Global Breast Surgery Retractors Market

Market Size in USD Million

CAGR :

%

USD

201.20 Million

USD

238.53 Million

2024

2032

USD

201.20 Million

USD

238.53 Million

2024

2032

| 2025 –2032 | |

| USD 201.20 Million | |

| USD 238.53 Million | |

|

|

|

|

Breast Surgery Retractors Market Size

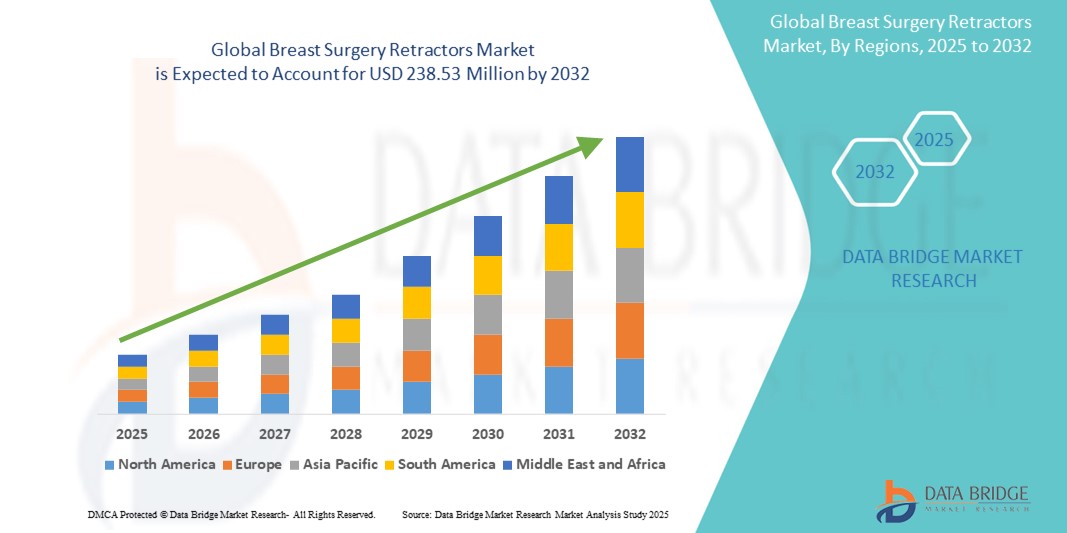

- The global breast surgery retractors market size was valued at USD 201.20 million in 2024 and is expected to reach USD 238.53 million by 2032, at a CAGR of 2.15% during the forecast period

- The market growth is largely driven by the rising prevalence of breast cancer and the increasing number of breast reconstruction and augmentation procedures worldwide, necessitating precision surgical tools

- Furthermore, technological advancements in retractor designs for improved visibility and access during minimally invasive procedures are enhancing surgical outcomes. These combined factors are propelling the demand for specialized breast surgery retractors, thereby accelerating growth in the global market

Breast Surgery Retractors Market Analysis

- Breast surgery retractors, designed to hold back tissue and improve visibility during surgical procedures, are becoming essential tools in breast reconstruction, augmentation, and oncological surgeries due to their ergonomic designs, precision handling, and compatibility with minimally invasive techniques

- The growing demand for breast surgery retractors is primarily driven by the rising global incidence of breast cancer, increasing awareness of reconstructive options post-mastectomy, and the growing number of cosmetic breast procedures

- North America dominated the breast surgery retractors market with the largest revenue share of 40.5% in 2024, supported by advanced healthcare infrastructure, high procedural volumes, and the presence of leading medical device manufacturers, with the U.S. at the forefront due to higher adoption of breast reconstructive and aesthetic surgeries

- Asia-Pacific is expected to be the fastest growing region in the breast surgery retractors market during the forecast period, owing to improving healthcare access, increasing medical tourism, and a rising number of breast cancer cases

- Double-Arm Retractors segment dominated the breast surgery retractors market with a market share of 47.8% in 2024, driven by its enhanced tissue retraction capability and stability, which improve surgical precision and visibility during complex breast procedures

Report Scope and Breast Surgery Retractors Market Segmentation

|

Attributes |

Breast Surgery Retractors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Breast Surgery Retractors Market Trends

“Advancements in Ergonomic Design and Minimally Invasive Surgery Compatibility”

