Global Branched Stent Grafts Market

Market Size in USD Million

CAGR :

%

USD

356.81 Million

USD

675.25 Million

2024

2032

USD

356.81 Million

USD

675.25 Million

2024

2032

| 2025 –2032 | |

| USD 356.81 Million | |

| USD 675.25 Million | |

|

|

|

|

Branched Stent Grafts Market Size

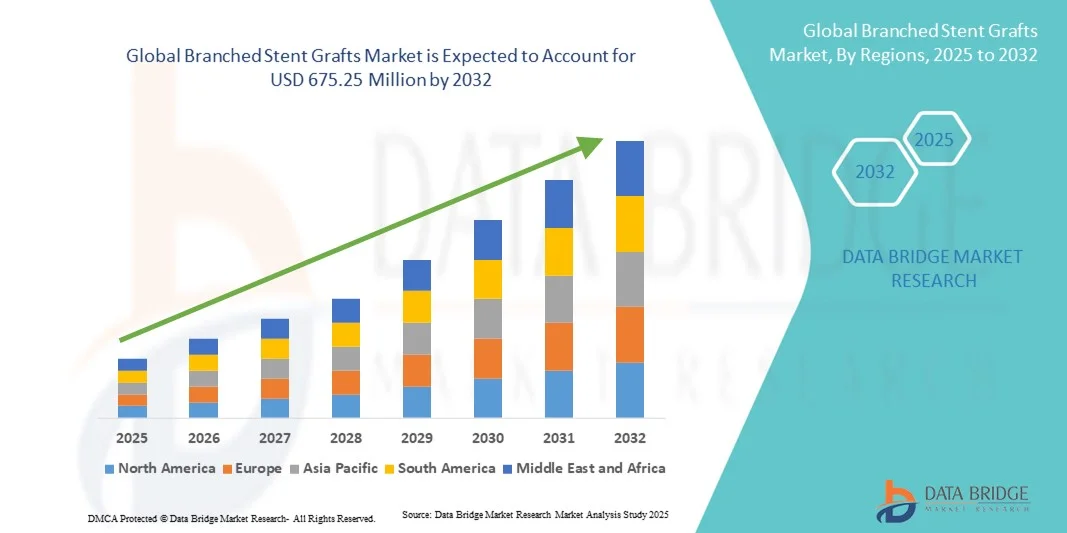

- The global branched stent grafts market size was valued at USD 356.81 million in 2024 and is expected to reach USD 675.25 million by 2032, at a CAGR of 8.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of complex aortic aneurysms and advancements in minimally invasive endovascular procedures, driving wider adoption of branched stent grafts across healthcare systems globally

- Furthermore, rising demand for customized and durable vascular repair solutions, coupled with technological innovation in graft design and materials, is positioning branched stent grafts as the preferred treatment option. These factors are accelerating adoption in both developed and emerging markets, thereby significantly boosting the industry's growth

Branched Stent Grafts Market Analysis

- Branched stent grafts, designed for endovascular repair of complex aortic aneurysms involving branch vessels, are increasingly vital in modern vascular surgery due to their minimally invasive approach, precision deployment, and ability to preserve blood flow to critical arteries

- The escalating demand for branched stent grafts is primarily fueled by the rising prevalence of aortic aneurysms, increasing adoption of minimally invasive endovascular procedures, and preference for reduced recovery times compared to open surgery

- North America dominated the branched stent grafts market with the largest revenue share of 37.9% in 2024, driven by early adoption of advanced endovascular technologies, well-established healthcare infrastructure, and a strong presence of key medical device companies, with the U.S. witnessing significant uptake due to procedural innovations and expansion of specialized vascular centers

- Asia-Pacific is expected to be the fastest growing region in the branched stent grafts market during the forecast period, supported by increasing healthcare investments, rising awareness of aortic diseases, and growing availability of advanced interventional cardiology and vascular surgery services

- EVAR segment dominated the branched stent grafts market by application with a market share of 43.2% in 2024, driven by its widespread use for endovascular aneurysm repair and strong clinical adoption in hospitals and specialized vascular centers

Report Scope and Branched Stent Grafts Market Segmentation

|

Attributes |

Branched Stent Grafts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Branched Stent Grafts Market Trends

Advancements in Imaging and Navigation-Assisted Deployment

- A significant and accelerating trend in the global branched stent grafts market is the integration of advanced imaging techniques such as 3D CT reconstruction and intraoperative navigation systems, improving procedural accuracy and clinical outcomes

- For instance, advanced imaging-assisted planning allows vascular surgeons to precisely measure aneurysm dimensions and branch vessel locations, facilitating the deployment of patient-specific branched stent grafts

