Global Brewing Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

42.02 Billion

USD

71.13 Billion

2024

2032

USD

42.02 Billion

USD

71.13 Billion

2024

2032

| 2025 –2032 | |

| USD 42.02 Billion | |

| USD 71.13 Billion | |

|

|

|

|

Brewing Ingredients Market Size

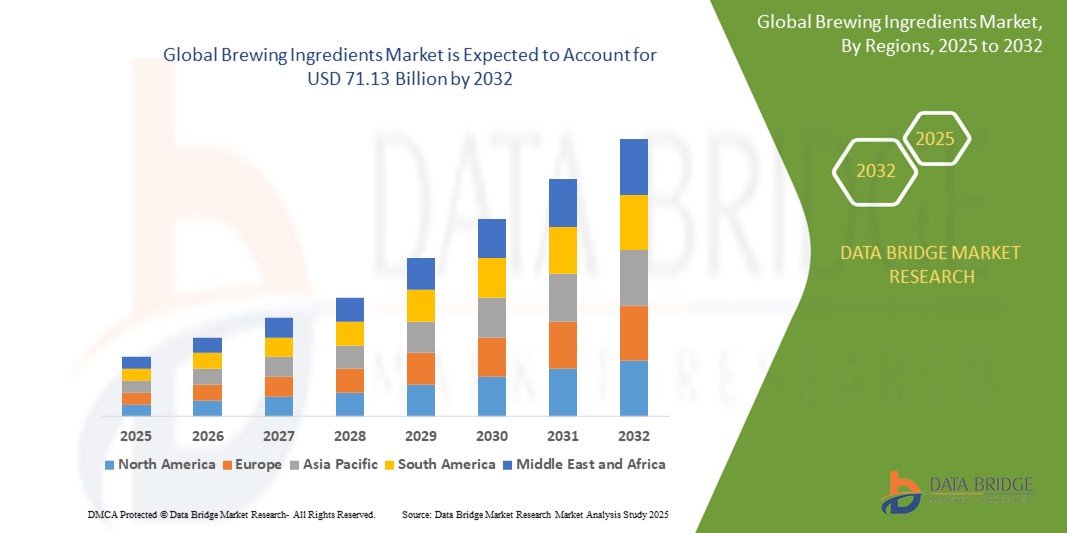

- The global brewing ingredients market size was valued at USD 42.02 billion in 2024 and is expected to reach USD 71.13 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by the expanding global consumption of beer and the rapid proliferation of craft breweries, driving increased demand for high-quality, diverse brewing ingredients across both established and emerging markets

- Furthermore, rising consumer demand for premium, artisanal, and flavor-rich beer variants is pushing breweries to innovate with specialty malts, hops, yeasts, and natural additives. These evolving preferences, coupled with supportive government regulations and modernization of brewing facilities, are significantly boosting the industry's growth

Brewing Ingredients Market Analysis

- Brewing ingredients such as malt extract, hops, yeast, and additives are fundamental to the beer production process, influencing flavor, color, aroma, mouthfeel, and shelf life. These ingredients are used by macro, micro, and craft breweries to create a wide range of beer styles tailored to consumer preferences

- The accelerating demand for brewing ingredients is primarily driven by the global rise in craft beer popularity, increasing disposable incomes, and the diversification of beer offerings. In addition, innovations in ingredient processing, the focus on sustainability, and a growing interest in local sourcing are shaping the future of the brewing ingredients market

- North America dominated the brewing ingredients market with a share of 41.8% in 2024, due to the strong presence of established breweries and the rising popularity of craft and specialty beers across the region

- Asia-Pacific is expected to be the fastest growing region in the brewing ingredients market during the forecast period due to urbanization, increasing disposable incomes, and a rising appetite for premium and imported beers

- Macro brewery segment dominated the market with a market share of 58.6% in 2024, due to large-scale operations, extensive distribution networks, and strong demand for mass-produced beers in mature markets. These breweries often prioritize consistent taste, efficient production, and cost-effective ingredients, giving them a structural advantage in volume-based sales

Report Scope and Brewing Ingredients Market Segmentation

|

Attributes |

Brewing Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Brewing Ingredients Market Trends

“Growing Popularity of Craft Beers”

