Global Blood Warmer Devices Sample Warmer Market

Market Size in USD Billion

CAGR :

%

USD

1.40 Billion

USD

2.64 Billion

2024

2032

USD

1.40 Billion

USD

2.64 Billion

2024

2032

| 2025 –2032 | |

| USD 1.40 Billion | |

| USD 2.64 Billion | |

|

|

|

|

Blood Warmer Devices Market Size

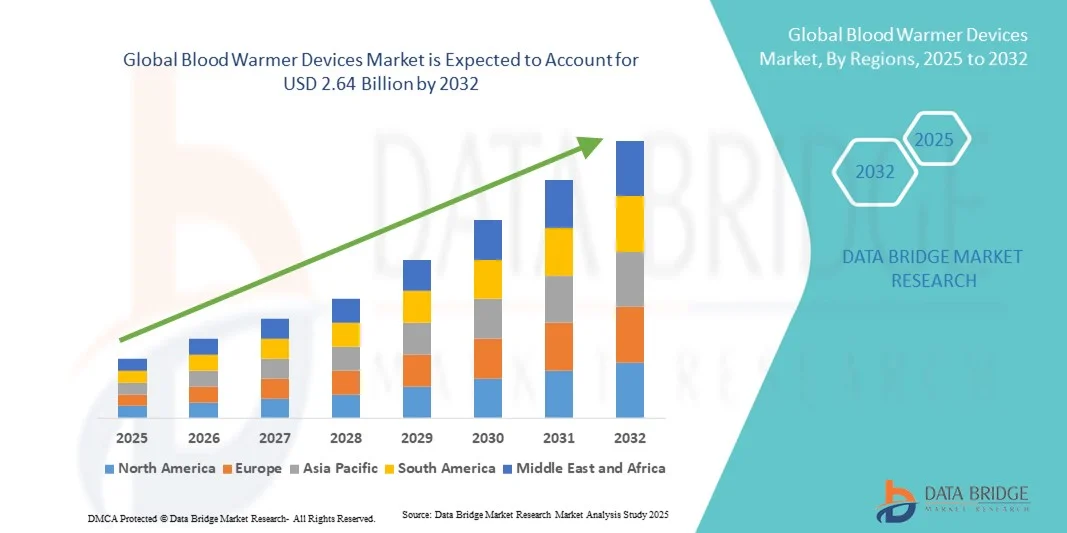

- The global blood warmer devices market size was valued at USD 1.40 billion in 2024 and is expected to reach USD 2.64 billion by 2032, at a CAGR of 8.23% during the forecast period

- The market growth is primarily driven by the rising number of surgeries, trauma cases, and blood transfusions, which are increasing the demand for efficient and safe blood warming solutions in hospitals and emergency care settings

- In addition, advancements in medical device technology, coupled with growing awareness of patient safety and compliance with clinical guidelines, are promoting the adoption of blood warmer devices across healthcare facilities. These factors are collectively enhancing market penetration, thereby supporting substantial growth in the industry

Blood Warmer Devices Market Analysis

- Blood warmer devices, designed to safely warm blood and blood components to optimal temperatures before transfusion, are increasingly essential in hospitals, trauma centers, and surgical settings due to their ability to prevent hypothermia and improve patient outcomes

- The rising demand for blood warmer devices is primarily driven by the increasing number of surgeries, trauma cases, and blood transfusions, coupled with growing awareness among healthcare providers of patient safety standards and clinical guidelines

- North America dominated the blood warmer devices market with the largest revenue share of 39.9% in 2024, attributed to advanced healthcare infrastructure, high adoption of medical technologies, and the presence of major industry players, with the U.S. leading in hospital installations and emergency care units, supported by innovations in rapid and automated warming systems

- Asia-Pacific is expected to be the fastest growing region in the blood warmer devices market during the forecast period due to rising healthcare expenditure, expanding hospital networks, and increasing awareness of safe transfusion practices

- Intravenous warming systems dominated the blood warmer devices market with a market share of 43.9% in 2024, driven by their effectiveness in rapidly warming blood and fluids for transfusions, ease of use in clinical settings, and compatibility with multiple patient types including adults and neonates

Report Scope and Blood Warmer Devices Market Segmentation

|

Attributes |

Blood Warmer Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blood Warmer Devices Market Trends

Adoption of IoT-Enabled and Automated Warming Systems

- A significant and accelerating trend in the global blood warmer devices market is the integration of IoT-enabled monitoring and automated warming controls, enhancing precision, safety, and efficiency in clinical transfusions

