Global Brain Disease Imaging And Software Market

Market Size in USD Billion

CAGR :

%

USD

14.95 Billion

USD

22.44 Billion

2024

2032

USD

14.95 Billion

USD

22.44 Billion

2024

2032

| 2025 –2032 | |

| USD 14.95 Billion | |

| USD 22.44 Billion | |

|

|

|

|

Brain Disease Imaging and Software Market Size

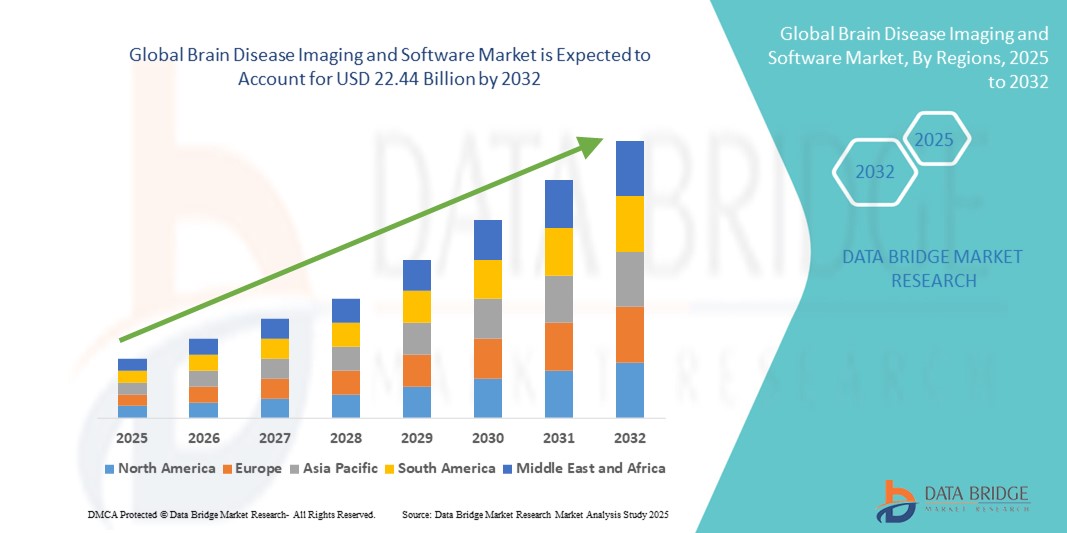

- The global brain disease imaging and software market size was valued at USD 14.95 billion in 2024 and is expected to reach USD 22.44 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within neuroimaging technologies and AI-enabled diagnostics, leading to increased digitalization of neurological assessments across hospitals and research institutions

- Furthermore, rising clinical demand for precise, non-invasive, and real-time imaging solutions for early detection and monitoring of neurological disorders is establishing advanced brain imaging modalities—such as fMRI, PET, and AI-driven image analysis software—as essential components of modern neurodiagnostics. These converging factors are accelerating the uptake of brain disease imaging and software solutions, thereby significantly boosting the industry's growth

Brain Disease Imaging and Software Market Analysis

- Brain disease imaging and software solutions, which facilitate precise visualization and analysis of neurological conditions, are becoming critical tools in both clinical and research settings due to their ability to enhance early diagnosis, enable personalized treatment, and improve surgical planning through high-resolution and AI-assisted imaging technologies

- The growing demand for advanced neuroimaging technologies is primarily driven by the increasing prevalence of brain-related disorders such as Alzheimer's, Parkinson's, epilepsy, and brain tumors, along with a rising geriatric population and the widespread integration of AI and machine learning in medical diagnostics

- North America dominated the brain disease imaging and software market with the largest revenue share of 41.7% in 2024, supported by high healthcare expenditure, early adoption of advanced imaging systems (such as MRI, PET, and CT), and strong presence of leading companies and research institutions. The U.S., in particular, has seen substantial adoption of neuroimaging software, boosted by AI innovation, FDA approvals, and increased focus on early detection of neurodegenerative conditions

- Asia-Pacific is expected to be the fastest growing region in the brain disease imaging and software market during the forecast period, with a projected CAGR of 12.9% from 2025 to 2032, driven by expanding healthcare infrastructure, increased government investment in medical imaging, and a growing burden of neurological diseases across populous countries such as China and India

