Global Botanical Ingredients For Neutraceutical Market

Market Size in USD Billion

CAGR :

%

USD

11.84 Billion

USD

25.21 Billion

2025

2033

USD

11.84 Billion

USD

25.21 Billion

2025

2033

| 2026 –2033 | |

| USD 11.84 Billion | |

| USD 25.21 Billion | |

|

|

|

|

Botanical Ingredients for Neutraceutical Market Size

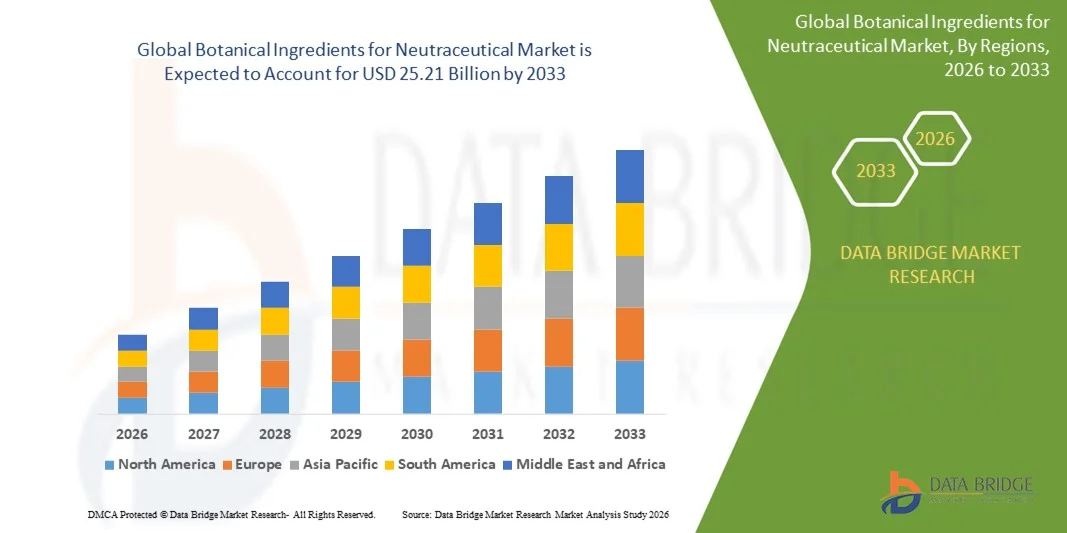

- The global botanical ingredients for neutraceutical market size was valued at USD 11.84 billion in 2025 and is expected to reach USD 25.21 billion by 2033, at a CAGR of 9.90% during the forecast period

- The growth of the botanical ingredients for nutraceutical market is primarily driven by the rising global shift toward natural, plant-based health solutions as consumers increasingly prefer botanical extracts for immunity, digestion, cognitive wellness, and overall preventive healthcare. This transition is supported by expanding awareness regarding the benefits of phytonutrients, antioxidants, and herbal bioactives, which is strengthening the demand for botanical-based nutraceutical formulations across diverse demographic groups

- In addition, manufacturers are rapidly investing in advanced extraction technologies and standardized botanical actives to improve purity, potency, and bioavailability, which is elevating the credibility and commercial appeal of botanical ingredients

Botanical Ingredients for Neutraceutical Market Analysis

- Botanical ingredients, derived from herbs, spices, flowers, leaves, and other plant sources, play a crucial role in nutraceutical formulations due to their functional therapeutic properties, natural origin, and compatibility with clean-label product trends. Their importance continues to grow as consumers seek organic, chemical-free, and sustainably sourced ingredients in products designed to support holistic health and wellness

- The accelerating demand for botanical-based nutraceuticals is further supported by rising chronic health concerns, increased focus on immunity enhancement, and growing preference for traditional and science-backed herbal remedies. These factors, combined with strong innovation in plant-based extracts and expanding global regulatory acceptance, are reinforcing the long-term market expansion of botanical ingredients across the nutraceutical ecosystem