- The brewing ingredients market is being strongly influenced by the surge in craft beer popularity, which emphasizes distinct flavor profiles, traditional brewing methods, and experimentation with specialty ingredients. The result is increased demand for high-quality malts, unique hop varieties, and innovative yeast strains that enable differentiation among brands and products

- For instance, companies such as Cargill Incorporated, Boortmalt, and Malteurop Groupe are expanding their brewing ingredients portfolios to supply craft breweries with premium and diverse ingredient options, supporting innovative recipes and unique beer experiences

- The craft beer segment’s dynamic growth, especially in North America, Europe, and fast-rising Asia-Pacific markets, encourages the formation of new microbreweries and brewpubs, boosting volumes of specialty grain, hops, and yeast purchased

- Collaborative trends between ingredient suppliers and independent breweries are leading to innovations such as locally sourced grains and new hop cultivars tailored for regional tastes and sustainability demands

- The homebrewing movement and growing consumer interest in artisanal beverages further propel demand for small-batch, high-value brewing ingredients, broadening the market scope

Brewing Ingredients Market Dynamics

Driver

“Rising Consumer Preferences for Premium Beverages”

- The market is driven by a shift in consumer tastes toward premium and artisanal beverages, with an increasing number of customers seeking high-quality, flavorful, and differentiated beer products

- For instance, key players such as Angel Yeast Co. Ltd., Rahr Corporation, and Lesaffre are responding by developing specialized yeast strains and malt extracts that enhance flavor, aroma, and brewing performance for premium beer segments

- Rising disposable incomes and urban lifestyles, particularly among Millennials and younger demographics, have led to increased willingness to pay for unique and superior beverage experiences

- The global rise in beer tourism, craft beer festivals, and specialty tasting events is encouraging breweries to improve product differentiation through innovative ingredient usage

- Adoption of western consumption habits and expanding middle-class populations in developing regions further amplify the demand for premium beer and, consequently, premium-grade brewing ingredients

Restraint/Challenge

“High Raw Material Costs”

- Volatility in prices of key raw materials—including barley malt, hops, and specialty yeast—poses a major challenge to both large-scale and craft brewers, impacting overall production costs and margins

- For instance, global suppliers such as Cargill Incorporated and Boortmalt have faced upward pressure on grain and hop prices due to extreme weather events, changing agricultural yields, and increased logistics costs

- Stringent quality requirements for premium ingredients add further cost to sourcing and quality assurance, especially for brewers positioned in the craft or artisanal segment

- Supply chain disruptions, tariffs, and international trade barriers (notably for imported hops and specialty malts) create cost unpredictability and limit flexibility for breweries in multiple regions

- Fluctuating global demand and regulation-driven shifts in farmland utilization may further exacerbate raw material price instability, posing strategic risks for ingredient suppliers and brewers alike

Brewing Ingredients Market Scope

The market is segmented on the basis of source, function type, brewery size, form, and end-user.

- By Source

On the basis of source, the brewing ingredients market is segmented into malt extract, adjuncts or grains, hops, beer yeast, and beer additives. The malt extract segment held the largest market revenue share in 2024, primarily due to its essential role in fermentation and its widespread use across both industrial and craft brewing setups. Malt extract provides the sugar needed for fermentation while also contributing to flavor, color, and mouthfeel, making it a foundational ingredient in beer production. Its ease of use and consistent quality make it particularly favored among small and mid-sized breweries seeking reliable brewing inputs.

The hops segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by the rising consumer demand for flavor-intense, aroma-rich craft beers. Hops contribute to bitterness, flavor, and preservation, and their growing varietal diversity is enabling brewers to innovate with distinctive taste profiles. The increasing popularity of hop-forward beer styles such as IPAs is also accelerating demand globally.

- By Function Type

On the basis of function type, the market is categorized into fragrance, preservatives, flavours, proteins, and others. The flavours segment led the market in revenue terms in 2024, owing to its central role in defining the sensory profile of beers and enabling differentiation among breweries. As consumer interest in novel and artisanal beer styles grows, there is increased experimentation with flavor compounds and natural flavoring ingredients.

The preservatives segment is expected to register the fastest growth rate during the forecast period, driven by rising concerns over shelf stability and microbial safety. Preservatives are particularly critical for packaged beers that undergo long-distance transportation or extended retail shelf life, especially in emerging markets with warm climates.

