Global Breweries Market

Market Size in USD Billion

CAGR :

%

USD

792.38 Billion

USD

1,184.16 Billion

2025

2033

USD

792.38 Billion

USD

1,184.16 Billion

2025

2033

| 2026 –2033 | |

| USD 792.38 Billion | |

| USD 1,184.16 Billion | |

|

|

|

|

Global Breweries Market Size

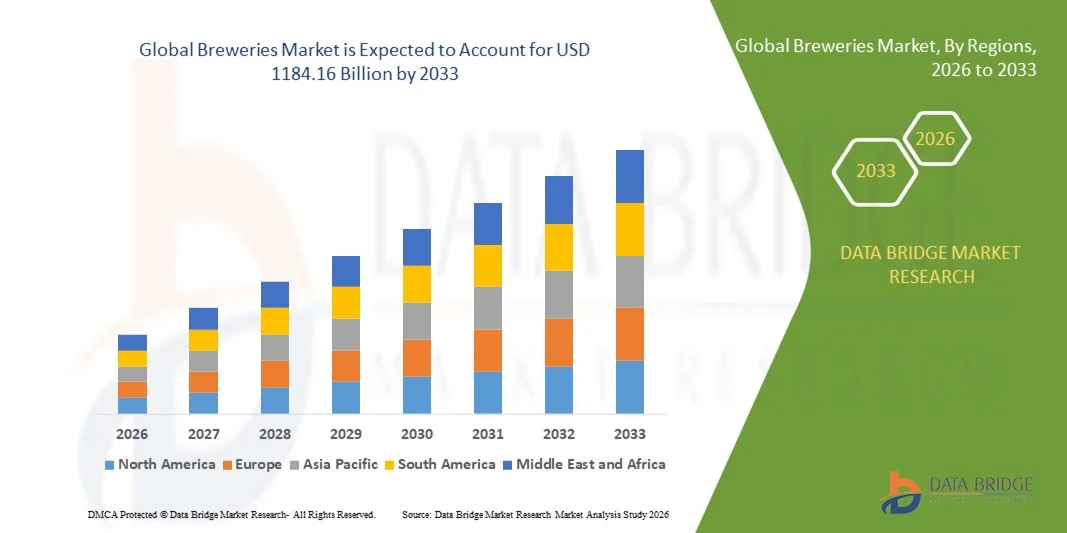

- The global Breweries Market size was valued at USD 792.38 billion in 2025 and is projected to reach USD 1184.16 billion by 2033, growing at a CAGR of 5.15% during the forecast period.

- The market expansion is primarily driven by the increasing consumer preference for craft and premium beers, coupled with innovations in brewing techniques and flavor diversification, which are enhancing product appeal across demographics.

- Additionally, the growing emphasis on sustainability, local sourcing, and low-alcohol or alcohol-free variants is reshaping the competitive landscape, attracting health-conscious consumers and fostering continuous industry growth worldwide.

Global Breweries Market Analysis

- The Global Breweries Market, encompassing large-scale and craft beer production, is becoming an essential segment of the global beverage industry due to its diverse product offerings, evolving consumer preferences, and continuous innovation in brewing technologies that enhance both quality and variety.

- The surging demand for breweries is primarily driven by the growing popularity of craft beers, rising disposable incomes, and a shift toward premium, flavored, and low-alcohol beverages, reflecting a global trend toward experiential and lifestyle-driven consumption.

- North America dominated the Global Breweries Market with the largest revenue share of 33.3% in 2025, supported by the strong presence of leading brewery brands, early adoption of craft and microbrewing trends, and a growing consumer base seeking innovative, locally brewed beers, particularly in the U.S. and Canada.

- Asia-Pacific is expected to be the fastest-growing region in the Global Breweries Market during the forecast period due to rapid urbanization, increasing disposable incomes, and a rising young population with changing social drinking habits.

- The Light Beer segment dominated the market with the largest revenue share of 52.4% in 2025, driven by growing consumer preference for low-calorie and low-alcohol options that align with health-conscious lifestyles.

Report Scope and Global Breweries Market Segmentation

|

Attributes |

Breweries Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Anheuser-Busch InBev (Belgium) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Breweries Market Trends

Enhanced Convenience Through Smart Brewing and Digital Integration

- A significant and accelerating trend in the Global Breweries Market is the integration of smart brewing technologies, data analytics, and digital platforms into both production and consumer-facing processes. This fusion of technologies is enhancing operational efficiency, quality consistency, and consumer engagement.

- For instance, automated brewing systems and IoT-enabled equipment allow breweries to precisely control fermentation, temperature, and flavor profiles, ensuring consistent quality across batches. Similarly, digital platforms enable breweries to offer customized beer subscriptions, online ordering, and real-time tracking of production.

