Global Body Control Module Market

Market Size in USD Billion

CAGR :

%

USD

33.99 Billion

USD

45.84 Billion

2023

2031

USD

33.99 Billion

USD

45.84 Billion

2023

2031

| 2024 –2031 | |

| USD 33.99 Billion | |

| USD 45.84 Billion | |

|

|

|

|

Body Control Module Market Size

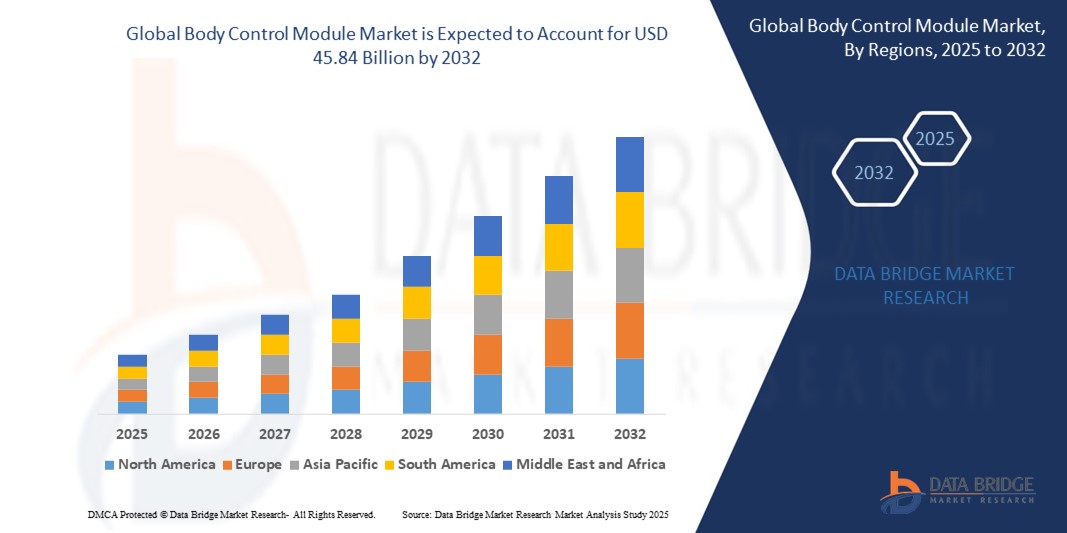

- The global body control module market size was valued at USD 33.99 billion in 2024 and is expected to reach USD 45.84 billion by 2032, at a CAGR of 3.81% during the forecast period

- The market growth is largely fueled by the rising integration of advanced electronics and communication protocols in modern vehicles, driven by the automotive industry’s shift toward electrification, automation, and enhanced user experience

- Furthermore, increasing demand for centralized control of vehicle functions such as lighting, security, comfort, and infotainment is establishing body control modules as a core component in both traditional and electric vehicles. These factors are accelerating the adoption of BCMs across vehicle segments, thereby significantly boosting the market's expansion

Body Control Module Market Analysis

- Body control modules, serving as centralized hubs for managing various electronic functions in vehicles, are becoming increasingly essential in both traditional and electric vehicles due to their role in streamlining communication between different subsystems, enhancing operational efficiency, and enabling advanced vehicle features

- The escalating demand for body control modules is primarily driven by the rapid growth of automotive electronics, rising consumer expectations for connected and feature-rich vehicles, and the industry's transition toward electric and autonomous mobility

- North America dominated the body control module market with a share of 35.5% in 2024, due to the high concentration of automotive OEMs and early adoption of advanced vehicle electronics

- Asia-Pacific is expected to be the fastest growing region in the body control module market during the forecast period due to rapid urbanization, vehicle electrification, and high-volume automotive production across China, India, and Japan

- Passenger car segment dominated the body control module market with a market share of 60.5% in 2024, due to the mass production of consumer vehicles and the increasing integration of electronics for comfort, safety, and convenience. With rising consumer demand for connected and feature-rich vehicles, BCMs are critical in managing a growing number of electronic systems

Report Scope and Body Control Module Market Segmentation

|

Attributes |

Body Control Module Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Body Control Module Market Trends

“Increasing Demand for Vehicle Electronics”

- A significant and accelerating trend in the global body control module (BCM) market is the growing integration of advanced vehicle electronics aimed at enhancing comfort, safety, and convenience through centralized control systems. Modern vehicles, especially electric and premium models, now rely heavily on BCMs to manage multiple subsystems including lighting, climate control, infotainment, and power windows

