Global Blister Packs Market

Market Size in USD Billion

CAGR :

%

USD

28.16 Billion

USD

43.87 Billion

2024

2032

USD

28.16 Billion

USD

43.87 Billion

2024

2032

| 2025 –2032 | |

| USD 28.16 Billion | |

| USD 43.87 Billion | |

|

|

|

|

Blister Packs Market Size

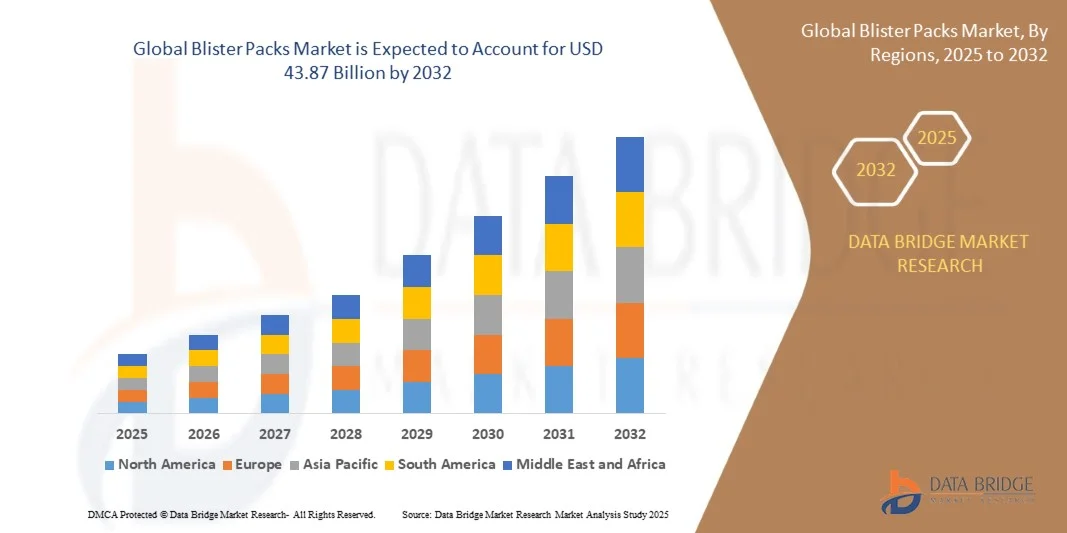

- The global blister packs market size was valued at USD 28.16 billion in 2024 and is expected to reach USD 43.87 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the rising demand for secure, tamper-evident, and cost-efficient packaging solutions in pharmaceuticals, consumer goods, and food industries, as blister packs ensure product integrity and extended shelf life

- Furthermore, increasing adoption of lightweight and sustainable materials in packaging, coupled with advancements in thermoforming and cold-forming technologies, is driving manufacturers toward innovative blister pack designs. These factors are accelerating the adoption of blister packs, significantly boosting the industry's expansion

Blister Packs Market Analysis

- Blister packs are pre-formed packaging solutions made of materials such as PVC, PVDC, COC, PP, aluminum, and paperboard, widely used for tablets, capsules, consumer goods, and food items. They provide product protection against moisture, light, and contamination, while offering tamper evidence and convenient visibility to consumers

- The escalating demand for blister packs is primarily fueled by the pharmaceutical sector’s need for dosage compliance and patient safety, rising consumer preference for unit-dose packaging, and the increasing shift toward sustainable, eco-friendly materials in line with global packaging regulations

- North America dominated the blister packs market with a share of 39.6% in 2024, due to the strong presence of pharmaceutical and consumer goods manufacturers and stringent regulatory standards for packaging

- Asia-Pacific is expected to be the fastest growing region in the blister packs market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing demand for packaged pharmaceuticals, foods, and consumer goods in countries such as China, Japan, and India

- Thermoforming segment dominated the market with a market share of 55.7% in 2024, due to its flexibility in producing a wide range of blister shapes and sizes while maintaining structural integrity. Thermoformed packs are compatible with multiple plastics, enabling efficient production and high-quality output suitable for pharmaceuticals, consumer goods, and electronics. The process allows easy customization for branding and tamper-evident features, making it a preferred choice among manufacturers focused on consumer safety and product visibility

