Global Brics Oral Care Market

Market Size in USD Billion

CAGR :

%

USD

13.16 Billion

USD

25.09 Billion

2025

2033

USD

13.16 Billion

USD

25.09 Billion

2025

2033

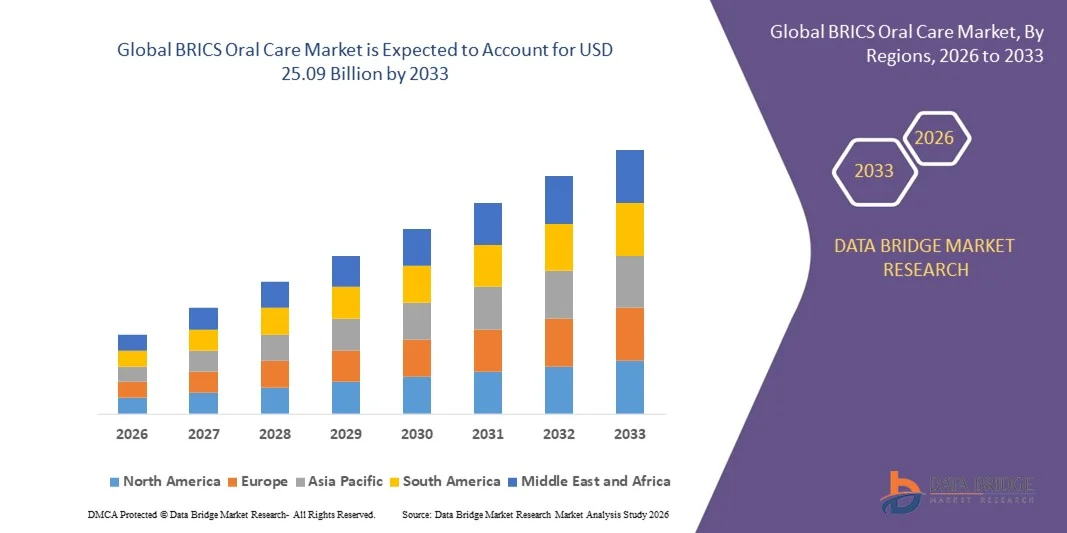

| 2026 –2033 | |

| USD 13.16 Billion | |

| USD 25.09 Billion | |

|

|

|

|

BRICS Oral Care Market Size

- The BRICS oral care market size was valued at USD 13.16 billion in 2025 and is expected to reach USD 25.09 billion by 2033, at a CAGR of 8.40% during the forecast period

- The market growth is largely fuelled by the rising awareness of oral hygiene, increasing disposable incomes, and growing adoption of advanced oral care products such as electric toothbrushes, mouthwashes, and whitening products

- Rapid urbanization, changing lifestyles, and increasing dental health concerns in BRICS countries are contributing to the market expansion

BRICS Oral Care Market Analysis

- The BRICS oral care market is witnessing significant growth due to rising demand for preventive dental care, oral hygiene awareness campaigns, and the availability of modern oral care products

- Increasing penetration of organized retail chains, e-commerce platforms, and branded products in urban and semi-urban areas is further driving market adoption

- Brazil BRICS oral care market accounted for the largest revenue share of 12.00% in 2025, driven by rising awareness of oral hygiene, growing disposable incomes, and increasing adoption of advanced oral care products

- Russia is expected to witness the highest compound annual growth rate (CAGR) in the BRICS oral care market due to increasing urbanization, rising disposable incomes, and growing awareness of oral hygiene in countries such as India and China

- The Primary Oral Care Products segment held the largest market revenue share in 2025, driven by the widespread daily use of toothpaste, toothbrushes, and mouthwash across all age groups. These products are essential for maintaining oral hygiene and are supported by awareness campaigns promoting preventive dental care, making them the backbone of oral care consumption

Report Scope and BRICS Oral Care Market Segmentation

|

Attributes |

BRICS Oral Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

BRICS Oral Care Market Trends

Rising Awareness and Adoption of Advanced Oral Care Products

- The growing focus on oral hygiene and preventive dental care is transforming the BRICS oral care landscape by encouraging regular use of toothpaste, mouthwash, and whitening products. Increased awareness campaigns are helping consumers make informed choices, improving overall dental health. Additionally, rising disposable incomes and urban lifestyles are contributing to a shift toward premium and innovative oral care solutions

- The high demand for professional dental treatments and at-home oral care solutions is accelerating the adoption of innovative products such as herbal toothpaste, fluoride-free options, and electric toothbrushes. These products are particularly effective in addressing dental caries, gum diseases, and sensitivity issues. Furthermore, consumers are increasingly prioritizing products that provide holistic oral wellness, including enamel protection and breath freshening