- A prominent and accelerating trend in the global breast surgery retractors market is the ongoing innovation in ergonomic design and compatibility with minimally invasive surgical techniques. These developments are enhancing surgeon precision, reducing fatigue, and improving patient outcomes during both cosmetic and oncologic breast procedures

- For instance, newer retractor models from companies such as Thompson Surgical Instruments and Integra LifeSciences are designed with improved angulation, flexible arms, and integrated illumination, allowing better visualization and access during deep-tissue procedures

- The focus on user-friendly, lightweight, and sterilizable retractors is growing, particularly for procedures such as lumpectomies and mastectomies where precision and visibility are critical. In addition, some retractors are now being tailored for robotic-assisted or image-guided surgeries, reflecting broader surgical trends toward technology-enhanced precision

- Retractors integrated with suction, lighting, or camera mounts are also gaining traction, as they allow for reduced instrument clutter and greater operational efficiency in operating rooms. These features are especially valuable in ambulatory and high-throughput surgical environments

- As patient demand rises for faster recovery and better aesthetic outcomes, particularly in reconstructive and plastic breast surgeries, the industry is seeing growing interest in retractors optimized for less invasive techniques. This shift is prompting manufacturers to invest in the development of next-generation surgical tools that support minimal scarring and shorter operative times

- The demand for breast surgery retractors that offer ergonomic efficiency, procedural adaptability, and compatibility with minimally invasive techniques is rapidly expanding across hospitals and specialty clinics, contributing to significant advancements in surgical practice standards

Breast Surgery Retractors Market Dynamics

Driver

“Rising Breast Cancer Incidence and Cosmetic Surgery Demand”

- The increasing global incidence of breast cancer and the rising number of breast reconstruction and augmentation procedures are key drivers accelerating the demand for breast surgery retractors. These devices are critical in ensuring surgical precision, visibility, and tissue management during complex operations

- For instance, the World Health Organization (WHO) reported breast cancer as the most commonly diagnosed cancer globally in 2023, with growing awareness and early diagnosis campaigns contributing to more surgical interventions, including mastectomies and lumpectomies

- In addition, the rising acceptance of aesthetic breast surgeries in both developed and emerging economies is fueling the need for specialized surgical instruments that provide optimal access and minimize tissue trauma

- Advancements in surgical training and growing access to reconstructive options post-mastectomy are also contributing to procedural volume, thereby supporting consistent market growth. Hospitals and surgical centers are increasingly investing in high-quality, re-usable retractors to meet rising procedural demands and improve patient outcomes

Restraint/Challenge

“Risk of Surgical Complications and Reimbursement Limitations”

- One of the primary challenges in the breast surgery retractors market is the risk of surgical complications, such as nerve or tissue damage, that may arise from improper retractor use or suboptimal device design. This risk has driven stringent clinical standards and cautious device adoption, especially in low-volume or less-experienced surgical settings

- Furthermore, limited reimbursement coverage for elective cosmetic procedures in many healthcare systems can hinder adoption of advanced or premium-priced retractors, particularly in markets where out-of-pocket payment is a major factor

- For instance, many insurers cover breast reconstruction post-mastectomy but exclude elective augmentation or aesthetic revisions, restricting the demand for high-end retractor systems in the plastic surgery segment

- Overcoming these challenges will require ongoing innovation in safer, surgeon-friendly device designs, clearer reimbursement guidelines for reconstructive surgery, and broader training programs to ensure optimal usage across all care settings

Breast Surgery Retractors Market Scope

The market is segmented on the basis of product type, usage type, procedure, and end user.

- By Product Type

On the basis of product type, the breast surgery retractors market is segmented into single-arm retractors and double-arm retractors. The double-arm retractors segment dominated the market with the largest revenue share of 47.8% in 2024, attributed to their superior tissue retraction capability, enhanced stability, and ability to provide broader surgical access in complex breast procedures such as mastectomies and reconstructions. Their ergonomic design allows for hands-free operation, which is particularly advantageous during prolonged surgeries requiring precise visualization and access.

The single-arm retractors segment is expected to experience the fastest growth during forecast period, due to their lightweight design and suitability for minor or localized procedures such as lumpectomies and cosmetic enhancements. Their ease of use and affordability make them attractive for smaller surgical centers and clinics.

