Global Blood And Organ Bank Market

Market Size in USD Billion

CAGR :

%

USD

66.17 Billion

USD

106.27 Billion

2025

2033

USD

66.17 Billion

USD

106.27 Billion

2025

2033

| 2026 –2033 | |

| USD 66.17 Billion | |

| USD 106.27 Billion | |

|

|

|

|

Blood and Organ Bank Market Size

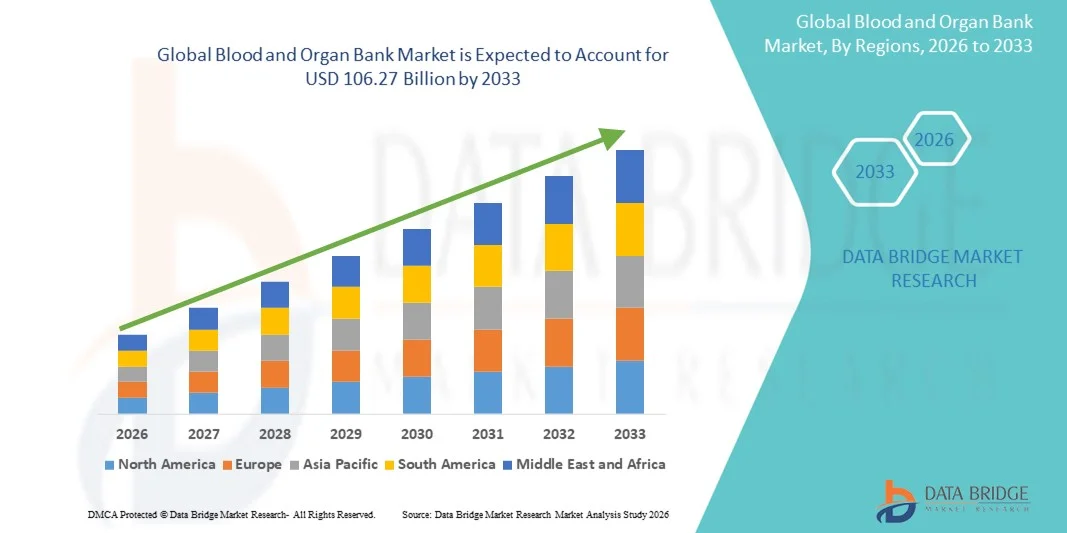

- The global blood and organ bank market size was valued at USD 66.17 billion in 2025 and is expected to reach USD 106.27 billion by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by increasing prevalence of chronic diseases, rising organ transplantation procedures, and growing awareness regarding the importance of blood donation and organ preservation

- Furthermore, advancements in storage technologies, automated management systems, and stringent regulatory frameworks for safety and quality are driving efficiency and reliability in blood and organ banking. These converging factors are accelerating the adoption of blood and organ bank services, thereby significantly boosting the industry's growth

Blood and Organ Bank Market Analysis

- Blood and organ banks, providing the collection, testing, processing, storage, and distribution of blood and organs, are increasingly vital components of modern healthcare infrastructure due to their critical role in supporting transfusions, organ transplantation, and emergency medical procedures

- The escalating demand for blood and organ bank services is primarily fueled by the rising prevalence of chronic diseases, increasing organ transplant procedures, and growing awareness among healthcare providers and the public regarding the importance of blood donation and organ preservation

- North America dominated the blood and organ bank market with the largest revenue share of 38.9% in 2025, characterized by advanced healthcare infrastructure, high adoption of automated storage and management systems, and a strong presence of key industry players, with the U.S. experiencing substantial growth in organ and blood banking services driven by technological innovations in preservation techniques and regulatory compliance

- Asia-Pacific is expected to be the fastest growing region in the blood and organ bank market during the forecast period due to expanding healthcare facilities, rising investments in healthcare infrastructure, and increasing public awareness regarding blood donation and organ transplantation

- Blood plasma collection segment dominated the blood and organ bank market with a market share of 42.2% in 2025, driven by its critical applications in therapeutic treatments, higher demand in hospitals, and well-established collection and storage protocols

Report Scope and Blood and Organ Bank Market Segmentation

|

Attributes |

Blood and Organ Bank Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Blood and Organ Bank Market Trends

Advancements in AI-Enabled Matching and Traceability

- A significant and accelerating trend in the global blood and organ bank market is the increasing adoption of artificial intelligence (AI) and blockchain-enabled platforms for donor-recipient matching and supply chain traceability. This integration enhances the efficiency, safety, and transparency of blood and organ distribution

- For instance, AI-powered platforms such as IBM Watson Health are being utilized to optimize organ allocation and predict demand for specific blood types, reducing wastage and improving patient outcomes

