Global Bookbinding Materials Market

Market Size in USD Billion

CAGR :

%

USD

8.99 Billion

USD

11.47 Billion

2024

2032

USD

8.99 Billion

USD

11.47 Billion

2024

2032

| 2025 –2032 | |

| USD 8.99 Billion | |

| USD 11.47 Billion | |

|

|

|

|

Bookbinding Materials Market Size

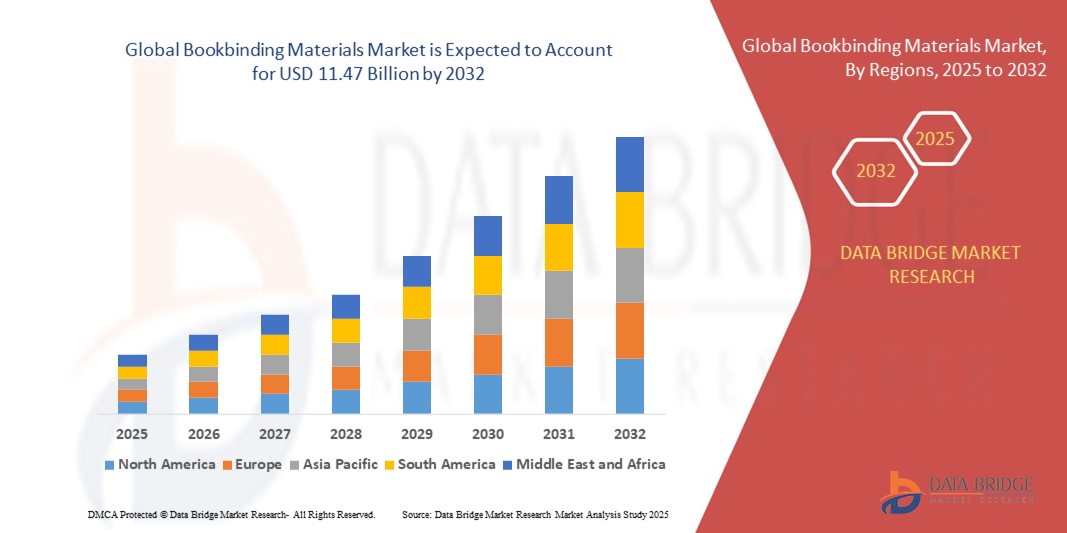

- The global bookbinding materials market size was valued at USD 8.99 billion in 2024 and is expected to reach USD 11.47 billion by 2032, at a CAGR of 3.1% during the forecast period

- The market growth is largely fuelled by the rising demand for printed books across educational institutions, publishing houses, and commercial printing, as well as advancements in eco-friendly and recyclable binding materials

- The increasing use of bookbinding materials in packaging applications, such as luxury boxes and promotional materials, is also supporting market expansion by diversifying end-use demand

Bookbinding Materials Market Analysis

- The market is witnessing steady growth owing to the resurgence of interest in physical books and premium binding for limited editions and customized publications

- Technological developments in adhesive and coating materials, along with a shift towards sustainable and durable binding solutions, are contributing to long-term market expansion

- Asia-Pacific dominated the bookbinding materials market with the largest revenue share in 2024, driven by the expanding education sector, strong presence of domestic publishers, and cost-effective manufacturing capabilities.

- North America region is expected to witness the highest growth rate in the global bookbinding materials market, driven by the resurgence of independent publishing, increased focus on sustainable materials, and consistent investments in high-end print media production

- The adhesive bonded segment held the largest revenue share in 2024, driven by its widespread use in mass-market books, magazines, and catalogs. Its cost-effectiveness and ability to support high-speed production lines make it the preferred choice for commercial printers and publishers. In addition, advancements in adhesive formulations have improved binding strength and durability, further supporting its market dominance

Report Scope and Bookbinding Materials Market Segmentation

|

Attributes |

Bookbinding Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Customized and Premium Binding Solutions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bookbinding Materials Market Trends

