Global Body Protection Equipment Market

Market Size in USD Billion

CAGR :

%

USD

3.47 Billion

USD

6.12 Billion

2025

2033

USD

3.47 Billion

USD

6.12 Billion

2025

2033

| 2026 –2033 | |

| USD 3.47 Billion | |

| USD 6.12 Billion | |

|

|

|

|

Body Protection Equipment Market Size

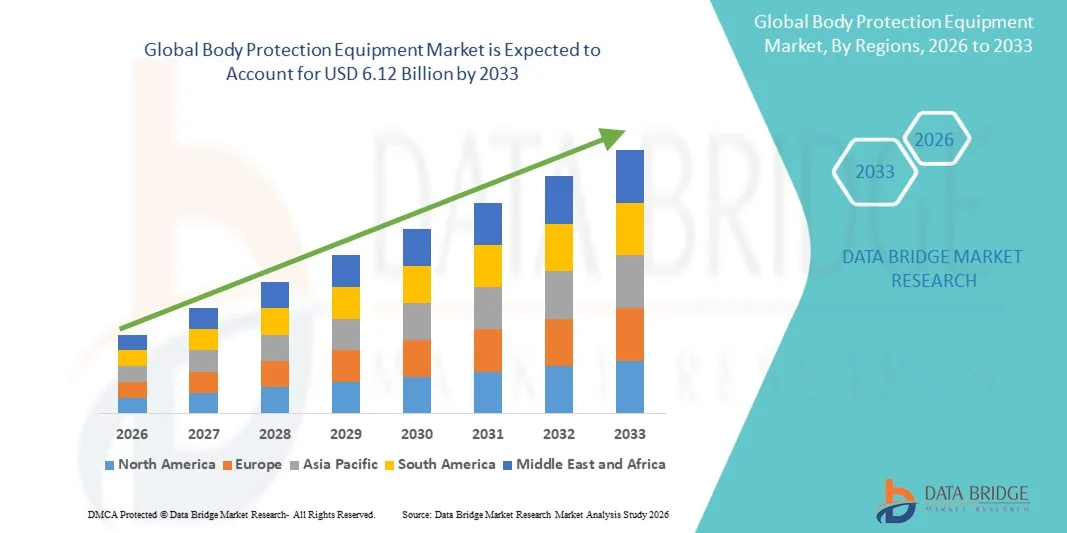

- The global body protection equipment market size was valued at USD 3.47 billion in 2025 and is expected to reach USD 6.12 billion by 2033, at a CAGR of 7.34% during the forecast period

- The market growth is primarily driven by the rising emphasis on occupational safety regulations and the increasing incidence of workplace injuries across manufacturing, construction, and healthcare sectors, fueling demand for advanced protective gear

- In addition, growing awareness regarding worker health, coupled with technological innovations such as lightweight and ergonomic materials, is transforming body protection equipment into a vital component of industrial safety systems. These factors collectively propel market expansion and enhance the industry’s long-term growth trajectory

Body Protection Equipment Market Analysis

- Body protection equipment, including laboratory coats, coveralls, full body suits, vests, and surgical gowns, forms an essential component of workplace safety, offering protection against physical, chemical, and biological hazards across various industrial sectors such as manufacturing, construction, and healthcare

- The rising demand for body protection equipment is primarily driven by increasing workplace safety awareness, stricter regulatory enforcement, and the growing need for durable, comfortable, and compliant protective solutions in high-risk work environments

- North America dominated the body protection equipment market with the largest revenue share of 39.6% in 2025, attributed to stringent OSHA regulations, technological advancements in protective textiles, and a strong presence of leading safety equipment manufacturers across the U.S. and Canada

- Asia-Pacific is anticipated to be the fastest-growing region in the body protection equipment market during the forecast period, fueled by rapid industrial expansion, urbanization, and growing safety mandates in industries such as construction, oil & gas, and manufacturing

- The protective clothing segment dominated the market in 2025 with a share of 42.6%, driven by its extensive use across industrial and healthcare settings to safeguard workers from exposure to heat, chemicals, and contaminants, solidifying its position as a key contributor to market growth

Report Scope and Body Protection Equipment Market Segmentation

|

Attributes |

Body Protection Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Body Protection Equipment Market Trends

Integration of Smart Textiles and Sensor-Based Protective Gear

- A significant and emerging trend in the global body protection equipment market is the integration of smart textiles and embedded sensors that enable real-time health and environmental monitoring, enhancing both safety and performance for workers in hazardous environments

- For instance, DuPont and HexArmor have introduced protective garments with embedded temperature and motion sensors, allowing monitoring of worker exposure to heat and physical strain in real-time. Similarly, companies are developing connected wearables that alert users and supervisors when safety thresholds are breached