- The adult segment dominated the brain disease imaging and software market with a share of 69.8% in 2024, due to the higher prevalence of neurological diseases such as dementia, stroke, and Parkinson’s in adults

Report Scope and Brain Disease Imaging and Software Market Segmentation

|

Attributes |

Brain Disease Imaging and Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Brain Disease Imaging and Software Market Trends

Growing Adoption of Intelligent Imaging Systems and Connected Diagnostic Platforms

- A significant and accelerating trend in the global brain disease imaging and software market is the increasing adoption of intelligent imaging systems integrated with advanced software platforms that support real-time data analysis, decision-making, and seamless interoperability across clinical settings

- Smart imaging software is increasingly equipped with machine learning algorithms that can identify abnormal brain structures, segment lesions, and generate predictive insights based on historical imaging data. These tools are proving critical for early detection of neurodegenerative conditions such as Alzheimer’s disease and glioblastomas

- The integration of these imaging platforms with hospital information systems (HIS), electronic health records (EHRs), and picture archiving and communication systems (PACS) allows for centralized control and streamlined workflows. This connectivity enables radiologists and neurologists to analyze, compare, and share patient scans in real-time—enhancing care coordination across departments

- Neuroimaging software is also evolving to offer automated 3D brain modeling and functional analysis tools, facilitating more precise surgical planning for conditions such as epilepsy and brain tumors. These capabilities are expanding access to complex neurological assessments even in secondary and tertiary care centers

- The demand for comprehensive, cloud-enabled imaging and diagnostic platforms is growing rapidly across hospitals, diagnostic labs, and academic institutions, as healthcare providers increasingly prioritize efficiency, accuracy, and data-driven decision-making in the treatment of brain disorders

Brain Disease Imaging and Software Market Dynamics

Driver

Growing Need Due to Rising Neurological Disease Burden and Advancements in Imaging Technology

- The increasing global prevalence of neurological disorders such as Alzheimer’s disease, Parkinson’s disease, epilepsy, and brain tumors, combined with advancements in neuroimaging technologies, is significantly driving the demand for Brain Disease Imaging and Software solutions

- For instance, in April 2024, GE HealthCare introduced its updated Revolution Apex platform with enhanced neuroimaging capabilities, offering clinicians high-resolution brain scans with lower radiation doses. Such innovations are expected to boost the Brain Disease Imaging and Software industry during the forecast period

- As healthcare systems seek to improve early diagnosis and monitoring of complex neurological conditions, imaging software that supports advanced MRI, CT, and PET integration is being adopted for its ability to provide accurate, real-time insights

- Furthermore, the growing use of brain imaging tools in academic research and clinical trials for new CNS (central nervous system) drugs is reinforcing the role of imaging software in disease progression tracking, patient stratification, and outcome assessment

- The convenience of digital platforms for data visualization, post-processing, and longitudinal patient monitoring is encouraging hospitals and diagnostic centers to invest in scalable imaging software. The trend toward personalized and precision medicine is also fueling demand for tools that can analyze individual brain structures, functions, and pathologies with greater specificity

- The proliferation of telemedicine, AI integration in radiology workflows, and cloud-based PACS (Picture Archiving and Communication Systems) are further accelerating the adoption of Brain Disease Imaging and Software solutions in both high-income and emerging economies

Restraint/Challenge

Concerns Regarding Data Privacy, System Integration, and High Implementation Costs

- Data privacy and security concerns associated with cloud-enabled and AI-powered imaging software present a major barrier to adoption in several regions, particularly where healthcare data protection regulations are still evolving

- For instance, countries with stringent data localization laws or lacking robust digital health policies may restrict the deployment of certain imaging platforms, slowing market expansion

- In addition, the complexity of integrating new imaging software with legacy radiology infrastructure and hospital information systems (HIS) can create implementation hurdles. Without seamless interoperability, institutions face workflow disruptions, which can limit clinical adoption

- High initial capital investment for advanced imaging systems and software platforms also presents a challenge, especially in smaller healthcare centers or public hospitals operating under budget constraints. While scalable cloud-based solutions are emerging, advanced features such as 3D modeling, AI-enhanced diagnostics, or multi-modal imaging analytics often require significant resources

- Addressing these challenges through modular software offerings, cybersecurity compliance, and vendor support for training and system integration will be critical for expanding market reach. Long-term growth will depend on sustained collaboration between software developers, imaging hardware manufacturers, and healthcare providers

Brain Disease Imaging and Software Market Scope

The brain disease imaging and software market is segmented into four notable segments based on type, application, patient type, and end user.