- AI integration in blood and organ banks enables features such as predictive inventory management, early detection of compatibility issues, and automated monitoring of storage conditions. For instance, some Transmedic organ transport systems utilize AI to track temperature and viability during transit, ensuring safe delivery

- The seamless integration of AI and digital monitoring systems with hospital management platforms facilitates centralized control over blood and organ inventories, enabling healthcare providers to efficiently manage resources, plan transfusions, and coordinate transplant surgeries

- This trend toward more intelligent, data-driven, and transparent blood and organ banking systems is fundamentally transforming operational standards and patient care. Consequently, companies such as CryoLife are developing AI-enabled solutions with features such as predictive demand forecasting and real-time monitoring of organ viability

- The demand for blood and organ banks offering AI-driven optimization, secure traceability, and enhanced inventory management is growing rapidly across both public and private healthcare sectors, as hospitals and clinics increasingly prioritize efficiency, safety, and regulatory compliance

- Increasing partnerships between blood and organ banks and biotechnology companies are facilitating research on advanced preservation solutions, including cryopreservation and bioengineering of organs, which improves availability for rare or high-demand types

- Remote monitoring technologies and IoT-enabled storage systems are emerging as a key trend, allowing continuous tracking of blood and organ conditions during transport and storage, minimizing spoilage and improving transplant success rates

Blood and Organ Bank Market Dynamics

Driver

Increasing Demand Due to Rising Chronic Diseases and Transplant Procedures

- The rising prevalence of chronic diseases, coupled with an increase in organ transplantation procedures, is a significant driver for the heightened demand for blood and organ bank services

- For instance, in March 2025, the U.S. Department of Health and Human Services reported a notable increase in kidney and liver transplants, driving demand for advanced organ banking and storage facilities

- As awareness grows regarding the importance of blood donation and organ preservation, blood and organ banks provide critical services such as safe collection, storage, and distribution, ensuring timely availability for medical procedures

- Furthermore, technological advancements in automated storage, preservation, and testing systems are making blood and organ banks more reliable and efficient, supporting higher volumes of donations and transplants

- The growing investment in public health campaigns, educational initiatives, and hospital partnerships is propelling the adoption of blood and organ bank services in both developed and emerging markets

- Expansion of rare blood type and high-demand organ registries is driving specialized banking services, enabling quicker matching and improved patient outcomes

- Rising government and private sector funding for healthcare infrastructure, including advanced storage and cold-chain logistics, is supporting the scalability of blood and organ banking operations

Restraint/Challenge

Storage Limitations and Regulatory Compliance Hurdles

- Challenges surrounding stringent regulatory requirements and limited storage capacities pose significant hurdles to broader market expansion. Blood and organs require precise temperature control, limited shelf life, and compliance with health standards, creating operational complexities

- For instance, reports of blood wastage due to suboptimal storage conditions have raised concerns among hospitals and healthcare providers regarding resource management

- Ensuring compliance with national and international regulations, such as FDA and EU tissue directives, requires investment in monitoring systems, staff training, and documentation, which can be costly for smaller or emerging banks

- In addition, high operational costs associated with advanced storage equipment, transportation, and testing can act as a barrier to market penetration in developing regions or budget-constrained hospitals

- Overcoming these challenges through expanded storage infrastructure, AI-enabled monitoring, and streamlined regulatory compliance is vital for the sustained growth and efficiency of the blood and organ bank market

- Limited donor availability and dependency on voluntary donations continue to restrict the supply of certain blood types and organs, particularly in regions with low awareness or cultural barriers

- Risks of contamination or spoilage during collection, storage, or transport remain a critical challenge, necessitating continuous investment in sterilization, monitoring, and cold-chain technologies

Blood and Organ Bank Market Scope

The market is segmented on the basis of product, application, and end-users.

- By Product

On the basis of product, the blood and organ bank market is segmented into red blood cell collection, processing and distribution services, blood plasma collection, organ bank services, tissue bank services, health screening services, all other human blood services, and reproductive and stem cell bank services. The Blood Plasma Collection segment dominated the market with the largest revenue share of 42.2% in 2025, driven by its wide therapeutic applications, critical role in transfusions, and high demand across hospitals and emergency care facilities. Blood plasma is essential for treating conditions such as hemophilia, immune deficiencies, and trauma cases, making its collection, processing, and distribution a priority for healthcare providers. In addition, advanced storage and preservation technologies ensure plasma availability for urgent medical needs. Growing awareness campaigns and robust donor networks further strengthen the dominance of this segment. The segment also benefits from ongoing research in plasma-derived medicines and fractionation processes.

