Global Body Composition Analyzers Market

Market Size in USD million

CAGR :

%

USD

702.46 million

USD

1,739.27 million

2024

2032

USD

702.46 million

USD

1,739.27 million

2024

2032

| 2025 –2032 | |

| USD 702.46 million | |

| USD 1,739.27 million | |

|

|

|

|

Body Composition Analysers Market Size

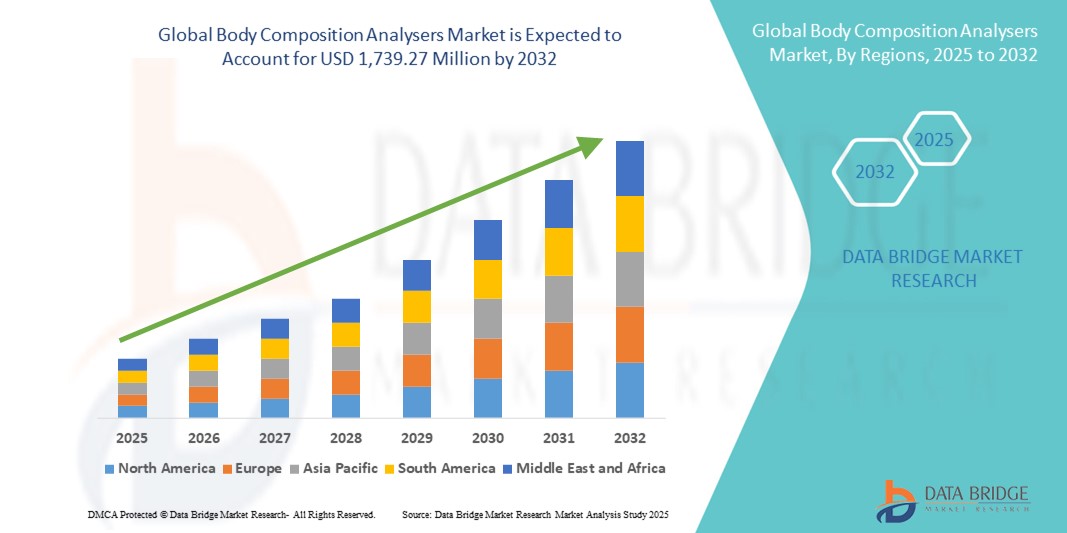

- The global body composition analysers market size was valued at USD 702.46 million in 2024 and is expected to reach USD 1,739.27 million by 2032, at a CAGR of 12.00% during the forecast period

- The market growth is primarily driven by the rising adoption of advanced health monitoring technologies and increasing awareness about personalized fitness and wellness, which are prompting healthcare providers and fitness centers to integrate precise body composition analysis into their services

- In addition, growing consumer focus on preventive healthcare, obesity management, and athletic performance optimization is fueling demand for non-invasive, accurate, and user-friendly body composition analysers. These factors collectively are accelerating the adoption of body composition analysis solutions, thereby substantially propelling the market's growth

Body Composition Analysers Market Analysis

- Body composition analysers, providing precise measurement of body fat, muscle mass, and other key health metrics, are becoming essential tools in fitness centers, healthcare facilities, and research institutions due to their non-invasive nature, accuracy, and integration with health monitoring systems

- The rising demand for body composition analysers is largely driven by increasing health consciousness, growing prevalence of obesity and lifestyle-related disorders, and the adoption of personalized fitness and wellness programs

- North America dominated the body composition analysers market with the largest revenue share of 39.4% in 2024, supported by high awareness of preventive healthcare, widespread adoption of advanced health monitoring devices, and the presence of leading market players offering innovative solutions, with the U.S. witnessing strong uptake in hospitals, gyms, and wellness centers

- Asia-Pacific is expected to be the fastest-growing region in the body composition analysers market during the forecast period due to increasing healthcare investments, rising fitness awareness, and expanding adoption of technologically advanced health monitoring devices in countries such as China, Japan, and India

- Bioelectrical impedance analysis (BIA) segment dominated the body composition analysers market with a market share of 43% in 2024, attributed to its affordability, ease of use, and capability to provide quick, reliable body composition metrics for both clinical and personal applications

Report Scope and Body Composition Analysers Market Segmentation

|

Attributes |

Body Composition Analysers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Body Composition Analysers Market Trends

