Global Blood Collection Devices Market

Market Size in USD Billion

CAGR :

%

USD

6.90 Billion

USD

11.13 Billion

2024

2032

USD

6.90 Billion

USD

11.13 Billion

2024

2032

| 2025 –2032 | |

| USD 6.90 Billion | |

| USD 11.13 Billion | |

|

|

|

|

Blood Collection Devices Market Size

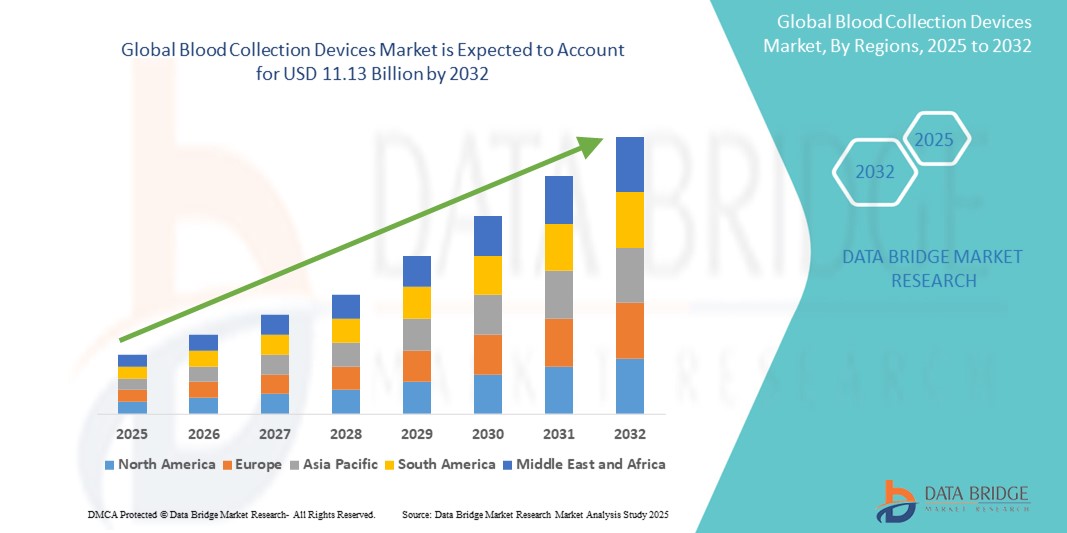

- The global blood collection devices market size was valued at USD 6.90 billion in 2024 and is expected to reach USD 11.13 billion by 2032, at a CAGR of 6.16% during the forecast period

- The Blood Collection Devices market growth is largely fueled by the increasing prevalence of chronic and infectious diseases, coupled with advancements in medical technology, leading to an increased demand for diagnostic testing and therapeutic procedures

- Furthermore, rising healthcare expenditure and growing awareness among consumers about the importance of early diagnosis and regular health monitoring are establishing blood collection devices as an essential component of modern healthcare systems. These converging factors are accelerating the uptake of blood collection devices solutions, thereby significantly boosting the industry's growth

Blood Collection Devices Market Analysis

- Blood collection devices, encompassing a range of instruments and consumables for drawing and processing blood samples, are increasingly vital components of modern healthcare systems in both diagnostic and therapeutic settings due to their enhanced safety features, efficiency, and critical role in disease management and patient care

- The escalating demand for blood collection devices is primarily fuelled by the rising global prevalence of chronic and infectious diseases, growing awareness about early disease detection, and continuous technological advancements leading to more efficient and patient-friendly collection methods

- North America dominates the blood collection devices market with the largest revenue share of 40.7% in 2024, characterized by advanced healthcare infrastructure, substantial R&D investments, and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest growing region in the blood collection devices market during the forecast period, with a projected CAGR of 8.6% from 2025 to 2032, due to increasing urbanization, rising disposable incomes, a higher prevalence of infections, and growing demand for advanced blood collection technologies across countries such as China, India, and Japan

- The blood collection tubes segment dominates the blood collection devices market with an estimated share of 33.8% in 2024, driven by the increasing prevalence of chronic diseases and the need for routine diagnostics. Innovations in tube technology and adherence to regulatory guidelines also support its dominant position

Report Scope and Blood Collection Devices Market Segmentation

|

Attributes |

Blood Collection Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blood Collection Devices Market Trends

“Deepening Integration with Advanced Automation Systems and Smart Data Analytics”

- A significant and accelerating trend in the global blood collection devices market is the deepening integration with advanced automation systems and smart data analytics. This fusion of technologies is significantly enhancing efficiency, precision, and patient experience during blood collection procedures