- For instance, the Level 1 Smart IV Blood Warmer features automated temperature regulation and real-time monitoring, ensuring blood is warmed consistently before transfusion

- IoT integration allows hospitals to track device performance, monitor patient outcomes, and generate alerts in case of irregularities, reducing human error and improving transfusion safety

- The centralized control of multiple devices through hospital management systems enables staff to oversee warming processes across various wards, improving workflow and patient care

- This trend towards intelligent, connected, and automated blood warming solutions is reshaping clinical expectations for transfusion safety, prompting manufacturers such as Belmont and Haemonetics to develop smart blood warmer models with real-time monitoring and alert features

- The demand for blood warmers with advanced automation and connectivity is rising across hospitals, blood banks, and emergency care units, as healthcare providers increasingly prioritize patient safety and operational efficiency

Blood Warmer Devices Market Dynamics

Driver

Increasing Demand Driven by Rising Surgeries and Transfusions

- The growing number of surgical procedures, trauma cases, and blood transfusions worldwide is a key driver boosting demand for blood warmer devices

- For instance, in March 2024, Haemonetics launched an upgraded intravenous warming system for high-volume hospital transfusions, reflecting strategies that support market expansion

- Blood warmers help prevent hypothermia and improve patient outcomes, making them essential in operating rooms, trauma centers, and emergency care settings

- The rising awareness among healthcare providers about clinical guidelines and patient safety standards is increasing adoption of advanced warming devices

- In addition, expanding hospital networks, increasing investment in healthcare infrastructure, and higher patient volumes in both developed and emerging regions are further propelling market growth

- Growing interest in portable and rapid-response blood warmers for emergency medical services and battlefield medicine is creating new market opportunities

- Increasing partnerships between blood banks and device manufacturers to standardize blood warming protocols are further driving adoption globally

Restraint/Challenge

High Device Costs and Maintenance Requirements

- The relatively high initial cost of advanced blood warmer devices, coupled with ongoing maintenance and calibration requirements, poses a challenge to widespread adoption, particularly in resource-limited healthcare settings

- For instance, hospitals with budget constraints may delay procurement of automated or IoT-enabled warmers, relying on basic warming methods instead

- Operational complexity and the need for trained personnel to manage advanced devices can hinder rapid deployment in smaller clinics or remote areas

- In addition, strict regulatory approvals and compliance requirements for medical devices increase lead time and cost, discouraging some healthcare facilities from adopting newer models

- Concerns about device durability and compatibility with different blood bag types can limit adoption in high-volume or multi-purpose hospitals

- Limited awareness and training among staff regarding optimal blood warming practices can reduce effective utilization of advanced devices

- Addressing these challenges through cost optimization, training programs, and simplified device designs will be essential to encourage broader market penetration and sustained growth

Blood Warmer Devices Market Scope

The market is segmented on the basis of devices, product, type, sample, patient type, application, and end user.

- By Devices

On the basis of devices, the blood warmer devices market is segmented into sample warmers and others. The sample warmers segment dominated the market with the largest revenue share in 2024, driven by their critical role in maintaining optimal temperature of blood and biological samples during storage and transport. Hospitals, blood banks, and laboratories rely heavily on sample warmers to prevent degradation of samples such as blood, embryos, and ovum, ensuring high patient safety and procedural accuracy. These devices are valued for precise temperature control, reliability, and easy integration into clinical workflows. Rising surgeries and transfusions globally further support their adoption. Manufacturers continue to innovate with portable and automated models, enhancing operational efficiency. The segment’s growth is also strengthened by regulatory focus on sample integrity in healthcare facilities.

The others segment is expected to witness the fastest growth during the forecast period due to rising demand for specialized warming devices for diverse biological applications, including semen and stem cell samples. This growth is fueled by increasing research activities, fertility treatments, and biobanking requirements. Technological advancements in automation, precision, and portability are driving adoption across hospitals and laboratories. Awareness of sample integrity and regulatory compliance is further supporting the segment. The increasing number of fertility clinics and specialized research centers globally is also contributing. Innovative features such as temperature monitoring and IoT-enabled control enhance efficiency and reliability.

- By Product

On the basis of product, the blood warmer devices market is segmented into intravenous warming systems, surface warming systems, and patient warming accessories. The intravenous warming system segment dominated the market with a revenue share of 43.9% in 2024, owing to its critical role in rapidly warming blood and IV fluids safely during transfusions. These systems are widely used in operating rooms, trauma centers, and emergency care units to prevent hypothermia and maintain patient stability. Hospitals prefer intravenous warming systems due to their precision, reliability, and real-time monitoring capabilities. Integration with hospital management systems ensures compliance and workflow efficiency. The segment’s dominance is reinforced by adaptability for adult and neonatal patients. Manufacturers continuously innovate automated and IoT-enabled features to enhance safety and usability.