Sustainable and Eco-Friendly Binding Materials Gaining Traction

- The bookbinding materials market is witnessing a significant shift toward sustainable and eco-friendly products, driven by rising environmental awareness and stricter global regulations. Publishers, printers, and institutions are increasingly opting for biodegradable adhesives, recycled paper boards, and water-based coatings to reduce their carbon footprint and align with sustainability goals

- The demand for recyclable and non-toxic bookbinding materials is particularly strong in educational publishing and government-funded print initiatives. Institutions are encouraging vendors to comply with green procurement policies, which has boosted innovation in eco-certified raw materials

- Manufacturers are responding to this trend by investing in R&D to develop durable, green alternatives without compromising on performance. Bio-based polymers and renewable backing substrates are being adopted in mainstream production lines, increasing availability and lowering costs for sustainable bookbinding options

- For instance, in 2023, several leading bookbinding manufacturers in Europe launched FSC-certified product lines featuring 100% recycled board and low-VOC adhesives, targeting schools, libraries, and public sector publishers. These lines received positive feedback for both print quality and environmental compliance

- Although adoption is rising, success in this segment will require further innovation in material strength, print compatibility, and cost efficiency. Strong collaboration across supply chains is essential to scale sustainable bookbinding across global markets

Bookbinding Materials Market Dynamics

Driver

Revival of Print Media and Growth of Academic Publishing

• Despite digital disruption, print books continue to maintain a stronghold in educational and literary segments, fueling demand for bookbinding materials. Academic institutions and libraries are expanding their print collections, especially in regions where digital access is limited or costly. This has led to increased bulk orders for textbooks, journals, and academic resources requiring durable binding

• Consumers continue to value the tactile experience and longevity of printed materials, particularly in gift editions, limited prints, and premium publications. The durability and aesthetic appeal of hardcovers and sewn bindings are drawing attention in high-end and specialty publishing sectors

• Developing countries are experiencing a surge in literacy and educational infrastructure, creating steady demand for printed textbooks and learning materials. Governments are allocating budgets for public school resources, ensuring long-term support for the bookbinding industry

• For instance, in 2022, the Indian government’s National Education Policy emphasized textbook distribution across rural areas, prompting large-scale procurement of bound academic materials, boosting demand for board stock, cloth covers, and spine adhesives

• While digital platforms grow, the continued relevance of printed books in learning and reference contexts secures a solid foundation for the bookbinding materials market, especially in structured academic and public-sector applications

Restraint/Challenge

Volatility in Raw Material Prices and Supply Chain Disruptions

• Bookbinding materials such as paperboard, adhesives, and specialty fabrics are highly dependent on raw material costs, which have seen significant fluctuations due to global supply chain instability. Price volatility in pulp, resin, and chemical compounds impacts production planning and margins for manufacturers and converters

• The global logistics crisis, especially during post-pandemic recovery phases, has resulted in extended lead times and increased freight costs. These issues are particularly challenging for small and medium-scale bookbinders who depend on consistent material availability and pricing

• Environmental regulations and energy costs in major production hubs such as China and Europe have also affected the output and pricing of core inputs such as synthetic adhesives and coated boards, limiting supply and raising costs

• For instance, in 2023, several European bookbinding suppliers reported project delays due to disrupted imports of cover cloth and specialty glues from Asia, pushing clients to seek local but costlier alternatives

• To mitigate these risks, stakeholders must explore material substitution strategies, strengthen supplier diversification, and invest in local production capabilities. Technology-driven inventory planning and flexible sourcing will be key to minimizing disruptions in the bookbinding supply chain

Bookbinding Materials Market Scope

The market is segmented on the basis of binding type, material type, application, bookbinding technique, end-use sector, grade, solvent type, and resin type.

