Global Blockchain Insuretech Market

Market Size in USD Billion

CAGR :

%

USD

2.20 Billion

USD

4.87 Billion

2025

2033

USD

2.20 Billion

USD

4.87 Billion

2025

2033

| 2026 –2033 | |

| USD 2.20 Billion | |

| USD 4.87 Billion | |

|

|

|

|

What is the Global Blockchain Insuretech Market Size and Growth Rate?

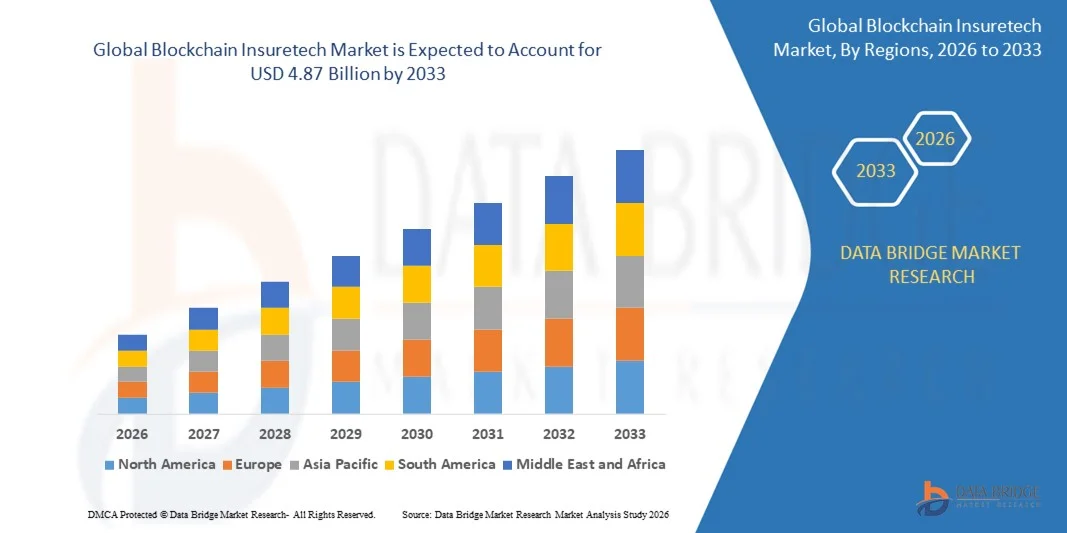

- The global blockchain insuretech market size was valued at USD 2.20 billion in 2025 and is expected to reach USD 4.87 billion by 2033, at a CAGR of10.40% during the forecast period

- Rising need to have transparent and trustworthy systems is a crucial factor accelerating the market growth, also increasing focus on reducing the total cost of ownership, rising adoption of the blockchain as service, and the internet of things (IOTs), rising reduction in the cost of ownership and rising number of industrial sector all over the globe are the major factors among others boosting the blockchain insuretech market

What are the Major Takeaways of Blockchain Insuretech Market?

- Increasing rapid penetration of IoT Devices, increasing growth of Baas and rising technological advancements and modernization in the devices used will further create new opportunities for blockchain insuretech market

- However, uncertain regulatory status and lack of common standards are the major factors among others restraining the market growth, while lack of awareness about the blockchain technology and lack of understanding of blockchain concept, skill sets, and technical knowledge will further challenge the blockchain insuretech market

- North America dominated the blockchain insuretech market with a 35.58% revenue share in 2025, supported by strong digital insurance adoption, rapid deployment of blockchain-based fraud prevention systems, and growing use of decentralized platforms across insurers in the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.32% from 2026 to 2033, driven by rapid digital insurance penetration, expanding fintech ecosystems, and strong adoption of blockchain for policy management, risk assessment, microinsurance, and smart contract automation across China, India, Japan, South Korea, and Southeast Asia

- The Health Insurance segment dominated the market with a 41.6% share in 2025, driven by rapid digitalization of claims processing, rising fraud cases, and increasing adoption of blockchain for member authentication, medical record verification, and smart claims settlement

Report Scope and Blockchain Insuretech Market Segmentation

|

Attributes |

Blockchain Insuretech Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Blockchain Insuretech Market?

