Global Breather Membrane Used In Building Envelope Market

Market Size in USD Billion

CAGR :

%

USD

2.09 Billion

USD

4.68 Billion

2024

2032

USD

2.09 Billion

USD

4.68 Billion

2024

2032

| 2025 –2032 | |

| USD 2.09 Billion | |

| USD 4.68 Billion | |

|

|

|

|

Breather Membrane Used in Building Envelope Market Size

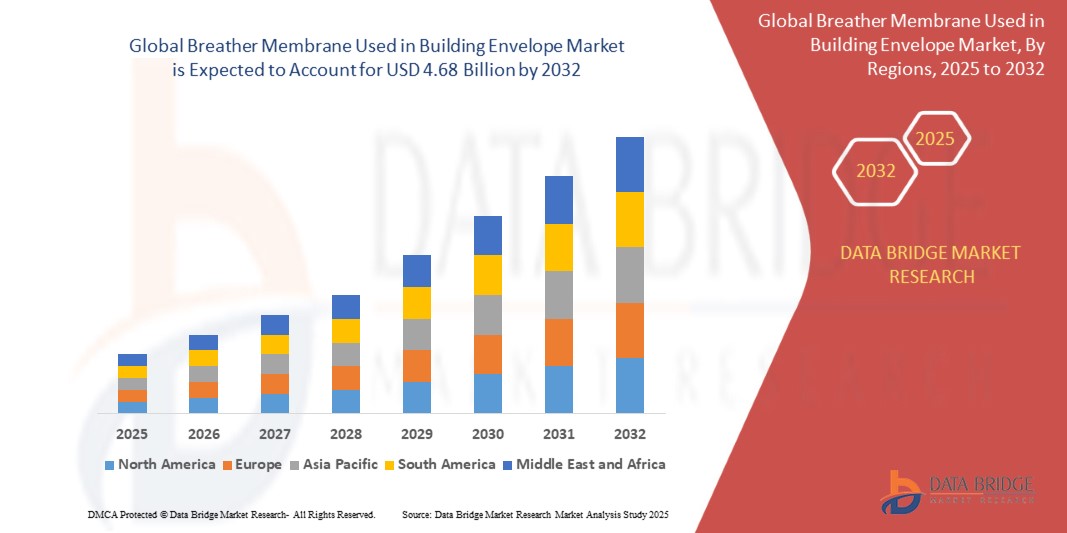

- The Global Breather Membrane Used in Building Envelope Market size was valued at USD 2.09 Billion in 2024 and is expected to reach USD 4.68 Billion by 2032, at a CAGR of 10.6% during the forecast period

- The market growth is largely fueled by increasing demand of imperishable building structures

- Furthermore, the rising durability and cost-effectiveness of breathable membranes and rising stringent environmental regulations in European countries, are further anticipated to propel the growth of the breather membrane used in building envelope market

Breather Membrane Used in Building Envelope Market Analysis

- Breather membrane is defined as a water- resistant material which is widely used in roofs and walls. They are sheets or films that allow the passage of water vapour and gases through the wall but restricts liquid so that they can prevent them from damaging the roofs.

- Due to rising urbanization they are widely used in the construction activities, so that they can protect the roofs and walls from getting damaged

- North America dominates the Breather Membrane Used in Building Envelope Market with the largest revenue share of 35.1% in 2024, characterized by strict building regulations and high demand for energy-efficient construction.

- Asia-Pacific is expected to be the fastest growing region in the Breather Membrane Used in Building Envelope Market during the forecast period due to rapid urbanization, expanding infrastructure, and green building initiatives

- The polypropylene segment is expected to dominate the Breather Membrane Used in Building Envelope Market with a market share of 42.3% in 2024, driven by its superior tensile strength, durability, and resistance to UV radiation

Report Scope and Breather Membrane Used in Building Envelope Market Segmentation

|

Attributes |

Glass Fiber Reinforced Plastics Composites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Breather Membrane Used in Building Envelope Market Trends

“Smart and Multifunctional Membranes for Enhanced Building Performance”

- A significant and accelerating trend in the Global Breather Membrane Used in Building Envelope Market is the development of smart and multifunctional membranes. These advanced materials integrate sensors and responsive technologies to monitor environmental conditions, adjust permeability, and enhance energy efficiency in real-time.