Report Scope and Blister Packs Market Segmentation

|

Attributes |

Blister Packs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blister Packs Market Trends

“Growing Shift Toward Eco-Friendly Blister Packaging”

- A prominent trend in the blister packs market is the growing shift toward eco-friendly alternatives, as increasing sustainability concerns influence packaging choices across industries. Manufacturers are focusing on producing recyclable and biodegradable blister packs to reduce environmental footprints while meeting consumer demand for greener packaging solutions

- For instance, Amcor plc launched recyclable polyethylene-based blister packaging designed for pharmaceuticals, which significantly reduces plastic waste while ensuring barrier protection for sensitive products. Companies such as Bemis Healthcare are also exploring sustainable material innovations to align with regulatory and environmental expectations

- The adoption of paper-based blister packs is gaining momentum, especially in healthcare and consumer goods, where brand owners aim to minimize dependence on single-use plastics. These alternatives combine fiber-based substrates with thin barrier coatings, offering both sustainability and performance without compromising product protection

- Pharmaceutical firms are increasingly supporting eco-friendly blister packs to meet their sustainability objectives and strengthen brand image. In addition, retailers are promoting eco-conscious products by favoring blister packaging solutions that enhance recyclability and reduce carbon emissions along the supply chain

- Collaborations between packaging providers and material innovators are leading to developments in bio-based films and polymers that are suitable for blister packaging applications. These initiatives reinforce the long-term relevance of sustainable blister packs in regulated industries such as healthcare and personal care products

- The industry’s clear move toward sustainable solutions is reshaping the competitive landscape, as demand for eco-friendly blister packs is expected to accelerate in line with global sustainability targets and stricter packaging waste reduction policies. This ensures that eco-based materials will represent the future growth engine for blister packaging demand

Blister Packs Market Dynamics

Driver

“Rising Pharmaceutical Demand for Tamper-Evident Solutions”

- The pharmaceutical sector is a leading driver of blister pack adoption due to the requirement for tamper-evident and secure packaging solutions. With the expanding demand for medicines, blister packs remain one of the most trusted formats for providing safety, compliance, and product integrity

- For instance, WestRock Company supplies advanced blister packaging for global pharmaceutical firms that emphasizes tamper resistance and patient safety. Such developments confirm the alignment of suppliers and healthcare companies to meet mandatory safety standards and improve ease of use for patients

- Blister packs serve a critical role in dosage accuracy and unit-dose dispensing, reducing the risks of contamination and ensuring long shelf life. They are particularly important in emerging economies, where the expanding pharmaceutical industry relies heavily on cost-effective yet protective packaging

- The adoption of blister packs in over-the-counter (OTC) medicines has expanded significantly, driven by growing consumer demand for safe, portable, and easy-to-track medication formats. In addition, pediatric and geriatric populations benefit from blister packaging as it improves dosage compliance and ease of administration

- As regulatory bodies continue to prioritize patient safety and anti-counterfeiting measures, the importance of tamper-evident blister packs is expected to rise. This ensures that blister packs will remain indispensable in the pharmaceutical sector as the demand for compliance-friendly and secure packaging strengthens worldwide

Restraint/Challenge

“Strict Regulations on Plastic Packaging”

- Strict environmental regulations regarding plastic usage and waste management present a critical challenge for blister pack manufacturers. Many traditional blister packs rely on PVC and aluminum laminates, which are difficult to recycle and face growing scrutiny from regulatory authorities

- For instance, European Union directives and compliance programs under Extended Producer Responsibility (EPR) are compelling pharmaceutical and consumer goods companies to reduce single-use plastics in their packaging portfolios. Companies such as Klöckner Pentaplast are actively innovating recyclable solutions but must still balance regulatory constraints with product safety needs

