Global Brake Sensors Market

Market Size in USD Billion

CAGR :

%

USD

4.40 Billion

USD

6.65 Billion

2024

2032

USD

4.40 Billion

USD

6.65 Billion

2024

2032

| 2025 –2032 | |

| USD 4.40 Billion | |

| USD 6.65 Billion | |

|

|

|

|

Brake Sensors Market Size

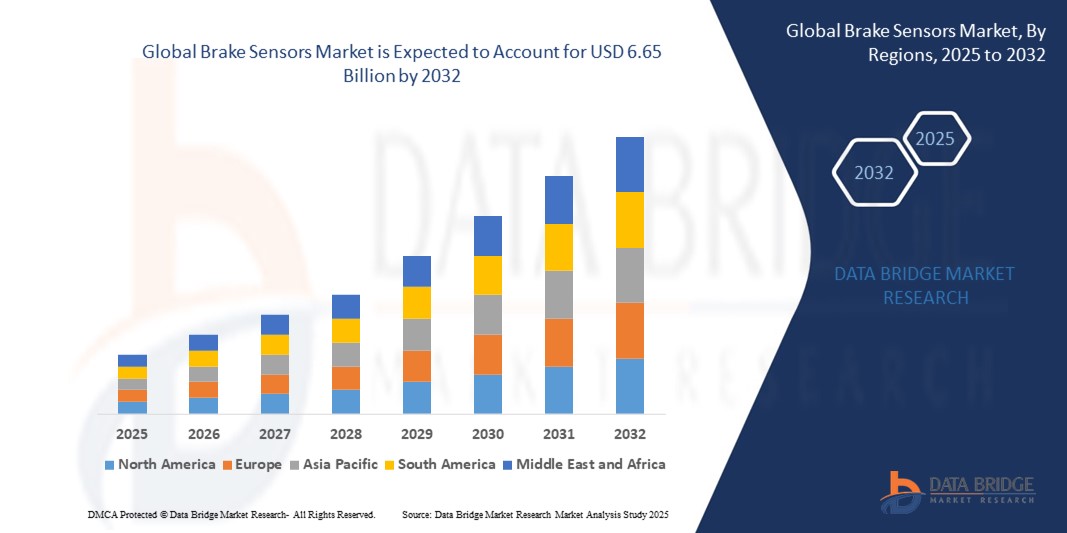

- The global brake sensors market size was valued at USD 4.40 billion in 2024 and is expected to reach USD 6.65 billion by 2032, at a CAGR of 5.3% during the forecast period

- The market growth is largely fueled by the increasing implementation of advanced driver assistance systems (ADAS) and stringent government regulations mandating safety features in vehicles, which are driving widespread adoption of brake sensors across passenger and commercial vehicles

- Furthermore, rising consumer awareness regarding road safety, coupled with the surge in electric and hybrid vehicle production, is establishing brake sensors as a critical component for ensuring precision braking and enhancing overall vehicle performance. These converging factors are significantly accelerating the uptake of brake sensor solutions, thereby boosting the industry’s growth

Brake Sensors Market Analysis

- Brake sensors are integral automotive components designed to monitor braking force, pad wear, and wheel speed, ensuring optimal braking efficiency and system safety. These sensors play a vital role in enabling modern safety technologies such as ABS, ESC, and autonomous emergency braking systems, making them indispensable in both conventional and electric vehicles

- The escalating demand for brake sensors is primarily fueled by rapid advancements in sensor technologies, increased integration of electronics in vehicles, and rising adoption of autonomous and semi-autonomous driving systems, which require highly reliable and responsive braking mechanisms

- Asia-Pacific dominated the brake sensors market with a share of 49.33% in 2024, due to rising vehicle production, increasing adoption of advanced safety systems, and rapid growth in the automotive manufacturing sector

- North America is expected to be the fastest growing region in the brake sensors market during the forecast period due to rising adoption of ADAS, stricter government mandates on vehicle safety, and growing production of SUVs and light trucks

