Global Blind Spot Solutions Market

Market Size in USD Billion

CAGR :

%

USD

12.41 Billion

USD

25.69 Billion

2024

2032

USD

12.41 Billion

USD

25.69 Billion

2024

2032

| 2025 –2032 | |

| USD 12.41 Billion | |

| USD 25.69 Billion | |

|

|

|

|

Blind Spot Solutions Market Size

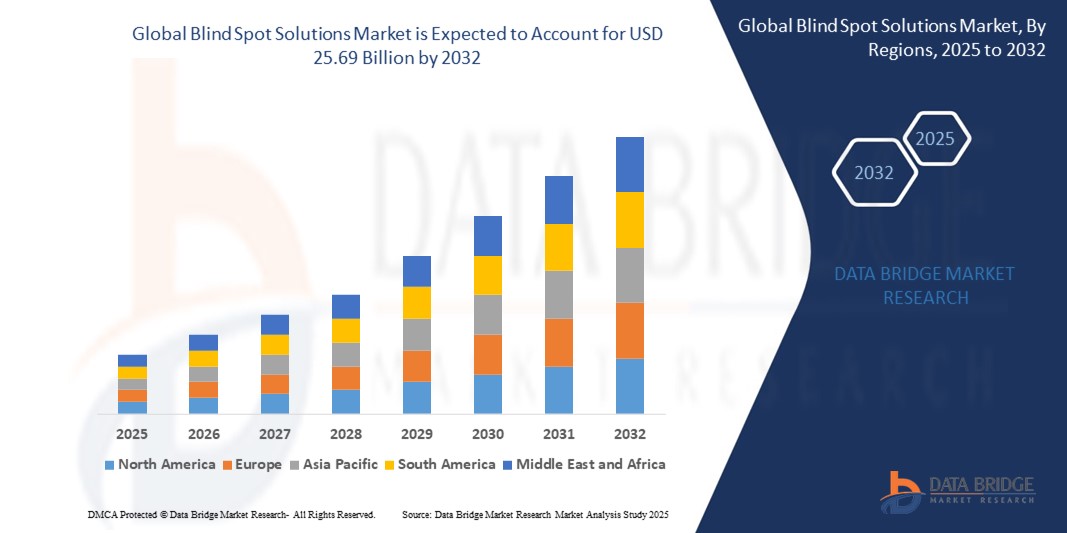

- The Global Blind Spot Solutions Market size was valued at USD 12.41 billion in 2024 and is expected to reach USD 25.69 billion by 2032, at a CAGR of 9.52% during the forecast period

- This robust growth is primarily driven by the increasing integration of smart and connected technologies across both residential and commercial applications. As digitalization expands, particularly through connected home devices and smart infrastructure, the demand for advanced safety and visibility systems like blind spot solutions continues to accelerate.

- Moreover, rising consumer expectations for secure, user-friendly, and fully integrated systems have positioned blind spot solutions as a preferred modern access and monitoring technology. These systems offer enhanced safety, convenience, and automation—features that are becoming essential in today's rapidly evolving smart environments.

Blind Spot Solutions Market Analysis

- Blind Spot Solutions—encompassing advanced electronic or digital access control systems for doors, gates, and vehicles—are emerging as essential components within modern residential and commercial security frameworks. Their ability to provide enhanced convenience, remote accessibility, and seamless integration with broader smart home and building automation ecosystems makes them a cornerstone of next-generation access control technologies.

- The rising adoption of smart home technologies, coupled with increasing consumer concerns over safety and privacy, is significantly boosting the global demand for these solutions. Consumers are increasingly seeking keyless, secure, and user-friendly entry systems, which has made Blind Spot Solutions a preferred choice in both new construction and retrofitting projects.

- Moreover, the functionality of these systems—often equipped with real-time monitoring, mobile app control, and integration with IoT platforms—positions them at the forefront of smart living trends. This shift reflects a broader movement toward digital transformation in residential and commercial infrastructure, further fueling market expansion.

- North America dominates the Global Blind Spot Solutions Market, accounting for the largest revenue share of 32.01% in 2024. This leadership is fueled by a growing demand for home automation and security, alongside a high degree of consumer awareness surrounding smart home technologies.