Accelerating Shift Toward Decentralized, Automated, and Smart-Contract-Driven Insurance Platforms

- The blockchain insuretech market is experiencing rapid adoption of decentralized, tamper-proof, and automated insurance platforms, enabling transparent policy management, seamless claim authentication, and fraud-resistant data exchange across insurers, brokers, and customers

- Companies are introducing smart-contract-powered ecosystems, self-executing claim verification tools, and blockchain-led identity solutions that improve operational efficiency, reduce manual errors, and enhance policyholder trust across digital insurance networks

- Growing demand for real-time risk assessment, automated underwriting, and secure multi-party data sharing is driving the integration of blockchain into health, auto, life, and commercial insurance value chains

- For instance, leading players such as IBM, AWS, Oracle, and ConsenSys are expanding blockchain frameworks that support immutable claims, audit trails, fraud detection, and interoperable insurance platforms

- Increasing need for fast settlements, improved transparency, and cost-efficient operations is accelerating the shift toward blockchain-based insuretech solutions

- As insurers modernize digital infrastructure, Blockchain Insuretech platforms will remain critical for reducing fraud, enabling trustless transactions, and supporting next-generation automated insurance ecosystems

What are the Key Drivers of Blockchain Insuretech Market?

- Rising demand for fraud mitigation, transparent policy processing, and secure data sharing is fueling adoption of blockchain across global insurance operations

- For instance, in 2025, major technology providers such as IBM, Microsoft, and SAP enhanced their blockchain-based insurance modules to support automated claim workflows, identity validation, and decentralized storage systems

- Growing penetration of IoT health devices, telematics-based auto insurance, and usage-based coverage models is boosting the need for decentralized data validation across the U.S., Europe, and Asia-Pacific

- Advancements in smart contracts, digital identity frameworks, multi-signature authentication, and distributed data engines are significantly improving speed, scalability, and accuracy in underwriting and claims management

- Rising integration of AI-driven risk scoring, tokenized insurance models, and peer-to-peer insurance platforms is accelerating demand for blockchain-enabled infrastructure

- Supported by growing investments in insurance modernization, cloud migration, and RegTech compliance, the Blockchain Insuretech market is poised for strong long-term expansion

Which Factor is Challenging the Growth of the Blockchain Insuretech Market?

- High implementation and integration costs associated with enterprise blockchain frameworks, smart-contract automation, and decentralized storage networks limit adoption among smaller insurers and regional brokers

- For instance, during 2024–2025, rising blockchain infrastructure costs, talent shortages, and extended deployment timelines increased overall modernization expenses for global insurance providers

- Complexity in managing interoperability across legacy systems, regulatory compliance, and multi-party smart-contract workflows increases the requirement for specialized technical expertise

- Limited awareness in emerging markets regarding blockchain benefits, governance models, and insurance-specific use cases slows down widespread adoption

- Competition from traditional digital insurance platforms, cloud-based policy systems, and centralized claim automation tools creates pricing pressure and affects technology differentiation

- To mitigate these challenges, companies are focusing on low-cost deployments, no-code smart-contract tools, plug-and-play blockchain modules, and cloud-managed node infrastructure to expand global adoption of Blockchain Insuretech platforms

How is the Blockchain Insuretech Market Segmented?

The market is segmented on the basis of sector, application, type, organization site, and service providers.

- By Sector:

The blockchain insuretech market is segmented into Health Insurance, Life Insurance, and Title Insurance. The Health Insurance segment dominated the market with a 41.6% share in 2025, driven by rapid digitalization of claims processing, rising fraud cases, and increasing adoption of blockchain for member authentication, medical record verification, and smart claims settlement. Health insurers are increasingly deploying blockchain platforms to reduce operational costs, improve auditability, and ensure tamper-proof data exchange across hospitals, third-party administrators, and diagnostic centers.

The Title Insurance segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising blockchain adoption in property ownership verification, land registry modernization, and secure title transfer management. As governments and real-estate ecosystems shift toward decentralized records to prevent duplication and fraud, blockchain-enabled title insurance solutions are witnessing accelerating demand.

- By Application:

On the basis of application, the blockchain insuretech market is segmented into GRC Management, Death & Claims Management, Identity Management & Fraud Detection, Payments, Smart Contracts, and Others. The Identity Management & Fraud Detection segment dominated the market with a 32.4% share in 2025, driven by increasing fraud incidents, rising digital insurance enrollments, and growing need for secure customer identity verification. Blockchain ensures immutable audit trails, multi-party authentication, and real-time policy verification, making it the preferred technology for insurers battling rising cyber threats.

The Smart Contracts segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by automation in policy issuance, claims settlement, underwriting, and premium calculation. As insurers move toward low-touch and automated workflows, blockchain smart contract platforms provide enhanced transparency, reduced processing time, and improved regulatory compliance.

