Global Blood Glucose Test Strip Packaging Market

Market Size in USD Billion

CAGR :

%

USD

2.61 Billion

USD

4.35 Billion

2025

2033

USD

2.61 Billion

USD

4.35 Billion

2025

2033

| 2026 –2033 | |

| USD 2.61 Billion | |

| USD 4.35 Billion | |

|

|

|

|

Blood Glucose Test Strip Packaging Market Size

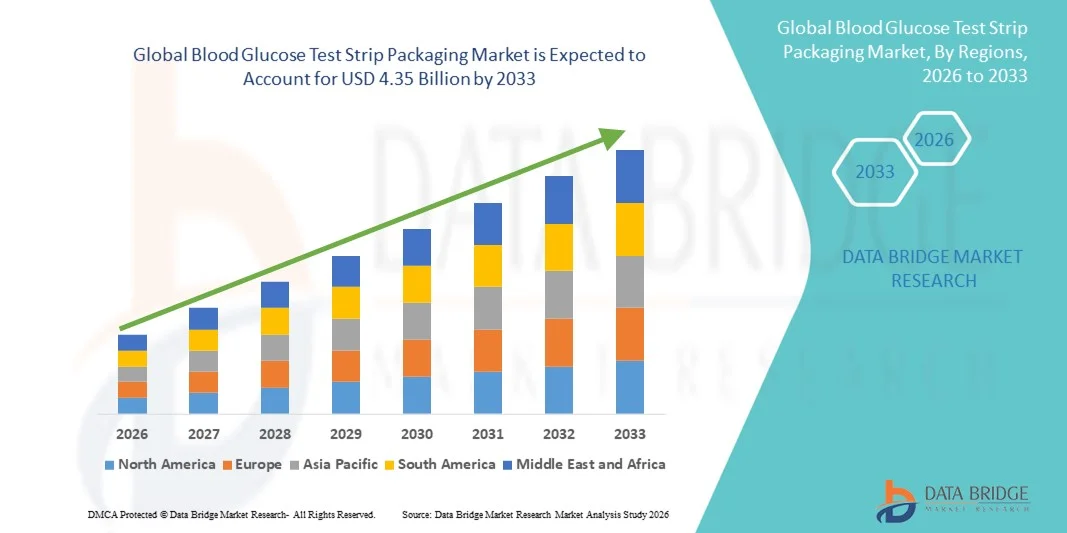

- The global blood glucose test strip packaging market size was valued at USD 2.61 billion in 2025 and is expected to reach USD 4.35 billion by 2033, at a CAGR of 6.61% during the forecast period

- The market growth is largely fueled by the increasing prevalence of diabetes worldwide, driving the demand for efficient and safe blood glucose monitoring solutions

- Furthermore, rising consumer awareness about diabetes management, coupled with technological advancements in testing and packaging solutions, is creating a surge in demand for innovative, user-friendly, and hygienic Blood Glucose Test Strip Packaging solutions, thereby significantly boosting the industry's growth

Blood Glucose Test Strip Packaging Market Analysis

- Blood glucose test strip packaging, providing safe, hygienic, and accurate storage for diabetes monitoring devices, is increasingly vital for ensuring product stability, usability, and compliance in both home and clinical settings due to enhanced convenience, improved shelf life, and better protection of the strips

- The escalating demand for blood glucose test strip packaging is primarily fueled by the rising prevalence of diabetes, increasing adoption of home-based glucose monitoring systems, and growing patient awareness about accurate and reliable self-monitoring solutions

- North America dominated the blood glucose test strip packaging market with the largest revenue share of 38.7% in 2025, supported by advanced healthcare infrastructure, high adoption of home-based glucose monitoring devices, and strong presence of key market players in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region in the blood glucose test Strip Packaging market during the forecast period, with a projected CAGR of 7.6%, fueled by rising diabetes prevalence, increasing urbanization, growing healthcare awareness, and expanding access to diagnostic and self-monitoring tools in countries such as China and India

- The glucose oxidase segment accounted for the largest market revenue share of 58.1% in 2025, attributed to its proven reliability, high specificity, and established use across commercial glucose monitoring devices

Report Scope and Blood Glucose Test Strip Packaging Market Segmentation

|

Attributes |

Blood Glucose Test Strip Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Blood Glucose Test Strip Packaging Market Trends

Rising Demand for Advanced and Patient-Friendly Packaging Solutions

- A key and accelerating trend in the global blood glucose test strip packaging market is the increasing adoption of advanced and patient-friendly packaging solutions. Manufacturers are focusing on moisture-resistant blister packs, tamper-evident designs, and individually sealed test strips that ensure product integrity, ease of use, and accurate results