- For instance, companies such as Continental AG and Robert Bosch GmbH have developed next-generation BCMs capable of handling over-the-air updates and facilitating seamless communication among ECUs, thereby improving vehicle performance and diagnostics. Similarly, Lear Corporation’s Smart BCMs are designed for scalable architecture and can manage complex electrical functions across various vehicle models

- The evolution of BCMs includes the integration of diagnostic and software management capabilities, allowing automakers to remotely monitor system health and improve vehicle uptime. For instance, Denso Corporation has introduced BCMs with enhanced CAN and LIN bus communication interfaces that support real-time data processing and faster response for active safety systems. Furthermore, advanced BCMs contribute to vehicle weight reduction by minimizing wiring complexity, which in turn improves fuel efficiency

- The ability of BCMs to support vehicle electrification is another driver of this trend. In electric vehicles, BCMs play a crucial role in coordinating functions such as battery thermal management, charging control, and energy recovery systems. This capability is leading companies such as Aptiv and ZF Friedrichshafen AG to invest in compact, high-performance BCM platforms suited for EV applications

- This shift toward smarter, more centralized, and software-defined electrical control systems is reshaping how automakers design vehicles, making BCMs a vital component in modern automotive architecture. As a result, demand for BCMs with enhanced electronic capabilities is rapidly growing across both internal combustion engine (ICE) and electric vehicle segments.

- The growing importance of electronics in vehicles—driven by rising consumer expectations, regulatory pressures, and OEM innovations—is significantly boosting the demand for high-performance body control modules across global automotive markets

Body Control Module Market Dynamics

Driver

“Automotive Industry Growth”

- The consistent expansion of the global automotive industry, especially in emerging economies, is a significant driver for the rising demand for body control modules (BCMs), as modern vehicles increasingly depend on electronic systems for comfort, safety, and efficiency

- For instance, in September 2023, Robert Bosch GmbH expanded its BCM production capabilities in India to meet rising local and international automotive demand, signaling strong market momentum. Similarly, Continental AG continues to invest in R&D for scalable BCM solutions tailored to various vehicle segments, including electric and connected vehicles

- As automakers strive to differentiate their offerings through advanced features, BCMs enable centralized control of diverse functions—such as lighting, HVAC, and security—providing a cost-effective and space-saving alternative to decentralized wiring systems

- Furthermore, the rise of EVs and connected cars is intensifying the demand for intelligent electronic control units, where BCMs serve as a crucial hub for managing communication among subsystems and reducing wiring complexity

- The increasing need for efficiency, real-time diagnostics, and enhanced vehicle performance is accelerating OEM reliance on BCM technology, with key players such as Denso Corporation and Lear Corporation actively developing solutions to support the growing electrification and digitalization of vehicles across both mass-market and premium models

Restraint/Challenge

“Supply Chain Disruptions”

- Supply chain disruptions, especially in the sourcing of semiconductors and electronic components, pose a significant challenge to the body control module (BCM) market, impacting production timelines and increasing costs for automotive OEMs

- For instance, the global chip shortage that intensified during 2021–2023 led to manufacturing delays for key players such as Bosch and Denso Corporation, forcing automakers to reduce production or omit non-essential electronic features, including certain BCM functionalities

- The heavy reliance on a limited number of suppliers for specialized microcontrollers and automotive-grade semiconductors exposes the BCM market to vulnerabilities in times of geopolitical tension, natural disasters, or pandemic-induced shutdowns

- To mitigate these risks, companies such as Continental AG and Aptiv are investing in regionalized manufacturing and supplier diversification strategies, but recovery from disruptions remains a slow and costly process

- In addition, fluctuating raw material prices and logistic constraints, particularly in Asia-Pacific—the region responsible for much of the global automotive electronics production—continue to pressure profit margins and delay the rollout of advanced BCM solutions

- Overcoming these challenges will require stronger supply chain resilience, strategic partnerships with semiconductor manufacturers, and long-term inventory planning to ensure consistent BCM availability for a rapidly evolving automotive landscape

Body Control Module Market Scope

The market is segmented on the basis of type, vehicle, application, power distribution, and component.

- By Type

On the basis of type, the body control module market is segmented into CAN Bus and LIN Bus. The CAN Bus segment dominates the largest market revenue share of 36.5% in 2024, owing to its robust communication capabilities, real-time performance, and suitability for complex vehicle functions. CAN Bus systems are widely adopted across both mid-range and premium vehicles due to their reliability in handling critical control functions such as lighting, power windows, and security systems. Their strong resistance to electrical disturbances and superior error detection make them the standard choice for modern vehicles where high-speed communication is vital.