- Data analytics integration in breweries allows for insights into consumer preferences, seasonal trends, and demand forecasting, enabling breweries to optimize production schedules and reduce waste. For example, some craft breweries use AI-driven analytics to experiment with new flavors or adjust recipes based on real-time customer feedback, improving market responsiveness.

- The seamless integration of breweries with digital platforms facilitates direct-to-consumer sales, loyalty programs, and interactive experiences, allowing consumers to engage with brands through apps, QR codes on packaging, and social media campaigns. This creates a more personalized and connected experience for beer enthusiasts.

- This trend towards more intelligent, automated, and digitally connected brewing operations is reshaping consumer expectations and competitive strategies in the industry. Consequently, companies such as AB InBev and Heineken are investing in smart brewing technologies, AI-enabled production, and digital engagement platforms to enhance product quality and consumer convenience.

- The demand for breweries that leverage automation, AI, and digital integration is growing rapidly worldwide, as both large-scale and craft producers seek to meet evolving consumer preferences, improve operational efficiency, and expand market reach.

Global Breweries Market Dynamics

Driver

Growing Demand Due to Changing Consumer Preferences and Health Trends

- The increasing consumer preference for craft, premium, and low-alcohol beers, coupled with rising health consciousness and evolving drinking habits, is a significant driver for the heightened demand in the Global Breweries Market.

- For instance, in 2025, Heineken introduced a range of low-alcohol and alcohol-free craft beers targeting health-conscious consumers, reflecting an industry-wide shift toward more diversified and lifestyle-oriented offerings. Such strategic innovations by leading breweries are expected to drive market growth during the forecast period.

- As consumers seek unique flavors, higher quality ingredients, and specialty brewing experiences, breweries are investing in craft techniques, experimental recipes, and limited-edition products, providing a compelling alternative to mass-produced beers.

- Furthermore, the growing popularity of direct-to-consumer sales, home delivery, and subscription-based beer clubs is making breweries an integral part of digital and experiential consumer engagement, enhancing brand loyalty and expanding market reach.

- The convenience of ready-to-drink formats, online ordering, and personalized beer experiences are key factors propelling adoption across urban and emerging markets. Additionally, the rise of eco-conscious packaging and sustainable production practices further strengthens consumer appeal, contributing to market growth.

Restraint/Challenge

High Production Costs and Regulatory Constraints

- The high initial investment required for modern brewing equipment, automation, and quality control systems, coupled with stringent regulatory requirements for alcohol production and distribution, poses a significant challenge to broader market expansion.

- For instance, smaller craft breweries often face high operational costs to comply with health, safety, and taxation regulations, which can limit growth potential or delay market entry.

- Addressing these challenges through cost-effective production methods, efficient supply chain management, and compliance support is crucial for sustaining growth. Companies such as AB InBev and Carlsberg are investing in automation, energy-efficient brewing, and sustainable sourcing to optimize costs while meeting regulatory standards.

- Furthermore, fluctuating raw material prices, particularly for barley, hops, and packaging materials, can impact profitability, especially for smaller players in developing regions.

- Overcoming these challenges through innovation in brewing efficiency, strategic partnerships, and adoption of scalable production technologies will be vital for sustained growth in the Global Breweries Market.

Global Breweries Market Scope

The breweries market is segmented on the basis of beer type, size, beer production, beer quality and beer packaging.

- By Beer Type

On the basis of beer type, the Global Breweries Market is segmented into Light Beer and Strong Beer. The Light Beer segment dominated the market with the largest revenue share of 52.4% in 2025, driven by growing consumer preference for low-calorie and low-alcohol options that align with health-conscious lifestyles. Light beers appeal to a wide demographic, including millennials and urban populations seeking refreshing beverages with moderate alcohol content.

In contrast, the Strong Beer segment is expected to witness the fastest CAGR of 8.7% from 2026 to 2033, fueled by rising demand for bold flavors and higher alcohol content, particularly in Europe and North America. Craft breweries and specialty beer producers are innovating with strong beer variants to cater to enthusiasts looking for unique taste experiences, limited-edition brews, and seasonal offerings, further driving growth in this segment.

- By Size

On the basis of beer size/style, the Global Breweries Market is segmented into Lager, Ale, Stout and Porter, Malt, and Others. The Lager segment dominated the market with the largest revenue share of 46.8% in 2025, owing to its widespread global consumption, mild taste, and mass-market appeal. Lager beers are produced at scale by major breweries, making them readily available in both retail and on-premise channels.

The Stout and Porter segment is expected to witness the fastest CAGR of 9.1% from 2026 to 2033, driven by growing interest in dark, full-bodied beers with rich flavor profiles. Specialty breweries and craft producers are introducing innovative variants with added flavors such as chocolate, coffee, and spices, attracting younger and premium-focused consumers seeking distinctive taste experiences.