- Sensor-enabled body protection equipment provides functionalities such as heart rate tracking, chemical exposure detection, and fatigue monitoring, allowing data-driven decisions to improve workplace safety and reduce accident risks

- Furthermore, the fusion of smart fabrics with IoT technology enables wireless data transmission and integration with centralized safety management systems, ensuring proactive hazard detection and swift response

- The integration of smart technologies in protective gear is reshaping safety protocols across industries, promoting predictive maintenance of equipment and personalized protection solutions. Consequently, manufacturers such as 3M and Honeywell are investing in advanced R&D for intelligent, connected protective clothing with adaptive comfort and real-time monitoring features

- The growing demand for smart, connected, and data-enabled safety gear is accelerating across industries such as construction, mining, and oil & gas, as organizations prioritize advanced worker safety and operational efficiency

Body Protection Equipment Market Dynamics

Driver

Rising Workplace Safety Regulations and Industrial Expansion

- The strengthening of occupational safety regulations and increasing enforcement by authorities such as OSHA and EU-OSHA are driving the widespread adoption of body protection equipment across multiple industries

- For instance, in March 2025, Honeywell expanded its industrial safety portfolio with a new line of lightweight, flame-resistant coveralls designed for high-risk environments, aligning with updated global safety standards

- As industries expand their operational capacities and safety budgets, the need for reliable, high-performance protective clothing continues to rise, ensuring compliance and minimizing injury-related costs

- Furthermore, the growth of sectors such as construction, oil & gas, and chemicals is creating continuous demand for protective apparel that meets evolving safety norms and provides ergonomic comfort

- The introduction of innovative, breathable materials and advanced manufacturing techniques enhances worker comfort and productivity, further encouraging adoption across both developed and emerging markets

- Increasing awareness of employee well-being and the implementation of corporate safety initiatives are fostering sustained investment in body protection equipment globally

- In addition, the rapid expansion of infrastructure projects and industrial automation in developing economies is propelling large-scale procurement of protective clothing and accessories

- Technological advancements such as nanomaterial coatings and antimicrobial fabrics are creating new opportunities for high-performance, multi-functional body protection solutions

Restraint/Challenge

High Product Costs and Regulatory Compliance Complexities

- The high initial cost of advanced body protection equipment, particularly smart or specialized protective clothing, poses a major restraint for small and medium-sized enterprises in cost-sensitive regions

- For instance, advanced sensor-integrated suits and flame-resistant full-body gear require significant R&D and material costs, making them less accessible to smaller organizations with limited safety budgets

- The complexity of meeting diverse regional and international certification standards adds to manufacturers’ regulatory burdens, often resulting in longer product approval timelines and increased compliance expenses

- Furthermore, varying material sourcing requirements and stringent testing protocols across countries can hinder smooth global trade and product standardization for protective equipment suppliers

- The lack of skilled workforce awareness about proper usage and maintenance of body protection equipment further limits optimal adoption and safety outcomes in some developing markets

- Overcoming these challenges through cost optimization, regulatory harmonization, and user education initiatives will be crucial for sustaining global market growth and accessibility

- In addition, fluctuating raw material prices, especially for high-grade synthetic fibers and specialty coatings, can impact product affordability and profit margins for manufacturers. The slow adoption of advanced technologies in traditional industries due to limited digital readiness also restrains the market’s transition toward smart, connected protective solutions

Body Protection Equipment Market Scope

The market is segmented on the basis of product type, application, and end user industries.

- By Product Type

On the basis of product type, the body protection equipment market is segmented into laboratory coats, coveralls, full body suits, surgical gowns, vests and jackets, aprons, and others. The coveralls segment dominated the market with the largest revenue share in 2025, owing to their extensive use across industrial, manufacturing, and construction environments where full-body protection against mechanical, chemical, and particulate hazards is required. Coveralls provide comprehensive coverage and durability, making them essential for high-risk operations. The segment benefits from continuous product innovation, such as flame-retardant, waterproof, and breathable fabrics, which enhance wearer comfort while maintaining safety compliance. Furthermore, the adoption of coveralls in oil & gas and chemical industries remains strong due to stringent workplace safety regulations. Manufacturers are also developing reusable and eco-friendly variants to align with sustainability goals, which further strengthens the market dominance of this segment.

The surgical gowns segment is anticipated to witness the fastest growth from 2026 to 2033, driven by rising demand in healthcare and life sciences sectors due to increased infection control awareness and procedural safety standards. The COVID-19 pandemic accelerated the global focus on medical-grade protective apparel, leading to sustained demand. These gowns offer superior barrier protection against biological contaminants, and manufacturers are investing in advanced materials that ensure both comfort and sterility. In addition, increasing healthcare expenditure, expanding hospital infrastructure, and ongoing innovation in antimicrobial and fluid-resistant textiles are expected to support the rapid growth of this segment globally.