- By Binding Type

On the basis of binding type, the bookbinding materials market is segmented into adhesive bonded and mechanically bonded. The adhesive bonded segment held the largest revenue share in 2024, driven by its widespread use in mass-market books, magazines, and catalogs. Its cost-effectiveness and ability to support high-speed production lines make it the preferred choice for commercial printers and publishers. In addition, advancements in adhesive formulations have improved binding strength and durability, further supporting its market dominance.

The mechanically bonded segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the rising demand for customization and durability in educational and corporate documentation. Mechanically bonded formats such as spiral and ring binding offer enhanced reusability and flexibility, making them ideal for training manuals, notebooks, and technical publications.

- By Material Type

On the basis of material type, the market is categorized into paper cover materials, leather, adhesives, cloth or fabric materials, and cover boards. The cover boards segment dominated the market in 2024 owing to their crucial role in providing structural integrity to hardcover books. These materials are extensively used across academic, archival, and luxury editions, offering rigidity and premium finish.

The adhesives segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increased adoption of perfect binding and the development of high-performance, eco-friendly adhesives. Innovations in polymer technologies and growing interest in sustainable alternatives are contributing to segment expansion.

- By Application

On the basis of application, the market is segmented into hardcover and softcover books, magazines and catalogues, and print on demand. The hardcover and softcover books segment led the market in 2024, driven by continued demand from the education and publishing industries. The durability of hardcover formats and the affordability of softcover books together cater to a wide readership spectrum.

The print on demand segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rapid digitization of publishing and rising preference for self-publishing. This model allows publishers and authors to reduce inventory costs while catering to niche markets and customized orders.

- By Bookbinding Technique

On the basis of bookbinding technique, the market is segmented into hard case binding, soft case binding, loose-leaf binding, ring binding, and perfect binding. The perfect binding segment accounted for the largest market share in 2024, due to its suitability for mass production and attractive finish. It is widely used in paperback books, catalogs, and reports for its clean spine and efficient stacking.

Ring binding is expected to witness the fastest growth rate from 2025 to 2032, as it offers flexibility, ease of use, and the ability to update contents—making it highly popular in corporate training and educational materials.

- By End-use Sector

On the basis of end-use sector, the market is categorized into education, publishing industry, commercial printing, packaging, and consumer goods. The education segment held the largest market share in 2024, supported by the high volume demand for textbooks, workbooks, and reference materials. The segment continues to benefit from government initiatives, curriculum expansions, and student population growth.

The commercial printing segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased demand for customized, short-run printing jobs such as promotional booklets, manuals, and company brochures.

- By Grade

On the basis of grade, the market is segmented into standard grade, premium grade, and archival grade. The standard grade segment dominated the market in 2024 due to its extensive usage in mainstream publishing and education materials where cost-efficiency is essential.

The archival grade segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing emphasis on document preservation across government archives, libraries, and museums.

- By Solvent Type

On the basis of solvent type, the market is segmented into solvent-based, water-based, and solvent-less adhesives. The solvent-based segment held the largest revenue share in 2024, due to its strong bonding capabilities and fast curing time, especially in high-speed printing operations.

The solvent-less adhesives segment i is expected to witness the fastest growth rate from 2025 to 2032, driven by growing environmental regulations, worker safety concerns, and the shift toward sustainable production practices.

- By Resin Type

On the basis of resin type, the market is segmented into ethylene vinyl acetate, polyurethane, and acrylic. Ethylene vinyl acetate dominated the market in 2024 due to its cost-effectiveness, ease of application, and strong adhesion properties in perfect binding processes.

The polyurethane segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its excellent resistance to heat, moisture, and mechanical stress—making it ideal for premium and archival-quality bookbinding.

Bookbinding Materials Market Regional Analysis

• Asia-Pacific dominated the bookbinding materials market with the largest revenue share in 2024, driven by the expanding education sector, strong presence of domestic publishers, and cost-effective manufacturing capabilities.

• Rapid urbanization, increasing literacy rates, and growing demand for printed educational and commercial content further accelerate market expansion across countries such as China, India, and Japan.