- Asia-Pacific is poised to record the fastest CAGR during 2025–2032, emerging as the most rapidly expanding market for Blind Spot Solutions. This growth is driven by rapid urbanization, rising disposable incomes, and increasing digitalization initiatives in countries such as China, Japan, and India.

- The blind spot detection (BSD) system segment captured the largest market revenue share in 2024, driven by rising concerns over vehicle safety and the implementation of stringent regulations requiring advanced driver assistance systems (ADAS).

Report Scope and Blind Spot Solutions Market Segmentation

|

Attributes |

Blind Spot Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blind Spot Solutions Market Trends

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- The global blind spot solutions market is witnessing robust growth driven by heightened awareness of security among consumers, both in residential and commercial spaces. With increasing incidents of theft, intrusion, and unauthorized access, there is a growing demand for intelligent systems that offer real-time monitoring, remote access, and tamper alerts.

- Blind spot solutions, such as BSD (Blind Spot Detection) and surround view systems, are being increasingly adopted in home automation setups to enhance situational awareness around vehicles and premises.

- For instance, in April 2024, Onity, Inc., a part of Honeywell International, introduced a new generation of IoT-based security systems that integrate sensors for advanced access control and surveillance. These technological advancements are setting new standards for smart home security.

- Additionally, the convenience of remote access, smartphone-based control, and integration with virtual assistants like Amazon Alexa and Google Assistant further promotes the adoption of these systems. This driver is especially influential in regions like North America and Europe, where smart home penetration is rapidly expanding.

Blind Spot Solutions Market Dynamics

Driver

“Rising Integration of ADAS (Advanced Driver Assistance Systems) in Vehicles”

- The incorporation of ADAS in automotive design is a key driver of blind spot solutions. As automotive manufacturers focus on enhancing driver safety, features such as blind spot monitoring, park assist, and backup camera systems are becoming standard in many new vehicle models.

- Regulatory mandates across the U.S., Europe, and Asia-Pacific encourage the use of technologies that reduce accidents caused by blind spots. Organizations like Euro NCAP and the NHTSA are pushing for wider integration of BSD systems, particularly in passenger cars and light commercial vehicles.

- Vehicle OEMs are responding by integrating radar-based and camera-based blind spot detection systems, leading to a spike in product demand. The global trend toward autonomous driving is further accelerating this adoption, as blind spot solutions play a vital role in vehicle awareness and collision avoidance systems.

Restraint/Challenge

“High Cost of Advanced Sensor-Based Blind Spot Systems”

- Despite their growing popularity, advanced blind spot solutions—especially those based on radar and multi-camera setups can be prohibitively expensive for many consumers and automotive OEMs in price-sensitive markets.

- The cost of these systems includes not only the initial purchase but also the expense of calibration, integration with vehicle systems, and ongoing maintenance. This high total cost of ownership makes them less accessible for entry-level vehicles or budget-conscious consumers.

- Furthermore, automakers in developing countries may prioritize cost efficiency over advanced safety features, limiting the widespread inclusion of such systems in low- and mid-tier vehicle segments.

- This cost barrier remains a significant challenge for blind spot solution providers seeking to expand their footprint in developing regions without compromising on product quality or performance.

Blind Spot Solutions Market Scope

The global blind spot solutions market is segmented on the basis of product type, technology type, distribution channel, electric vehicle (EV) type, and internal combustion engine (ICE) vehicle type.

- By Product Type

On the basis of product type, the Blind Spot Solutions Market is segmented into blind spot detection (BSD) system, backup camera system, park assist system, surround view system, and virtual pillars. The blind spot detection (BSD) system segment captured the largest market revenue share in 2024, driven by rising concerns over vehicle safety and the implementation of stringent regulations requiring advanced driver assistance systems (ADAS). Automakers are widely incorporating BSD systems across various vehicle models to enhance driver awareness and reduce lane-change collisions.

The surround view system segment is expected to witness the fastest CAGR from 2025 to 2032, due to growing demand for 360-degree visibility and enhanced parking assistance. Increasing integration in mid-range and luxury vehicles, along with improved image processing technologies, is fueling segment growth.

- By Technology Type

Based on technology type, the market is segmented into camera-based, radar-based, and ultrasonic-based systems. The radar-based segment held the largest share in 2024, owing to its accuracy and performance in detecting objects under diverse environmental conditions such as fog, rain, and low light. Radar sensors are increasingly utilized in BSD systems due to their reliability and decreasing cost.

