Global Boring Tools Market

Market Size in USD Million

CAGR :

%

USD

805.07 Million

USD

1,127.48 Million

2024

2032

USD

805.07 Million

USD

1,127.48 Million

2024

2032

| 2025 –2032 | |

| USD 805.07 Million | |

| USD 1,127.48 Million | |

|

|

|

|

What is the Global Boring Tools Market Size and Growth Rate?

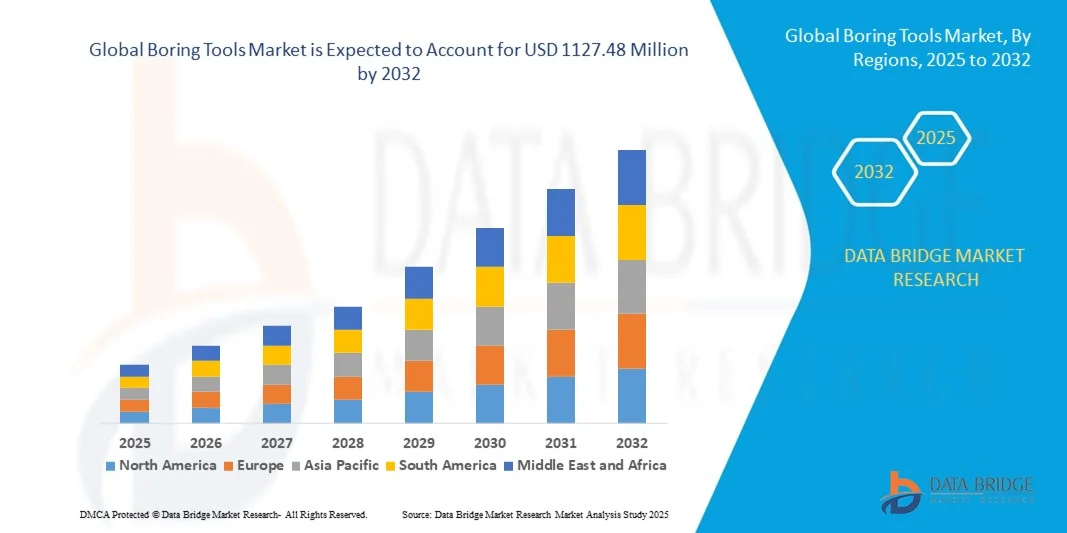

- The global boring tools market size was valued at USD 805.07 million in 2024 and is expected to reach USD 1127.48 million by 2032, at a CAGR of 4.30% during the forecast period

- Growing focus on the technological advancements by the major manufacturers, rising up gradation of existing infrastructure with advanced systems, rising emergence of CNC- based boring tools and growing focus of the manufacturers and the need to develop superior-quality products are the major factors attributable to the growth of boring tools market

What are the Major Takeaways of Boring Tools Market?

- Rising globalization and growth in the number of manufacturing activities will emerge as the major boring tools market growth driving factor. Growing demand for fabricated metals by the automotive sector, surging focus on the advancements and up gradations in manufacturing technology and growth and expansion of transportation industry especially in the developing economies will further aggravate the boring tools market value

- Growing expenditure to undertake research and development proficiencies, supportive government policies, surging buildings and construction activities especially in the emerging economies such as India and China, growing availability of metal cutting tools owing to rapid urbanization and rising demand for carbide materials for boring tools will further carve the way for the growth of the boring tools market

- North America dominated the boring tools market with the largest revenue share of 36.87% in 2024, driven by the increasing demand for high-precision machining, industrial automation, and advanced manufacturing technologies

- Asia-Pacific boring tools market is poised to grow at the fastest CAGR of 7.3% during 2025–2032, driven by rapid industrialization, rising manufacturing output, and growing demand in countries such as China, Japan, and India

- The Fine Boring segment dominated the market with the largest revenue share of 58.4% in 2024, driven by its ability to deliver high precision, tight tolerances, and superior surface finishing required in aerospace, automotive, and energy industries

Report Scope and Boring Tools Market Segmentation

|

Attributes |

Boring Tools Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Boring Tools Market?

Automation and Digitalization in Manufacturing Processes

- A significant trend in the global boring tools market is the integration of automation, digital monitoring, and CNC-based systems to improve machining accuracy and operational efficiency. Advanced boring tools are increasingly compatible with Industry 4.0 practices, allowing real-time data collection and predictive maintenance

- For instance, Sandvik Coromant has been developing digital boring heads that transmit cutting data wirelessly, enabling enhanced precision in machining processes. Similarly, BIG KAISER offers digital fine-boring tools designed for optimized diameter adjustments with micron-level accuracy

- Automation enables features such as tool condition monitoring, adaptive cutting, and reduced downtime, leading to greater productivity and consistency across industries such as automotive, aerospace, and oil & gas. The digital integration of boring tools with smart manufacturing platforms facilitates seamless connectivity within the production line

- This trend towards smart and connected machining solutions is reshaping user expectations, pushing companies to adopt advanced boring tools that ensure higher productivity, precision, and reduced human error

- Consequently, global players are focusing on developing digital-ready boring solutions to remain competitive in the evolving industrial landscape

What are the Key Drivers of Boring Tools Market?