Advanced Accuracy Through AI and Multi-Parameter Integration

- A notable and growing trend in the global body composition analysers market is the integration of artificial intelligence (AI) and multi-parameter analysis, allowing devices to provide more accurate and personalized health metrics such as fat mass, lean mass, visceral fat, and hydration levels

- For instance, devices such as the InBody 770 and seca mBCA 525 incorporate AI algorithms to improve measurement precision and offer predictive insights based on individual health data. Similarly, Tanita’s AI-enabled models provide detailed analytics on muscle quality and segmental body composition

- AI integration enhances the functionality of body composition analysers by detecting irregular patterns, tracking progress over time, and generating personalized fitness or nutrition recommendations. Some devices also offer predictive health insights, alerting users to potential risks such as sarcopenia or obesity-related conditions

- The incorporation of multi-parameter measurements and connectivity with mobile applications or cloud platforms allows users to manage and visualize their body composition data seamlessly. Through a single interface, users can track long-term trends, set goals, and integrate data with other fitness or medical devices for a comprehensive health overview

- This shift towards more intelligent, interconnected, and data-driven body composition analysers is reshaping consumer and clinical expectations for health monitoring. Companies such as InBody and seca are expanding AI-driven features, including personalized recommendations and cloud-based analytics, to enhance user engagement and decision-making

- The demand for body composition analysers offering advanced AI capabilities, multi-metric insights, and seamless data integration is growing rapidly across healthcare, fitness, and research sectors as consumers and professionals increasingly prioritize precision and actionable health insights

Body Composition Analysers Market Dynamics

Driver

Increasing Health Awareness and Personalized Fitness Focus

- The rising awareness of obesity, lifestyle disorders, and preventive healthcare, along with the growing emphasis on personalized fitness and nutrition plans, is a major driver for the adoption of body composition analysers

- For instance, in March 2024, InBody launched a cloud-connected body composition analyser designed for fitness centers and clinics, offering real-time tracking and personalized recommendations, highlighting the increasing focus on precision health monitoring

- Healthcare providers, gyms, and wellness centers are integrating body composition analysers to provide detailed assessments, track patient or client progress, and support tailored fitness and nutrition plans, which adds value over traditional BMI or weight measurements

- Furthermore, the rising prevalence of obesity and metabolic disorders globally is encouraging institutions to adopt advanced body composition tools for early detection, monitoring, and intervention, thereby fueling market growth

- Convenience, non-invasive operation, rapid results, and connectivity with mobile and cloud applications are additional factors driving widespread adoption in clinical, fitness, and home settings

Restraint/Challenge

High Device Costs and Regulatory Compliance Hurdles

- The relatively high cost of advanced body composition analysers, particularly models with AI capabilities and multi-parameter analysis, can limit adoption among small clinics, gyms, and individual consumers, especially in developing regions

- For instance, premium devices from InBody or seca with advanced analytics and cloud integration often carry a substantial price premium compared to simpler BIA-based devices, making them less accessible for budget-conscious users

- Regulatory compliance and accuracy validation are also challenges, as devices must meet stringent health and safety standards in different regions to ensure reliable measurements, which can slow market entry for new players

- In addition, concerns regarding data privacy and secure storage of personal health metrics are growing as cloud-connected devices become more common, necessitating robust encryption and secure authentication protocols

- Overcoming these challenges through cost optimization, enhanced data security, regulatory approvals, and consumer education on the benefits of advanced body composition analysis will be crucial for sustained market growth

Body Composition Analysers Market Scope

The market is segmented on the basis of product type, compartment model type, and end user.

- By Product Type

On the basis of product type, the body composition analysers market is segmented into bioelectrical impedance analysers (BIA), skinfold callipers, hydrostatic weighing equipment, air displacement plethysmography, dual energy X-ray absorptiometry (DEXA), and others. The bioelectrical impedance analyser (BIA) segment dominated the market with the largest revenue share of 43% in 2024, driven by its affordability, ease of use, and non-invasive measurement capabilities. BIA devices are widely adopted across hospitals, fitness centers, and home environments, providing rapid results for body fat, lean mass, and hydration status. Their compatibility with mobile apps and cloud platforms further enhances data management and tracking, supporting personalized health and fitness programs. The popularity of BIA devices is reinforced by increasing awareness of preventive healthcare and the demand for convenient body composition monitoring tools.