- The complex multilayer structure of conventional blister packs, designed to provide barrier protection and durability, often limits recyclability. This creates challenges in aligning with global initiatives to minimize packaging waste, placing additional cost and innovation pressure on manufacturers

- Compliance with stricter carbon reduction targets, recyclable material mandates, and packaging taxes has increased the financial and operational burden on blister pack producers. These challenges are particularly strong in regions such as Europe and North America, where policy frameworks are becoming more stringent

- Overcoming these regulatory and sustainability challenges will require continued investment in innovative materials, collaborative recycling initiatives, and design modifications. By addressing these barriers, the blister packaging market can adapt while ensuring compliance with environmental priorities and sustaining competitiveness in global markets

Blister Packs Market Scope

The market is segmented on the basis of product type, raw material, process, material, and end-user industry.

• By Product Type

On the basis of product type, the blister packs market is segmented into carded and clamshell. The carded segment dominated the largest market revenue share in 2024, driven by its widespread use in pharmaceuticals and consumer goods for secure packaging and enhanced product visibility. Carded blister packs allow easy customization in terms of size, shape, and printing, enabling brands to strengthen product appeal and ensure tamper evidence. Their compatibility with automated packaging lines also supports efficient large-scale production, making them highly preferred by manufacturers. The protective features of carded packs, including barrier properties against moisture and contamination, further reinforce their adoption across diverse industries.

The clamshell segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by rising demand in consumer electronics and retail packaging. Clamshell packs provide clear visibility of the product, easy resealability, and superior structural integrity, which enhances product safety and consumer convenience. Their ability to combine functionality with aesthetic appeal drives adoption in sectors where product presentation is crucial. Increasing regulatory focus on child-resistant and tamper-evident packaging is also supporting clamshell growth.

• By Raw Material

On the basis of raw material, the market is segmented into Polyvinyl Chloride (PVC), Aclar, Polyvinylidene Chloride (PVDC), Cyclic Olefin Copolymer (COC), and Polypropylene (PP). The PVC segment dominated the market in 2024 due to its cost-effectiveness, versatility, and excellent barrier properties against moisture and gases. PVC blister packs are highly adaptable across pharmaceutical and consumer product applications, ensuring product safety while supporting high-speed packaging operations. Their ability to be thermoformed and heat-sealed efficiently makes them a preferred choice for large-scale manufacturing.

The COC segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing demand for high-performance packaging with superior clarity, chemical resistance, and low moisture permeability. COC-based blister packs are particularly favored for sensitive pharmaceutical drugs and high-value consumer electronics. The material’s lightweight yet durable nature also helps reduce overall packaging costs and carbon footprint. Rising awareness of environmentally sustainable alternatives and the material’s recyclability further accelerates adoption.

• By Process

On the basis of manufacturing process, the market is segmented into thermoforming and cold forming. The thermoforming segment dominated the largest market share of 55.7% in 2024 due to its flexibility in producing a wide range of blister shapes and sizes while maintaining structural integrity. Thermoformed packs are compatible with multiple plastics, enabling efficient production and high-quality output suitable for pharmaceuticals, consumer goods, and electronics. The process allows easy customization for branding and tamper-evident features, making it a preferred choice among manufacturers focused on consumer safety and product visibility.

The cold forming segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by increasing use in pharmaceutical applications requiring superior barrier properties. Cold-formed packs offer excellent protection against moisture, oxygen, and light, making them suitable for sensitive drugs such as tablets and capsules. Rising regulatory requirements for product integrity and shelf life, coupled with advancements in aluminum-based cold forming, drive this segment’s adoption.

• By Material

On the basis of material, the blister packs market is segmented into plastic films, paper and paperboard, aluminium, and other materials. The plastic films segment dominated the market in 2024 due to its versatility, lightweight nature, and compatibility with various thermoforming and cold forming processes. Plastic films offer excellent transparency, enabling clear product visibility, and provide adequate barrier properties against moisture and gases. Their cost-effectiveness and suitability for automated production lines further enhance their adoption across pharmaceuticals, consumer goods, and electronics.