- By Type:

By type, the blockchain insuretech market is divided into Automotive & Transportation, Aerospace & Defence, IT & Telecommunications, Education & Government, Electronics & Semiconductor, Industrial, and Healthcare. The IT & Telecommunications segment dominated the market with a 28.7% share in 2025, driven by the sector’s rapid adoption of decentralized identity management, fraud mitigation tools, and blockchain-based service assurance platforms. High-volume customer onboarding, rising digital service transactions, and increased cybersecurity requirements are pushing telecom companies toward blockchain-enabled insurance solutions.

The Automotive & Transportation segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising adoption of blockchain for usage-based insurance, EV telematics, connected vehicle risk assessment, and automated claims validation. Increasing integration of AI, IoT, and blockchain is enabling insurers to assess driver behavior, validate accident reports, and streamline policy pricing, driving segment expansion.

- By Organization Size:

The blockchain insuretech market is segmented into SMEs and Large Enterprises. The Large Enterprises segment dominated the market with a 62.1% share in 2025, driven by higher investments in digital transformation, strong focus on fraud prevention, and increasing adoption of blockchain for integrated policy administration, identity validation, and real-time claims reconciliation. Large insurers leverage blockchain to manage vast customer databases, reduce data duplication, streamline cross-border operations, and meet strict compliance regulations.

The SMEs segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising adoption of affordable, cloud-based blockchain platforms that help smaller insurers improve transparency, reduce underwriting time, and prevent operational inefficiencies. Growing availability of subscription-based blockchain services is further encouraging SMEs to adopt digital insurance solutions.

- By Service Provider:

The blockchain insuretech market is segmented into Application & Solution Providers, Middleware Service Providers, and Infrastructure & Protocols Providers. The Application & Solution Providers segment dominated the market with a 49.8% share in 2025, driven by increasing deployment of blockchain platforms for claims automation, fraud analytics, risk scoring, identity authentication, and policy lifecycle management. Insurers rely heavily on these providers for customized applications, integration capabilities, and blockchain-enabled workflow optimization.

The Infrastructure & Protocols Providers segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by growing demand for scalable blockchain networks, consensus layer enhancements, cross-chain interoperability, and secure data-sharing frameworks. Rising adoption of decentralized architectures by large insurers and government agencies is accelerating the need for robust blockchain infrastructure providers.

Which Region Holds the Largest Share of the Blockchain Insuretech Market?

- North America dominated the blockchain insuretech market with a 35.58% revenue share in 2025, supported by strong digital insurance adoption, rapid deployment of blockchain-based fraud prevention systems, and growing use of decentralized platforms across insurers in the U.S. and Canada. High implementation of blockchain for claims automation, secure identity management, underwriting workflows, and risk assessment continues to strengthen market demand. The region benefits from advanced InsurTech ecosystems, strong regulatory support, and high enterprise digital maturity, enabling insurers to adopt scalable, secure, and interoperable blockchain solutions

- Leading companies in North America are investing in blockchain-driven smart contract platforms, decentralized claims networks, and multi-party data-sharing infrastructure, boosting technological leadership. Wide usage of AI, IoT, and cloud-based insurance systems further accelerates blockchain adoption for transparency and operational efficiency

- Strong concentration of InsurTech startups, extensive enterprise blockchain deployments, and consistent investments in digital transformation reinforce North America’s leadership in the global blockchain insuretech market

U.S. Blockchain Insuretech Market Insight

The U.S. is the largest contributor within North America, supported by large-scale adoption of blockchain for claims automation, policy verification, fraud detection, and customer authentication. Insurers across automotive, health, property, and life insurance segments are integrating decentralized platforms to enhance transparency, reduce processing time, and improve regulatory compliance. Rapid development of AI-powered underwriting tools, growing usage of smart contracts, and increasing investment in cyber insurance infrastructure further strengthen blockchain adoption. A strong ecosystem of blockchain developers, technology providers, and digital-first insurers makes the U.S. a dominant market driver.

Canada Blockchain Insuretech Market Insight

Canada contributes significantly to regional growth due to rising adoption of blockchain across health insurance, property insurance, and digital identity verification. Growing modernization of insurance infrastructure, government-backed digital innovation programs, and increased interest in decentralized data-sharing platforms support strong market expansion. Insurers and technology labs across the country are using blockchain to reduce fraud, improve auditability, streamline claims workflows, and enhance interoperability across insurance networks. The country’s supportive regulatory environment and growing InsurTech ecosystem further drive adoption.

