Global Body Worn Sensors Market

Market Size in USD Million

CAGR :

%

USD

137.70 Million

USD

794.91 Million

2024

2032

USD

137.70 Million

USD

794.91 Million

2024

2032

| 2025 –2032 | |

| USD 137.70 Million | |

| USD 794.91 Million | |

|

|

|

|

Body Worn Sensors Market Size

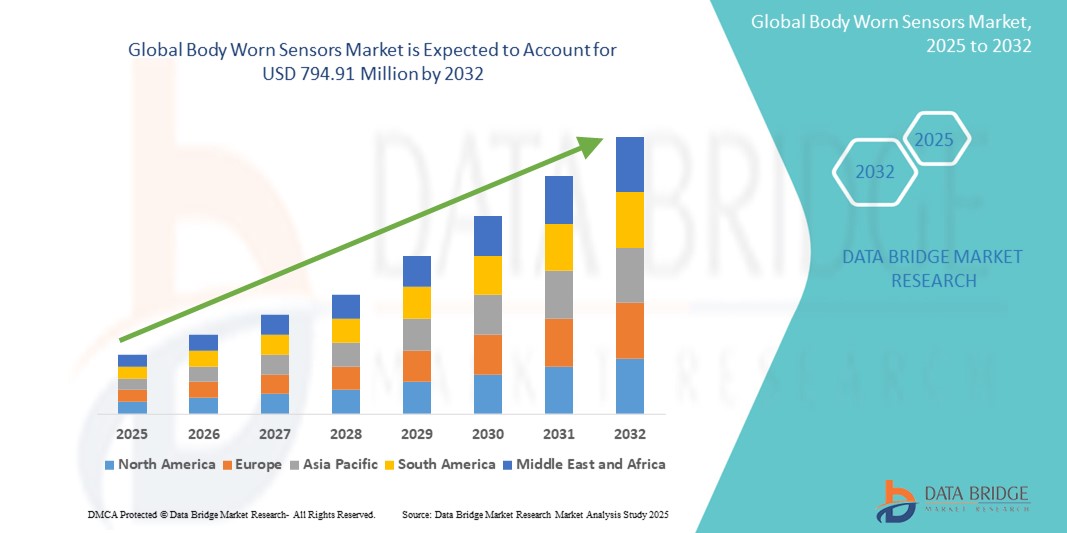

- The global body worn sensors market size was valued at USD 137.70 million in 2024 and is expected to reach USD 794.91 million by 2032, at a CAGR of 24.5% during the forecast period

- The market expansion is primarily driven by the increasing integration of wearable technologies and advancements in sensor accuracy, enabling real-time health monitoring and data collection across various sectors including healthcare, sports, and occupational safety

- Furthermore, growing consumer preference for convenient, non-invasive health tracking devices and the rising emphasis on personalized healthcare solutions are positioning body worn sensors as essential tools for continuous monitoring and early detection. These combined trends are accelerating adoption and fueling robust growth within the body worn sensors industry

Body Worn Sensors Market Analysis

- Body worn sensors, designed to monitor physiological and movement data in real-time, are becoming essential tools in healthcare, fitness, and occupational safety sectors due to their ability to provide continuous, accurate, and non-invasive tracking of vital signs and physical activity

- The rising adoption of wearable health technologies, increasing awareness of preventive healthcare, and demand for remote patient monitoring solutions are the primary factors driving the growing market for body worn sensors

- North America dominates the body worn sensors market with the largest revenue share of 40.5% in 2024, characterized by advanced healthcare infrastructure, high adoption rates of wearable devices, and significant investments in research and development

- Asia-Pacific is expected to be the fastest-growing region in the body worn sensors market during the forecast period due to rapid urbanization, rising disposable incomes, expanding healthcare access, and increasing adoption of digital health technologies in countries such as China, India, and Japan

- Wearable patch segment dominates the body worn sensors market with a market share of 43.2% in 2024, favoured for its comfort, ease of use, and ability to continuously monitor various health parameters without interrupting daily activities

Report Scope and Body Worn Sensors Market Segmentation

|

Attributes |

Body Worn Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Body Worn Sensors Market Trends

