Global Brightness Enhancement Film Market

Market Size in USD Million

CAGR :

%

USD

209.97 Million

USD

314.99 Million

2024

2032

USD

209.97 Million

USD

314.99 Million

2024

2032

| 2025 –2032 | |

| USD 209.97 Million | |

| USD 314.99 Million | |

|

|

|

|

Brightness Enhancement Film Market Size

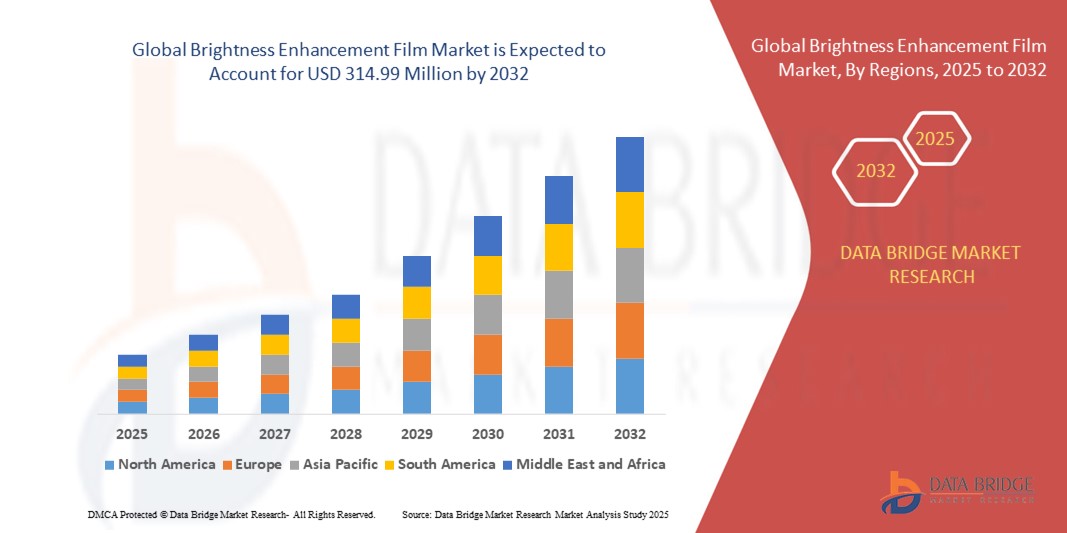

- The global brightness enhancement film market size was valued at USD 209.97 million in 2024 and is expected to reach USD 314.99 million by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the rising demand for high-performance displays in consumer electronics, including smartphones, tablets, laptops, and TVs, along with the need for improved screen clarity, luminance efficiency, and energy savings

- Technological advancements in multilayer optical films and light guide panels, as well as increasing adoption of OLED and LCD displays, are further driving the market expansion globally

Brightness Enhancement Film Market Analysis

- The global brightness enhancement film market is expanding due to rising demand for high-quality displays in TVs, smartphones, tablets, and automotive screens, driving adoption across multiple electronics sectors

- Technological advancements in optical films, energy-efficient LED and OLED integration, and improved light management are enhancing display brightness, visual performance, and consumer experience

- Asia-Pacific dominated the brightness enhancement film market with the largest revenue share of 38.5% in 2024, driven by rapid growth in consumer electronics manufacturing, increasing adoption of high-brightness displays, and rising urbanization

- North America region is expected to witness the highest growth rate in the global brightness enhancement film market, driven by widespread adoption of advanced display technologies, strong R&D activities, and high penetration of smartphones, tablets, and TVs

- The Microreplicated Films segment held the largest market revenue share in 2024, driven by their superior light-guiding efficiency and ability to enhance display brightness without increasing power consumption. Microreplicated films are widely used in LCD and LED displays to improve luminance uniformity, contrast, and viewing angles, making them a preferred choice for consumer electronics

Report Scope and Brightness Enhancement Film Market Segmentation

|

Attributes |

Brightness Enhancement Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Adoption Of High-Definition Displays In Consumer Electronics |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Brightness Enhancement Film Market Trends

Increasing Demand for High-Performance Displays

• The growing shift toward high-performance displays is transforming the brightness enhancement film (BEF) market by enabling better screen clarity and visual experience. These films enhance luminance efficiency, reduce power consumption, and improve display readability under varied lighting conditions. This results in superior user experience and energy-efficient devices, while also supporting thinner and lighter display designs for portable electronics

• Rising demand from consumer electronics, including smartphones, tablets, laptops, and TVs, is accelerating the adoption of advanced BEF technologies. Manufacturers are integrating these films to boost brightness, contrast, and color accuracy, making them essential in high-end display applications. The films also enable broader viewing angles and consistent image quality across devices, enhancing market appeal

• Technological advancements in multilayer optical films, light guide panels, and reflective coatings are improving the performance, durability, and compatibility of BEFs across display types. These innovations make the films increasingly competitive with conventional display enhancement solutions, reducing energy consumption while maintaining visual performance