- By Type

On the basis of type, the brain disease imaging and software market is segmented into Imaging devices and software. The imaging devices segment dominated the market with a 64.3% revenue share in 2024, owing to the widespread deployment of CT, MRI, and PET systems in neurological diagnostics.

The software segment is projected to grow at the fastest CAGR of 18.9% from 2025 to 2032, due to rising demand for AI-powered analytics, image processing, and cloud-based diagnostic tools.

- By Application

On the basis of application, the brain disease imaging and software market is segmented into Alzheimer's Disease, dementia, stroke, multiple sclerosis, Parkinson's Disease, brain tumors, epilepsy, and traumatic brain injury (TBI). Alzheimer's Disease led the market with a 27.6% share in 2024, driven by the increasing elderly population and emphasis on early detection.

Brain Tumors is expected to grow at the fastest CAGR of 19.5% from 2025 to 2032, fueled by rising incidence and the need for high-resolution imaging for surgical planning and monitoring.

- By Patient Type

On the basis of patient type, the brain disease imaging and software market is segmented into adults, pediatrics, and infants. The Adult segment accounted for the largest share at 69.8% in 2024, due to the higher prevalence of neurological diseases such as dementia, stroke, and Parkinson’s in adults.

The pediatrics segment is projected to grow at a CAGR of 16.7% from 2025 to 2032, driven by advances in pediatric neuroimaging and early diagnostic initiatives for congenital and developmental disorders.

- By End User

On the basis of end user, the brain disease imaging and software market is segmented into hospitals and clinics, ambulatory surgery centers, diagnostic imaging centers, and research institutions. Hospitals and Clinics dominated the segment with a 54.2% revenue share in 2024, as they conduct the majority of diagnostic and treatment-related imaging procedures.

Research institutions are expected to grow at the highest CAGR of 20.1% from 2025 to 2032, driven by rising neuroscience research, clinical trials, and government and academic funding initiatives.

Brain Disease Imaging and Software Market Regional Analysis

- North America dominated the brain disease imaging and software market with the largest revenue share of 41.7% in 2024, driven by increased investments in neuroimaging technologies, AI-based diagnostics, and rising incidence of neurodegenerative disorders

- The region benefits from robust healthcare infrastructure, strong R&D presence, and growing demand for early diagnosis of conditions such as Alzheimer’s, Parkinson’s, and stroke

- Increasing partnerships between medical imaging companies and research institutions, alongside the presence of key market players, are further enhancing the region’s technological advancement in brain disease diagnostics and monitoring tools

U.S. Brain Disease Imaging and Software Market Insight

The U.S. brain disease imaging and software market captured the largest revenue share of 79.4% in 2024 within North America, supported by high adoption of AI-enabled imaging software, government funding for neurological research, and strong demand for advanced MRI and PET scan solutions in hospitals and diagnostic centers. The market is further driven by the increasing implementation of brain mapping and decision support systems across academic research and clinical settings.

Europe Brain Disease Imaging and Software Market Insight

The Europe brain disease imaging and software market is projected to expand at a substantial CAGR during the forecast period, led by a growing aging population and increased incidence of dementia and stroke. Key initiatives such as the EU’s Horizon research programs and country-level investments in digital health are promoting adoption of innovative brain imaging platforms. The presence of leading imaging companies such as Siemens Healthineers and Philips also contributes significantly to market growth across the region.

U.K. Brain Disease Imaging and Software Market Insight

The U.K. brain disease imaging and software market is anticipated to grow at a noteworthy CAGR, driven by increased funding for mental health and neuroscience research, integration of AI into radiology workflows, and growing collaboration between NHS institutions and private imaging tech firms. The U.K. is also focused on expanding cloud-based imaging platforms and real-time diagnostics to improve neurological care outcomes.