The Reproductive and Stem Cell Bank Services segment is anticipated to witness the fastest growth rate of 22.3% from 2026 to 2033, fueled by increasing demand for fertility preservation, regenerative therapies, and advanced stem cell applications. Growing adoption of cord blood and stem cell banking services among expecting parents and biotech companies is driving this growth. Technological advancements in cryopreservation and automated storage solutions make reproductive and stem cell banking more reliable and accessible. Rising awareness regarding future therapeutic applications of stem cells and personalized medicine is further contributing to its adoption. This segment is particularly gaining traction in developed regions, where disposable income and healthcare awareness are higher.

- By Application

On the basis of application, the market is segmented into collecting blood, storing blood, distributing blood, storing organs, distributing organs, researching storage technology, and reproducing tissue. The Storing Organs segment dominated the market in 2025 due to the critical need for organ preservation for transplantation, stringent regulatory requirements, and adoption of advanced cold-chain logistics. Hospitals and transplant centers rely heavily on organ banks to maintain organ viability during storage, ensuring successful transplant outcomes. Enhanced storage technologies such as hypothermic and normothermic preservation are driving efficiency in this segment. The growing number of organ transplant procedures globally further reinforces the dominance of this application.

The Researching Storage Technology segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increased investment in innovative preservation techniques and AI-enabled monitoring systems. Research initiatives focus on extending organ and blood shelf life, reducing wastage, and optimizing inventory management. Growing collaboration between research institutions, biotech companies, and healthcare providers accelerates technological advancements. This segment is also benefiting from public-private funding for organ and blood preservation research. Innovations such as cryopreservation improvements and real-time monitoring sensors are expanding the scope and adoption of this application.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, diagnostics centers, blood banks, and others. The Hospitals segment dominated the market with the largest share in 2025, due to their critical role in transfusions, surgeries, emergency care, and organ transplantation. Hospitals maintain strong partnerships with blood and organ banks to ensure timely access to essential biological materials. They also benefit from in-house storage facilities, trained personnel, and established logistics networks for efficient distribution. The increasing number of surgical procedures and organ transplants continues to drive demand from this segment.

The Blood Banks segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising public awareness, voluntary donations, and expansion of collection centers. Blood banks are increasingly adopting automated storage and distribution systems to enhance operational efficiency. Growing government and NGO initiatives to encourage blood donation further boost the segment. Technological integration for real-time inventory tracking and AI-driven demand forecasting is enabling blood banks to scale operations and meet growing healthcare demands efficiently.

Blood and Organ Bank Market Regional Analysis

- North America dominated the blood and organ bank market with the largest revenue share of 38.9% in 2025, characterized by advanced healthcare infrastructure, high adoption of automated storage and management systems, and a strong presence of key industry players, with the U.S. experiencing substantial growth in organ and blood banking services driven by technological innovations in preservation techniques and regulatory compliance

- Healthcare providers and hospitals in the region prioritize access to safe, high-quality blood and organs, relying on established blood and organ banks to meet the growing demand for transfusions and transplants

- This widespread adoption is further supported by strong government support, regulatory frameworks ensuring safety and quality, and well-developed logistics for blood and organ distribution, establishing North America as a leading region for blood and organ banking services

U.S. Blood and Organ Bank Market Insight

The U.S. blood and organ bank market captured the largest revenue share of 82% in 2025 within North America, fueled by advanced healthcare infrastructure, high organ transplantation rates, and growing awareness of blood donation and organ preservation. Healthcare providers are increasingly prioritizing timely access to safe and high-quality blood and organs, driving demand for well-established banking services. The adoption of automated storage, AI-enabled inventory management, and advanced cold-chain logistics further strengthens the market. Moreover, government support, stringent regulations, and public health initiatives promoting blood donation are significantly contributing to market expansion.

Europe Blood and Organ Bank Market Insight

The Europe blood and organ bank market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent safety and regulatory standards, rising organ transplant procedures, and growing healthcare investments. Increasing urbanization and rising awareness regarding blood donation are fostering the adoption of blood and organ banking services. European healthcare providers are focusing on improving inventory management and ensuring timely distribution, with blood and organ banks being increasingly integrated into both public and private healthcare networks.

U.K. Blood and Organ Bank Market Insight

The U.K. blood and organ bank market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising organ transplant procedures, public awareness campaigns, and the emphasis on safe, reliable blood supply chains. In addition, the prevalence of chronic diseases and the growing demand for specialized blood and stem cell services are encouraging both hospitals and research centers to rely on professional banking services. The U.K.’s well-established healthcare infrastructure, combined with active donor recruitment programs, is expected to continue to stimulate market growth.

