Global Body Worn Camera Market

Market Size in USD Billion

CAGR :

%

USD

1.29 Billion

USD

5.47 Billion

2024

2032

USD

1.29 Billion

USD

5.47 Billion

2024

2032

| 2025 –2032 | |

| USD 1.29 Billion | |

| USD 5.47 Billion | |

|

|

|

|

Body-Worn Camera Market Size

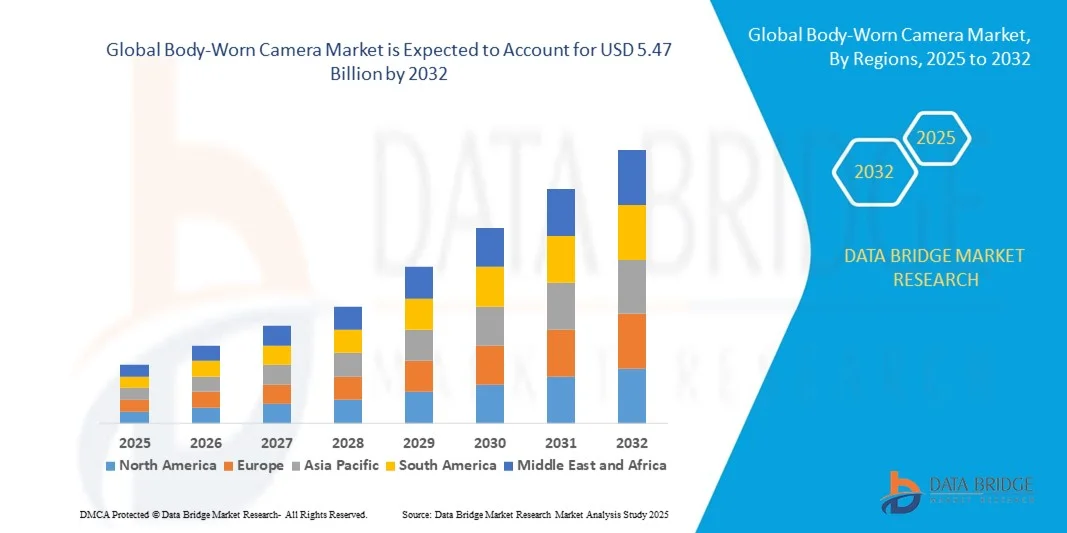

- The global body-worn camera market size was valued at USD 1.29 billion in 2024 and is expected to reach USD 5.47 billion by 2032, at a CAGR of 19.80% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced surveillance technologies and the growing emphasis on public safety and accountability across law enforcement and defense sectors, driving the demand for body-worn cameras to record real-time evidence and ensure transparency in operations

- Furthermore, rising investments by government agencies in body-worn camera programs for law enforcement and emergency response units are accelerating market expansion, as these devices enhance situational awareness, officer protection, and evidence management efficiency

Body-Worn Camera Market Analysis

- Body-worn cameras, designed to capture video and audio during field operations, are becoming essential tools for law enforcement, military, and security personnel due to their ability to document interactions, deter misconduct, and support legal proceedings

- The growing demand for these cameras is primarily driven by the increasing focus on transparency and accountability in policing, technological advancements such as cloud storage and AI-based video analytics, and the rising adoption of digital evidence management systems across public safety organizations

- North America dominated the body-worn camera market with a share of 43.2% in 2024, due to increasing adoption across law enforcement, defense, and private security sectors

- Asia-Pacific is expected to be the fastest growing region in the body-worn camera market during the forecast period due to rapid urbanization, expanding law enforcement modernization programs, and increasing safety concerns in countries such as China, Japan, and India

- Recording segment dominated the market with a market share of 65.3% in 2024, due to its wide adoption among law enforcement and security personnel for evidence collection and incident documentation. The segment benefits from its cost-effectiveness, ease of storage, and reliability in environments with limited or no network connectivity. Many agencies prefer this type for ensuring uninterrupted footage capture without dependency on real-time transmission, supporting post-event analysis and legal verification. Continuous advancements in battery efficiency and storage capacity further enhance its demand for long-hour operations

Report Scope and Body-Worn Camera Market Segmentation

|

Attributes |

Body-Worn Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Body-Worn Camera Market Trends

Integration of AI and Cloud-Based Video Analytics

- The global body-worn camera market is witnessing a strong trend toward the integration of artificial intelligence (AI) and cloud-based video analytics, enabling more efficient data processing and intelligent insights extraction from recorded footage. This technological convergence allows for automated tagging, object detection, and behavior analysis to enhance evidence management and operational efficiency

