Global Bromelain Market

Market Size in USD Billion

CAGR :

%

USD

30.22 Billion

USD

51.15 Billion

2024

2032

USD

30.22 Billion

USD

51.15 Billion

2024

2032

| 2025 –2032 | |

| USD 30.22 Billion | |

| USD 51.15 Billion | |

|

|

|

|

Bromelain Market Size

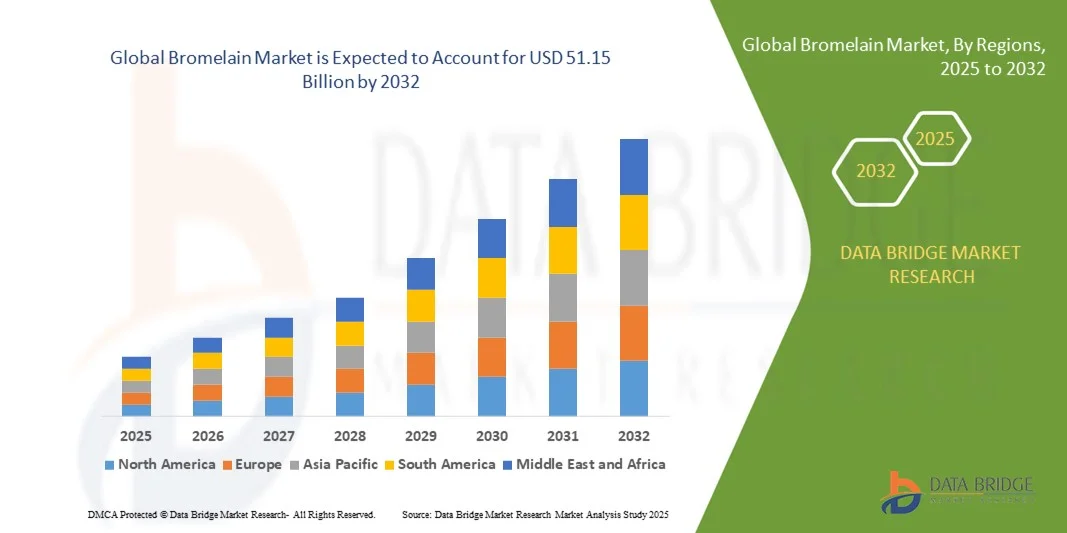

- The global bromelain market size was valued at USD 30.22 billion in 2024 and is expected to reach USD 51.15 billion by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely fueled by the increasing consumer awareness of natural health supplements and functional foods, coupled with rising demand for plant-derived bioactive ingredients in dietary supplements, cosmetics, and healthcare products

- Furthermore, growing preference for digestive health, anti-inflammatory benefits, and natural wellness solutions is driving the adoption of bromelain across multiple applications. These converging factors are accelerating product uptake, thereby significantly boosting the industry's growth

Bromelain Market Analysis

- Bromelain is a plant-derived proteolytic enzyme primarily extracted from pineapples. It is widely used for its digestive aid, anti-inflammatory, and therapeutic properties in dietary supplements, functional foods, beverages, and cosmetics

- The escalating demand for bromelain is primarily fueled by increasing health-consciousness, the rising trend of natural and plant-based ingredients, and the growing preference for preventive healthcare solutions across global markets

- North America dominated the bromelain market with a share of 29.4% in 2024, due to rising awareness of natural health supplements, increasing demand for functional foods, and a well-established dietary supplement industry

- Asia-Pacific is expected to be the fastest growing region in the bromelain market during the forecast period due to rising health awareness, increasing disposable incomes, and rapid urbanization in countries such as China, Japan, and India

- Powder segment dominated the market with a market share of over 50% in 2024, due to its ease of incorporation into dietary supplements, beverages, and food products. Powdered Bromelain offers higher stability, longer shelf life, and flexible dosage options, making it highly preferred by manufacturers across pharmaceuticals, nutraceuticals, and functional food sectors

Report Scope and Bromelain Market Segmentation

|

Attributes |

Bromelain Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bromelain Market Trends

Rising Demand for Natural Dietary Supplements

- The bromelain market is witnessing robust growth driven by the increasing demand for natural and plant-based dietary supplements. Consumers are increasingly inclined toward nutraceuticals sourced from fruits and herbs due to growing awareness of their health benefits, safety profile, and sustainability compared to synthetic alternatives

- For instance, Enzybel International offers bromelain extracted from pineapple stems and fruit for use in digestive support and inflammation management supplements. Similarly, Biozym GmbH produces high-purity bromelain for nutraceutical formulations emphasizing natural enzyme therapy within functional foods and health supplements