“Transforming Health Monitoring with Connected Devices”

- A rapidly growing trend in the global body worn sensors market is the increasing integration with intelligent digital assistants and voice-controlled platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit. This combination is significantly improving user experience by offering easier access to health data and device management

- For instance, some advanced body worn sensor devices now connect seamlessly with popular voice assistants, enabling users to retrieve health metrics, receive alerts, or adjust settings using simple voice commands. This hands-free operation is especially valuable for individuals with limited mobility or busy lifestyles

- Integration with smart ecosystems also enables personalized health insights and automated notifications, enhancing proactive health management. Some devices can detect unusual health patterns and notify users or caregivers promptly, ensuring timely interventions

- The ability to control body worn sensors alongside other smart home devices—such as lighting, thermostats, and security systems—through a unified platform provides users with a streamlined, connected living environment. This centralized management boosts convenience and encourages continuous use of health monitoring technologies

- This move toward smarter, more interconnected sensor systems is raising user expectations for wearable health devices. Companies such as Fitbit and Garmin are incorporating voice control and intelligent features to offer automatic health tracking adjustments and seamless integration with popular smart home platforms

- Demand for body worn sensors featuring intuitive voice control and smart ecosystem compatibility is expanding quickly across healthcare, fitness, and consumer wellness sectors, driven by consumers’ desire for convenience, real-time health insights, and comprehensive digital health management

Body Worn Sensors Market Dynamics

Driver

“Increasing Demand Driven by Growing Health Awareness and Technological Advancements”

- The rising focus on health monitoring and fitness tracking among consumers, combined with rapid technological innovations, is a key driver propelling the demand for body worn sensors globally

- For instance, in early 2024, Fitbit launched a new line of advanced wearable sensors that offer continuous health monitoring, encouraging widespread adoption in both consumer health and clinical applications. Such initiatives by leading companies are expected to accelerate the body worn sensors market growth during the forecast period

- Consumers are increasingly seeking wearable devices that provide real-time data on vital signs, activity levels, and chronic condition management, enabling proactive health decisions and better disease management

- Furthermore, the growing integration of body worn sensors with smartphones, cloud platforms, and health apps is enhancing data accessibility and user engagement, making these devices a crucial part of personalized healthcare ecosystems

- The increasing popularity of fitness tracking, remote patient monitoring, and telehealth services further boosts the demand for body worn sensors across various demographics and healthcare settings. The rising trend of DIY health management and improved affordability of wearable sensor technology also contribute significantly to market expansion

Restraint/Challenge

“Data Privacy Concerns and High Device Costs Limit Market Penetration”

- Privacy issues related to the collection, storage, and sharing of sensitive health data from body worn sensors present a major challenge to widespread acceptance. Users are often concerned about unauthorized access and misuse of personal health information

- Several reported incidents of data breaches in healthcare IoT devices have made some potential customers hesitant to adopt wearable health monitoring technologies

- Addressing these privacy concerns requires stringent data encryption, secure transmission protocols, and transparent user consent frameworks. Companies such as Garmin and Apple emphasize robust security features to reassure users and build trust

- In addition, the relatively high cost of advanced body worn sensor devices compared to traditional health monitoring tools may limit adoption among price-sensitive consumers, especially in emerging markets. While basic fitness trackers are becoming more affordable, devices offering sophisticated biometric and medical-grade monitoring often carry premium prices

- Although prices are gradually decreasing with technological advancements and economies of scale, the perception of high cost and privacy risks can slow market growth, particularly among older or less tech-savvy users

- Overcoming these challenges through enhanced data security measures, public awareness campaigns on privacy best practices, and the development of cost-effective sensor options will be critical for sustained growth in the body worn sensors market

Body Worn Sensors Market Scope

The body worn sensors market is segmented on the basis of sensor types, application, care setting, type, device placement, and end-user.

• By Sensor Types

On the basis of sensor types, the body worn sensors market is segmented into pressure sensors, motion sensors, temperature sensors, image sensors, position sensors, medical-based sensors, and others. The pressure sensors segment dominates the market with a revenue share of 35.7% in 2024, driven by its broad application in health monitoring and fitness devices for tracking vital parameters such as blood pressure and respiration.