Germany Blood and Organ Bank Market Insight

The Germany blood and organ bank market is expected to expand at a considerable CAGR during the forecast period, fueled by technological advancements in storage and preservation, a strong emphasis on research, and the increasing number of organ transplants. Germany’s advanced healthcare infrastructure, stringent regulatory compliance, and focus on innovation in biobanking promote the adoption of blood and organ banking services. The integration of digital monitoring and AI-based inventory systems is becoming increasingly prevalent, with healthcare providers prioritizing safety, traceability, and efficiency.

Asia-Pacific Blood and Organ Bank Market Insight

The Asia-Pacific blood and organ bank market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2026 to 2033, driven by expanding healthcare infrastructure, rising chronic disease prevalence, and government initiatives promoting voluntary blood donation. Countries such as China, Japan, and India are witnessing growing investments in cold-chain logistics, automated storage systems, and organ preservation facilities. The region’s increasing healthcare awareness, rapid urbanization, and adoption of advanced technologies are driving the expansion of blood and organ banking services.

Japan Blood and Organ Bank Market Insight

The Japan blood and organ bank market is gaining momentum due to the country’s aging population, high awareness regarding organ donation, and advanced healthcare infrastructure. The demand for efficient storage, safe distribution, and research in preservation technologies is driving market growth. Integration of AI and digital monitoring systems into blood and organ banks is facilitating traceability, reducing wastage, and improving patient outcomes. In addition, Japan’s focus on medical research and regenerative therapies is contributing to the increasing reliance on professional blood and organ banking services.

India Blood and Organ Bank Market Insight

The India blood and organ bank market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising public awareness, government-led donation drives, and expanding healthcare facilities. India’s growing middle class, increasing number of hospitals, and rapid urbanization are driving demand for reliable blood and organ storage and distribution services. The establishment of modern cold-chain logistics, stem cell banks, and automated inventory management systems, along with domestic investments in biobanking infrastructure, are key factors propelling market growth in India.

Blood and Organ Bank Market Share

The Blood and Organ Bank industry is primarily led by well-established companies, including:

- The American National Red Cross (U.S.)

- CSL Plasma (U.S.)

- NHS Blood and Transplant (U.K.)

- Cordlife Group Limited (Singapore)

- Cryo Cell International, Inc. (U.S.)

- LifeCell International Pvt. Ltd. (India)

- Cells4Life Group LLP (U.K.)

- New York Blood Center (U.S.)

- Bloodworks Northwest (U.S.)

- Anthony Nolan (U.K.)

- DKMS gGmbH (Germany)

- LifeSouth Community Blood Centers (U.S.)

- Sanquin (Netherlands)

- OneBlood (U.S.)

- ViaCord (U.S.)

- FamiCord Group (Poland)

- Blood Centers of America (U.S.)

- American Foundation for Donation and Transplantation (U.S.)

- National Marrow Donor Program (U.S.)

What are the Recent Developments in Global Blood and Organ Bank Market?

- In October 2025, The Blood Center in New Orleans deployed the Reveos™ Automated Blood Processing System, becoming the second U.S. facility to adopt this FDA‑cleared automation technology, expanding its platelet supply and modernizing its blood processing operations to better support hospitals and patients in the region

- In September 2025, the Organ Donation & Transplantation Alliance announced a national call for participation in the Artificial Intelligence Transplant & Donation Resource Collaborative, a multi‑stakeholder initiative aimed at coordinating AI‑driven innovations to enhance organ donation and transplantation processes, improve patient outcomes, and foster data sharing and collaboration across the ecosystem

- In January 2025, Carter BloodCare became the first U.S. blood center to complete the transition to automated whole blood processing by implementing Terumo BCT’s Reveos™ system and Lumia™ Software Platform, significantly improving its capacity to produce platelets, plasma, and red blood cells while increasing efficiency and consistency in blood component production

- In August 2023, Terumo Blood and Cell Technologies received U.S. FDA clearance for its Reveos® Automated Whole Blood Processing System, an innovative device that automates whole blood separation into platelets, plasma, and red blood cells in a single cycle to bolster blood center operational efficiency and platelet supplies. This clearance marked a significant technological advancement in blood processing automation, helping centers better meet clinical demands while reducing labor and costs

- In November 2021, the American Red Cross Blood Donor App was named a Best Charitable Giving App by BestApp.com, recognizing its effectiveness in helping donors find nearby blood drives, schedule appointments, and track donation history a development that highlighted the growing role of digital platforms in improving donor engagement and blood collection convenience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.