Global Bone Substitutes Market

Market Size in USD Billion

CAGR :

%

USD

3.67 Billion

USD

6.31 Billion

2024

2032

USD

3.67 Billion

USD

6.31 Billion

2024

2032

| 2025 –2032 | |

| USD 3.67 Billion | |

| USD 6.31 Billion | |

|

|

|

|

Bone Substitutes Market Size

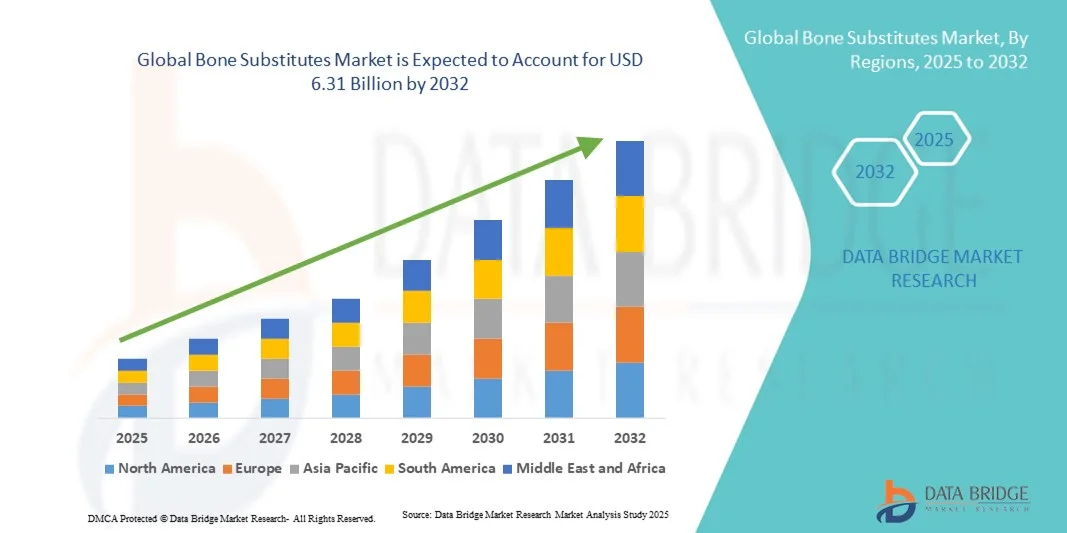

- The global bone substitutes market size was valued at USD 3.67 billion in 2024 and is expected to reach USD 6.31 billion by 2032, at a CAGR of 7.00% during the forecast period

- The market growth is largely fueled by the rising incidence of orthopedic conditions, such as bone fractures, infections, and tumors, along with the increasing number of orthopedic surgeries worldwide. Growing adoption of synthetic substitutes and new product approvals by regulatory authorities are further accelerating market expansion

- Furthermore, rising demand for biocompatible, safe, and effective bone graft solutions in both spinal and orthopedic applications is establishing bone substitutes as the preferred choice for surgeons and patients. These converging factors are driving market adoption, thereby significantly boosting the industry's growth

Bone Substitutes Market Analysis

- Bone substitutes, including allografts, autografts, and synthetic grafts, are increasingly vital in orthopedic and spinal surgeries due to their ability to support bone regeneration, reduce donor site complications, and enhance surgical outcomes in both trauma and elective procedures

- The escalating demand for bone substitutes is primarily fueled by the rising incidence of orthopedic conditions, increasing number of spinal fusion and reconstructive surgeries, and growing awareness of advanced grafting materials among surgeons and patients

- North America dominated the bone substitutes market with the largest revenue share of 42.6% in 2024, characterized by high surgical volumes, advanced healthcare infrastructure, and a strong presence of key market players. The U.S. is witnessing substantial growth in synthetic and allograft adoption, driven by technological advancements and approvals of novel bone graft products

- Asia-Pacific is expected to be the fastest growing region in the bone substitutes market during the forecast period due to increasing healthcare expenditure, growing number of orthopedic surgeries, and rising awareness of modern grafting techniques

- Allograft segment dominated the bone substitutes market with a market share of 60.7% in 2024, driven by its widespread clinical use, proven safety, and strong acceptance among surgeons for spinal and orthopedic applications

Report Scope and Bone Substitutes Market Segmentation

|

Attributes |

Bone Substitutes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Bone Substitutes Market Trends

Increasing Adoption of Synthetic and 3D-Printed Bone Grafts

- A significant and accelerating trend in the global bone substitutes market is the growing use of synthetic and 3D-printed bone grafts, which offer enhanced biocompatibility, faster healing, and customizable shapes for complex orthopedic procedures