• The region's abundant raw material availability, large-scale printing hubs, and government support for educational infrastructure fuel the growth of both traditional and modern bookbinding solutions.

China Bookbinding Materials Market Insight

The China bookbinding materials market captured the largest revenue share within Asia-Pacific in 2024, supported by its dominant publishing industry and high consumption of educational and commercial printed materials. Strong domestic demand, coupled with increasing investments in digital printing technologies and aesthetic book presentation, drives growth. In addition, China’s role as a leading global manufacturing hub for binding materials ensures wide availability and competitive pricing across product segments.

Japan Bookbinding Materials Market Insight

The Japan bookbinding materials market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s long-standing publishing traditions, high-quality print production, and emphasis on archival-grade materials. Demand is primarily driven by premium binding materials for literature, manga, and academic publishing. Japan’s focus on sustainability and innovation is encouraging the adoption of eco-friendly adhesives and recyclable cover materials in the bookbinding process.

North America Bookbinding Materials Market Insight

The North America bookbinding materials market is expected to witness the fastest growth rate from 2025 to 2032, led by increased demand for high-end and archival-grade products, particularly in the education and publishing sectors. The region's robust commercial printing industry, coupled with innovations in binding techniques and rising interest in artisanal and short-run publications, supports growth. Eco-conscious consumers and publishers are also influencing the shift toward sustainable binding materials and water-based adhesives.

U.S. Bookbinding Materials Market Insight

The U.S. bookbinding materials market held the majority share in North America in 2024, driven by a mature publishing industry, strong educational infrastructure, and demand for premium-quality binding solutions. Growth in on-demand publishing, self-publishing, and boutique book production has created new opportunities for advanced binding technologies and aesthetically appealing materials. U.S.-based manufacturers are also investing in digital transformation and sustainable product development to meet evolving consumer preferences.

Europe Bookbinding Materials Market Insight

The Europe bookbinding materials market is expected to witness the fastest growth rate from 2025 to 2032, supported by regulatory focus on sustainable packaging and the continued relevance of print in education and culture. Countries such as Germany, France, and the U.K. contribute significantly to market expansion through investments in academic publishing, art books, and hardcover productions. The region's commitment to quality, preservation, and innovation encourages the use of archival-grade adhesives and specialty cover materials.

Germany Bookbinding Materials Market Insight

The Germany bookbinding materials market is expected to witness the fastest growth rate from 2025 to 2032, driven by its well-established printing and publishing sectors, along with a strong tradition of bookmaking craftsmanship. Demand is high for premium binding materials used in literary, legal, and academic publications. Germany’s focus on environmental sustainability and product longevity is fostering the development of solvent-less adhesives and biodegradable binding solutions.

Bookbinding Materials Market Share

The Bookbinding Materials industry is primarily led by well-established companies, including:

- Henkel AG (Germany)

- H.B. Fuller Company (U.S.)

- Arkema (France)

- Dow Chemical Company (U.S.)

- UPM Global (Finland)

- BASF SE (Germany)

- Henkel AG & Co. KGaA (Germany)

- 3M Company (U.S.)

- Arkema Group (France)

- Dow Inc. (U.S.)

- Paramelt B.V. (Netherlands)

- Evonik Industries AG (Germany)

- H.B. Fuller Company (U.S.)

- Bostik (France)

- Ashland Global Holdings Inc. (U.S.)

Latest Developments in Global Bookbinding Materials Market

In July 2022, Arkema completed the acquisition of Permoseal, a prominent South African adhesive manufacturer, to expand its product portfolio under the Bostik brand. This strategic development is aimed at strengthening Arkema’s footprint in the dynamic industrial, construction, and DIY adhesive markets across South Africa and Sub-Saharan Africa. The acquisition is expected to enhance local manufacturing capabilities, broaden customer reach, and drive growth in emerging regional markets. It also reinforces Arkema’s global adhesive business by tapping into new growth opportunities in developing economies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bookbinding Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bookbinding Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bookbinding Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.