The LIN Bus segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its cost-efficiency and suitability for simpler, non-critical functions. As automotive OEMs strive to reduce costs while maintaining system integrity, LIN Bus modules are increasingly used for applications such as mirror control, seat adjustment, and interior lighting, especially in entry-level and mid-range vehicles.

- By Vehicle

On the basis of vehicle, the body control module market is segmented into Passenger Car, Commercial Car, and Electric Car. The Passenger Car segment accounted for the largest market revenue share of 60.5% in 2024, propelled by the mass production of consumer vehicles and the increasing integration of electronics for comfort, safety, and convenience. With rising consumer demand for connected and feature-rich vehicles, BCMs are critical in managing a growing number of electronic systems.

The Electric Car segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the global shift toward electrification and increased focus on lightweight, software-controlled vehicle architectures. Electric cars require more advanced and efficient electronic control units, and BCMs play a key role in managing battery systems, thermal regulation, and interior functionalities, making them indispensable in EV manufacturing.

- By Application

On the basis of application, the body control module market is segmented into Interior and Exterior. The Interior segment held the largest market revenue share in 2024, owing to the wide range of electronically managed features such as ambient lighting, infotainment systems, climate control, and seat adjustment. As consumers increasingly value comfort and personalization in vehicle cabins, demand for sophisticated BCMs handling these functions continues to grow.

The Exterior segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by advancements in ADAS technologies and exterior lighting systems. Features such as automatic headlights, power mirrors, and keyless entry systems require robust BCMs for precise coordination and control, particularly in premium and autonomous vehicle platforms.

- By Power Distribution

On the basis of power distribution, the body control module market is segmented into Relays and Fuses. The Relays segment held the largest revenue share in 2024, attributed to their ability to manage high current loads efficiently while ensuring safety across multiple circuits. Modern BCMs leverage advanced relay systems to activate and deactivate various electronic components with minimal energy loss, contributing to vehicle efficiency.

The Fuses segment is expected to witness the fastest growth from 2025 to 2032, supported by ongoing innovations in solid-state and resettable fuses. These are increasingly favored for their compact design, durability, and ability to safeguard complex electronic circuits in electric and hybrid vehicles, where electrical protection is paramount.

- By Component

On the basis of component, the body control module market is segmented into Hardware and Software. The Hardware segment dominated the market share in 2024, driven by the physical need for robust, automotive-grade controllers that can endure temperature fluctuations, vibrations, and other harsh operating conditions. The widespread use of microcontrollers, sensors, and power management ICs within BCMs contributes to the segment’s substantial share.

The Software segment is anticipated to register the fastest CAGR from 2025 to 2032, owing to the increasing complexity of vehicle functions and the rising importance of over-the-air updates and diagnostics. As automakers move toward software-defined vehicles, BCM software becomes critical for enabling features such as remote configuration, predictive maintenance, and cybersecurity, driving rapid investment and innovation in this area.

Body Control Module Market Regional Analysis

- North America dominated the body control module market with the largest revenue share of 35.5% in 2024, driven by the high concentration of automotive OEMs and early adoption of advanced vehicle electronics

- The region benefits from increasing demand for passenger and electric vehicles integrated with intelligent systems, where BCMs are critical to controlling functions such as lighting, security, and comfort

- Strong investment in vehicle innovation, coupled with a consumer base accustomed to connected car technologies and stringent vehicle safety norms, continues to fuel BCM market growth across North America

U.S. Body Control Module Market Insight

The U.S. body control module market captured the largest revenue share in 2024 within North America, supported by robust demand for high-performance vehicles and consistent investment in automotive R&D. Leading U.S. automakers are integrating BCMs into both conventional and electric vehicle platforms to enhance efficiency, reduce wiring complexity, and enable advanced features. Rising adoption of software-defined vehicles and over-the-air updates is also driving the shift toward more sophisticated BCMs with embedded software and diagnostic capabilities.

Europe Body Control Module Market Insight

The Europe body control module market is projected to grow at a considerable CAGR during the forecast period, supported by stringent emission and safety standards that promote the adoption of electronics for efficient vehicle management. Growing popularity of electric and hybrid vehicles across the region demands highly reliable BCMs to manage increasingly complex electrical architectures. Furthermore, manufacturers across Germany, France, and the U.K. are focusing on innovation and modular design in BCMs, enabling scalable solutions across multiple vehicle models.