- For instance, 3D-printed tricalcium phosphate scaffolds are being used in spinal fusion surgeries to precisely match patient-specific anatomical defects, improving surgical outcomes and reducing recovery time

- These advanced bone substitutes can be engineered to incorporate growth factors or bioactive molecules, promoting faster osteointegration and tissue regeneration compared to conventional grafts

- The integration of additive manufacturing technology in bone substitutes allows for the production of highly porous and patient-specific implants, enabling surgeons to tailor treatments to complex bone defects

- This trend towards personalized, high-performance grafting solutions is reshaping clinical expectations in orthopedic and spinal surgery. Consequently, companies such as Stryker and Medtronic are developing synthetic and 3D-printed bone graft solutions for spine and orthopedic applications

- The demand for synthetic and 3D-printed bone substitutes is increasing rapidly across both hospital and outpatient surgical settings, as clinicians seek improved patient outcomes and reduced donor site complications

Bone Substitutes Market Dynamics

Driver

Rising Incidence of Orthopedic Conditions and Surgeries

- The increasing prevalence of fractures, spinal disorders, and bone-related diseases, coupled with the rising number of orthopedic and reconstructive surgeries, is a significant driver for the heightened demand for bone substitutes

- For instance, in 2024, Medtronic reported increased usage of synthetic grafts in spinal fusion procedures, reflecting the growing reliance on advanced graft materials in surgical practice

- As the global population ages and the incidence of osteoporosis and trauma-related fractures rises, bone substitutes offer reliable and safe alternatives to autografts, reducing donor site morbidity

- Furthermore, the growing preference for minimally invasive procedures and outpatient surgeries is driving the adoption of ready-to-use bone substitutes that simplify surgical workflows

- Increasing awareness among surgeons and patients about the benefits of allografts and synthetic grafts, combined with regulatory approvals of new products, is further boosting market adoption

- Hospitals and specialized orthopedic centers are increasingly integrating bone substitutes into standard care protocols, enhancing surgical efficiency and patient outcomes

Restraint/Challenge

High Costs and Regulatory Compliance Hurdle

- The relatively high cost of advanced bone substitutes compared to traditional autografts or local bone harvesting poses a significant challenge to broader market adoption, particularly in price-sensitive regions

- For instance, complex synthetic or 3D-printed grafts for spinal surgeries can cost several times more than conventional graft materials, limiting accessibility in developing countries

- Regulatory requirements for clinical trials, safety testing, and approvals can delay product launches and increase development costs, posing barriers for new entrants

- In addition, variations in reimbursement policies across regions can impact the affordability and adoption of advanced bone graft products in hospitals and clinics

- While manufacturers are working to optimize production costs and improve affordability, price remains a critical consideration for healthcare providers and patients asuch as

- Overcoming these challenges through cost-effective manufacturing, streamlined regulatory processes, and insurance coverage expansion will be essential for sustained market growth

Bone Substitutes Market Scope

The market is segmented on the basis of product, end user, and application.

- By Product

On the basis of product, the bone substitutes market is segmented into autotransplantation, allografts, synthetic, and xenotransplantation. The allografts segment dominated the market with the largest revenue share of 60.7% in 2024, driven by their wide availability, proven safety profile, and established clinical acceptance among surgeons. Allografts reduce the need for donor site harvesting and associated complications, making them a preferred choice in spinal fusion and orthopedic reconstruction procedures. Surgeons often favor allografts for their versatility across multiple applications and predictable outcomes. The segment also benefits from consistent regulatory approvals and strong distribution networks, ensuring availability in both hospitals and specialty clinics. In addition, advancements in sterilization and processing techniques have improved graft safety, further strengthening demand. The combination of clinical familiarity and ease of use continues to solidify allografts as the dominant product in the bone substitutes market.

The synthetic segment is anticipated to witness the fastest growth rate of 7.5% CAGR from 2025 to 2032, fueled by increasing demand for customizable, biocompatible grafts with reduced risk of disease transmission. Synthetic substitutes, including hydroxyapatite, tricalcium phosphate, and bioactive glass, offer tailored porosity and mechanical properties for specific surgical needs. For instance, synthetic grafts are increasingly used in minimally invasive spinal procedures where autografts or allografts may be impractical. The ongoing innovation in bioactive and composite materials also enhances osteointegration, driving adoption among orthopedic surgeons. Furthermore, rising awareness of synthetic graft benefits among patients and healthcare providers is accelerating market penetration. These factors make synthetic substitutes the fastest-growing product segment globally.

