Global Brake Pad Market

Market Size in USD Billion

CAGR :

%

USD

3.33 Billion

USD

6.45 Billion

2024

2032

USD

3.33 Billion

USD

6.45 Billion

2024

2032

| 2025 –2032 | |

| USD 3.33 Billion | |

| USD 6.45 Billion | |

|

|

|

|

Brake Pad Market Size

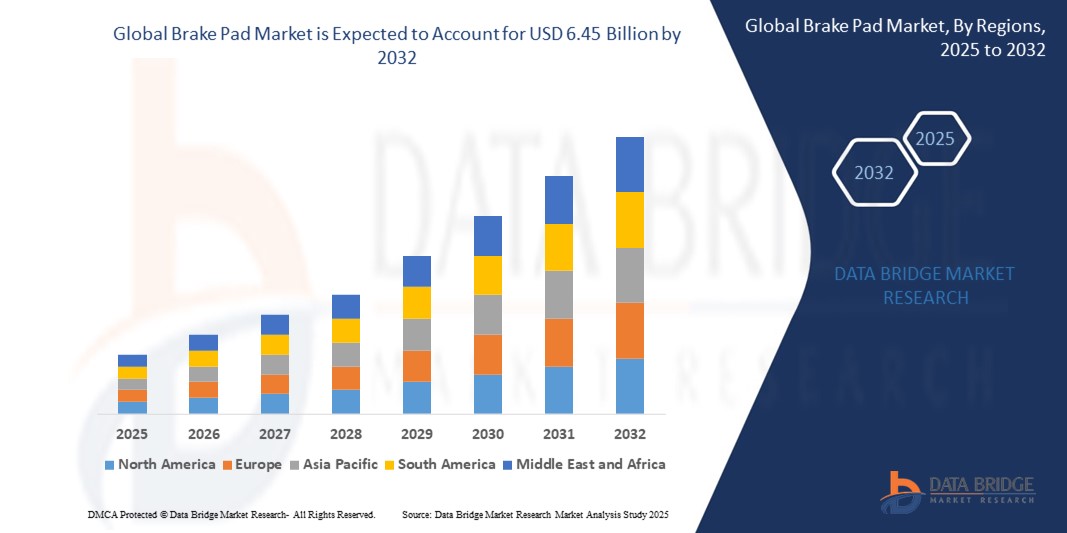

- The global brake pad market size was valued at USD 3.33 billion in 2024 and is expected to reach USD 6.45 billion by 2032, at a CAGR of 8.60% during the forecast period

- The market growth is largely fueled by the rising global vehicle production, increasing vehicle ownership, and growing awareness regarding road safety and periodic maintenance, leading to consistent demand for brake pad replacement across both OEM and aftermarket channels

- Furthermore, the implementation of stringent safety regulations and emission norms is encouraging the adoption of advanced brake pad materials such as ceramic and non-asbestos organic (NAO), which offer enhanced performance, reduced noise, and lower environmental impact. These converging factors are accelerating the uptake of high-quality brake pads, thereby significantly boosting the industry's growth

Brake Pad Market Analysis

- Brake pads are a critical component of disc braking systems, designed to convert kinetic energy into thermal energy through friction, ensuring effective deceleration and vehicle control. They are widely used in passenger cars, commercial vehicles, and two-wheelers across both front and rear wheel assemblies

- The demand for brake pads is being driven by the expansion of the global automotive sector, increasing average vehicle age, and the growth of electric and hybrid vehicles, which require specialized braking solutions compatible with regenerative systems

- North America dominated the brake pad market with a share of 36.1% in 2024, due to a mature automotive sector, high vehicle ownership rates, and stringent safety regulations

- Asia-Pacific is expected to be the fastest growing region in the brake pad market during the forecast period due to expanding vehicle production, urbanization, and increased disposable incomes

- Front segment dominated the market with a market share of 56.8% in 2024, due to the fact that front wheels handle a majority of the braking force in most vehicles, leading to higher wear rates and replacement frequency. Front brake pads are essential for ensuring vehicle safety and are subject to stringent quality standards across passenger and commercial vehicles alike