- For instance, recent advancements have led to the creation of membranes that can detect humidity, temperature, and air pressure within building envelopes. This data enables dynamic adjustments to moisture management and insulation properties, optimizing indoor air quality and comfort.

- Similarly, the integration of IoT technologies in building materials has facilitated the development of membranes with enhanced performance and monitoring capabilities, aligning with the growing demand for smart homes and energy-efficient buildings.

- The adoption of these smart membranes aligns with the increasing emphasis on sustainable construction practices and the need for materials that contribute to energy conservation and environmental responsiveness

Breather Membrane Used in Building Envelope Market Dynamics

Driver

“Increasing Demand for Energy-Efficient and Sustainable Buildings”

- The rising global emphasis on environmental sustainability and energy conservation is a major driver for the Global Breather Membrane Used in Building Envelope Market.

- Breather membranes play a critical role in enhancing thermal performance and moisture management in buildings, contributing to improved energy efficiency and indoor air quality.

- Stringent building codes and regulations worldwide are mandating the use of high-performance materials, such as breather membranes, to ensure effective control of moisture, condensation, and air permeability within building structures.

- This trend is further supported by the growing awareness of moisture control in building design and the need for materials that align with green building certifications.

Restraint/Challenge

“High Initial Installation Costs and Material Compatibility Issues”

- The high initial installation costs associated with advanced breather membranes pose a significant challenge for the market.

- Retrofitting breather membranes into existing buildings can be complex and costly due to differences in building materials, designs, and construction techniques, leading to challenges in material compatibility.

- In existing structures, compatibility issues often arise when integrating new membranes with older materials, such as traditional brick, stone, or wood, which may not provide the required level of adhesion or sealing.

- Additionally, the process of retrofitting can be time-consuming, requiring specialized labor and potentially causing disruptions in the building’s operation, particularly in commercial or residential spaces.

- These factors may deter some building owners or developers from adopting breather membranes, especially in regions where retrofitting is not a common practice, thereby limiting market growth.

Breather Membrane Used in Building Envelope Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Breather Membrane Used in Building Envelope Market is segmented into Polyethylene, Polypropylene, and Others. The Polypropylene segment dominates the largest market revenue share of 42.3% in 2025, driven by its superior tensile strength, durability, and resistance to UV radiation. These membranes offer excellent breathability and water resistance, making them the preferred material in both residential and commercial roofing systems. The ease of installation and compatibility with various insulation materials support their widespread adoption.

The Polyethylene segment is anticipated to witness the fastest growth rate of 9.6% from 2025 to 2032, propelled by advancements in polymer engineering and increased adoption in cost-sensitive markets. Polyethylene membranes provide adequate vapor permeability and water resistance at a lower price point. Growing construction activity in emerging economies and increased focus on energy-efficient building envelopes are key factors driving segment expansion.

- By Application

On the basis of application, the Breather Membrane Used in Building Envelope Market is segmented into Pitched Roof and Walls. The Pitched Roof segment held the largest market revenue share in 2025, driven by rising demand for breathable yet waterproof underlays in sloped roofing systems. These membranes support condensation control and thermal efficiency, particularly in colder climates where roof insulation performance is critical. Broad application across residential housing developments and retrofitting projects enhances market penetration.

The Walls segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing trend toward airtight yet breathable external wall constructions. Breather membranes in wall systems provide critical moisture control, preventing mold growth and material degradation. Demand is rising with the global shift to net-zero energy buildings, stricter building codes, and the adoption of timber frame and modular construction techniques.

Breather Membrane Used in Building Envelope Market Regional Analysis

- North America dominates the Breather Membrane Used in Building Envelope Market with the largest revenue share of 35.1% in 2024, driven by strict building regulations and high demand for energy-efficient construction.

- Advancements in green building technologies and retrofitting older buildings further boost market growth.

- Both residential and commercial sectors are adopting breather membranes to reduce moisture buildup and enhance energy performance.

U.S. Breather Membrane Used in Building Envelope Market Insight

The U.S. Breather Membrane Used in Building Envelope Market captured the largest revenue share of 82.03% in 2025 within North America, fueled by a thriving construction sector, growing interest in sustainable infrastructure, and government incentives for energy efficiency. Green building certifications like LEED promote the use of breathable membranes in residential and commercial structures. The push for zero-energy buildings also supports long-term demand for high-performance, moisture-regulating envelope solutions.

