kraft pulp and substantially contributing to market expansion

Bleached Eucalyptus Kraft Pulp Market Analysis

- Bleached eucalyptus kraft pulp, recognized for its superior fiber strength, uniformity, and softness, is increasingly essential to the production of premium tissue, packaging, and printing papers across global industries. Its compatibility with advanced papermaking technologies and its high yield efficiency make it a critical raw material for manufacturers focused on performance enhancement and sustainability

- The rising market demand is strongly supported by the shift toward recyclable, lightweight, and high-brightness paper solutions, as well as ongoing investments in environmentally responsible bleaching methods. Growing consumption in hygiene products, e-commerce packaging, and specialty applications continues to reinforce the strategic importance of eucalyptus-based pulp within the broader pulp and paper sector

- Asia-Pacific dominated the bleached eucalyptus kraft pulp market with a share of over 40% in 2025, due to strong growth in paper production, rising demand for high-quality fiber, and the region’s expanding packaging and tissue industries

- North America is expected to be the fastest growing region in the bleached eucalyptus kraft pulp market during the forecast period due to rising demand for premium tissue, packaging, and specialty papers

- Chemical segment dominated the market with a market share of 65.5% in 2025, due to its ability to produce high-quality pulp with superior strength, brightness, and fiber uniformity essential for premium-grade paper. Manufacturers prefer chemical pulping due to its higher yield consistency and suitability for large-scale industrial processing. The segment benefits from technological advancements in cooking, washing, and recovery systems, improving efficiency and reducing chemical losses. Its wide acceptance across packaging, tissue, and printing applications further strengthens market dominance through established production infrastructure and supply networks

Report Scope and Bleached Eucalyptus Kraft Pulp Market Segmentation

|

Attributes |

Bleached Eucalyptus Kraft Pulp Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bleached Eucalyptus Kraft Pulp Market Trends

Growing Preference for Sustainable Eucalyptus Fiber-Based Paper Products

- A rising trend in the bleached eucalyptus kraft pulp market is the growing preference for sustainable fiber-based paper products as manufacturers increasingly prioritize eco-efficient materials that support high-quality tissue, packaging, and specialty paper production. This shift is driven by the superior uniformity, softness, and strength of eucalyptus fibers, making them an ideal choice for environmentally conscious producers

- For instance, companies such as Suzano are expanding their eucalyptus pulp portfolios to support large-scale demand for high-performance and renewable paper solutions. Their focus on sustainable plantations and optimized pulping methods strengthens market confidence in eucalyptus-based pulp

- The trend is further supported by the increasing emphasis on high-brightness and high-yield pulp grades that enhance product performance across various applications. Manufacturers are choosing eucalyptus pulp for its consistent fiber characteristics that improve processing efficiency and final paper quality

- Growing adoption of lightweight and recyclable packaging materials is reinforcing the demand for eucalyptus fiber-based pulp as brands seek to reduce environmental impact while maintaining durability. This trend is also supporting large converters transitioning toward sustainable raw materials

- Sustainability-driven regulations and environmental certifications are encouraging companies to invest in eucalyptus-based pulp solutions that align with reduced carbon footprints and responsible forest management. These regulatory alignments strengthen long-term growth for sustainable pulp materials

- This trend is expected to intensify as industries continue to prioritize renewable, high-performance, and environmentally responsible paper products, positioning eucalyptus kraft pulp as a leading solution for sustainable papermaking

Bleached Eucalyptus Kraft Pulp Market Dynamics

Driver

Rising Demand for High-Quality Pulp in Tissue and Packaging

- A major driver in the market is the increasing demand for high-quality pulp used in premium tissue and packaging applications as manufacturers seek fibers that deliver superior softness, strength, and printability. The structural advantages of eucalyptus pulp are supporting its rapid adoption across global paper industries

- For instance, leading producers such as International Paper continue to expand their use of eucalyptus pulp to meet rising demand for high-strength packaging and premium tissue products. Their focus on high-performance fiber inputs strengthens the adoption of eucalyptus kraft pulp across large-scale production lines

- Growing consumption of hygiene products, e-commerce packaging, and specialty papers is supporting the demand for pulp grades that offer consistent fiber characteristics. Manufacturers are increasingly selecting eucalyptus pulp for its high yield efficiency and uniform morphology