Report Scope and Brake Pad Market Segmentation

|

Attributes |

Brake Pad Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Brake Pad Market Trends

“Increasing Vehicle Production”

- The brake pad market is experiencing robust growth aligned with the steady increase in global vehicle production across both passenger and commercial categories, driving baseline demand for high-performance braking components

- For instance, as global car and commercial vehicle sales rose substantially in recent years, companies such as Continental introduced new designs such as the Green Caliper brake for EVs, supporting the needs of automotive manufacturers focused on both volume and innovation

- Expanding commercial vehicle fleets, particularly in sectors such as logistics and delivery, are further propelling the requirement for durable, reliable brake pads capable of handling heavy and frequent use

- Rising adoption of electric and hybrid vehicles is influencing brake pad technology, with an emphasis on low-noise, long-life, and specialized formulations compatible with regenerative braking systems

- Regulatory pressures and consumer demand for safety are pushing automakers and suppliers to invest in materials advancements and performance improvements, with a strong focus on exceeding global safety standards

- The aftermarket for brake pads is expanding due to consumer awareness regarding routine brake maintenance, easier purchasing through e-commerce channels, and the longevity benefits of new material innovations

Brake Pad Market Dynamics

Driver

“Increase in Demand for Lightweight Materials”

- Vehicle manufacturers and brake system suppliers are increasingly focused on reducing vehicle weight to improve fuel efficiency and performance, resulting in greater demand for lightweight brake pad materials such as advanced ceramics and composites

- For instance, leading manufacturers such as Brembo and SGL Carbon are investing in the development and large-scale adoption of next-generation, lightweight, and environmentally friendly brake pads to serve both the OEM and aftermarket segments

- Environmental regulations against the use of heavy metals and asbestos have accelerated the shift toward innovative, eco-friendly, and lighter material formulations that deliver high friction and extended durability

- Lightweight brake pads contribute to enhanced handling, reduced emissions, and more efficient integration with electric and hybrid vehicle architectures, supporting automotive sector sustainability targets

- Ongoing R&D in material science is allowing brake pad producers to maintain key safety and performance standards while continuing to lessen weight—a growing priority for vehicle manufacturers worldwide

Restraint/Challenge

“High Price Volatility of Raw materials”

- The profitability and cost structure of brake pad manufacturers are challenged by significant price fluctuations in key raw materials such as metals, specialty resins, and advanced ceramics

- For instance, as the demand for copper-free and eco-friendly brake pads rises, companies face elevated and unpredictable costs for substitute friction materials and high-performance composites, which can impact pricing and supply reliability

- Sourcing environmental-friendly or regulatory-compliant raw materials often entails higher expenses and susceptibility to supply chain disruptions, which can be exacerbated by geopolitical or logistical events

- Price instability may deter smaller manufacturers from implementing necessary technology upgrades or product innovations, potentially resulting in a less competitive market for advanced, sustainable brake pads

- Consistent access to quality raw materials at reasonable prices is increasingly difficult as both automotive production volumes and regulatory standards continue to rise, putting pressure across the value chain

Brake Pad Market Scope

The market is segmented on the basis of vehicle type, material, position, and sales channel.

- By Vehicle Type

On the basis of vehicle type, the brake pad market is segmented into passenger cars (PCV), light commercial vehicles (LCV), heavy commercial vehicles (HCV), and two-wheelers. The PCV segment dominated the largest revenue share in 2024, owing to the high global production volume of passenger vehicles and increased demand for personal mobility solutions. Urbanization, improved road infrastructure, and growing consumer awareness around vehicle safety have further driven the need for efficient braking systems, positioning PCVs as a major contributor to brake pad consumption.

The two-wheeler segment is projected to witness the fastest CAGR from 2025 to 2032, supported by the rising adoption of motorcycles and scooters in densely populated countries. The cost-effectiveness of two-wheelers, especially in Asia-Pacific and Latin America, combined with growing safety regulations around braking performance, is leading to greater demand for advanced and durable brake pads in this segment.