Surface warming systems are expected to witness the fastest growth during the forecast period, driven by the increasing demand for non-invasive patient warming during surgeries, preoperative care, and neonatal care. Lightweight and portable designs with advanced temperature sensors make them suitable for diverse clinical applications. Rising surgical volumes, emergency care requirements, and awareness of hypothermia prevention further fuel adoption. Hospitals and clinics increasingly invest in surface warming systems to improve patient outcomes and operational efficiency. Technological innovations and automation enhance their clinical utility. The segment’s growth is also supported by favorable reimbursement policies and hospital procurement strategies.

- By Type

On the basis of type, the blood warmer devices market is segmented into portable and non-portable blood warmers. The non-portable segment dominated the market in 2024 due to extensive use in hospital settings and blood banks with high-volume transfusions. Non-portable systems provide reliable, consistent warming, advanced safety features, and integration with hospital infrastructure. They are preferred in operating rooms, trauma centers, and intensive care units where large-scale warming is required. These devices often support simultaneous warming of multiple blood products and fluids, enhancing efficiency. Continuous product innovation and regulatory approvals ensure safety and maintain dominance. Adoption is strong in developed regions with advanced healthcare infrastructure.

The portable segment is expected to witness the fastest CAGR during the forecast period during the forecast period due to growing demand in emergency medical services, field hospitals, and remote healthcare setups. Portability enables rapid deployment, timely transfusions, and ease of use in trauma care, military operations, and disaster response. Portable warmers are increasingly integrated with monitoring systems for real-time alerts. Rising awareness of hypothermia risks in critical care settings supports adoption. Technological enhancements improve accuracy, reliability, and battery life. The segment’s growth is further driven by rising home care and outpatient care requirements.

- By Sample

On the basis of sample, the blood warmer devices market is segmented into blood, embryo, ovum, and semen. The blood segment dominated the market in 2024 due to the high frequency of transfusions, surgeries, and trauma cases requiring safe and efficient warming solutions. Blood warmers are essential to prevent hypothermia and maintain patient safety during transfusions. Hospitals and blood banks prioritize advanced warming devices for blood due to regulatory standards and sample criticality. Automated and IoT-enabled devices enhance efficiency and reliability. Rising global healthcare expenditure and hospital infrastructure growth support the segment. Innovations in portable and rapid-response devices further strengthen adoption.

The embryo segment is expected to witness the fastest growth during the forecast period due to expanding fertility treatments and assisted reproduction procedures. Warming devices for embryos are crucial in IVF to ensure sample viability and higher success rates. Fertility clinics and research labs are driving adoption of automated, precise, and portable warmers. Rising awareness about reproductive health and advanced reproductive technologies fuels demand. Regulatory compliance and quality standards also support segment growth. Technological innovations in monitoring and control further enhance clinical outcomes.

- By Patient Type

On the basis of patient type, the blood warmer devices market is segmented into pediatric and neonates, and adults. The adult segment dominated the market in 2024 due to higher surgery, trauma, and transfusion volumes among adults, requiring reliable warming solutions. Adult blood warmers are widely used in hospitals, trauma centers, and ICUs. Automated and IoT-enabled systems provide real-time monitoring and compliance with clinical protocols. Availability of portable and non-portable devices supports workflow efficiency. Hospitals invest in advanced devices to enhance patient safety and minimize complications. Rising healthcare infrastructure and awareness about hypothermia prevention strengthen the segment.

The pediatric and neonates segment is expected to witness the fastest growth during the forecast period due to increasing preterm births, neonatal surgeries, and pediatric trauma cases. Specialized warming devices ensure safety for vulnerable patients. Neonatal care units and pediatric hospitals are adopting advanced, automated, and IoT-enabled warmers. Awareness about hypothermia risks and clinical compliance drives demand. Portable solutions support rapid interventions and home care applications. Technological innovations in monitoring and temperature control further fuel growth.

- By Application

On the basis of application, the blood warmer devices market is segmented into preoperative care, home care, acute care, newborn care, and others. The acute care segment dominated the market in 2024 due to high demand for blood warmers in ERs, operating theaters, and trauma centers where rapid transfusion is critical. Acute care requires devices offering precision, reliability, and real-time monitoring to prevent hypothermia. Hospitals prefer automated and IoT-enabled systems for workflow efficiency. Rising surgeries, trauma cases, and transfusions support adoption. Regulatory compliance and clinical guidelines further drive segment growth. The need for multiple simultaneous warming functions strengthens the segment.