- In addition, advancements in pulping and bleaching technologies are enhancing production capacities and improving pulp quality, which boosts supply for growing industrial requirements. These improvements allow producers to better meet global demand patterns

- This driver continues to reinforce the market’s expansion as industries prioritize high-performance and reliable pulp materials, ultimately supporting sustained growth in the eucalyptus kraft pulp sector

Restraint/Challenge

Fluctuating Raw Material Supply and Environmental Regulations

- A major challenge in the market is the fluctuating availability of raw materials caused by environmental conditions, plantation management constraints, and supply chain disruptions. These variations can influence production stability and affect the availability of high-quality eucalyptus pulp

- For instance, instances of weather-driven shortages and regulatory restrictions have affected companies such as Canfor, creating uncertainties in fiber sourcing and compliance requirements. Such situations can impact operational planning and industry supply levels

- Strict environmental regulations governing forestry operations and bleaching processes present additional challenges for producers seeking consistent output. Companies must comply with evolving standards that influence production timelines and investment needs

- Producers are required to implement resource-efficient processes and sustainable land-management practices to navigate these regulatory and supply-related constraints. These adaptations often require significant operational adjustments and technological investments

- As regulations become more stringent and raw material availability faces periodic pressures, the market must continuously adapt to ensure stable production, making this challenge an ongoing factor that shapes long-term industry planning

Bleached Eucalyptus Kraft Pulp Market Scope

The market is segmented on the basis of pulping process, bleaching method, and application.

- By Pulping Process

On the basis of pulping process, the BEKP market is segmented into mechanical, chemical, and semi-chemical. The chemical pulping segment dominated the market with the largest share of 65.5% in 2025, supported by its ability to produce high-quality pulp with superior strength, brightness, and fiber uniformity essential for premium-grade paper. Manufacturers prefer chemical pulping due to its higher yield consistency and suitability for large-scale industrial processing. The segment benefits from technological advancements in cooking, washing, and recovery systems, improving efficiency and reducing chemical losses. Its wide acceptance across packaging, tissue, and printing applications further strengthens market dominance through established production infrastructure and supply networks.

The semi-chemical pulping segment is anticipated to witness the fastest growth from 2026 to 2033, driven by rising demand for cost-efficient and partially mechanically processed pulp used in lightweight packaging papers. Semi-chemical methods offer a balanced combination of fiber strength and production efficiency, making them attractive for manufacturers aiming to reduce operational costs. The growing shift toward sustainable paper packaging supports demand due to its lower chemical usage and reduced environmental burden. Growing adoption in emerging markets enhances its potential as industries invest in modernizing pulp mills with hybrid pulping technologies.

- By Bleaching Method

On the basis of bleaching method, the BEKP market is segmented into chlorine bleaching, totally chlorine free (TCF), elemental chlorine free (ECF), and oxygen/ozone bleached. The elemental chlorine free (ECF) segment dominated the market in 2025, supported by its ability to deliver high brightness levels and improved fiber quality while meeting global environmental regulations. ECF bleaching is widely preferred by large pulp manufacturers due to operational efficiency, established mill configurations, and reliable performance in high-volume production. Its balance between cost-effectiveness and lower chlorine emissions positions it as the most adopted bleaching technology. Strong demand from printing, packaging, and tissue applications reinforces its dominant market share.

The totally chlorine free (TCF) segment is expected to grow at the fastest rate from 2026 to 2033, driven by increasing environmental awareness and stricter sustainability standards across global pulp and paper industries. TCF bleaching eliminates chlorine compounds entirely, supporting improved biodegradability and reduced environmental toxicity. Growing adoption by eco-conscious producers contributes to expansion, especially in regions emphasizing green certifications. Improvements in ozone, peroxide, and oxygen-based bleaching technologies continue to enhance pulp brightness and fiber strength, making TCF increasingly competitive with established bleaching processes.