- North America dominated the botanical ingredients for neutraceutical market with a share of 39% in 2025, due to rising consumer interest in plant-based wellness, preventive healthcare, and functional nutrition

- Asia-Pacific is expected to be the fastest growing region in the botanical ingredients for neutraceutical market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing adoption of traditional herbal practices integrated into nutraceuticals across China, India, Japan, and other emerging economies

- Powder segment dominated the market with a market share of 68.9% in 2025, due to its extended shelf life, high stability, and ease of incorporation into capsules, tablets, drink mixes, and dietary supplements. Manufacturers prefer powdered botanical ingredients because they maintain potency during storage and transportation while offering precise dosing flexibility for nutraceutical formulations. This format is widely adopted in large-scale nutraceutical production facilities where efficiency and consistency are essential. Growing consumer demand for convenient supplement formats such as powders and effervescent blends further strengthens segment dominance. The ability to blend multiple botanical powders without compromising bioactive integrity also supports its wider utilization across functional nutrition products

Report Scope and Botanical Ingredients for Neutraceutical Market Segmentation

|

Attributes |

Botanical Ingredients for Neutraceutical Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Botanical Ingredients for Neutraceutical Market Trends

Growing Preference for Plant-Based and Clean-Label Nutraceutical Ingredients

- A major trend shaping the botanical ingredients for nutraceutical market is the strong consumer shift toward plant-derived, clean-label, and minimally processed formulations that support natural wellness needs. This trend is driven by rising interest in holistic health approaches, where individuals seek supplements sourced from botanicals that offer recognizable and trustworthy ingredient profiles

- For instance, Gaia Herbs develops a wide range of plant-based nutraceutical ingredients sourced from organically grown botanicals, reinforcing consumer trust through transparency and clean-label positioning. Such offerings highlight how companies are emphasizing purity, traceability, and natural extraction methods to meet the expectations of health-conscious users

- Manufacturers are increasingly innovating natural extracts such as adaptogens, antioxidants, and phytonutrient-rich botanicals that appeal to the consumer demand for safe and effective nutraceutical solutions. This shift is further supported by ongoing research that validates the functional benefits of botanicals including immune enhancement, stress reduction, and digestive health support

- Clean-label botanical ingredients are also gaining momentum due to rising skepticism toward synthetic additives, artificial preservatives, and chemically processed supplement formulations. As a result, companies are focusing on gentle extraction methods and plant-based compositions that reinforce the authenticity of their products

- The trend is expanding across global nutraceutical brands that are reformulating existing product lines with botanical alternatives to meet growing expectations for natural, transparent, and health-supporting supplements. This market transition is driving higher adoption of botanical extracts, powders, oils, and concentrates across multiple nutraceutical categories

- Overall, the growing preference for clean-label botanical ingredients is reshaping the product development landscape and reinforcing consumer trust by meeting the evolving expectations for safer, plant-derived, and wellness-driven nutraceutical solutions

Botanical Ingredients for Neutraceutical Market Dynamics

Driver

Increasing Consumer Focus on Preventive Health and Natural Supplementation

- The expanding emphasis on preventive health is significantly driving demand for botanical ingredients across nutraceutical applications as consumers increasingly seek natural solutions that support immunity, vitality, and long-term wellness. This shift is fueled by growing awareness of chronic disease prevention and interest in natural alternatives that align with healthier lifestyles

- For instance, Nature’s Way has strengthened its range of botanical supplements using elderberry, turmeric, echinacea, and other plant-based ingredients to address consumer needs for immune support and overall wellness. Such product strategies highlight how brands are responding to rising interest in naturally sourced preventive health solutions

- Consumers are giving greater priority to plant-derived supplements such as herbal extracts, functional blends, and antioxidant-rich botanicals that deliver targeted wellness benefits without reliance on synthetic compounds. This demand is further reinforced by the perception that botanical nutraceuticals are safer, gentler, and more compatible with long-term preventive health routines

- Growing global awareness of holistic wellness practices is also encouraging the use of botanical-based nutraceuticals that support daily health needs including digestion, cognitive function, energy balance, and stress management. This preference is influencing purchasing decisions and shaping brand innovation across all major product categories