- By Usage Type

On the basis of usage type, the breast surgery retractors market is divided into disposable retractors and re-usable retractors. The re-usable retractors segment held the largest market share of 58.9% in 2024, driven by their cost-efficiency, durability, and widespread adoption in high-volume surgical facilities. Hospitals and specialty centers prefer re-usable retractors for their long-term utility and compatibility with rigorous sterilization protocols, particularly in complex procedures requiring robust instrumentation.

The disposable retractors segment is expected to experience the fastest growth during forecast period, fueled by increasing demand in outpatient and ambulatory surgical settings. Their single-use nature minimizes the risk of cross-contamination and reduces turnaround time between procedures, aligning with infection control best practices.

- By Procedure

On the basis of procedure, the breast surgery retractors market is segmented into breast reconstruction, plastic surgery, lumpectomy, and mastectomy. The breast reconstruction segment dominated the market with the highest share of 36.5% in 2024, driven by rising global breast cancer cases and increasing awareness of post-mastectomy reconstructive options. Advancements in oncoplastic techniques and favorable reimbursement policies in developed nations further support segment growth.

The plastic surgery segment is expected to experience the fastest growth during forecast period, to the increasing popularity of cosmetic breast augmentation and reshaping procedures, particularly in urban centers and among younger demographics seeking aesthetic improvements.

- By End User

On the basis of end user, the breast surgery retractors market is segmented into hospitals, ambulatory surgical centers, and gynecology clinics. The hospitals segment led the market with a dominant share of 61.2% in 2024, supported by the presence of skilled surgical teams, access to advanced surgical tools, and a high volume of breast-related surgeries, both reconstructive and cosmetic.

The ambulatory surgical centers segment is expected to experience the fastest growth during forecast period, due to the shift toward minimally invasive procedures and outpatient care models that reduce patient stay and healthcare costs. Gynecology clinics also contribute to market demand, particularly in regions where breast surgeries are integrated with women’s health services.

Breast Surgery Retractors Market Regional Analysis

- North America dominated the breast surgery retractors market with the largest revenue share of 40.5% in 2024, supported by advanced healthcare infrastructure, high procedural volumes, and the presence of leading medical device manufacturers, with the U.S. at the forefront due to higher adoption of breast reconstructive and aesthetic surgeries

- Patients and surgeons in the region prioritize advanced surgical instruments that enhance precision, safety, and outcomes in both oncological and cosmetic breast procedures

- This strong regional demand is further supported by favorable reimbursement policies, rising breast cancer incidence, and increased adoption of minimally invasive surgical techniques, positioning breast surgery retractors as essential tools in modern surgical practices across hospitals and ambulatory centers

U.S. Breast Surgery Retractors Market Insight

The U.S. breast surgery retractors market captured the largest revenue share of 79% in 2024 within North America, driven by a high volume of breast reconstruction and cosmetic procedures, along with widespread adoption of advanced surgical technologies. The rising incidence of breast cancer and increasing awareness of reconstructive options are key growth factors. In addition, the presence of leading medical device companies, favorable reimbursement frameworks, and a strong focus on surgical precision and patient outcomes further support the market’s expansion.

Europe Breast Surgery Retractors Market Insight

The Europe breast surgery retractors market is projected to expand at a steady CAGR throughout the forecast period, fueled by growing demand for minimally invasive surgeries and a well-established healthcare infrastructure. Rising breast cancer screening rates and awareness campaigns across the region are leading to more early-stage surgical interventions. Surgeons and hospitals across Europe are increasingly investing in ergonomic and re-usable retractors to enhance surgical efficiency and comply with sustainability goals in the healthcare sector.

U.K. Breast Surgery Retractors Market Insight

The U.K. breast surgery retractors market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by an increase in both public and private sector investments in breast health services. Rising demand for cosmetic breast surgeries and improved access to breast reconstruction procedures post-mastectomy are key contributors. The National Health Service (NHS) and private clinics asuch as are adopting innovative surgical tools that offer improved visualization and reduced procedural time.

Germany Breast Surgery Retractors Market Insight

The Germany breast surgery retractors market is expected to expand at a considerable CAGR during the forecast period, supported by the country's focus on medical innovation, surgeon training, and surgical quality standards. Germany’s robust healthcare system and its leadership in adopting high-precision surgical instruments are facilitating the uptake of advanced breast retractors in both oncological and aesthetic procedures. Demand is particularly strong in university hospitals and specialized surgical centers.