- By Material

On the basis of material, the market is categorized into semi-metallic, non-asbestos organic (NAO), low-metallic NAO, and ceramic. The semi-metallic segment held the largest market share in 2024 due to its balanced performance in terms of heat dissipation, braking power, and cost-effectiveness. These pads are widely used across a range of vehicle types, particularly in regions where cost-efficiency and performance are equally important. Their durability under high-load conditions makes them a preferred choice for heavier vehicles and high-speed driving.

The ceramic segment is anticipated to grow at the highest rate from 2025 to 2032, driven by rising demand for noise reduction, cleaner wheel appearance, and improved braking smoothness. Ceramic pads are gaining traction in the premium automotive segment, as they produce less dust and offer longer lifespan, appealing to consumers prioritizing quality and performance over cost.

- By Position

On the basis of position, the brake pad market is segmented into front and front & rear. The front segment dominated the market with a share of 56.8% in 2024, primarily due to the fact that front wheels handle a majority of the braking force in most vehicles, leading to higher wear rates and replacement frequency. Front brake pads are essential for ensuring vehicle safety and are subject to stringent quality standards across passenger and commercial vehicles alike.

The front and rear segment is expected to grow significantly over the forecast period, reflecting a growing preference for full-vehicle brake pad replacements to ensure balanced performance and uniform wear. This trend is especially notable in electric vehicles and high-performance automobiles, where manufacturers are increasingly designing systems that demand evenly distributed braking efficiency.

- By Sales Channel

On the basis of sales channel, the brake pad market is bifurcated into OEM and aftermarket. The OEM segment accounted for the largest revenue share in 2024, bolstered by long-term contracts between automakers and component suppliers, as well as rising vehicle production globally. OEM brake pads are favored for their guaranteed fit, performance consistency, and adherence to original vehicle specifications.

The aftermarket segment is projected to register the fastest growth from 2025 to 2032, driven by the growing aging vehicle fleet and increasing consumer awareness regarding routine brake maintenance. Aftermarket pads offer a wide range of options in terms of material, price, and performance, making them attractive to both individual vehicle owners and fleet operators seeking cost-effective replacement solutions.

Brake Pad Market Regional Analysis

- North America dominated the brake pad market with the largest revenue share of 36.1% in 2024, driven by a mature automotive sector, high vehicle ownership rates, and stringent safety regulations

- Consumers in the region prioritize performance, reliability, and compliance with safety standards, which has led to a steady demand for high-quality brake pads across both passenger and commercial vehicles

- The presence of major automotive manufacturers, widespread adoption of advanced braking technologies, and an increasing shift toward electric vehicles further reinforce the region's market leadership

U.S. Brake Pad Market Insight

The U.S. brake pad market captured the largest revenue share in 2024 within North America, supported by a large vehicle fleet, regular replacement cycles, and regulatory compliance related to vehicle safety. The U.S. market benefits from strong OEM and aftermarket dynamics, with consumers favoring brake pad materials that offer a balance between performance and durability. The growth of EVs and hybrid vehicles also contributes to rising demand for regenerative braking-compatible pads.

Europe Brake Pad Market Insight

The Europe brake pad market is projected to grow at a notable CAGR throughout the forecast period, supported by strict environmental regulations, rising demand for low-noise, low-dust solutions, and the region's strong automotive production base. European automakers and consumers are increasingly opting for advanced materials such as ceramic and NAO to meet performance and sustainability goals. The region also benefits from a well-established aftermarket network, especially in countries with aging vehicle fleets.

U.K. Brake Pad Market Insight

The U.K. brake pad market is expected to grow steadily, driven by increasing vehicle parc, periodic safety inspections (MOT), and growing awareness of vehicle maintenance. The transition to electric and hybrid vehicles is influencing material choices, with ceramic and low-metallic options gaining popularity. High urban vehicle usage and traffic density also contribute to frequent brake pad replacement needs.

Germany Brake Pad Market Insight

The Germany brake pad market is expanding steadily, backed by its leadership in automotive engineering and a strong domestic manufacturing ecosystem. German consumers and OEMs demand high-performance and long-lasting brake solutions, particularly for premium vehicles. The adoption of eco-friendly brake pads is also gaining pace, in line with the country’s sustainability focus and Euro emission standards compliance.