Asia-Pacific Blockchain Insuretech Market

Asia-Pacific is projected to register the fastest CAGR of 9.32% from 2026 to 2033, driven by rapid digital insurance penetration, expanding fintech ecosystems, and strong adoption of blockchain for policy management, risk assessment, microinsurance, and smart contract automation across China, India, Japan, South Korea, and Southeast Asia. High-volume insurance customer bases, rising digital payments, and increasing fraud incidents push insurers to adopt secure, decentralized platforms. Growth in regulatory sandboxes, InsurTech investments, and digital health ecosystems further accelerates demand for Blockchain Insuretech solutions across the region.

China Blockchain Insuretech Market Insight

China is the largest contributor to Asia-Pacific, supported by strong government backing for blockchain, rapid digital insurance growth, and large-scale deployment of smart contracts, decentralized claims platforms, and identity verification systems. Insurers use blockchain to manage high-volume customer data, reduce fraud, and enable real-time policy processing. Strong technology manufacturing capabilities and competitive solution pricing further expand domestic adoption and export potential.

Japan Blockchain Insuretech Market Insight

Japan demonstrates steady adoption of blockchain across life insurance, health insurance, and corporate risk management. Strong focus on system reliability, digital modernization, and transparent claims management drives demand for blockchain-enabled insurance platforms. Growth in robotics, telehealth, and digital payments strengthens the need for secure, tamper-proof insurance data systems, reinforcing long-term market expansion.

India Blockchain Insuretech Market Insight

India is emerging as a significant growth hub, driven by expanding digital insurance penetration, rising use of Aadhaar-integrated identity systems, and government support for blockchain adoption. Increasing demand for microinsurance, health insurance, and digital claim settlement fuels adoption of blockchain in fraud detection, customer verification, and policy automation. Rapid growth in InsurTech startups and digital infrastructure further accelerates market expansion.

South Korea Blockchain Insuretech Market Insight

South Korea contributes strongly due to rapid adoption of blockchain for health insurance claims, digital identity verification, and smart contract-based policy issuance. Strong demand for cybersecurity, advanced mobile insurance platforms, and AI-enabled underwriting accelerates adoption of blockchain-backed transparency and automation solutions. The country’s robust digital ecosystems, blockchain innovation programs, and high technology adoption rates support sustained market growth.

Which are the Top Companies in Blockchain Insuretech Market?

The blockchain insuretech industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Microsoft (U.S.)

- SAP SE (Germany)

- Oracle (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Auxesis Services & Technologies (P) Ltd. (India)

- Netherlands)

- Digital Asset Holdings LLC (U.S.)

- Consensus Systems (ConsenSys) (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Factom (U.S.)

- Stratis Group Ltd (U.K.)

- Intel (U.S.)

- Symbiont (U.S.)

- Earthport (U.K.)

- Guardtime (Estonia)

- AlphaPoint (U.S.)

- NTT Data (Japan)

- Ripple (U.S.)

- Applied Blockchain Ltd. (U.K.)

What are the Recent Developments in Global Blockchain Insuretech Market?

- In June 2023, JP Morgan partnered with six major Indian banks—Axis Bank, HDFC Bank, Yes Bank, ICICI Bank, IndusInd Bank, and JPMorgan’s GIFT City—to launch a blockchain-based platform for U.S. dollar settlements, aiming to eliminate inefficiencies associated with traditional finance, ultimately strengthening cross-border transactional transparency and speed

- In December 2022, Italy adopted Algorand’s blockchain technology to modernize its traditional banking infrastructure starting in 2023, becoming the first European Union member to integrate blockchain into national insurance and financial systems, marking a major step toward digital transformation

- In September 2022, the insurance division of Ant Group introduced the Xingyun platform, a blockchain-enabled digital operations system designed to support insurance providers in China by improving efficiency and customer experience, reflecting the nation’s shift toward smarter InsurTech ecosystems

- In November 2020, B3i Services AG collaborated with TCS to build blockchain-based solutions for the insurance sector, combining TCS’s innovation strengths with B3i’s advanced DLT platform to accelerate insurance digitization, setting the foundation for enhanced customer-centric operations

- In July 2019, Aon partnered with Etherisc and Oxfam to launch a blockchain-powered agricultural insurance platform in Sri Lanka, delivering micro-insurance to smallholder paddy farmers facing weather-related crop losses, supporting resilience and financial protection for vulnerable farming communities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.