The home care segment is expected to witness the fastest growth during the forecast period, driven by rising demand for at-home transfusions, chronic care, and elderly patient management. Portable and easy-to-use warming devices enable safe administration in home settings. Increasing awareness among patients and caregivers supports adoption. Technological innovations enhance usability and safety. Home care expansion, particularly in developed regions, further drives growth. Integration with monitoring systems ensures compliance and real-time alerts.

- By End User

On the basis of end user, the blood warmer devices market is segmented into hospitals, blood banks and transfusion centers, home care settings, tissue banks, clinics, and others. The hospitals segment dominated the market in 2024 due to high volumes of surgeries, transfusions, and critical care requiring reliable blood warmers. Hospitals demand both portable and non-portable devices for patient safety and operational efficiency. Automated and IoT-enabled devices help with real-time monitoring and workflow management. Regulatory compliance further strengthens adoption. Investments in healthcare infrastructure and hospital expansion fuel growth. Hospitals are key buyers for both adult and neonatal warming solutions.

The blood banks and transfusion centers segment is expected to witness the fastest growth during the forecast period owing to increasing organized blood donation programs and the need for safe storage and transport of blood. Advanced warming solutions maintain sample integrity and comply with regulations. Blood banks adopt automated and IoT-enabled devices to streamline operations. Growing awareness of hypothermia risks and patient safety drives adoption. Technological innovations enhance workflow efficiency and monitoring capabilities. Expansion of blood banking infrastructure globally supports the segment’s rapid growth.

Blood Warmer Devices Market Regional Analysis

- North America dominated the blood warmer devices market with the largest revenue share of 39.9% in 2024, attributed to advanced healthcare infrastructure, high adoption of medical technologies, and the presence of major industry players, with the U.S. leading in hospital installations and emergency care units, supported by innovations in rapid and automated warming systems

- Hospitals, trauma centers, and blood banks in the region prioritize the use of blood warmers to prevent hypothermia during transfusions and surgeries, ensuring optimal patient outcomes

- This widespread adoption is further supported by the presence of major market players, technologically advanced hospitals, and high healthcare expenditure, establishing blood warmers as an essential solution in both routine and critical care procedures

U.S. Blood Warmer Devices Market Insight

The U.S. blood warmer devices market captured the largest revenue share of 82% in 2024 within North America, driven by the high volume of surgeries, trauma cases, and blood transfusions requiring safe and efficient warming solutions. Hospitals and trauma centers increasingly prioritize the use of automated and IoT-enabled blood warmers to prevent hypothermia and improve patient outcomes. The strong presence of key manufacturers, coupled with advanced healthcare infrastructure and high healthcare expenditure, further supports market dominance. Growing adoption of portable and rapid-response warmers in emergency medical services is also contributing to market expansion. Moreover, increasing awareness about patient safety standards and compliance with clinical guidelines is encouraging widespread adoption of advanced devices. The trend of integrating warming devices with hospital management systems for real-time monitoring is further fueling growth.

Europe Blood Warmer Devices Market Insight

The Europe blood warmer devices market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing surgical procedures, blood transfusions, and stringent patient safety regulations. Hospitals and clinics across the region are adopting advanced blood warming systems to improve transfusion safety and workflow efficiency. Rising awareness about hypothermia prevention, coupled with technological advancements such as automated and IoT-enabled devices, is fostering market growth. The growing need for reliable warming solutions in neonatal, acute, and surgical care is further supporting adoption. In addition, European healthcare providers are focusing on integrating blood warmers with broader clinical workflows, ensuring compliance and efficiency. Market expansion is also encouraged by the increasing number of trauma centers, emergency care units, and blood banks adopting modern warming technologies.

U.K. Blood Warmer Devices Market Insight

The U.K. blood warmer devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand in hospitals, blood banks, and emergency care units. Increasing focus on patient safety and clinical compliance is encouraging the adoption of advanced warming systems for blood and IV fluids. Growing surgical volumes and trauma cases are prompting healthcare providers to deploy automated and portable devices to ensure timely transfusions and prevent hypothermia. The U.K.’s well-developed healthcare infrastructure, combined with strong government regulations, supports market growth. The trend of using portable blood warmers in home care and remote healthcare settings is also boosting adoption. Furthermore, technological integration with monitoring systems and real-time alerts enhances operational efficiency, further driving demand.