- With consumers increasingly integrating botanical supplements into their everyday routines, preventive health has become a central driver of sustained demand for natural nutraceutical solutions. This shift is reinforcing the adoption of botanicals as essential components in long-term wellness strategies

Restraint/Challenge

Quality Variability and Standardization Issues in Botanical Raw Materials

- Quality variability in botanical raw materials poses a major challenge for nutraceutical manufacturers due to fluctuations in active compound levels, environmental conditions, and agricultural practices that impact consistency. These variations affect product reliability and require rigorous quality control measures to ensure standardized outcomes

- For instance, several nutraceutical companies have reported challenges in maintaining consistent potency in botanical extracts such as ginseng, as fluctuations in soil quality and growing conditions influence the concentration of bioactive compounds. This inconsistency affects formulation accuracy and requires advanced testing

- Ensuring standardized botanical ingredients requires extensive analytical evaluation, controlled sourcing, and careful monitoring of plant cultivation, extraction processes, and environmental influences. Manufacturers must meet stringent quality benchmarks to deliver ingredients with predictable therapeutic effects

- Variability also increases production complexity since suppliers must adopt sustainable and consistent agricultural practices while implementing strict testing protocols to maintain uniformity in bioactive profiles. These requirements lead to higher production effort and greater supply chain dependency

- This challenge ultimately affects product formulation, regulatory compliance, and consumer trust, making standardization one of the most critical hurdles in botanical nutraceutical development. Overcoming it will be essential for ensuring dependable, safe, and high-quality botanical solutions

Botanical Ingredients for Neutraceutical Market Scope

The market is segmented on the basis of form and source.

- By Form

On the basis of form, the Botanical Ingredients for Nutraceutical Market is segmented into liquid and powder. The powder segment dominated the market with the largest share of 68.9% in 2025 due to its extended shelf life, high stability, and ease of incorporation into capsules, tablets, drink mixes, and dietary supplements. Manufacturers prefer powdered botanical ingredients because they maintain potency during storage and transportation while offering precise dosing flexibility for nutraceutical formulations. This format is widely adopted in large-scale nutraceutical production facilities where efficiency and consistency are essential. Growing consumer demand for convenient supplement formats such as powders and effervescent blends further strengthens segment dominance. The ability to blend multiple botanical powders without compromising bioactive integrity also supports its wider utilization across functional nutrition products.

The liquid segment is projected to witness the fastest growth rate from 2026 to 2033 driven by increasing preference for ready-to-consume nutraceutical beverages, tinctures, and liquid extracts that offer faster absorption and higher bioavailability. Liquid botanical ingredients appeal strongly to consumers seeking natural wellness solutions with rapid physiological impact, especially in immunity-boosting and detoxification categories. For instance, companies such as Gaia Herbs continue expanding their liquid botanical extract portfolios to meet rising demand for plant-based liquid supplements. The segment also benefits from clean-label trends where liquids help maintain the purity and natural essence of botanicals without heavy processing. Their growing adoption in functional drinks, wellness shots, and flavored nutraceutical beverages further accelerates segment growth as brands innovate with convenient dosing formats.

- By Source

On the basis of source, the market is categorized into herbs, leaves, spices, flowers, and others. The herbs segment dominated the Botanical Ingredients for Nutraceutical Market in 2025 due to its broad availability, high concentration of therapeutic phytochemicals, and widespread integration into immunity, digestion, and stress-relief formulations. Herbal extracts such as ashwagandha, ginseng, and milk thistle remain highly preferred owing to their established clinical benefits and consumer trust surrounding traditional herbal wellness. Nutraceutical manufacturers increasingly rely on herbal ingredients because they offer multifunctional health benefits suitable for a wide range of product categories including capsules, powders, teas, and liquid extracts. The herbs segment also gains strong traction from the expanding adoption of natural preventive healthcare, which fuels consistent demand for plant-based formulations internationally.

