Global Bread Maker Market

Market Size in USD Billion

CAGR :

%

USD

8.10 Billion

USD

12.25 Billion

2025

2033

USD

8.10 Billion

USD

12.25 Billion

2025

2033

| 2026 –2033 | |

| USD 8.10 Billion | |

| USD 12.25 Billion | |

|

|

|

|

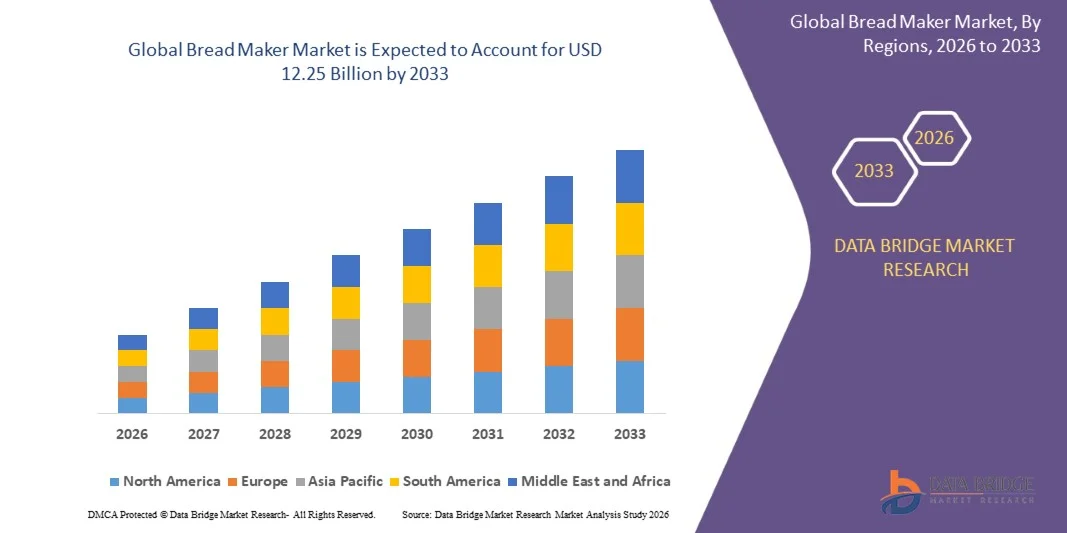

What is the Global Bread Maker Market Size and Growth Rate?

- The global bread maker market size was valued at USD 8.10 billion in 2025 and is expected to reach USD 12.25 billion by 2033, at a CAGR of 5.30% during the forecast period

- The high consumption of bread among consumers across the globe, increasing adoption of automated machines and devices due to the busy lifestyles and growing awareness regarding hygiene are the major factors driving the bread maker market

- The increasing awareness about health, rise in consumer preference to buy bread machines due to growing demand for home made products and the high adoption of healthy lifestyle owning to the high adulteration in food products nowadays accelerate the bread maker market growth

- The increasing demand for home automation rises in the demand for automatic bread machines because they are known to bake healthier and hygienic, technological advancement and presence of sensors in the machine and the ability of these devices to provide view window for the consumer to watch the mix along with the handles influence the bread maker market

What are the Major Takeaways of Bread Maker Market?

- The utilization of automatic bread machines to make various savory products such as bread, bun, patties, pastries, and cake, and their use in commercial spaces such as cafés, restaurants, food parks, hotels and in the residential sector also boost the bread maker market

- In addition, rising disposable income of consumers, increasing awareness about health, demand for high quality products, change in lifestyles positively affect the bread maker market. Furthermore, developments and innovations in the products to produce advanced and consumer friendly extend profitable opportunities to the bread maker market players

- North America dominated the bread maker market with a 37.5% revenue share in 2025, driven by strong consumer demand for multifunctional, nutrient-enriched, and clean-label appliances across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.3% from 2026 to 2033, driven by rising disposable incomes, increasing health awareness, and preference for homemade, preservative-free bread in China, Japan, India, and South Korea

- The Dry segment dominated the market with a revenue share of 61.8% in 2025, driven by its long shelf life, ease of use, and broad compatibility with multiple bread types including whole grain, gluten-free, and protein-enriched recipes

Report Scope and Bread Maker Market Segmentation

|

Attributes |

Bread Maker Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Bread Maker Market?