- For instance, automated phlebotomy devices are being developed that utilize advanced imaging to identify optimal venipuncture sites, allowing for more accurate and consistent blood draws. Similarly, smart blood collection tubes are integrating features that enable automatic sample labeling and tracking, streamlining the pre-analytical phase of laboratory testing

- The integration of advanced analytics in blood collection devices enables features such as learning optimal venipuncture parameters based on patient demographics and vein characteristics, predicting potential complications, and providing intelligent alerts for deviations in sample quality. For instance, some advanced systems utilize algorithms to improve vein visualization accuracy over time and can send intelligent alerts if a collection error is detected. Furthermore, automation capabilities offer healthcare professionals the ease of hands-free operation for repetitive tasks, allowing them to focus more on patient interaction and critical decision-making

- The seamless integration of blood collection devices with laboratory information systems (LIS) and electronic health records (EHR) facilitates centralized control over various aspects of the diagnostic workflow. Through a single interface, users can manage patient orders, track samples, and access results, creating a unified and automated diagnostic experience

- This trend towards more intelligent, intuitive, and interconnected blood collection systems is fundamentally reshaping user expectations for efficiency and patient comfort in diagnostics. Consequently, companies are developing automated blood collection devices with features such as robotic venipuncture for consistent draws and automated sample processing to reduce manual handling

Blood Collection Devices Market Dynamics

Driver

“Growing Need Due to Rising Disease Prevalence and Diagnostic Demands”

- The increasing global prevalence of various chronic and infectious diseases, coupled with a growing emphasis on early diagnosis and routine health check-ups, is a significant driver for the heightened demand for blood collection devices

- For instance, the rising incidence of diabetes, cardiovascular diseases, and various infectious diseases (such as, influenza, COVID-19, HIV/AIDS) necessitates frequent blood testing for diagnosis, monitoring, and treatment management. Such persistent health challenges are expected to drive the blood collection devices industry growth in the forecast period

- As healthcare providers become more aware of the importance of precise and timely diagnostic results, and seek enhanced patient safety during collection, modern blood collection devices offer advanced features such as safety-engineered needles, pre-barcoded tubes, and sterile collection systems, providing a compelling upgrade over traditional methods

- Furthermore, the growing popularity of point-of-care (PoC) diagnostics and the desire for streamlined laboratory workflows are making advanced blood collection devices an integral component of these systems, offering seamless integration with automated analyzers and laboratory information systems

- The convenience of less invasive collection methods (such as capillary blood collection), reduced risk of needlestick injuries, and the ability to ensure sample integrity are key factors propelling the adoption of blood collection devices in hospitals, clinics, and even home care settings. The trend towards decentralized testing and the increasing availability of user-friendly blood collection options further contributes to market growth

Restraint/Challenge

“Concerns Regarding Sample Integrity and High Initial Costs”

- Concerns surrounding the potential for sample integrity issues (for instance, hemolysis, clotting, contamination) during blood collection pose a significant challenge to broader market penetration of certain advanced devices. As blood collection relies on precise techniques and sterile conditions, improper collection or handling can lead to inaccurate test results, raising anxieties among healthcare professionals about diagnostic reliability

- For instance, reports of compromised samples due to incorrect collection tube usage or improper storage conditions can make some healthcare facilities hesitant to adopt new or more complex blood collection methodologies without extensive training

- Addressing these concerns through robust quality control, standardized training protocols, and clear device instructions is crucial for building user trust. Companies often emphasize their devices' design for ease-of-use and features that minimize sample degradation. In addition, the relatively high initial cost of some advanced automated blood collection systems and specialized devices compared to traditional manual methods can be a barrier to adoption for budget-sensitive healthcare facilities, particularly in developing regions or smaller clinics. While basic blood collection consumables remain affordable, premium features such as integrated vein visualization, robotic systems, or advanced safety mechanisms often come with a higher price tag

- While prices for some components are gradually decreasing, the perceived premium for sophisticated automation and safety technology can still hinder widespread adoption, especially for those who do not see an immediate return on investment for the advanced features offered

- Overcoming these challenges through enhanced training programs, clear demonstration of cost-effectiveness and patient safety benefits, and the development of more affordable, high-quality blood collection options will be vital for sustained market growth

Blood Collection Devices Market Scope

The market for blood collection devices is segmented into four notable segments based on product, method, application, and end-user.

- By Product

On the basis of product, the global blood collection devices market is segmented into blood collection tubes, needles and syringes, blood bags, blood collection systems/monitors and lancets. The blood collection tubes segment dominates the largest market revenue share of 33.8% in 2024, driven by the increasing prevalence of chronic diseases requiring routine diagnostics and continuous advancements in tube technology. These tubes are essential for various tests, and innovations in additives and designs enhance sample stability and laboratory efficiency.

