Global Brazil Nuts Market

Market Size in USD Billion

CAGR :

%

USD

96.40 Billion

USD

151.34 Billion

2024

2032

USD

96.40 Billion

USD

151.34 Billion

2024

2032

| 2025 –2032 | |

| USD 96.40 Billion | |

| USD 151.34 Billion | |

|

|

|

|

Brazil Nuts Market Size

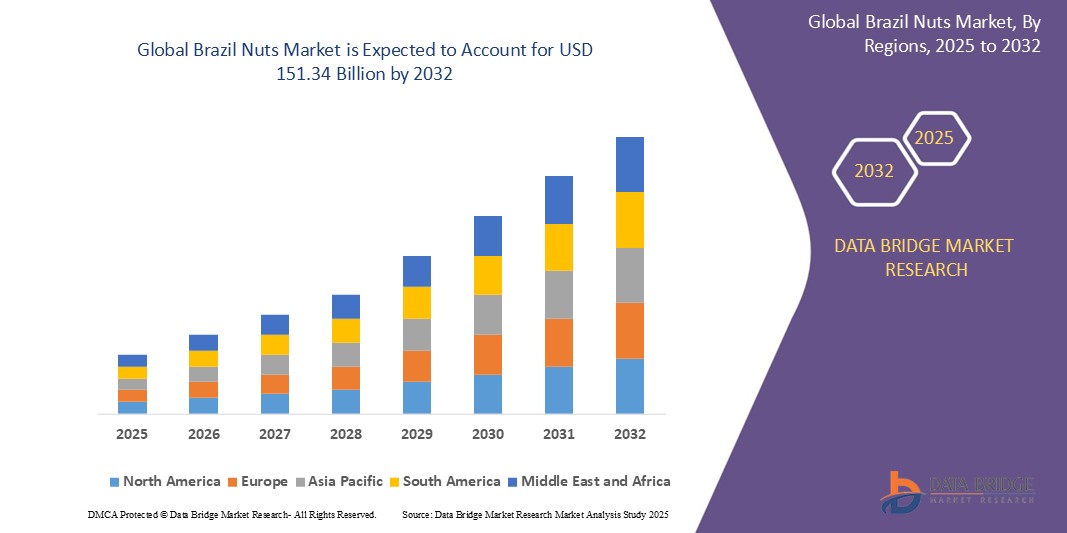

- The global Brazil nuts market size was valued at USD 96.4 million in 2024 and is expected to reach USD 151.34 billion by 2032, at a CAGR of 5.8% during the forecast period

- This growth is driven by factors such as rising consumer awareness of health benefits, growing demand for plant-based diets, and increasing preference for organic and sustainably sourced nuts

Brazil Nuts Market Analysis

- Brazil nuts are nutrient-rich tree nuts primarily harvested from the Amazon rainforest and are valued for their high selenium content, making them popular in health and wellness food segments. They are commonly used in snacks, confectionery, and dietary supplements

- The demand for Brazil nuts is significantly driven by increasing health consciousness, rising popularity of plant-based diets, and growing awareness of selenium’s health benefits

- Latin America is expected to dominate the brazil nuts market with largest market share of approximately 45%, due to being the primary production hub and the presence of favorable climatic and harvesting conditions

- Asia-Pacific is expected to be the fastest growing region in the brazil nuts market during the forecast period due to increasing disposable incomes and growing demand for nutrient-rich superfoods

- Conventional Brazil nuts segment is expected to dominate the market with a largest market share of approximately 70%, due to the historically lower production costs and broader availability of conventionally grown Brazil nuts. Conventional farming methods have been the traditional approach, resulting in a more established supply chain and consumer base. These nuts are produced using standard agricultural practices, which make them more cost-effective compared to organic alternatives

Report Scope and Brazil Nuts Market Segmentation

|

Attributes |

Brazil Nuts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Brazil Nuts Market Trends

“Increasing Demand for Plant-Based & Sustainable Brazil Nuts Products”

- One prominent trend in the global Brazil nuts market is the growing consumer demand for plant-based and sustainably sourced food products

- This trend is being driven by a rising awareness of the health benefits of Brazil nuts, such as their high selenium content and nutritional value, alongside the increasing popularity of plant-based diets

- For instance, Brazil nuts are being incorporated into plant-based snacks, energy bars, dairy alternatives, and other functional food products, catering to health-conscious consumers seeking nutrient-dense, vegan options

- These developments are contributing to the expansion of the Brazil nuts market, driving innovation in product offerings, and aligning with the increasing preference for clean-label, environmentally friendly, and ethical food sources

Brazil Nuts Market Dynamics

Driver

“Growing Consumer Awareness of Health Benefits”

- The rising awareness of the health benefits of Brazil nuts, particularly their high selenium content, is significantly contributing to the increased demand for Brazil nuts in various food products

- As consumers become more health-conscious, there is an increased focus on nutrient-rich foods, with Brazil nuts being recognized for their antioxidant properties, healthy fats, and ability to support heart health and immune function

- As more individuals seek healthier snack options and functional foods, the demand for Brazil nuts continues to grow, influencing their inclusion in dietary supplements, energy bars, snacks, and other health-focused products

For instance,

- In 2023, a report by GlobalData highlighted the rising preference for superfoods among consumers, with Brazil nuts being considered a key ingredient in the growing market for nutrient-dense snacks and plant-based foods

- As a result of increasing awareness about their nutritional benefits, there is a significant boost in the demand for Brazil nuts, particularly in the health and wellness sector

Opportunity

“Expanding into the Growing Global Vegan and Plant-Based Food Market”

- The rising adoption of vegan and plant-based diets presents a significant opportunity for the Brazil nuts market, as consumers seek plant-based sources of protein, healthy fats, and essential nutrients