Germany Brain Disease Imaging and Software Market Insight

The Germany brain disease imaging and software market is expected to expand at a considerable CAGR during the forecast period due to strong emphasis on precision medicine and digitalization of healthcare services. With Germany’s leading role in innovation and clinical trials, the adoption of advanced brain imaging modalities and automated analysis software is rising rapidly, especially for applications in epilepsy, MS, and brain tumors.

Asia-Pacific Brain Disease Imaging and Software Market Insight

The Asia-Pacific brain disease imaging and software market is poised to grow at the fastest CAGR of 12.9% during 2025 to 2032, driven by increasing investments in healthcare infrastructure, rising awareness of brain health, and rapid urbanization. Countries such as China, Japan, and India are seeing increased installation of neuroimaging systems in tertiary care centers and expansion of teleradiology networks.

Japan Brain Disease Imaging and Software Market Insight

The Japan brain disease imaging and software market is witnessing strong demand due to a super-aging population and government focus on dementia care. Technological advancements in compact imaging devices and AI-supported analysis tools are making early screening more accessible. Additionally, collaborations between universities and medical device firms are fueling innovation in brain mapping technologies.

China Brain Disease Imaging and Software Market Insight

The China brain disease imaging and software market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to aggressive digitization of hospitals, government initiatives such as “Healthy China 2030,” and a sharp rise in neurological disorders. Domestic manufacturers are rapidly scaling production of cost-effective brain imaging systems, while foreign firms are entering partnerships to localize AI-powered diagnostic tools.

Brain Disease Imaging and Software Market Share

The brain disease imaging and software industry is primarily led by well-established companies, including:

- Quantib (Netherlands)

- Brainomix (U.K.)

- General Electric Company (GE Healthcare) (U.S.)

- United Imaging Healthcare Co. Ltd. (China)

- Siemens Healthineers AG (Germany)

- Imaging Biometrics, LLC (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Canon Inc. (Japan)

- Vuno Co. Ltd. (South Korea)

- Aspect Imaging (Israel)

- IXICO (U.K.)

- Fujifilm Holdings Corporation (Japan)

Latest Developments in Global Brain Disease Imaging and Software Market

- In July 2025, Hyperfine completed the first commercial sales of its next-generation Swoop Portable MR Imaging System, powered by Optive AI. The systems were sold to hospitals in the U.S. for use in ICU and emergency settings, marking a major step in real-time bedside neuroimaging capabilities

- In May 2025, Hyperfine, Inc. announced the commercial launch of its Optive AI sofware, an advanced imaging algorithm that enhances the company’s portable MRI system by improving image quality and reducing noise and scan time—without the need for new hardware

- In November 2024, Philips Healthcare in collaboration with icometrix introduced a ew AI-powered neuroimaging solution for its BlueSeal MRI systems. The integrated solution enables quantitative analysis of brain volume and white matter changes, supporting early detection and monitoring of conditions such as Alzheimer's and multiple sclerosis

- In May 2024, Imaging Biometrics deployed its IB Neuro software at Insel Gruppe AG in Switzerland, a major university hospital network. The solution allows advanced imaging analysis for brain tumor and stroke evaluation, supporting clinicians in generating parametric maps and perfusion insights from routine MRIs

- In March 2024, Brainomix announced that its Brainomix 360 Stroke platform was featured in The Economist Impact Report as a transformative AI-enabled neuroimaging solution. The platform enables faster and more accurate diagnosis of stroke through automated CT scan analysis, helping improve clinical workflows and patient outcomes across European hospitals

- In Jan 2022, New MRI technology is developed by Siemens company in alliance with researchers at The Ohio State University College, will magnify imaging access for patients with implanted medical devices, claustrophobia, and severe obesity

- In Mar 2021, DiA Imaging Analysis declared its collaboration with Royal Phillips to offer high-quality ultrasound imaging with artificial intelligence (AI)-based image quantification. Al-based solutions are applied to a range of applications, including image detection, diagnosis and decision support, image acquisition, reporting and communication, triage, image analysis, and predictive analysis and risk assessment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.