U.K. Body Control Module Market Insight

The U.K. body control module market is expected to expand steadily, fueled by increasing demand for feature-rich passenger vehicles and compliance with evolving safety regulations. As consumer interest in connected cars and electric mobility rises, the integration of intelligent control systems such as BCMs is becoming a standard. Moreover, the presence of automotive design and engineering hubs in the country supports the development of advanced BCM solutions with enhanced functionality and energy efficiency.

Germany Body Control Module Market Insight

The Germany body control module market is anticipated to grow at a notable CAGR, driven by the country's strong automotive manufacturing base and leadership in automotive electronics. German automakers are at the forefront of implementing next-generation BCMs with integrated power distribution, communication protocols, and sensor management. The push toward EVs and autonomous vehicles further boosts the demand for reliable and centralized control modules capable of handling complex electronic functions.

Asia-Pacific Body Control Module Market Insight

The Asia-Pacific body control module market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, vehicle electrification, and high-volume automotive production across China, India, and Japan. Government initiatives supporting EV adoption and smart mobility solutions are accelerating the need for advanced BCMs across vehicle categories. The availability of cost-effective manufacturing and growing demand for compact and mid-size vehicles further promote regional market expansion.

Japan Body Control Module Market Insight

The Japan body control module market continues to expand, supported by the country’s focus on high-tech, energy-efficient vehicles. Japanese automakers are increasingly integrating BCMs with software-controlled architectures to enable seamless connectivity and advanced safety features. In addition, Japan’s strong aftermarket and hybrid vehicle segments create consistent demand for reliable BCMs capable of supporting a wide range of electrical systems and diagnostics tools.

China Body Control Module Market Insight

The China body control module market held the largest revenue share in Asia-Pacific in 2024, propelled by massive domestic automotive production, a booming electric vehicle sector, and the proliferation of smart mobility solutions. Chinese manufacturers are rapidly advancing BCM technology, focusing on affordability, integration, and energy efficiency. As government policies encourage EV adoption and localized production of vehicle electronics, China continues to be a key driver of growth for BCMs across both domestic and export markets.

Body Control Module Market Share

The body control module industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Aptiv (Ireland)

- Lear Corporation (U.S.)

- DENSO CORPORATION (Japan)

- Texas Instruments Incorporated (U.S.)

- Renesas Electronics Corporation (Japan)

- HELLA GmbH & Co. KG. (Germany)

- Visteon Corporation (U.S.)

- ST Microelectronics (Switzerland)

- Infineon Technologies AG (Germany)

- Mitsubishi Electric Corporation (Japan)

- Panasonic Corporation (Japan)

- ROHM Co. (Japan)

- DIAMOND ELECTRIC HOLDINGS LTD. (Japan)

- MAXIM Integrated (U.S.)

Latest Developments in Global Body Control Module Market

- In January 2025, Marelli unveiled its BCM solutions tailored for the Indian automotive market. The system supports power distribution, lighting, and secure gateway functions. In addition, Marelli launched its Body Cluster Control Module (BCCM), integrating BCM with instrument cluster and HMI functions. This innovation is set to enhance cost-efficiency, reduce system complexity, and accelerate BCM adoption in emerging markets such as India

- In October 2023, Continental AG introduced a new generation of body control modules equipped with advanced cybersecurity features and over-the-air update capabilities. This launch strengthens Continental’s position in the premium vehicle segment and highlights the growing demand for secure, software-updatable BCMs, pushing the market toward more intelligent and connected vehicle platforms

- In May 2023, General Assembly Holdings launched its Shiping vehicle BCM solution, leveraging NXP’s S32K344 automotive-grade chip. This development enhances the company’s offerings in Asia-Pacific and reflects the regional trend toward high-performance, chip-based BCM architectures, thereby intensifying competition and innovation in the market

- In May 2022, Renesas and Intel collaborated to create an advanced BCM utilizing Intel's Atom processor, boasting increased power and energy efficiency compared to previous models, while also offering expanded support for features such as ADAS and autonomous driving

- In January 2022, Bosch and Nvidia joined forces to develop a cutting-edge BCM leveraging Nvidia's Drive Orin platform, aiming for heightened power and efficiency over earlier models, along with broader support for functionalities such as ADAS and autonomous driving

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.