- For instance, companies such as Roche Diagnostics and Abbott Laboratories have introduced innovative strip packaging that combines user convenience with improved protection against humidity and contamination, supporting both home and clinical use

- There is also a strong move towards sustainable and eco-friendly materials, with biodegradable or recyclable films being increasingly adopted to reduce environmental impact. Packaging solutions that simplify storage, improve labeling clarity, and ensure easy handling for elderly and differently-abled patients are becoming key differentiators in the market

- The shift towards compact, pre-dosed, and visually intuitive packaging is enhancing patient compliance and facilitating easier at-home monitoring. These innovations are gradually reshaping expectations in terms of product usability, safety, and convenience, driving the market forward

- The demand for high-quality, secure, and patient-oriented packaging is rising across both residential and clinical settings, as manufacturers aim to address the needs of a growing diabetic population globally

Blood Glucose Test Strip Packaging Market Dynamics

Driver

Rising Incidence of Diabetes and Growing At-Home Monitoring

- The increasing prevalence of diabetes worldwide is a major driver for the blood glucose test strip packaging market. According to the International Diabetes Federation, over 537 million adults were living with diabetes in 2021, and the number continues to rise steadily

- For instance, in March 2023, Abbott Laboratories expanded its Freestyle Libre test strip packaging line to include moisture-proof, individually sealed strips for easier home use. This strategy underscores the demand for reliable and safe packaging that maintains product efficacy and facilitates self-monitoring

- The growing trend of at-home blood glucose monitoring, fueled by rising health awareness and patient-centric care initiatives, is driving demand for protective and easy-to-use packaging solutions. Packaging that ensures proper dosage, clarity in labeling, and safe storage is critical for maintaining accuracy and patient compliance

- Increasing adoption of point-of-care and home-based monitoring systems, combined with the need for safe transport and storage of test strips in various climates, is contributing to market expansion

- The preference for user-friendly, pre-packaged, and clearly labeled test strips further strengthens the demand in both developed and emerging regions, making innovative packaging a crucial factor in market growth

Restraint/Challenge

Regulatory Compliance and High Production Costs

- Stringent regulatory requirements for sterility, labeling, tamper evidence, and safety pose significant challenges for manufacturers of blood glucose test strip packaging. Compliance with FDA, ISO, and CE standards increases production complexity and costs

- For instance, the need to incorporate moisture-resistant and light-protective materials into packaging while adhering to international safety standards adds to manufacturing expenses, particularly for smaller regional players

- High-quality, innovative packaging solutions may raise the cost of test strips, making affordability a barrier in price-sensitive markets such as India and Southeast Asia

- Balancing regulatory compliance, product safety, and environmental sustainability with cost-effectiveness remains a key challenge for companies seeking widespread adoption and competitive positioning

- Addressing these challenges through process optimization, adoption of cost-efficient materials, and adherence to global quality standards is critical for ensuring market growth while maintaining accessibility to diabetic patients globally

Blood Glucose Test Strip Packaging Market Scope

The Blood Glucose Test Strip Packaging market is segmented into four notable segments based on type, technology, and end-use.

- By Type

On the basis of type, the Blood Glucose Test Strip Packaging market is segmented into thick film electrochemical films, thin film electrochemical films, and optical strips. The thick film electrochemical films segment dominated the largest market revenue share of 52.4% in 2025, driven by its high reliability, ease of mass production, and compatibility with a wide range of glucose meters. Thick film strips offer consistent performance, high accuracy, and robust packaging solutions suitable for both hospital and home care applications. The materials and coatings used enhance shelf life, maintain enzyme stability, and reduce manufacturing defects. High adoption in established markets is supported by regulatory approvals and long-term clinical validation. Hospitals and diagnostic laboratories prefer thick film strips for high-throughput testing due to durability and reproducibility. Consumer confidence in their accuracy and performance contributes to market dominance. The segment also benefits from well-established supply chains and widespread clinician familiarity. Patient demand for fast, reliable, and convenient testing solutions reinforces adoption. The segment continues to see innovation in enzyme stabilization and packaging formats, strengthening its market position. Integration with automated analyzers and POCT devices further boosts usage.