- Navigation-assisted systems enable real-time visualization during endovascular procedures, reducing operative time, minimizing radiation exposure, and lowering complication rates. For instance, some centers use 3D overlay techniques to guide graft positioning with enhanced precision

- The integration of imaging and navigation technologies allows seamless planning and execution of complex endovascular repairs, enabling safer treatment of thoracoabdominal and aortic arch aneurysms while preserving branch vessel perfusion

- This trend towards more accurate, image-guided, and minimally invasive procedures is fundamentally reshaping clinical expectations for vascular interventions. Consequently, companies such as Terumo and Cook Medical are developing navigation-compatible branched stent graft systems with real-time imaging support

- The demand for branched stent grafts with integrated imaging and navigation capabilities is growing rapidly across hospitals and specialized surgical centers, as clinicians increasingly prioritize procedural safety and precision

Branched Stent Grafts Market Dynamics

Driver

Increasing Prevalence of Complex Aortic Aneurysms and Minimally Invasive Procedures

- The rising incidence of complex aortic aneurysms, coupled with the growing preference for minimally invasive endovascular procedures, is a significant driver for the heightened demand for branched stent grafts

- For instance, in March 2024, Medtronic reported increased adoption of its branched stent graft systems in complex thoracoabdominal aneurysm repair, reflecting the expanding clinical need for endovascular solutions

- As more patients require safe and effective alternatives to open surgery, branched stent grafts offer advanced features such as precise branch vessel preservation, lower complication rates, and shorter hospital stays, providing a compelling clinical solution

- Furthermore, the growing number of specialized vascular centers and increasing clinician expertise in complex endovascular procedures are making branched stent grafts an integral part of modern vascular treatment protocols

- The convenience of minimally invasive access, reduced recovery times, and compatibility with navigation and imaging technologies are key factors propelling the adoption of branched stent grafts in hospitals and ambulatory surgical centers

- The trend towards patient-specific solutions and expanding procedural indications further contributes to market growth

Restraint/Challenge

Technical Complexity and Regulatory Hurdles

- The intricate design and deployment requirements of branched stent grafts pose a significant challenge to broader market penetration. As these devices require high clinician skill and precise procedural planning, adoption may be limited in less specialized centers

- For instance, complex aortic arch and thoracoabdominal aneurysm repairs demand careful preoperative planning and intraoperative imaging, making training and experience critical for successful outcomes

- Addressing these technical challenges through specialized training programs, procedural simulation, and device design simplification is crucial for wider adoption. Companies such as Cook Medical and Terumo emphasize surgeon education and device support to mitigate procedural complexity

- In addition, stringent regulatory requirements and the need for extensive clinical data for approval can delay product launches and limit availability, particularly in emerging markets

- While technological advancements are gradually simplifying device deployment, the perceived complexity and high cost of branched stent graft systems can hinder adoption, especially in regions with limited vascular expertise

- Overcoming these challenges through training, regulatory support, and procedural standardization will be vital for sustained market growth

Branched Stent Grafts Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the branched stent grafts market is segmented into iliac stent and others. The iliac stent segment dominated the market with the largest revenue share of 45.3% in 2024, driven by its widespread use in treating iliac artery aneurysms and peripheral aortic branch involvement. Iliac stents are preferred due to their established clinical efficacy, compatibility with various endovascular devices, and ability to maintain blood flow to critical arteries. The segment also benefits from continuous technological improvements in stent design, including better radial strength, flexibility, and delivery systems, making procedures safer and more effective. Increasing procedural adoption in hospitals and specialized vascular centers further supports the dominance of iliac stents in the branched stent graft market. Moreover, growing awareness among physicians about minimally invasive vascular repair is sustaining market demand.

The others segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising demand for customized stent solutions addressing complex aortic anatomies beyond iliac branches. Innovations in modular and branched graft designs allow clinicians to treat previously untreatable aneurysms, expanding market potential. Growth is also supported by increasing awareness among healthcare providers about minimally invasive endovascular options and the need for tailored stent grafts for individual patient anatomies. Technological advancements in graft materials and delivery systems are further enhancing clinical adoption. In addition, increasing investments in research and development of novel stent platforms are driving this segment’s growth.

- By Application

On the basis of application, the branched stent grafts market is segmented into EVAR, FEVAR, Chimney, and others. The EVAR segment dominated the market with the largest market revenue share of 43.2% in 2024, driven by its established use in endovascular aneurysm repair procedures. EVAR offers significant clinical benefits such as reduced operative time, minimal blood loss, and faster patient recovery, making it the preferred choice among hospitals and vascular surgeons. Its dominance is also supported by extensive clinical data validating efficacy and safety, along with widespread adoption across major healthcare centers globally. The availability of trained specialists and advanced imaging infrastructure further reinforces EVAR’s leading position. Continuous updates in procedural protocols and device iterations help maintain its strong market presence. Hospitals and specialty centers increasingly favor EVAR for standard and complex aneurysm cases due to procedural reliability.

