Global Blood Meal For Aquafeed Market

Market Size in USD Million

CAGR :

%

USD

230.49 Million

USD

345.76 Million

2024

2032

USD

230.49 Million

USD

345.76 Million

2024

2032

| 2025 –2032 | |

| USD 230.49 Million | |

| USD 345.76 Million | |

|

|

|

|

Blood Meal for Aquafeed Market Size

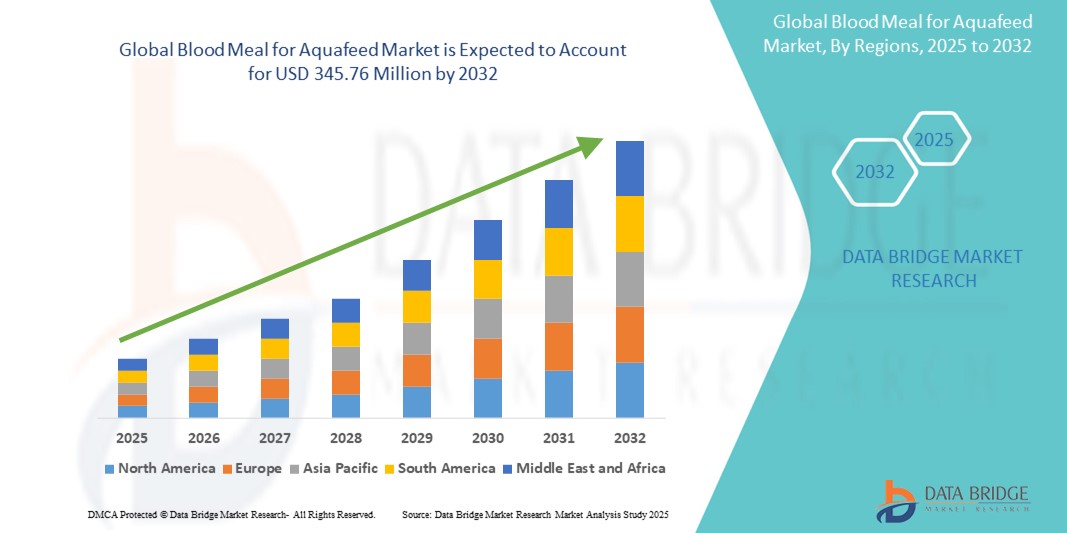

- The global blood meal for aquafeed market size was valued at USD 230.49 million in 2024 and is expected to reach USD 345.76 million by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-protein, cost-effective feed ingredients to enhance fish growth, health, and feed conversion ratios in aquaculture operations

- The rising expansion of aquaculture farming in developing countries and the need to optimize feed formulations with alternative protein sources are expected to contribute to the steady growth of the blood meal for aquafeed market

Blood Meal for Aquafeed Market Analysis

- The market is witnessing a growing shift toward sustainable and efficient protein sources, with blood meal emerging as a viable alternative to fishmeal due to its high lysine and protein content

- Strong demand for aquaculture products such as tilapia, catfish, and shrimp, particularly in Asia-Pacific and Latin America, is contributing to increased consumption of blood meal in feed formulations

- North America dominated the blood meal for aquafeed market with the largest revenue share in 2024, driven by the well-established aquaculture industry, rising demand for sustainable animal protein sources, and increasing use of high-protein feed ingredients

- Asia-Pacific region is expected to witness the highest growth rate in the global blood meal for aquafeed market, driven by rapid expansion of aquaculture in countries such as China, Vietnam, and Indonesia, coupled with increasing awareness of efficient feed utilization, rising seafood consumption, and supportive regulatory frameworks promoting sustainable feed practices

- The poultry blood segment accounted for the largest market revenue share in 2024, driven by its abundant supply from poultry processing plants and superior digestibility for aquatic species. Poultry blood-based meal is widely favored in aquafeed formulations due to its high protein concentration and balanced amino acid profile, which supports optimal fish and shrimp growth. The availability of poultry blood across regions with large-scale poultry farming further supports its dominance in the global market

Report Scope and Blood Meal for Aquafeed Market Segmentation

|

Attributes |

Blood Meal for Aquafeed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Sustainable Protein Alternatives in Aquafeed |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blood Meal for Aquafeed Market Trends

“Rising Shift Toward Sustainable and Circular Protein Sources in Aquafeed”