“Rising Demand for Multifunctional and Health-Focused Bread Makers”

- The bread maker market is witnessing strong growth driven by multifunctional devices that allow consumers to bake nutrient-enriched breads, gluten-free options, and specialty recipes at home. Integration with smart technology, pre-programmed recipes, and customization for dietary preferences is increasing product adoption

- Manufacturers are launching bread makers with capabilities such as low-sugar, whole-grain, and high-protein baking, supporting diverse consumer needs including weight management, diabetes-friendly diets, and clean-label lifestyles

- Consumers are increasingly seeking safe, convenient, and healthy alternatives to traditional bakery products, fueling demand across households, fitness enthusiasts, and wellness-focused users

- For instance, companies such as Panasonic, Breville, Cuisinart, and De’Longhi are expanding portfolios with smart, programmable, and multifunctional bread makers to cater to evolving home-baking trends

- Growing interest in home-cooking, meal customization, and functional nutrition is accelerating global adoption

- As consumers continue prioritizing convenience, health, and customization, Bread Makers are expected to remain central to innovation within the global home appliance segment

What are the Key Drivers of Bread Maker Market?

- Rising consumer focus on health, convenience, and multifunctionality is driving strong adoption of bread makers worldwide

- For instance, in 2025, Panasonic, Breville, and Cuisinart introduced smart programmable bread makers with gluten-free, whole-grain, and protein-enriched options, expanding product versatility for home users

- Growing global interest in home-baking, personalized nutrition, and functional diets is boosting demand across the U.S., Europe, and Asia-Pacific

- Technological advancements in automation, digital controls, and multi-function baking programs have improved ease of use, consistency, and efficiency, increasing adoption in urban households

- Rising demand for energy-efficient, compact, and user-friendly appliances further contributes to market growth, supported by the trend of home-based healthy cooking

- With ongoing R&D, product innovations, retail expansions, and online distribution, the Bread Maker market is expected to maintain robust growth over the coming years

Which Factor is Challenging the Growth of the Bread Maker Market?

- High manufacturing costs, advanced technology integration, and premium pricing limit affordability in price-sensitive regions

- For instance, during 2024–2025, fluctuations in component costs, supply chain constraints, and import duties impacted production volumes for several global manufacturers

- Strict regulatory standards for appliance safety, energy efficiency, and quality certifications increase operational complexities

- Limited consumer awareness in emerging markets about multifunctional and health-focused bread makers restricts widespread adoption

- Strong competition from traditional bakery products, low-cost appliances, and alternative cooking devices creates pricing and differentiation pressures

- To overcome these challenges, companies are focusing on cost optimization, regulatory compliance, targeted marketing, and consumer education to expand global adoption of high-quality, multifunctional Bread Makers

How is the Bread Maker Market Segmented?

The market is segmented on the basis of form, nature, and distribution channel.

• By Form

On the basis of form, the bread maker market is segmented into Liquid and Dry. The Dry segment dominated the market with a revenue share of 61.8% in 2025, driven by its long shelf life, ease of use, and broad compatibility with multiple bread types including whole grain, gluten-free, and protein-enriched recipes. Dry bread mixes and pre-packaged dry ingredients are widely preferred by consumers and manufacturers due to storage convenience, consistent performance, and simple handling in home and commercial settings. They support a variety of baking preferences and ensure predictable results for health-conscious consumers.

The Liquid segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for pre-mixed liquid doughs, ready-to-bake batters, and functional bread mixes that simplify home baking. Rising consumer interest in quick, convenient, and consistent bread-making solutions is driving adoption globally.

• By Nature

On the basis of nature, the bread maker market is segmented into Organic and Conventional. The Conventional segment dominated the market with a revenue share of 63.5% in 2025, supported by wide availability, lower cost, and strong adoption among mass-market consumers. Conventional bread mixes are easily accessible across retail channels and offer consistent performance for baking a range of bread types, from classic white loaves to enriched multi-grain variants. Their affordability and ready-to-use formats drive preference in households and foodservice sectors.

The Organic segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising health consciousness, clean-label preferences, and demand for chemical-free, non-GMO ingredients. Increasing adoption of organic bread mixes in premium households, health-focused consumers, and specialized dietary segments is fueling rapid growth across North America, Europe, and Asia-Pacific.