- The affordability and availability of modern oral care products are making them accessible to a broader population. Consumers benefit from easy-to-use and effective solutions, leading to increased adoption across urban and semi-urban regions. Growing e-commerce penetration is also expanding access to a wider variety of oral care products, helping overcome geographical limitations

- For instance, in 2023, several dental clinics and retail chains in Brazil and India reported increased sales of electric toothbrushes and herbal toothpaste, contributing to improved oral hygiene and consumer satisfaction. The trend also coincided with promotional campaigns and bundled offerings, further boosting product penetration and consumer engagement

- While adoption of advanced oral care products continues to rise, market growth depends on continuous product innovation, consumer education, and distribution network expansion. Companies must focus on localized product development and marketing strategies to fully capitalize on growing demand. In addition, collaborations with dental professionals and influencer campaigns are enhancing consumer trust and driving long-term adoption

BRICS Oral Care Market Dynamics

Driver

Increasing Focus on Preventive Dental Care and Oral Health Awareness

- Rising prevalence of dental diseases and increased consumer awareness is driving the demand for oral care products across BRICS countries. Governments and NGOs are promoting oral hygiene through awareness campaigns, school programs, and preventive initiatives. Moreover, workplace wellness programs and insurance-driven dental coverage are supporting regular oral health practices

- Consumers are increasingly seeking products that provide multiple benefits, including cavity prevention, whitening, and sensitivity relief. This has accelerated the introduction of multifunctional toothpaste, mouth rinses, and oral gels across the market. Consumers are also favoring products with natural ingredients and ethical certifications, reflecting a shift toward conscious consumption

- Technological advancements in product formulations and packaging are enabling manufacturers to deliver innovative, convenient, and effective oral care solutions. These innovations help enhance consumer satisfaction and loyalty. Smart oral care devices with app integration and sensor feedback are gaining traction, especially among tech-savvy urban populations

- For instance, in 2022, several manufacturers in Russia and South Africa launched new fluoride-free and herbal toothpaste variants to cater to consumer demand for natural and safer alternatives. These launches were accompanied by educational campaigns to raise awareness about the benefits of such products, driving adoption among health-conscious consumers

- While awareness and preventive care focus are driving market growth, continuous education, accessibility, and affordability are essential to ensure sustained adoption and long-term expansion. Partnerships with dental clinics, schools, and digital platforms are increasingly being leveraged to extend market reach and reinforce the importance of oral health

Restraint/Challenge

High Cost of Premium Oral Care Products and Limited Rural Penetration

- Premium oral care products such as electric toothbrushes, whitening kits, and specialized mouthwashes remain expensive, limiting adoption among price-sensitive consumers in rural and semi-urban areas. Additionally, limited availability of financing or promotional schemes further discourages low-income households from trying advanced products

- In many BRICS regions, lack of access to modern retail channels and distribution networks hinders product availability in remote locations, leading to lower penetration and continued reliance on traditional oral care solutions. Consumers in these areas may depend on small local shops that carry limited product variety and inconsistent stock

- Supply chain constraints, import duties, and inconsistent product availability further restrict the reach of high-quality oral care products, affecting overall market growth. Factors such as transportation delays, regulatory bottlenecks, and dependency on imported raw materials exacerbate the challenge, particularly for niche and premium offerings

- For instance, in 2023, rural distributors in India and Brazil reported challenges in supplying advanced oral care products due to high costs and limited logistical infrastructure. These disruptions led to delayed product launches and inconsistent market presence, impacting both consumer trust and sales performance

- While oral care technologies and formulations continue to advance, addressing affordability, distribution, and awareness challenges remains critical. Market players must focus on cost-effective solutions, localized manufacturing, and strong distribution networks to unlock long-term market potential. In addition, leveraging digital marketplaces and mobile outreach programs can help bridge accessibility gaps in underserved areas

BRICS Oral Care Market Scope

The market is segmented on the basis of product type, distribution channel, and application.

- By Product Type

On the basis of product type, the BRICS oral care market is segmented into Primary Oral Care Products and Secondary Oral Care Products. The Primary Oral Care Products segment held the largest market revenue share in 2025, driven by the widespread daily use of toothpaste, toothbrushes, and mouthwash across all age groups. These products are essential for maintaining oral hygiene and are supported by awareness campaigns promoting preventive dental care, making them the backbone of oral care consumption.