- By Application

On the basis of application, the BEKP market is segmented into packaging paper, tissue paper, graphic paper, newsprint paper, and specialty. The tissue paper segment accounted for the largest market share in 2025, supported by strong demand for soft, highly absorbent, and hygienic tissue products in residential and commercial settings. BEKP’s short-fiber characteristics improve softness and uniformity, making it the preferred raw material for premium toilet tissue, facial tissue, and napkins. Increasing hygiene awareness and expanding tissue conversion capacities across Asia-Pacific and Latin America contribute to segment leadership. Strong adoption by global tissue manufacturers further strengthens its dominant position.

The packaging paper segment is projected to witness the fastest growth from 2026 to 2033, driven by the accelerated shift toward sustainable, fiber-based packaging solutions across consumer goods, food service, and e-commerce. BEKP’s excellent printability, formation quality, and fiber uniformity support its rising use in lightweight packaging grades. The global movement toward reducing plastic waste increases preference for renewable pulp-based packaging alternatives. Advancements in high-performance packaging applications, including coated and specialty packaging boards, further enhance growth prospects for this segment.

Bleached Eucalyptus Kraft Pulp Market Regional Analysis

- Asia-Pacific dominated the bleached eucalyptus kraft pulp market with the largest revenue share of over 40% in 2025, driven by strong growth in paper production, rising demand for high-quality fiber, and the region’s expanding packaging and tissue industries

- The region’s cost-efficient raw material availability, large-scale plantation forestry, and increasing investments in advanced pulping technologies are accelerating market expansion

- Growing industrialization, rising consumption of tissue and hygiene products, and the presence of major pulp-exporting countries are further strengthening demand across paper and specialty application segments

China Bleached Eucalyptus Kraft Pulp Market Insight

China held the largest share in the Asia-Pacific bleached eucalyptus kraft pulp market in 2025 due to its robust paper and packaging manufacturing base and strong reliance on high-yield eucalyptus fiber for premium grades. The country’s expanding consumer goods sector, steady growth in tissue and hygiene product consumption, and continuous upgrades in pulping capacity contribute to substantial market demand. Rising investments in sustainable pulp production and increasing imports to meet domestic fiber shortages further support market growth.

India Bleached Eucalyptus Kraft Pulp Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by expanding paper consumption, rising demand for tissue and packaging products, and a growing shift toward high-quality eucalyptus-based pulp. The country’s ongoing industrial expansion, capacity upgrades in paper mills, and increasing focus on sustainable fiber sourcing are propelling market development. Government support for forestry enhancement and rising investment in pulp and paper infrastructure are further boosting demand.

Europe Bleached Eucalyptus Kraft Pulp Market Insight

The Europe market is growing steadily owing to increasing demand for sustainable, lightweight, and high-strength paper products across packaging, printing, and hygiene sectors. The region’s emphasis on environmental standards, high-quality pulp imports, and advancements in eco-friendly bleaching processes support market expansion. Rising adoption of specialty pulp grades for high-performance applications and strong investment in circular paper-based solutions are reinforcing market growth.

Germany Bleached Eucalyptus Kraft Pulp Market Insight

Germany’s market growth is driven by its advanced paper manufacturing sector, strong focus on premium graphic and specialty papers, and consistent demand for high-strength eucalyptus fiber. The country benefits from well-established R&D capabilities, continuous technological improvements in papermaking, and strong partnerships between pulp suppliers and industrial users. Increased demand for sustainable packaging and high-grade tissue products further supports market expansion.

U.K. Bleached Eucalyptus Kraft Pulp Market Insight

The U.K. market is supported by rising demand for sustainable packaging materials, increasing reliance on imported high-quality eucalyptus pulp, and growing adoption of recyclable and biodegradable paper solutions. Strong R&D activity within specialty paper manufacturing, rising investments in advanced tissue production, and expanding emphasis on eco-compliant materials are strengthening the market. The country’s ongoing transition toward greener paper products continues to drive demand for bleached eucalyptus pulp.

North America Bleached Eucalyptus Kraft Pulp Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for premium tissue, packaging, and specialty papers. Strong emphasis on sustainable fiber alternatives, advancements in high-purity pulp processing, and growing adoption of eucalyptus pulp to improve softness and strength performance are supporting market expansion. Increasing investments in sustainable paper solutions and growing collaboration between pulp suppliers and packaging manufacturers further bolster growth.

