Global Breast Tomosynthesis Market

Market Size in USD Billion

CAGR :

%

USD

2.95 Billion

USD

7.90 Billion

2024

2032

USD

2.95 Billion

USD

7.90 Billion

2024

2032

| 2025 –2032 | |

| USD 2.95 Billion | |

| USD 7.90 Billion | |

|

|

|

|

Breast Tomosynthesis Market Size

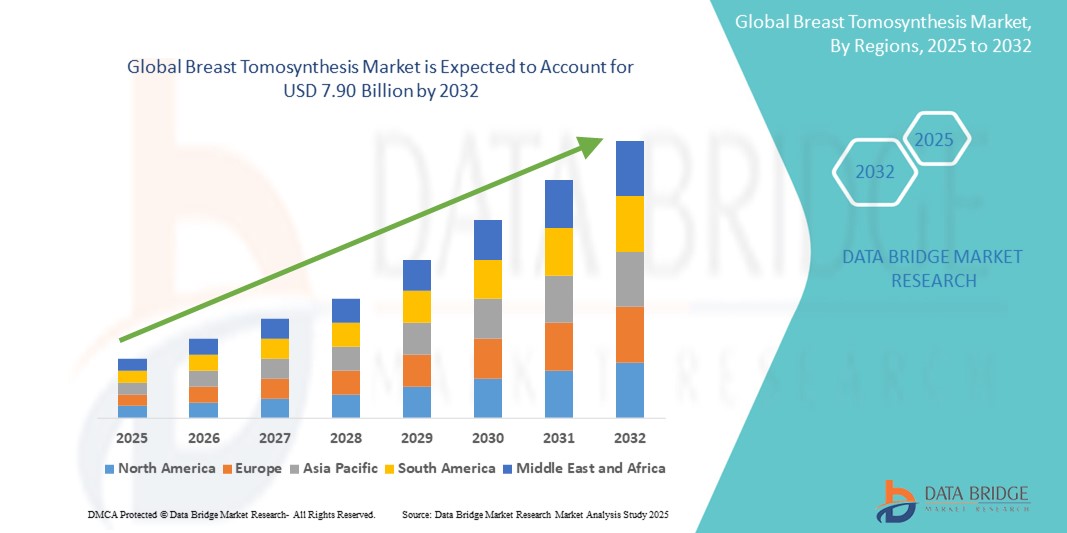

- The global breast tomosynthesis market size was valued at USD 2.95 billion in 2024 and is expected to reach USD 7.90 billion by 2032, at a CAGR of 13.10% during the forecast period

- The market growth is largely fueled by the rising incidence of breast cancer, along with increased awareness and early screening initiatives, which have driven the demand for more accurate diagnostic imaging techniques such as digital breast tomosynthesis (DBT)

- Furthermore, growing investments in advanced healthcare infrastructure, coupled with technological innovations offering enhanced image clarity and reduced recall rates, are positioning breast tomosynthesis as a preferred modality in breast cancer diagnostics. These combined factors are accelerating adoption across diagnostic centers and hospitals, thereby significantly boosting the industry’s growth

Breast Tomosynthesis Market Analysis

- Breast tomosynthesis, a next-generation 3D mammography technology, is becoming a key diagnostic tool in breast cancer detection due to its enhanced imaging accuracy, reduced false positives, and superior detection in dense breast tissues, making it increasingly essential in both hospital and diagnostic center settings

- The accelerating demand for breast tomosynthesis is primarily fueled by the rising global incidence of breast cancer, growing public awareness around early screening, and expanding government support for breast health initiatives and imaging infrastructure upgrades

- North America dominated the breast tomosynthesis market with the largest revenue share of 42.3% in 2024, driven by high screening rates, favorable reimbursement policies, and the strong presence of industry leaders, especially in the U.S., where rapid technology adoption and preventive health focus are propelling growth in both hospitals and independent imaging centers

- Asia-Pacific is expected to be the fastest growing region in the breast tomosynthesis market during the forecast period due to improving healthcare access, increasing public-private investments in diagnostic technologies, and heightened awareness campaigns in countries such as China, India, and South Korea

- 2D/3D combination systems segment dominated the breast tomosynthesis market with a market share of 67.8% in 2024, supported by their clinical versatility, ease of integration into existing workflows, and wider regulatory acceptance in routine breast cancer screenings

Report Scope and Breast Tomosynthesis Market Segmentation

|

Attributes |

Breast Tomosynthesis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Breast Tomosynthesis Market Trends