- Passenger vehicle segment dominated the market with a market share of 64.8% in 2024, due to the rising production of passenger cars and the surging integration of smart safety technologies. Consumer preference for safer, high-performance vehicles has pushed automakers to integrate advanced brake sensors, particularly in mid-range and luxury cars. Moreover, regulatory mandates for improved braking efficiency and crash avoidance systems in passenger vehicles further accelerate the adoption of brake sensors, making this segment a dominant contributor to overall market growth

Report Scope and Brake Sensors Market Segmentation

|

Attributes |

Brake Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Brake Sensors Market Trends

Growing Demand for IoT and Connected Devices

- Expansion of IoT and connected vehicle technologies is driving innovation in brake sensors, enabling real-time monitoring, predictive maintenance, and enhanced safety features through data connectivity and integration with smart mobility platforms

- For instance, automotive suppliers such as Bosch, Continental, and Denso are launching next-generation brake sensors embedded with wireless communication modules and cloud analytics to deliver instant feedback, fault diagnostics, and adaptive braking control for modern vehicles

- Surge in connected cars and fleet management systems is supporting the adoption of brake sensors that can transmit performance data and maintenance alerts to centralized dashboards for more efficient operation and downtime reduction

- Integration of sensors with advanced driver assistance systems (ADAS), collision avoidance, and emergency braking functions elevates demand for precision and reliability, especially in premium passenger and commercial vehicle segments

- Growth of autonomous vehicles and electrification trends necessitates sophisticated brake sensor solutions capable of interfacing with multiple vehicle subsystems for optimized control and safety

- Increased consumer expectations for safety, reliability, and digital experiences continue to shape manufacturers’ investment in smart sensor technologies for both OEM and aftermarket applications

Brake Sensors Market Dynamics

Driver

Rapid Urbanization Across the Globe

- Accelerating urban growth globally is escalating traffic volumes and road congestion, prompting automakers to integrate advanced brake sensors in vehicles for improved safety, agile responsiveness, and compliance with escalating regulatory standards

- For instance, automotive manufacturers such as Toyota, Hyundai, and Ford are increasingly deploying intelligent brake sensor systems in city-focused models and mass-market vehicles to cater to urban driving challenges and public transport fleets

- Urban mobility trends, including ride-sharing, electric buses, and last-mile logistics, require robust, maintenance-free brake sensor technologies for high-frequency, stop-and-go operations

- Expanding urban infrastructure investment supports adoption of sensor-equipped intelligent vehicles for public safety, emissions reduction, and smart city initiatives

- Growing awareness of road safety and stricter accident-reduction mandates in major cities intensifies focus on sensor-driven braking solutions to mitigate risks and enhance traffic flow. Continued growth in emerging-market urbanization accelerates replacement demand for sensor-equipped vehicles and parts in expanding used-car and commercial fleets

Restraint/Challenge

High Cost of Sensor Technology

- Substantial investment in research, materials, manufacturing, and calibration processes required for modern brake sensor technologies results in higher unit costs, creating barriers for broad adoption in entry-level and cost-sensitive vehicle segments

- For instance, suppliers and automakers face profitability pressures when integrating advanced sensors into mass-market models, often passing higher costs on to consumers or limiting adoption to high-margin vehicles

- Complexity in design, integration, and compatibility with multi-brand systems compounds the cost of installation and upgrades, especially for aftermarket solutions

- Price competition in the industry may discourage smaller manufacturers or new entrants from pursuing innovation, slowing overall market development

- Ongoing expenses related to software updates, diagnostics, and warranty servicing for high-tech sensor systems increase total cost of ownership. Cost-related challenges may restrict widespread adoption and delay transition to advanced, connected sensor solutions in developing markets or older vehicle fleets

Brake Sensors Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the brake sensors market is segmented into electronic brake sensors and disc brake sensors. The electronic brake sensors segment dominated the largest market revenue share in 2024, owing to the increasing adoption of advanced driver-assistance systems (ADAS) and the growing integration of electronic components in modern vehicles. These sensors play a crucial role in detecting brake performance, enhancing driver safety, and enabling features such as electronic stability control (ESC) and anti-lock braking systems (ABS). Rising demand for connected and intelligent braking systems across passenger and commercial vehicles further drives the dominance of electronic brake sensors, making them essential in ensuring regulatory compliance with global safety standards.