The spices segment is expected to experience the fastest growth rate from 2026 to 2033 supported by growing research on the antioxidant, anti-inflammatory, and metabolic health properties of spice-derived bioactives. For instance, companies such as Sabinsa Corporation continue to commercialize standardized spice extracts including curcumin and piperine to meet rising demand for clinically backed nutraceutical ingredients. Spices are increasingly used in functional supplements targeting lifestyle disorders, boosting segment acceleration as consumers turn toward natural alternatives for chronic health management. Their rising integration into fortified foods, nutraceutical beverages, and metabolic-boosting formulations enhances market penetration. The global popularity of spices for both culinary and medicinal use further accelerates growth, strengthening their position as high-impact botanical ingredients in modern nutraceutical innovation.

Botanical Ingredients for Neutraceutical Market Regional Analysis

- North America dominated the botanical ingredients for neutraceutical market with the largest revenue share of 39% in 2025, driven by rising consumer interest in plant-based wellness, preventive healthcare, and functional nutrition

- Consumers in the region strongly prefer botanical ingredients due to growing awareness of natural formulations, clean-label supplements, and science-backed herbal extracts for immunity, digestion, and stress management

- This overall adoption is further supported by high disposable incomes, strong nutraceutical brand presence, and expanding retail distribution, establishing botanical ingredients as essential components across dietary supplements, fortified foods, and functional beverages

U.S. Botanical Ingredients for Nutraceutical Market Insight

The U.S. botanical ingredients for nutraceutical market captured the largest revenue share in 2025 within North America, fueled by the widespread consumption of dietary supplements and the strong shift toward natural and holistic wellness. Consumers increasingly prioritize botanical ingredients due to rising interest in herbal immunity boosters, metabolic health solutions, and natural stress-relief formulations. The region’s strong e-commerce penetration and transparent regulatory environment encourage rapid product innovation. The presence of leading nutraceutical manufacturers focusing on herbal standardization and clinically validated ingredients further propels the U.S. market.

Europe Botanical Ingredients for Nutraceutical Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period driven by rising adoption of herbal supplements, strict quality standards, and growing demand for natural preventive health solutions. Increasing urbanization and consumer awareness of plant-derived bioactives strengthen regional uptake. European consumers also show high interest in functional foods and botanical extracts promoting immunity and digestive wellness. The region is witnessing strong nutraceutical integration across pharmacies, wellness stores, and fortified food categories, with botanical ingredients increasingly incorporated into both mass-market and premium formulations.

U.K. Botanical Ingredients for Nutraceutical Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR driven by increased usage of natural supplements and a rising desire for botanical-based health and wellness products. Consumers are turning toward herbal extracts for immunity, cognitive support, and stress relief, influenced by awareness of clean-label nutrition. The strong retail presence of nutraceutical brands and established online supplement sales channels further support the market. The growing use of botanical ingredients in functional beverages and healthy lifestyle products continues to expand regional adoption.

Germany Botanical Ingredients for Nutraceutical Market Insight

The Germany market is expected to expand at a considerable CAGR fueled by the nation's emphasis on natural healthcare solutions, regulatory focus on quality, and preference for science-backed phytochemicals. Germany’s well-developed nutraceutical manufacturing infrastructure and strong herbal tradition encourage widespread acceptance of botanical ingredients across supplements and functional foods. Integrating plant-derived extracts into immunity and metabolic health formulations is becoming more common, supported by consumer demand for sustainable, trustworthy nutraceutical options.

Asia-Pacific Botanical Ingredients for Nutraceutical Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing adoption of traditional herbal practices integrated into nutraceuticals across China, India, Japan, and other emerging economies. The region's shift toward natural wellness, combined with government initiatives promoting herbal health systems and dietary supplement usage, supports strong momentum. As APAC remains a leading source of botanical raw materials and extracts, affordability and easy accessibility further widen consumer adoption across various nutraceutical categories.