- Blood meal is increasingly adopted as a sustainable protein source, helping reduce reliance on overfished marine ingredients such as fishmeal

- The use of blood meal supports circular economy models by upcycling slaughterhouse waste into valuable inputs for aquafeed formulations

- Aquafeed manufacturers are aligning with sustainability goals and regulatory pressures to cut environmental impact and carbon emissions

- Eco-conscious buyers are driving demand for feed products that incorporate ethical and traceable ingredients such as blood meal

- For instance, a 2022 Indonesian shrimp feed producer replaced 30% of fishmeal with blood meal to achieve eco-label certification and reduce supply chain costs

Blood Meal for Aquafeed Market Dynamics

Driver

“High Protein Content and Enhanced Feed Conversion Efficiency”

- Blood meal contains over 80% crude protein and a rich amino acid profile, particularly high in lysine, supporting muscle development and metabolic health in aquatic species

- It significantly improves feed conversion ratios (FCR), enabling faster weight gain and better feed efficiency in aquaculture operations

- As a highly digestible protein source, blood meal enhances nutrient absorption and overall health performance in species such as tilapia, catfish, and shrimp

- It provides a cost-effective alternative to fishmeal, especially during price volatility or supply shortages of marine-based proteins

- For instance, in a 2021 Vietnamese study, shrimp diets formulated with 25% fishmeal replacement using blood meal showed better growth performance and reduced feed costs compared to conventional diets

Restraint/Challenge

“Stringent Regulatory Constraints and Quality Concerns”

- Regulatory differences across regions, especially in the European Union, impose complex compliance requirements for animal-derived feed ingredients such as blood meal

- Strict traceability, pathogen control, and hygiene protocols must be met, raising processing and certification costs for manufacturers

- Inconsistent raw material quality and varying processing methods can lead to unstable nutritional composition, affecting feed consistency and animal performance

- Consumer perception and biosecurity risks often deter aquaculture operators, particularly in countries with strict import-export feed standards

- For instance, EU regulations classify blood meal under processed animal proteins, demanding extensive documentation and sanitary controls, which can hinder market expansion for exporters

Blood Meal for Aquafeed Market Scope

The market is segmented on the basis of source and process.

- By Source

On the basis of source, the blood meal for aquafeed market is segmented into porcine blood, poultry blood, and ruminant blood. The poultry blood segment accounted for the largest market revenue share in 2024, driven by its abundant supply from poultry processing plants and superior digestibility for aquatic species. Poultry blood-based meal is widely favored in aquafeed formulations due to its high protein concentration and balanced amino acid profile, which supports optimal fish and shrimp growth. The availability of poultry blood across regions with large-scale poultry farming further supports its dominance in the global market.

The porcine blood segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to increased pork production and its rich iron and lysine content, which enhances feed efficiency. Growing awareness of animal by-product utilization and advancements in safe processing techniques are also contributing to rising adoption of porcine-sourced blood meal in aquaculture applications.

- By Process

On the basis of process, the market is segmented into solar drying, drum drying, ring and flash drying, and spray drying. The spray drying segment held the largest market revenue share in 2024 due to its ability to produce high-quality, fine, and highly digestible blood meal with minimal nutrient loss. This method is preferred by premium feed manufacturers as it ensures consistent texture, longer shelf life, and enhanced nutritional retention, which are crucial for high-performance aquafeed products.

The ring and flash drying segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-efficiency, shorter processing time, and growing adoption in regions with moderate technological infrastructure. This method enables quick moisture evaporation while preserving protein content, making it a viable choice for mass production of blood meal for aquafeed use.

Blood Meal for Aquafeed Market Regional Analysis

- North America dominated the blood meal for aquafeed market with the largest revenue share in 2024, driven by the well-established aquaculture industry, rising demand for sustainable animal protein sources, and increasing use of high-protein feed ingredients

- The region benefits from advanced feed manufacturing technologies and strict quality standards, which support the widespread adoption of processed blood meal in fish diets

- North America's growth is also propelled by rising investments in environmentally friendly feed additives and a growing emphasis on improving feed efficiency across commercial fish farms

U.S. Blood Meal for Aquafeed Market Insight

The U.S. blood meal for aquafeed market held the dominant revenue share within North America in 2024, supported by the country’s robust aquaculture infrastructure and emphasis on improving livestock productivity through high-quality feed inputs. The rising production of trout, catfish, and tilapia has led to an increased requirement for protein-rich feed components, such as blood meal. Furthermore, advancements in feed formulations and strategic partnerships among aquafeed manufacturers and meat processing companies have strengthened the supply chain, ensuring consistency in quality and availability.