The thin film electrochemical films segment is expected to witness the fastest CAGR of 9.6% from 2026 to 2033, fueled by rising adoption of compact, portable, and user-friendly glucose monitoring devices. Thin film strips offer enhanced flexibility, faster response times, and suitability for home care devices. Growth is supported by increasing prevalence of diabetes globally and demand for minimally invasive, accurate monitoring solutions. Advancements in printing technologies and enzyme immobilization improve performance. The thin film segment is gaining traction in both emerging and developed markets. Home-care users increasingly prefer thin films due to convenience and easy disposal. Manufacturers are investing in R&D to optimize sensitivity and shelf life. Thin film strips are also compatible with smart devices and integrated monitoring systems. Clinical endorsements and growing patient awareness drive adoption. Rising demand for continuous and self-monitoring applications enhances growth. Strategic partnerships with device manufacturers accelerate market penetration.

- By Technology

On the basis of technology, the Blood Glucose Test Strip Packaging market is segmented into glucose oxidase and glucose dehydrogenase. The glucose oxidase segment accounted for the largest market revenue share of 58.1% in 2025, attributed to its proven reliability, high specificity, and established use across commercial glucose monitoring devices. Glucose oxidase strips provide accurate readings with minimal interference from other blood components. Their widespread acceptance in hospitals and home care settings supports steady adoption. Regulatory approvals, clinical studies, and long-term usage reinforce confidence. These strips are compatible with a variety of meter technologies and packaging formats, enhancing convenience. Patient preference for trusted and validated technology strengthens dominance. Integration with automated analyzers in diagnostic laboratories ensures consistent performance. Training programs and clinician familiarity boost market share. The segment benefits from high-volume production capabilities and cost efficiency. Manufacturers continue to improve enzyme stability and shelf life. Compatibility with single-use and disposable formats further drives adoption. Clinical reliability ensures strong acceptance across global markets.

The glucose dehydrogenase segment is projected to witness the fastest CAGR of 10.2% from 2026 to 2033, driven by rising demand for advanced, interference-resistant, and multi-sample glucose monitoring systems. Glucose dehydrogenase technology provides accurate readings even in challenging physiological conditions, reducing errors due to oxygen and other interfering substances. Home care devices increasingly adopt this technology for improved patient outcomes. Innovations in enzyme formulations and miniaturized strip designs support portability and convenience. Growth is also fueled by the expansion of diabetes care programs and rising patient awareness. Hospitals and diagnostic laboratories are adopting glucose dehydrogenase strips for specialized monitoring needs. Collaboration between device manufacturers and strip producers accelerates adoption. Enhanced compatibility with smart meters and digital monitoring platforms drives growth. Continuous improvements in sensitivity, reproducibility, and shelf life support rapid uptake. Emerging markets with increasing diabetes prevalence contribute to accelerated CAGR.

- By End-Use

On the basis of end-use, the Blood Glucose Test Strip Packaging market is segmented into hospitals, home care, and diagnostic laboratories. The hospitals segment held the largest market revenue share of 46.8% in 2025, driven by high patient throughput, stringent quality requirements, and the need for accurate and rapid glucose monitoring. Hospitals prefer packaged strips that ensure minimal errors, long shelf life, and compatibility with automated analyzers. Adoption is supported by procurement contracts, bulk usage, and regulatory compliance. Diagnostic accuracy, clinician trust, and integration into routine patient care reinforce dominance. Hospitals benefit from centralized distribution systems, standardized testing protocols, and trained personnel. Continuous monitoring and high-volume consumption ensure consistent demand. Advanced packaging solutions maintain enzyme stability and prevent contamination. Hospitals continue to invest in modernized POCT solutions, further boosting adoption. Partnerships between manufacturers and healthcare institutions strengthen market penetration. Rising prevalence of diabetes and inpatient monitoring requirements also contribute.

The home care segment is expected to witness the fastest CAGR of 11.4% from 2026 to 2033, fueled by growing diabetes prevalence, increasing patient awareness, and the convenience of self-monitoring at home. The segment benefits from user-friendly strip designs, portable meters, and stable enzyme formulations suitable for lay users. Rising adoption of telemedicine and connected health devices enhances growth. Home care patients increasingly demand accurate, disposable, and cost-effective strips. Expansion of home healthcare services in emerging markets further drives uptake. Strategic collaborations with meter manufacturers and digital health platforms support growth. Patient education programs and insurance coverage promote adoption. Technological innovations improve usability, response time, and result accuracy. Easy availability through retail and online channels enhances penetration. Rising emphasis on preventive care and proactive monitoring boosts demand. Continuous product development ensures compliance with evolving patient needs.