The lancets segment is anticipated to witness the fastest growth rate of 7.9% from 2025 to 2032, fueled by the rising incidence of chronic diseases such as diabetes, which drives demand for frequent capillary blood sampling for monitoring. This growth is also supported by the increasing popularity of at-home testing and minimally invasive collection methods.

- By Method

On the basis of method, the global blood collection devices market is segmented into manual blood collection and automated blood collection. The manual blood collection segment held the largest market revenue share of 67.1% in 2024, driven by its cost-effectiveness, widespread applicability across various healthcare settings, and patient comfort. This method remains widely used in hospitals, clinics, and diagnostic laboratories, supported by ongoing advancements in needle technology and simplified collection procedures.

The automated blood collection segment is expected to witness the fastest CAGR of 7.7% from 2025 to 2032, driven by the increasing demand for safer, more efficient, and standardized collection procedures. Automation reduces human error, enhances sample quality, and improves workflow efficiency, making it increasingly attractive for high-volume settings.

- By Application

On the basis of application, the Global blood collection devices market is segmented into diagnostics and therapeutics. The diagnostics segment leads the market with 65.6% market share in 2024, driven by the continuously rising demand for blood tests to diagnose a wide array of chronic diseases such as cancer, diabetes, and cardiovascular conditions. Blood samples are crucial for confirming diagnoses, monitoring disease progression, and guiding treatment decisions across various medical specialties.

The therapeutics segment is expected to record the fastest CAGR of approximately 7.2% from 2025 to 2032, fueled by the rising demand for blood monitoring in therapeutic procedures, such as transfusions, apheresis, and innovations in personalized medicine requiring specific blood component collection.

- By End-User

On the basis of end-user, the global blood collection devices market is segmented into hospitals, blood bank centers, academics, and home care. The hospital segment accounted for the largest market revenue share of 34.2% in 2024, driven by the high volume of diagnostic tests performed daily, increased blood transfusion needs related to surgeries and chronic conditions, and the comprehensive range of medical services offered. Hospitals serve as primary points of care for a large patient influx requiring blood collection.

The blood bank center segment is expected to register the fastest CAGR of 7.5% during the forecast period, fueled by advancements in blood sampling technologies and the rising number of specialized diagnostic tests conducted in these dedicated facilities.

Blood Collection Devices Market Regional Analysis

- North America dominates the blood collection devices market with the largest revenue share of 40.7% in 2024, driven by its highly advanced healthcare infrastructure and significant investments in research and development

- Healthcare providers in the region highly value the enhanced patient safety features, improved accuracy, and streamlined workflows offered by modern blood collection devices, which seamlessly integrate with electronic health records and laboratory information systems

- This widespread adoption is further supported by high healthcare expenditure, a strong focus on preventive diagnostics and early disease detection, and the prominent presence of key industry players actively engaged in developing innovative blood collection technologies. This positions blood collection devices as an essential component for efficient and safe patient care across North America

U.S. Blood Collection Devices Market Insight

The U.S. blood collection devices market captured the largest revenue share of 72.6% in 2024 within North America, fueled by the swift adoption of advanced diagnostic technologies and the expanding healthcare infrastructure. Healthcare providers are increasingly prioritizing patient safety and efficiency through integrated, high-quality blood collection systems. The growing preference for advanced pre-analytical solutions, combined with robust demand for automated systems and integrated data management, further propels the blood collection devices industry. Moreover, the increasing integration of healthcare IT systems and a strong focus on clinical outcomes are significantly contributing to the market's expansion.

Europe Blood Collection Devices Market Insight

The Europe blood collection devices market is projected to expand at a substantial CAGR from 2025 to 2032, primarily driven by the rising prevalence of chronic and infectious diseases and the escalating need for enhanced diagnostic capabilities in hospitals and laboratories. The increase in aging populations, coupled with the demand for safer and more efficient blood collection methods, is fostering the adoption of advanced devices. European healthcare systems are also drawn to the precision and reliability these devices offer. The region is experiencing significant growth across hospital, diagnostic center, and blood bank applications, with advanced blood collection devices being incorporated into both new facility designs and existing laboratory upgrades.

U.K. Blood Collection Devices Market Insight

The U.K. blood collection devices market is anticipated to grow at a noteworthy CAGR from 2025 to 2032, driven by the escalating demand for advanced diagnostics and a desire for heightened patient comfort and safety during blood draws. In addition, concerns regarding healthcare efficiency and reduced risk of needlestick injuries are encouraging both healthcare providers and patients to choose modern blood collection solutions. The U.K.'s embrace of advanced medical technologies, alongside its robust healthcare infrastructure, is expected to continue to stimulate market growth.