The camera-based segment is projected to grow at the fastest rate, supported by advancements in image recognition and processing technologies. High-resolution cameras are enabling more intelligent detection of blind spots, pedestrians, and nearby vehicles, further enhancing driver safety.

- By Distribution Channel

On the basis of distribution channel, the market is bifurcated into OEM and aftermarket. The OEM segment dominated the market in 2024, attributed to the rising incorporation of advanced safety features directly during vehicle manufacturing. Regulatory mandates and consumer preference for pre-installed systems are driving demand in this channel.

The aftermarket segment is expected to witness a strong CAGR, driven by the growing inclination among vehicle owners to upgrade safety features post-purchase. The increasing availability of affordable aftermarket BSD kits is supporting segment growth, especially in emerging economies.

- By Electric Vehicle (EV) Type

The market is segmented into battery electric vehicle (BEV), fuel-cell electric vehicle (FCEV), hybrid electric vehicle (HEV), and plug-in hybrid electric vehicle (PHEV). The battery electric vehicle (BEV) segment accounted for the largest share in 2024, driven by the rapid adoption of fully electric vehicles and their alignment with autonomous driving technology, where blind spot solutions play a key role.

The plug-in hybrid electric vehicle (PHEV) segment is projected to grow at the highest CAGR from 2025 to 2032, fueled by government incentives, growing EV charging infrastructure, and the inclusion of safety systems like BSDs to meet evolving consumer and regulatory expectations.

- By Internal Combustion Engine (ICE) Vehicle Type

Based on ICE vehicle type, the market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger cars segment held the largest revenue share in 2024, due to the widespread use of blind spot technologies in mid-range to premium vehicle models. Rising safety awareness among consumers and vehicle safety rating agencies is accelerating BSD adoption in this segment.

The light commercial vehicles (LCVs) segment is expected to record the fastest CAGR, driven by the increasing use of LCVs in logistics and last-mile delivery operations. The need to minimize accidents and improve fleet safety is encouraging the deployment of advanced safety systems, including blind spot solutions, in commercial fleets.

Blind Spot Solutions Market Regional Analysis

- North America dominates the Global Blind Spot Solutions Market, accounting for the largest revenue share of 32.01% in 2024. This leadership is fueled by a growing demand for home automation and security, alongside a high degree of consumer awareness surrounding smart home technologies.

- Consumers in the region value the convenience, advanced security features, and seamless integration of Blind Spot Solutions with other smart systems like thermostats, lighting, and surveillance equipment.

- This widespread adoption is further driven by high disposable incomes, a technology-savvy population, and a growing inclination toward remote monitoring and keyless access, solidifying Blind Spot Solutions as a top choice for both residential and commercial applications.

U.S. Blind Spot Solutions Market Insight

The U.S. held a commanding 81% share of North America’s Blind Spot Solutions Market in 2024, driven by the accelerated uptake of connected devices and the popularity of home automation. American consumers increasingly prioritize smart, secure, and convenient entry systems, with rising demand for DIY installations, voice-command integration, and mobile app controls. Integration with platforms such as Alexa, Google Assistant, and Apple HomeKit is further catalyzing market expansion across the country.

Europe Blind Spot Solutions Market Insight

Europe is projected to grow at a substantial CAGR during the forecast period, driven by stringent security regulations, an urbanizing population, and a rising emphasis on connected living. The demand for smart and energy-efficient solutions is pushing consumers toward Blind Spot Solutions in residential, commercial, and multi-family housing sectors. The adoption trend is strong across both new constructions and retrofit projects, aligning with Europe’s push for sustainable and digitized infrastructure.

U.K. Blind Spot Solutions Market Insight

The U.K. market is expected to grow at a noteworthy CAGR, supported by the surge in home automation, increased burglary concerns, and consumer demand for convenience. The country’s developed digital landscape and retail infrastructure promote widespread accessibility of Blind Spot Solutions. A rising preference for connected, keyless security systems among both homeowners and small businesses continues to boost adoption.