• For instance, in 2023, several leading TV and laptop manufacturers incorporated next-generation BEFs in their devices, enhancing brightness and energy efficiency, thereby improving consumer satisfaction and brand perception. The adoption also allowed devices to meet stricter energy regulations in multiple regions

• While adoption is growing, continued R&D, cost optimization, and integration with emerging display technologies will be key to sustaining market growth globally. Market expansion will also depend on scalable manufacturing processes and the ability to meet increasing consumer demand for high-performance displays

Brightness Enhancement Film Market Dynamics

Driver

Rising Adoption of High-Brightness and Energy-Efficient Displays

• The increasing adoption of high-brightness, energy-efficient displays in smartphones, tablets, and TVs is driving demand for brightness enhancement films. BEFs enable higher screen luminance without increasing power consumption, supporting longer device battery life and reducing heat generation. This ensures devices can operate efficiently even in outdoor or high-ambient-light environments

• Manufacturers are increasingly integrating BEFs to enhance display performance, boost user experience, and meet the expectations of premium electronics consumers. This adoption is further encouraged by the rising popularity of OLED, LCD, and LED display technologies, as well as emerging microLED displays for next-generation devices

• Government regulations promoting energy-efficient devices and sustainable electronics are reinforcing market growth, encouraging the use of films that reduce overall energy consumption. These policies are driving investments in high-performance materials that help manufacturers meet environmental compliance requirements

• For instance, in 2022, several leading smartphone brands incorporated advanced BEFs in their OLED displays, improving brightness levels while maintaining energy efficiency and minimizing heat generation. This contributed to longer battery life and enhanced user satisfaction, further supporting market adoption

• While high-brightness adoption is driving growth, continued material innovation, precise manufacturing, and improved scalability will be critical for sustained market expansion. In addition, partnerships between display manufacturers and BEF suppliers will play a crucial role in introducing next-generation high-performance displays

Restraint/Challenge

High Manufacturing Costs and Technological Complexities

• Advanced BEFs often involve sophisticated multilayer structures and precision manufacturing, resulting in higher production costs compared to conventional display films. This limits adoption among cost-sensitive device manufacturers and affects the overall pricing of end products in competitive markets

• Integration challenges, such as film alignment, compatibility with diverse display types, and maintaining uniform brightness across large screens, can hinder widespread implementation. These technological complexities require skilled personnel, advanced equipment, and robust quality assurance measures to ensure consistent performance

• Supply chain constraints, including the availability of raw optical films and adhesives, can affect production timelines and scalability, particularly for large-volume display manufacturers. Delays in sourcing high-quality materials may slow down product launches and impact revenue growth

• For instance, in 2023, several mid-tier display manufacturers reported delays and increased costs in adopting next-generation BEFs due to sourcing difficulties and manufacturing challenges. These issues highlighted the need for improved supply chain management and technological standardization across regions

• While BEF technology continues to evolve, addressing cost, supply chain, and technical integration challenges remains critical to ensuring broader market penetration and long-term growth. Developing efficient production methods, strategic partnerships, and alternative material sourcing will be essential to overcome these restraints and sustain market momentum

Brightness Enhancement Film Market Scope

The market is segmented on the basis of type, material, and application.

- By Type

On the basis of type, the brightness enhancement film (BEF) market is segmented into Microreplicated Films, Prismatic Films, Optical Coatings, Polarizing Films, and Diffusion Films. The Microreplicated Films segment held the largest market revenue share in 2024, driven by their superior light-guiding efficiency and ability to enhance display brightness without increasing power consumption. Microreplicated films are widely used in LCD and LED displays to improve luminance uniformity, contrast, and viewing angles, making them a preferred choice for consumer electronics.

The Prismatic Films segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their ability to redirect light efficiently and optimize display performance. Prismatic films are particularly popular for large-screen displays and high-end devices, offering improved brightness, energy savings, and enhanced visual experience.

- By Material

On the basis of material, the market is segmented into PET (Polyethylene Terephthalate), PC (Polycarbonate), PMMA (Polymethyl Methacrylate), and Others. The PET segment dominated the market in 2024 due to its excellent optical clarity, mechanical strength, and cost-effectiveness. PET-based films are compatible with a wide range of display technologies and are increasingly adopted in smartphones, laptops, and TVs.

The PC segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its durability, high heat resistance, and suitability for premium and flexible display applications. Manufacturers are increasingly leveraging PC-based BEFs to enhance display quality while maintaining robustness and lightweight characteristics.

- By Application

On the basis of application, the market is segmented into LCD Displays, OLED Displays, and Others. The LCD Displays segment held the largest market share in 2024, owing to the widespread adoption of LCD technology across televisions, monitors, and laptops. LCD displays benefit significantly from BEFs for improved brightness, contrast, and energy efficiency.

The OLED Displays segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for high-end smartphones, wearable devices, and advanced television panels. OLED displays integrated with brightness enhancement films offer superior color reproduction, uniformity, and energy savings, driving the adoption of BEFs in premium electronics.