Europe Breather Membrane Used in Building Envelope Market Insight

The European Breather Membrane Used in Building Envelope Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by robust environmental regulations and early adoption of energy-efficient construction standards. Strong governmental support for reducing building emissions and improving thermal insulation efficiency propels demand. European countries prioritize sustainability, with widespread use of breather membranes in both new builds and retrofitting projects across commercial and residential segments.

U.K. Breather Membrane Used in Building Envelope Market Insight

The U.K. Breather Membrane Used in Building Envelope Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government policies support energy-efficient housing, especially through programs like the Future Homes Standard. Consumer awareness around indoor air quality and building health fuels demand. Builders prefer breather membranes for their durability and moisture control, especially in timber frame and lightweight steel construction widely used across the country.

Germany Breather Membrane Used in Building Envelope Market Insight

The German Breather Membrane Used in Building Envelope Market is expected to expand at a considerable CAGR during the forecast period, fueled by stringent energy performance standards and sustainability mandates like EnEV. The country is a leader in passive house construction, which relies on airtight yet breathable building envelopes. Technological innovation and material science advancements from domestic firms further enhance market competitiveness and position Germany as a leader in eco-construction.

Asia-Pacific Breather Membrane Used in Building Envelope Market Insight

The Asia-Pacific Breather Membrane Used in Building Envelope Market is poised to grow at the fastest CAGR of over 8.5% during the forecast period of 2025 to 2032, driven by rapid urbanization, expanding infrastructure, and green building initiatives across countries like China, India, and Southeast Asia fuel growth. Government support for sustainable housing and increasing awareness of building performance drive adoption of breathable membranes.

Japan Breather Membrane Used in Building Envelope Market Insight

The Japan Breather Membrane Used in Building Envelope Market is gaining momentum due to country’s high seismic activity also demands lightweight, high-performance materials that improve structural integrity. Growing adoption in modular construction, along with innovations in polymer and film technology, supports strong market expansion for durable, vapor-permeable building materials that meet energy efficiency goals.

China Breather Membrane Used in Building Envelope Market Insight

China Breather Membrane Used in Building Envelope Market accounted for the largest market revenue share in Asia Pacific in 2025, driven by a vast construction pipeline and policies favoring green buildings under programs like the Green Building Evaluation Standard. The availability of raw materials and rising demand for moisture-resistant and energy-saving materials strengthen local production. Demand grows particularly in urban high-rise and industrial building applications requiring thermal efficiency.

Breather Membrane Used in Building Envelope Market Share

The Glass Fiber Reinforced Plastics Composites Industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Saint-Gobain (France)

- SOPREMA Group (France)

- GAF (U.S.)

- Kingspan Group (Ireland)

- Low & Bonar (U.K.)

- Knauf Insulation (Germany)

- DELTA (Dörken GmbH & Co. KG) (Germany)

- IKO Industries Ltd (Canada)

- RIWEGA SRL (Italy)

- Thermafleece (U.K.)

- Novia Ltd (U.K.)

- A. Proctor Group Ltd (U.K.)

- Industrial Textiles & Plastics Ltd (U.K.)

- NATURAL BUILDING TECHNOLOGIES (U.K.)

Latest Developments in Global Breather Membrane Used in Building Envelope Market

- In October 2024, eVent Fabrics, a global pioneer in waterproof and breathable fabric technologies, announced the supply of its eco-friendly eVent BIO Footwear laminate to Topo Athletic, a brand recognized for producing sustainable footwear for activities like walking, running, and hiking.

- In July 2024, Industrial Textiles & Plastics (ITP) Ltd., a specialist in construction membranes, unveiled a new Euroclass A1-rated non-combustible breather membrane, delivering the highest standard of fire resistance for external wall applications.

- In May 2024, DuPont Performance Building Solutions, a key innovator in advanced building materials, launched Tyvek Trifecta, the latest evolution in their range of high-performance breather membranes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Breather Membrane Used In Building Envelope Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Breather Membrane Used In Building Envelope Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Breather Membrane Used In Building Envelope Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.