“Technological Advancements Driving Accuracy and Early Detection”

- A significant and accelerating trend in the global breast tomosynthesis market is the continual advancement in imaging technology, including higher-resolution detectors, synthetic 2D imaging, and AI-enhanced interpretation tools. These innovations are significantly improving diagnostic accuracy and workflow efficiency for radiologists and healthcare providers

- For instance, Hologic’s Genius 3D Mammography system offers superior cancer detection rates and fewer false positives compared to traditional 2D mammography, enhancing both patient outcomes and clinician confidence. Similarly, GE Healthcare’s SenoClair tomosynthesis system provides a low-dose 3D imaging option that improves lesion visibility in dense breast tissue

- AI integration in breast tomosynthesis systems enables intelligent image analysis, prioritization of cases, and assistance in identifying early-stage tumors. Tools such as iCAD’s ProFound AI are being used to enhance clinical decision-making by providing real-time insights during image review

- The integration of tomosynthesis with PACS (Picture Archiving and Communication Systems) and EMRs (Electronic Medical Records) also supports centralized imaging workflows, enabling seamless data management and collaborative diagnostics. These innovations are particularly impactful in busy hospital and diagnostic settings where quick turnaround is critical

- This trend toward more accurate, AI-powered, and digitally integrated imaging systems is fundamentally transforming breast cancer diagnostics. As a result, companies are increasingly investing in next-generation tomosynthesis platforms that promise lower radiation, faster scanning, and enhanced detection—making advanced screening accessible to a broader population

- The growing demand for systems that offer greater precision, efficiency, and patient comfort is driving rapid adoption across hospitals, diagnostic centers, and mobile screening units, reinforcing breast tomosynthesis as a standard for modern breast imaging

Breast Tomosynthesis Market Dynamics

Driver

“Rising Breast Cancer Prevalence and Emphasis on Early Detection”

- The increasing global incidence of breast cancer, alongside heightened awareness campaigns and government screening initiatives, is a major driver behind the growing demand for breast tomosynthesis systems

- For instance, national screening programs across the U.S., U.K., and parts of Europe are now incorporating digital breast tomosynthesis to improve detection rates and reduce diagnostic uncertainty. Such policy-level endorsements are fueling market expansion and clinical acceptance of the technology

- Breast tomosynthesis offers substantial benefits over traditional 2D mammography, such as superior imaging of dense breast tissue, reduced recall rates, and improved lesion characterization. These features support early and more accurate cancer diagnosis, which is crucial for effective treatment planning and improved survival rates

- In addition, the aging female population and rising health awareness in developing regions are contributing to the increasing number of routine screenings, boosting demand for tomosynthesis systems

- The push for technologically advanced, patient-friendly imaging solutions—combined with increasing investments in healthcare infrastructure and favorable reimbursement policies—is further strengthening market growth across both developed and emerging economies

Restraint/Challenge

“High Equipment Cost and Limited Access in Low-Income Regions”

- One of the key challenges in the widespread adoption of breast tomosynthesis is the high cost associated with the equipment, installation, and maintenance, which can be a barrier for smaller diagnostic centers and facilities in low-income or rural areas

- For instance, while major hospitals in North America and Europe have largely adopted tomosynthesis systems, facilities in parts of Asia, Africa, and Latin America still rely on conventional 2D mammography due to budget constraints and limited funding

- In addition, the need for trained radiologists and technical personnel to operate and interpret tomosynthesis images creates a bottleneck in expanding access, particularly in underserved regions

- Regulatory approvals and reimbursement limitations in some countries also slow adoption rates. Moreover, integration with existing digital imaging infrastructure can be complex and costly for smaller providers

- Overcoming these challenges will require the development of cost-effective systems, government subsidies for public screening programs, expansion of mobile screening services, and enhanced training programs for radiology professionals. These efforts are essential to ensure that the benefits of breast tomosynthesis reach a wider population and contribute meaningfully to global cancer detection efforts

Breast Tomosynthesis Market Scope

The market is segmented on the basis of product and end user.

- By Product

On the basis of product, the breast tomosynthesis market is segmented into 2D/3D combination systems and standalone 3D systems. The 2D/3D combination systems segment dominated the market with the largest market revenue share of 67.8% in 2024, driven by its clinical versatility and widespread adoption across both developed and emerging healthcare systems. These systems offer radiologists the dual advantage of conventional 2D mammograms along with high-resolution 3D tomosynthesis in a single imaging session, improving cancer detection accuracy and reducing recall rates. The demand is supported by established reimbursement policies and integration into existing screening workflows, especially in North America and Europe.