- By Brewery Size

On the basis of brewery size, the market is segmented into macro brewery and craft brewery. The macro brewery segment held the dominant share of 58.6% in 2024, supported by large-scale operations, extensive distribution networks, and strong demand for mass-produced beers in mature markets. These breweries often prioritize consistent taste, efficient production, and cost-effective ingredients, giving them a structural advantage in volume-based sales.

In contrast, the craft brewery segment is projected to experience the highest CAGR from 2025 to 2032, underpinned by shifting consumer preferences toward premium, locally sourced, and unique beer offerings. The segment is being driven by increasing global appreciation for artisanal brewing techniques and the cultural value associated with supporting local craft brands.

- By Form

On the basis of form, the brewing ingredients market is divided into dry and liquid. The dry segment captured the largest market share in 2024, largely because of its extended shelf life, ease of storage, and consistent dosing in large-scale operations. Dry ingredients such as dry malt extract and powdered hops are widely used for their cost-effectiveness and convenience in industrial settings.

The liquid segment is expected to record the fastest growth through 2032, driven by its appeal among craft brewers and homebrewing enthusiasts seeking enhanced flavor profiles and more traditional brewing practices. Liquid forms often offer superior solubility and are associated with richer aromatic characteristics in the final product.

- By End-User

On the basis of end-user, the market is segmented into microbreweries, brewpubs, contract brewery, and craft brewers. Microbreweries accounted for the highest market share in 2024, supported by their agility in adopting innovative recipes and their appeal to local consumers looking for fresh and unique beers. These breweries typically emphasize ingredient quality and are strong contributors to the demand for specialty and organic brewing inputs.

The craft brewers segment is forecast to witness the fastest growth rate during the forecast period, bolstered by expanding consumer interest in niche, flavorful beer varieties and the increasing establishment of small-scale breweries globally. Craft brewers often use premium, diverse ingredients and are key players in driving market demand for novel hops, yeast strains, and additives.

Brewing Ingredients Market Regional Analysis

- North America dominated the brewing ingredients market with the largest revenue share of 41.8% in 2024, driven by the strong presence of established breweries and the rising popularity of craft and specialty beers across the region

- Consumers in the region show a growing preference for premium ingredients, including unique hop varieties, organic adjuncts, and customized yeast strains that enhance flavor and quality

- The region’s advanced brewing infrastructure, supportive regulatory environment, and high per capita beer consumption are key contributors to sustained demand for high-quality brewing ingredients

U.S. Brewing Ingredients Market Insight

The U.S. brewing ingredients market captured the largest revenue share in 2024 within North America, fueled by the country’s dominance in craft beer production and the widespread adoption of innovative brewing techniques. The rise of microbreweries and brewpubs has spurred demand for specialty malts, aromatic hops, and proprietary yeast blends. Additionally, shifting consumer interest toward gluten-free, low-alcohol, and flavored beer variants is encouraging ingredient experimentation, further driving market expansion.

Europe Brewing Ingredients Market Insight

The Europe brewing ingredients market is projected to expand at a considerable CAGR throughout the forecast period, driven by a deep-rooted beer culture, the proliferation of craft breweries, and increasing consumer demand for traditional and regional beer styles. European brewers continue to emphasize ingredient traceability, sustainability, and quality, which is boosting demand for locally sourced and organic brewing ingredients. The market is witnessing strong growth in Germany, the U.K., and Belgium—regions known for their brewing heritage and innovation.

U.K. Brewing Ingredients Market Insight

The U.K. brewing ingredients market is anticipated to grow at a notable CAGR during the forecast period, driven by the craft beer boom and a resurgence in small-scale, artisanal brewing. Consumer preferences are shifting towards flavorful, low-ABV, and sessionable beers, fueling demand for customized hops, malt varieties, and natural additives. The U.K.'s dynamic pub culture and strong e-commerce presence in craft beer retailing continue to support the expansion of the brewing ingredients sector.

Germany Brewing Ingredients Market Insight

The Germany brewing ingredients market is expected to grow steadily, underpinned by the country’s position as one of the largest beer producers in Europe and its adherence to the Reinheitsgebot (Beer Purity Law), which emphasizes the use of traditional ingredients. There is rising interest in specialty malts and hop innovation, especially among independent brewers catering to evolving tastes. Germany’s sustainability-focused consumer base is also contributing to increased demand for eco-friendly and organic brewing components.