• By Distribution Channel

On the basis of distribution channel, the bread maker market is segmented into Supermarkets/Hypermarkets, Convenience Stores, Online Channels, and Others. The Supermarkets/Hypermarkets segment dominated the market with a revenue share of 47.9% in 2025, supported by strong product visibility, trusted brands, and broad accessibility. These stores offer diverse bread-making solutions, from pre-packaged dry mixes to multifunctional bread makers, ensuring widespread reach in urban and suburban regions.

The Online Channels segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising e-commerce penetration, subscription-based models, home delivery convenience, and promotional campaigns. Platforms such as Amazon, Walmart Online, and brand-owned websites expand the reach of both conventional and premium organic bread-making products. Consumer preference for online comparison, discounts, and bulk purchases is accelerating the shift toward digital retail globally.

Which Region Holds the Largest Share of the Bread Maker Market?

- North America dominated the bread maker market with a 37.5% revenue share in 2025, driven by strong consumer demand for multifunctional, nutrient-enriched, and clean-label appliances across the U.S. and Canada

- Health-conscious consumers and home baking enthusiasts are increasingly adopting programmable and multi-grain bread makers. Manufacturers are focusing on features such as gluten-free, whole-grain, and smart baking functions to cater to diverse preferences

- Strong retail and e-commerce networks, combined with rising disposable incomes, urbanization, and awareness of healthy diets, further support adoption. Regulatory standards for appliance safety and energy efficiency strengthen the region’s market leadership

U.S. Bread Maker Market Insight

The U.S. is the largest contributor in North America, fueled by growing interest in home baking and specialty bread. Consumers are adopting smart, programmable, and energy-efficient bread makers, with multifunctional capabilities such as kneading, proofing, and baking. Retail and online distribution channels are expanding product accessibility. The rising demand for healthy and clean-label food options, coupled with urban lifestyles, supports steady growth. Manufacturers are investing in R&D to improve baking performance, convenience, and appliance durability, ensuring continued market expansion in the region.

Canada Bread Maker Market Insight

Canada contributes significantly to regional growth, supported by increasing home baking trends and demand for health-focused bread makers. Consumers are showing preference for appliances with multiple functionalities, energy efficiency, and gluten-free options. Retail expansion and online sales penetration are enhancing accessibility across urban and suburban areas. Rising health awareness, convenience-oriented lifestyles, and the desire for fresh homemade bread are driving adoption. Manufacturers are launching localized products tailored to consumer preferences, ensuring higher adoption rates and strengthening Canada’s position as a key contributor to the North American market.

Asia-Pacific Bread Maker Market Insight

Asia-Pacific is projected to register the fastest CAGR of 7.3% from 2026 to 2033, driven by rising disposable incomes, increasing health awareness, and preference for homemade, preservative-free bread in China, Japan, India, and South Korea. Growing urbanization and digital retail penetration, including e-commerce and appliance subscription models, are boosting market access. Manufacturers are introducing smart, multifunctional bread makers with localized features, including multi-grain, sweet, and savory baking options. Expansion of appliance rental services and digital promotions further supports adoption, making Asia-Pacific the most dynamic and fastest-growing region in the global Bread Maker market.

China Bread Maker Market Insight

China is the largest contributor in Asia-Pacific due to increasing urbanization, rising middle-class spending, and a growing interest in home baking appliances. Consumers are adopting programmable, multifunctional bread makers suitable for various breads, including whole grain and sweet varieties. The market benefits from strong e-commerce networks, social media promotions, and product customization. Manufacturers are investing in R&D to improve functionality, energy efficiency, and smart connectivity. Rising health consciousness and demand for preservative-free home-baked products continue to drive China’s growth, reinforcing its position as the leading country in the Asia-Pacific Bread Maker market.

Japan Bread Maker Market Insight

Japan shows steady growth, supported by consumers’ preference for compact, multifunctional, and energy-efficient bread makers. Home bakers favor appliances capable of producing diverse bread types, including whole grain and specialty varieties. Manufacturers focus on innovative designs, high durability, and smart baking features to meet Japanese consumer expectations. Retail and e-commerce channels ensure product availability nationwide. Health-conscious lifestyles and demand for high-quality, preservative-free baked products contribute to market growth. Government standards on energy efficiency and appliance safety support adoption. Japan’s market remains stable and gradually expanding due to technological innovation and increasing interest in home baking.