The dual energy X-ray absorptiometry (DEXA) segment is anticipated to witness the fastest growth with a CAGR of 19.3% from 2025 to 2032, fueled by the need for highly accurate assessments of bone density and body composition in clinical and research applications. DEXA systems are increasingly used for osteoporosis evaluation, sports performance monitoring, and metabolic health assessments. The growing adoption of advanced diagnostic tools and the rising investment in healthcare infrastructure are accelerating DEXA adoption, particularly in developed regions and specialized healthcare centers.

- By Compartment Model Type

On the basis of compartment model type, the body composition analysers market is segmented into two-compartment models, three-compartment models, and multi-compartment models. The two-compartment model segment dominated the market with a revenue share of 44.1% in 2024, owing to its simplicity, reliability, and cost-effectiveness for general health and fitness assessments. These models, commonly integrated in BIA devices, allow users to monitor fat and lean mass with sufficient accuracy for clinical and personal use. Hospitals, gyms, and wellness centers often rely on two-compartment models due to their ease of use and quick measurement capabilities, making them the preferred choice for routine assessments.

The multi-compartment model segment is expected to witness the fastest growth during the forecast period, driven by increasing demand in research institutions, specialized healthcare centers, and professional sports facilities. Multi-compartment models provide comprehensive insights by measuring fat, water, protein, and mineral content separately, offering superior accuracy for clinical diagnosis, advanced research, and athletic performance evaluation. Rising investments in personalized healthcare, metabolic studies, and performance optimization programs are fueling adoption in this segment.

- By End User

On the basis of end user, the body composition analysers market is segmented into hospitals, fitness clubs and wellness centres, academic and research centres, and others. The hospitals segment dominated the market with a revenue share of 40.8% in 2024, due to the growing use of body composition analysers in obesity management, chronic disease monitoring, and patient assessment. Hospitals prefer devices that provide accurate, repeatable results and can integrate with electronic health records for streamlined patient care. The increasing focus on preventive healthcare and early diagnosis of metabolic disorders is driving widespread adoption in clinical settings.

The fitness clubs and wellness centres segment is projected to witness the fastest growth with a CAGR of 18.7% from 2025 to 2032, fueled by rising health awareness and demand for personalized fitness programs. Fitness centers are increasingly leveraging body composition analysers to monitor member progress, customize exercise regimens, and provide data-driven guidance, making these devices essential for modern wellness services. The integration of analysers with mobile applications and digital fitness platforms further enhances user engagement and the overall growth potential of this segment.

Body Composition Analysers Market Regional Analysis

- North America dominated the body composition analysers market with the largest revenue share of 39.4% in 2024, supported by high awareness of preventive healthcare, widespread adoption of advanced health monitoring devices

- Consumers and healthcare providers in the region highly value accurate, non-invasive, and rapid body composition assessments that aid in personalized fitness planning, chronic disease management, and preventive healthcare strategies

- This strong adoption is further supported by high healthcare expenditure, technologically advanced healthcare infrastructure, and the presence of key market players offering innovative and connected body composition analysers

U.S. Body Composition Analysers Market Insight

The U.S. body composition analysers market captured the largest revenue share of 79% in 2024 within North America, driven by growing health awareness, rising obesity rates, and the increasing adoption of advanced health monitoring technologies. Consumers and healthcare providers are prioritizing accurate, non-invasive assessment tools for personalized fitness, wellness programs, and clinical management of chronic diseases. The rising demand for connected and cloud-enabled devices, along with the integration of body composition analysers into hospitals, gyms, and wellness centers, further propels the market. Moreover, innovations in AI-driven analytics and mobile application compatibility are contributing to the market’s expansion.

Europe Body Composition Analysers Market Insight

The Europe body composition analysers market is projected to expand at a significant CAGR during the forecast period, fueled by increasing health consciousness, government initiatives promoting preventive healthcare, and a growing elderly population. The rising prevalence of lifestyle-related disorders, combined with the demand for precise body composition monitoring in hospitals, fitness centers, and research facilities, is supporting market growth. European consumers are also drawn to non-invasive, accurate, and easy-to-use analysers that provide actionable health insights. The market is experiencing steady adoption across residential wellness programs, clinical applications, and academic research.

U.K. Body Composition Analysers Market Insight

The U.K. body composition analysers market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing trend of preventive healthcare and fitness monitoring. Rising awareness about obesity, chronic diseases, and personalized nutrition plans encourages the use of analysers in hospitals, clinics, and fitness centers. In addition, the U.K.’s advanced healthcare infrastructure and high consumer inclination toward connected health devices are expected to support market expansion. The integration of analysers with mobile and cloud platforms, offering user-friendly monitoring and reporting, further stimulates adoption in both residential and commercial settings.