Japan Botanical Ingredients for Nutraceutical Market Insight

The Japan market is gaining momentum due to a strong preference for functional nutrition, advanced health consciousness, and rapid integration of botanical extracts into daily wellness routines. The population emphasizes safety, purity, and scientifically supported natural ingredients, driving adoption of herbal supplements for immunity, healthy aging, and digestive support. Japan’s aging demographic also supports demand for easy-to-consume, plant-based nutraceutical formats tailored to senior wellness.

China Botanical Ingredients for Nutraceutical Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2025 attributed to a rapidly expanding middle class, strong domestic herbal tradition, and high acceptance of botanical nutraceutical ingredients. China stands as one of the largest consumers and producers of botanical extracts used across supplements, functional beverages, and fortified foods. The country’s push toward modernizing traditional herbal systems and expanding nutraceutical manufacturing capacity further accelerates market growth, supported by widespread retail and online availability.

Botanical Ingredients for Neutraceutical Market Share

The botanical ingredients for neutraceutical industry is primarily led by well-established companies, including:

- New Directions Aromatics Inc. (Canada)

- PT. Indesso Aroma (Indonesia)

- Lipoid Kosmetik AG (Switzerland)

- The Herbarie at Stoney Hill Farm, Inc. (U.S.)

- Rutland Biodynamics Ltd (U.K.)

- Ambe Phytoextracts Pvt Ltd (India)

- The Green Labs LLC (U.S.)

- Berjé Inc. (U.S.)

- Bell Flavors & Fragrances (U.S.)

- Prakruti Products (India)

- Umalaxmi Organics Pvt. Ltd (India)

- Saba Botanical of USA (U.S.)

- DSM (Netherlands)

- ADM (U.S.)

- Kerry (Ireland)

- Glanbia plc (Ireland)

- A&B Ingredients (U.S.)

- Carolina Ingredients (U.S.)

- HP Ingredients (U.S.)

- Prinova Group LLC (U.S.)

Latest Developments in Global Botanical Ingredients for Neutraceutical Market

- In November 2025, BioHarvest Sciences reported a strong surge in quarterly revenue alongside a significant rise in active users for its botanical-cell–derived product portfolio, signaling accelerated commercial acceptance of high-purity, lab-grown botanical actives. This momentum is expanding the competitive landscape by demonstrating that advanced botanical synthesis can meet large-scale nutraceutical demand while maintaining consistency, thereby encouraging greater investment in next-generation botanical production technologies across the industry

- In August 2025, ADM expanded its botanical extracts portfolio with new multi-functional plant-based blends tailored for sports nutrition, functional beverages, and metabolic-health nutraceuticals. This expansion strengthens ADM’s position as an integrated botanical ingredient supplier and elevates the market by increasing the availability of standardized, clinically supported botanical compounds, helping manufacturers formulate more targeted and differentiated nutraceutical products

- In June 2025, Gaia Herbs introduced a new series of concentrated liquid botanical shots aimed at immunity, energy, and digestive wellness, catering to rising interest in fast-acting, easy-to-consume herbal nutraceuticals. This launch broadens the appeal of botanical ingredients beyond traditional capsule formats and encourages other companies to innovate with high-potency liquid formulations, boosting the overall adoption of plant-based extracts in convenient daily-use nutraceutical products

- In February 2025, Martin Bauer Group completed strategic enhancements to its botanical supply chain by strengthening its sourcing partnerships for herbs, spices, and functional plant extracts. This move improves global access to sustainably sourced botanicals, ensuring better supply security for nutraceutical manufacturers. It also enhances transparency and quality assurance across the market, supporting the growing demand for ethically sourced and traceable botanical ingredients

- In December 2024, Sabinsa Corporation introduced new clinically standardized botanical actives for applications in metabolic health, skin wellness, and cognitive support. This development expands Sabinsa’s specialty ingredient portfolio and shapes the market by reinforcing the importance of evidence-based botanical extracts. The introduction of research-driven formulations encourages nutraceutical brands to incorporate more scientifically validated plant actives into their product lines, improving consumer trust and driving category growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Botanical Ingredients For Neutraceutical Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Botanical Ingredients For Neutraceutical Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Botanical Ingredients For Neutraceutical Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.