- For instance, Axon Enterprise, Inc. has been at the forefront of integrating cloud solutions with AI-capable camera systems such as the Axon Body 4, which offers automatic video categorization and real-time situational intelligence through its Evidence.com platform. This integration enables faster review and retrieval of footage while supporting secure cloud storage and scalable data access for law enforcement agencies

- The adoption of AI-powered analytics allows cameras to detect unusual behavior, recognize facial identities, and flag critical incidents automatically, improving situational awareness and timely decision-making. Such capabilities minimize manual review efforts and help security personnel respond quickly to potential threats during patrol or crowd monitoring tasks

- Cloud-based platforms are increasingly being preferred for their scalability and accessibility, allowing agencies to manage large volumes of video data without the constraints of on-premise storage infrastructure. In addition, these systems improve inter-department collaboration by enabling secure data sharing across authorized users

- Companies are focusing on refining AI algorithms and integrating features such as real-time alerts and natural language processing to enhance operational insights from recorded video. For instance, Motorola Solutions is advancing its AI suite to provide real-time analytics through its WatchGuard system, improving both accountability and situational reaction capabilities

- The continued evolution of AI and cloud-based analytics is transforming body-worn cameras from passive recording tools into proactive intelligence systems. This trend is expected to define the market’s technological trajectory over the coming years, aligning with the growing demand for transparency, evidence integrity, and operational efficiency in law enforcement and security applications

Body-Worn Camera Market Dynamics

Driver

Rising Demand for Law Enforcement Transparency

- Growing awareness of civil rights, increasing public scrutiny, and the need for accountability in law enforcement activities are major factors driving the adoption of body-worn cameras. These devices help document real-time interactions between officers and the public, fostering trust and reinforcing transparency across agencies

- For instance, in 2024, the New York Police Department expanded its deployment of Axon body-worn cameras to over 25,000 officers to ensure unbiased documentation of field operations. Such initiatives demonstrate how law enforcement organizations leverage camera technology to promote accountability and address community concerns about fairness and responsible policing

- The use of body-worn cameras acts as both a deterrent and evidentiary support mechanism, reducing false complaints and improving the accuracy of investigations. In addition, video evidence captured through these devices can serve as crucial proof in legal proceedings, supporting officers and departments when addressing misconduct allegations

- Rising government mandates and funding programs for body-worn camera implementation in various countries are accelerating adoption rates. In regions such as North America and Europe, several police departments are upgrading legacy video systems to advanced AI-enabled solutions for higher-quality footage and seamless data synchronization

- The increasing emphasis on transparency, community engagement, and ethical policing continues to strengthen the market outlook for body-worn cameras. As public expectation for accountability rises, this driver will remain one of the most important forces sustaining demand growth in the forecast period

Restraint/Challenge

Data Privacy and Storage Management Concerns

- One of the primary restraints in the body-worn camera market is the challenge of maintaining data privacy and secure storage management due to the large and sensitive volume of information captured during operations. The footage may contain personally identifiable details, posing potential risks if mishandled or stored without sufficient protection

- For instance, in 2023, reports emerged of data handling issues faced by smaller U.S. law enforcement departments that lacked sufficient cybersecurity protocols on their cloud storage systems. Such cases highlighted vulnerabilities in securing digital evidence and underscored the need for advanced privacy measures in video data management solutions

- Managing vast amounts of recorded video introduces complexities in data categorization, retention policies, and retrieval systems. Agencies must comply with regional data protection regulations such as GDPR and CJIS standards while ensuring quick accessibility for authorized users during investigations

- High storage costs and bandwidth requirements associated with continuous recording further strain departmental resources. In addition, variations in local data retention mandates make it difficult for agencies to standardize workflows, leading to operational inefficiencies in multi-jurisdictional enforcement bodies

- To overcome these challenges, companies are advancing encryption protocols, secure cloud frameworks, and automated data management tools to balance transparency with privacy protection. The market’s sustained growth will rely heavily on building trust in data governance frameworks and providing scalable, compliant solutions that ensure both evidence preservation and individual privacy safeguards

Body-Worn Camera Market Scope

The market is segmented on the basis of recording type, resolution, and end-user.

- By Recording Type

On the basis of recording type, the body-worn camera market is segmented into recording and live streaming and recording. The recording segment dominated the market with the largest revenue share of 65.3% in 2024, driven by its wide adoption among law enforcement and security personnel for evidence collection and incident documentation. The segment benefits from its cost-effectiveness, ease of storage, and reliability in environments with limited or no network connectivity. Many agencies prefer this type for ensuring uninterrupted footage capture without dependency on real-time transmission, supporting post-event analysis and legal verification. Continuous advancements in battery efficiency and storage capacity further enhance its demand for long-hour operations.