The standalone 3D systems segment is anticipated to witness the fastest growth rate of 19.6% from 2025 to 2032, fueled by advancements in imaging technology and increasing preference for low-dose, high-clarity diagnostic tools. These systems are gaining traction in specialty diagnostic settings where precision imaging is paramount. Hospitals and advanced cancer centers are increasingly investing in standalone 3D systems to strengthen early detection and improve diagnostic outcomes, particularly in patients with dense breast tissue. As AI-assisted interpretation and faster scanning capabilities become more accessible, the standalone systems are expected to capture a growing share of new installations.

- By End User

On the basis of end user, the breast tomosynthesis market is segmented into hospitals, diagnostic centres, and others. The hospitals segment dominated the market with the largest market revenue share of 46.5% in 2024, driven by their comprehensive diagnostic infrastructure, access to public and private funding, and inclusion of breast tomosynthesis in structured cancer screening programs. Hospitals serve as central points for large-scale screening and treatment, and benefit from integrated patient management systems and multidisciplinary care models, which enhance the adoption of advanced imaging technologies.

The diagnostic centres segment is anticipated to witness the fastest growth rate of 21.4% from 2025 to 2032, fueled by rising demand for accessible, fast, and specialized imaging services. These centers are increasingly adopting breast tomosynthesis to offer premium diagnostic options, attract patient referrals, and reduce waiting times. Their flexibility in equipment procurement, lower operational costs, and growing urban footprint make them well-positioned to capitalize on the expanding need for early breast cancer detection across diverse populations.

Breast Tomosynthesis Market Regional Analysis

- North America dominated the breast tomosynthesis market with the largest revenue share of 42.3% in 2024, driven by high screening rates, favorable reimbursement policies, and the strong presence of industry leaders, especially in the U.S., where rapid technology adoption and preventive health focus are propelling growth in both hospitals and independent imaging centers

- Consumers and healthcare providers in the region increasingly adopt breast tomosynthesis due to its superior accuracy, reduced false positives, and compatibility with dense breast tissue screening, improving both patient experience and clinical outcomes

- This strong regional presence is further supported by robust healthcare infrastructure, favorable reimbursement policies, and government-led screening initiatives, positioning breast tomosynthesis as a standard imaging tool across hospitals and diagnostic centers

U.S. Breast Tomosynthesis Market Insight

The U.S. breast tomosynthesis market captured the largest revenue share of 79.6% in 2024 within North America, fueled by the country’s advanced healthcare infrastructure, widespread breast cancer screening programs, and favorable reimbursement frameworks. The U.S. has witnessed rapid adoption of digital breast tomosynthesis in both public and private healthcare facilities, driven by increasing awareness of early detection and strong clinical evidence supporting its diagnostic superiority. In addition, the presence of key manufacturers and frequent technology upgrades are further enhancing the market’s momentum.

Europe Breast Tomosynthesis Market Insight

The Europe breast tomosynthesis market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of breast cancer, government-backed screening initiatives, and a shift toward 3D imaging in routine diagnostics. Countries across the region are integrating breast tomosynthesis into national screening programs, particularly in response to clinical studies demonstrating improved detection in dense breast tissue. The growing availability of mobile screening units and AI-enabled imaging platforms is contributing to deeper market penetration across both urban and rural populations.

U.K. Breast Tomosynthesis Market Insight

The U.K. breast tomosynthesis market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing government support for breast cancer screening and the modernization of diagnostic infrastructure within the National Health Service (NHS). Rising public awareness, coupled with an emphasis on reducing false positives and unnecessary recalls, is prompting the adoption of 3D imaging technologies. In addition, collaborations between the NHS and medical imaging companies are aiding wider implementation of breast tomosynthesis systems across regional healthcare trusts.

Germany Breast Tomosynthesis Market Insight

The Germany breast tomosynthesis market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s high investment in medical technology, well-structured cancer screening programs, and strong public health awareness. Hospitals and diagnostic centers in Germany are actively incorporating tomosynthesis systems to enhance diagnostic precision and workflow efficiency. The country’s focus on early detection, in combination with AI-assisted diagnostic tools, is significantly improving adoption rates across both public and private institutions.