The aluminium segment is expected to witness the fastest growth from 2025 to 2032, driven by high demand in pharmaceuticals and healthcare industries for moisture, oxygen, and light-sensitive products. Aluminium blister packs ensure extended product shelf life, tamper evidence, and compliance with stringent regulatory standards. Increasing focus on high-barrier, premium, and sustainable packaging solutions further propels the growth of aluminium-based blister packs.

• By End User Industry

On the basis of end user industry, the market is segmented into consumer goods, healthcare, foods, and other end user industries. The healthcare segment dominated in 2024, driven by the critical need for safe, tamper-evident, and hygienic packaging for pharmaceuticals. Blister packs ensure dosage accuracy, product protection, and compliance with global regulatory standards, making them a primary choice for drug manufacturers. The segment also benefits from growing global pharmaceutical production, rising chronic disease prevalence, and expanding access to healthcare.

The consumer goods segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by rising demand for convenient, visually appealing, and protective packaging for items such as personal care, electronics, and household products. Blister packs offer brand differentiation, enhanced product visibility, and user convenience, which are key drivers in retail-driven industries. Growing e-commerce penetration and preference for easy-to-open and resealable packaging further support the segment’s expansion.

Blister Packs Market Regional Analysis

- North America dominated the blister packs market with the largest revenue share of 39.6% in 2024, driven by the strong presence of pharmaceutical and consumer goods manufacturers and stringent regulatory standards for packaging

- Companies in the region prioritize high-quality, tamper-evident, and visually appealing packaging to ensure product safety and compliance

- This widespread adoption is further supported by advanced manufacturing infrastructure, technological advancements in packaging machinery, and high disposable incomes, establishing blister packs as a preferred solution across healthcare, food, and consumer goods sectors

U.S. Blister Packs Market Insight

The U.S. blister packs market captured the largest revenue share in North America in 2024, fueled by rising pharmaceutical production and increasing demand for safe and convenient consumer goods packaging. Manufacturers are emphasizing packaging innovation, including child-resistant and eco-friendly designs. The growth of e-commerce and retail distribution channels, combined with high regulatory standards for drug and food safety, continues to propel the market. Furthermore, the integration of automation and smart packaging technologies enhances efficiency and supports rapid adoption.

Europe Blister Packs Market Insight

The Europe blister packs market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent packaging regulations and the increasing demand for product safety and extended shelf life. Pharmaceutical and consumer goods companies are adopting advanced packaging solutions to maintain product integrity. The growth is supported by rising healthcare awareness, urbanization, and the presence of well-established packaging machinery manufacturers, with blister packs being widely used across multiple industries, including foods, healthcare, and consumer goods.

U.K. Blister Packs Market Insight

The U.K. blister packs market is expected to grow at a noteworthy CAGR, driven by rising healthcare and pharmaceutical production and the demand for convenient, tamper-evident packaging. Increasing safety concerns among consumers and regulatory compliance requirements are promoting adoption. The country’s mature pharmaceutical and consumer goods sectors, along with strong distribution networks and e-commerce growth, are supporting the expansion of blister pack usage.

Germany Blister Packs Market Insight

The Germany blister packs market is expected to expand at a considerable CAGR, fueled by the country’s focus on product safety, quality, and sustainability. Pharmaceutical and food packaging industries are investing in innovative, eco-friendly materials and advanced packaging processes. The strong industrial infrastructure, high consumer awareness, and technological advancements in packaging machinery are further boosting the adoption of blister packs across residential and commercial product applications.

Asia-Pacific Blister Packs Market Insight

The Asia-Pacific blister packs market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing demand for packaged pharmaceuticals, foods, and consumer goods in countries such as China, Japan, and India. The region benefits from a growing manufacturing base, cost-effective production, and government initiatives promoting healthcare and food safety. Increasing adoption of automated packaging solutions and rising awareness of product safety and convenience are further fueling market growth.