Germany Blood Collection Devices Market Insight

The Germany blood collection devices market is expected to expand at a considerable CAGR from 2025 to 2032, fueled by increasing awareness of diagnostic accuracy and the demand for technologically advanced, high-quality solutions. Germany’s well-developed healthcare infrastructure, combined with its emphasis on innovation and stringent quality standards, promotes the adoption of advanced blood collection devices, particularly in hospitals and clinical laboratories. The integration of blood collection solutions with laboratory automation systems is also becoming increasingly prevalent, with a strong preference for secure, patient-focused solutions aligning with local healthcare expectations.

Asia-Pacific Blood Collection Devices Market Insight

The Asia-Pacific blood collection devices market is poised to grow at the fastest CAGR of 8.6% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and significant technological advancements in countries such as China, Japan, and India. The region's growing healthcare expenditure, supported by government initiatives promoting access to diagnostics, is driving the adoption of advanced blood collection devices. Furthermore, as APAC emerges as a manufacturing hub for medical components and systems, the affordability and accessibility of blood collection devices are expanding to a wider healthcare consumer base.

China Blood Collection Devices Market Insight

The China blood collection devices market accounted for a significant revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and high rates of healthcare technological adoption. China stands as one of the largest markets for medical devices, and blood collection devices are becoming increasingly essential in hospitals, diagnostic centers, and blood banks. The push towards modernizing healthcare infrastructure and the availability of increasingly sophisticated blood collection options, alongside strong domestic manufacturers, are key factors propelling the market in China.

India Blood Collection Devices Market Insight

The India blood collection devices market is expected to witness the highest CAGR of 8.15% from 2025 to 2032, fueled by the rapidly improving healthcare infrastructure, rising awareness about early disease diagnosis, and a large patient pool. The increasing prevalence of infectious and chronic diseases necessitates a growing volume of blood tests. Government initiatives aimed at improving healthcare accessibility and affordability, coupled with increasing private investments in diagnostic laboratories and hospitals, are significant drivers for the adoption of blood collection devices across the country.

Blood Collection Devices Market Share

The blood collection devices industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Medtronic (Ireland)

- BD (U.S.)

- Terumo Corporation (Japan)

- NIPRO (Japan)

- QIAGEN (Germany)

- MEDICAL S.r.l. (Italy)

- TERUMO BCT, Inc. (U.S.)

- Fresenius Kabi AG (Germany)

- Grifols, S.A. (Spain)

- Jiangsu Micsafe Medical Technology Co., Ltd. (China)

- SARSTEDT AG & Co. KG (Germany)

- Retractable Technologies, Inc. (U.S.)

- FL MEDICAL s.r.l. Unipersonale (Italy)

- AB Medical Academy (Netherlands)

Latest Developments in Global Blood Collection Devices Market

- In April 2024, Streck introduced Protein Plus BCT, a new direct draw whole blood collection tube designed to stabilize plasma protein concentrations during storage at room temperature. This launch expands the company's product portfolio and strengthens its competitive position in the market

- In April 2024, Becton, Dickinson and Company (BD) introduced the BD Vacutainer UltraTouch Push Button Blood Collection Set in India. This innovative product features BD RightGauge technology, allowing the use of a thinner needle for blood collection, and BD PentaPoint technology to significantly reduce insertion pain for patients

- In January 2025, Fresenius Kabi announced that the FDA granted 510(k) clearance for its Adaptive Nomogram, an alternative algorithm for the Aurora Xi Plasmapheresis System, aimed at optimizing plasma collection efficiency

- In March 2025, BD (Becton, Dickinson and Company) and Babson Diagnostics announced results of new studies demonstrating that common blood tests using several drops of blood collected via the BD MiniDraw Capillary Blood Collection System are as accurate as higher-volume draws from veins, potentially improving patient access to testing

- In October 2024, Terumo Blood and Cell Technologies kicked off the U.S. launch of the Reveos Automated Blood Processing System with Blood Centers of America. Used globally for over a decade, Reveos targets efficiency and bolstering the platelet supply

- In November 2023, BD introduced the PIVO Pro Needle-free Blood Collection Device, which allows blood samples to be drawn directly from a patient's peripheral IV line without using a traditional needle. This device builds upon BD's existing PIVO technology

- In January 2023, Capitainer collaborated with AstraZeneca to use a novel device from Capitainer to develop protocols for biomarkers relevant to AstraZeneca's clinical drug programs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.