- By Beer Production

On the basis of beer production, the Global Breweries Market is segmented into Macro-brewery, Micro-brewery, Craft Brewery, and Others. The Macro-brewery segment dominated the market with the largest revenue share of 55.3% in 2025, due to large-scale production, strong distribution networks, and established brand loyalty. Macro-breweries continue to dominate mainstream markets with affordable, widely available beers.

The Craft Brewery segment is expected to witness the fastest CAGR of 10.2% from 2026 to 2033, driven by rising consumer preference for artisanal, small-batch, and experimental brews. The growing trend of supporting local breweries, coupled with increasing disposable incomes in urban areas, is boosting demand for craft beers with unique flavors, premium quality, and innovative packaging.

- By Beer Quality

On the basis of beer quality, the Global Breweries Market is segmented into Premium, Super Premium, and Normal. The Premium segment dominated the market with the largest revenue share of 48.7% in 2025, driven by rising consumer disposable incomes and preference for higher-quality, branded beers. Premium beers are perceived as offering superior taste, ingredients, and craftsmanship, appealing to urban consumers and millennials seeking aspirational products.

The Super Premium segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, fueled by the increasing demand for exclusive, imported, or limited-edition beers. Factors such as innovative brewing techniques, unique flavors, and luxury packaging contribute to growth, particularly in developed markets where consumers are willing to pay a premium for differentiated beer experiences.

- By Beer Packaging

On the basis of beer packaging, the Global Breweries Market is segmented into Canned, Bottled, Draught, Glass, PET Bottle, Metal Can, and Others. The Bottled segment dominated the market with the largest revenue share of 44.6% in 2025, owing to its convenience, shelf stability, and strong brand recognition. Bottled beers are widely consumed in both on-premise and off-premise settings, making them a preferred choice for mainstream consumers.

The Canned segment is expected to witness the fastest CAGR of 10.8% from 2026 to 2033, driven by growing demand for portability, lightweight packaging, and environmentally friendly solutions. Cans are particularly favored for outdoor events, craft beer distribution, and export markets, with breweries increasingly investing in innovative can designs and branding to attract younger consumers.

Global Breweries Market Regional Analysis

- North America dominated the Global Breweries Market with the largest revenue share of 33.3% in 2025, driven by a strong beer culture, high consumer spending, and the presence of major breweries and craft beer producers.

- Consumers in the region show a growing preference for premium, craft, and specialty beers, as well as innovative beer experiences such as limited editions, seasonal brews, and low-alcohol variants. This demand is supported by well-established distribution networks, a mature retail and on-premise market, and high awareness of global beer trends.

- This widespread adoption is further bolstered by high disposable incomes, urbanization, and an evolving taste for diverse beer styles, positioning North America as a leading market for both large-scale macro-breweries and emerging craft breweries. The region continues to attract investments in brewery expansions, technological upgrades, and marketing initiatives, reinforcing its dominance in the global beer industry.

U.S. Breweries Market Insight

The U.S. breweries market captured the largest revenue share of 38% in 2025 within North America, driven by a strong beer culture, high consumer spending, and the growing popularity of craft and specialty beers. Consumers are increasingly seeking premium, low-alcohol, and flavored beer options, while the rising trend of home brewing and brewery tours further fuels market demand. The presence of major macro-breweries, alongside a dynamic craft beer segment, supports widespread availability and innovation. Additionally, robust distribution networks, well-developed retail channels, and evolving consumer tastes continue to propel growth across residential, commercial, and hospitality sectors.

Europe Breweries Market Insight

The Europe breweries market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising demand for premium and craft beers and increasing beer consumption in both residential and on-premise settings. Strict regulations on quality and safety, coupled with the growing urban population and tourism, are fostering market growth. European consumers increasingly value unique flavors, seasonal brews, and imported beers, while investments in innovative brewing technologies and marketing campaigns enhance adoption across major markets such as Germany, France, and Belgium.

U.K. Breweries Market Insight

The U.K. breweries market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by consumer demand for craft, specialty, and low-alcohol beer variants. The rising trend of premiumization, combined with a strong pub and hospitality culture, encourages higher beer consumption. Additionally, growing awareness of local and artisanal brewing traditions, along with e-commerce and retail distribution expansion, supports market growth. The U.K. continues to attract investments from both domestic and international breweries seeking to leverage consumer preference for innovative beer styles.

Germany Breweries Market Insight

The Germany breweries market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s deep-rooted beer culture and demand for high-quality, craft, and specialty beers. Germany’s well-established brewing infrastructure, strong focus on innovation, and export-oriented production foster market growth. Consumers increasingly prefer unique flavors, seasonal brews, and premium-quality beers. The integration of sustainable brewing practices and eco-friendly packaging further enhances adoption, while both residential and commercial sectors continue to support robust beer consumption.