Asia-Pacific Brake Pad Market Insight

The Asia-Pacific brake pad market is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by expanding vehicle production, urbanization, and increased disposable incomes in countries such as China, India, and Japan. The region's booming two-wheeler and small car segments generate significant brake pad demand, especially in the aftermarket. Government safety mandates and growing awareness of regular brake maintenance further stimulate market expansion.

Japan Brake Pad Market Insight

The Japan brake pad market continues to grow due to a strong domestic automotive industry, technological innovation, and consumer preference for precision-engineered, low-noise braking systems. The aging population and focus on road safety have increased the adoption of quality brake pads, especially in urban commuting vehicles. Japan’s early shift toward hybrid and EV technology is also shaping demand for specialized braking systems.

China Brake Pad Market Insight

The China brake pad market accounted for the largest share in Asia-Pacific in 2024, fueled by massive automotive production, rising urban mobility, and the rapid expansion of the aftermarket sector. With increasing safety awareness and evolving emission standards, demand is rising for advanced, low-copper and eco-friendly materials. The presence of major domestic manufacturers and the push toward electric mobility are expected to further boost market growth.

Brake Pad Market Share

The brake pad industry is primarily led by well-established companies, including:

- Wilwood Engineering, Inc. (U.S.)

- Brembo S.p.A. (Italy)

- EBC Brakes (U.K.)

- ICER BRAKES S.A. (Spain)

- Nisshinbo (Japan)

- Hawk Performance (U.S.)

- Hunan BoYun Automobile Brake Materials Co., Ltd. (China)

- Sangsin Brake Co., Ltd. (South Korea)

- KFE Brake Systems (U.S.)

- Brakewel Automotive Components India Private Limited (India)

- TMD FRICTION HOLDINGS GMBH (Germany)

- G.U.D. Holdings (Pty) Ltd. (Australia)

- Sundaram Brake Linings Ltd (India)

- CENTRIC PARTS. (U.S.)

- Ford Motor Company (U.S.)

- Allied Nippon (India)

- Tenneco Inc. (U.S.)

- ZF Friedrichshafen AG (Germany)

- MAT Holding, Inc. (U.S.)

- Rane Holdings Limited (India)

- Akebono Brake Corporation (Japan)

Latest Developments in Global Brake Pad Market

- In January 2025, Uno Minda introduced Heavy Duty Organic Brake Pads with Shim for the Indian aftermarket, reinforcing its position in the domestic brake pad segment. This launch enhances the brand's value proposition by offering improved safety, braking efficiency, and durability, catering to the growing demand for high-performance, replacement-grade components in India’s expanding vehicle fleet

- In November 2024, Akebono Brake Corporation strengthened its foothold in the premium brake pad market by launching seven new part numbers under its EURO and Severe Duty Ultra-Premium Disc Brake Pad lines. This expansion allows Akebono to increase its product coverage across newer vehicle models, bolstering its market share in North America and Europe. The inclusion of premium stainless steel abutment hardware and electric wear sensors further elevates its product differentiation, reinforcing the brand’s reputation for quality and reliability in critical braking applications

- In October 2023, Brembo and SGL Carbon collaborates to launch the two cutting-edge production facilities spanning 8,500 square meters for Brembo SGL Carbon Ceramic Brakes (BSCCB). Scheduled for completion by October 2024, production is set to commence in January 2025, creating about 80 new job opportunities and bolstering the automotive industry

- In September 2023, Brembo S.p.A announced a strategic initiative to meet the rising demand for carbon ceramic brake discs in passenger cars and commercial vehicles. Their joint venture, Brembo SGL Carbon Ceramic Brakes (BSCCB), committed a EUR 150 million investment by 2027, facilitating a remarkable 70% expansion in production capacities across facilities in Meitingen, Germany, and Stezzano, Italy

- In May 2023, Robert Bosch GmbH launched Elite brake pads tailored for the TVS Apache, featuring stripe-coating infused with proprietary ABRACOAT technology. This innovation aims to enhance braking performance and durability for TVS Apache motorcycles, addressing specific needs of enthusiasts and improving safety on the road

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.