Germany Blood Warmer Devices Market Insight

The Germany blood warmer devices market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of patient safety and the demand for technologically advanced healthcare solutions. Hospitals and trauma centers prioritize reliable and precise blood warming devices for critical care and surgical procedures. Germany’s robust healthcare infrastructure, combined with emphasis on innovation and regulatory compliance, promotes adoption of advanced devices. The integration of automated and IoT-enabled systems ensures real-time monitoring and workflow efficiency. Rising focus on neonatal care and preoperative safety also supports segment growth. Moreover, research institutions and blood banks are increasingly adopting specialized warming systems for biological samples, enhancing the market’s expansion.

Asia-Pacific Blood Warmer Devices Market Insight

The Asia-Pacific blood warmer devices market is poised to grow at the fastest CAGR of 25% during the forecast period of 2025 to 2032, driven by increasing surgical procedures, trauma cases, and blood transfusions in countries such as China, Japan, and India. Rising healthcare expenditure, expanding hospital networks, and increasing awareness of patient safety standards are key growth drivers. Technological adoption, including automated and portable blood warmers, is enhancing clinical efficiency and safety. Government initiatives promoting digital healthcare and hospital modernization are further supporting market expansion. In addition, the growing number of neonatal care units, trauma centers, and emergency medical services is boosting demand for reliable warming solutions. Asia-Pacific is also emerging as a hub for manufacturing and affordable blood warming devices, improving accessibility for healthcare facilities.

Japan Blood Warmer Devices Market Insight

The Japan blood warmer devices market is gaining momentum due to advanced healthcare infrastructure, high surgical volumes, and growing awareness of patient safety. Hospitals and emergency care units increasingly adopt automated and IoT-enabled blood warmers to prevent hypothermia and improve clinical outcomes. Integration with hospital management systems for real-time monitoring is becoming common, enhancing workflow efficiency. The country’s focus on technological innovation and safety standards encourages adoption in neonatal and adult care units. Rising demand for portable and rapid-response devices in emergency settings further supports market growth. Moreover, Japan’s aging population increases the need for safe and easy-to-use transfusion solutions in both residential and clinical environments.

India Blood Warmer Devices Market Insight

The India blood warmer devices market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to increasing surgical procedures, trauma cases, and blood transfusions across hospitals and clinics. Expanding healthcare infrastructure, rising government initiatives, and growing awareness of patient safety are driving adoption. Portable and automated blood warmers are becoming increasingly popular in emergency care, neonatal units, and home care settings. The rise of smart hospitals and digital health integration is further fueling demand. Strong domestic manufacturing and availability of cost-effective devices improve accessibility for healthcare providers. In addition, growing investments in trauma centers, blood banks, and surgical units support continued market expansion.

Blood Warmer Devices Market Share

The Blood Warmer Devices industry is primarily led by well-established companies, including:

- Belmont Medical Technologies (U.S.)

- 3M (U.S.)

- MEQU (Denmark)

- Enthermics (U.S.)

- Quality In Flow Ltd (QinFlow) (Denmark)

- Estill Medical Technologies, Inc. (U.S.)

- Elltec Co., Ltd. (Japan)

- TSC Life (U.S.)

- Beurer GmbH (Germany)

- Smiths Group plc (U.S.)

- Keewell Medical Technology Co., Ltd. (China)

- hawkmedical (China)

- GE HealthCare (Denmark)

- Medtronic (Ireland)

- Stryker (U.S.)

What are the Recent Developments in Global Blood Warmer Devices Market?

- In May 2025, a prototype of a disposable-free blood warmer was showcased, designed to reduce waste and operational costs in healthcare settings. This innovative device eliminates the need for single-use components, aligning with sustainability goals and offering long-term cost savings

- In August 2024, Delta Development Team launched the SUBW, a versatile single-unit blood warmer capable of both blood warming and plasma thawing. It offers multi-power options, including 110V, 240V, and military-standard lithium battery, making it adaptable for various environments

- In June 2024, Danish MedTech company MEQU received FDA 510(k) clearance for its °M Warmer System, a portable blood and IV fluid warmer designed for both military and civilian use. The device rapidly warms fluids to body temperature in under 10 seconds, enhancing patient safety during transfusions

- In June 2023, ICU Medical introduced the Level 1 H-1200 Fast Flow Fluid Warmer. This device is designed for rapid warming of blood and fluids in hospital settings, featuring an integrated air detector and clamp for enhanced patient safety

- In June 2023, QinFlow Inc. entered into a distribution agreement with Bound Tree Medical to supply the Warrior line of blood and fluid warmers. This collaboration aims to enhance the availability of advanced warming solutions in pre-hospital settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.