Motion sensors segment is expected to witness the fastest CAGR of 22.4% from 2025 to 2032, fueled by increasing demand in sports, healthcare, and rehabilitation monitoring.

• By Application

On the basis of application, the body worn sensors market is segmented into fitness and wellness, infotainment, healthcare and medical, clinical setting, and industrial and military. The healthcare and medical segment held the largest revenue share of 42.1% in 2024, supported by the rising adoption of body worn sensors for chronic disease management and remote patient monitoring.

The fitness and wellness segment is projected to grow at the highest CAGR of 23.5% during the forecast period, driven by the popularity of wearable fitness trackers and smartwatches.

• By Care Setting

On the basis of care setting, the body worn sensors market is segmented into hospital, home, outpatient clinic, and long-term care facility. The home care segment accounts for the largest market share of 38.9% in 2024, reflecting the growing trend of remote patient monitoring and home-based health management.

Hospitals are expected to experience robust growth with a CAGR of 20.2% from 2025 to 2032, driven by increased integration of body worn sensors in critical care and continuous monitoring systems.

• By Type

On the basis of type, the body worn sensors market is segmented into biosensors, smart watches, wearable patches, hand worn terminals, smart clothing, and others. Wearable patch segment dominated the market with a market share of 43.2% in 2024, favoured for its comfort, ease of use, and ability to continuously monitor various health parameters without interrupting daily activities.

Wearable patches are also anticipated to record the fastest growth rate at 24.1% CAGR, benefiting from advancements in flexible electronics and their use in continuous health monitoring.

• By Device Placement

On the basis of device placement, the body worn sensors market is segmented into body wear, eye wear, foot wear, wrist wear, and others. Wrist wear leads the market with a share of 45.6% in 2024, primarily attributed to the popularity of smartwatches and fitness bands worn on the wrist.

Body wear devices such as smart clothing and patches are expected to grow rapidly at a CAGR of 21.8%, expanding applications in sports and healthcare sectors.

• By End-User

On the basis of end-user, the body worn sensors market is segmented into manufacturing, retail, trade and transportation, government and public utilities, healthcare, media and entertainment, banking and financial services, telecommunication, information technology, and others. The healthcare sector held the largest market share of 40.8% in 2024, driven by the adoption of body worn sensors for patient monitoring and health diagnostics. The manufacturing sector is projected to witness the fastest CAGR of 19.9%, owing to growing usage of wearable sensors for worker safety and productivity monitoring.

Body Worn Sensors Market Regional Analysis

- North America dominates the body worn sensors market with the largest revenue share of 40.5% in 2024, driven by rising demand for wearable health monitoring devices and advancements in sensor technology

- Consumers and healthcare providers in the region increasingly prioritize real-time health data tracking, remote patient monitoring, and fitness management, boosting adoption across hospitals, home care, and outpatient settings

- The growth is further fueled by high healthcare expenditure, widespread smartphone penetration, and strong investments from key industry players focusing on AI-enabled and multi-sensor body worn devices, positioning the region as a leader in innovation and adoption

U.S. Body Worn Sensors Market Insight

The U.S. body worn sensors market captured the largest revenue share of 79.3% in 2024 within North America, driven by rapid adoption of wearable health monitoring devices and increased focus on remote patient care. The growing demand for fitness tracking, chronic disease management, and integration with mobile health applications further fuels market expansion. Technological innovations, including advanced biosensors and multi-functional wearable devices, are boosting consumer interest and healthcare provider adoption alike.

Europe Body Worn Sensors Market Insight

The Europe body worn sensors market is expected to grow at a significant CAGR over the forecast period, propelled by stringent health and safety regulations and rising awareness about preventive healthcare. Increased urbanization and digital health initiatives encourage the adoption of wearable medical devices across residential and clinical settings. The demand is notably high in countries such as Germany, France, and the U.K., where government programs support telehealth and remote monitoring solutions.