U.S. Bleached Eucalyptus Kraft Pulp Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by its large packaging and tissue production base, strong investment in sustainable paper materials, and increasing use of eucalyptus pulp to enhance fiber quality. The country’s advanced manufacturing capabilities, strong R&D networks, and adoption of eco-friendly bleaching technologies drive steady demand. Rising focus on recyclable packaging and consistent demand from healthcare and consumer goods sectors solidify the U.S.’s leading position.

Bleached Eucalyptus Kraft Pulp Market Share

The bleached eucalyptus kraft pulp industry is primarily led by well-established companies, including:

- Tokushu Tokai Paper Co., Ltd. (Japan)

- Nordic Paper (Sweden)

- Oji Holdings Corporation (Japan)

- Canfor (Canada)

- Segezha Group (Russia)

- Gascogne (France)

- Natron-Hayat d.o.o. (Bosnia and Herzegovina)

- Mondi (U.K.)

- Canadian Kraft Paper Ltd. (Canada)

- Smurfit Kappa (Ireland)

- SCG Packaging (Thailand)

- Forest Company (Country Not Specified)

- International Paper (U.S.)

- COPAMEX (Mexico)

- Primo Tedesco S.A. (Argentina)

- WestRock Company (U.S.)

- Fujian Qingshan Paper Co., Ltd. (China)

- BillerudKorsnäs (Sweden)

- Georgia-Pacific LLC (U.S.)

- Genus Paper & Boards Limited (India)

- CTI Paper USA (U.S.)

- Goodwin Robbins Packaging Company Inc. (U.S.)

Latest Developments in Global Bleached Eucalyptus Kraft Pulp Market

- In April 2025, Prabhat significantly expanded its international footprint by completing the acquisition of a major eucalyptus kraft pulp mill in Brazil, adding 350,000 TPY of high-quality pulp capacity. This move provides the company with direct access to one of the world’s most competitive pulp-producing regions, ensuring lower production costs, steady raw material availability, and improved integration across its global supply chain. The acquisition reinforces Prabhat’s long-term strategy of securing stable fiber sources amid rising global pulp demand and strengthens its role as a key supplier in the Asia-Pacific and South American markets

- In December 2024, Suzano announced a substantial investment in next-generation bleaching technology aimed at improving pulp brightness levels while minimizing chemical consumption and environmental emissions. This technological enhancement boosts Suzano’s ability to produce higher-grade, eco-friendly eucalyptus kraft pulp tailored to premium tissue, packaging, and specialty paper applications. The upgrade enhances sustainability credentials, strengthens compliance with global environmental standards, and positions Suzano to capture a growing share of demand for low-impact, high-performance pulp products

- In May 2024, the European Union approved the use of bleached eucalyptus kraft pulp in food-contact packaging applications, marking a major regulatory milestone for the global pulp sector. This approval allows manufacturers to incorporate eucalyptus pulp into food-safe papers and packaging materials, expanding market opportunities for producers targeting the EU’s high-value packaging industry. The decision increases commercial potential for pulp suppliers and also accelerates Europe’s transition toward renewable, fiber-based packaging alternatives as environmental regulations tighten across the region

- In March 2024, Smurfit Kappa entered a long-term strategic partnership with Veracel to secure consistent and sustainable eucalyptus kraft pulp supply for its expanding packaging portfolio. This collaboration strengthens Smurfit Kappa’s vertical integration, reduces supply chain risks, and supports its commitment to renewable raw materials as demand for sustainable packaging solutions grows worldwide. The partnership also helps lower the company’s carbon footprint by relying on eucalyptus—a fast-growing, renewable fiber—thus enhancing the overall environmental performance of its paper-based packaging

- In January 2024, Arauco launched a new eucalyptus kraft pulp mill in Chile, increasing its production capacity by an additional 500,000 TPY. This development significantly boosts global supply, enhances Arauco’s ability to meet rising demand for high-strength and high-brightness pulp grades, and reinforces the company’s position as a leading global pulp producer. By expanding operational capacity, Arauco strengthens supply stability for global end-users in packaging, tissue, and specialty paper segments, supporting long-term market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bleached Eucalyptus Kraft Pulp Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bleached Eucalyptus Kraft Pulp Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bleached Eucalyptus Kraft Pulp Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.