Global Blow Fill Seal Technology Market

Market Size in USD Million

CAGR :

%

USD

366.66 Million

USD

630.46 Million

2024

2032

USD

366.66 Million

USD

630.46 Million

2024

2032

| 2025 –2032 | |

| USD 366.66 Million | |

| USD 630.46 Million | |

|

|

|

|

Global Blow-Fill-Seal Technology Market Size

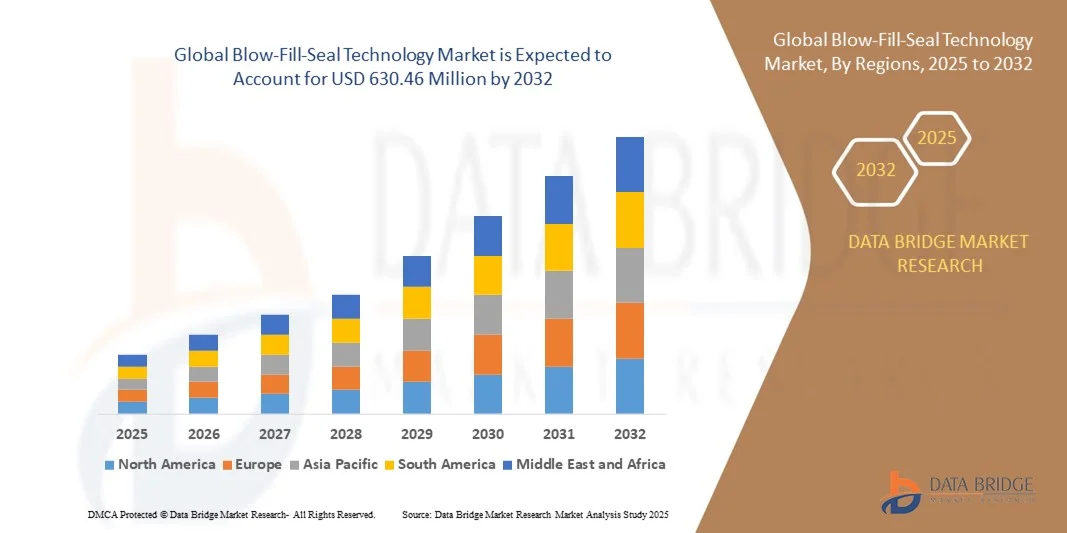

- The global Blow-Fill-Seal Technology Market size was valued at USD 366.66 million in 2024 and is expected to reach USD 630.46 million by 2032, growing at a CAGR of 7.01% during the forecast period.

- The market growth is primarily driven by increasing demand for sterile and contamination-free packaging in pharmaceutical, food and beverage, and cosmetics industries, along with technological advancements in blow-fill-seal processes.

- Additionally, stringent regulatory standards for product safety and quality, combined with rising awareness about efficient and automated packaging solutions, are propelling the adoption of blow-fill-seal technology globally, significantly contributing to market expansion.

Global Blow-Fill-Seal Technology Market Analysis

- Blow-Fill-Seal (BFS) technology, an advanced aseptic manufacturing technique used to form, fill, and seal containers in a single continuous process, is increasingly vital in the pharmaceutical, biotechnology, and healthcare sectors due to its superior sterility assurance, reduced human intervention, and cost-efficient large-scale production capabilities.

- The escalating demand for Blow-Fill-Seal technology is primarily fueled by the rising global production of sterile pharmaceutical products, stricter regulatory compliance for aseptic packaging, and growing needs for high-efficiency, contamination-free drug delivery solutions.

- North America dominated the Blow-Fill-Seal technology market with the largest revenue share of 38% in 2024, characterized by a well-established pharmaceutical industry, strong regulatory frameworks, and significant investments in sterile manufacturing facilities. The U.S. leads the market with robust growth in biopharmaceutical production and adoption of BFS technology in injectable and ophthalmic drug packaging.

- Asia-Pacific is expected to be the fastest growing region in the Blow-Fill-Seal technology market during the forecast period due to increasing pharmaceutical manufacturing capacity, rising healthcare expenditures, supportive government initiatives, and growing domestic demand for affordable sterile medications in countries like China and India.

- The vials segment dominated the market with the largest revenue share of 38.5% in 2024, primarily due to its extensive application in injectable pharmaceuticals, vaccines, and biologics that require sterile and precise dosing.