The disc brake sensors segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising installation of disc braking systems in passenger and light commercial vehicles. These sensors are widely valued for their precision in monitoring brake wear and ensuring timely maintenance, which helps reduce downtime and improves vehicle performance. The rapid expansion of electric and hybrid vehicles, which predominantly rely on disc brake setups, further boosts the demand for disc brake sensors. In addition, increasing consumer awareness regarding safety and performance efficiency continues to accelerate the adoption of disc brake sensors in both developed and emerging markets.

- By Application

On the basis of application, the brake sensors market is segmented into passenger vehicles and commercial vehicles. The passenger vehicle segment accounted for the largest market revenue share of 64.8% in 2024, driven by the rising production of passenger cars and the surging integration of smart safety technologies. Consumer preference for safer, high-performance vehicles has pushed automakers to integrate advanced brake sensors, particularly in mid-range and luxury cars. Moreover, regulatory mandates for improved braking efficiency and crash avoidance systems in passenger vehicles further accelerate the adoption of brake sensors, making this segment a dominant contributor to overall market growth.

The commercial vehicle segment is expected to record the fastest CAGR from 2025 to 2032, largely supported by the increasing demand for heavy-duty trucks, buses, and logistics fleets across global markets. Brake sensors in commercial vehicles are critical for ensuring safety in long-haul operations, reducing accident risks, and meeting stricter government safety regulations. The rising focus on fleet management efficiency and predictive maintenance also drives the adoption of advanced brake sensor technologies. In addition, the rapid expansion of e-commerce and logistics industries worldwide creates a strong demand for sensor-equipped commercial vehicles, further propelling this segment’s accelerated growth.

Brake Sensors Market Regional Analysis

- Asia-Pacific dominated the brake sensors market with the largest revenue share of 49.33% in 2024, driven by rising vehicle production, increasing adoption of advanced safety systems, and rapid growth in the automotive manufacturing sector

- The region’s strong automotive supply chain, cost-effective manufacturing base, and rising consumer demand for passenger and commercial vehicles are accelerating market expansion

- Supportive government regulations on vehicle safety, expanding electric vehicle adoption, and growing presence of global automotive OEMs are contributing to the dominance of Asia-Pacific in the brake sensors market

China Brake Sensors Market Insight

China held the largest share in the Asia-Pacific brake sensors market in 2024, owing to its position as the world’s leading automotive producer and strong focus on vehicle safety technologies. The country’s massive passenger car market, robust commercial vehicle sales, and ongoing electrification initiatives are fueling demand for brake sensors. Favorable government policies supporting EV growth, coupled with a vast domestic supply chain, are further strengthening China’s leading role in the regional market.

India Brake Sensors Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing passenger car ownership, government initiatives to enforce stricter vehicle safety standards, and rising demand for commercial vehicles. The country’s expanding automotive manufacturing capacity, supported by the "Make in India" program, is boosting the installation of advanced brake monitoring systems. Growth in EV production and heightened consumer awareness of safety are further accelerating demand for brake sensors in India.

Europe Brake Sensors Market Insight

The Europe brake sensors market is expanding steadily, supported by stringent regulatory frameworks mandating advanced braking systems and rising focus on vehicle safety. Growing adoption of electronic stability control, anti-lock braking systems, and advanced driver-assistance features is fueling demand. The region’s strong automotive heritage, focus on sustainability, and leadership in electric and premium vehicle manufacturing are further enhancing market expansion.

Germany Brake Sensors Market Insight

Germany’s brake sensors market is driven by its position as a global leader in automotive engineering, with strong production of high-performance and premium vehicles. The presence of leading automakers, focus on R&D in mobility technologies, and integration of advanced braking systems in EVs and luxury cars are boosting demand. The country’s export-oriented automotive industry and strict safety regulations further consolidate Germany’s leadership in the European market.