The FEVAR segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing prevalence of complex thoracoabdominal aneurysms requiring fenestrated stent grafts. FEVAR allows for precise preservation of branch vessel perfusion, making it essential for patients with anatomically challenging aneurysms. Growth is supported by technological advancements in fenestrated graft designs and increased training of vascular specialists in complex endovascular procedures, especially in emerging markets. Expanding awareness of minimally invasive options among patients and surgeons is also propelling adoption. In addition, regulatory approvals for newer fenestrated devices are enabling market expansion. Rising healthcare investments in advanced vascular care centers further accelerate this segment’s growth.

- By End User

On the basis of end user, the branched stent grafts market is segmented into hospitals and ambulatory surgical centers. The hospitals segment dominated the market with the largest revenue share of 71.5% in 2024, driven by the availability of advanced imaging equipment, trained vascular surgeons, and comprehensive patient care facilities. Hospitals are preferred for complex aneurysm repairs due to their ability to manage complications and provide post-operative care. The dominance is further reinforced by reimbursement coverage and established procedural protocols in hospital settings. Hospitals also benefit from strong clinical trial networks, supporting adoption of new branched stent graft technologies. High procedural volumes and multidisciplinary teams enable hospitals to handle a wide range of complex cases efficiently. The presence of specialized vascular centers within hospitals contributes significantly to maintaining market leadership.

The ambulatory surgical centers segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing demand for outpatient endovascular procedures and minimally invasive aneurysm repair solutions. ASC growth is supported by cost efficiency, reduced hospital stay requirements, and the ability to perform selected EVAR and branched stent graft procedures in a controlled, high-quality environment. Expansion of ASCs in emerging markets with increasing healthcare investments further accelerates this segment’s growth. In addition, patient preference for convenient and lower-cost treatment options is driving ASC adoption. Integration of advanced imaging tools and trained staff in ASCs is making complex procedures more accessible. Collaboration between device manufacturers and ASCs to provide procedure support further supports this segment’s growth.

Branched Stent Grafts Market Regional Analysis

- North America dominated the branched stent grafts market with the largest revenue share of 37.9% in 2024, driven by early adoption of advanced endovascular technologies, well-established healthcare infrastructure, and a strong presence of key medical device companies

- Patients and healthcare providers in the region highly value the precision, safety, and reduced recovery times offered by branched stent grafts, along with compatibility with advanced imaging and navigation systems

- This widespread adoption is further supported by well-established healthcare infrastructure, high healthcare spending, and the presence of key medical device companies, establishing branched stent grafts as a preferred solution for complex aneurysm repairs in hospitals and specialized vascular centers

U.S. Branched Stent Grafts Market Insight

The U.S. branched stent grafts market captured the largest revenue share of 79% in 2024 within North America, fueled by the high prevalence of complex aortic aneurysms and advanced adoption of minimally invasive endovascular procedures. Hospitals and specialized vascular centers increasingly prefer branched stent grafts due to their precision, safety, and ability to preserve branch vessel perfusion. The growing number of trained vascular specialists, combined with widespread availability of advanced imaging and navigation systems, further propels the market. Moreover, increasing patient awareness about less invasive treatment options and faster recovery times is significantly contributing to market expansion.

Europe Branched Stent Grafts Market Insight

The Europe branched stent grafts market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising incidence of thoracoabdominal and complex aortic aneurysms and well-developed healthcare infrastructure. Increasing urbanization, coupled with growing awareness of minimally invasive treatments, is fostering the adoption of branched stent grafts. European hospitals are increasingly investing in advanced endovascular technologies, while reimbursement coverage and regulatory support facilitate market growth. The region is witnessing significant adoption across both elective and emergency vascular procedures, enhancing market demand.

U.K. Branched Stent Grafts Market Insight

The U.K. branched stent grafts market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising need for precise, minimally invasive aneurysm repair solutions. In addition, the prevalence of vascular diseases and concerns regarding post-surgical complications are encouraging hospitals to adopt advanced branched stent graft systems. The U.K.’s focus on healthcare innovation, along with strong hospital infrastructure and trained vascular surgeons, is expected to continue stimulating market growth. Increasing clinical trials and adoption of navigation-assisted procedures further support expansion.