Report Scope and Global Blow-Fill-Seal Technology Market Segmentation

|

Attributes |

Blow-Fill-Seal Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Blow-Fill-Seal Technology Market Trends

Enhanced Efficiency Through Automation and AI Integration

- A significant and accelerating trend in the global Blow-Fill-Seal (BFS) Technology Market is the increasing incorporation of automation and artificial intelligence (AI) to optimize production efficiency and product quality. This integration is transforming traditional BFS processes by enabling real-time monitoring, predictive maintenance, and adaptive control systems that reduce downtime and increase throughput.

- For Instance, leading BFS equipment manufacturers such as Rommelag and Unither are embedding AI-powered sensors and machine learning algorithms into their filling lines to detect inconsistencies early, allowing rapid adjustments without halting production. These systems help maintain sterility and precision during aseptic packaging, crucial for pharmaceuticals and biotech products.

- AI integration also enhances process validation by analyzing large volumes of operational data to identify trends and potential risks. This leads to smarter decision-making and compliance with stringent regulatory standards. Additionally, AI-driven robotics can handle delicate tasks such as vial filling and sealing with higher accuracy and speed, reducing human error and contamination risks.

- The fusion of BFS technology with Industry 4.0 principles allows centralized control and remote monitoring of packaging lines, facilitating seamless integration with broader manufacturing execution systems (MES). This holistic approach supports end-to-end visibility and operational agility, enabling manufacturers to quickly respond to demand fluctuations and supply chain challenges.

- This trend towards intelligent, automated BFS systems is reshaping expectations for aseptic liquid packaging, pushing companies like Catalent and Recipharm to invest heavily in AI-enabled BFS innovations that improve scalability and reduce production costs.

- The demand for BFS technologies featuring AI and automation is surging globally, driven by the pharmaceutical industry’s need for contamination-free, high-speed packaging solutions that ensure product safety and efficiency across both emerging and established markets.

Global Blow-Fill-Seal Technology Market Dynamics

Driver

Growing Need Due to Increasing Demand for Sterile and Efficient Packaging

- The rising global demand for sterile liquid packaging in pharmaceutical, biotech, and healthcare industries is a significant driver boosting the adoption of Blow-Fill-Seal (BFS) technology. BFS offers an efficient, contamination-free method for aseptic packaging that meets strict regulatory requirements.

- For instance, companies such as Rommelag and Catalent have expanded their BFS capacities to meet increasing production needs for vaccines, injectables, and biologics, especially in response to global health challenges such as the COVID-19 pandemic. These developments are expected to propel market growth throughout the forecast period.

- As manufacturers seek faster, more reliable, and cost-effective aseptic packaging solutions, BFS technology’s ability to combine container formation, filling, and sealing in a sterile environment provides a compelling advantage over traditional methods.

- Furthermore, the growing focus on patient safety, product integrity, and shelf-life extension is encouraging pharmaceutical companies to adopt BFS systems more widely. The technology’s compatibility with various container types and sizes also supports its increasing popularity across different applications.

- The rising trend toward single-dose and unit-dose packaging, driven by regulatory guidelines and patient convenience, further fuels BFS technology adoption globally, especially in emerging markets where healthcare infrastructure is rapidly developing.

Restraint/Challenge

Complex Regulatory Compliance and High Capital Investment

- Strict regulatory standards for aseptic processing and packaging impose significant challenges on BFS technology adoption. Compliance with agencies like the FDA, EMA, and WHO requires substantial investment in validation, quality control, and documentation, which can slow down implementation and increase costs.

- For Instance, pharmaceutical companies must navigate complex regulatory landscapes to gain approvals for BFS-packaged products, often involving lengthy and costly clinical trials and inspections. This regulatory burden can deter smaller manufacturers from adopting the technology.

- Additionally, the high initial capital expenditure for BFS machinery, including equipment, cleanroom infrastructure, and automation, represents a significant financial barrier, especially for startups and manufacturers in developing regions. Companies like Recipharm and Unither often highlight the long-term cost savings and efficiency benefits to justify the upfront investment.

- While operating costs are generally lower due to reduced contamination risks and faster production cycles, the perceived financial and technical complexity of BFS systems can hinder widespread adoption in cost-sensitive markets.

- Overcoming these challenges through streamlined regulatory pathways, government incentives, and technological advancements to reduce costs will be critical to sustaining the growth of the global BFS technology market.

Global Blow-Fill-Seal Technology Market Scope

Global blow-fill-seal technology market is segmented on the basis of product, material, end user industry and specification.

- By Product

On the basis of product, the Global Blow-Fill-Seal Technology Market is segmented into bottles, ampoules, vials, and others. The vials segment dominated the market with the largest revenue share of 38.5% in 2024, primarily due to its extensive application in injectable pharmaceuticals, vaccines, and biologics that require sterile and precise dosing. Vials packaged using BFS technology ensure aseptic conditions, reducing contamination risks, which is critical in healthcare.