Brightness Enhancement Film Market Regional Analysis

• Asia-Pacific dominated the brightness enhancement film market with the largest revenue share of 38.5% in 2024, driven by rapid growth in consumer electronics manufacturing, increasing adoption of high-brightness displays, and rising urbanization.

• Manufacturers and consumers in the region highly value films that enhance luminance, energy efficiency, and visual quality for devices such as smartphones, tablets, laptops, and TVs.

• This widespread adoption is further supported by government initiatives promoting energy-efficient electronics, growing disposable incomes, and a technologically inclined population, establishing brightness enhancement films as a key component in modern display technologies.

China Brightness Enhancement Film Market Insight

The China brightness enhancement film market captured the largest revenue share in Asia-Pacific in 2024, fueled by the country’s expanding electronics manufacturing base, high technological adoption, and rising demand for premium displays. Manufacturers are increasingly integrating BEFs in smartphones, TVs, and laptops to enhance brightness, contrast, and energy efficiency. Furthermore, the push toward smart cities and advanced consumer electronics, along with cost-effective domestic production, continues to propel market growth.

Japan Brightness Enhancement Film Market Insight

The Japan brightness enhancement film market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high-tech culture, strong electronics sector, and consumer preference for energy-efficient, high-performance displays. The adoption of BEFs is driven by growing demand for OLED, LCD, and LED displays in smartphones, TVs, and monitors. Integration of BEFs with other optical and display technologies enhances user experience, reduces power consumption, and supports sustainability goals, fueling further market expansion.

North America Brightness Enhancement Film Market Insight

The North America brightness enhancement film market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong demand for high-performance consumer electronics, including smartphones, tablets, laptops, and TVs. Manufacturers are integrating BEFs to improve display brightness, contrast, and energy efficiency, catering to premium device segments. The market growth is further supported by the presence of major electronics companies, technological innovation, and increasing adoption of energy-efficient display standards, which collectively enhance user experience and drive market expansion across the U.S. and Canada.

U.S. Brightness Enhancement Film Market Insight

The U.S. brightness enhancement film market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid adoption of high-brightness, energy-efficient displays across consumer electronics. Manufacturers are leveraging advanced BEFs to meet consumer expectations for superior visual performance and battery efficiency. The market is further supported by the presence of major electronics companies, technological innovation, and strong R&D capabilities, boosting overall growth in both domestic and export markets.

Europe Brightness Enhancement Film Market Insight

The Europe brightness enhancement film market is expected to witness the fastest growth rate from 2025 to 2032, supported by stringent energy efficiency regulations, growing consumer electronics demand, and emphasis on sustainable and high-performance display solutions. Key electronics manufacturers in Germany, the U.K., and France are increasingly incorporating BEFs in laptops, TVs, and smartphones. Rising urbanization, high disposable income, and eco-conscious consumer behavior are further stimulating market adoption.

U.K. Brightness Enhancement Film Market Insight

The U.K. brightness enhancement film market is expected to witness the fastest growth rate from 2025 to 2032, driven by consumer preference for high-quality displays and energy-efficient electronics. BEFs are widely adopted in laptops, tablets, and TVs to enhance brightness, contrast, and viewing experience. The growing electronics retail sector, coupled with government initiatives supporting energy-efficient devices, continues to support the market’s expansion.

Germany Brightness Enhancement Film Market Insight

The Germany brightness enhancement film market is expected to witness the fastest growth rate from 2025 to 2032, driven by technological innovation in display manufacturing, high adoption of OLED and LCD displays, and demand for energy-efficient consumer electronics. Manufacturers are increasingly deploying advanced BEFs to improve luminance efficiency and display quality. The country’s focus on sustainability and high-tech manufacturing infrastructure further fuels market growth.

Brightness Enhancement Film Market Share

The Brightness Enhancement Film industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- MNtech Co., Ltd. (South Korea),

- Shinwha Co., Ltd. (South Korea),

- Samsung SDI Co., Ltd (South Korea),

- SKC Haas Display Films Co., Ltd. (South Korea)

- LG Chem, Ltd. (South Korea)

- Lintec Corporation (Japan)

- Kolon Industries, Inc. (South Korea)

- Hyosung Corporation (South Korea)

- Changchun Group (China)

- BenQ Materials Corporation (Taiwan)

- Cosmo Films Ltd. (India)

Latest Developments in Global Brightness Enhancement Film Market

- In December 2023, Ubright Optronics marked its 20th anniversary as a prominent manufacturer of brightness enhancement film (BEF) for LCDs. Diversifying beyond LCDs, the company expanded into non-LCD applications and acquired a precision coating firm within its corporate group. This strategic evolution positions Ubright Optronics to capitalize on emerging market opportunities and reinforces its leadership in the brightness enhancement film sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Brightness Enhancement Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Brightness Enhancement Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Brightness Enhancement Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.