Germany Branched Stent Grafts Market Insight

The Germany branched stent grafts market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing prevalence of complex aortic conditions and emphasis on minimally invasive treatment options. Germany’s advanced healthcare infrastructure, combined with strong research and development capabilities, promotes adoption of branched stent grafts in hospitals and specialized vascular centers. Integration of advanced imaging and patient-specific graft planning is becoming increasingly prevalent, with a strong preference for solutions that ensure safety, precision, and reduced complications. Growing awareness among clinicians and patients further drives demand.

Asia-Pacific Branched Stent Grafts Market Insight

The Asia-Pacific branched stent grafts market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by increasing healthcare investments, rising incidence of aortic aneurysms, and growing adoption of minimally invasive procedures in countries such as China, Japan, and India. The region’s expanding number of specialized vascular centers and trained surgeons is facilitating adoption. Moreover, government initiatives promoting advanced healthcare infrastructure and awareness programs on vascular diseases are driving market growth. Asia-Pacific is also emerging as a focus region for medical device manufacturers, improving accessibility and affordability of branched stent graft solutions.

Japan Branched Stent Grafts Market Insight

The Japan branched stent grafts market is gaining momentum due to the country’s aging population, rising prevalence of aortic aneurysms, and high adoption of minimally invasive vascular procedures. Japanese hospitals prioritize safety, precision, and reduced recovery times, which fuels the adoption of branched stent graft systems. Integration with advanced imaging and navigation systems supports complex aneurysm repair procedures. Moreover, increasing awareness among clinicians and patients regarding endovascular solutions contributes to market growth in both hospitals and specialized surgical centers.

India Branched Stent Grafts Market Insight

The India branched stent grafts market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to increasing prevalence of aortic aneurysms, rapid expansion of specialized vascular centers, and growing adoption of minimally invasive procedures. India is witnessing rising investments in advanced healthcare infrastructure and training of endovascular specialists, enhancing procedural success rates. Government initiatives supporting awareness of vascular diseases and technological adoption in hospitals further propel the market. The availability of cost-effective and locally manufactured branched stent graft systems is also driving demand across both public and private healthcare facilities.

Branched Stent Grafts Market Share

The Branched Stent Grafts industry is primarily led by well-established companies, including:

- MicroPort Scientific Corporation (China)

- Artivion, Inc. (U.S.)

- Medtronic (Ireland)

- Terumo Corporation (Japan)

- Lombard Medical (U.K.)

- Cook Medical (U.S.)

- BD (U.S.)

- Boston Scientific Corporation (U.S.)

- Cardinal Health (U.S.)

- Abbott (U.S.)

- Merit Medical Systems (U.S.)

- Avimedica (Turkey)

- Terumo Aortic (Japan)

- OrbusNeich Medical Group Holdings Limited (Hong Kong)

- Alvimedica (Turkey)

- LeMaitre Vascular, Inc. (U.S.)

- Braile Biomedica (Brazil)

- SB-KAWASUMI LABORATORIES, INC. (Japan)

What are the Recent Developments in Global Branched Stent Grafts Market?

- In August 2025, Cook Medical announced the completion of patient enrollment in the global clinical study of its ZENITH FENESTRATED+ Endovascular Graft (ZFEN+). This is a significant milestone in the development of the device, which is designed to treat complex abdominal and thoracoabdominal aortic aneurysms with more fenestrations and a broader range of applications than previous models

- In July 2025, MicroPort Endovastec announced the completion of the first batch of commercial uses of its next-generation Cratos Branched Aortic Stent Graft System. This device features an adjustable proximal stent end and is designed for the minimally invasive endovascular treatment of thoracic aortic dissections involving aortic arch branches. The first clinical implantations were successfully performed at Zhongshan Hospital Fudan University in China

- In June 2025, MicroPort Endovastec announced that its Castor Branched Aortic Stent Graft System achieved its first clinical use in multiple countries, including Singapore, Malaysia, Kazakhstan, and South Korea. The system is designed for the treatment of complex aortic pathologies and aims to expand the availability of personalized endovascular care globally

- In May 2025, Endovastec announced that its Minos Abdominal Aortic Stent Graft and Delivery System received CE MDR certification. This certification, a key regulatory approval for the European market, validates the device's compliance with strict new European medical device regulations. The Minos™ system is designed for the endovascular treatment of abdominal aortic aneurysms and this certification will allow the company to expand its presence and make the device available to more patients in the European Union

- In April 2025, Terumo Aortic received FDA approval for an expanded indication for its RELAYPRO Thoracic Stent-Graft System. The device is now approved for the treatment of aortic dissections and transections, in addition to its existing indication for aneurysms and ulcers. This expansion provides a minimally invasive option for patients with these acute aortic conditions, broadening the use of the RELAYPRO® system in the U.S. market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.