The live streaming and recording segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising emphasis on real-time situational awareness in public safety and defense operations. Live-streaming body cameras enable command centers to monitor ongoing incidents, improving response coordination and accountability. The integration of 4G, 5G, and cloud technologies has strengthened connectivity and made live transmission more reliable, even in high-mobility scenarios. Increasing adoption across transportation monitoring and emergency response sectors further supports this segment’s expansion as agencies seek faster, data-driven decision-making capabilities.

- By Resolution

On the basis of resolution, the body-worn camera market is segmented into Full HD, HD, 4K, and others. The Full HD segment dominated the market in 2024, attributed to its balance between video clarity, storage efficiency, and affordability. Full HD body cameras are widely used by police forces and private security firms for their ability to capture detailed footage without excessive data consumption. The segment also benefits from compatibility with existing data management systems and the ability to deliver clear visuals for evidence verification. Continuous improvements in Full HD sensors and low-light performance further solidify its position as the preferred standard across professional applications.

The 4K segment is expected to record the fastest growth from 2025 to 2032, driven by the increasing demand for ultra-high-resolution video for forensic analysis and enhanced visual documentation. 4K body cameras provide superior image detail that aids in accurate identification and review during investigations. The falling cost of 4K-enabled hardware and advancements in compression technology are making high-resolution capture more accessible to law enforcement and industrial sectors. The growing focus on accountability, transparency, and accurate incident reproduction continues to propel the adoption of 4K cameras, particularly in urban policing and high-security environments.

- By End User

On the basis of end user, the body-worn camera market is segmented into law enforcement, military, transportation, sports & leisure, and others. The law enforcement segment dominated the market with the largest revenue share in 2024, driven by increasing global initiatives for police accountability and public transparency. Body-worn cameras are being widely deployed across police departments to record interactions, deter misconduct, and strengthen evidence documentation. Government funding programs and mandates in countries such as the U.S. and U.K. have accelerated large-scale deployments. The growing integration of AI analytics for behavior monitoring and facial recognition further enhances the utility of body-worn cameras for law enforcement applications.

The military segment is expected to witness the fastest growth from 2025 to 2032, supported by rising adoption of wearable surveillance technologies for tactical and operational visibility. Body-worn cameras in the defense sector enhance situational awareness, mission documentation, and real-time communication between field personnel and command centers. The demand is further propelled by the development of rugged, lightweight, and high-durability cameras suited for extreme environments. Integration with IoT and edge analytics for live intelligence gathering strengthens the use of such systems in training and combat operations, driving robust growth in this segment.

Body-Worn Camera Market Regional Analysis

- North America dominated the body-worn camera market with the largest revenue share of 43.2% in 2024, driven by increasing adoption across law enforcement, defense, and private security sectors

- The region’s emphasis on transparency, accountability, and evidence-based operations has led to strong integration of body-worn cameras in public safety initiatives

- High investments in digital infrastructure, coupled with advanced cloud and AI-based analytics platforms, further enhance their utility and efficiency in incident management and monitoring

U.S. Body-Worn Camera Market Insight

The U.S. body-worn camera market captured the largest revenue share in 2024 within North America, fueled by rising government mandates for police accountability and the surge in digital evidence collection. Law enforcement agencies are increasingly equipping officers with high-resolution, connected cameras to record field interactions and reduce misconduct claims. The growing adoption of cloud storage, AI-driven analytics, and video management software further supports operational transparency. In addition, federal funding programs and ongoing public demand for safety reforms are accelerating widespread deployment across states.

Europe Body-Worn Camera Market Insight

The Europe body-worn camera market is projected to grow at a notable CAGR during the forecast period, driven by stringent data protection laws and the growing focus on public safety and surveillance efficiency. European countries are deploying wearable recording systems for policing, transportation safety, and security monitoring across cities. Increasing awareness of digital evidence management and its legal admissibility is encouraging adoption across law enforcement and government sectors. The region’s strong regulatory framework and technological maturity contribute significantly to steady market expansion.

U.K. Body-Worn Camera Market Insight

The U.K. body-worn camera market is anticipated to grow at a substantial CAGR through the forecast period, supported by the country’s early adoption of wearable recording solutions for police forces and local authorities. Government-backed initiatives promoting officer transparency and citizen protection are major drivers. The growing deployment of cloud-based video management platforms and AI-powered analytics for footage review is also transforming evidence handling. Rising demand across retail, transport, and event security segments further amplifies market growth in the U.K.

Germany Body-Worn Camera Market Insight

The Germany body-worn camera market is expected to witness solid growth, driven by the country’s commitment to innovation, safety, and regulatory compliance. German police departments and private security firms are increasingly adopting body cameras for operational efficiency and accountability. The strong emphasis on data privacy and high-quality recording standards aligns with the integration of locally produced, privacy-compliant technologies. The adoption of cameras for industrial safety monitoring and public transport services also contributes to market expansion in Germany.