- By Application

On the basis of application, the body protection equipment market is segmented into head, eye and face protection; hearing protection; protective clothing; respiratory protection; protective footwear; fall protection; hand protection; and others. The protective clothing segment dominated the market in 2025 with the largest revenue share of 42.6%, as it forms the core of industrial safety standards across manufacturing, mining, and chemical processing sectors. Protective clothing provides essential coverage against heat, flame, chemicals, and biological agents, ensuring worker safety in hazardous conditions. Increased industrialization and stricter regulatory enforcement by organizations such as OSHA and ISO continue to drive segment demand. The use of lightweight and high-performance fabrics, including aramid fibers and coated textiles, enhances comfort and functionality. Moreover, the rise in workplace automation has spurred demand for adaptable and ergonomic clothing designed to accommodate wearable technology and movement flexibility.

The respiratory protection segment is projected to be the fastest-growing during the forecast period, supported by heightened awareness of airborne hazards and occupational health risks in industries such as oil & gas, mining, and healthcare. Respiratory equipment, including masks and respirators, became increasingly vital during global health emergencies and continues to witness strong demand post-pandemic. For instance, industrial players are investing in multi-layer filtration technologies and reusable respirators that combine comfort with high filtration efficiency. The growing emphasis on employee health protection, coupled with advancements in lightweight, eco-friendly respirator designs, is expected to sustain the segment’s rapid growth through 2033.

- By End User Industries

On the basis of end user industries, the body protection equipment market is segmented into construction, manufacturing, oil and gas, food and beverages, chemicals and petrochemicals, transportation, mining, and others. The manufacturing segment dominated the market in 2025, driven by the large workforce exposure to mechanical hazards, chemical splashes, and high-temperature environments in production facilities. The need to comply with stringent workplace safety regulations and minimize injury-related downtime has led manufacturers to invest heavily in protective apparel. Continuous modernization of production lines and automation has increased the importance of body protection equipment compatible with mobility and ergonomic comfort. In addition, innovations in flame-retardant and chemical-resistant fabrics have further strengthened the adoption of advanced protective gear in the manufacturing industry. The growing focus on worker well-being and corporate sustainability initiatives is also influencing procurement decisions in this sector.

The construction segment is expected to register the fastest growth from 2026 to 2033, driven by global infrastructure expansion, urbanization, and an increasing emphasis on occupational safety training programs. Construction sites expose workers to multiple risks such as falling debris, sharp objects, and environmental hazards, necessitating reliable body protection solutions. For instance, governments across Asia-Pacific and the Middle East have tightened enforcement of construction safety standards, leading to higher PPE adoption. Advancements in lightweight, breathable, and weather-resistant materials are improving comfort and compliance rates among workers. Furthermore, the growing number of smart city projects and large-scale infrastructure investments are expected to propel sustained demand for protective apparel in this segment.

Body Protection Equipment Market Regional Analysis

- North America dominated the body protection equipment market with the largest revenue share of 39.6% in 2025, attributed to stringent OSHA regulations, technological advancements in protective textiles, and a strong presence of leading safety equipment manufacturers across the U.S. and Canada

- Organizations in the region prioritize compliance with occupational safety standards set by OSHA and ANSI, leading to consistent demand for high-performance protective apparel and accessories that ensure worker safety and operational continuity

- This steady adoption is further supported by the presence of major PPE manufacturers, growing investment in industrial automation, and increasing emphasis on worker well-being, positioning body protection equipment as an indispensable element of workplace safety across both established industries and emerging high-risk environments

U.S. Body Protection Equipment Market Insight

The U.S. body protection equipment market captured the largest revenue share of 79% in 2025 within North America, driven by stringent occupational safety standards and the strong presence of industrial and construction sectors. The country’s robust regulatory framework under OSHA mandates consistent adoption of protective apparel and gear to minimize workplace hazards. Rising demand for high-performance materials and ergonomic designs is fueling product innovation. Moreover, increased investment in infrastructure, oil & gas, and healthcare facilities continues to propel the need for reliable protective equipment. The growing focus on sustainability and domestically manufactured safety products further strengthens market expansion across the U.S.

Europe Body Protection Equipment Market Insight

The Europe body protection equipment market is projected to expand at a significant CAGR throughout the forecast period, fueled by strict safety regulations and a strong emphasis on worker health and well-being. The region’s industrialized economies such as Germany, the U.K., and France prioritize compliance with EN and ISO standards, ensuring widespread use of certified protective clothing. Increasing industrial automation, coupled with awareness campaigns on occupational hazards, is enhancing market penetration. The demand for eco-friendly, reusable, and smart protective apparel is gaining momentum across various industries. In addition, the rise of advanced material innovation is transforming Europe’s industrial safety landscape.