Asia-Pacific Breweries Market Insight

The Asia-Pacific breweries market is poised to grow at the fastest CAGR of 11.5% from 2026 to 2033, fueled by rising disposable incomes, rapid urbanization, and changing consumer lifestyles in countries such as China, Japan, and India. Growing awareness of premium, craft, and low-alcohol beer options, coupled with an expanding hospitality and retail sector, is driving adoption. Additionally, the region’s emergence as a manufacturing hub for beer production and packaging, alongside increasing exposure to global beer trends, is further boosting market growth across residential, commercial, and institutional segments.

Japan Breweries Market Insight

The Japan breweries market is gaining momentum due to high consumer preference for premium and craft beers, a growing number of on-premise drinking establishments, and evolving tastes toward innovative flavors. Urbanization, tourism, and a mature retail infrastructure contribute to strong demand. Moreover, Japan’s aging population and focus on healthier lifestyle options are increasing the consumption of low-alcohol and light beer variants. Domestic breweries continue to innovate by integrating modern brewing techniques with traditional styles, enhancing consumer appeal in both residential and commercial sectors.

China Breweries Market Insight

The China breweries market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by a rapidly growing middle class, increasing urbanization, and rising disposable incomes. Consumer interest in premium, craft, and flavored beers is on the rise, complemented by the country’s thriving hospitality and retail sectors. Strong domestic brewery presence, coupled with government initiatives supporting the beverage industry and increasing exposure to international beer trends, further fuels market expansion. Affordable options, innovative marketing campaigns, and the rise of e-commerce channels are enabling breweries to reach a broader consumer base across both urban and emerging regions.

Global Breweries Market Share

The Breweries industry is primarily led by well-established companies, including:

• Anheuser-Busch InBev (Belgium)

• Heineken N.V. (Netherlands)

• Carlsberg Group (Denmark)

• Molson Coors Beverage Company (U.S.)

• Diageo Plc (U.K.)

• Kirin Holdings Company, Ltd. (Japan)

• Asahi Group Holdings, Ltd. (Japan)

• SABMiller (U.K./South Africa)

• Constellation Brands, Inc. (U.S.)

• Tsingtao Brewery Group (China)

• Sapporo Holdings Limited (Japan)

• Budweiser Brewing Company APAC (China)

• Corona (Mexico, AB InBev)

• Brau Union Österreich AG (Austria)

• Foster’s Group (Australia)

• Guinness (Ireland, Diageo)

• COFCO Tunhe (China)

• National Beverage Corp. (U.S.)

• Carlsberg India Pvt. Ltd. (India)

• SABMiller India Ltd. (India)

What are the Recent Developments in Global Breweries Market?

- In April 2023, Anheuser-Busch InBev, a global leader in the beer industry, launched a strategic initiative in South Africa to expand its premium and craft beer portfolio. This initiative focused on increasing the availability of specialty and imported beers while enhancing distribution channels to reach both urban and emerging markets. By leveraging its global expertise and strong brand portfolio, Anheuser-Busch InBev is addressing regional consumer preferences and reinforcing its position in the rapidly growing Global Breweries Market.

- In March 2023, BrewDog, a Scottish craft brewery, inaugurated a new state-of-the-art brewery in the United States, designed to meet rising consumer demand for innovative craft beers. The facility emphasizes sustainable brewing practices and production of seasonal and limited-edition beers. This expansion underscores BrewDog’s commitment to global growth and delivering premium, differentiated beer experiences to new markets.

- In March 2023, Heineken N.V. launched the Smart Brew Initiative in India, aimed at modernizing production processes and improving distribution efficiency for its beer portfolio. The initiative integrates advanced brewing technologies and environmentally friendly practices, highlighting Heineken’s focus on sustainability while catering to the growing demand for premium and craft beers in urban centers.

- In February 2023, Carlsberg Group partnered with the Asia-Pacific Beverage Alliance to expand its craft beer offerings across key emerging markets, including China and Southeast Asia. This collaboration is designed to enhance consumer access to innovative beer varieties, streamline supply chains, and strengthen Carlsberg’s market presence. The initiative reflects the company’s focus on innovation and operational excellence in the competitive Global Breweries Market.

- In January 2023, Molson Coors Beverage Company introduced its limited-edition premium lager series at major international trade shows, featuring innovative flavor profiles and sustainable packaging. The launch highlights Molson Coors’ strategy to capture the growing consumer preference for premium, craft, and eco-friendly beer options while expanding its influence in both residential and commercial consumption segments.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Breweries Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Breweries Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Breweries Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.