- Bromelain’s versatility as a natural ingredient supports its integration into a diverse range of nutritional products such as digestion aids, joint support capsules, and anti-inflammatory blends. The global shift toward natural wellness products is reinforcing its importance as a recognized bioactive enzyme in preventive healthcare

- In addition, the increasing consumer interest in clean-label and chemical-free dietary products is accelerating bromelain adoption in both capsules and powder formats. Manufacturers are emphasizing transparency and traceability by sourcing bromelain from non-GMO and sustainably cultivated pineapples to align with eco-conscious consumer values

- The expanding application of bromelain in sports nutrition and recovery products is further enriching its market presence. Its use in combination with other natural enzymes and vitamins contributes to improved muscle recovery and reduced soreness after physical exertion, supporting active lifestyle segments globally

- As the preference for natural supplements gains global momentum, bromelain’s role as a multifunctional, plant-derived enzyme continues to strengthen. The rising acceptance of botanical and enzyme-based nutrition reinforces the overall shift toward holistic wellness and clean supplementation trends across consumer health industries

Bromelain Market Dynamics

Driver

Growing Awareness of Digestive and Anti-Inflammatory Benefits

- The rising awareness of bromelain’s bioactive health properties, particularly its digestive and anti-inflammatory effects, is a major driver for market growth. Consumers are increasingly recognizing the role of natural enzymes in promoting gut health, reducing inflammation, and aiding nutrient absorption across all age groups

- For instance, companies such as EnzyMedica and NOW Foods market bromelain supplements highlighting their dual benefits in supporting digestion and providing natural inflammation relief. These products are widely used by consumers seeking non-pharmaceutical solutions for digestive comfort and injury recovery

- Bromelain functions as a proteolytic enzyme that assists in protein breakdown, enhancing digestive efficiency and nutrient bioavailability. Its anti-inflammatory and analgesic properties have also made it a vital component in nutraceuticals designed for joint health, post-surgical recovery, and sports therapy

- In addition, ongoing clinical research validating the therapeutic role of bromelain in conditions such as sinusitis, arthritis, and muscle strain is boosting consumer confidence and medical endorsement. This scientific support is reinforcing its adoption across dietary supplements and functional health formulations

- With the growing focus on natural remedies and enzyme-based therapies, bromelain’s perceived efficacy in improving overall digestion and mitigating inflammation continues to drive its global demand. The expanding consumer preference for herbal and enzyme-oriented wellness products ensures the enzyme’s pivotal role in the evolving nutraceutical market

Restraint/Challenge

Limited Stability in Some Formulations

- One of the key challenges in the bromelain market is the enzyme’s limited stability under certain processing and formulation conditions. Bromelain’s activity can deteriorate when exposed to high temperatures, pH variations, or prolonged storage, posing constraints for manufacturers developing long-shelf-life or heat-processed products

- For instance, manufacturers such as Challenge Bioproducts Co. Ltd. face challenges in maintaining enzymatic activity during capsule filling and food processing stages, especially when combining bromelain with other active compounds. To address this, companies are investing in protective coating and microencapsulation technologies to improve product stability and absorption efficiency

- The enzyme’s sensitivity to external conditions complicates its integration into beverage and baked food formulations where heat exposure is prevalent. This limits product diversification opportunities and requires precise process control to preserve bioactivity during development and transportation

- In addition, variations in enzyme quality depending on extraction methods, storage conditions, and raw material composition can lead to inconsistent performance. These factors necessitate continuous quality assurance measures, increasing production and R&D costs for supplement manufacturers

- While technology-driven solutions such as lyophilization and nanoencapsulation are improving bromelain’s stability, formulation sensitivity continues to restrict its widespread use across all product categories. Achieving consistent efficacy and shelf stability will remain a key challenge influencing the enzyme’s broader commercialization potential in the competitive nutraceutical market

Bromelain Market Scope

The market is segmented on the basis of source, form, type, application, and distribution channel.

- By Source

On the basis of source, the Bromelain market is segmented into stem and fruits. The stem-derived Bromelain segment dominated the market with the largest revenue share in 2024, driven by its higher enzyme concentration and widespread use in dietary supplements and pharmaceutical formulations. Stem Bromelain is preferred by manufacturers due to its consistent quality, higher stability during processing, and proven efficacy in digestive and anti-inflammatory applications. The long-established supply chain and extensive research supporting stem-derived Bromelain further reinforce its dominance in the market.

The fruit-derived Bromelain segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer interest in natural and plant-based ingredients for functional foods and beverages. Fruit Bromelain is valued for its gentle enzymatic activity suitable for cosmetic formulations and dietary applications, and its rising adoption in health-conscious consumer products contributes to the segment’s rapid expansion.