Japan Blister Packs Market Insight

The Japan blister packs market is gaining momentum due to the country’s emphasis on high-quality, safe, and visually appealing packaging. The pharmaceutical and consumer goods sectors are major contributors, with a growing trend toward automated and sustainable packaging solutions. Japan’s aging population also drives demand for convenient and easy-to-use packaging formats that enhance safety and accessibility.

China Blister Packs Market Insight

The China blister packs market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding pharmaceutical and consumer goods sectors, rapid urbanization, and increasing disposable incomes. Rising demand for high-quality, tamper-evident, and visually attractive packaging is driving adoption. The availability of cost-effective manufacturing, robust domestic packaging industry, and government initiatives supporting healthcare and food safety further propel the market’s growth.

Blister Packs Market Shar

The blister packs industry is primarily led by well-established companies, including:

- Klöckner Pentaplast (Germany)

- Amcor plc (Switzerland)

- Constantia Flexibles (Austria)

- WestRock Company. (U.S.)

- Honeywell International Inc. (U.S.)

- Berry Global Inc. (U.S.)

- Bemis Manufacturing Company (U.S.)

- Sonoco Products Company (U.S.)

- Dow. (U.S.)

- Pharma Packaging Solutions (U.S.)

- Tekni-Plex. (U.S.)

- Blisterpak, Inc. (U.S.)

- VisiPak (U.S.)

- Algus Packaging, Inc. (U.S.)

- Powerpak Industries LLC (U.S.)

- Clearwater Packaging, Inc. (U.S.)

- VP Plastics and Engineering. (U.S.)

- Navnitblisters (India)

- ECOBLISS (Netherlands)

- Nirmala Industries (India)

Latest Developments in Blister Packs Market

- In May 2025, the N 760 blister packaging machine from Romaco Noack made its trade fair debut at PCI Days in Warsaw, Poland. This launch highlights Romaco’s commitment to providing advanced, integrated solutions for oral solid dosage forms. The N 760, along with innovative granulating, drying, coating, and tableting technologies, is expected to improve operational efficiency and precision in pharmaceutical packaging. Its adoption is likely to drive wider implementation of automated blister packaging solutions across Europe and other global markets, supporting faster production cycles, reduced material waste, and enhanced product quality

- In March 2025, Atlantic Packaging introduced Paperform, a sustainable alternative to traditional single-use plastic blister packs, showcased at PACK EXPO Southeast. This eco-friendly innovation addresses growing consumer and regulatory demand for recyclable and environmentally responsible packaging. By providing a paper-based solution, Atlantic Packaging is expected to influence market trends toward sustainable materials, particularly in pharmaceuticals and consumer goods, encouraging competitors to explore green alternatives while reducing the environmental footprint of blister packs

- In October 2024, Bayer, in partnership with Liveo Research, launched a first-of-its-kind polyethylene terephthalate (PET) blister packaging for its Aleve brand. This environmentally sustainable solution reduces the carbon footprint of packaging by 38% and eliminates the use of polyvinyl chloride (PVC). By introducing this green innovation, Bayer strengthens its leadership in sustainable healthcare packaging, likely accelerating the adoption of PET blister packs and prompting other pharmaceutical manufacturers to integrate eco-conscious solutions into their product lines

- In October 2024, AstraZeneca announced the availability of TRUQAP blister packs through the Big 3 Specialty Distributors starting October 28. This launch improves the company’s distribution efficiency, ensuring timely and broader access to its pharmaceutical products. Offering TRUQAP in blister form enhances patient safety, adherence, and convenience, which is expected to boost demand for specialized, high-quality blister packaging solutions within the pharmaceutical market

- In October 2024, Sepha launched the EZ Blister II, a new mobile, table-top blister packing machine designed for flexible short-run production. The machine addresses the increasing demand for adaptable, cost-efficient packaging solutions in pharmaceutical and clinical trial laboratories. Its compact and versatile design allows manufacturers to handle complex blister pack designs with minimal investment, supporting smaller-scale operations and encouraging wider adoption of flexible packaging technologies in niche pharmaceutical applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Blister Packs Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Blister Packs Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Blister Packs Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.