U.K. Brake Sensors Market Insight

The U.K. market is supported by a robust automotive aftermarket, rising focus on road safety compliance, and ongoing investments in electric and hybrid vehicles. The presence of a mature automotive design and testing ecosystem is driving the adoption of advanced brake sensing technologies. Post-Brexit initiatives to localize supply chains and boost domestic vehicle production are further strengthening the U.K.’s role in the European brake sensors market.

North America Brake Sensors Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising adoption of ADAS, stricter government mandates on vehicle safety, and growing production of SUVs and light trucks. Expanding EV adoption, strong consumer preference for technologically advanced vehicles, and integration of predictive maintenance systems are fueling market growth. The region’s innovation-driven automotive industry and increasing collaborations between OEMs and technology providers are also boosting demand for brake sensors.

U.S. Brake Sensors Market Insight

The U.S. accounted for the largest share in the North America brake sensors market in 2024, underpinned by its vast automotive fleet, strong EV ecosystem, and leadership in safety technology adoption. High demand for SUVs and trucks, combined with regulatory enforcement of braking performance standards, is driving sensor installation. The presence of leading automakers, significant investments in advanced braking technologies, and a well-established aftermarket network further support the U.S.’s dominance in the regional market.

Brake Sensors Market Share

The brake sensors industry is primarily led by well-established companies, including:

- Knorr-Bremse AG (Germany)

- WABCO (U.S.)

- Meritor, Inc. (U.S.)

- ZF Friedrichshafen AG (Germany)

- Wabtec Corporation (U.S.)

- Nabtesco Automotive Corporation (U.S.)

- Tenneco Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- DENSO Corporation (Japan)

- Hitachi Astemo Ltd. (Japan)

- Delphi Technologies (U.K.)

- Akebono Brake Industry Co., Ltd. (Japan)

- Brembo S.p.A. (Italy)

- Sensata Technologies, Inc. (U.S.)

- Mando Corporation (South Korea)

- Nissin Kogyo Co., Ltd. (Japan)

Latest Developments in Global Brake Sensors Market

- In May 2025, the European Union approved new regulations mandating the installation of brake wear sensors in all new passenger cars starting from 2027. This regulatory shift is expected to significantly accelerate market growth in Europe, as automakers will be compelled to integrate these safety components into their vehicle designs. The policy ensures higher adoption rates and also creates substantial opportunities for suppliers and manufacturers of advanced brake wear sensors, strengthening Europe’s position as a leading region in the global market

- In April 2025, Aptiv completed the acquisition of Autoness, a provider of advanced driver assistance systems (ADAS) and sensor technologies. This acquisition strengthens Aptiv’s capabilities in the automotive sensor domain, particularly brake wear sensors, by combining Autoness’s expertise in intelligent sensing with Aptiv’s strong market presence. The move is anticipated to enhance innovation pipelines, accelerate product development, and improve Aptiv’s competitiveness in supplying integrated safety solutions to global OEMs

- In March 2024, Bosch entered into a strategic collaboration with Autoliv to jointly develop and produce brake wear sensors. This partnership is set to leverage Bosch’s technological leadership in sensor development and Autoliv’s specialization in automotive safety systems, creating synergies that will improve sensor accuracy, reliability, and cost efficiency. The alliance is expected to expand the availability of advanced sensor solutions in global markets, boosting adoption among automakers seeking compliant and innovative safety technologies

- In January 2024, Continental AG launched a new generation of brake wear sensors featuring enhanced accuracy and longer service life through the use of ultrasonic technology. This product innovation reflects Continental’s commitment to improving real-time brake monitoring and predictive maintenance capabilities. The introduction of these advanced sensors is likely to increase the company’s market share, as automakers and aftermarket players look for high-performance solutions that can reduce warranty claims and improve vehicle safety standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.