Germany Body Composition Analysers Market Insight

The Germany body composition analysers market is expected to expand at a considerable CAGR during the forecast period, propelled by growing health awareness, robust healthcare infrastructure, and the rising adoption of advanced diagnostic technologies. German consumers and healthcare providers value precision, reliability, and integration with electronic health systems, making body composition analysers an essential tool for clinical assessments and wellness monitoring. In addition, the country’s emphasis on preventive healthcare, research, and innovation supports the adoption of advanced analysers in hospitals, fitness centers, and academic institutions.

Asia-Pacific Body Composition Analysers Market Insight

The Asia-Pacific body composition analysers market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by rising health awareness, increasing obesity rates, and expanding investments in healthcare and fitness infrastructure. Countries such as China, Japan, and India are witnessing growing demand for advanced and affordable analysers across hospitals, wellness centers, gyms, and research facilities. Government initiatives promoting preventive healthcare and the digitalization of health monitoring systems further accelerate adoption. In addition, the region’s emergence as a manufacturing hub for health monitoring devices is improving accessibility and affordability.

Japan Body Composition Analysers Market Insight

The Japan body composition analysers market is gaining momentum due to the country’s high health consciousness, aging population, and demand for precise, non-invasive health monitoring tools. The growing prevalence of chronic diseases and interest in personalized fitness and nutrition plans are driving adoption in hospitals, wellness centers, and research institutions. Integration with IoT devices and mobile applications enables real-time tracking and data analysis, enhancing convenience and effectiveness. Moreover, Japan’s focus on preventive healthcare and technology-driven solutions is expected to continue stimulating market growth.

India Body Composition Analysers Market Insight

The India body composition analysers market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, increasing health awareness, and rapid urbanization. Rising prevalence of lifestyle-related diseases and demand for preventive healthcare are fueling adoption in hospitals, fitness centers, and wellness facilities. Government initiatives promoting digital health solutions and the availability of affordable analysers from domestic and international manufacturers are key factors propelling market growth.

Body Composition Analysers Market Share

The Body Composition Analysers industry is primarily led by well-established companies, including:

- Omron Corporation (Japan)

- Hologic Inc. (U.S.)

- GE Healthcare (U.S.)

- InBody Co., Ltd. (South Korea)

- Tanita Corporation (Japan)

- SECA GmbH & Co. KG (Germany)

- COSMED Srl (Italy)

- Bodystat Ltd. (U.K.)

- Charder Electronic Co., Ltd. (Taiwan)

- RJL Systems, Inc. (U.S.)

- Biospace Co., Ltd. (South Korea)

- Maltron International Ltd. (U.K.)

- Evolt 360 (Australia)

- Beurer GmbH (Germany)

- Jawon Medical Co., Ltd. (South Korea)

- BioTekna (Italy)

- Selvas Healthcare (South Korea)

- Swissray International, Inc. (U.S.)

- Shanghai Goldenwell Medical Technology Co., Ltd. (China)

- Xiaomi Corporation (China)

What are the Recent Developments in Global Body Composition Analysers Market?

- In May 2025, Seca released the mBCA Alpha, a compact and portable body composition scanner designed for primary care settings. Utilizing bioelectrical impedance analysis, it provides comprehensive body composition results in just 24 seconds, facilitating early detection of conditions such as sarcopenia and obesity

- In March 2025, Seca introduced the Treatment Tracker, an AI-driven platform that integrates body composition data with patient treatment plans. This innovation enables healthcare providers to monitor clinical interventions and adjust treatments in real-time, aiming to improve patient outcomes by offering personalized car

- In January 2025, InBody participated in CES 2025, unveiling its latest body composition analyzers, including the InBody380 and InBody580. These devices offer enhanced precision and integration capabilities, catering to both professional and consumer markets. The showcase emphasized InBody's commitment to advancing healthcare technology through body composition analysis

- In December 2024, Bruker introduced the minispec LF Series, a benchtop whole-body composition analyzer utilizing TD-NMR technology. This system offers precise, non-destructive measurements of lean and fat tissues in small animal specimens, aiding researchers in longitudinal studies without the need for anesthesia

- In November 2023, the U.S. Army procured 145 InBody 770 devices to be distributed across various military units by January 2024. These advanced analyzers are intended to improve the assessment of service members' body composition, supporting better health and fitness monitoring within the armed forces

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.