Blood Glucose Test Strip Packaging Market Regional Analysis

- North America dominated the blood glucose test strip packaging market with the largest revenue share of approximately 38.7% in 2025

- The region’s growth is supported by advanced healthcare infrastructure, high adoption of home-based glucose monitoring devices, and the strong presence of key market players in both the U.S. and Canada

- The increasing prevalence of diabetes and rising patient awareness about self-monitoring are driving demand for reliable and convenient packaging solutions that maintain test strip integrity

U.S. Blood Glucose Test Strip Packaging Market Insight

The U.S. blood glucose test strip packaging market captured the largest share within North America in 2025, fueled by widespread use of self-monitoring blood glucose (SMBG) devices in homes, clinics, and hospitals. Growth is driven by increasing diabetes prevalence, high patient awareness, and strong adoption of innovative blood glucose test strips, including strips based on advanced chemistry or improved shelf-life. The presence of major healthcare and diagnostic companies, along with a focus on quality and regulatory compliance, ensures a steady demand for safe, hygienic, and easy-to-use packaging solutions.

Canada Blood Glucose Test Strip Packaging Market Insight

Canada blood glucose test strip packaging market contributes significantly to North America’s market, supported by well-established healthcare systems, increasing prevalence of diabetes, and strong patient education initiatives. Growth is also driven by rising adoption of at-home testing kits and the need for packaging solutions that maintain product quality during storage and transportation.

Europe Blood Glucose Test Strip Packaging Market Insight

The Europe blood glucose test strip packaging market is projected to grow steadily, driven by rising diabetes awareness, increasing urbanization, and strong healthcare infrastructure. Countries such as Germany, France, and the U.K. are witnessing higher adoption of home-based glucose monitoring, with demand for high-quality, reliable packaging solutions that ensure strip integrity and accuracy. Growth is further supported by stringent regulatory standards and initiatives promoting patient-centric diabetes care.

U.K. Blood Glucose Test Strip Packaging Market Insight

The U.K. blood glucose test strip packaging market is expected to grow during the forecast period, driven by the rising prevalence of diabetes and government programs supporting self-monitoring and diabetes management. Patients and healthcare providers are increasingly adopting packaging solutions that offer ease of use, product protection, and hygienic handling.

Germany Blood Glucose Test Strip Packaging Market Insight

Germany’s blood glucose test strip packaging market is expanding due to strong healthcare infrastructure, patient awareness, and technological advancements in diagnostic devices. The demand for reliable, safe, and compliant packaging solutions is high, especially in clinical and home-based testing applications. Regulatory compliance ensures product quality and drives continued growth in the segment.

Asia-Pacific Blood Glucose Test Strip Packaging Market Insight

The Asia-Pacific blood glucose test strip packaging market is projected to be the fastest-growing region with a CAGR of 7.6% during the forecast period. Growth is fueled by rising diabetes prevalence, increasing urbanization, improving healthcare infrastructure, and greater awareness of self-monitoring solutions in countries such as China, India, and Japan. Expanding home-based glucose testing, coupled with demand for durable and convenient packaging, is driving market expansion.

Japan Blood Glucose Test Strip Packaging Market Insight

Japan blood glucose test strip packaging market is experiencing steady growth due to an aging population, high healthcare awareness, and increasing adoption of at-home blood glucose monitoring systems. The market demand is supported by the need for high-quality packaging that ensures accuracy, safety, and prolonged shelf life of test strips.

China Blood Glucose Test Strip Packaging Market Insight

China blood glucose test strip packaging market accounted for a major share in the Asia-Pacific market in 2025, driven by the rising middle-class population, growing diabetes prevalence, and increased adoption of self-monitoring devices. Government initiatives to enhance healthcare accessibility, combined with awareness campaigns about diabetes management, are boosting demand for effective and reliable packaging solutions.

Blood Glucose Test Strip Packaging Market Share

The Blood Glucose Test Strip Packaging industry is primarily led by well-established companies, including:

• Abbott (U.S.)

• Roche Diagnostics (Switzerland)

• Bayer AG (Germany)

• Ascensia Diabetes Care (Switzerland)

• Sinocare Inc. (China)

• Arkray Inc. (Japan)

• EKF Diagnostics (U.K.)

• Nova Biomedical (U.S.)

• ForaCare Suisse AG (Switzerland)

• ACON Laboratories (U.S.)

• Trividia Health (U.S.)

• i-SENS, Inc. (South Korea)

• Lifescan, Inc. (U.S.)

• On Call (China)

Latest Developments in Global Blood Glucose Test Strip Packaging Market

- In February 2023, Oliver Healthcare Packaging announced the construction of a new manufacturing facility in Johor, Malaysia to produce advanced packaging components such as pouches, lids, CleanCut cards, and roll stock to support increasing demand for medical device and blood glucose test strip packaging in the Asia‑Pacific region. This expansion underscores efforts to localize production and improve supply chain resilience for diagnostic consumables packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.