- Brazil nuts, being a rich source of selenium, healthy fats, and antioxidants, align perfectly with the nutritional needs of those following plant-based diets

- There is increasing demand for plant-based snacks, dairy alternatives, and functional food products that include Brazil nuts as a key ingredient

For instance,

- In 2024, a report by the Plant-Based Foods Association highlighted the exponential growth of plant-based foods, with Brazil nuts being featured in plant-based milks, butter, and energy bars, catering to the growing vegan and health-conscious consumer base

- With the rise in demand for plant-based and dairy-free alternatives, expanding Brazil nuts into this growing market presents a profitable opportunity for producers and manufacturers

Restraint/Challenge

“Supply Chain Disruptions and Environmental Challenges”

- The global Brazil nuts market faces significant challenges due to supply chain disruptions and environmental factors, particularly in the Amazon region where these nuts are harvested

- Factors such as deforestation, climate change, and unpredictable weather patterns can impact the availability and quality of Brazil nuts, leading to fluctuations in supply and price instability

- The reliance on traditional harvesting methods and the wild nature of Brazil nut trees make the supply chain vulnerable to environmental changes and economic pressures

For instance,

- In December 2023, according to an article by the Food and Agriculture Organization (FAO), environmental challenges, including the impact of climate change and illegal logging, are threatening the sustainability of Brazil nut harvesting in the Amazon. This has raised concerns about long-term supply stability and environmental preservation

- Consequently, such disruptions can affect the overall growth of the Brazil nuts market, leading to price volatility and potential shortages, which could limit market expansion and consumer access

Brazil Nuts Market Scope

The market is segmented on the basis of product, type, end user, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By End User |

|

|

By Distribution Channel

|

|

In 2025, the conventional Brazil nuts is projected to dominate the market with a largest share in product segment

The conventional Brazil nuts segment is expected to dominate the Brazil nuts market with the largest share of approximately 70%, due to the historically lower production costs and broader availability of conventionally grown Brazil nuts. Conventional farming methods have been the traditional approach, resulting in a more established supply chain and consumer base. These nuts are produced using standard agricultural practices, which make them more cost-effective compared to organic alternatives

The organic Brazil nuts is expected to account for the largest share during the forecast period in product segment

In 2025, the organic Brazil nuts segment is expected to dominate the market with the largest market share of approximately 30%, due to their health benefits and sustainable farming practices, they currently hold a smaller market share compared to conventional nuts

Brazil Nuts Market Regional Analysis

“Latin America Holds the Largest Share in the Brazil Nuts Market”

- The Latin America region dominates the Brazil nuts market with largest market share of approximately 45%, driven by the abundant availability of Brazil nuts in countries like Brazil, which is the world’s largest producer

- Brazil holds a significant share of approximately 65%, due to well-established harvesting process in the Amazon Rainforest, supporting both local economies and international trade

- The increasing demand for sustainable and natural food products has further strengthened the position of Brazil as the leading market player, with the availability of high-quality, ethically sourced Brazil nuts

- In addition, the rising popularity of Brazil nuts in the global health food market, especially as a superfood rich in selenium, has fueled the region’s market dominance

“Asia-Pacific is Projected to Register the Highest CAGR in the Brazil Nuts Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the Brazil nuts market, driven by increasing awareness of health benefits and rising demand for nutrient-dense snacks

- Countries such as China, India, and Japan are emerging as key markets due to growing consumer preferences for plant-based diets, healthy snacks, and functional foods

- Japan, with its advanced consumer health trends, is witnessing increased demand for superfoods like Brazil nuts, which are rich in essential nutrients

- China and India, with their large populations and growing middle-class income, are showing heightened interest in premium food products, contributing to the expanding market for Brazil nuts in the region

Brazil Nuts Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Ecofruit Ltda (Brazil)

- Nuttybyte (U.S.)

- Sincerely Nuts (U.S.)

- Sunbest Natural (U.S.)

- We Got Nuts (U.S.)

- NOW Foods (U.S.)

- Nut Cravings (U.S.)

- Bata Food (U.S.)

- Royal Nut Company (Australia)

- Archer Daniels Midland Co. (ADM) (U.S.)

- Basse Nuts (Canada)

- Food to Live (U.S.)

- Happilo International Pvt. Ltd. (India)

- Healthy Truth (U.S.)

- NOW Health Group Inc. (U.S.)

- Nuts.com Inc. (U.S.)

- Nut Cravings (U.S.)

- Nutshup (U.S.)

- Select Harvests Ltd. (Australia)

- Sunfood (U.S.)

Latest Developments in Global Brazil Nuts Market

- In February 2025, Peru exported 349 tons of Brazil nuts, generating $3.5 million in revenue. This marks a 14% decrease in volume compared to the previous year but a 38% increase in value, reflecting a 60% rise in average price per kilogram, reaching $9.96. The significant increase in export value underscores the growing demand for Brazil nuts, particularly in markets like South Korea, which accounted for 34% of Peru's Brazil nut exports in February 2025

- In September 2024 Brazilian government has successfully secured new export authorizations, enabling the export of Brazilian pecan nuts to Thailand, thereby expanding the country’s trade opportunities. This development highlights Brazil’s efforts to diversify its export markets and strengthen its position in the global nut trade

- In February 2024, Brazil's Brazil nut exports saw a significant increase, reaching $679,000 in total export value. The United States emerged as the highest-paying destination, with a price of $3,630 per ton for Brazilian Brazil nuts. This development is a clear indicator of the continued market potential for Brazil nuts, with demand being driven by health trends and the rising popularity of plant-based and sustainable food products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.