Asia-Pacific Breast Tomosynthesis Market Insight

The Asia-Pacific breast tomosynthesis market is poised to grow at the fastest CAGR of 23.2% during the forecast period of 2025 to 2032, driven by rising breast cancer incidence, rapid urbanization, and growing healthcare investments in countries such as China, Japan, and India. Increasing awareness about early detection, combined with government initiatives to upgrade imaging infrastructure, is accelerating the adoption of breast tomosynthesis systems. The expanding presence of global imaging companies and local manufacturing capabilities is also making advanced screening technologies more affordable and accessible.

Japan Breast Tomosynthesis Market Insight

The Japan breast tomosynthesis market is gaining momentum due to its technologically advanced healthcare system, strong national screening policies, and aging population. Japanese hospitals are adopting breast tomosynthesis to improve detection rates and reduce false alarms, especially in dense breast cases. Integration with AI and PACS systems is improving workflow efficiency and image analysis. Moreover, growing demand for precise, patient-friendly imaging solutions is reinforcing the country’s leadership in breast imaging innovation.

India Breast Tomosynthesis Market Insight

The India breast tomosynthesis market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to increasing breast cancer awareness, government-led screening campaigns, and expanding diagnostic infrastructure. India is witnessing rising adoption of advanced imaging technologies in both public hospitals and private diagnostic centers, especially in metropolitan and tier-1 cities. Mobile screening units equipped with tomosynthesis systems are improving outreach in rural areas. The growing involvement of domestic healthcare companies and affordability of newer systems are further propelling market growth across the country.

Breast Tomosynthesis Market Share

The Breast Tomosynthesis industry is primarily led by well-established companies, including:

- Siemens (Germany)

- Hologic, Inc. (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Abbott (U.S.)

- BD (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Shimadzu Medical (India) pvt. Ltd. (Japan)

- GENERAL ELECTRIC (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Sysmex India Pvt. Ltd. (Japan)

- Hitachi, Ltd. (Japan)

- Canon Inc. (Japan)

- FUJIFILM Holdings Corporation (U.K)

- Agfa-Gevaert Group (Belgium)

- Carestream Health, Inc. (United States)

- Planmed Oy (Finland)

- Analogic Corporation (U.S.)

- Toshiba Medical Systems Corporation (Japan)

What are the Recent Developments in Global Breast Tomosynthesis Market?

- In April 2023, Hologic, Inc., a leading innovator in women’s health, launched the Genius Digital Diagnostics System expansion for breast tomosynthesis, integrating artificial intelligence (AI) to enhance 3D image analysis and diagnostic accuracy. This system is designed to streamline radiology workflows while improving early breast cancer detection, particularly in women with dense breast tissue. The development underscores Hologic’s focus on leveraging AI-powered tools to improve clinical outcomes and solidify its leadership in breast imaging technologies

- In March 2023, GE HealthCare announced the commercial release of its upgraded Senographe Pristina with Serena Bright, a tomosynthesis-guided biopsy solution that allows for improved accuracy in lesion targeting. The innovation enhances patient comfort and enables radiologists to perform biopsies directly within the 3D mammography system. This advancement demonstrates GE’s commitment to providing holistic, minimally invasive breast care solutions and improving diagnostic precision across global screening programs

- In March 2023, Siemens Healthineers introduced AI enhancements to its Mammomat Revelation breast tomosynthesis system, focusing on improving detection capabilities and reducing the time required for image reading. These upgrades support radiologists by enabling quicker, more confident diagnoses, especially in high-volume screening environments. Siemens’ emphasis on AI-driven efficiency reflects the growing demand for technology that balances clinical performance with operational productivity

- In February 2023, iCAD, Inc. announced the deployment of its ProFound AI Risk platform across multiple hospitals in Europe and North America, enabling personalized risk assessments in conjunction with digital breast tomosynthesis. This development marks a shift toward more personalized screening protocols, where risk-based assessments guide the frequency and type of breast imaging. iCAD’s innovation illustrates the expanding role of AI in predictive diagnostics and breast cancer prevention strategies

- In January 2023, Planmed Oy, a Finland-based imaging company, showcased the Planmed Clarity 3D tomosynthesis system with low-dose imaging capabilities at Arab Health 2023. The system is designed to deliver high-quality images with minimal radiation exposure, meeting growing global demands for safer, patient-friendly diagnostics. This launch highlights Planmed’s dedication to radiation safety, accessibility, and technological advancement in emerging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.