- The rising demand in automotive and aerospace manufacturing, driven by the need for precision machining of engine components, gearboxes, and structural parts, is a major growth driver for the boring tools market

- For instance, in March 2024, Kennametal Inc. launched a new range of modular boring solutions optimized for lightweight materials used in electric vehicles, supporting efficiency in high-volume production. Such developments are expected to propel industry growth during the forecast period

- The expansion of industrialization and infrastructure projects worldwide further drives demand for boring tools in oil & gas, energy, and heavy machinery applications, where precision boring is critical for reliability and performance

- In addition, the increasing adoption of CNC machines and automated machining centers in developing economies is boosting the uptake of advanced boring tools. Their ability to improve cycle times, reduce wastage, and enable large-scale production makes them integral to modern manufacturing setups

- The growing emphasis on cost-efficiency, high-quality finishing, and productivity in industrial machining processes continues to strengthen the adoption of advanced boring tools globally

Which Factor is Challenging the Growth of the Boring Tools Market?

- The high cost of advanced boring tools and their associated CNC systems poses a challenge, especially for small and medium-sized enterprises (SMEs) in developing economies. The need for frequent tool replacements due to wear and tear further adds to operational expenses

- For instance, precision digital boring heads can cost significantly more than conventional tools, making it difficult for price-sensitive businesses to justify the investment despite long-term productivity gains

- Another major challenge is the shortage of skilled labor capable of operating advanced boring machines, programming CNC tools, and managing digital integration. This skills gap slows down adoption rates in several regions

- Moreover, market players face growing pressure to develop durable, cost-effective tools that can withstand high-performance machining without compromising quality. Addressing these challenges through training initiatives, innovative coatings, and affordable product lines will be critical for sustained growth

- Overcoming these hurdles by improving tool life, offering financing options, and enhancing workforce training will be essential for ensuring broader adoption of boring tools across industries

How is the Boring Tools Market Segmented?

The market is segmented on the basis of product type and end user.

- By Product Type

On the basis of product type, the boring tools market is segmented into Rough Boring and Fine Boring. The Fine Boring segment dominated the market with the largest revenue share of 58.4% in 2024, driven by its ability to deliver high precision, tight tolerances, and superior surface finishing required in aerospace, automotive, and energy industries. Fine boring tools are widely adopted in high-value applications where accuracy and repeatability are critical, making them indispensable in precision machining environments. Their growing use in EV component manufacturing and aircraft engine parts further supports segment leadership.

The Rough Boring segment is anticipated to witness the fastest CAGR of 20.6% from 2025 to 2032, fueled by rising demand for efficient material removal in large-scale production. Rough boring tools offer cost-effectiveness and durability, making them highly suitable for heavy-duty machining in construction equipment and oil & gas applications.

- By End User

On the basis of end user, the boring tools market is segmented into Transportation, General Machinery, Precision Engineering, and Others. The Transportation segment captured the largest revenue share of 46.2% in 2024, driven by strong demand from the automotive and aerospace industries, where boring tools are essential for machining engine blocks, gear housings, turbine components, and other critical parts. The increasing production of electric vehicles and aircraft modernization projects continue to strengthen demand in this segment.

The Precision Engineering segment is projected to grow at the fastest CAGR of 22.1% during 2025–2032, supported by rising adoption in medical devices, electronics, and high-tech instrumentation. The need for extreme accuracy, miniaturization, and customized designs in these industries is fueling investment in advanced boring tools. The segment also benefits from digital and automated tool advancements, aligning with Industry 4.0 practices.

Which Region Holds the Largest Share of the Boring Tools Market?

- North America dominated the boring tools market with the largest revenue share of 36.87% in 2024, driven by the increasing demand for high-precision machining, industrial automation, and advanced manufacturing technologies

- Manufacturers and end users in the region highly value the reliability, precision, and durability offered by Boring Tools in sectors such as aerospace, automotive, and heavy machinery

- This widespread adoption is further supported by well-established industrial infrastructure, a skilled workforce, and high investment in advanced manufacturing technologies, establishing Boring Tools as a preferred choice across diverse applications

U.S. Boring Tools Market Insight

The U.S. boring tools market captured the largest revenue share in 2024 within North America, driven by the rapid adoption of precision manufacturing and automation technologies. The industrial sector’s demand for accurate, reliable, and efficient boring solutions is fueling market growth. Increasing investments in aerospace, automotive, and defense manufacturing, alongside technological advancements in smart machining and CNC integration, are further propelling the market expansion.