Germany Blind Spot Solutions Market Insight

Germany is expected to witness considerable CAGR growth, underpinned by high awareness of digital security, and a strong national focus on technological innovation and sustainability. The integration of Blind Spot Solutions with home automation ecosystems is on the rise, especially in eco-conscious and privacy-sensitive consumer segments. Germany’s mature infrastructure and advanced engineering standards are also accelerating product penetration.

Asia-Pacific Blind Spot Solutions Market Insight

Asia-Pacific is poised to record the fastest CAGR during 2025–2032, emerging as the most rapidly expanding market for Blind Spot Solutions. This growth is driven by rapid urbanization, rising disposable incomes, and increasing digitalization initiatives in countries such as China, Japan, and India. The region’s transformation into a manufacturing hub has lowered product costs, increasing access to Blind Spot Solutions across middle-income and mass markets.

Japan Blind Spot Solutions Market Insight

Japan’s market is gaining strong momentum due to its tech-savvy population, urban density, and strong demand for convenient, secure smart access systems. High integration of Blind Spot Solutions with IoT-enabled home automation systems including lighting, cameras, and alarms—is driving growth. Additionally, Japan’s aging population is pushing demand for easy-to-use and secure systems, particularly in residential and assisted-living segments.

China Blind Spot Solutions Market Insight

China held the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, a growing middle class, and widespread adoption of smart home technologies. Government support for smart city initiatives, availability of cost-effective domestic brands, and booming real estate development across urban centers are major growth drivers. Blind Spot Solutions are gaining traction in residential, commercial, and rental sectors, with increasing consumer preference for integrated, connected ecosystems.

Blind Spot Solutions Market Share

The Blind Spot Solutions industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- DENSO CORPORATION (Japan)

- Valeo (France)

- Magna International Inc. (Canada)

- Faurecia (France)

- HYUNDAI MOBIS (South Korea)

- Aptiv (Ireland)

- TOYOTA MOTOR CORPORATION (Japan)

- Schaeffler AG (Germany)

- Ficosa Internacional SA (Spain)

- Autoliv Inc. (Sweden)

- ZF Friedrichshafen AG (Germany)

- GENTEX CORPORATION (United States)

- Motherson (India)

- Murakami Corporation (Japan)

- Renesas Electronics Corporation (Japan)

- SAMSUNG ELECTRO-MECHANICS (South Korea)

- SL Corporation (South Korea)

- STONKAM CO., LTD. (China)

Latest Developments in Global Blind Spot Solutions Market

- In May 2024, Continental AG introduced its next-generation Radar-Based Blind Spot Detection System tailored for electric vehicles and hybrid models. This system enhances driver safety by expanding the radar field and introducing AI-based object detection, ensuring more accurate monitoring in dense traffic and harsh weather conditions. This innovation positions Continental at the forefront of intelligent driver assistance systems (ADAS) while aligning with the increasing EV adoption worldwide.

- In April 2024, DENSO Corporation announced a strategic partnership with Toyota Motor Corporation to develop an integrated blind spot and surround-view monitoring module. The solution combines ultrasonic, radar, and camera-based technologies to improve vehicle safety and is expected to be deployed in Toyota’s next-generation hybrid and battery electric vehicles. This collaboration reflects growing OEM demand for consolidated safety technologies that support Level 2+ autonomous driving features.

- In March 2024, Ficosa Internacional SA unveiled its latest Digital Rear-View System, incorporating advanced blind spot visualization through high-definition cameras and AI-powered alerts. Designed primarily for commercial vehicles and heavy-duty trucks, the system aims to reduce accident rates caused by large blind zones. This innovation aligns with stricter European Union safety mandates under the General Safety Regulation (GSR) 2024.

- In February 2024, Gentex Corporation partnered with Aptiv PLC to integrate smart mirror-based blind spot detection systems into mid-range and premium passenger vehicles. These systems feature real-time alerts, lane-change support, and driver behavior analytics. The solution offers automakers a sleek, integrated approach to safety features, catering to the growing consumer demand for minimalistic and tech-enhanced interiors.

- In January 2024, Valeo launched a 360-Degree Surround View Monitoring System with enhanced blind spot coverage for use in autonomous shuttles and next-gen passenger vehicles. Built using proprietary AI algorithms and wide-angle cameras, the system ensures precise object recognition and risk assessment. This launch further strengthens Valeo’s position in the autonomous and semi-autonomous vehicle safety ecosystem.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.