- By Form

On the basis of form, the Bromelain market is segmented into powder, cream, tablet, and capsule. The powder form dominated the market with the largest revenue share of over 50% in 2024, owing to its ease of incorporation into dietary supplements, beverages, and food products. Powdered Bromelain offers higher stability, longer shelf life, and flexible dosage options, making it highly preferred by manufacturers across pharmaceuticals, nutraceuticals, and functional food sectors.

The capsule form is expected to witness the fastest CAGR from 2025 to 2032, driven by growing consumer preference for convenient, ready-to-consume dosage formats. Capsules ensure precise dosing, enhanced bioavailability, and portability, which appeal to health-conscious individuals seeking supplementation for digestive health, joint support, and anti-inflammatory benefits.

- By Type

On the basis of type, the Bromelain market is segmented into 1,200 GDU/g, 2,000 GDU/g, 2,500 GDU/g, and others. The 2,000 GDU/g segment dominated the market in 2024 with the largest revenue share due to its balanced enzymatic activity suitable for a wide range of applications, including dietary supplements, cosmetics, and functional foods. Manufacturers favor this type for its reliability, efficacy, and adaptability across different formulations.

The 2,500 GDU/g segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for high-potency Bromelain in therapeutic applications, sports nutrition, and specialized supplements. Its superior enzyme strength ensures enhanced effectiveness in digestive support and anti-inflammatory formulations, driving rapid adoption across healthcare and nutraceutical markets.

- By Application

On the basis of application, the Bromelain market is segmented into dietary supplements, food and beverages, cosmetics, healthcare, and others. The dietary supplements segment held the largest market revenue share in 2024, driven by rising consumer awareness about digestive health, joint care, and inflammation management. Bromelain’s proven benefits in supporting immunity and gut health make it a preferred ingredient in capsules, tablets, and functional foods.

The cosmetics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing incorporation of Bromelain in skincare formulations for exfoliation, anti-aging, and anti-inflammatory properties. The growing trend of natural and enzyme-based cosmetic products is further accelerating its adoption in personal care products.

- By Distribution Channel

On the basis of distribution channel, the Bromelain market is segmented into retail sales, pharmacies and drug stores, and online sale. The pharmacies and drug stores segment dominated the market with the largest revenue share in 2024, owing to established trust, professional recommendations, and easy access for consumers seeking medicinal and dietary supplementation. These channels also allow verified sourcing and authenticity, which is crucial for enzyme-based products.

The online sales segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising adoption of e-commerce, direct-to-consumer models, and subscription-based health products. Convenience, wide product availability, and increasing health awareness among digital consumers are driving rapid growth in online Bromelain sales.

Bromelain Market Regional Analysis

- North America dominated the bromelain market with the largest revenue share of 29.4% in 2024, driven by rising awareness of natural health supplements, increasing demand for functional foods, and a well-established dietary supplement industry

- Consumers in the region highly value bromelain for its digestive and anti-inflammatory properties, along with its incorporation into nutraceuticals, cosmetics, and healthcare products

- This widespread adoption is further supported by high disposable incomes, strong health-conscious trends, and growing preference for plant-based bioactive ingredients, establishing bromelain as a favored supplement across both retail and pharmaceutical channels

U.S. Bromelain Market Insight

The U.S. bromelain market captured the largest revenue share in North America in 2024, fueled by increasing consumer preference for natural supplements and functional foods. Rising awareness regarding digestive health, joint health, and anti-inflammatory benefits is driving demand across dietary supplements, beverages, and cosmetic formulations. The growing popularity of online sales channels and pharmacies, coupled with product innovations such as capsules, tablets, and powders, further strengthens market growth. Moreover, collaborations between nutraceutical manufacturers and healthcare providers are contributing to the expansion of the bromelain market.

Europe Bromelain Market Insight

The Europe bromelain market is projected to expand at a significant CAGR during the forecast period, primarily driven by rising health awareness and growing adoption of dietary supplements. Consumers are increasingly incorporating bromelain into functional foods, beverages, and cosmetic products due to its therapeutic properties. The market growth is further supported by regulatory support for natural bioactive ingredients, urbanization, and rising disposable incomes. Countries such as Germany, France, and Italy are witnessing robust demand across retail, pharmacy, and online channels.

U.K. Bromelain Market Insight

The U.K. bromelain market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a surge in demand for natural and plant-based ingredients in dietary supplements and cosmetics. Growing concerns over digestive and joint health, combined with an expanding e-commerce sector, are encouraging adoption. Increasing consumer education on nutraceutical benefits and rising preference for organic and safe formulations are key factors supporting market growth.