- By End User

On the basis of end user, the bone substitutes market is segmented into hospitals and specialty clinics. The hospitals segment dominated the market in 2024 due to the high volume of orthopedic and spinal surgeries conducted in these settings, along with advanced surgical infrastructure and availability of specialized surgical teams. Hospitals also benefit from established supply chains and regulatory compliance frameworks that facilitate easy procurement of bone substitutes. Surgeons prefer hospitals for complex procedures that require high-quality grafts and precise instrumentation. Hospitals’ focus on patient outcomes and reduced postoperative complications further drives the adoption of allografts and synthetic substitutes. Moreover, hospital purchasing policies often include bulk procurement, enhancing cost-efficiency and availability. The combination of procedure volume, advanced infrastructure, and skilled professionals cements hospitals as the dominant end user in the market.

Specialty clinics are expected to witness the fastest CAGR from 2025 to 2032, fueled by the rise of outpatient orthopedic and spine centers offering minimally invasive procedures. These clinics increasingly adopt ready-to-use allografts and synthetic substitutes to reduce surgical time and enhance patient convenience. For instance, specialized spinal clinics use pre-packaged synthetic grafts for outpatient spinal fusion surgeries, improving workflow efficiency. The growing number of such clinics in developed and emerging markets also expands the adoption of innovative bone graft materials. In addition, cost-effectiveness, faster recovery times, and patient preference for outpatient care are accelerating growth in this segment.

- By Application

On the basis of application, the bone substitutes market is segmented into spinal fusion, joint reconstruction, foot and ankle, and others. The spinal fusion segment held the largest revenue share of 60.1% in 2024, driven by the high prevalence of spinal disorders and increasing number of fusion procedures globally. Spinal fusion surgeries require reliable bone grafts to ensure structural stability and promote bone healing, making allografts and synthetic substitutes the preferred choices. Hospitals and specialty clinics increasingly rely on advanced grafts to reduce complications such as non-union and infection. For instance, allograft corticocancellous grafts are widely used in multi-level spinal fusions for their proven effectiveness. The segment also benefits from innovations in minimally invasive techniques and instrumentation, further boosting graft adoption. The combination of high procedural volume, clinical effectiveness, and surgeon preference underpins spinal fusion as the dominant application segment.

The joint reconstruction segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing orthopedic surgeries for knee, hip, and shoulder replacement procedures. Rising incidences of osteoarthritis, trauma, and sports injuries drive demand for bone grafts in joint reconstruction to ensure proper implant integration and bone repair. Synthetic and allograft substitutes are preferred in these procedures due to their ability to provide structural support and enhance recovery. For instance, synthetic bone void fillers are increasingly used in knee arthroplasty to fill defects and improve outcomes. The segment’s growth is further accelerated by the expansion of outpatient orthopedic centers and rising awareness of advanced grafting options among surgeons.

Bone Substitutes Market Regional Analysis

- North America dominated the bone substitutes market with the largest revenue share of 42.6% in 2024, characterized by high surgical volumes, advanced healthcare infrastructure, and a strong presence of key market players. The U.S. is witnessing substantial growth in synthetic and allograft adoption, driven by technological advancements and approvals of novel bone graft products

- Surgeons and hospitals in the region highly value the clinical effectiveness, safety, and availability of allografts and synthetic bone substitutes, which reduce donor site complications and improve patient outcomes in spinal fusion and joint reconstruction procedures

- This widespread adoption is further supported by strong regulatory frameworks, well-established supply chains, and the presence of key market players such as Medtronic, Stryker, and NuVasive, establishing bone substitutes as a preferred solution in hospitals and specialty clinics across North America

U.S. Bone Substitutes Market Insight

The U.S. bone substitutes market captured the largest revenue share of 38% in 2024 within North America, fueled by the high volume of orthopedic and spinal surgeries and the increasing prevalence of musculoskeletal disorders. Hospitals and specialty clinics are prioritizing advanced allografts and synthetic grafts to improve patient outcomes and reduce donor site complications. The growing preference for minimally invasive procedures, combined with rising awareness of synthetic and 3D-printed graft solutions, further propels market growth. Moreover, strong regulatory approvals and a well-established healthcare infrastructure are significantly contributing to the market's expansion.

Europe Bone Substitutes Market Insight

The Europe bone substitutes market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising incidence of orthopedic conditions and the growing number of reconstructive surgeries. Increasing urbanization and healthcare infrastructure development are fostering the adoption of bone substitutes. European healthcare providers are also drawn to the clinical effectiveness, safety, and reduced recovery times offered by allografts and synthetic grafts. The region is experiencing significant growth across hospitals and specialty clinics, with bone substitutes being incorporated into both spinal fusion and joint reconstruction procedures.