Asia-Pacific Brewing Ingredients Market Insight

The Asia-Pacific brewing ingredients market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, supported by urbanization, increasing disposable incomes, and a rising appetite for premium and imported beers. Markets such as China, Japan, and India are witnessing an uptick in craft beer consumption, leading to higher demand for quality brewing ingredients. Government initiatives supporting microbrewery licensing and foreign investment in beverage sectors are further accelerating market expansion.

Japan Brewing Ingredients Market Insight

The Japan brewing ingredients market is gaining momentum due to a surge in demand for craft and regional beers, as well as an expanding homebrewing community. Japanese brewers are increasingly exploring unique hop blends, local adjuncts such as rice and yuzu, and custom yeast strains to create distinctive beer profiles. Cultural appreciation for quality, innovation, and clean-label beverages is shaping ingredient demand, particularly in premium and seasonal product categories.

China Brewing Ingredients Market Insight

The China brewing ingredients market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s massive beer consumption base and rapid rise of craft breweries. Domestic brewers are investing heavily in premiumization and product differentiation, leading to increased imports of specialty malts and hop varieties. China’s shift toward Western-style beers, coupled with strong government support for industrial modernization and urban leisure culture, is driving demand for diverse and high-grade brewing ingredients.

Brewing Ingredients Market Share

The brewing ingredients industry is primarily led by well-established companies, including:

- BOORTMALT (Belgium)

- Malteurop (France)

- Rahr Corporation (U.S.)

- Lallemand Inc. (Canada)

- Viking Malt (Finland)

- Lesaffre (France)

- Maltexco (Chile)

- Simpsons Malt (U.K.)

- Briess Malt & Ingredients (U.S.)

- GrainCorp. (Australia)

- The Soufflet Group (France)

- BSG CraftBrewing (U.S.)

- Muntons plc (U.K.)

- Heineken N.V. (Netherlands)

- Diamalteria Italiana Srl (Italy)

- Carlsberg Breweries A/S (Denmark)

- ASAHI GROUP HOLDINGS Ltd. (Japan)

- Boston Beer Company (U.S.)

Latest Developments in Global Brewing Ingredients Market

- In July 2024, AB Biotek, a subsidiary of AB Mauri, expanded its presence in the brewing ingredients market by introducing a new range of dry yeast under its premium brand, Pinnacle. This strategic launch targets both industrial and craft brewers, enhancing the company’s product portfolio with high-performance yeast solutions. By catering to a broader spectrum of brewing applications, AB Biotek is positioned to meet the rising global demand for consistent, high-quality fermentation products, thereby reinforcing its competitive edge in the premium yeast segment

- In March 2024, Far Yeast Brewing Co., Ltd. revitalized its product lineup by renewing its core “Far Yeast Tokyo Series” and “Far Yeast Genryu Series,” alongside relaunching the “Far Yeast Series.” These developments reflect the company’s commitment to innovation and responsiveness to evolving brewer preferences. By enhancing the appeal and functionality of its yeast offerings, Far Yeast Brewing aims to strengthen its market positioning and cater more effectively to the growing craft and specialty beer segment in Asia and beyond

- In November 2023, Malteries Soufflet made a significant move in the malt ingredient market by acquiring a 100% stake in United Malt Group Limited for approximately USD 994.46 million. This acquisition expands Malteries’ production capabilities and geographic reach and also solidifies its leadership in the global craft brewing supply chain. By integrating United Malt’s operations, Malteries is better equipped to serve the increasing demand for premium malt ingredients, especially from the fast-growing craft brewery segment, enhancing both supply chain efficiency and product innovation potential

- In February 2023, Stone Brewing introduced a groundbreaking beer featuring a new ingredient called ‘Phantasm.’ This novel component, derived from Sauvignon Blanc grapes, is designed to enhance aromatic and flavor profiles, offering a unique twist to their craft brews and pushing the boundaries of beer innovation

- In April 2022, Rahr Corporation, in collaboration with Marcus Baskerville, launched the Harriet Baskerville Incubation Program. This initiative supports the growth of underrepresented groups in craft brewing, including women and BIPOC brewers. It provides structured brewing education, professional mentoring, and essential resources to foster diversity and innovation in the industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Brewing Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Brewing Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Brewing Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.