The Secondary Oral Care Products segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising adoption of specialized products such as whitening gels, dental floss, herbal formulations, and electric toothbrushes. These products cater to evolving consumer preferences for enhanced oral health benefits, convenience, and aesthetics, particularly in urban and semi-urban areas.

- By Distribution Channel

On the basis of distribution channel, the BRICS oral care market is segmented into Convenience Stores, Department Stores, Direct Selling, General Merchandise Retailers, Hypermarkets and Supermarkets, Vending Machines, Specialty Stores and Pharmacies, and Others. The Hypermarkets and Supermarkets segment held the largest market revenue share in 2025, driven by the wide availability of oral care products under one roof, competitive pricing, and promotional campaigns that attract bulk purchases. Consumers prefer these channels for their convenience, variety, and accessibility, particularly in urban regions.

The Direct Selling segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by personalized consultations, doorstep delivery, and growing awareness of oral health benefits through direct marketing. This channel is gaining traction in semi-urban and rural regions where traditional retail presence is limited, enabling companies to reach a broader consumer base effectively.

- By Application

On the basis of application, the BRICS oral care market is segmented into Infant, Children, Adult, and Old Age. The Adult segment held the largest market revenue share in 2025, driven by the high awareness of oral hygiene, preventive care, and cosmetic dental products among working-age populations. Adults increasingly prefer specialized toothpaste, mouth rinses, and whitening products, contributing to steady demand growth.

The Children segment is expected to witness the fastest growth rate from 2026 to 2033, propelled by rising parental awareness of early oral care, increasing availability of child-friendly oral hygiene products, and government programs promoting dental health in schools. This segment benefits from innovations in flavors, packaging, and educational campaigns that encourage consistent oral care habits from a young age.

BRICS Oral Care Market Regional Analysis

- The Brazil BRICS oral care market accounted for the largest revenue share of 12.00% in 2025, driven by rising awareness of oral hygiene, growing disposable incomes, and increasing adoption of advanced oral care products

- Consumers in Brazil are increasingly prioritizing preventive dental care and are adopting toothpaste, mouthwash, and electric toothbrushes to maintain oral health

- The widespread adoption is further supported by robust retail infrastructure, urbanization, and increasing penetration of modern oral care products, establishing Brazil as a key market within BRICS

Russia BRICS Oral Care Market Insight

The Russia BRICS oral care market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising awareness of oral health, government campaigns promoting dental hygiene, and increasing demand for multifunctional oral care products. Urban populations are particularly inclined towards products offering whitening, cavity protection, and sensitivity relief. The region is experiencing significant growth across both retail and professional dental care channels, with oral care products being increasingly incorporated into daily preventive routines.

India BRICS Oral Care Market Insight

The India BRICS oral care market is expected to witness substantial growth from 2026 to 2033, fueled by rising dental health awareness, increasing middle-class population, and the rapid expansion of modern retail and e-commerce platforms. Indian consumers are embracing herbal, fluoride-free, and electric oral care products, while government initiatives supporting preventive care further encourage adoption. The growing preference for at-home oral care solutions is expanding the reach of oral care products across both urban and semi-urban regions.

China BRICS Oral Care Market Insight

The China BRICS oral care market is expected to witness the fastest growth rate from 2026 to 2033, attributed to rapid urbanization, increasing disposable incomes, and a strong focus on preventive dental care. Consumers in China are showing high interest in advanced oral care products, including electric toothbrushes, whitening toothpaste, and mouth rinses. The push towards healthier lifestyles, coupled with the availability of affordable modern oral care options, is significantly contributing to the expansion of the market in China.

South Africa BRICS Oral Care Market Insight

The South Africa BRICS oral care market is expected to witness robust growth from 2026 to 2033, driven by rising dental disease awareness, government initiatives promoting oral hygiene, and increasing adoption of premium and herbal oral care products. Consumers are seeking effective, multifunctional solutions for dental health, while the expansion of modern retail networks is improving accessibility. The combination of preventive care focus and growing disposable incomes is propelling the adoption of oral care products across urban and semi-urban populations.

BRICS Oral Care Market Share

The BRICS Oral Care industry is primarily led by well-established companies, including:

• GlaxoSmithKline Consumer Healthcare (India)

• Hindustan Unilever Limited (India)

• Dabur India Ltd (India)

• Patanjali Ayurved Ltd (India)

• Condor SA (Brazil)

• Natura &Co (Brazil)

• Yunnan Baiyao Group Co., Ltd (China)

• Guangzhou Weimeizi Industrial Co. Ltd (China)

• Faber-Castell Russia (Russia)

• Colgate-Palmolive South Africa (South Africa)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.