U.K. Bone Substitutes Market Insight

The U.K. bone substitutes market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of minimally invasive orthopedic and spinal surgeries and increasing patient awareness of advanced grafting solutions. In addition, the growing prevalence of bone-related disorders is encouraging hospitals and specialty clinics to adopt ready-to-use allografts and synthetic substitutes. The U.K.’s strong healthcare system and focus on patient outcomes are expected to continue to stimulate market growth, particularly in spinal fusion and joint reconstruction applications.

Germany Bone Substitutes Market Insight

The Germany bone substitutes market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of advanced grafting materials and growing demand for high-quality orthopedic care. Germany’s well-developed healthcare infrastructure, combined with its emphasis on innovation and clinical research, promotes the adoption of allografts and synthetic substitutes, particularly in hospitals. The integration of bone substitutes into standard surgical protocols is also becoming increasingly prevalent, with a strong preference for safe and effective solutions aligning with local clinical standards.

Asia-Pacific Bone Substitutes Market Insight

The Asia-Pacific bone substitutes market is poised to grow at the fastest CAGR of 8.5% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising healthcare expenditure, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards modern orthopedic treatments, supported by government healthcare initiatives and rising awareness of bone graft benefits, is driving adoption. Furthermore, as APAC emerges as a manufacturing hub for synthetic and allograft products, the affordability and accessibility of bone substitutes are expanding to a wider patient base.

Japan Bone Substitutes Market Insight

The Japan bone substitutes market is gaining momentum due to the country’s aging population, high surgical standards, and demand for effective bone graft solutions. The Japanese market places significant emphasis on improving patient recovery and surgical outcomes, and the adoption of allografts and synthetic grafts is driven by the increasing number of spinal fusion and joint reconstruction procedures. Integration of advanced grafting solutions with minimally invasive surgical techniques is fueling growth. Moreover, Japan’s healthcare focus on safety and precision is such as to spur demand for clinically proven and easy-to-use bone substitutes in both hospital and specialty clinic settings.

India Bone Substitutes Market Insight

The India bone substitutes market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country's expanding healthcare infrastructure, rising orthopedic surgeries, and growing middle-class population. India stands as one of the fastest-growing markets for advanced bone graft materials, and allografts and synthetic substitutes are becoming increasingly popular in hospitals and specialty clinics. Government initiatives to promote modern orthopedic care, the availability of cost-effective graft options, and strong domestic and international manufacturing presence are key factors propelling the market in India.

Bone Substitutes Market Share

The Bone Substitutes industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Zimmer Biomet (U.S.)

- Stryker (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Smith & Nephew (U.K.)

- DePuy Synthes Companies (U.S.)

- Integra LifeSciences Holdings Corporation (U.S.)

- Wright Medical Group N.V. (U.S.)

- AlloSource, Inc. (U.S.)

- NuVasive, Inc. (U.S.)

- B. Braun SE (Germany)

- Geistlich Pharma AG (Switzerland)

- Bioventus LLC (U.S.)

- LifeNet Health (U.S.)

- RTI Surgical Holdings, Inc. (U.S.)

- Collagen Matrix, Inc. (U.S.)

- Botiss Biomaterials GmbH (Germany)

- Graftys (France)

- Kuros Biosciences AG (Switzerland)

- Tissue Regenix Group plc (U.K.)

What are the Recent Developments in Global Bone Substitutes Market?

- In September 2025, Researchers at Sungkyunkwan University (SKKU) developed a handheld device that 3D prints synthetic bone grafts directly onto living tissue during surgery. Utilizing biodegradable polymer sticks infused with hydroxyapatite, the device creates scaffolds that promote natural bone growth. In 12-week trials, the technique showed improved bone healing without inflammation or tissue damage

- In June 2025, The U.S. FDA approved a new synthetic bone graft substitute developed by Orthofix Medical Inc. This graft combines bioresorbable materials with osteoinductive properties, aiming to enhance bone healing in spinal fusion surgeries. The approval marks a significant advancement in synthetic graft technology

- In April 2024, Medtronic's INFUSE™ Bone Graft for the transforaminal lumbar interbody fusion (TLIF) indication received Breakthrough Device Designation from the FDA. This designation is intended for devices that have the potential to provide more effective treatment or diagnosis of life-threatening or irreversibly debilitating conditions

- In October 2023, Orthofix Medical Inc. received FDA 510(k) clearance for its advanced bioactive synthetic graft, OsteoCove. This graft is designed for use in spine and orthopedic procedures, offering superior bone-forming capabilities and best-in-class handling characteristics. The product is now commercially available in both putty and strip configurations

- In August 2022, Stryker introduced OsteoSet® resorbable beads, synthetic calcium sulfate beads for bone grafting. These beads are mixed and molded at the point of use to support new bone regeneration by acting as a passive osteoconductive scaffold for native bone to remodel

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.