Europe Blood Meal for Aquafeed Market Insight

The Europe blood meal for aquafeed market is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing focus on sustainable aquaculture practices and the need to reduce reliance on fishmeal. European aquafeed producers are turning to blood meal as a viable protein alternative due to its digestibility and amino acid profile. Regulatory support for reducing environmental impacts of aquaculture feed and growing demand for organic and traceable feed solutions are fostering regional adoption.

U.K. Blood Meal for Aquafeed Market Insight

The U.K. blood meal for aquafeed market is expected to witness the fastest growth rate from 2025 to 2032, influenced by the expanding demand for nutritionally enhanced aquafeed in fish farming operations. With salmon and trout farming being dominant in the country, producers are increasingly incorporating blood meal to improve feed conversion ratios. The government’s support for sustainable aquaculture and the adoption of circular economy principles, including valorization of slaughterhouse byproducts, are further stimulating market expansion.

Germany Blood Meal for Aquafeed Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032, driven by growing awareness of feed sustainability and efficiency. German aquaculture operators, particularly those engaged in closed-system farming, are integrating blood meal due to its low environmental impact and high nutrient density. The country’s stringent feed quality standards and increasing consumer demand for eco-certified aquaculture products are creating a conducive environment for blood meal adoption in the feed industry.

Asia-Pacific Blood Meal for Aquafeed Market Insight

The Asia-Pacific blood meal for aquafeed market is expected to witness the fastest growth rate from 2025 to 2032, owing to the region’s large and rapidly expanding aquaculture sector. Countries such as China, India, Vietnam, and Indonesia are increasingly turning to blood meal to support the nutritional needs of farmed fish species. Government initiatives to boost aquaculture productivity and the availability of cost-effective blood meal through local slaughterhouses are fueling market growth.

Japan Blood Meal for Aquafeed Market Insight

The Japan blood meal for aquafeed market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s focus on high-value aquaculture species such as eel and yellowtail. Japanese aquafeed manufacturers are emphasizing the use of high-quality ingredients, including blood meal, to enhance fish health and growth performance. The adoption of advanced feed production technologies and a strong regulatory framework governing feed safety are contributing to the steady integration of blood meal in the aquafeed supply chain.

China Blood Meal for Aquafeed Market Insight

China accounted for the largest revenue share in the Asia-Pacific blood meal for aquafeed market in 2024, driven by its massive aquaculture output and large-scale feed manufacturing capacity. Chinese producers are adopting blood meal as a cost-effective and protein-rich alternative to fishmeal, particularly in carp and tilapia farming. The government’s push for sustainable aquaculture practices and growing investments in integrated meat and feed processing operations are further propelling the market in China.

Blood Meal for Aquafeed Market Share

The Blood Meal for Aquafeed industry is primarily led by well-established companies, including:

- Terramar GmbH (Germany)

- WCRL (U.S.)

- Valley Proteins, Inc. (U.S.)

- Ridley Corporation Limited (Australia)

- DuPont (U.S.)

- Natural Remedies (India)

- DSM (Netherlands)

- Synthite Industries Ltd. (India)

- Kemin Industries, Inc. (U.S.)

- Allanasons Pvt Ltd (India)

- The Boyer Valley Company, Inc. (U.S.)

- AB „Fasa“(Lithuania)

- Sanimax (Canada)

- Schneider Electric (France)

- Apelsa Guadalajara (Mexico)

- The Fertrell Company (U.S.)

- Agro-industrial Complex Backa Topola LTD (Serbia)

- Darling Ingredients (U.S.)

Latest Developments in Global Blood Meal for Aquafeed Market

- In May 2022, Darling Ingredients made a strategic acquisition of Fasa Group for USD 560 million, a move aimed at expanding its geographical footprint and diversifying its product range in the global blood meal market. This acquisition enables Darling to leverage Fasa's capabilities, enhancing its offerings and positioning the company to better serve the growing demand for high-quality animal feed ingredients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.