Asia-Pacific Breast Surgery Retractors Market Insight

The Asia-Pacific breast surgery retractors market is poised to grow at the fastest CAGR of 22.4% during the forecast period of 2025 to 2032, driven by increasing breast cancer incidence, expanding healthcare access, and rising cosmetic surgery demand in countries such as China, Japan, and India. Government-led healthcare reforms, coupled with the expansion of urban surgical centers, are improving surgical capabilities and fueling market growth. Moreover, local manufacturing of surgical instruments is enhancing affordability and availability across the region.

Japan Breast Surgery Retractors Market Insight

The Japan breast surgery retractors market is gaining momentum due to its aging population, focus on early cancer detection, and advanced medical technology landscape. Surgeons in Japan are increasingly incorporating minimally invasive and robotic-assisted breast surgeries, which require precision retractors. The country’s healthcare system supports high standards in cancer care, driving consistent demand for high-performance surgical tools.

India Breast Surgery Retractors Market Insight

The India breast surgery retractors market accounted for the largest market revenue share in Asia Pacific in 2024, driven by rising breast cancer awareness, improving surgical infrastructure, and an increasing number of plastic and reconstructive surgeries. Growth is further supported by government initiatives to expand breast health programs and the rise of private surgical clinics. Domestic production of surgical instruments and increasing affordability are making breast retractors more accessible across both urban and tier-2 cities.

Breast Surgery Retractors Market Share

The breast surgery retractors industry is primarily led by well-established companies, including:

- Accurate Surgical & Scientific Instruments Corporation (U.S.)

- Integra LifeSciences Corporation (U.S.)

- B. Braun SE (Germany)

- Thompson Surgical (U.S.)

- Medtronic (Ireland)

- CooperSurgical Inc. (U.S.)

- Mediflex Surgical Products (U.S.)

- Black & Black Surgical (U.S.)

- Novo Surgical Inc. (U.S.)

- Medical Device Business Services, Inc. (U.S.)

- Stryker (U.S.)

- CONMED Corporation (U.S.)

- Smith + Nephew (U.K.)

- Zimmer Biomet (U.S.)

- BD (U.S.)

- Surgical Innovations (U.K.)

- OmniGuide Holdings, Inc. (U.S.)

- Applied Medical Resources Corporation (U.S.)

- KARL STORZ SE & Co. KG (Germany)

- KLS Martin Group (Germany)

What are the Recent Developments in Global Breast Surgery Retractors Market?

- In April 2023, Thompson Surgical Instruments, a renowned manufacturer of surgical retraction systems, introduced a next-generation breast retractor set designed specifically for reconstructive and oncoplastic breast surgeries. The system includes adjustable blades and integrated lighting to enhance visibility and reduce surgical time, reinforcing the company’s commitment to delivering ergonomic, surgeon-friendly solutions that align with modern minimally invasive practices

- In March 2023, Integra LifeSciences expanded its surgical instruments portfolio by launching a re-usable retractor system tailored for breast surgeries, particularly lumpectomy and mastectomy procedures. This product features enhanced tissue control and simplified assembly, supporting sustainability goals and improving reprocessing efficiency in hospital settings. The launch reflects Integra’s strategy to advance precision tools that meet the evolving demands of oncological and reconstructive surgeries

- In February 2023, OBP Medical, a leading developer of self-contained, single-use surgical devices, released an innovative breast retractor with built-in LED illumination. Designed for ambulatory surgical centers and outpatient clinics, this disposable device enhances visualization in smaller incisions and short-duration procedures. The development emphasizes OBP’s focus on safety, sterility, and operational efficiency in high-turnover surgical environments

- In January 2023, Medline Industries, LP entered a strategic distribution agreement with a European surgical device manufacturer to supply advanced breast retractors across North America. This partnership aims to address the growing demand for specialized surgical tools in breast oncology and aesthetics, improving access to high-quality instruments while expanding Medline’s surgical product footprint in key hospital networks

- In January 2023, Black & Black Surgical, known for precision surgical instruments, unveiled a lightweight breast surgery retractor with interchangeable blades designed for cosmetic procedures such as breast augmentation and lifts. The retractor improves surgeon control and patient safety during delicate tissue manipulation, demonstrating the company’s dedication to advancing aesthetic surgical instrumentation through clinician-driven innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.