Germany Bromelain Market Insight

The Germany bromelain market is expected to expand at a considerable CAGR, fueled by high consumer awareness of natural health products and strong demand for functional foods and supplements. Germany’s focus on wellness and preventive healthcare, along with stringent quality standards, promotes the adoption of bromelain-based products. In addition, the integration of bromelain into dietary supplements, beverages, and cosmetic formulations is growing, particularly in urban regions with a health-conscious population.

Asia-Pacific Bromelain Market Insight

The Asia-Pacific bromelain market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising health awareness, increasing disposable incomes, and rapid urbanization in countries such as China, Japan, and India. The growing preference for natural and plant-based supplements, coupled with expanding retail and online distribution networks, is boosting bromelain adoption. Furthermore, APAC’s role as a major producer of pineapple and bromelain-rich raw materials enhances product availability and affordability, supporting regional market growth.

Japan Bromelain Market Insight

The Japan bromelain market is witnessing steady growth due to high consumer awareness of functional foods and natural health supplements. Increasing adoption of bromelain in dietary supplements, cosmetics, and healthcare products is driven by its anti-inflammatory and digestive health benefits. The integration of bromelain into ready-to-consume health drinks and supplements, along with a strong retail and e-commerce presence, is further supporting market expansion.

China Bromelain Market Insight

The China bromelain market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s growing health-conscious population, rising disposable incomes, and rapid adoption of natural supplements. Bromelain is increasingly incorporated into dietary supplements, functional foods, and cosmetic products. Government initiatives supporting health and wellness, alongside strong domestic production and availability of pineapple as a raw material, are key factors driving market growth.

Bromelain Market Share

The bromelain industry is primarily led by well-established companies, including:

- Creative Enzymes (U.S.)

- CHANGSHA NATUREWAY (China)

- NUTRITECH (New Zealand)

- Enzyme Development Corporation (U.S.)

- Advanced Enzyme Technologies (India)

- ENZYBEL GROUP (Belgium)

- Krishna Enzytech Pvt. Ltd (India)

- URSAPHARM Arzneimittel GmbH (Germany)

- Great Food Group of Companies (U.K.)

- S.I. Biozyme (India)

- Senthil Group of Companies (India)

- Biolaxi Corporation (India)

- Biofact India Enterprises (India)

- Xena Bio Herbal Pvt Ltd. (India)

- Gunung Sewu Group (Indonesia)

- Antozyme Biotech Pvt Ltd (India)

- RAJVI ENTERPRISE (India)

- Mitushi Biopharma (India)

- Alpspure Lifesciences Private Limited (India)

- Meteoric Biopharmaceuticals Pvt. Ltd. (India)

Latest Developments in Global Bromelain Market

- In January 2023, Sun Pharma acquired three established brands—Phlogam, Disperzyme-CD, and Disperzyme—from Aksigen Hospital Care, a research-driven healthcare company with over two decades of experience. This acquisition strengthens Sun Pharma’s presence in the bromelain segment, enhancing its product portfolio across anti-inflammatory and digestive health supplements. By integrating these brands, the company is expected to gain a competitive edge in the nutraceutical and healthcare markets, leveraging established customer trust and expanding its distribution channels

- In September 2021, the collaboration between Now Foods and Amazonia Bio focused on obtaining bromelain from the Amazon jungle through sustainable practices. This initiative supports ethical and environmentally responsible sourcing and also enhances the credibility of bromelain products in the global market. By emphasizing traceability and sustainability, the partnership is expected to influence market trends toward responsibly sourced bioactive ingredients

- In September 2021, Now Foods, a U.S.-based natural foods and supplements manufacturer, partnered with Amazonia Bio in Brazil to source sustainably harvested bromelain from the Amazon rainforest. This collaboration emphasizes ethical and eco-friendly sourcing, positioning Now Foods as a leader in sustainable bromelain production. The initiative is likely to attract environmentally conscious consumers and strengthen the brand’s market presence in global dietary supplement markets

- In October 2020, Giellepi S.p.A. introduced its proprietary bromelain ingredient, Bromeyal. This plant-derived enzyme offers the full health benefits of bromelain without requiring enteric-coating technologies, simplifying formulation and manufacturing for supplement and functional food producers. The launch enhances market accessibility of bromelain-based products and is expected to accelerate adoption across dietary supplements, functional foods, and nutraceutical applications

- In June 2020, Enzymedica, a U.S.-based supplement company, launched its Enzyme Science product line, featuring a bromelain supplement marketed for digestive support and anti-inflammatory benefits. This launch strengthens Enzymedica’s position in the bromelain market, targeting health-conscious consumers seeking natural solutions for gastrointestinal and inflammatory conditions, and supporting the broader growth of the digestive enzyme segment globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bromelain Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bromelain Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bromelain Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.