Europe Boring Tools Market Insight

The Europe boring tools market is projected to expand at a substantial CAGR during the forecast period, supported by stringent industrial quality standards and growing adoption of automated machining systems. Countries such as Germany, Italy, and France are witnessing increased investments in precision engineering and industrial equipment modernization, fostering demand for Boring Tools. European manufacturers value reliability, energy efficiency, and versatility, driving steady adoption across industrial and commercial applications.

U.K. Boring Tools Market Insight

The U.K. boring tools market is expected to grow at a noteworthy CAGR, fueled by the rise in precision engineering and manufacturing activities. The country’s focus on high-quality machinery and equipment, combined with advanced R&D facilities, encourages the adoption of technologically advanced boring tools. The industrial sector’s emphasis on productivity, accuracy, and cost-efficiency further supports market growth.

Germany Boring Tools Market Insight

The Germany boring tools market is anticipated to expand at a considerable CAGR during the forecast period, driven by advanced industrial infrastructure and innovation in machining technology. Germany’s industrial base, particularly in automotive, aerospace, and mechanical engineering, relies heavily on high-performance Boring Tools. The integration of precision machining and automation enhances productivity while ensuring superior component quality.

Which Region is the Fastest Growing Region in the Boring Tools Market?

Asia-Pacific boring tools market is poised to grow at the fastest CAGR of 7.3% during 2025–2032, driven by rapid industrialization, rising manufacturing output, and growing demand in countries such as China, Japan, and India. Government initiatives supporting industrial automation, smart factories, and local manufacturing are accelerating adoption.

Japan Boring Tools Market Insight

The Japan boring tools market is witnessing strong growth due to advanced manufacturing technologies, high precision requirements, and rising demand in automotive, electronics, and aerospace sectors. The integration of Boring Tools with CNC machines and automated production lines is boosting efficiency and quality, further accelerating adoption.

China Boring Tools Market Insight

The China boring tools market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s rapid industrial expansion, large-scale manufacturing capabilities, and increasing adoption of high-precision machining. Local manufacturing of cost-effective Boring Tools and government support for industrial modernization are key factors driving market growth across multiple end-use industries.

Which are the Top Companies in Boring Tools Market?

The boring tools industry is primarily led by well-established companies, including:

- Berkshire Hathaway Inc. (U.S.)

- OSG Corporation (Japan)

- Sandvik AB (publ) (Sweden)

- Cogsdill (U.S.)

- Kennametal Inc. (U.S.)

- Mitsubishi Materials Corporation (Japan)

- NACHI-FUJIKOSHI CORP. (Japan)

- Allied Machine & Engineering Corp. (U.S.)

- BIG KAISER Precision Tooling Inc. (Switzerland)

- Schlumberger Limited. (U.S.)

- NOV Inc. (U.S.)

- Baker Hughes Company (U.S.)

- Tenaris (Luxembourg)

- 3M (U.S.)

- Robert Bosch GmbH (Germany)

- Koki Holdings Co., Ltd. (Japan)

- Emerson Electric Co. (U.S.)

- Festool GmbH (Germany)

- KYOCERA Corporation (Japan)

- Vallourec (France)

What are the Recent Developments in Global Boring Tools Market?

- In July 2023, National Pile Croppers (NPC), a specialized equipment manufacturer, introduced an expanded version of its Quad cropper, named the Quad XXL, designed to handle bored piles from 900mm to 1,200mm in diameter. The tool is optimized for piles with 'de-bonded' reinforcement bars and allows cropping of contiguous and secant piled walls even with narrow spacing of 150mm, enhancing efficiency in complex construction projects

- In August 2022, Sandvik AB acquired Switzerland-based Sphinx Tools Ltd, a precision solid round tools provider, along with its subsidiary P. Rieger Werkzeugfabrik AG, aiming to strengthen its position in the round cutting tools market and expand its precision tooling portfolio

- In May 2022, Sandvik AB acquired Preziss, a developer of advanced solutions for composite and aluminum machining, further bolstering its capabilities in specialized material processing and precision manufacturing solutions.

- In June 2022, Liebherr launched the LRH 200 unplugged machine for piling and drilling applications, offering zero-emission operation, minimal noise output, and exceptional operational flexibility, marking it as one of the first battery-powered machines in its category, supporting sustainable construction practices

- In January 2021, Allied Machine & Engineering Corp. announced the launch of a large-diameter rough boring tool capable of extracting large volumes of material at high speeds and light feed rates in a single cut, providing significant productivity gains in heavy machining operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Boring Tools Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Boring Tools Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Boring Tools Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.