The ampoules segment is anticipated to witness the fastest CAGR of 19.3% from 2025 to 2032, driven by growing demand for single-dose packaging and personalized medicines. Ampoules’ compact size, ease of use, and compliance with regulatory standards make them increasingly popular, particularly in emerging markets where demand for safe, efficient packaging is rising rapidly.

- By Material

On the basis of material, the Global Blow-Fill-Seal Technology Market is segmented into polyethylene (PE), polypropylene (PP), and others. The polypropylene (PP) segment held the largest market share of 45.7% in 2024, attributed to its excellent chemical resistance, thermal stability, and barrier properties, making it ideal for pharmaceutical and biotech packaging. PP’s durability ensures product integrity and sterility over extended periods.

The polyethylene (PE) segment is projected to witness the fastest CAGR of 18.9% from 2025 to 2032, supported by its cost-effectiveness, flexibility, and increasing adoption in food and beverage sectors. PE’s recyclability and suitability for various container forms also contribute to its growing demand amid rising environmental concerns.

- By End User Industry

The Global Blow-Fill-Seal Technology Market is segmented by end user industry into pharmaceuticals, food and beverages, cosmetics and personal care, and others. The pharmaceuticals segment dominated the market with a revenue share of 52.3% in 2024, fueled by the rising need for sterile liquid packaging of vaccines, biologics, and injectables. BFS technology’s aseptic processing capabilities make it indispensable for this sector.

The cosmetics and personal care segment is expected to register the fastest CAGR of 20.1% from 2025 to 2032, driven by innovations in hygienic packaging and increased consumer preference for tamper-proof containers. The growing demand for premium personal care products further propels BFS adoption in this industry.

- By Specification

On the basis of specification, the Global Blow-Fill-Seal Technology Market is segmented into small volume and large volume packaging. The small volume segment accounted for the largest market share of 57.4% in 2024, due to extensive use in single-dose vials, ampoules, and unit-dose bottles that require aseptic conditions and precise dosing. This segment is critical for pharmaceuticals, especially vaccines and biologics.

The large volume segment is projected to witness the fastest CAGR of 17.5% from 2025 to 2032, driven by rising demand in the food and beverage industry and certain pharmaceutical applications requiring bulk sterile packaging. Large volume BFS packaging offers efficient aseptic solutions for products such as intravenous fluids and liquid nutrition.

Global Blow-Fill-Seal Technology Market Regional Analysis

- North America dominated the Global Blow-Fill-Seal Technology Market with the largest revenue share of 38% in 2024, driven by a robust pharmaceutical industry and increased demand for aseptic packaging solutions.

- Manufacturers and consumers in the region highly prioritize product safety, sterility, and regulatory compliance, which BFS technology effectively delivers in pharmaceuticals, food, and personal care sectors.

- This widespread adoption is further supported by advanced healthcare infrastructure, significant R&D investments, and a strong focus on innovation, establishing BFS technology as the preferred aseptic packaging solution for both commercial and industrial applications.

U.S. Blow-Fill-Seal Technology Market Insight

The U.S. blow-fill-seal technology market captured the largest revenue share of 38% in 2024 within North America, driven by a strong pharmaceutical and biotechnology industry focused on aseptic packaging solutions. The country’s emphasis on vaccine production, biologics, and injectable drugs fuels demand for BFS technology. Increased investments in advanced packaging systems and regulatory compliance further accelerate market growth. Additionally, the growing trend of personalized medicine and sterile liquid packaging in hospitals and clinics supports BFS adoption.

Europe Blow-Fill-Seal Technology Market Insight

The Europe blow-fill-seal technology market is projected to expand at a significant CAGR throughout the forecast period, propelled by stringent regulatory requirements for sterile drug packaging and increasing pharmaceutical manufacturing. The region’s rising focus on patient safety and contamination prevention fosters BFS adoption in injectable drugs and vaccines. The growth is supported by technological advancements and expanding applications across pharmaceuticals, food, and cosmetics sectors, with BFS technology increasingly incorporated into new production lines and facility upgrades.

U.K. Blow-Fill-Seal Technology Market Insight

The U.K. blow-fill-seal technology market is expected to grow steadily during the forecast period, driven by heightened demand for aseptic packaging in the pharmaceutical industry. The country’s commitment to innovation, combined with increasing investments in biologics and vaccine manufacturing, bolsters BFS technology adoption. Furthermore, the U.K.’s regulatory environment and focus on healthcare quality encourage manufacturers to implement advanced aseptic packaging solutions, enhancing market growth.