U.K. Body Protection Equipment Market Insight

The U.K. body protection equipment market is anticipated to witness notable growth during the forecast period, driven by growing awareness of workplace safety and adherence to stringent Health and Safety Executive (HSE) regulations. The construction, chemical, and food processing industries are major consumers of body protection gear. Rising demand for lightweight, flame-resistant, and chemical-proof protective apparel supports continuous product innovation. Furthermore, government-backed initiatives for worker training and PPE compliance are boosting adoption. The country’s shift toward sustainable materials and digital monitoring wearables is expected to further enhance market expansion.

Germany Body Protection Equipment Market Insight

The Germany body protection equipment market is expected to grow steadily during the forecast period, supported by strong manufacturing and chemical industries with rigorous safety standards. The German government’s commitment to occupational safety and worker protection drives consistent PPE adoption across industrial facilities. Manufacturers are increasingly developing smart textiles and advanced protective suits integrating temperature and chemical sensors. Furthermore, the country’s sustainability-driven approach encourages the use of recyclable and durable materials. High investment in R&D and automation also promotes the adoption of innovative, high-performance protective clothing across industrial and research environments.

Asia-Pacific Body Protection Equipment Market Insight

The Asia-Pacific body protection equipment market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rapid industrialization, expanding construction projects, and stringent workplace safety initiatives. Countries such as China, Japan, and India are witnessing increased enforcement of occupational safety laws and growing awareness of worker protection. Rising foreign investment in manufacturing and mining sectors is further propelling PPE demand. Moreover, local production capabilities and cost-effective manufacturing are making protective equipment more accessible. The region’s evolving safety culture and government-led industrial reforms are reinforcing sustained market growth.

Japan Body Protection Equipment Market Insight

The Japan body protection equipment market is gaining traction due to its advanced industrial infrastructure, strong technological orientation, and emphasis on precision safety. High demand from electronics, chemical, and healthcare sectors is fueling the adoption of specialized protective gear. For instance, Japanese companies are developing smart garments with integrated biometric sensors for real-time worker monitoring. In addition, Japan’s aging workforce has increased the demand for lightweight, comfortable, and ergonomic protective solutions. Government initiatives promoting industrial safety and the adoption of automation-compatible PPE continue to drive growth in the country’s evolving protective equipment market.

India Body Protection Equipment Market Insight

The India body protection equipment market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by expanding industrialization, rapid infrastructure development, and growing awareness of workplace safety. India’s construction, mining, and oil & gas sectors are major drivers of PPE demand, with increasing regulatory compliance under national safety standards. Local manufacturing and cost-effective production of protective apparel are contributing to market growth. Furthermore, initiatives under “Make in India” and smart city projects are creating significant opportunities for PPE suppliers. Rising investments in worker safety programs and adoption of advanced protective textiles are expected to further accelerate market expansion in India.

Body Protection Equipment Market Share

The Body Protection Equipment industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Honeywell International Inc. (U.S.)

- DuPont (U.S.)

- ANSELL LTD (Australia)

- Globus (U.K.)

- MSA Safety Incorporated (U.S.)

- Kimberly-Clark Worldwide, Inc. (U.S.)

- Lakeland Inc (U.S.)

- HexArmor (U.S.)

- JSP Limited. (U.K.)

- uvex group (Germany)

- Portwest UC (Ireland)

- Drägerwerk AG & Co. KGaA, (Germany)

- Avon Protection (U.K.)

- Safariland, LLC (U.S.)

- Radians, Inc. (U.S.)

- Tenacious Holdings, Inc. (U.S.)

- Bullard (U.S.)

- KARAM Safety Pvt. Ltd. (India)

What are the Recent Developments in Global Body Protection Equipment Market?

- In January 2025, Dyneema® (owned by Avient Corporation) launched its third-generation ballistic materials HB330 and HB332 designed for hard armour inserts, helmets and vehicle armour, enabling body armour systems roughly 45% lighter while maintaining protection

- In October 2024, the U.S. Army unveiled its “Next Generation Advanced Bomb Suit” (EOD equipment) that integrates body armour (including the MSV vest) plus sensors, cameras and mobility improvements increasing survivability by ~72% and being 5% lighter than previous versions

- In July 2024, Globus Group published a news piece highlighting the trend of modern PPE gear with improved comfort, design and advanced technologies (e.g., anti-fog eyewear, advanced textiles, eco-friendly materials) which reflects ongoing innovation in body protection equipment

- In January 2024, DuPont and Point Blank Enterprises announced an exclusive partnership to offer new body armour made with Kevlar® EXO™ aramid fibre for North American state and local law enforcement agencies. The collaboration emphasises lighter weight, increased flexibility and comfort while meeting elevated ballistic standard

- In January 2024, Point Blank Enterprises introduced a complete new duty-gear product line under its “Point Blank Duty Gear” brand, aiming to modernise patrol officer and SWAT operator equipment lighter, better design and function, leveraging advanced materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.