Asia-Pacific Body-Worn Camera Market Insight

The Asia-Pacific body-worn camera market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, expanding law enforcement modernization programs, and increasing safety concerns in countries such as China, Japan, and India. Governments in the region are investing in digital policing and surveillance programs to enhance real-time monitoring and operational readiness. The availability of affordable devices from regional manufacturers, combined with the rise of smart city initiatives, is propelling the market’s rapid expansion across both public and private sectors.

Japan Body-Worn Camera Market Insight

The Japan body-worn camera market is gaining traction due to strong technological adoption, urban security initiatives, and the rising need for efficient public safety systems. Japanese agencies are integrating high-resolution, lightweight wearable cameras with IoT and cloud-based analytics for real-time situational assessment. The country’s focus on advanced, compact designs and reliable connectivity aligns with the growing demand from both law enforcement and commercial users. Moreover, the increasing use of such devices in transportation, healthcare, and corporate security contributes to steady market growth.

China Body-Worn Camera Market Insight

The China body-worn camera market accounted for the largest revenue share within Asia-Pacific in 2024, driven by the country’s large-scale deployment across law enforcement, traffic control, and public surveillance projects. The government’s ongoing investments in smart city infrastructure and AI-based monitoring systems are fueling adoption. Domestic manufacturers’ ability to produce cost-effective, high-performance devices further enhances accessibility across regions. The rising need for accountability, coupled with increased deployment in commercial and industrial safety applications, continues to strengthen China’s leadership position in the regional market.

Body-Worn Camera Market Share

The body-worn camera industry is primarily led by well-established companies, including:

- Axon Enterprise, Inc. (U.S.)

- Panasonic Corporation (Japan)

- Motorola Solutions, Inc. (U.S.)

- GoPro, Inc. (U.S.)

- Transcend Information, Inc. (Taiwan)

- WatchGuard Technologies, Inc. (U.S.)

- Reveal Media (U.K.)

- Digital Ally Inc. (U.S.)

- COBAN Technologies, Inc. (U.S.)

- Pinnacle Response (U.K.)

- Sony Corporation (Japan)

- CP PLUS International (India)

- Wireless CCTV (U.K.)

- NICE (Israel)

- Intrensic (U.S.)

- VIEVU LLC (U.S.)

- ShenZhen AEE Technology Company (China)

- Veho (U.K.)

- Wolfcom Enterprises (U.S.)

Latest Developments in Global Body-Worn Camera Market

- In August 2025, Axon reported Q2 2025 revenue of USD 669 million, marking a 33% year-over-year increase and raising its full-year guidance, reflecting the surging global demand for connected public safety solutions. This financial performance underscores the company’s strengthening presence in the body-worn camera market, driven by expanding law enforcement adoption and enhanced integration of cloud-based evidence management systems. The growth also signals accelerating investment and technological innovation in digital policing solutions worldwide

- In July 2025, Japan’s National Police Agency initiated a pilot program deploying 76 body-worn cameras across 13 prefectures to assess the feasibility of nationwide implementation. This trial highlights Japan’s growing commitment to leveraging wearable surveillance technologies to enhance transparency, accountability, and public safety operations. The initiative is expected to drive regional market growth and encourage further adoption of connected camera systems in Asia-Pacific

- In May 2025, Motorola Solutions announced record Q1 2025 sales of USD 2.5 billion and introduced the SVX body-camera-radio hybrid, a product designed to improve real-time communication and situational awareness. This innovation demonstrates the company’s strategic focus on integrating multiple public safety tools into a single device, reinforcing its position in the competitive body-worn camera market. The launch is anticipated to boost adoption among emergency response and law enforcement agencies seeking multifunctional, connected solutions

- In July 2022, Digital Ally Inc. secured an order for 176 FirstVuPro body cameras from the Kansas Department of Wildlife and Parks, intended for deployment among law enforcement personnel across the state. This development emphasizes the growing penetration of body-worn cameras in specialized public safety departments beyond traditional policing. The order strengthens Digital Ally’s market presence and highlights the increasing recognition of wearable recording devices as vital tools for field accountability and incident documentation

- In May 2022, Axon and Fūsus formed a strategic partnership to enhance the integration between Axon Respond and the Fūsus Real Time Crime Center in the Cloud (RTC3) platform. This collaboration aims to improve real-time situational awareness, data sharing, and coordinated response for public safety agencies. The alliance reinforces Axon’s ecosystem of connected technologies and accelerates the development of intelligent, cloud-based crime management systems, strengthening the company’s influence in the evolving body-worn camera landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Body Worn Camera Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Body Worn Camera Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Body Worn Camera Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.