U.K. Body Worn Sensors Market Insight

The U.K. body worn sensors market is forecasted to expand at a robust CAGR, driven by the rise in chronic diseases and the National Health Service's push for digital health technologies. The demand for wearable devices that assist in real-time monitoring and elderly care is growing rapidly. Moreover, strong e-commerce infrastructure and increasing consumer tech literacy are contributing to market penetration in both healthcare and fitness sectors.

Germany Body Worn Sensors Market Insight

The Germany’s body worn sensors market is anticipated to register a healthy CAGR, fueled by the country’s advanced healthcare infrastructure and emphasis on innovation. Increasing investments in smart medical devices and growing adoption of wearable biosensors for chronic disease management support the market. The preference for eco-friendly and energy-efficient sensor technologies aligns with Germany’s sustainability goals, promoting the integration of wearable sensors in both clinical and home care environments.

Asia-Pacific Body Worn Sensors Market Insight

The Asia-Pacific body worn sensors market is poised for the fastest growth, with a CAGR of 24.2% from 2025 to 2032. This growth is driven by rapid urbanization, rising disposable incomes, and expanding healthcare infrastructure in countries such as China, Japan, and India. Government initiatives promoting digital health and smart healthcare devices are accelerating adoption. In addition, APAC’s role as a manufacturing hub for wearable sensor technologies increases affordability and accessibility for a broad consumer base.

Japan Body Worn Sensors Market Insight

The Japan’s body worn sensors market is gaining momentum due to its technologically advanced population and a growing elderly demographic requiring continuous health monitoring. The integration of wearable sensors with IoT platforms for smart homes and healthcare facilities is a key growth factor. Demand is further supported by government programs aimed at improving elderly care and reducing hospital stays through remote monitoring.

China Body Worn Sensors Market Insight

The China body worn sensors market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by an expanding middle class, rapid urbanization, and high smartphone penetration. The country's strong focus on smart cities and digital health solutions, along with competitive domestic manufacturers, fosters widespread use of body worn sensors in healthcare, fitness, and industrial applications. Affordable pricing and government subsidies for wearable health devices further propel market growth across residential and commercial sectors.

Body Worn Sensors Market Share

The body worn sensors industry is primarily led by well-established companies, including:

- Siemens (Germany)

- General Electric Company (U.S.)

- Sensirion AG (Switzerland)

- Heimann Sensor GmbH (Germany)

- Dexter Research Center (U.S.)

- CARRE TECHNOLOGIES INC. (Canada)

- Isansys Ltd. (India)

- MBIENTLAB INC (U.S.)

- Adidas AG (Germany)

- Analog Devices, Inc. (U.S.)

- TDK Corporation (Japan)

- ZOLL Medical Corporation (U.S.)

- Allegro MicroSystems, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

Latest Developments in Global Body Worn Sensors Market

- In April 2023, Honeywell International Inc. launched a next-generation body-worn sensor system designed for first responders and industrial workers. The new system integrates real-time environmental monitoring with biometric data tracking to enhance safety and situational awareness. This launch highlights Honeywell’s commitment to advancing wearable technology that improves worker health and operational efficiency

- In March 2023, Garmin Ltd. announced the release of its latest multisensor wearable device featuring advanced physiological monitoring, including heart rate variability, blood oxygen saturation, and stress tracking. The device is targeted at both fitness enthusiasts and healthcare providers, aiming to bridge the gap between consumer wearables and clinical-grade monitoring

- In February 2023, Bosch Sensortec GmbH introduced a new compact, low-power body-worn sensor module that combines motion sensing with environmental awareness capabilities. This innovation is aimed at enhancing wearable devices' performance in medical, sports, and safety applications, supporting the growing demand for multifunctional health monitoring tools

- In January 2023, Xsens Technologies B.V. partnered with a leading sports analytics company to integrate its motion capture body-worn sensors into professional athlete training programs. This collaboration focuses on improving real-time biomechanical feedback and injury prevention through enhanced sensor accuracy and data analytics

- In January 2023, Medtronic plc received FDA clearance for its innovative body-worn continuous glucose monitoring sensor designed for diabetes management. The device offers improved accuracy, longer wear time, and real-time data sharing with healthcare providers, underlining Medtronic’s commitment to advancing patient-centric wearable medical technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.