India Bread Maker Market Insight

India is emerging as a key growth market, fueled by increasing awareness of healthy eating, diabetes management, and home baking trends. Consumers are adopting multifunctional bread makers capable of kneading, proofing, and baking a variety of breads, including whole grain and gluten-free options. E-commerce platforms and appliance rental models are expanding accessibility in urban and semi-urban areas. Rising disposable incomes, health consciousness, and preference for preservative-free products are driving adoption. Manufacturers are introducing localized features and multi-grain baking options to meet regional preferences. India’s market is expected to grow rapidly as more consumers embrace convenience and health-focused appliances.

South Korea Bread Maker Market Insight

South Korea contributes significantly to the Asia-Pacific market, supported by growing interest in healthy home baking and multifunctional bread makers. Consumers are increasingly choosing compact, smart, and energy-efficient appliances for baking whole grain, sweet, and savory breads. Social media trends, K-food culture, and wellness-focused lifestyles are influencing purchasing behavior. Manufacturers are focusing on innovation, including improved baking performance, durability, and premium designs. E-commerce and retail channels provide wide accessibility. Rising awareness of natural, preservative-free homemade bread drives adoption, making South Korea an important market within Asia-Pacific. Continued innovation and convenience-oriented solutions ensure steady growth in the coming years.

Which are the Top Companies in Bread Maker Market?

The bread maker industry is primarily led by well-established companies, including:

- Panasonic India (India)

- Zojirushi America Corporation (U.S.)

- Cuisinart (U.S.)

- Jarden Consumer Solutions (U.S.)

- KUISSENTIAL (U.S.)

- S.k.Gupta & Company (India)

- Midea Group (China)

- De’Longhi Appliances S.r.l. (Italy)

- Koninklijke Philips N.V. (Netherlands)

- Electrolux (Sweden)

- Galanz (China)

- Breville USA, Inc. (U.S.)

- PETRUS (China)

- Nathome (China)

- JVCKENWOOD Corporation (Japan)

- The Vermont Teddy Bear Company (U.S.)

- Procter & Gamble (U.S.)

- Shenzhen Chulux Electric Appliances Co., Ltd. (China)

- FUNAI ELECTRIC CO., LTD. (Japan)

- NACCO Industries, Inc. (U.S.)

- Newell Brands (U.S.)

What are the Recent Developments in Global Bread Maker Market?

- In August 2024, ProCook Group, a U.K.-based kitchenware company, introduced its lifestyle-focused ProCook Bread Maker, featuring intuitive controls and 12 selectable programs. This innovative appliance is designed to simplify home baking for busy consumers, offering versatility and convenience in preparing a variety of breads. The launch reinforced the company’s commitment to combining functionality with modern kitchen lifestyles and is expected to enhance its presence in the European home appliance market

- In July 2024, GEA Group Aktiengesellschaft launched the GEA BreadingFeeder, a machine engineered to feed diverse bread crumbs efficiently into the GEA CrumbMaster. This solution reduces labor requirements and minimizes production downtime in bakery facilities, improving overall operational efficiency. The equipment supports large-scale bakery production by optimizing workflow and consistency, reflecting the company’s focus on automation and productivity enhancement

- In November 2023, Fritsch Group unveiled two new bakery maker lines and a vacuum cooling system at FRITSCH’s iba 2023 exhibition. The new lines incorporate technological advancements and strict hygiene standards to meet industrial bakery requirements, offering enhanced performance and safety. These innovations are positioned to improve production efficiency while maintaining high-quality output for commercial bakeries globally

- In September 2022, Rheon Automatic Machinery Co. Ltd. developed the Rheon VX122 stress-free divider for high-hydration and long floor-time artisan breads. This adjustable-width V4 dough divider minimizes side trim and ensures precise portion dimensions for flatbreads, baguettes, and loaves. The innovation enhances dough handling efficiency and supports artisanal bakery operations, promoting consistency and reducing waste

- In September 2020, MULTIVAC partnered operationally with FRITSCH to co-develop equipment for dough processing and bakery item preparation. This collaboration aimed to integrate advanced technologies to streamline bakery production and improve manufacturing flexibility. The joint initiative strengthened both companies’ capabilities in delivering high-performance bakery solutions and industrial automation for food production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.