Germany Blow-Fill-Seal Technology Market Insight

The Germany blow-fill-seal technology market is anticipated to experience robust growth, fueled by the country’s leading pharmaceutical manufacturing sector and strong focus on sustainable, eco-friendly packaging solutions. Germany’s well-established healthcare infrastructure and emphasis on innovation drive the adoption of BFS for sterile liquid packaging. Integration of BFS with Industry 4.0 and automation trends further supports the market, particularly in pharmaceutical and personal care product packaging.

Asia-Pacific Blow-Fill-Seal Technology Market Insight

The Asia-Pacific blow-fill-seal technology market is poised to grow at the fastest CAGR of 25% from 2025 to 2032, driven by rapid urbanization, expanding pharmaceutical production, and rising healthcare expenditure in countries such as China, India, and Japan. Government initiatives to boost vaccine manufacturing and aseptic packaging infrastructure, along with increasing demand for safe, contamination-free packaging in food and cosmetics, contribute to market expansion. The region is also emerging as a major manufacturing hub for BFS equipment, increasing affordability and accessibility.

Japan Blow-Fill-Seal Technology Market Insight

The Japan blow-fill-seal technology market is gaining traction due to the country’s advanced pharmaceutical industry, technological innovation, and aging population requiring specialized drug delivery systems. The demand for high-quality, sterile packaging in hospitals and clinics, combined with integration of BFS technology in smart manufacturing processes, drives market growth. Additionally, Japan’s focus on sustainability and efficient resource use supports BFS adoption in personal care and pharmaceutical sectors.

China Blow-Fill-Seal Technology Market Insight

The China blow-fill-seal technology market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid pharmaceutical industry growth, government support for vaccine and biologic production, and increased focus on sterile packaging solutions. China’s expanding middle class and rising healthcare awareness fuel demand for BFS-packaged products in both urban and rural areas. The country’s role as a global manufacturing hub for BFS machinery and components also strengthens market penetration and technological advancements.

Global Blow-Fill-Seal Technology Market Share

The Blow-Fill-Seal Technology industry is primarily led by well-established companies, including:

- Rommelag (Germany)

- Unither (France)

- HealthStar (U.S.)

- Automatic Liquid Packaging Solutions, LLC (U.S.),

- Weiler Engineering, Inc. (U.S.)

- Pharmapack Co., Ltd. (Taiwan)

- Mahanagar Engineering Pvt. Ltd. (India)

- Catalent, Inc. (U.S.)

- Filling Machines Division (Italy)

- Albasit India Packaging (India)

- Wuxi Jingpai Machinery Co., Ltd. (China)

- Shanghai Sunway International Trade Co., Ltd. (China)

- Hunan FE Pharmaceutical Machinery Co., Ltd. (China)

- Recipharm (Sweden),

- The Ritedose Corporation (U.S.)

- Unicep Packaging (U.S.)

What are the Recent Developments in Global Blow-Fill-Seal Technology Market?

- In April 2023, Rommelag Group, a global leader in blow-fill-seal technology, launched a strategic expansion in South Africa to enhance aseptic packaging capabilities for pharmaceuticals and biologics. This initiative highlights Rommelag’s commitment to addressing regional healthcare needs with advanced, reliable BFS solutions, reinforcing its leadership in the rapidly growing global BFS technology market.

- In March 2023, HealthStar, a key player in aseptic packaging machinery, introduced its latest BFS filling system designed specifically for high-speed production in vaccine manufacturing. This innovative equipment aims to improve throughput and maintain sterility standards, showcasing HealthStar’s focus on delivering cutting-edge solutions for critical healthcare applications.

- In March 2023, Pharmapack Co., Ltd. successfully completed the installation of a BFS line as part of the Shanghai Smart Pharma Initiative, aimed at increasing efficiency and safety in pharmaceutical packaging. This project underscores Pharmapack’s expertise in integrating BFS technology with smart manufacturing processes to support urban healthcare infrastructure development.

- In February 2023, Catalent, Inc., a global contract development and manufacturing organization, announced a partnership with leading vaccine manufacturers to scale up BFS packaging capacity for injectable biologics. This collaboration aims to streamline aseptic packaging processes, enhancing product safety and accelerating time-to-market for critical medicines.

- In January 2023, Recipharm, a major pharmaceutical contract manufacturer, unveiled its upgraded BFS aseptic filling line featuring advanced automation and real-time quality monitoring at the CPhI Worldwide event. The new system reflects Recipharm’s dedication to integrating innovative technologies to improve precision, reduce contamination risk, and meet stringent regulatory standards in drug packaging.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Blow Fill Seal Technology Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Blow Fill Seal Technology Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Blow Fill Seal Technology Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.